Key Insights

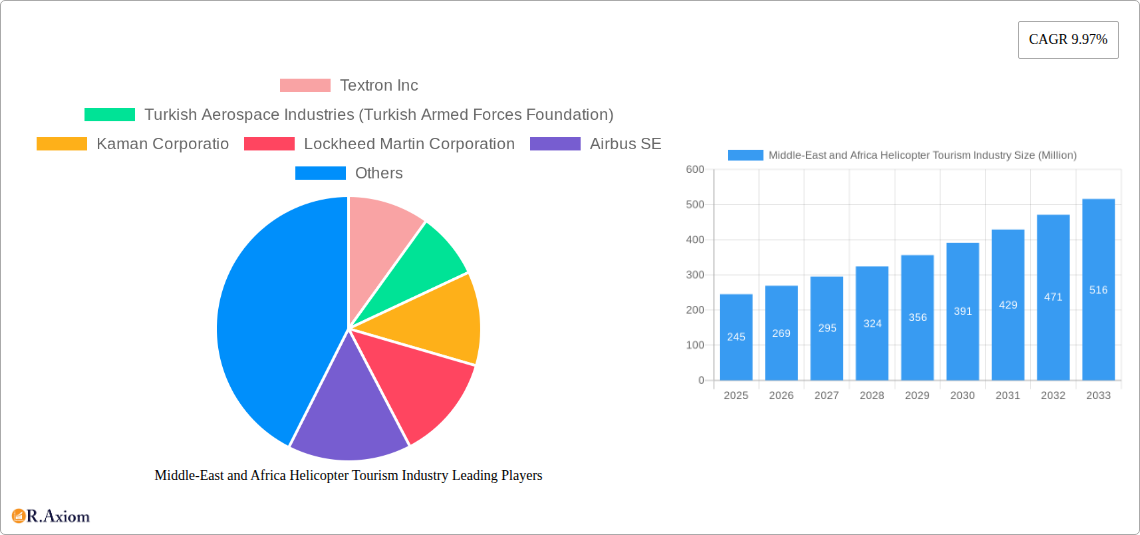

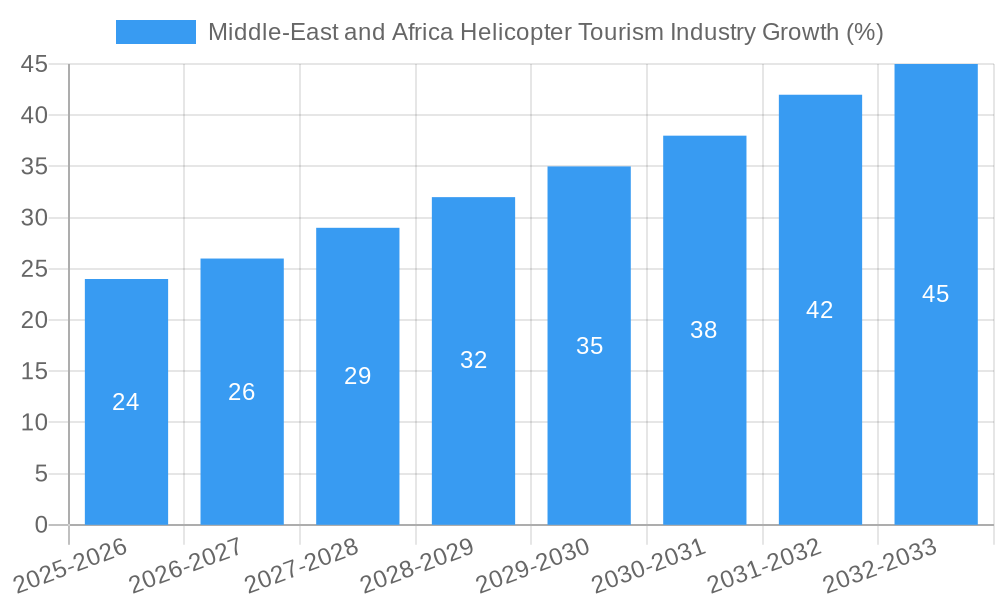

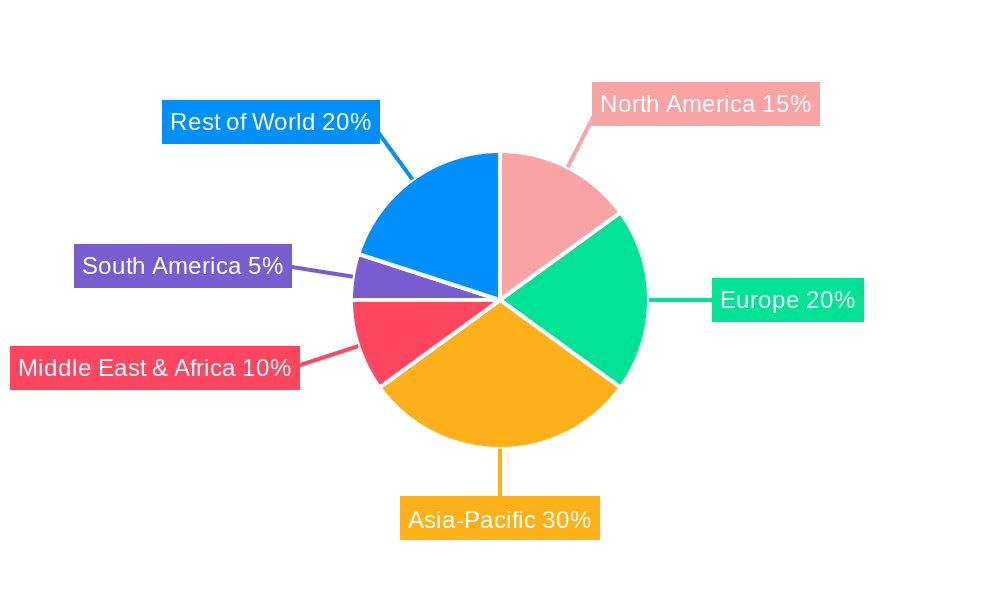

The Middle East and Africa helicopter tourism market, while currently smaller than other regions, exhibits significant growth potential. The market's 9.97% CAGR (2019-2033) suggests a robust expansion, driven by increasing disposable incomes in key tourist destinations, a rising demand for luxury travel experiences, and the unique perspectives offered by helicopter tours. Factors such as improved infrastructure in some regions and the development of specialized tourism packages incorporating helicopter rides are further fueling this growth. The segment breakdown reveals a strong presence of both single-engine and multi-engine helicopters catering to varying group sizes and tour lengths. The commercial segment (civil and commercial applications) likely dominates the market share, with military applications representing a smaller, yet potentially growing, niche. Geographical distribution within the Middle East and Africa will likely show concentration in areas with established tourism infrastructure and attractive landscapes, such as the coastlines of South Africa, Kenya, and the United Arab Emirates, as well as unique natural landmarks in other regions. Challenges, however, include regulatory hurdles for helicopter operations in some countries, safety concerns, and environmental considerations regarding noise and emissions. Overcoming these through collaborations between tourism operators, government agencies, and helicopter manufacturers will be key to realizing the market's full potential.

The forecast for the Middle East and Africa helicopter tourism market anticipates continued growth, potentially exceeding the global average CAGR. Companies like Textron, Airbus, and Leonardo, known for their helicopter manufacturing and tourism-oriented services, are well-positioned to capitalize on this expansion. However, local operators and smaller companies may also play a significant role in providing niche tours and catering to specific markets. The market will likely witness diversification in service offerings, including personalized luxury tours, wildlife viewing excursions, and unique experiences tied to cultural heritage sites. Technological advancements in helicopter design, safety features, and noise reduction technologies will influence the market's trajectory. Successful players will need to balance growth with sustainability, addressing environmental concerns and adhering to stringent safety regulations to maintain public confidence and ensure long-term success in this burgeoning sector.

Middle-East and Africa Helicopter Tourism Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Middle East and Africa helicopter tourism industry, covering market size, segmentation, growth drivers, challenges, and key players. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. The forecast period extends from 2025 to 2033, encompassing the historical period from 2019 to 2024. The report utilizes robust data and insightful analysis to provide actionable intelligence for industry stakeholders.

Middle-East and Africa Helicopter Tourism Industry Market Concentration & Innovation

The Middle East and Africa helicopter tourism market exhibits a moderately concentrated landscape, with a few major players holding significant market share. While precise market share figures for each company are unavailable (xx%), the industry is characterized by a blend of established global manufacturers and regional operators. Innovation is driven by advancements in helicopter technology, increasing demand for luxurious travel experiences, and the adoption of advanced safety features. Regulatory frameworks vary across the region, impacting operational costs and market access. Substitute options such as private jets exist, but helicopters offer unique advantages in terms of accessibility to remote locations. End-user trends reflect a growing preference for personalized, high-end travel experiences. Mergers and acquisitions (M&A) activity has been relatively limited in recent years (xx Million USD in total M&A deal value for the period 2019-2024), but strategic partnerships are becoming increasingly prevalent.

- Key Innovation Drivers: Technological advancements (e.g., fly-by-wire systems, improved fuel efficiency), rising disposable incomes, and increasing demand for unique travel experiences.

- Regulatory Landscape: Varies significantly across countries; impacts operational costs and market access.

- M&A Activity: Relatively low in recent years, with focus shifting towards strategic partnerships and joint ventures.

Middle-East and Africa Helicopter Tourism Industry Industry Trends & Insights

The Middle East and Africa helicopter tourism market is experiencing robust growth, driven by increasing disposable incomes, particularly in certain regions, and a growing preference for luxury travel. The market’s Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) is estimated at xx%. Technological advancements such as the development of quieter and more fuel-efficient helicopters are further stimulating market expansion. Consumer preferences increasingly favor personalized and bespoke travel experiences. Competitive dynamics are characterized by a mix of global and regional operators, leading to intense competition in certain segments. Market penetration remains relatively low, presenting significant growth opportunities. The projected CAGR for the forecast period (2025-2033) is estimated at xx%, indicating continued market expansion. This growth is fueled by tourism infrastructure developments and the increased adoption of helicopter services for both leisure and business purposes.

Dominant Markets & Segments in Middle-East and Africa Helicopter Tourism Industry

The dominant segment within the Middle East and Africa helicopter tourism market is the Civil and Commercial application, fueled by the rising number of high-net-worth individuals seeking exclusive travel experiences and the increasing use of helicopters for corporate travel. While the Military segment is significant, its focus is not primarily on tourism. The multi-engine helicopter segment dominates due to its superior safety, payload capacity, and longer range, making it preferred for longer tourism journeys.

- Key Drivers of Civil and Commercial Segment Dominance: Rising disposable incomes, luxury travel preferences, and business travel demands.

- Key Drivers of Multi-Engine Segment Dominance: Enhanced safety, increased payload capacity, and extended range.

- Regional Dominance: The UAE, South Africa and Kenya are leading markets within the region.

- Country-Specific Drivers: Strong tourism infrastructure, supportive government policies, and high levels of disposable income.

Middle-East and Africa Helicopter Tourism Industry Product Developments

Recent product developments focus on enhancing safety features, fuel efficiency, and passenger comfort. Manufacturers are increasingly incorporating advanced technologies such as fly-by-wire systems and improved noise reduction capabilities to enhance the overall passenger experience. These innovations cater to the growing demand for luxurious and sustainable helicopter tourism options. The focus is on creating a seamless and premium travel experience tailored to the affluent segment of travelers.

Report Scope & Segmentation Analysis

This report segments the Middle East and Africa helicopter tourism market based on application (Civil and Commercial, Military) and number of engines (Single-Engine, Multi-Engine).

Application: The Civil and Commercial segment is projected to witness significant growth driven by increasing demand for luxury travel and corporate charters. The Military segment is expected to maintain steady growth due to government investments in defense and security.

Number of Engines: The Multi-Engine segment is anticipated to dominate the market due to its enhanced safety and capacity. The Single-Engine segment caters to niche applications and is expected to witness comparatively slower growth.

Key Drivers of Middle-East and Africa Helicopter Tourism Industry Growth

The growth of the Middle East and Africa helicopter tourism industry is propelled by several factors:

- Rising Disposable Incomes: A growing middle and upper class fuels increased demand for luxury travel experiences.

- Tourism Infrastructure Development: Investments in airports, resorts, and tourist attractions create opportunities for helicopter tourism.

- Technological Advancements: Improved helicopter technology leads to enhanced safety, fuel efficiency, and passenger comfort.

- Government Support: Favorable regulatory environments and tourism promotion policies contribute to industry growth.

Challenges in the Middle-East and Africa Helicopter Tourism Industry Sector

Significant challenges hinder industry growth:

- High Operational Costs: Fuel prices, maintenance, and insurance costs remain substantial.

- Regulatory Hurdles: Varying regulations across countries complicate operations and increase compliance burdens.

- Infrastructure Limitations: Inadequate infrastructure in some regions restricts accessibility.

- Safety Concerns: Ensuring high safety standards is crucial, requiring significant investment in training and maintenance.

Emerging Opportunities in Middle-East and Africa Helicopter Tourism Industry

Several emerging opportunities exist:

- Eco-Tourism: Demand for sustainable and environmentally conscious tourism is growing.

- Remote Destination Access: Helicopters offer unique access to previously inaccessible locations.

- Technological Integration: Integration of digital technologies such as augmented reality and virtual reality can enhance the tourist experience.

- Expansion into New Markets: Untapped tourism markets present significant growth potential.

Leading Players in the Middle-East and Africa Helicopter Tourism Industry Market

- Textron Inc

- Turkish Aerospace Industries (Turkish Armed Forces Foundation)

- Kaman Corporation

- Lockheed Martin Corporation

- Airbus SE

- Robinson Helicopter Company Inc

- MD Helicopters LLC

- Rostec State Corporation

- Leonardo S p A

- The Boeing Company

Key Developments in Middle-East and Africa Helicopter Tourism Industry Industry

- November 2023: The UAE’s Strategic Development Fund announced plans to independently develop the VRT500 and VRT300 co-axial light helicopters, potentially impacting regional helicopter supply and innovation.

- January 2023: The US Army awarded Boeing a USD 426 Million contract to produce 12 CH-47F Chinooks for the Egyptian Air Force, signifying investment in military helicopter fleet upgrades and potential trickle-down effects to the civilian market.

Strategic Outlook for Middle-East and Africa Helicopter Tourism Industry Market

The Middle East and Africa helicopter tourism market presents a significant growth trajectory, driven by increasing affluence, tourism development, and technological advancements. Strategic investments in infrastructure, safety, and sustainable practices are essential for realizing the market's full potential. Focusing on personalized experiences and expanding into new and emerging markets will be critical for capturing future growth opportunities. The market is expected to witness substantial growth in the coming years, with lucrative opportunities for both established players and new entrants.

Middle-East and Africa Helicopter Tourism Industry Segmentation

-

1. Application

- 1.1. Civil And Commercial

- 1.2. Military

-

2. Number of Engines

- 2.1. Single-Engine

- 2.2. Multi-Engine

-

3. Geography

-

3.1. Middle-East and Africa

- 3.1.1. Saudi Arabia

- 3.1.2. United Arab Emirates

- 3.1.3. Israel

- 3.1.4. Qatar

- 3.1.5. Egypt

- 3.1.6. Turkey

- 3.1.7. Rest of Middle-East and Africa

-

3.1. Middle-East and Africa

Middle-East and Africa Helicopter Tourism Industry Segmentation By Geography

-

1. Middle East and Africa

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Egypt

- 1.6. Turkey

- 1.7. Rest of Middle East and Africa

Middle-East and Africa Helicopter Tourism Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.97% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Military Segment to Exhibit the Highest Growth Rate During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East and Africa Helicopter Tourism Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Civil And Commercial

- 5.1.2. Military

- 5.2. Market Analysis, Insights and Forecast - by Number of Engines

- 5.2.1. Single-Engine

- 5.2.2. Multi-Engine

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Middle-East and Africa

- 5.3.1.1. Saudi Arabia

- 5.3.1.2. United Arab Emirates

- 5.3.1.3. Israel

- 5.3.1.4. Qatar

- 5.3.1.5. Egypt

- 5.3.1.6. Turkey

- 5.3.1.7. Rest of Middle-East and Africa

- 5.3.1. Middle-East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. South Africa Middle-East and Africa Helicopter Tourism Industry Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Middle-East and Africa Helicopter Tourism Industry Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Middle-East and Africa Helicopter Tourism Industry Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Middle-East and Africa Helicopter Tourism Industry Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Middle-East and Africa Helicopter Tourism Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Middle-East and Africa Helicopter Tourism Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Textron Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Turkish Aerospace Industries (Turkish Armed Forces Foundation)

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Kaman Corporatio

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Lockheed Martin Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Airbus SE

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Robinson Helicopter Company Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 MD Helicopters LLC

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Rostec State Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Leonardo S p A

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 The Boeing Company

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Textron Inc

List of Figures

- Figure 1: Middle-East and Africa Helicopter Tourism Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle-East and Africa Helicopter Tourism Industry Share (%) by Company 2024

List of Tables

- Table 1: Middle-East and Africa Helicopter Tourism Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle-East and Africa Helicopter Tourism Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Middle-East and Africa Helicopter Tourism Industry Revenue Million Forecast, by Number of Engines 2019 & 2032

- Table 4: Middle-East and Africa Helicopter Tourism Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Middle-East and Africa Helicopter Tourism Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Middle-East and Africa Helicopter Tourism Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: South Africa Middle-East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Sudan Middle-East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Uganda Middle-East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tanzania Middle-East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Kenya Middle-East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Africa Middle-East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Middle-East and Africa Helicopter Tourism Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Middle-East and Africa Helicopter Tourism Industry Revenue Million Forecast, by Number of Engines 2019 & 2032

- Table 15: Middle-East and Africa Helicopter Tourism Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 16: Middle-East and Africa Helicopter Tourism Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Saudi Arabia Middle-East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United Arab Emirates Middle-East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Israel Middle-East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Qatar Middle-East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Egypt Middle-East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Turkey Middle-East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Middle East and Africa Middle-East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East and Africa Helicopter Tourism Industry?

The projected CAGR is approximately 9.97%.

2. Which companies are prominent players in the Middle-East and Africa Helicopter Tourism Industry?

Key companies in the market include Textron Inc, Turkish Aerospace Industries (Turkish Armed Forces Foundation), Kaman Corporatio, Lockheed Martin Corporation, Airbus SE, Robinson Helicopter Company Inc, MD Helicopters LLC, Rostec State Corporation, Leonardo S p A, The Boeing Company.

3. What are the main segments of the Middle-East and Africa Helicopter Tourism Industry?

The market segments include Application, Number of Engines, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.45 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Military Segment to Exhibit the Highest Growth Rate During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

November 2023: The UAE’s Strategic Development Fund announced that it had planned to independently develop the VRT500 and VRT300 co-axial light helicopters after the invasion of Ukraine by Russia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East and Africa Helicopter Tourism Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East and Africa Helicopter Tourism Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East and Africa Helicopter Tourism Industry?

To stay informed about further developments, trends, and reports in the Middle-East and Africa Helicopter Tourism Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence