Key Insights

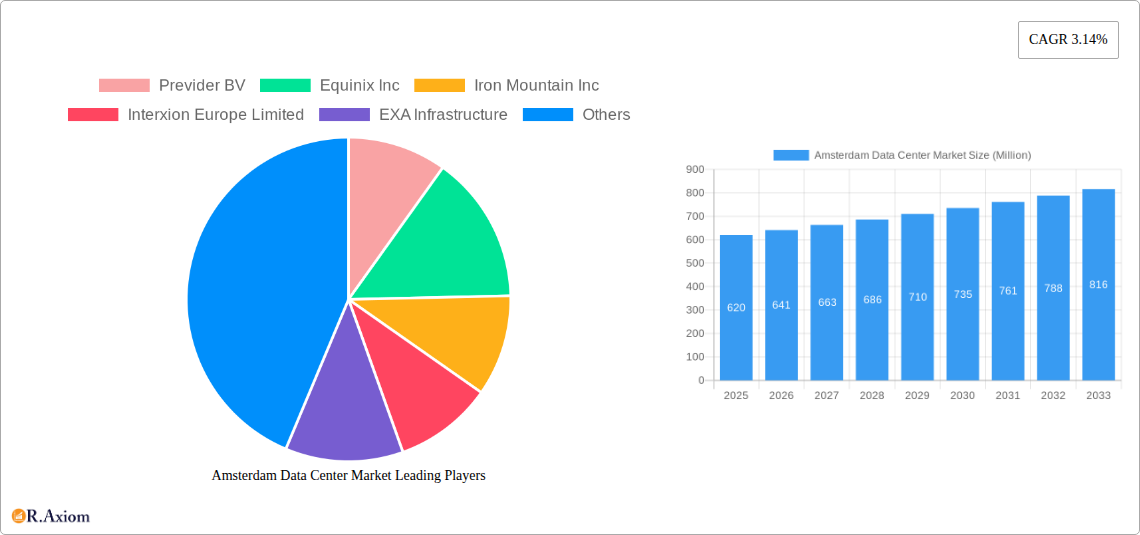

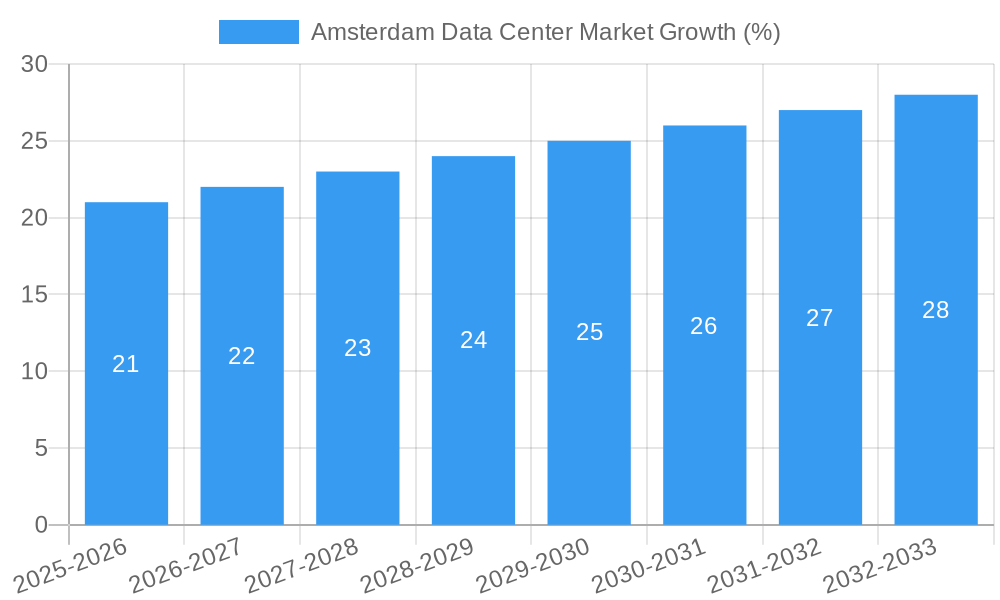

The Amsterdam data center market is experiencing robust growth, driven by factors such as increasing cloud adoption, the rise of big data analytics, and the Netherlands' strategic location as a digital gateway to Europe. The market's strong CAGR of 3.14% indicates sustained expansion throughout the forecast period (2025-2033). While precise market size figures for 2025 are unavailable, extrapolating from the provided CAGR and assuming a reasonable base year market size (e.g., €500 million in 2019, a figure consistent with similar European markets), a 2025 market size exceeding €600 million is plausible. Key market segments include large and hyperscale colocation facilities catering to the growing needs of cloud providers and IT companies. The strong presence of major players like Equinix, Interxion, and others indicates a competitive but mature market landscape with significant ongoing investment. Growth is further fueled by increasing demand from the Telecom, Media & Entertainment, and BFSI sectors. While regulatory hurdles and land availability could potentially constrain expansion, the overall outlook for the Amsterdam data center market remains positive, driven by technological advancements and evolving business needs.

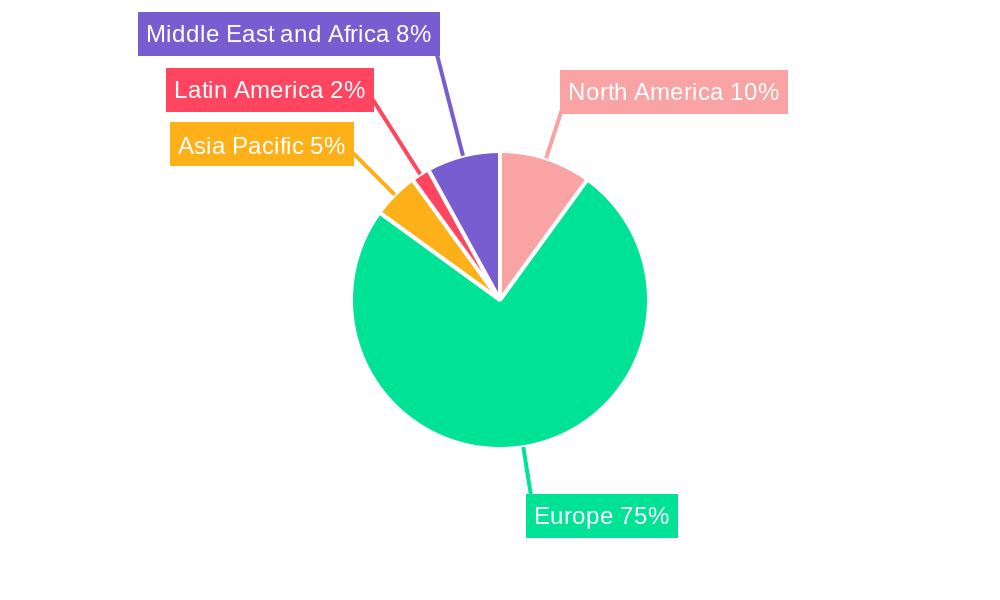

The Amsterdam data center market's segmentation reveals a strong focus on larger facilities, reflecting the requirements of hyperscale cloud providers and major enterprises. The utilized capacity within these facilities indicates high demand, pointing toward further investment in expansion and development of new sites to meet future requirements. Retail colocation remains a significant part of the market, providing options for smaller businesses and startups, ensuring a diverse range of services to meet varied customer needs. Geographic analysis, while lacking precise figures, suggests a significant portion of the market share resides within Europe, with Amsterdam benefiting from its central location and robust digital infrastructure. Further growth is expected from within the European region, driven by increasing digital transformation across multiple sectors. The presence of numerous international data center providers demonstrates Amsterdam’s standing as a crucial European hub.

Amsterdam Data Center Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Amsterdam data center market, covering market size, segmentation, key players, industry trends, and future outlook. The report utilizes data from the historical period (2019-2024), base year (2025), and estimated year (2025) to forecast market trends until 2033. It's an essential resource for industry stakeholders, investors, and businesses seeking to understand and capitalize on opportunities within this dynamic market.

Amsterdam Data Center Market Market Concentration & Innovation

The Amsterdam data center market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the presence of numerous smaller players and ongoing M&A activity contributes to a dynamic competitive environment. Innovation is driven by the increasing demand for high-capacity, energy-efficient, and sustainable data center solutions. The regulatory framework, while generally supportive of data center development, is constantly evolving to address issues related to energy consumption and data privacy. Product substitutes, such as cloud computing services, exert competitive pressure, while end-user trends toward digital transformation fuel market growth.

- Market Share (MW): Equinix Inc. holds an estimated xx% market share, followed by Interxion Europe Limited at xx%, and Iron Mountain Inc. at xx%. The remaining market share is distributed among numerous smaller players, including Previder BV, NorthC Group BV, and others. (Note: Precise market share data is unavailable and represented with xx; further market research is needed.)

- M&A Activity: Recent deals like the Berenberg Digital Infrastructure Fund's financing for AMS3 Data Centre highlight the ongoing investment in the Amsterdam market. While precise deal values for all transactions are unavailable, these activities indicate considerable investor confidence.

Amsterdam Data Center Market Industry Trends & Insights

The Amsterdam data center market is experiencing robust growth, driven by factors including the increasing adoption of cloud computing, the rise of big data analytics, and the expansion of digital infrastructure across various sectors. Technological disruptions, such as the increasing use of AI and edge computing, are further shaping market dynamics. Consumer preferences are shifting toward more sustainable and environmentally friendly data center solutions. The competitive landscape is characterized by intense competition among established players and the emergence of new entrants, leading to ongoing innovation and price pressures. The CAGR for the Amsterdam data center market during the forecast period (2025-2033) is projected to be xx%. Market penetration is expected to reach xx% by 2033, indicating considerable growth potential.

Dominant Markets & Segments in Amsterdam Data Center Market

The Amsterdam data center market is dominated by the Large and Mega data center size segments, driven by the requirements of hyperscale cloud providers and large enterprises. Within Tier types, Tier III facilities are the most prevalent, offering a balance between reliability and cost-effectiveness. The Utilized absorption segment naturally dominates, indicating the high demand for data center capacity. Retail colocation services represent a significant segment of the market, followed by Wholesale and Hyperscale offerings. The Cloud and IT sector represents the largest end-user segment, followed by the Telecom industry.

- Key Drivers:

- Strong digital economy: Amsterdam’s established position as a major European tech hub drives demand.

- Excellent connectivity: Robust fiber optic infrastructure supports high bandwidth needs.

- Government support: Supportive policies encourage data center investment.

- Talent pool: A skilled workforce is available to support the sector.

Amsterdam Data Center Market Product Developments

Recent product innovations focus on enhancing energy efficiency, improving cooling systems, and optimizing security features. The adoption of modular data center designs and the increasing use of AI-powered management tools are improving operational efficiency and reducing costs. These developments align with the market's increasing demand for environmentally conscious solutions and higher operational efficiency.

Report Scope & Segmentation Analysis

This report comprehensively segments the Amsterdam data center market across several parameters:

- DC Size: Small, Medium, Large, Massive, Mega. Each segment's growth is projected based on current trends and future demand forecasts, highlighting market size and competitive intensity within each category.

- Tier Type: Tier I, Tier II, Tier III, Tier IV. The report analyzes the distribution across tier levels and the driving factors behind the growth of each tier.

- Absorption: Utilized, Non-utilized. This analysis focuses on capacity utilization rates and identifies growth opportunities in both segments.

- Colocation Type: Retail, Wholesale, Hyperscale. It dives deep into the market share of different colocation models and growth potential.

- End User: Cloud and IT, Telecom, Media and Entertainment, Government, BFSI, Manufacturing, E-commerce, Other End User. The report analyzes sector-specific growth drivers and challenges influencing the demand for data center services.

Key Drivers of Amsterdam Data Center Market Growth

The Amsterdam data center market’s growth is fueled by several key factors: the booming digital economy, the increasing demand for cloud services, the rise of big data and IoT applications, and the favorable regulatory environment. Amsterdam's strategic location in Europe and robust digital infrastructure further enhance its attractiveness as a data center hub. Government initiatives promoting digitalization and investment in infrastructure are also contributing to growth.

Challenges in the Amsterdam Data Center Market Sector

Key challenges include energy consumption constraints, increasing land scarcity, and rising operational costs. Competition from established and emerging players creates price pressure. Regulatory hurdles and environmental concerns regarding energy use and sustainability pose ongoing challenges for data center operators. The total economic impact from these challenges is predicted to be around xx Million in lost revenue by 2033.

Emerging Opportunities in Amsterdam Data Center Market

Emerging opportunities include the expansion of edge computing, the growing demand for sustainable data centers, and the increasing adoption of AI and machine learning in data center management. New market segments, such as the healthcare and finance sectors, are also creating new growth prospects. Investment in advanced cooling technologies and renewable energy sources presents significant opportunities for innovation and market differentiation.

Leading Players in the Amsterdam Data Center Market Market

- Previder BV

- Equinix Inc.

- Iron Mountain Inc.

- Interxion Europe Limited

- EXA Infrastructure

- NorthC Group BV

- Keppel Data Center Pte Ltd

- AtlasEdge LLC

- EdgeConneX Inc

- Switch Datacenters Group

- CyrusOne Inc

- Global Switch Holdings Limited

- ColoHouse LLC

- NTT Ltd

Key Developments in Amsterdam Data Center Market Industry

- December 2022: Equinix Inc. announced a commitment to reduce power consumption by increasing data center operating temperatures, aiming for more efficient cooling and lower carbon footprints.

- May 2022: Berenberg Digital Infrastructure Fund provided financing for Angelo Gordon's AMS3 Data Centre in Amsterdam, highlighting continued investment in the market.

Strategic Outlook for Amsterdam Data Center Market Market

The Amsterdam data center market is poised for continued growth, driven by sustained demand from various sectors and technological advancements. Opportunities exist in developing sustainable and efficient data center solutions, expanding edge computing infrastructure, and capitalizing on the growth of emerging technologies. The market's future hinges on addressing challenges related to energy consumption, land availability, and competition while embracing innovation and sustainability.

Amsterdam Data Center Market Segmentation

-

1. DC Size

- 1.1. Small

- 1.2. Medium

- 1.3. Large

- 1.4. Massive

- 1.5. Mega

-

2. Tier Type

- 2.1. Tier 1 & 2

- 2.2. Tier 3

- 2.3. Tier 4

-

3. Absorption

-

3.1. Utilized

-

3.1.1. Colocation Type

- 3.1.1.1. Retail

- 3.1.1.2. Wholesale

- 3.1.1.3. Hyperscale

-

3.1.2. End User

- 3.1.2.1. Cloud and IT

- 3.1.2.2. Telecom

- 3.1.2.3. Media and Entertainment

- 3.1.2.4. Government

- 3.1.2.5. BFSI

- 3.1.2.6. Manufacturing

- 3.1.2.7. E-commerce

- 3.1.2.8. Other End User

-

3.1.1. Colocation Type

- 3.2. Non-utilized

-

3.1. Utilized

Amsterdam Data Center Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Amsterdam Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.14% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Deployment of Data Center Facilities; Growing Cloud Computing Adoption Leading to Investment in Hyperscale Data Centers; BFSI Sector Expected to Hold a Significant Share

- 3.3. Market Restrains

- 3.3.1. Increasing Utilization of Blade Servers

- 3.4. Market Trends

- 3.4.1. Tier 4 is Expected to Hold Significant Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Amsterdam Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 5.1.1. Small

- 5.1.2. Medium

- 5.1.3. Large

- 5.1.4. Massive

- 5.1.5. Mega

- 5.2. Market Analysis, Insights and Forecast - by Tier Type

- 5.2.1. Tier 1 & 2

- 5.2.2. Tier 3

- 5.2.3. Tier 4

- 5.3. Market Analysis, Insights and Forecast - by Absorption

- 5.3.1. Utilized

- 5.3.1.1. Colocation Type

- 5.3.1.1.1. Retail

- 5.3.1.1.2. Wholesale

- 5.3.1.1.3. Hyperscale

- 5.3.1.2. End User

- 5.3.1.2.1. Cloud and IT

- 5.3.1.2.2. Telecom

- 5.3.1.2.3. Media and Entertainment

- 5.3.1.2.4. Government

- 5.3.1.2.5. BFSI

- 5.3.1.2.6. Manufacturing

- 5.3.1.2.7. E-commerce

- 5.3.1.2.8. Other End User

- 5.3.1.1. Colocation Type

- 5.3.2. Non-utilized

- 5.3.1. Utilized

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 6. North America Amsterdam Data Center Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by DC Size

- 6.1.1. Small

- 6.1.2. Medium

- 6.1.3. Large

- 6.1.4. Massive

- 6.1.5. Mega

- 6.2. Market Analysis, Insights and Forecast - by Tier Type

- 6.2.1. Tier 1 & 2

- 6.2.2. Tier 3

- 6.2.3. Tier 4

- 6.3. Market Analysis, Insights and Forecast - by Absorption

- 6.3.1. Utilized

- 6.3.1.1. Colocation Type

- 6.3.1.1.1. Retail

- 6.3.1.1.2. Wholesale

- 6.3.1.1.3. Hyperscale

- 6.3.1.2. End User

- 6.3.1.2.1. Cloud and IT

- 6.3.1.2.2. Telecom

- 6.3.1.2.3. Media and Entertainment

- 6.3.1.2.4. Government

- 6.3.1.2.5. BFSI

- 6.3.1.2.6. Manufacturing

- 6.3.1.2.7. E-commerce

- 6.3.1.2.8. Other End User

- 6.3.1.1. Colocation Type

- 6.3.2. Non-utilized

- 6.3.1. Utilized

- 6.1. Market Analysis, Insights and Forecast - by DC Size

- 7. South America Amsterdam Data Center Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by DC Size

- 7.1.1. Small

- 7.1.2. Medium

- 7.1.3. Large

- 7.1.4. Massive

- 7.1.5. Mega

- 7.2. Market Analysis, Insights and Forecast - by Tier Type

- 7.2.1. Tier 1 & 2

- 7.2.2. Tier 3

- 7.2.3. Tier 4

- 7.3. Market Analysis, Insights and Forecast - by Absorption

- 7.3.1. Utilized

- 7.3.1.1. Colocation Type

- 7.3.1.1.1. Retail

- 7.3.1.1.2. Wholesale

- 7.3.1.1.3. Hyperscale

- 7.3.1.2. End User

- 7.3.1.2.1. Cloud and IT

- 7.3.1.2.2. Telecom

- 7.3.1.2.3. Media and Entertainment

- 7.3.1.2.4. Government

- 7.3.1.2.5. BFSI

- 7.3.1.2.6. Manufacturing

- 7.3.1.2.7. E-commerce

- 7.3.1.2.8. Other End User

- 7.3.1.1. Colocation Type

- 7.3.2. Non-utilized

- 7.3.1. Utilized

- 7.1. Market Analysis, Insights and Forecast - by DC Size

- 8. Europe Amsterdam Data Center Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by DC Size

- 8.1.1. Small

- 8.1.2. Medium

- 8.1.3. Large

- 8.1.4. Massive

- 8.1.5. Mega

- 8.2. Market Analysis, Insights and Forecast - by Tier Type

- 8.2.1. Tier 1 & 2

- 8.2.2. Tier 3

- 8.2.3. Tier 4

- 8.3. Market Analysis, Insights and Forecast - by Absorption

- 8.3.1. Utilized

- 8.3.1.1. Colocation Type

- 8.3.1.1.1. Retail

- 8.3.1.1.2. Wholesale

- 8.3.1.1.3. Hyperscale

- 8.3.1.2. End User

- 8.3.1.2.1. Cloud and IT

- 8.3.1.2.2. Telecom

- 8.3.1.2.3. Media and Entertainment

- 8.3.1.2.4. Government

- 8.3.1.2.5. BFSI

- 8.3.1.2.6. Manufacturing

- 8.3.1.2.7. E-commerce

- 8.3.1.2.8. Other End User

- 8.3.1.1. Colocation Type

- 8.3.2. Non-utilized

- 8.3.1. Utilized

- 8.1. Market Analysis, Insights and Forecast - by DC Size

- 9. Middle East & Africa Amsterdam Data Center Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by DC Size

- 9.1.1. Small

- 9.1.2. Medium

- 9.1.3. Large

- 9.1.4. Massive

- 9.1.5. Mega

- 9.2. Market Analysis, Insights and Forecast - by Tier Type

- 9.2.1. Tier 1 & 2

- 9.2.2. Tier 3

- 9.2.3. Tier 4

- 9.3. Market Analysis, Insights and Forecast - by Absorption

- 9.3.1. Utilized

- 9.3.1.1. Colocation Type

- 9.3.1.1.1. Retail

- 9.3.1.1.2. Wholesale

- 9.3.1.1.3. Hyperscale

- 9.3.1.2. End User

- 9.3.1.2.1. Cloud and IT

- 9.3.1.2.2. Telecom

- 9.3.1.2.3. Media and Entertainment

- 9.3.1.2.4. Government

- 9.3.1.2.5. BFSI

- 9.3.1.2.6. Manufacturing

- 9.3.1.2.7. E-commerce

- 9.3.1.2.8. Other End User

- 9.3.1.1. Colocation Type

- 9.3.2. Non-utilized

- 9.3.1. Utilized

- 9.1. Market Analysis, Insights and Forecast - by DC Size

- 10. Asia Pacific Amsterdam Data Center Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by DC Size

- 10.1.1. Small

- 10.1.2. Medium

- 10.1.3. Large

- 10.1.4. Massive

- 10.1.5. Mega

- 10.2. Market Analysis, Insights and Forecast - by Tier Type

- 10.2.1. Tier 1 & 2

- 10.2.2. Tier 3

- 10.2.3. Tier 4

- 10.3. Market Analysis, Insights and Forecast - by Absorption

- 10.3.1. Utilized

- 10.3.1.1. Colocation Type

- 10.3.1.1.1. Retail

- 10.3.1.1.2. Wholesale

- 10.3.1.1.3. Hyperscale

- 10.3.1.2. End User

- 10.3.1.2.1. Cloud and IT

- 10.3.1.2.2. Telecom

- 10.3.1.2.3. Media and Entertainment

- 10.3.1.2.4. Government

- 10.3.1.2.5. BFSI

- 10.3.1.2.6. Manufacturing

- 10.3.1.2.7. E-commerce

- 10.3.1.2.8. Other End User

- 10.3.1.1. Colocation Type

- 10.3.2. Non-utilized

- 10.3.1. Utilized

- 10.1. Market Analysis, Insights and Forecast - by DC Size

- 11. North America Amsterdam Data Center Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Amsterdam Data Center Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Amsterdam Data Center Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Amsterdam Data Center Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Amsterdam Data Center Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Previder BV

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Equinix Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Iron Mountain Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Interxion Europe Limited

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 EXA Infrastructure

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 NorthC Group BV

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Keppel Data Center Pte Ltd

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 AtlasEdge LLC

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 EdgeConneX Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Switch Datacenters Group*List Not Exhaustive 7 2 Market Share Analysis (In terms of MW)7 3 List of Companie

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 CyrusOne Inc

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Global Switch Holdings Limited

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 ColoHouse LLC

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 NTT Ltd

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.1 Previder BV

List of Figures

- Figure 1: Global Amsterdam Data Center Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Amsterdam Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Amsterdam Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Amsterdam Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Amsterdam Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Amsterdam Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Amsterdam Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Amsterdam Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Amsterdam Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Amsterdam Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Amsterdam Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Amsterdam Data Center Market Revenue (Million), by DC Size 2024 & 2032

- Figure 13: North America Amsterdam Data Center Market Revenue Share (%), by DC Size 2024 & 2032

- Figure 14: North America Amsterdam Data Center Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 15: North America Amsterdam Data Center Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 16: North America Amsterdam Data Center Market Revenue (Million), by Absorption 2024 & 2032

- Figure 17: North America Amsterdam Data Center Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 18: North America Amsterdam Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Amsterdam Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: South America Amsterdam Data Center Market Revenue (Million), by DC Size 2024 & 2032

- Figure 21: South America Amsterdam Data Center Market Revenue Share (%), by DC Size 2024 & 2032

- Figure 22: South America Amsterdam Data Center Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 23: South America Amsterdam Data Center Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 24: South America Amsterdam Data Center Market Revenue (Million), by Absorption 2024 & 2032

- Figure 25: South America Amsterdam Data Center Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 26: South America Amsterdam Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 27: South America Amsterdam Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Europe Amsterdam Data Center Market Revenue (Million), by DC Size 2024 & 2032

- Figure 29: Europe Amsterdam Data Center Market Revenue Share (%), by DC Size 2024 & 2032

- Figure 30: Europe Amsterdam Data Center Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 31: Europe Amsterdam Data Center Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 32: Europe Amsterdam Data Center Market Revenue (Million), by Absorption 2024 & 2032

- Figure 33: Europe Amsterdam Data Center Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 34: Europe Amsterdam Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Europe Amsterdam Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East & Africa Amsterdam Data Center Market Revenue (Million), by DC Size 2024 & 2032

- Figure 37: Middle East & Africa Amsterdam Data Center Market Revenue Share (%), by DC Size 2024 & 2032

- Figure 38: Middle East & Africa Amsterdam Data Center Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 39: Middle East & Africa Amsterdam Data Center Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 40: Middle East & Africa Amsterdam Data Center Market Revenue (Million), by Absorption 2024 & 2032

- Figure 41: Middle East & Africa Amsterdam Data Center Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 42: Middle East & Africa Amsterdam Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East & Africa Amsterdam Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: Asia Pacific Amsterdam Data Center Market Revenue (Million), by DC Size 2024 & 2032

- Figure 45: Asia Pacific Amsterdam Data Center Market Revenue Share (%), by DC Size 2024 & 2032

- Figure 46: Asia Pacific Amsterdam Data Center Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 47: Asia Pacific Amsterdam Data Center Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 48: Asia Pacific Amsterdam Data Center Market Revenue (Million), by Absorption 2024 & 2032

- Figure 49: Asia Pacific Amsterdam Data Center Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 50: Asia Pacific Amsterdam Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 51: Asia Pacific Amsterdam Data Center Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Amsterdam Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Amsterdam Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 3: Global Amsterdam Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 4: Global Amsterdam Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 5: Global Amsterdam Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Amsterdam Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Amsterdam Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Amsterdam Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Amsterdam Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Amsterdam Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Amsterdam Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 17: Global Amsterdam Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 18: Global Amsterdam Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 19: Global Amsterdam Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United States Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Canada Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Mexico Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Amsterdam Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 24: Global Amsterdam Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 25: Global Amsterdam Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 26: Global Amsterdam Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Brazil Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Argentina Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of South America Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Amsterdam Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 31: Global Amsterdam Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 32: Global Amsterdam Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 33: Global Amsterdam Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: United Kingdom Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Germany Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: France Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Italy Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Spain Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Russia Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Benelux Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Nordics Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Europe Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global Amsterdam Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 44: Global Amsterdam Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 45: Global Amsterdam Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 46: Global Amsterdam Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 47: Turkey Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Israel Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: GCC Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: North Africa Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: South Africa Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Rest of Middle East & Africa Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Global Amsterdam Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 54: Global Amsterdam Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 55: Global Amsterdam Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 56: Global Amsterdam Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 57: China Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: India Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Japan Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: South Korea Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: ASEAN Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Oceania Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Rest of Asia Pacific Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Amsterdam Data Center Market?

The projected CAGR is approximately 3.14%.

2. Which companies are prominent players in the Amsterdam Data Center Market?

Key companies in the market include Previder BV, Equinix Inc, Iron Mountain Inc, Interxion Europe Limited, EXA Infrastructure, NorthC Group BV, Keppel Data Center Pte Ltd, AtlasEdge LLC, EdgeConneX Inc, Switch Datacenters Group*List Not Exhaustive 7 2 Market Share Analysis (In terms of MW)7 3 List of Companie, CyrusOne Inc, Global Switch Holdings Limited, ColoHouse LLC, NTT Ltd.

3. What are the main segments of the Amsterdam Data Center Market?

The market segments include DC Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Deployment of Data Center Facilities; Growing Cloud Computing Adoption Leading to Investment in Hyperscale Data Centers; BFSI Sector Expected to Hold a Significant Share.

6. What are the notable trends driving market growth?

Tier 4 is Expected to Hold Significant Share of the Market.

7. Are there any restraints impacting market growth?

Increasing Utilization of Blade Servers.

8. Can you provide examples of recent developments in the market?

December 2022: Equinix Inc., the world's digital infrastructure firm, announced the first pledge by a colocation data center operator to reduce overall power consumption by increasing operating temperature ranges within its data centers. Equinix will begin defining a multi-year global roadmap for thermal operations within its data centers immediately, aiming for much more efficient cooling and lower carbon footprints while maintaining the premium operating environment for which the company is recognized. This program is expected to help thousands of Equinix customers to reduce the Scope 3 carbon emissions connected with their data center operations over time as supply chain sustainability becomes an increasingly essential aspect of today's enterprises' total environmental activities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Amsterdam Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Amsterdam Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Amsterdam Data Center Market?

To stay informed about further developments, trends, and reports in the Amsterdam Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence