Key Insights

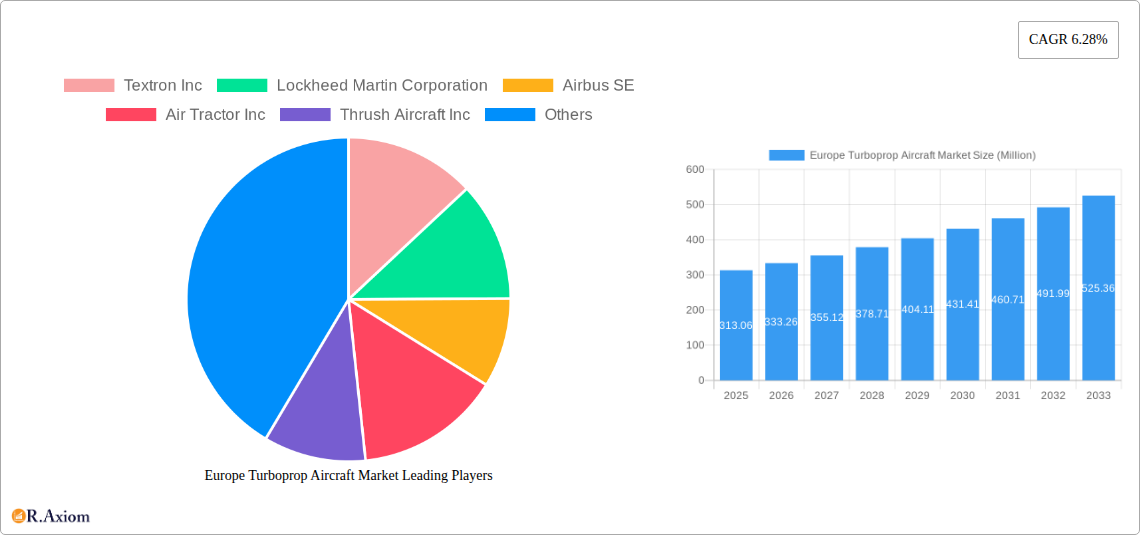

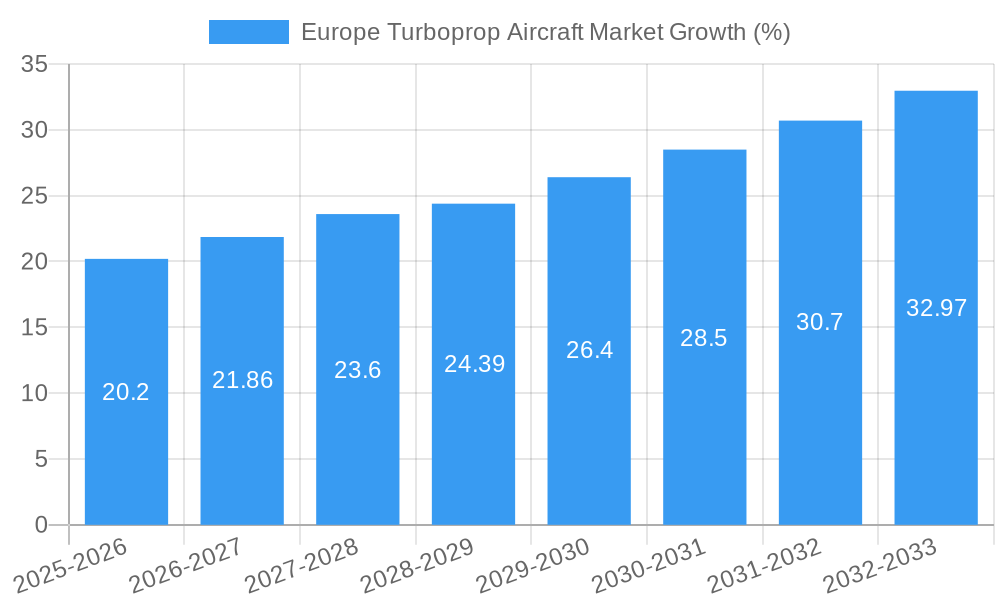

The European turboprop aircraft market, valued at €313.06 million in 2025, is projected to experience robust growth, driven by increasing demand for regional air travel, a growing need for efficient cargo transportation, and the ongoing replacement of aging fleets. The market's Compound Annual Growth Rate (CAGR) of 6.28% from 2025 to 2033 indicates a significant expansion. Key segments contributing to this growth include commercial aviation, experiencing strong demand for short-haul flights and regional connectivity, and military aviation, where turboprop aircraft continue to be vital for surveillance, training, and light transport missions. The general aviation segment, encompassing private and corporate aircraft, also contributes, albeit at a smaller scale, to the overall market volume. Leading manufacturers like Textron, Lockheed Martin, Airbus, and Embraer are driving innovation with improved fuel efficiency, enhanced avionics, and advanced materials, further fueling market expansion. Growth is also spurred by governmental initiatives promoting regional air connectivity and investments in upgrading airport infrastructure. However, challenges remain, including fluctuating fuel prices and potential regulatory hurdles.

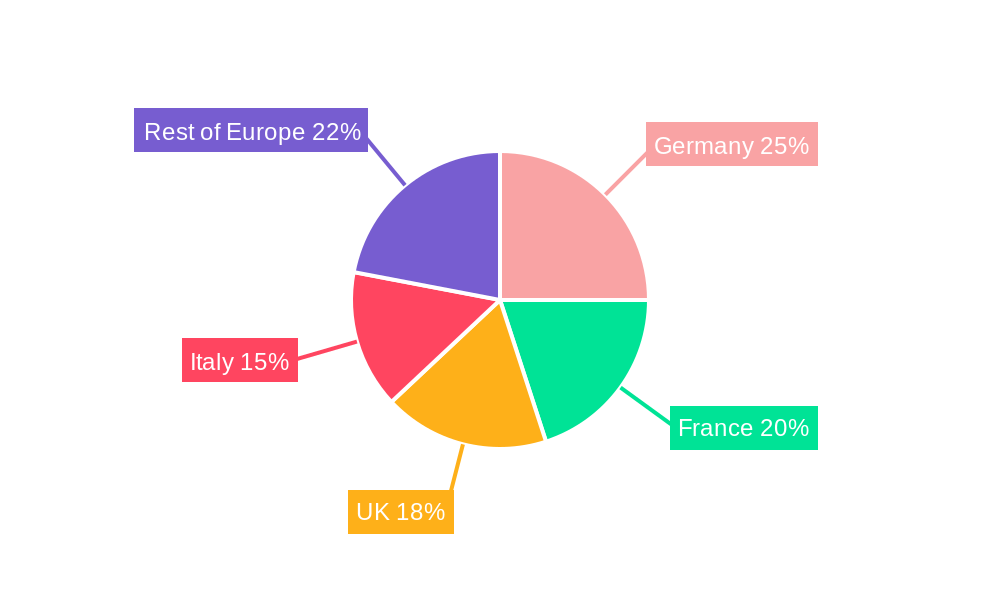

The geographical distribution within Europe reveals strong market presence in key countries like Germany, France, the United Kingdom, and Italy, reflecting their well-established aviation industries and dense air traffic networks. These nations' robust economies and support for infrastructure development further bolster the market. The "Rest of Europe" segment also exhibits considerable potential, driven by increasing tourism and the expansion of regional air services. Competitive factors, including technological advancements, pricing strategies, and after-sales service, will heavily influence market share amongst manufacturers. The forecast period (2025-2033) anticipates a significant increase in market size, fueled by continued technological improvements and rising demand, although geopolitical factors and economic fluctuations could present potential risks. The historical period (2019-2024) provides a baseline for understanding market trajectory and identifying emerging trends.

This detailed report provides a comprehensive analysis of the Europe Turboprop Aircraft Market, covering market size, growth drivers, challenges, opportunities, and competitive landscape. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period is 2025-2033, and the historical period covers 2019-2024. This report is crucial for industry stakeholders, investors, and market entrants seeking actionable insights into this dynamic market.

Europe Turboprop Aircraft Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities within the European turboprop aircraft market. The market exhibits a moderately concentrated structure, with a few major players holding significant market share. Airbus SE and ATR, for example, control an estimated xx% of the market, while other players like Embraer and Pilatus hold smaller but still significant shares.

Market Concentration Metrics:

- Airbus SE & ATR combined market share: xx% (2025 Estimate)

- Top 5 players combined market share: xx% (2025 Estimate)

- Average M&A deal value (2019-2024): USD xx Million

Innovation Drivers:

- Focus on fuel efficiency and reduced emissions leading to development of more sustainable turboprop aircraft.

- Advancements in avionics and flight control systems enhancing safety and operational efficiency.

- Increased demand for regional connectivity driving the need for versatile and cost-effective turboprop aircraft.

Regulatory Frameworks & Product Substitutes:

The European Union Aviation Safety Agency (EASA) plays a crucial role in shaping the regulatory landscape. Stringent safety and environmental regulations are driving innovation. While jet aircraft represent a substitute, turboprops maintain advantages in specific applications due to their cost-effectiveness and ability to operate from shorter runways.

End-User Trends & M&A Activities:

The increasing preference for regional air travel is fueling demand. Recent M&A activities have focused on consolidating market share and accessing new technologies. Examples include (but are not limited to) partnerships to develop new aircraft models and expansion of maintenance and support networks.

Europe Turboprop Aircraft Market Industry Trends & Insights

The Europe Turboprop Aircraft Market demonstrates a robust growth trajectory, driven by factors like increasing air travel demand, particularly in regional markets, and governmental investment in infrastructure development. Technological advancements and the demand for fuel-efficient and environmentally conscious aircraft also contribute to growth. The market is expected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033).

Market penetration of turboprop aircraft in regional air travel continues to grow, particularly in underserved regions. Competitive dynamics are shaping the market, with manufacturers focusing on product differentiation, technological innovation, and strategic partnerships to maintain a competitive edge. Consumer preferences are shifting towards enhanced comfort, advanced in-flight entertainment, and environmentally friendly aircraft.

Dominant Markets & Segments in Europe Turboprop Aircraft Market

The analysis of the Europe Turboprop Aircraft market reveals that the Commercial Aviation segment is the dominant sector. This is attributable to the increasing demand for regional air travel and the cost-effectiveness of turboprop aircraft for short-haul flights. Within the commercial aviation sector, the United Kingdom and Germany represent leading regional markets.

Key Drivers of Commercial Aviation Segment Dominance:

- Robust economic growth in several European nations, fueling passenger traffic.

- Well-established air transportation infrastructure supporting turboprop operations.

- Government policies promoting regional connectivity and the development of regional airports.

- Growing demand for short-haul flights.

Germany and the UK exhibit strong market positions due to their developed air travel networks, significant investment in transportation infrastructure, and favorable regulatory environments for airlines operating turboprop aircraft. Other regions, including France, Spain and Italy, represent notable contributors to the market with varying degrees of segment contribution from military and general aviation.

Europe Turboprop Aircraft Market Product Developments

Recent product innovations focus on improved fuel efficiency, reduced noise pollution, enhanced safety features, and improved passenger comfort. Manufacturers are investing heavily in the development of advanced turboprop engines and lightweight aircraft designs to optimize operational costs and environmental impact. These developments are aligning with market demands for sustainable and cost-effective regional air travel solutions, enhancing market fit and competitiveness.

Report Scope & Segmentation Analysis

This report segments the Europe Turboprop Aircraft Market by application:

Commercial Aviation: This segment comprises aircraft used by commercial airlines for scheduled and chartered passenger and cargo flights. Growth is projected at a CAGR of xx% from 2025 to 2033. Market size in 2025 is estimated at USD xx Million. Competitive dynamics are marked by intense rivalry among major manufacturers and increasing pressure on pricing.

Military Aviation: This segment includes aircraft used for military training, surveillance, and other military operations. The forecast period (2025-2033) projects a CAGR of xx%, with a 2025 market size estimated at USD xx Million. The market is characterized by large government contracts and stringent regulatory requirements.

General Aviation: This segment covers aircraft used for private and business flights, air taxi services, and other non-commercial purposes. The expected CAGR is xx% from 2025-2033 with a 2025 market size of USD xx Million. This segment is characterized by a diverse range of aircraft types and competitive pricing strategies.

Key Drivers of Europe Turboprop Aircraft Market Growth

Several key factors drive the growth of the Europe Turboprop Aircraft Market:

- Increasing demand for regional connectivity: The rising preference for shorter flights fuels demand for efficient turboprop aircraft.

- Technological advancements: Innovations in engine technology and aerodynamics enhance fuel efficiency and performance.

- Government support for regional air transport: Many European governments are investing in regional airports and infrastructure to promote connectivity.

Challenges in the Europe Turboprop Aircraft Market Sector

Several challenges impact market growth:

- Stringent emission regulations: Meeting stringent environmental standards necessitates ongoing investments in technology and research.

- High initial investment costs: The acquisition cost of turboprop aircraft can be a barrier for some operators.

- Supply chain disruptions: Global supply chain challenges can impact production and delivery timelines.

Emerging Opportunities in Europe Turboprop Aircraft Market

Emerging opportunities include:

- Growing demand for sustainable aviation fuels: The transition to sustainable fuels presents significant opportunities for manufacturers.

- Expansion into new regional markets: Untapped potential exists in several under-served regions of Europe.

- Technological advancements: Further innovation in areas such as hybrid-electric propulsion can open new market avenues.

Leading Players in the Europe Turboprop Aircraft Market Market

- Textron Inc

- Lockheed Martin Corporation

- Airbus SE

- Air Tractor Inc

- Thrush Aircraft Inc

- Viking Air Limited

- PILATUS AIRCRAFT LTD

- Embraer S A

- DAHER

- ATR

- PIAGGIO AERO INDUSTRIES S p A

- Piper Aircraft Inc

Key Developments in Europe Turboprop Aircraft Market Industry

May 2023: Deutsche Aircraft and Private Wings signed a Letter of Intent (LOI) to deliver five D328eco aircraft, signaling a commitment to sustainable turboprop technology. This development reflects a shift towards environmentally conscious solutions.

March 2023: The Spanish Air Force ordered an additional 16 Pilatus PC-21 aircraft, signifying a substantial investment in military aviation and a vote of confidence in Pilatus's capabilities. This order indicates a strong demand for advanced training aircraft within the military sector.

Strategic Outlook for Europe Turboprop Aircraft Market Market

The Europe Turboprop Aircraft Market is poised for continued growth, fueled by the increasing demand for regional air travel, technological innovation, and governmental support. The focus on sustainability and the development of eco-friendly aircraft will shape future market dynamics. Opportunities abound for manufacturers to capitalize on technological advancements and cater to the evolving needs of regional airlines and military operators. The market is expected to expand significantly in the coming years, offering substantial growth potential for key players.

Europe Turboprop Aircraft Market Segmentation

-

1. Application

- 1.1. Commercial Aviation

- 1.2. Military Aviation

- 1.3. General Aviation

Europe Turboprop Aircraft Market Segmentation By Geography

- 1. United Kingdom

- 2. France

- 3. Germany

- 4. Spain

- 5. Rest of Europe

Europe Turboprop Aircraft Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.28% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Commercial Segment Will Showcase Remarkable Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Turboprop Aircraft Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial Aviation

- 5.1.2. Military Aviation

- 5.1.3. General Aviation

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United Kingdom

- 5.2.2. France

- 5.2.3. Germany

- 5.2.4. Spain

- 5.2.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. United Kingdom Europe Turboprop Aircraft Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commercial Aviation

- 6.1.2. Military Aviation

- 6.1.3. General Aviation

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. France Europe Turboprop Aircraft Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commercial Aviation

- 7.1.2. Military Aviation

- 7.1.3. General Aviation

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Germany Europe Turboprop Aircraft Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Commercial Aviation

- 8.1.2. Military Aviation

- 8.1.3. General Aviation

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Spain Europe Turboprop Aircraft Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Commercial Aviation

- 9.1.2. Military Aviation

- 9.1.3. General Aviation

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Rest of Europe Europe Turboprop Aircraft Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Commercial Aviation

- 10.1.2. Military Aviation

- 10.1.3. General Aviation

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Germany Europe Turboprop Aircraft Market Analysis, Insights and Forecast, 2019-2031

- 12. France Europe Turboprop Aircraft Market Analysis, Insights and Forecast, 2019-2031

- 13. Italy Europe Turboprop Aircraft Market Analysis, Insights and Forecast, 2019-2031

- 14. United Kingdom Europe Turboprop Aircraft Market Analysis, Insights and Forecast, 2019-2031

- 15. Netherlands Europe Turboprop Aircraft Market Analysis, Insights and Forecast, 2019-2031

- 16. Sweden Europe Turboprop Aircraft Market Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Europe Europe Turboprop Aircraft Market Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Textron Inc

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Lockheed Martin Corporation

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Airbus SE

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Air Tractor Inc

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Thrush Aircraft Inc

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Viking Air Limited

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 PILATUS AIRCRAFT LTD

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Embraer S A

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 DAHER

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 ATR

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 PIAGGIO AERO INDUSTRIES S p A

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.12 Piper Aircraft Inc

- 18.2.12.1. Overview

- 18.2.12.2. Products

- 18.2.12.3. SWOT Analysis

- 18.2.12.4. Recent Developments

- 18.2.12.5. Financials (Based on Availability)

- 18.2.1 Textron Inc

List of Figures

- Figure 1: Europe Turboprop Aircraft Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Turboprop Aircraft Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Turboprop Aircraft Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Turboprop Aircraft Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Europe Turboprop Aircraft Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Europe Turboprop Aircraft Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany Europe Turboprop Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: France Europe Turboprop Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Italy Europe Turboprop Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Europe Turboprop Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Netherlands Europe Turboprop Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sweden Europe Turboprop Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Europe Turboprop Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Europe Turboprop Aircraft Market Revenue Million Forecast, by Application 2019 & 2032

- Table 13: Europe Turboprop Aircraft Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Europe Turboprop Aircraft Market Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Europe Turboprop Aircraft Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe Turboprop Aircraft Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Europe Turboprop Aircraft Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Europe Turboprop Aircraft Market Revenue Million Forecast, by Application 2019 & 2032

- Table 19: Europe Turboprop Aircraft Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Europe Turboprop Aircraft Market Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Europe Turboprop Aircraft Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Turboprop Aircraft Market?

The projected CAGR is approximately 6.28%.

2. Which companies are prominent players in the Europe Turboprop Aircraft Market?

Key companies in the market include Textron Inc, Lockheed Martin Corporation, Airbus SE, Air Tractor Inc, Thrush Aircraft Inc, Viking Air Limited, PILATUS AIRCRAFT LTD, Embraer S A, DAHER, ATR, PIAGGIO AERO INDUSTRIES S p A, Piper Aircraft Inc.

3. What are the main segments of the Europe Turboprop Aircraft Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 313.06 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Commercial Segment Will Showcase Remarkable Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

May 2023: Deutsche Aircraft and Private Wings signed a Letter of Intent (LOI) to deliver five D328eco aircraft, the new 40-seater sustainable turboprop regional airliner from Deutsche Aircraft.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Turboprop Aircraft Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Turboprop Aircraft Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Turboprop Aircraft Market?

To stay informed about further developments, trends, and reports in the Europe Turboprop Aircraft Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence