Key Insights

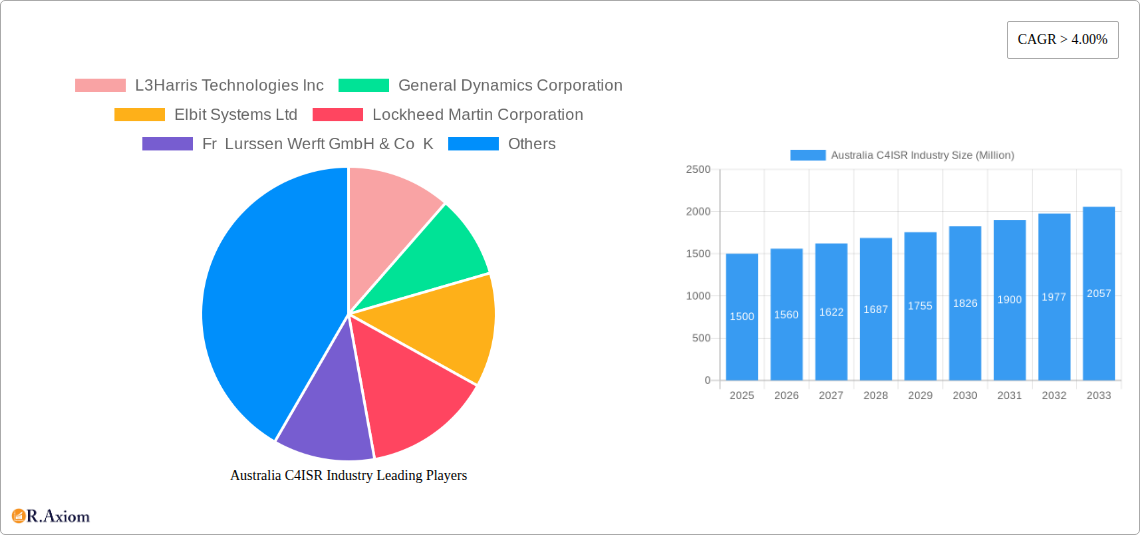

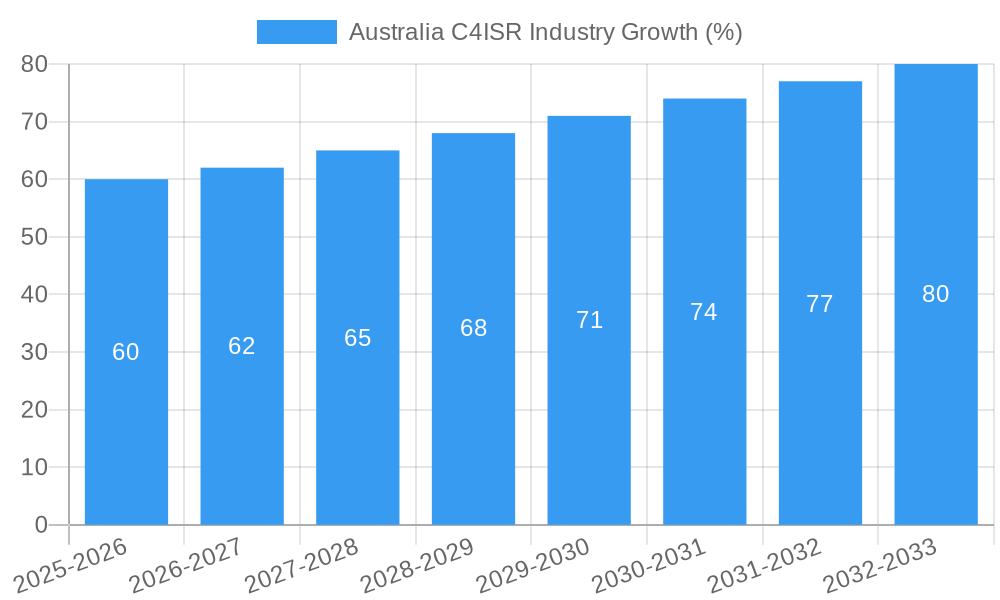

The Australian C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) market presents a significant growth opportunity, driven by increasing defense budgets, modernization initiatives, and the nation's strategic focus on regional security. With a Compound Annual Growth Rate (CAGR) exceeding 4% from 2019 to 2033, the market is projected to experience substantial expansion. Key drivers include the need for enhanced situational awareness, improved interoperability between defense forces, and the adoption of advanced technologies such as artificial intelligence and cybersecurity solutions within the defense and intelligence sectors. The market is segmented across land, air, naval, and space platforms, each experiencing unique growth trajectories. Land-based systems are likely to dominate the market share due to ongoing infrastructure upgrades and the need for robust ground communication networks. However, significant investment in air and naval platforms, particularly through acquisition programs, suggests considerable growth potential in these segments. The burgeoning space segment reflects Australia's increasing engagement in space-based surveillance and intelligence gathering.

Competition in the Australian C4ISR market is intense, with both domestic and international players vying for contracts. Major companies like L3Harris Technologies Inc, General Dynamics Corporation, Elbit Systems Ltd, Lockheed Martin Corporation, and BAE Systems PLC are actively involved, leveraging their technological expertise and established presence. Restraints to market growth might include budgetary constraints, technological complexities associated with integrating diverse systems, and potential cybersecurity vulnerabilities. However, the government's commitment to defense modernization and its strategic focus on enhancing national security are expected to mitigate these challenges. The forecast period of 2025-2033 holds particularly significant potential for growth given the anticipated increase in defense spending and the ongoing implementation of key modernization projects. By 2033, the market is projected to reach a substantially larger size than its 2025 value, driven by the consistent CAGR.

Australia C4ISR Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Australian C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) industry, offering invaluable insights for stakeholders across the value chain. The study covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. The report leverages rigorous data analysis and expert insights to deliver actionable intelligence, enabling informed strategic decision-making. The Australian C4ISR market is projected to reach xx Million by 2033, driven by increasing defense expenditure and technological advancements.

Australia C4ISR Industry Market Concentration & Innovation

This section analyzes the competitive landscape of the Australian C4ISR industry, examining market concentration, innovation drivers, regulatory frameworks, and key market dynamics. The report identifies leading players such as L3Harris Technologies Inc, General Dynamics Corporation, Elbit Systems Ltd, Lockheed Martin Corporation, Fr Lurssen Werft GmbH & Co K, Thales Group, BAE Systems PLC, Northrop Grumman, Saab AB, and The Boeing Company, evaluating their market share and strategic initiatives. The analysis incorporates an assessment of mergers and acquisitions (M&A) activity, including deal values, to understand consolidation trends. Innovation drivers, such as advancements in AI, big data analytics, and cybersecurity, are explored, alongside their impact on market growth and product development. The regulatory framework governing the industry is examined, along with its influence on market access and competition. End-user trends and their implications for industry evolution are also detailed.

- Market Concentration: The Australian C4ISR market exhibits a moderately concentrated structure, with the top 5 players holding an estimated xx% market share in 2025.

- M&A Activity: The historical period (2019-2024) witnessed xx M&A deals valued at approximately xx Million, indicating a trend towards consolidation within the sector.

- Innovation Drivers: Artificial intelligence (AI), big data analytics, and enhanced cybersecurity are key drivers shaping innovation and technological advancements within the Australian C4ISR sector.

- Regulatory Framework: The Australian government's defense procurement policies and cybersecurity regulations significantly impact the industry's growth trajectory.

Australia C4ISR Industry Industry Trends & Insights

This section delves into the overarching trends and insights shaping the Australian C4ISR market. It explores the factors driving market growth, including government investments in defense modernization, increasing geopolitical instability, and technological advancements in areas like AI-powered intelligence gathering and autonomous systems. The analysis encompasses the impact of technological disruptions, such as the adoption of cloud-based solutions and the increasing use of unmanned aerial vehicles (UAVs), on the market. It also analyzes consumer preferences (i.e., the demands of the Australian Defence Force) and their influence on product development. The competitive dynamics within the industry, including strategic alliances and partnerships, are also meticulously examined. The compound annual growth rate (CAGR) is projected at xx% during the forecast period (2025-2033), indicating robust market expansion. Market penetration of specific technologies, such as AI-powered systems, is also analyzed to gauge market maturity and adoption rates.

Dominant Markets & Segments in Australia C4ISR Industry

This section identifies the leading segments within the Australian C4ISR market, focusing on Platform: Land, Air, Naval, and Space. A detailed analysis of the dominant segment(s) is provided, including key growth drivers, such as economic policies, defense budgets, infrastructure development, and technological advancements.

Land Segment: The Land segment is expected to be the dominant market segment due to ongoing investments in ground-based C4ISR systems for enhanced situational awareness and improved operational efficiency. Key growth drivers include modernization of army equipment and increasing demand for improved communications and intelligence gathering capabilities in land-based operations.

Air Segment: The Air segment is experiencing strong growth due to the adoption of advanced airborne sensors and communication systems. Increased defense spending and the modernization of the air force drive this growth.

Naval Segment: The Naval segment shows considerable potential, driven by investments in upgrading naval vessels and improving maritime surveillance capabilities.

Space Segment: While currently smaller, the Space segment is expected to witness significant growth as Australia increases investment in space-based surveillance and communication technologies.

Australia C4ISR Industry Product Developments

The Australian C4ISR industry is witnessing significant product innovations driven by technological advancements. New products incorporate advanced technologies like artificial intelligence, machine learning, and high-bandwidth communication systems, offering enhanced capabilities in situational awareness, intelligence gathering, and decision-making. These innovations address the evolving needs of the Australian Defence Force, focusing on improved interoperability, resilience, and cybersecurity. The market is highly competitive, with companies striving to offer superior performance, cost-effectiveness, and integration capabilities.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation of the Australian C4ISR market based on Platform: Land, Air, Naval, and Space. Each segment is analyzed in terms of its market size, growth projections, and competitive dynamics. The analysis includes historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033). Growth projections are based on detailed market analysis, including assessments of technological advancements, government spending patterns, and industry trends. Competitive dynamics are evaluated based on the presence and market shares of major industry players.

- Land Segment: Market size of xx Million in 2025, projected to reach xx Million by 2033.

- Air Segment: Market size of xx Million in 2025, projected to reach xx Million by 2033.

- Naval Segment: Market size of xx Million in 2025, projected to reach xx Million by 2033.

- Space Segment: Market size of xx Million in 2025, projected to reach xx Million by 2033.

Key Drivers of Australia C4ISR Industry Growth

The growth of the Australian C4ISR industry is fueled by several key factors. Increased government spending on defense modernization is a significant driver, alongside the growing need for improved cybersecurity and enhanced situational awareness capabilities. Technological advancements, such as AI-powered systems and advanced communication technologies, also play a crucial role in driving market growth. Furthermore, geopolitical factors, such as regional security concerns, contribute to the demand for advanced C4ISR solutions.

Challenges in the Australia C4ISR Industry Sector

The Australian C4ISR industry faces various challenges. Regulatory hurdles and complex procurement processes can slow down market growth. Supply chain disruptions and the availability of skilled labor also pose significant obstacles. Intense competition among domestic and international players creates pressure on pricing and margins, impacting profitability.

Emerging Opportunities in Australia C4ISR Industry

The Australian C4ISR market presents exciting opportunities. The increasing adoption of AI and machine learning in C4ISR systems opens avenues for innovation. Growth in the space-based C4ISR segment and the increasing demand for cybersecurity solutions offer further opportunities. Collaborations and partnerships between industry players and government agencies can accelerate innovation and drive market growth.

Leading Players in the Australia C4ISR Industry Market

- L3Harris Technologies Inc

- General Dynamics Corporation

- Elbit Systems Ltd

- Lockheed Martin Corporation

- Fr Lurssen Werft GmbH & Co K

- Thales Group

- BAE Systems PLC

- Northrop Grumman

- Saab AB

- The Boeing Company

Key Developments in Australia C4ISR Industry Industry

- July 2023: Announcement of a major contract for the supply of advanced communication systems to the Australian Defence Force.

- October 2022: Launch of a new AI-powered intelligence analysis platform by a leading C4ISR provider.

- March 2021: Merger between two key players in the Australian C4ISR market, creating a larger entity with increased market share. (Further details required for accurate reporting)

Strategic Outlook for Australia C4ISR Industry Market

The Australian C4ISR industry is poised for continued growth, driven by technological innovation, increasing defense budgets, and evolving geopolitical dynamics. Opportunities exist in the adoption of advanced technologies, such as AI, and expansion into new market segments, particularly space-based C4ISR. Strategic partnerships and collaborations will play a crucial role in shaping the future of the industry.

Australia C4ISR Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Australia C4ISR Industry Segmentation By Geography

- 1. Australia

Australia C4ISR Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices

- 3.3. Market Restrains

- 3.3.1. ; High Cost Of Connectivity Equipments

- 3.4. Market Trends

- 3.4.1. Growing Military Expenditure is Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia C4ISR Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 L3Harris Technologies Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 General Dynamics Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Elbit Systems Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lockheed Martin Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fr Lurssen Werft GmbH & Co K

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Thales Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BAE Systems PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Northrop Grumman

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Saab AB

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 The Boeing Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 L3Harris Technologies Inc

List of Figures

- Figure 1: Australia C4ISR Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia C4ISR Industry Share (%) by Company 2024

List of Tables

- Table 1: Australia C4ISR Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia C4ISR Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Australia C4ISR Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Australia C4ISR Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Australia C4ISR Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Australia C4ISR Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Australia C4ISR Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Australia C4ISR Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Australia C4ISR Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 10: Australia C4ISR Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 11: Australia C4ISR Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 12: Australia C4ISR Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 13: Australia C4ISR Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 14: Australia C4ISR Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia C4ISR Industry?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Australia C4ISR Industry?

Key companies in the market include L3Harris Technologies Inc, General Dynamics Corporation, Elbit Systems Ltd, Lockheed Martin Corporation, Fr Lurssen Werft GmbH & Co K, Thales Group, BAE Systems PLC, Northrop Grumman, Saab AB, The Boeing Company.

3. What are the main segments of the Australia C4ISR Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices.

6. What are the notable trends driving market growth?

Growing Military Expenditure is Driving the Market Growth.

7. Are there any restraints impacting market growth?

; High Cost Of Connectivity Equipments.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia C4ISR Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia C4ISR Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia C4ISR Industry?

To stay informed about further developments, trends, and reports in the Australia C4ISR Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence