Key Insights

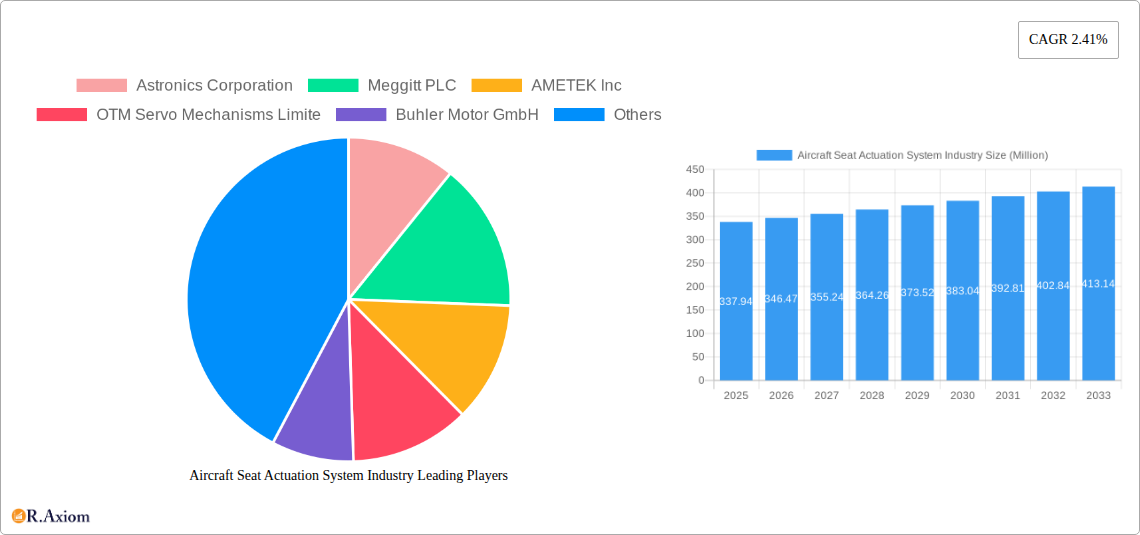

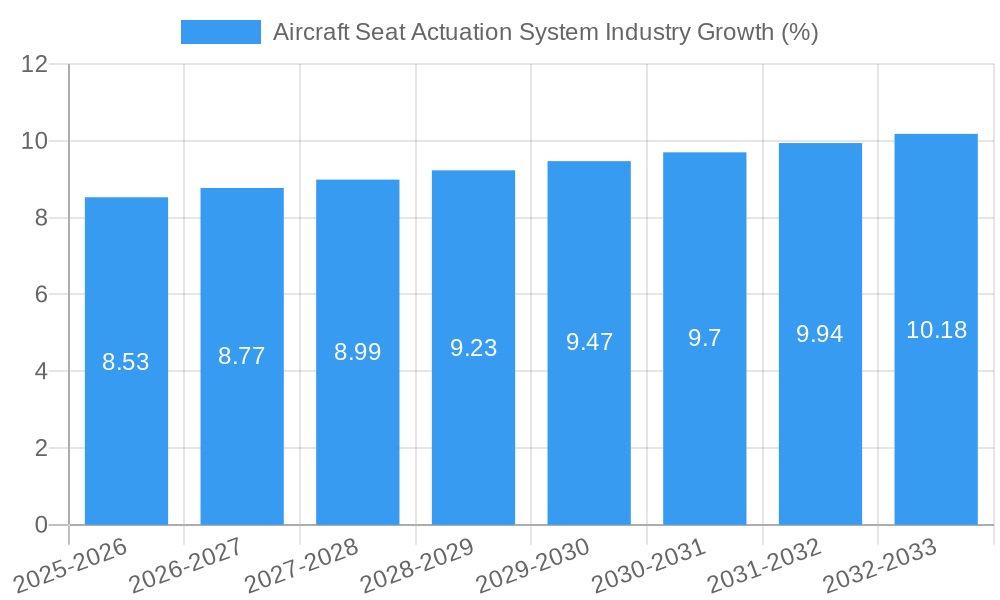

The Aircraft Seat Actuation System market, valued at $337.94 million in 2025, is projected to experience steady growth, driven by increasing air travel demand and the ongoing trend towards enhanced passenger comfort and in-flight entertainment. The market's Compound Annual Growth Rate (CAGR) of 2.41% from 2025 to 2033 indicates a moderate yet consistent expansion. Key drivers include the integration of advanced actuation systems enabling features like improved seat adjustability, enhanced recline mechanisms, and powered lumbar support, all of which contribute to a superior passenger experience. Technological advancements in lightweight materials and more efficient motor designs are also fueling growth. Market segmentation reveals a preference for linear mechanisms over rotary ones, particularly in fixed-wing aircraft. However, the growth of the helicopter segment holds considerable potential, driven by the increasing demand for comfortable and safe helicopter travel. While potential restraints could include supply chain disruptions and the overall economic climate impacting aircraft manufacturing, the long-term outlook remains positive, fuelled by the continued prioritization of passenger comfort and airline investment in modernizing their fleets.

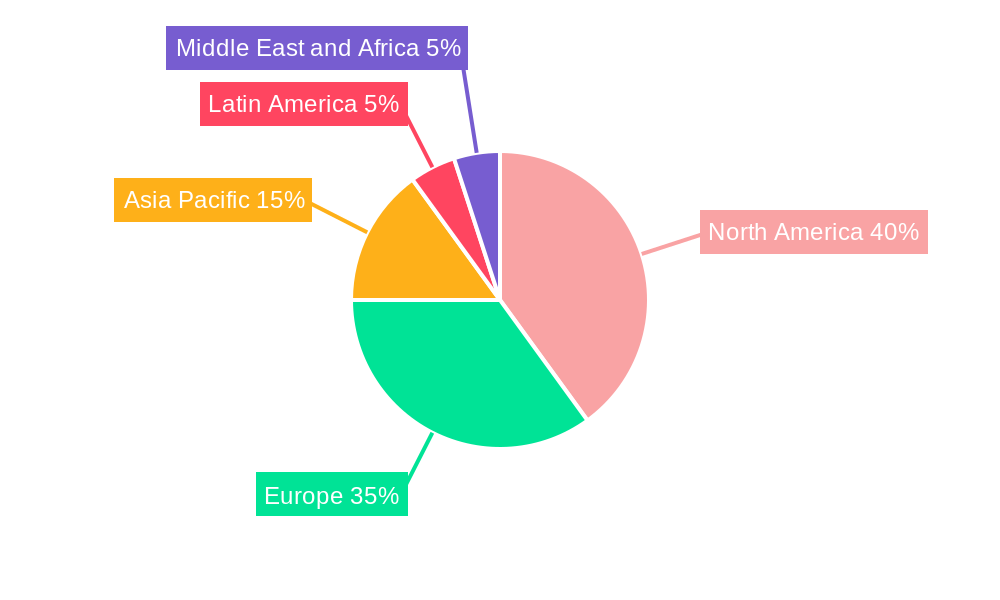

The regional breakdown reveals that North America and Europe currently hold significant market shares, due to the presence of major aircraft manufacturers and a strong focus on passenger experience. However, the Asia-Pacific region is expected to witness robust growth in the coming years, driven by the rapid expansion of low-cost carriers and a surge in air travel within the region. Companies such as Astronics Corporation, Meggitt PLC, and AMETEK Inc. are leading players, continuously innovating to enhance their product offerings and meet the evolving demands of the market. The competitive landscape is characterized by ongoing research and development efforts, mergers, and acquisitions, and strategic partnerships aimed at consolidating market share and driving further innovation. The future trajectory of this market hinges on successfully navigating technological advancements, addressing environmental concerns (like reducing energy consumption), and reacting to evolving passenger preferences.

This comprehensive report provides an in-depth analysis of the Aircraft Seat Actuation System industry, offering invaluable insights for stakeholders seeking to understand market dynamics, growth opportunities, and competitive landscapes. The study covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. The report leverages extensive primary and secondary research to deliver actionable intelligence. Key players analyzed include Astronics Corporation, Meggitt PLC, AMETEK Inc, OTM Servo Mechanisms Limite, Buhler Motor GmbH, CEF Industries LLC, ElectroCraft Inc, Safran SA, Rollon SpA, ITT Inc, Lee Air Inc, Kyntronics, Crane Co, and NOOK Industries Inc.

Aircraft Seat Actuation System Industry Market Concentration & Innovation

The Aircraft Seat Actuation System market exhibits a moderately concentrated landscape, with a handful of established players holding significant market share. Astronics Corporation and Meggitt PLC are estimated to jointly hold approximately xx% of the market share in 2025, reflecting their strong technological capabilities and extensive industry experience. However, the market is witnessing increased competition from smaller, specialized companies focusing on niche segments. Innovation is a key driver, with continuous advancements in lightweight materials, improved efficiency, and enhanced passenger comfort features shaping the competitive dynamics. Stringent safety regulations imposed by governing bodies like the FAA and EASA significantly influence product development and adoption. Furthermore, the industry is witnessing a notable increase in M&A activities, with deal values exceeding $xx Million in the last five years, signaling consolidation and a quest for technological synergies.

- Market Concentration: Moderately Concentrated, top 5 players hold xx% market share (2025).

- Innovation Drivers: Lightweight materials, improved efficiency, enhanced passenger comfort.

- Regulatory Framework: Stringent safety standards (FAA, EASA).

- Product Substitutes: Limited, due to safety and performance criticality.

- End-User Trends: Increasing demand for advanced features and enhanced passenger experience.

- M&A Activities: Significant activity observed, with deal values exceeding $xx Million in the past five years.

Aircraft Seat Actuation System Industry Industry Trends & Insights

The Aircraft Seat Actuation System market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This robust growth is primarily fueled by the burgeoning global air travel industry, coupled with increasing demand for enhanced passenger comfort and technological advancements in seat actuation systems. The market penetration of advanced actuation technologies, such as electric and smart actuation systems, is gradually increasing. The preference for lighter and more fuel-efficient aircraft contributes to the adoption of these advanced systems. However, the competitive landscape is dynamic, with ongoing technological disruptions leading to continuous improvements in efficiency, durability, and passenger comfort features. This necessitates continuous innovation and strategic adaptation for sustained market success. Market penetration of electric actuation systems is expected to reach xx% by 2033.

Dominant Markets & Segments in Aircraft Seat Actuation System Industry

North America is currently the leading region for Aircraft Seat Actuation Systems, driven by a robust domestic aviation industry and high adoption rates of advanced technologies. Within the segment breakdown:

- Mechanism: The Linear mechanism segment dominates due to its suitability in various seat applications, while the Rotary mechanism finds specialized use in specific features. The linear segment is projected to hold xx% market share in 2025.

- Aircraft Type: Fixed-wing aircraft constitutes the largest segment, reflecting the higher volume of this aircraft type in the global fleet. The market for Helicopter actuation systems is expected to show significant growth with the increasing popularity of helicopters for commercial and private use.

- Key Drivers (North America): Strong domestic aviation industry, high technological adoption rates, favorable regulatory environment, robust aircraft manufacturing base.

The dominance of North America stems from the region's substantial aircraft manufacturing base and high passenger traffic volumes. However, Asia-Pacific and Europe are emerging as significant markets, fueled by rapid economic growth and expanding aviation sectors.

Aircraft Seat Actuation System Industry Product Developments

Recent advancements focus on lightweight, energy-efficient designs using advanced materials and smart actuators. These innovations aim to reduce weight, enhance reliability, and improve passenger comfort. The integration of electric and electronically controlled systems enhances automation and precision, allowing for customizable seat positions and enhanced functionality. The development of modular designs facilitates easier maintenance and adaptability for different seat models, thus addressing the needs of various aircraft manufacturers and airlines.

Report Scope & Segmentation Analysis

This report segments the Aircraft Seat Actuation System market by Mechanism (Linear, Rotary) and Aircraft Type (Fixed-wing Aircraft, Helicopters). Each segment is analyzed based on market size, growth projections, and competitive dynamics.

- Mechanism: The Linear mechanism segment is projected to experience a CAGR of xx% due to its widespread use. The Rotary segment is expected to witness moderate growth driven by specialized applications.

- Aircraft Type: Fixed-wing aircraft holds a significant market share; however, the Helicopter segment shows promising growth potential driven by increasing commercial and private helicopter usage.

Key Drivers of Aircraft Seat Actuation System Industry Growth

The primary growth drivers include the increasing air passenger traffic, the demand for enhanced passenger comfort, and technological advancements driving the adoption of lighter, more efficient, and feature-rich actuation systems. Stringent safety regulations also necessitate continuous improvement in actuator technology and reliability. Furthermore, the trend towards fuel efficiency in aircraft design directly contributes to the demand for lightweight actuation systems.

Challenges in the Aircraft Seat Actuation System Industry Sector

The industry faces challenges such as the high cost of advanced technologies, the complexity of integrating these systems into aircraft seats, and maintaining a balance between weight reduction and durability. Supply chain disruptions can also impact production timelines and costs. The highly competitive nature of the market requires continuous innovation to maintain a competitive edge.

Emerging Opportunities in Aircraft Seat Actuation System Industry

Emerging opportunities lie in the development of advanced, highly customizable actuation systems incorporating smart technologies for enhanced passenger experience. The growing demand for eco-friendly solutions presents opportunities for developing lightweight, sustainable designs. Expanding into emerging markets in Asia-Pacific and other regions also presents significant growth potential.

Leading Players in the Aircraft Seat Actuation System Industry Market

- Astronics Corporation

- Meggitt PLC

- AMETEK Inc

- OTM Servo Mechanisms Limite

- Buhler Motor GmbH

- CEF Industries LLC

- ElectroCraft Inc

- Safran SA

- Rollon SpA

- ITT Inc

- Lee Air Inc

- Kyntronics

- Crane Co

- NOOK Industries Inc

Key Developments in Aircraft Seat Actuation System Industry Industry

- September 2021: Recaro Aircraft Seating selected to equip Qatar Airways' A321neo fleet with CL3810 economy seats (delivery starting end of 2022).

- August 2021: Geven and PriestmanGoode unveiled Elemento, a next-generation aircraft seat with innovative features.

Strategic Outlook for Aircraft Seat Actuation System Market

The Aircraft Seat Actuation System market is poised for sustained growth, driven by technological advancements, increasing air travel, and the ongoing demand for improved passenger comfort and fuel efficiency. The focus on lightweight, energy-efficient, and smart actuation systems will continue to shape industry innovation and market dynamics. Expanding into new markets and developing innovative solutions will be crucial for sustained success in this competitive landscape.

Aircraft Seat Actuation System Industry Segmentation

-

1. Mechanism

- 1.1. Linear

- 1.2. Rotary

-

2. Aircraft Type

- 2.1. Fixed-wing Aircraft

- 2.2. Helicopters

Aircraft Seat Actuation System Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. Egypt

- 5.4. Rest of Middle East and Africa

Aircraft Seat Actuation System Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.41% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. The Fixed-wing Aircraft Segment Accounted for Major Revenue Share in 2021

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aircraft Seat Actuation System Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Mechanism

- 5.1.1. Linear

- 5.1.2. Rotary

- 5.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 5.2.1. Fixed-wing Aircraft

- 5.2.2. Helicopters

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Mechanism

- 6. North America Aircraft Seat Actuation System Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Mechanism

- 6.1.1. Linear

- 6.1.2. Rotary

- 6.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 6.2.1. Fixed-wing Aircraft

- 6.2.2. Helicopters

- 6.1. Market Analysis, Insights and Forecast - by Mechanism

- 7. Europe Aircraft Seat Actuation System Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Mechanism

- 7.1.1. Linear

- 7.1.2. Rotary

- 7.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 7.2.1. Fixed-wing Aircraft

- 7.2.2. Helicopters

- 7.1. Market Analysis, Insights and Forecast - by Mechanism

- 8. Asia Pacific Aircraft Seat Actuation System Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Mechanism

- 8.1.1. Linear

- 8.1.2. Rotary

- 8.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 8.2.1. Fixed-wing Aircraft

- 8.2.2. Helicopters

- 8.1. Market Analysis, Insights and Forecast - by Mechanism

- 9. Latin America Aircraft Seat Actuation System Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Mechanism

- 9.1.1. Linear

- 9.1.2. Rotary

- 9.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 9.2.1. Fixed-wing Aircraft

- 9.2.2. Helicopters

- 9.1. Market Analysis, Insights and Forecast - by Mechanism

- 10. Middle East and Africa Aircraft Seat Actuation System Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Mechanism

- 10.1.1. Linear

- 10.1.2. Rotary

- 10.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 10.2.1. Fixed-wing Aircraft

- 10.2.2. Helicopters

- 10.1. Market Analysis, Insights and Forecast - by Mechanism

- 11. North America Aircraft Seat Actuation System Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Aircraft Seat Actuation System Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United Kingdom

- 12.1.2 France

- 12.1.3 Germany

- 12.1.4 Rest of Europe

- 13. Asia Pacific Aircraft Seat Actuation System Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 India

- 13.1.3 Japan

- 13.1.4 South Korea

- 13.1.5 Rest of Asia Pacific

- 14. Latin America Aircraft Seat Actuation System Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Rest of Latin America

- 15. Middle East and Africa Aircraft Seat Actuation System Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Saudi Arabia

- 15.1.2 United Arab Emirates

- 15.1.3 Egypt

- 15.1.4 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Astronics Corporation

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Meggitt PLC

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 AMETEK Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 OTM Servo Mechanisms Limite

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Buhler Motor GmbH

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 CEF Industries LLC

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 ElectroCraft Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Safran SA

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Rollon SpA

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 ITT Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Lee Air Inc

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Kyntronics

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Crane Co

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 NOOK Industries Inc

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.1 Astronics Corporation

List of Figures

- Figure 1: Global Aircraft Seat Actuation System Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Aircraft Seat Actuation System Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Aircraft Seat Actuation System Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Aircraft Seat Actuation System Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Aircraft Seat Actuation System Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Aircraft Seat Actuation System Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Aircraft Seat Actuation System Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Aircraft Seat Actuation System Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Aircraft Seat Actuation System Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Aircraft Seat Actuation System Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Aircraft Seat Actuation System Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Aircraft Seat Actuation System Industry Revenue (Million), by Mechanism 2024 & 2032

- Figure 13: North America Aircraft Seat Actuation System Industry Revenue Share (%), by Mechanism 2024 & 2032

- Figure 14: North America Aircraft Seat Actuation System Industry Revenue (Million), by Aircraft Type 2024 & 2032

- Figure 15: North America Aircraft Seat Actuation System Industry Revenue Share (%), by Aircraft Type 2024 & 2032

- Figure 16: North America Aircraft Seat Actuation System Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Aircraft Seat Actuation System Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Aircraft Seat Actuation System Industry Revenue (Million), by Mechanism 2024 & 2032

- Figure 19: Europe Aircraft Seat Actuation System Industry Revenue Share (%), by Mechanism 2024 & 2032

- Figure 20: Europe Aircraft Seat Actuation System Industry Revenue (Million), by Aircraft Type 2024 & 2032

- Figure 21: Europe Aircraft Seat Actuation System Industry Revenue Share (%), by Aircraft Type 2024 & 2032

- Figure 22: Europe Aircraft Seat Actuation System Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Aircraft Seat Actuation System Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Aircraft Seat Actuation System Industry Revenue (Million), by Mechanism 2024 & 2032

- Figure 25: Asia Pacific Aircraft Seat Actuation System Industry Revenue Share (%), by Mechanism 2024 & 2032

- Figure 26: Asia Pacific Aircraft Seat Actuation System Industry Revenue (Million), by Aircraft Type 2024 & 2032

- Figure 27: Asia Pacific Aircraft Seat Actuation System Industry Revenue Share (%), by Aircraft Type 2024 & 2032

- Figure 28: Asia Pacific Aircraft Seat Actuation System Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Aircraft Seat Actuation System Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Aircraft Seat Actuation System Industry Revenue (Million), by Mechanism 2024 & 2032

- Figure 31: Latin America Aircraft Seat Actuation System Industry Revenue Share (%), by Mechanism 2024 & 2032

- Figure 32: Latin America Aircraft Seat Actuation System Industry Revenue (Million), by Aircraft Type 2024 & 2032

- Figure 33: Latin America Aircraft Seat Actuation System Industry Revenue Share (%), by Aircraft Type 2024 & 2032

- Figure 34: Latin America Aircraft Seat Actuation System Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Aircraft Seat Actuation System Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Aircraft Seat Actuation System Industry Revenue (Million), by Mechanism 2024 & 2032

- Figure 37: Middle East and Africa Aircraft Seat Actuation System Industry Revenue Share (%), by Mechanism 2024 & 2032

- Figure 38: Middle East and Africa Aircraft Seat Actuation System Industry Revenue (Million), by Aircraft Type 2024 & 2032

- Figure 39: Middle East and Africa Aircraft Seat Actuation System Industry Revenue Share (%), by Aircraft Type 2024 & 2032

- Figure 40: Middle East and Africa Aircraft Seat Actuation System Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Aircraft Seat Actuation System Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Aircraft Seat Actuation System Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Aircraft Seat Actuation System Industry Revenue Million Forecast, by Mechanism 2019 & 2032

- Table 3: Global Aircraft Seat Actuation System Industry Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 4: Global Aircraft Seat Actuation System Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Aircraft Seat Actuation System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Aircraft Seat Actuation System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Aircraft Seat Actuation System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Aircraft Seat Actuation System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United Kingdom Aircraft Seat Actuation System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: France Aircraft Seat Actuation System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Germany Aircraft Seat Actuation System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Aircraft Seat Actuation System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Aircraft Seat Actuation System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: China Aircraft Seat Actuation System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: India Aircraft Seat Actuation System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Japan Aircraft Seat Actuation System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: South Korea Aircraft Seat Actuation System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Asia Pacific Aircraft Seat Actuation System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Aircraft Seat Actuation System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Brazil Aircraft Seat Actuation System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Latin America Aircraft Seat Actuation System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Aircraft Seat Actuation System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Saudi Arabia Aircraft Seat Actuation System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: United Arab Emirates Aircraft Seat Actuation System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Egypt Aircraft Seat Actuation System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Middle East and Africa Aircraft Seat Actuation System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Aircraft Seat Actuation System Industry Revenue Million Forecast, by Mechanism 2019 & 2032

- Table 28: Global Aircraft Seat Actuation System Industry Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 29: Global Aircraft Seat Actuation System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: United States Aircraft Seat Actuation System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Canada Aircraft Seat Actuation System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Aircraft Seat Actuation System Industry Revenue Million Forecast, by Mechanism 2019 & 2032

- Table 33: Global Aircraft Seat Actuation System Industry Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 34: Global Aircraft Seat Actuation System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 35: United Kingdom Aircraft Seat Actuation System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: France Aircraft Seat Actuation System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Germany Aircraft Seat Actuation System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Europe Aircraft Seat Actuation System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Aircraft Seat Actuation System Industry Revenue Million Forecast, by Mechanism 2019 & 2032

- Table 40: Global Aircraft Seat Actuation System Industry Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 41: Global Aircraft Seat Actuation System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 42: China Aircraft Seat Actuation System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: India Aircraft Seat Actuation System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Japan Aircraft Seat Actuation System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: South Korea Aircraft Seat Actuation System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Rest of Asia Pacific Aircraft Seat Actuation System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Global Aircraft Seat Actuation System Industry Revenue Million Forecast, by Mechanism 2019 & 2032

- Table 48: Global Aircraft Seat Actuation System Industry Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 49: Global Aircraft Seat Actuation System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 50: Brazil Aircraft Seat Actuation System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Rest of Latin America Aircraft Seat Actuation System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Global Aircraft Seat Actuation System Industry Revenue Million Forecast, by Mechanism 2019 & 2032

- Table 53: Global Aircraft Seat Actuation System Industry Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 54: Global Aircraft Seat Actuation System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 55: Saudi Arabia Aircraft Seat Actuation System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: United Arab Emirates Aircraft Seat Actuation System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Egypt Aircraft Seat Actuation System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Middle East and Africa Aircraft Seat Actuation System Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aircraft Seat Actuation System Industry?

The projected CAGR is approximately 2.41%.

2. Which companies are prominent players in the Aircraft Seat Actuation System Industry?

Key companies in the market include Astronics Corporation, Meggitt PLC, AMETEK Inc, OTM Servo Mechanisms Limite, Buhler Motor GmbH, CEF Industries LLC, ElectroCraft Inc, Safran SA, Rollon SpA, ITT Inc, Lee Air Inc, Kyntronics, Crane Co, NOOK Industries Inc.

3. What are the main segments of the Aircraft Seat Actuation System Industry?

The market segments include Mechanism, Aircraft Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 337.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

The Fixed-wing Aircraft Segment Accounted for Major Revenue Share in 2021.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

In September 2021, Recaro Aircraft Seating was selected to equip Qatar Airways's new A321neo fleet with the brand-new CL3810 economy class seat. The company will begin to equip the new CL3810 seats 20 A321neo aircraft from the end of 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aircraft Seat Actuation System Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aircraft Seat Actuation System Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aircraft Seat Actuation System Industry?

To stay informed about further developments, trends, and reports in the Aircraft Seat Actuation System Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence