Key Insights

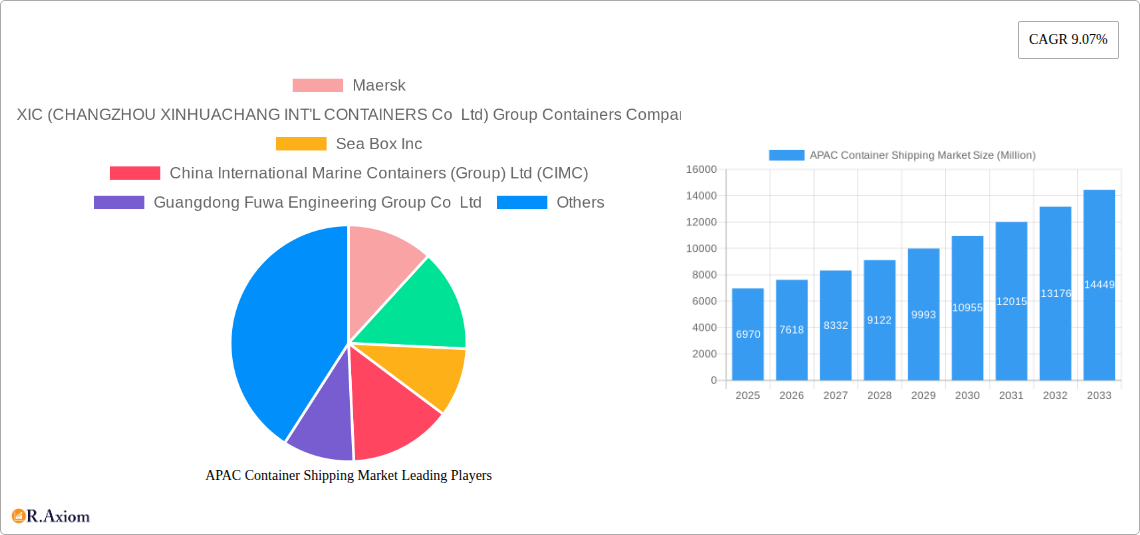

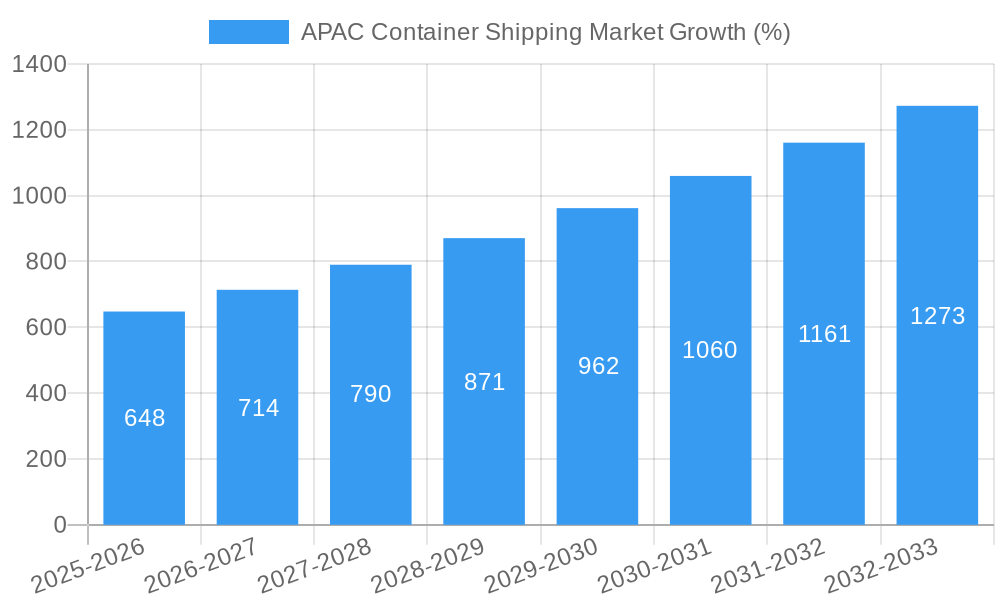

The Asia-Pacific (APAC) container shipping market, valued at $6.97 billion in 2025, is projected to experience robust growth, driven by the region's expanding e-commerce sector, rising industrialization, and increasing cross-border trade. A Compound Annual Growth Rate (CAGR) of 9.07% from 2025 to 2033 indicates a significant market expansion, fueled by infrastructure development initiatives across several APAC nations and the consequent surge in cargo volume. The market's segmentation reveals substantial opportunities across various container sizes (small, large, high-cube), transportation modes (road, sea, rail, air), and key countries like China, India, and others. China's dominance as a manufacturing hub and its robust export-oriented economy significantly influence the overall market growth. However, factors like fluctuating fuel prices, geopolitical uncertainties, and port congestion pose challenges to consistent market expansion. The rising adoption of technological advancements like digitalization in logistics and supply chain management will contribute significantly to optimizing operational efficiency and driving overall market growth. Growth will also depend on the successful integration of multimodal transportation systems and improved port infrastructure to address capacity constraints and reduce transportation times.

The competitive landscape is characterized by both global giants like Maersk and regional players such as CIMC. This competition fosters innovation and efficiency improvements within the industry. The market's future growth will depend on adapting to evolving consumer demands, addressing sustainability concerns through eco-friendly shipping practices, and proactively managing supply chain disruptions. Strategic alliances and mergers & acquisitions will likely shape the industry's consolidation. Furthermore, continuous investment in infrastructure and technology, alongside improved regulatory frameworks will positively influence the expansion of the APAC container shipping market during the forecast period (2025-2033). The considerable growth potential justifies sustained interest from investors and stakeholders across various segments of this dynamic market.

APAC Container Shipping Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific (APAC) container shipping market, covering the period from 2019 to 2033. It offers invaluable insights into market dynamics, growth drivers, competitive landscape, and future opportunities for industry stakeholders. The report leverages rigorous research methodology and incorporates data from various sources to provide accurate market sizing, segmentation, and forecasting. With a focus on key players like Maersk, CIMC, and Singamas Container Holdings, this report is an essential resource for businesses operating in or seeking to enter the dynamic APAC container shipping sector. The report's base year is 2025, with estimations for the same year and forecasts extending to 2033. The historical period covered is 2019-2024.

APAC Container Shipping Market Market Concentration & Innovation

The APAC container shipping market exhibits a moderately concentrated structure, with a few major players holding significant market share. Maersk, for example, commands a substantial portion of the market, while other key players such as CIMC and Singamas Container Holdings Limited contribute significantly. However, the market also features a number of smaller, regional players who specialize in niche segments or geographic areas. This creates a competitive environment marked by both consolidation and fragmentation.

Market concentration is further analyzed through metrics such as the Herfindahl-Hirschman Index (HHI) and market share analysis, which are detailed in the full report. Innovation is a key driver, with companies continuously investing in technologies like digitalization, automation, and data analytics to enhance efficiency and improve service offerings. Recent M&A activities indicate a trend toward consolidation, aiming to improve economies of scale and expand market reach. Estimated deal values for these activities totaled xx Million during the study period.

- Regulatory Frameworks: Stringent safety and environmental regulations are shaping market dynamics, pushing companies towards greener solutions.

- Product Substitutes: The rise of alternative transportation modes, such as rail and road freight, poses a challenge to container shipping.

- End-User Trends: Growing e-commerce and cross-border trade are driving demand for container shipping services.

- M&A Activities: Consolidation through mergers and acquisitions is reshaping the competitive landscape, leading to greater efficiency and market share concentration.

APAC Container Shipping Market Industry Trends & Insights

The APAC container shipping market has experienced significant growth over recent years, driven by several factors. The robust economic growth across many APAC nations has fueled increased trade volumes. The burgeoning e-commerce sector, with its reliance on efficient logistics, has contributed significantly to demand. Technological advancements, including digitalization of supply chains, improved tracking systems, and autonomous vessel technology, are transforming the industry. However, the market also faces challenges such as fluctuations in global trade, geopolitical uncertainties, and environmental concerns.

The compound annual growth rate (CAGR) for the APAC container shipping market during the forecast period (2025-2033) is estimated at xx%. Market penetration of containerized freight within the overall cargo transport market in the region is also projected to increase during this period. Competitive dynamics are characterized by intense competition among established players and emerging entrants, prompting companies to invest in innovation, partnerships, and service differentiation. Consumer preferences are increasingly focused on efficiency, reliability, transparency and sustainability, influencing service provider strategies.

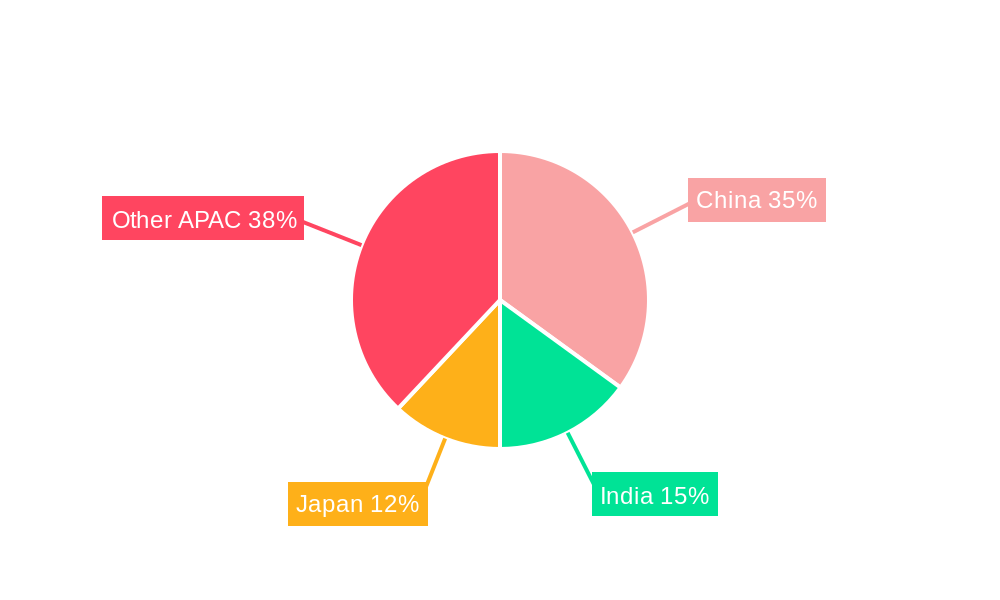

Dominant Markets & Segments in APAC Container Shipping Market

China remains the dominant market within the APAC container shipping sector, owing to its massive manufacturing base, extensive export activities, and well-developed port infrastructure. Other key markets include India, Japan, and Vietnam. These countries are characterized by high economic growth, expanding industrial sectors, and increasing reliance on container shipping for their global trade operations.

By Size: The Large container segment holds the largest market share, primarily driven by the high volume of goods requiring larger capacities. High Cube containers show robust growth due to the increasing demand for carrying tall and bulky goods.

By Mode of Transportation: Sea transportation remains the dominant mode due to its cost efficiency for long-distance shipments. However, road and rail transportation are gaining traction for shorter distances and last-mile delivery, optimizing logistics. Air transportation remains a niche segment due to its higher cost, typically used for high-value and time-sensitive goods.

By Country:

- China: Booming manufacturing and exports are key drivers.

- India: Rapid economic growth and expanding infrastructure are fostering growth.

- Japan: A mature market with a strong emphasis on efficiency and technology.

- Other Countries: Vietnam, Thailand, Indonesia, and other Southeast Asian nations are experiencing significant growth in the container shipping sector, fueled by industrial development, expanding economies, and increased global trade.

APAC Container Shipping Market Product Developments

Recent innovations focus on enhancing efficiency, tracking, and sustainability. Smart containers with integrated sensors provide real-time data on cargo conditions, while digital platforms streamline logistics processes. Companies are also increasingly adopting eco-friendly technologies to reduce environmental impact, including the use of alternative fuels and improved vessel designs. These advancements are improving cost-effectiveness and providing a competitive advantage in the market.

Report Scope & Segmentation Analysis

This report segments the APAC container shipping market in several ways to provide a comprehensive understanding of the market.

By Size: Small, Large, and High Cube containers are analyzed based on their capacity and usage in various industry segments. Growth projections and market sizes are provided for each segment.

By Mode of Transportation: Sea, Road, Rail, and Air transportation modes are examined, considering their individual characteristics and market share. Competitive dynamics within each mode are discussed.

By Country: The report analyzes the container shipping market in key APAC countries including Australia, Bangladesh, China, India, Indonesia, Japan, Pakistan, Philippines, Thailand, and Vietnam. Country-specific growth projections and factors driving market dynamics are explored.

Key Drivers of APAC Container Shipping Market Growth

Several factors are driving the growth of the APAC container shipping market. The robust economic growth in many APAC countries is increasing demand for goods transportation. The rise of e-commerce fuels the need for efficient and timely logistics. The development of infrastructure, such as new ports and improved transportation networks, enhances shipping efficiency. Technological advancements such as smart containers and digital platforms increase transparency and efficiency in the supply chain. Supportive government policies and regulations further stimulate market growth.

Challenges in the APAP Container Shipping Market Sector

The APAC container shipping market faces several challenges. Port congestion and capacity constraints in certain regions can lead to delays and increased costs. Fluctuations in global trade and economic uncertainty can impact shipping volumes. Geopolitical risks and disruptions can disrupt supply chains. Intense competition among shipping companies puts pressure on pricing and profit margins. Environmental regulations and the need for sustainable practices present both challenges and opportunities. The ongoing impact of these challenges on the market is quantified within the report.

Emerging Opportunities in APAC Container Shipping Market

The APAC container shipping market presents several promising opportunities. The growth of e-commerce and cross-border trade is creating new demand for logistics services. The development of new ports and improved infrastructure in emerging markets opens up opportunities for expansion. Technological advancements in automation, digitalization, and sustainable shipping provide opportunities for innovation and efficiency improvements. The growing focus on sustainability and environmental concerns presents opportunities for companies to invest in eco-friendly solutions and gain a competitive edge.

Leading Players in the APAC Container Shipping Market Market

- Maersk

- CXIC (CHANGZHOU XINHUACHANG INT'L CONTAINERS Co Ltd)

- Group Containers Company Limited

- Sea Box Inc

- China International Marine Containers (Group) Ltd (CIMC)

- Guangdong Fuwa Engineering Group Co Ltd

- Singamas Container Holdings Limited

- W&K Conatiners Ltd

- TLS Offshore Containers International Pvt Ltd

- Florens Asset Management Company Limited

- China Eastern Containers

Key Developments in APAC Container Shipping Market Industry

March 2023: Maersk launched the new Captain Peter Integrated package, enhancing data integration and customer access to shipment details. This improved transparency and data accessibility for customers.

April 2023: CIMC and POWIN established a joint venture to collaborate on energy storage solutions. This strategic partnership positions CIMC for growth in the burgeoning renewable energy sector and signifies a move towards sustainable practices within the container shipping industry.

Strategic Outlook for APAC Container Shipping Market Market

The APAC container shipping market is poised for continued growth, driven by favorable economic conditions, expanding trade volumes, and technological innovation. Opportunities exist in leveraging digital technologies to improve efficiency and customer service, expanding into emerging markets, and investing in sustainable practices. Companies that adapt to evolving market dynamics and invest in innovation will be well-positioned to capitalize on the significant growth potential within the APAC region.

APAC Container Shipping Market Segmentation

-

1. Size

- 1.1. Small

- 1.2. Large

- 1.3. High Cube Containers

-

2. Mode of Transportation

- 2.1. Road

- 2.2. Sea

- 2.3. Rail

- 2.4. Air

APAC Container Shipping Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

APAC Container Shipping Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.07% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand for Pharmaceutical Products4.; Increasing Demand for frozen persihable commodities

- 3.3. Market Restrains

- 3.3.1. 4.; Operational and Financial Challenges Associated with Reefer Containers

- 3.4. Market Trends

- 3.4.1. Preference for maritime trade over aerial trade growing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Container Shipping Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Size

- 5.1.1. Small

- 5.1.2. Large

- 5.1.3. High Cube Containers

- 5.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 5.2.1. Road

- 5.2.2. Sea

- 5.2.3. Rail

- 5.2.4. Air

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Size

- 6. North America APAC Container Shipping Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Size

- 6.1.1. Small

- 6.1.2. Large

- 6.1.3. High Cube Containers

- 6.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 6.2.1. Road

- 6.2.2. Sea

- 6.2.3. Rail

- 6.2.4. Air

- 6.1. Market Analysis, Insights and Forecast - by Size

- 7. South America APAC Container Shipping Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Size

- 7.1.1. Small

- 7.1.2. Large

- 7.1.3. High Cube Containers

- 7.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 7.2.1. Road

- 7.2.2. Sea

- 7.2.3. Rail

- 7.2.4. Air

- 7.1. Market Analysis, Insights and Forecast - by Size

- 8. Europe APAC Container Shipping Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Size

- 8.1.1. Small

- 8.1.2. Large

- 8.1.3. High Cube Containers

- 8.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 8.2.1. Road

- 8.2.2. Sea

- 8.2.3. Rail

- 8.2.4. Air

- 8.1. Market Analysis, Insights and Forecast - by Size

- 9. Middle East & Africa APAC Container Shipping Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Size

- 9.1.1. Small

- 9.1.2. Large

- 9.1.3. High Cube Containers

- 9.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 9.2.1. Road

- 9.2.2. Sea

- 9.2.3. Rail

- 9.2.4. Air

- 9.1. Market Analysis, Insights and Forecast - by Size

- 10. Asia Pacific APAC Container Shipping Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Size

- 10.1.1. Small

- 10.1.2. Large

- 10.1.3. High Cube Containers

- 10.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 10.2.1. Road

- 10.2.2. Sea

- 10.2.3. Rail

- 10.2.4. Air

- 10.1. Market Analysis, Insights and Forecast - by Size

- 11. Mexico APAC Container Shipping Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Brazil APAC Container Shipping Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Colombia APAC Container Shipping Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Rest Of Latin America APAC Container Shipping Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Maersk

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 CXIC (CHANGZHOU XINHUACHANG INT'L CONTAINERS Co Ltd) Group Containers Company Limited

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Sea Box Inc

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 China International Marine Containers (Group) Ltd (CIMC)

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Guangdong Fuwa Engineering Group Co Ltd

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Singamas Container Holdings Limited

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 W&K Conatiners Ltd **List Not Exhaustive

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 TLS Offshore Containers International Pvt Ltd

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 Florens Asset Management Company Limited

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 China Eastern Containers

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.1 Maersk

List of Figures

- Figure 1: Global APAC Container Shipping Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Mexico APAC Container Shipping Market Revenue (Million), by Country 2024 & 2032

- Figure 3: Mexico APAC Container Shipping Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Brazil APAC Container Shipping Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Brazil APAC Container Shipping Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Colombia APAC Container Shipping Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Colombia APAC Container Shipping Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest Of Latin America APAC Container Shipping Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest Of Latin America APAC Container Shipping Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America APAC Container Shipping Market Revenue (Million), by Size 2024 & 2032

- Figure 11: North America APAC Container Shipping Market Revenue Share (%), by Size 2024 & 2032

- Figure 12: North America APAC Container Shipping Market Revenue (Million), by Mode of Transportation 2024 & 2032

- Figure 13: North America APAC Container Shipping Market Revenue Share (%), by Mode of Transportation 2024 & 2032

- Figure 14: North America APAC Container Shipping Market Revenue (Million), by Country 2024 & 2032

- Figure 15: North America APAC Container Shipping Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: South America APAC Container Shipping Market Revenue (Million), by Size 2024 & 2032

- Figure 17: South America APAC Container Shipping Market Revenue Share (%), by Size 2024 & 2032

- Figure 18: South America APAC Container Shipping Market Revenue (Million), by Mode of Transportation 2024 & 2032

- Figure 19: South America APAC Container Shipping Market Revenue Share (%), by Mode of Transportation 2024 & 2032

- Figure 20: South America APAC Container Shipping Market Revenue (Million), by Country 2024 & 2032

- Figure 21: South America APAC Container Shipping Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Europe APAC Container Shipping Market Revenue (Million), by Size 2024 & 2032

- Figure 23: Europe APAC Container Shipping Market Revenue Share (%), by Size 2024 & 2032

- Figure 24: Europe APAC Container Shipping Market Revenue (Million), by Mode of Transportation 2024 & 2032

- Figure 25: Europe APAC Container Shipping Market Revenue Share (%), by Mode of Transportation 2024 & 2032

- Figure 26: Europe APAC Container Shipping Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe APAC Container Shipping Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East & Africa APAC Container Shipping Market Revenue (Million), by Size 2024 & 2032

- Figure 29: Middle East & Africa APAC Container Shipping Market Revenue Share (%), by Size 2024 & 2032

- Figure 30: Middle East & Africa APAC Container Shipping Market Revenue (Million), by Mode of Transportation 2024 & 2032

- Figure 31: Middle East & Africa APAC Container Shipping Market Revenue Share (%), by Mode of Transportation 2024 & 2032

- Figure 32: Middle East & Africa APAC Container Shipping Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Middle East & Africa APAC Container Shipping Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Asia Pacific APAC Container Shipping Market Revenue (Million), by Size 2024 & 2032

- Figure 35: Asia Pacific APAC Container Shipping Market Revenue Share (%), by Size 2024 & 2032

- Figure 36: Asia Pacific APAC Container Shipping Market Revenue (Million), by Mode of Transportation 2024 & 2032

- Figure 37: Asia Pacific APAC Container Shipping Market Revenue Share (%), by Mode of Transportation 2024 & 2032

- Figure 38: Asia Pacific APAC Container Shipping Market Revenue (Million), by Country 2024 & 2032

- Figure 39: Asia Pacific APAC Container Shipping Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global APAC Container Shipping Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global APAC Container Shipping Market Revenue Million Forecast, by Size 2019 & 2032

- Table 3: Global APAC Container Shipping Market Revenue Million Forecast, by Mode of Transportation 2019 & 2032

- Table 4: Global APAC Container Shipping Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global APAC Container Shipping Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: APAC Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global APAC Container Shipping Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: APAC Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global APAC Container Shipping Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: APAC Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global APAC Container Shipping Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: APAC Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global APAC Container Shipping Market Revenue Million Forecast, by Size 2019 & 2032

- Table 14: Global APAC Container Shipping Market Revenue Million Forecast, by Mode of Transportation 2019 & 2032

- Table 15: Global APAC Container Shipping Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United States APAC Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Canada APAC Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico APAC Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global APAC Container Shipping Market Revenue Million Forecast, by Size 2019 & 2032

- Table 20: Global APAC Container Shipping Market Revenue Million Forecast, by Mode of Transportation 2019 & 2032

- Table 21: Global APAC Container Shipping Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Brazil APAC Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Argentina APAC Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of South America APAC Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global APAC Container Shipping Market Revenue Million Forecast, by Size 2019 & 2032

- Table 26: Global APAC Container Shipping Market Revenue Million Forecast, by Mode of Transportation 2019 & 2032

- Table 27: Global APAC Container Shipping Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: United Kingdom APAC Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Germany APAC Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: France APAC Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Italy APAC Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Spain APAC Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Russia APAC Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Benelux APAC Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Nordics APAC Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Rest of Europe APAC Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global APAC Container Shipping Market Revenue Million Forecast, by Size 2019 & 2032

- Table 38: Global APAC Container Shipping Market Revenue Million Forecast, by Mode of Transportation 2019 & 2032

- Table 39: Global APAC Container Shipping Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Turkey APAC Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Israel APAC Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: GCC APAC Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: North Africa APAC Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Africa APAC Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Rest of Middle East & Africa APAC Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global APAC Container Shipping Market Revenue Million Forecast, by Size 2019 & 2032

- Table 47: Global APAC Container Shipping Market Revenue Million Forecast, by Mode of Transportation 2019 & 2032

- Table 48: Global APAC Container Shipping Market Revenue Million Forecast, by Country 2019 & 2032

- Table 49: China APAC Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: India APAC Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Japan APAC Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: South Korea APAC Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: ASEAN APAC Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Oceania APAC Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Rest of Asia Pacific APAC Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Container Shipping Market?

The projected CAGR is approximately 9.07%.

2. Which companies are prominent players in the APAC Container Shipping Market?

Key companies in the market include Maersk, CXIC (CHANGZHOU XINHUACHANG INT'L CONTAINERS Co Ltd) Group Containers Company Limited, Sea Box Inc, China International Marine Containers (Group) Ltd (CIMC), Guangdong Fuwa Engineering Group Co Ltd, Singamas Container Holdings Limited, W&K Conatiners Ltd **List Not Exhaustive, TLS Offshore Containers International Pvt Ltd, Florens Asset Management Company Limited, China Eastern Containers.

3. What are the main segments of the APAC Container Shipping Market?

The market segments include Size, Mode of Transportation.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.97 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Pharmaceutical Products4.; Increasing Demand for frozen persihable commodities.

6. What are the notable trends driving market growth?

Preference for maritime trade over aerial trade growing.

7. Are there any restraints impacting market growth?

4.; Operational and Financial Challenges Associated with Reefer Containers.

8. Can you provide examples of recent developments in the market?

April 2023: CIMC and POWIN set up a joint venture to deepen cooperation in energy storage business. Powin is an American battery energy storage system integrator and manufacturer headquartered in Portland, Oregon. It was engaged in the energy storage field for nearly 10 years, and is one of the head energy storage integrators in the United States. According to the ranking released by Navigant Research, a market research organization in the United States, Powin is ranked among the TOP 3 global energy storage system integrators in recent years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Container Shipping Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Container Shipping Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Container Shipping Market?

To stay informed about further developments, trends, and reports in the APAC Container Shipping Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence