Key Insights

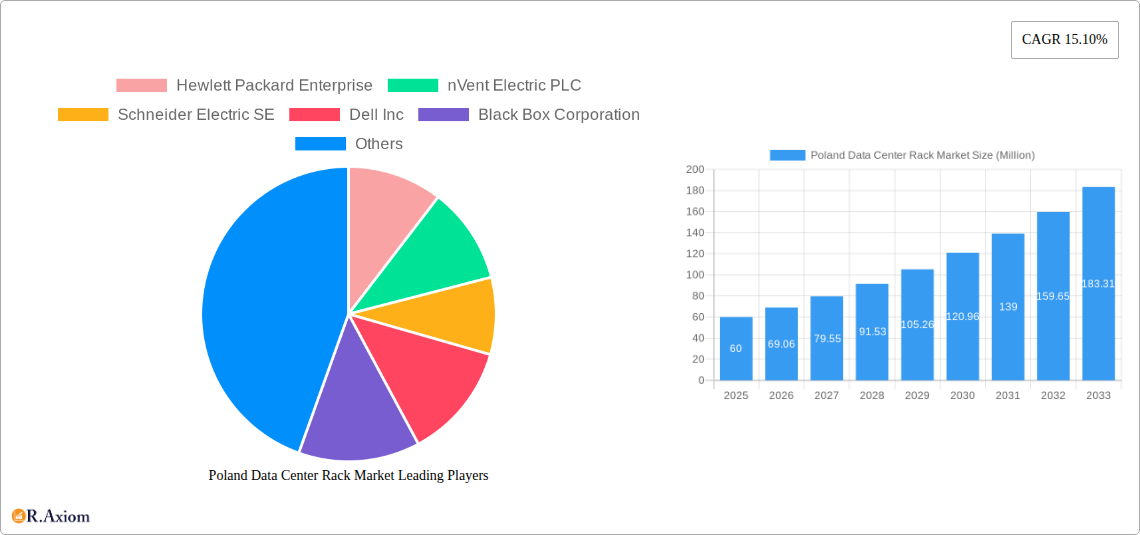

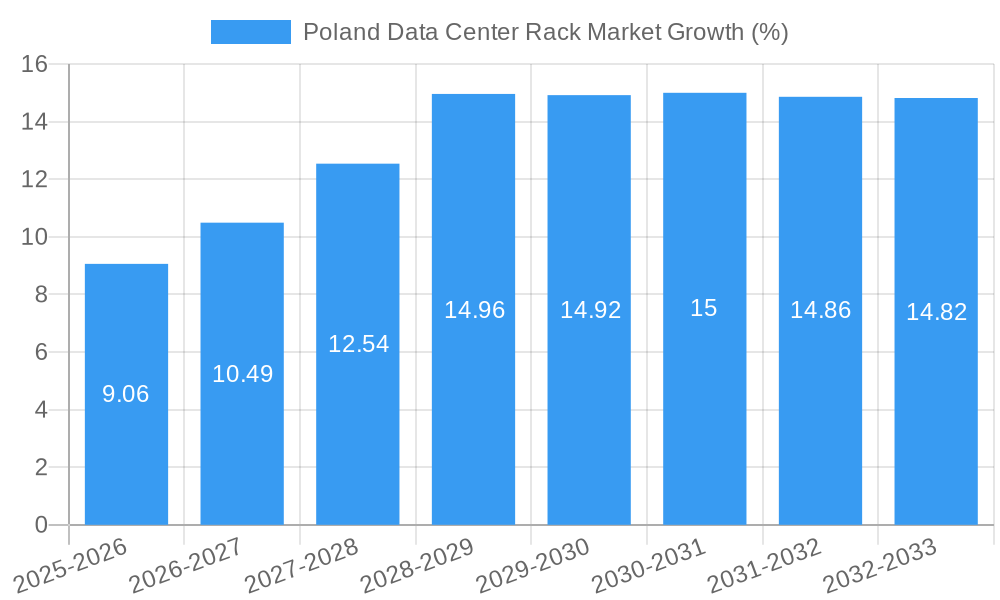

The Poland data center rack market, valued at approximately €60 million in 2025, is experiencing robust growth, projected to maintain a 15.10% Compound Annual Growth Rate (CAGR) from 2025 to 2033. This expansion is driven by several key factors. The increasing adoption of cloud computing and big data analytics necessitates robust data center infrastructure, fueling demand for reliable and scalable rack solutions. Furthermore, the burgeoning IT and telecommunication sectors in Poland, coupled with significant investments in digital infrastructure by the government and BFSI (Banking, Financial Services, and Insurance) entities, are major contributors to market growth. The trend towards edge computing, which requires decentralized data center deployments, further strengthens the market outlook. While rising raw material costs and potential supply chain disruptions represent challenges, the overall market trajectory remains positive, particularly given Poland's growing role as a regional IT hub within the European Union.

Market segmentation reveals a diversified demand landscape. Full rack solutions likely dominate the market share owing to their capacity and suitability for large-scale deployments. However, the demand for quarter and half rack solutions is expected to witness significant growth, driven by small and medium-sized businesses and the increasing adoption of microservices architectures. Key players like Hewlett Packard Enterprise, Schneider Electric, and Vertiv are strategically positioned to capitalize on this growth, leveraging their established brand recognition and extensive product portfolios. The continued expansion of data centers across various end-user sectors, including media and entertainment, ensures sustained growth for the foreseeable future. The Polish government's initiatives aimed at improving digital infrastructure will also play a significant role in shaping the market's trajectory over the forecast period.

This comprehensive report provides an in-depth analysis of the Poland Data Center Rack Market, offering valuable insights for stakeholders including manufacturers, investors, and industry professionals. The study period covers 2019-2033, with 2025 as the base and estimated year. The report forecasts market trends from 2025-2033, using data from the historical period of 2019-2024. Key players analyzed include Hewlett Packard Enterprise, nVent Electric PLC, Schneider Electric SE, Dell Inc, Black Box Corporation, Vertiv Group Corp, Econnex Comparison, Rittal GMBH & Co KG, and Eaton Corporation. The market is segmented by rack size (Quarter Rack, Half Rack, Full Rack) and end-user (IT & Telecommunication, BFSI, Government, Media & Entertainment, Other End-Users). The report utilizes Million (M) as the unit for all values.

Poland Data Center Rack Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory landscape, product substitutes, end-user trends, and mergers & acquisitions (M&A) activities within the Poland Data Center Rack Market. The market exhibits a moderately concentrated structure, with the top five players holding approximately xx% of the market share in 2024. Innovation is driven by the increasing demand for higher density, energy-efficient racks, and advanced cooling solutions. The regulatory framework, while generally supportive of data center growth, is subject to ongoing evolution. Key product substitutes include custom-built rack solutions and virtualized infrastructure. End-user trends reveal a shift towards cloud-based solutions and colocation facilities, impacting rack demand. M&A activity has been relatively moderate in recent years, with a total deal value of approximately xx M in the period 2019-2024.

- Market Share: Top 5 players: xx% (2024)

- M&A Deal Value (2019-2024): xx M

- Key Innovation Drivers: Energy efficiency, higher density racks, advanced cooling.

- Regulatory Landscape: Supportive, but evolving.

Poland Data Center Rack Market Industry Trends & Insights

The Poland Data Center Rack Market is experiencing robust growth, driven by factors such as increasing data consumption, rising digitalization across sectors, and government initiatives promoting digital infrastructure development. The market is projected to witness a CAGR of xx% during the forecast period (2025-2033), reaching a market size of xx M by 2033. Technological disruptions, including the adoption of edge computing and 5G networks, are further fueling market expansion. Consumer preferences are shifting toward customized and scalable rack solutions, tailored to specific infrastructure requirements. Competitive dynamics are characterized by intense competition among established players and the emergence of niche providers offering specialized solutions. Market penetration of advanced rack technologies, such as intelligent power distribution units (PDUs) and environmental monitoring systems, is steadily increasing.

Dominant Markets & Segments in Poland Data Center Rack Market

The IT & Telecommunication sector dominates the Poland Data Center Rack Market, accounting for approximately xx% of the total market value in 2024. The Full Rack segment holds the largest market share among rack sizes, driven by the high demand for large-scale data center deployments. The Warsaw region remains the dominant market, benefiting from well-established infrastructure and proximity to major IT hubs.

- Dominant End-User Segment: IT & Telecommunication (xx% in 2024)

- Dominant Rack Size Segment: Full Rack

- Dominant Geographic Region: Warsaw

- Key Drivers for IT & Telecommunication: Expansion of cloud services, growth of internet penetration.

- Key Drivers for Full Rack Segment: Large-scale data center deployments.

- Key Drivers for Warsaw Region: Established infrastructure, proximity to IT hubs.

Poland Data Center Rack Market Product Developments

Recent product innovations have focused on enhancing energy efficiency, improving cooling performance, and increasing rack density. Manufacturers are incorporating advanced features such as intelligent PDUs, remote monitoring capabilities, and integrated cable management systems. These developments are improving data center operations and addressing increasing demands for higher energy efficiency and streamlined management in the Poland market. The market is witnessing a rise in modular and customizable rack solutions that cater to specific customer needs.

Report Scope & Segmentation Analysis

This report segments the Poland Data Center Rack Market by rack size (Quarter Rack, Half Rack, Full Rack) and end-user (IT & Telecommunication, BFSI, Government, Media & Entertainment, Other End-Users). Each segment's growth projections, market sizes, and competitive dynamics are analyzed comprehensively. The IT & Telecommunication sector is expected to witness the highest growth, driven by the expansion of cloud services and increasing data traffic. The full rack segment dominates due to requirements of large data centers.

Key Drivers of Poland Data Center Rack Market Growth

The growth of the Poland Data Center Rack Market is driven by several factors, including: the increasing adoption of cloud computing and big data analytics across various sectors; significant government investments in digital infrastructure; rising demand for high-speed internet and mobile connectivity; and a growing awareness of data security and disaster recovery solutions among businesses. These factors have created a strong demand for sophisticated and efficient data center infrastructure, including racks.

Challenges in the Poland Data Center Rack Market Sector

The Poland Data Center Rack Market faces challenges such as fluctuations in raw material prices, supply chain disruptions, and increasing competition from international vendors. Additionally, the market is experiencing shortages of skilled labor needed for data center design and installation. These factors could potentially constrain market growth. The impact of these challenges is estimated to reduce the market growth by approximately xx% during the forecast period.

Emerging Opportunities in Poland Data Center Rack Market

Emerging opportunities include the growth of edge computing, increasing adoption of AI and machine learning, and the expansion of 5G networks. These trends are creating new demands for data center infrastructure and opening doors for specialized rack solutions that can address the unique requirements of these applications. There’s an expanding opportunity in providing sustainable and energy-efficient rack solutions.

Leading Players in the Poland Data Center Rack Market Market

- Hewlett Packard Enterprise (https://www.hpe.com/)

- nVent Electric PLC (https://www.nvent.com/)

- Schneider Electric SE (https://www.se.com/ww/en/)

- Dell Inc (https://www.dell.com/)

- Black Box Corporation (https://www.blackbox.com/)

- Vertiv Group Corp (https://www.vertiv.com/)

- Econnex Comparison

- Rittal GMBH & Co KG (https://www.rittal.com/)

- Eaton Corporation (https://www.eaton.com/)

Key Developments in Poland Data Center Rack Market Industry

- August 2022: The Polish government announced plans to create a national data center comprising three new facilities connected by fiber optics, significantly impacting future rack demand.

- December 2022: Atman sp. z o.o. acquired land to construct a new data center (Warsaw-3) with a planned 43 MW IT capacity, scheduled to open in Q4 2024, indicating substantial future rack requirements.

Strategic Outlook for Poland Data Center Rack Market Market

The Poland Data Center Rack Market is poised for continued growth, driven by ongoing digital transformation, government initiatives, and the expansion of key industries. The market will benefit from increasing investments in cloud computing, the rise of edge computing, and the growing need for advanced data center technologies. Opportunities exist for players who can provide innovative, energy-efficient, and scalable rack solutions tailored to meet the specific needs of the Polish market.

Poland Data Center Rack Market Segmentation

-

1. Rack Size

- 1.1. Quarter Rack

- 1.2. Half Rack

- 1.3. Full Rack

-

2. End-User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End-Users

Poland Data Center Rack Market Segmentation By Geography

- 1. Poland

Poland Data Center Rack Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid adoption of Cloud Services in the country; Significant growth in Data generation

- 3.3. Market Restrains

- 3.3.1. Increasing number of Data Security Breaches; Low Availability of Resources

- 3.4. Market Trends

- 3.4.1. Full Rack is the fastest growing segment in 2023.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland Data Center Rack Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Rack Size

- 5.1.1. Quarter Rack

- 5.1.2. Half Rack

- 5.1.3. Full Rack

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Rack Size

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Hewlett Packard Enterprise

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 nVent Electric PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Schneider Electric SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dell Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Black Box Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Vertiv Group Corp

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Econnex Camparison

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rittal GMBH & Co KG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Eaton Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Hewlett Packard Enterprise

List of Figures

- Figure 1: Poland Data Center Rack Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Poland Data Center Rack Market Share (%) by Company 2024

List of Tables

- Table 1: Poland Data Center Rack Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Poland Data Center Rack Market Revenue Million Forecast, by Rack Size 2019 & 2032

- Table 3: Poland Data Center Rack Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: Poland Data Center Rack Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Poland Data Center Rack Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Poland Data Center Rack Market Revenue Million Forecast, by Rack Size 2019 & 2032

- Table 7: Poland Data Center Rack Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 8: Poland Data Center Rack Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland Data Center Rack Market?

The projected CAGR is approximately 15.10%.

2. Which companies are prominent players in the Poland Data Center Rack Market?

Key companies in the market include Hewlett Packard Enterprise, nVent Electric PLC, Schneider Electric SE, Dell Inc, Black Box Corporation, Vertiv Group Corp, Econnex Camparison, Rittal GMBH & Co KG, Eaton Corporation.

3. What are the main segments of the Poland Data Center Rack Market?

The market segments include Rack Size, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid adoption of Cloud Services in the country; Significant growth in Data generation.

6. What are the notable trends driving market growth?

Full Rack is the fastest growing segment in 2023..

7. Are there any restraints impacting market growth?

Increasing number of Data Security Breaches; Low Availability of Resources.

8. Can you provide examples of recent developments in the market?

December 2022: Atman sp. z o.o. purchased land, the 5.5-hectare site in Duchnice near Ożarów Mazowiecki, to build another data center. The Atman Data Center Warsaw-3 campus was scheduled to open in Q4 2024 with a target IT capacity of 43 MW.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland Data Center Rack Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland Data Center Rack Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland Data Center Rack Market?

To stay informed about further developments, trends, and reports in the Poland Data Center Rack Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence