Key Insights

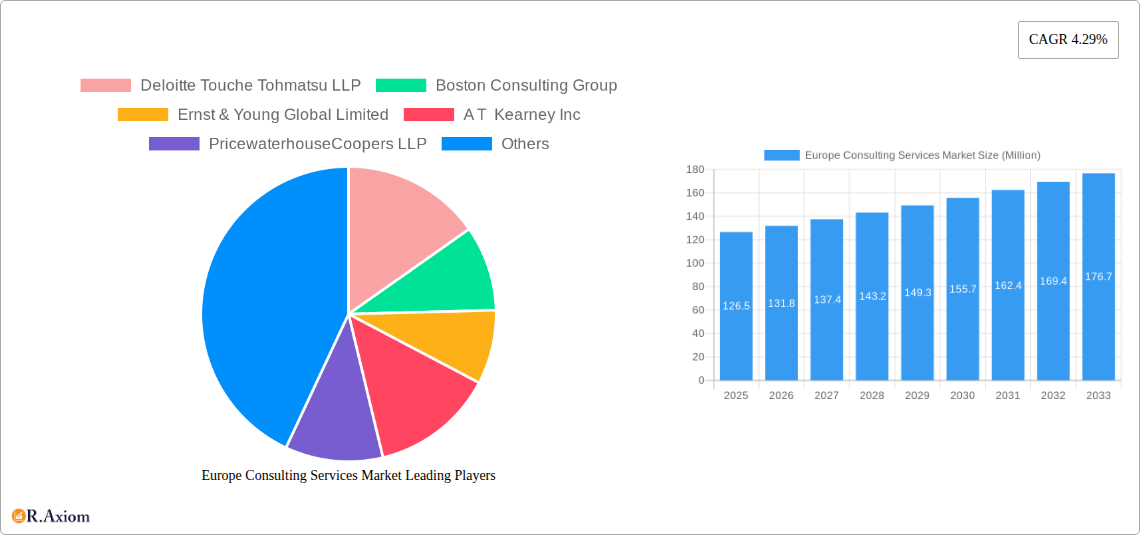

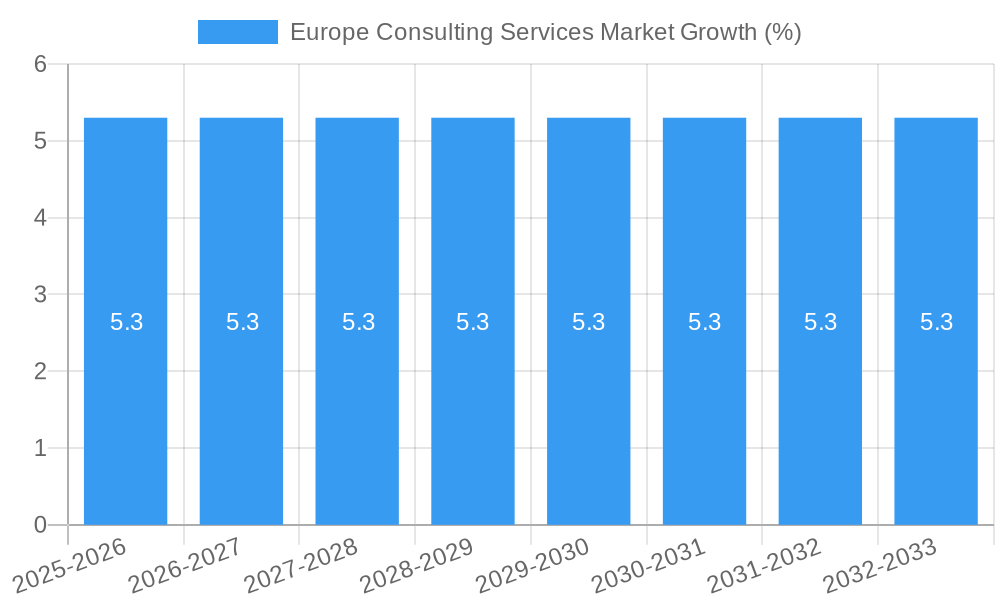

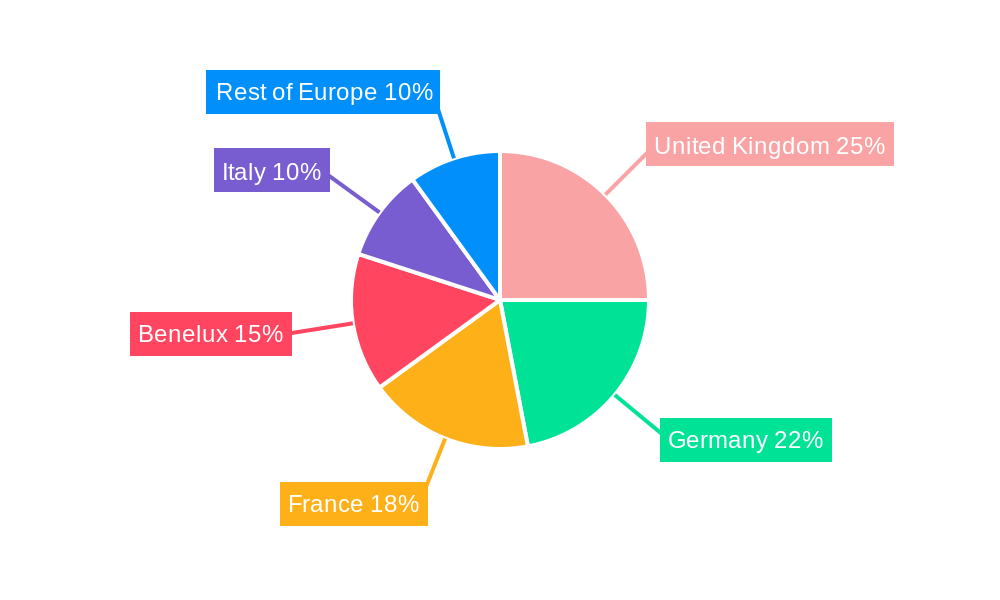

The European consulting services market, valued at €126.5 million in 2025, is projected to experience robust growth, driven by increasing business complexity, the need for digital transformation, and a surge in regulatory compliance demands across various sectors. This necessitates expert guidance from consulting firms specializing in operations, strategy, finance, and technology. The market's compound annual growth rate (CAGR) of 4.29% from 2025 to 2033 indicates a steady expansion, with significant contributions expected from key countries like the United Kingdom, Germany, and France, which boast mature economies and robust business landscapes. The prevalence of multinational corporations and a competitive market environment further fuels the demand for strategic and operational consulting services. Growth will also be fueled by increased investments in technology across industries, driving the demand for technology advisory services. However, economic uncertainties and potential talent shortages within the consulting sector could act as moderating influences on market expansion. The segmentation by service type allows for a granular understanding of market dynamics, showing the relative strengths of different specializations within the consulting sector across the European Union.

Growth in specific segments will vary, with the technology advisory sector likely experiencing faster growth than traditional operational consulting due to the accelerating pace of technological change. While the UK, Germany, and France will remain dominant, other countries within the Benelux region and Italy are poised for notable growth, driven by their increasing economic activity and adoption of advanced technologies. The presence of major global consulting firms such as Deloitte, McKinsey, and BCG ensures a high level of competition, fostering innovation and driving service quality enhancements. This competitive landscape will likely continue to shape the evolution of the European consulting market in the coming years, with strategic acquisitions and partnerships becoming increasingly prevalent. The long-term outlook for the European consulting services market remains positive, reflecting the enduring need for expert guidance in an increasingly complex and rapidly evolving business environment.

Europe Consulting Services Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Consulting Services Market, covering the period 2019-2033. It offers actionable insights into market dynamics, segmentation, key players, and future growth prospects, equipping stakeholders with the knowledge needed to navigate this evolving landscape. The report utilizes data from the historical period (2019-2024), the base year (2025), and provides estimates for 2025 and a forecast for 2025-2033. All values are expressed in Millions.

Europe Consulting Services Market Concentration & Innovation

The European consulting services market is characterized by a high degree of concentration, with a few large multinational firms dominating the landscape. Deloitte Touche Tohmatsu LLP, Boston Consulting Group (BCG), Ernst & Young Global Limited, A.T. Kearney Inc., PricewaterhouseCoopers LLP, KPMG, Bain & Company Inc., McKinsey & Company, Accenture PLC, and Booz Allen Hamilton Inc. are among the key players, collectively holding an estimated xx% market share in 2025. Market concentration is driven by significant economies of scale, brand recognition, and extensive global networks. However, smaller, specialized firms are also emerging, focusing on niche service areas and leveraging innovative technologies.

Innovation within the sector is fueled by several factors:

- Technological advancements: The increasing adoption of AI, big data analytics, and cloud computing is transforming consulting methodologies and service offerings.

- Regulatory changes: Evolving regulations across Europe (e.g., GDPR) are driving demand for specialized consulting expertise in compliance and data security.

- Client demand for digital transformation: Businesses are seeking consulting support to navigate digital transformation, driving demand for technology advisory services.

- Mergers and Acquisitions (M&A) activity: M&A activities, such as KPMG UK's recent integration of Consulting and Deal Advisory arms, contribute to consolidation and innovation by combining capabilities and expertise. The total value of M&A deals in the European consulting services market in 2024 was estimated at $xx Million. This activity is expected to continue, driven by the need to enhance service portfolios and expand market reach.

Product substitution is limited, mainly stemming from internal capabilities development within client organizations. End-user trends reflect a growing preference for outcome-based consulting engagements and increased demand for specialized expertise in emerging fields like sustainability and cybersecurity.

Europe Consulting Services Market Industry Trends & Insights

The Europe Consulting Services market is expected to witness robust growth throughout the forecast period (2025-2033), driven by several factors: The increasing complexity of business operations, coupled with the need for digital transformation and regulatory compliance, fuels the demand for expert consulting services. The market's Compound Annual Growth Rate (CAGR) is projected to be xx% from 2025 to 2033. This growth is fueled by a number of trends:

- Digital transformation: Businesses across various sectors are investing heavily in digital transformation initiatives, creating significant opportunities for consulting firms specializing in areas like cloud computing, cybersecurity, and data analytics. Market penetration for digital transformation consulting services is estimated at xx% in 2025, with significant growth projected.

- Increased regulatory scrutiny: Growing regulatory compliance demands, particularly in sectors like finance and healthcare, are driving demand for regulatory consulting services.

- Focus on sustainability: Growing awareness of environmental, social, and governance (ESG) issues is creating new demand for sustainability-focused consulting.

- Economic recovery post-pandemic: A gradual economic recovery is driving increased investment in business consulting to improve operational efficiency and competitiveness.

- Competitive dynamics: The market is fiercely competitive, with large multinational firms competing for market share. This competition drives innovation and pushes firms to offer increasingly specialized and high-value services.

Dominant Markets & Segments in Europe Consulting Services Market

By Country: The United Kingdom, Germany, and France constitute the largest national markets within the European consulting services sector, primarily due to their robust economies, developed infrastructure, and presence of significant multinational corporations. The Benelux region (Belgium, Netherlands, and Luxembourg) also displays substantial growth potential due to its strong economic performance and high concentration of international businesses.

- United Kingdom: Key drivers include a strong financial sector, significant government spending on infrastructure projects, and a robust technology ecosystem.

- Germany: Strong industrial base, substantial investments in R&D, and a focus on manufacturing excellence are key drivers.

- France: A large and diverse economy, coupled with government initiatives to promote innovation, supports market growth.

- Benelux: High concentration of multinational corporations and a favorable business environment contribute to this region's growth.

- Italy: While smaller than the UK, Germany, and France, the Italian market shows consistent growth potential thanks to its industrial clusters.

- Rest of Europe: This segment is marked by heterogeneous economic conditions, with growth opportunities varying across different countries.

By Service Type: Strategy consulting and financial advisory services are currently the largest segments, driven by high demand for strategic guidance and support in mergers and acquisitions. However, technology advisory services are experiencing rapid growth due to the increasing importance of digital transformation.

- Strategy Consulting: Driven by increased need for strategic guidance amidst market uncertainties.

- Financial Advisory: Driven by M&A activity and corporate restructuring needs.

- Technology Advisory: Rapid growth driven by the increasing need for digital transformation.

- Operations Consulting: Steady growth driven by the constant need for improved operational efficiency.

- Other Service Types: This segment includes niche consulting areas that are showing gradual growth.

Europe Consulting Services Market Product Developments

Recent product innovations focus on integrating advanced technologies like AI and big data analytics into consulting services. This enables more sophisticated data analysis, predictive modelling, and improved client outcomes. These developments create competitive advantages by offering clients more comprehensive and efficient solutions. The market is witnessing a shift towards cloud-based solutions and digital platforms, improving collaboration and accessibility of consulting services.

Report Scope & Segmentation Analysis

This report segments the European consulting services market by service type (Operations Consulting, Strategy Consulting, Financial Advisory, Technology Advisory, Other Service Types) and by country (United Kingdom, Germany, France, Benelux, Italy, Rest of Europe). Each segment is analyzed in detail, providing insights into market size, growth projections, and competitive dynamics. Growth projections vary across segments, with technology advisory and other specialized areas exhibiting the most rapid expansion. Competitive dynamics are influenced by the size and specialization of firms, with larger firms dominating broader service areas and smaller firms specializing in niche segments.

Key Drivers of Europe Consulting Services Market Growth

Several factors are driving growth in the European consulting services market. These include: a) the increasing complexity of business operations, leading to a heightened need for expert advice; b) the rapid pace of technological change, requiring businesses to adapt and implement new technologies; c) growing regulatory requirements across various sectors, driving demand for compliance-related services; and d) sustained investment in infrastructure development across many European countries, creating new opportunities for consulting firms.

Challenges in the Europe Consulting Services Market Sector

The European consulting services market faces various challenges, including: increasing competition from both established players and new entrants, pressure to reduce costs and maintain profitability, securing and retaining skilled talent, and adapting to rapidly evolving technological landscapes. Furthermore, economic fluctuations and geopolitical uncertainties can impact client spending and overall market growth. The inability to effectively integrate new technologies and adapt to changing client demands poses a significant risk to market players.

Emerging Opportunities in Europe Consulting Services Market

Emerging opportunities lie in specialized areas like sustainability consulting, cybersecurity consulting, and digital transformation services. The growth of AI and big data analytics offers significant potential for innovative service offerings. Furthermore, expanding into new markets within Europe and catering to the needs of small and medium-sized enterprises (SMEs) present additional opportunities for growth.

Leading Players in the Europe Consulting Services Market Market

- Deloitte Touche Tohmatsu LLP

- Boston Consulting Group

- Ernst & Young Global Limited

- A T Kearney Inc

- PricewaterhouseCoopers LLP

- KPMG

- Bain & Company Inc

- McKinsey & Company

- Accenture PL

- Booz Allen Hamilton Inc

Key Developments in Europe Consulting Services Market Industry

- October 2023: KPMG UK launched Advisory – a new business that combines its Consulting and Deal Advisory arms to create a new practice called Advisory. This move aims to enhance its customer base and cater to a wider range of clients across the UK, potentially increasing market share.

- September 2023: BCG partnered with Anthropic to launch an AI consulting initiative. This partnership positions BCG as a leader in AI consulting, allowing it to offer cutting-edge solutions and gain a competitive edge.

Strategic Outlook for Europe Consulting Services Market Market

The European consulting services market is poised for continued growth, driven by technological advancements, increasing regulatory complexity, and the ongoing need for businesses to adapt and transform. Opportunities exist for firms that can successfully leverage technology, offer specialized expertise in high-growth areas, and effectively cater to the diverse needs of clients across various industries and market segments. Focus on digital transformation, sustainability, and cybersecurity will be crucial for future success.

Europe Consulting Services Market Segmentation

-

1. Service Type

- 1.1. Operations Consulting

- 1.2. Strategy Consulting

- 1.3. Financial Advisory

- 1.4. Technology Advisory

- 1.5. Other Service Types

Europe Consulting Services Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Consulting Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.29% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Regulatory Changes; Growing Investment in Emerging Technologies

- 3.3. Market Restrains

- 3.3.1. Shift in the Consulting Marketplace

- 3.4. Market Trends

- 3.4.1. Operations Consulting to Witness Major Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Consulting Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Operations Consulting

- 5.1.2. Strategy Consulting

- 5.1.3. Financial Advisory

- 5.1.4. Technology Advisory

- 5.1.5. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Germany Europe Consulting Services Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Consulting Services Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Consulting Services Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Consulting Services Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Consulting Services Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Consulting Services Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Consulting Services Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Deloitte Touche Tohmatsu LLP

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Boston Consulting Group

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Ernst & Young Global Limited

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 A T Kearney Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 PricewaterhouseCoopers LLP

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 KPMG

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Bain & Company Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 McKinsey & Company

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Accenture PL

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Booz Allen Hamilton Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Deloitte Touche Tohmatsu LLP

List of Figures

- Figure 1: Europe Consulting Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Consulting Services Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Consulting Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Consulting Services Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 3: Europe Consulting Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Europe Consulting Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany Europe Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: France Europe Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Italy Europe Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Europe Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Netherlands Europe Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sweden Europe Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Europe Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Europe Consulting Services Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 13: Europe Consulting Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United Kingdom Europe Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Germany Europe Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France Europe Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Italy Europe Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Spain Europe Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Europe Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Belgium Europe Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Sweden Europe Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Norway Europe Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Poland Europe Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Denmark Europe Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Consulting Services Market?

The projected CAGR is approximately 4.29%.

2. Which companies are prominent players in the Europe Consulting Services Market?

Key companies in the market include Deloitte Touche Tohmatsu LLP, Boston Consulting Group, Ernst & Young Global Limited, A T Kearney Inc, PricewaterhouseCoopers LLP, KPMG, Bain & Company Inc, McKinsey & Company, Accenture PL, Booz Allen Hamilton Inc.

3. What are the main segments of the Europe Consulting Services Market?

The market segments include Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 126.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Regulatory Changes; Growing Investment in Emerging Technologies.

6. What are the notable trends driving market growth?

Operations Consulting to Witness Major Growth.

7. Are there any restraints impacting market growth?

Shift in the Consulting Marketplace.

8. Can you provide examples of recent developments in the market?

October 2023 - KPMG UK launched Advisory – a new business that combines its Consulting and Deal Advisory arms to create a new practice called Advisory. This can help the company gain a customer base and cater to a wider range of customers across the UK.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Consulting Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Consulting Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Consulting Services Market?

To stay informed about further developments, trends, and reports in the Europe Consulting Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence