Key Insights

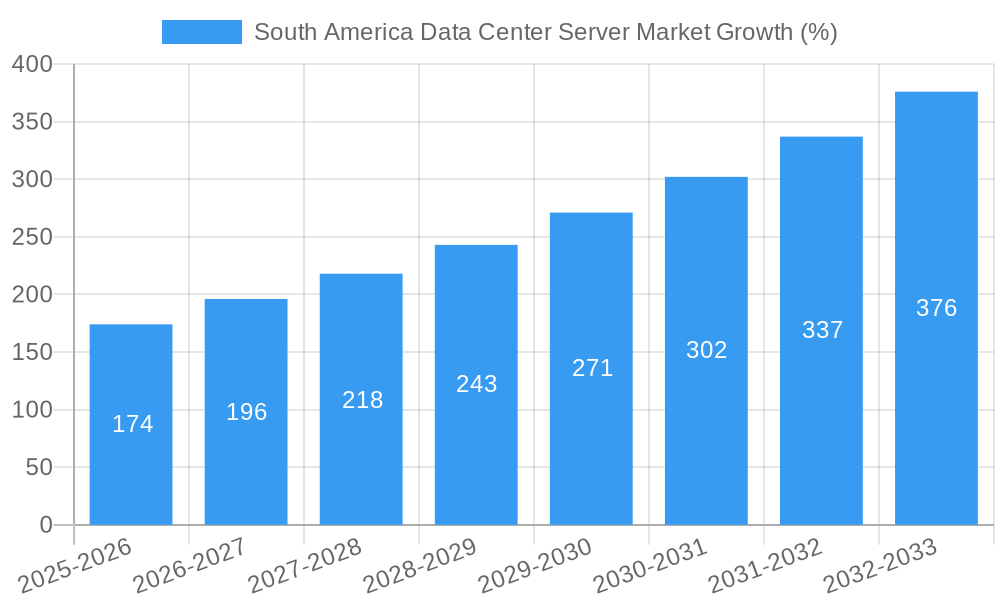

The South American data center server market is experiencing robust growth, driven by increasing digital transformation initiatives across various sectors. The region's burgeoning IT & telecommunication industry, coupled with the expanding financial services (BFSI) and government sectors, is fueling demand for high-performance computing infrastructure. The market is segmented by form factor (blade, rack, and tower servers) and end-user, with IT & Telecommunication currently dominating, followed by BFSI and government. While precise figures for the South American market size in 2025 are unavailable, considering a global CAGR of 11.60% and regional economic growth trends, a reasonable estimate for the South American data center server market value in 2025 would be around $1.5 billion USD, based on extrapolation from larger global market reports and regional economic indicators. This figure is expected to continue its upward trajectory, propelled by trends such as cloud computing adoption, the increasing need for big data analytics, and growing investments in advanced technologies like AI and machine learning. However, constraints like fluctuating currency exchange rates, potential infrastructure bottlenecks, and economic instability in some parts of South America could pose challenges to the market's consistent growth. The market's future will likely be shaped by the degree to which these challenges can be mitigated and further investment in digital infrastructure takes place.

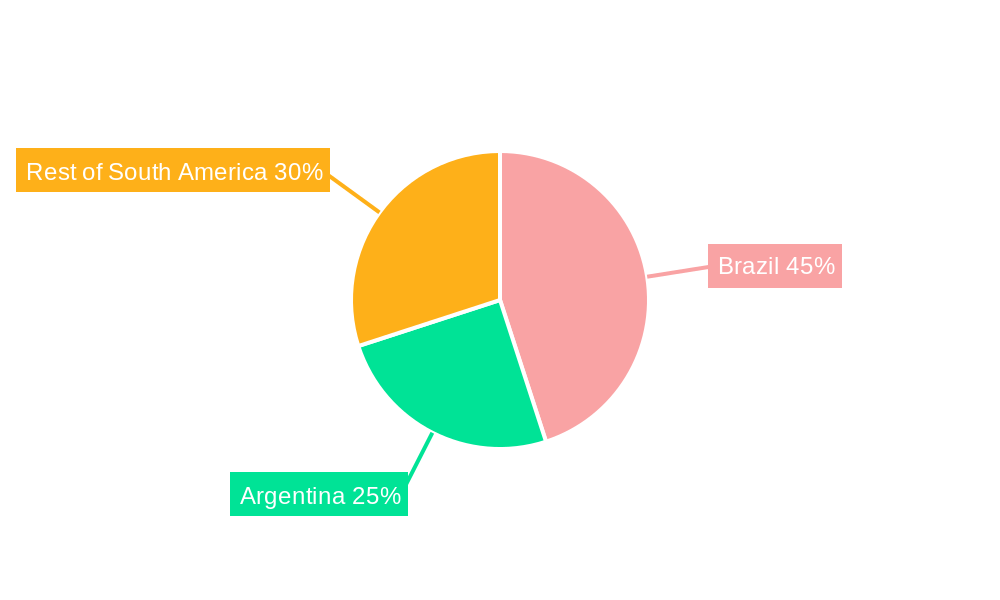

The leading players in this market include Lenovo, IBM, Inspur, Hewlett Packard Enterprise, Cisco, Fujitsu, Dell, Kingston Technology, and Huawei. Their competitive strategies are focused on providing advanced server technologies tailored to specific industry needs and expanding their distribution networks within South America. The competitive landscape is characterized by strong competition amongst these global players, but also increasing opportunities for regional providers to cater to unique local requirements and preferences. Brazil and Argentina constitute the largest markets within South America, followed by a diverse "Rest of South America" segment exhibiting varied growth rates according to economic conditions and technology adoption levels. The forecast period of 2025-2033 presents significant growth potential, particularly with the anticipated rise in cloud computing adoption and the increasing focus on digital infrastructure development within the region.

South America Data Center Server Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the South America Data Center Server market, covering the period from 2019 to 2033. It offers a granular view of market dynamics, competitive landscapes, and future growth potential, equipping stakeholders with actionable insights for strategic decision-making. The report includes detailed segmentation by form factor (Blade Server, Rack Server, Tower Server) and end-user (IT & Telecommunication, BFSI, Government, Media & Entertainment, Other End-User), providing a 360° perspective of this dynamic market. Key players analyzed include Lenovo Group Limited, International Business Machines (IBM) Corporation, Inspur Group, Hewlett Packard Enterprise, Cisco Systems Inc, Fujitsu Limited, Dell Inc, Kingston Technology Company Inc, and Huawei Technologies Co Ltd. The base year for this report is 2025, with estimations for 2025 and forecasts extending to 2033.

South America Data Center Server Market Concentration & Innovation

The South American data center server market exhibits a moderately concentrated landscape, with a few major players holding significant market share. While exact figures vary across segments, the top 5 vendors likely account for approximately xx% of the total market revenue in 2025. Innovation is driven by the increasing demand for high-performance computing (HPC), cloud computing, and artificial intelligence (AI), pushing vendors to develop advanced server technologies such as those incorporating Intel's Sapphire Rapids processors (as seen in Lenovo's 2022 product launches). Regulatory frameworks, while varying across South American nations, generally promote digital infrastructure development, although data privacy regulations can influence vendor strategies. Product substitutes, like cloud-based services, exert competitive pressure. End-user trends indicate a shift towards hyperscale data centers and hybrid cloud solutions, demanding greater scalability and efficiency from server technology. M&A activity in the region has been relatively moderate in recent years, with deal values totaling approximately xx Million in the period 2019-2024; however, increased investment in the digital infrastructure is expected to drive future consolidation.

- Market Share: Top 5 vendors holding approximately xx% of total revenue (2025).

- M&A Deal Values: Approximately xx Million (2019-2024).

- Innovation Drivers: HPC, Cloud Computing, AI.

- Regulatory Influences: Variable across South American nations, with a general positive trend toward digital infrastructure.

South America Data Center Server Market Industry Trends & Insights

The South America data center server market is experiencing robust growth, driven by the expanding digital economy and increasing adoption of cloud services. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033). Market penetration of advanced server technologies, such as blade servers optimized for AI and HPC workloads (as exemplified by Supermicro's 2023 launch), is steadily increasing. Technological disruptions, such as the transition to next-generation processors (e.g., Intel Sapphire Rapids), are shaping vendor strategies. Consumer preferences are shifting towards energy-efficient and scalable solutions, leading to increased demand for high-density server designs. Competitive dynamics are marked by intense rivalry among established players and the emergence of niche players focusing on specialized segments. The overall market is characterized by a dynamic interplay between technology advancements, evolving end-user needs, and competitive pressures.

Dominant Markets & Segments in South America Data Center Server Market

Brazil holds the dominant position in the South America data center server market, driven by its larger economy, significant IT investments, and well-developed infrastructure. Other key markets include Colombia, Argentina, and Chile, though at a smaller scale.

Form Factor: Rack servers constitute the largest segment, due to their versatility and scalability. Blade servers are gaining traction, especially in cloud and HPC deployments. Tower servers hold a smaller share, primarily catering to small and medium-sized businesses.

End-User: The IT & Telecommunication sector is the largest end-user segment, followed by the BFSI and Government sectors. Media & Entertainment and Other End-Users represent smaller but growing market shares.

Key Drivers:

- Brazil: Strong economy, high IT spending, established infrastructure.

- Other Markets: Growing digitalization, government initiatives to improve infrastructure.

South America Data Center Server Market Product Developments

Recent product innovations highlight trends toward greater performance, efficiency, and scalability. Supermicro’s new server and storage portfolio, including SuperBlade, emphasizes high-density, AI-optimized solutions. Lenovo's introduction of new servers incorporating Intel Sapphire Rapids processors underscores the importance of next-generation processor technology in enhancing performance and energy efficiency. These developments reflect a strong market fit for advanced server technologies catering to the demands of cloud computing, AI, and HPC applications.

Report Scope & Segmentation Analysis

This report segments the South America data center server market by form factor (Blade, Rack, Tower) and end-user (IT & Telecommunication, BFSI, Government, Media & Entertainment, Other). Each segment’s growth projections are detailed, along with respective market sizes and competitive analyses. For example, the Rack Server segment is projected to maintain its dominant position due to its broad applicability, while Blade Servers are expected to witness the highest CAGR due to growing adoption in high-performance computing environments. Similarly, the IT & Telecommunication sector is expected to remain the largest end-user segment driven by continuous investments in expanding network infrastructure.

Key Drivers of South America Data Center Server Market Growth

The South American data center server market is propelled by several key factors: The increasing adoption of cloud computing and digital transformation initiatives across various industries fuels demand for robust server infrastructure. Government investments in digital infrastructure development across several South American nations are creating favorable conditions for market expansion. Furthermore, the growing adoption of advanced technologies such as AI and HPC is further driving the need for high-performance server solutions.

Challenges in the South America Data Center Server Market Sector

The market faces challenges including uneven infrastructure development across the region, leading to variations in market penetration across different countries. Supply chain disruptions and fluctuations in global component prices represent significant obstacles. Competitive pressures from both established international players and local providers also impact market dynamics. These factors contribute to uncertainties in forecasting exact growth figures.

Emerging Opportunities in South America Data Center Server Market

Significant opportunities exist in the expansion of data center infrastructure in underserved regions. The growing adoption of edge computing presents opportunities for specialized server solutions. Furthermore, increased government support for digital transformation initiatives creates a favorable environment for market expansion. Finally, the rise of AI and HPC will lead to sustained demand for high-performance servers.

Leading Players in the South America Data Center Server Market Market

- Lenovo Group Limited (Lenovo)

- International Business Machines (IBM) Corporation (IBM)

- Inspur Group

- Hewlett Packard Enterprise (HPE)

- Cisco Systems Inc (Cisco)

- Fujitsu Limited (Fujitsu)

- Dell Inc (Dell)

- Kingston Technology Company Inc (Kingston)

- Huawei Technologies Co Ltd (Huawei)

Key Developments in South America Data Center Server Market Industry

September 2022: Lenovo Group Ltd. launched new servers, storage systems, and Hyperconverged Infrastructure appliances, incorporating Intel's Sapphire Rapids processors (planned for future release). This reflects a push for improved performance and efficiency.

January 2023: Supermicro launched a new server and storage portfolio, including SuperBlade, focusing on cloud computing, AI, and HPC workloads. This signifies a trend toward high-density, performance-optimized solutions.

Strategic Outlook for South America Data Center Server Market Market

The South America data center server market is poised for significant growth, driven by the continuous expansion of the digital economy, increasing government investment in digital infrastructure, and strong demand for high-performance computing solutions. The adoption of advanced technologies, such as AI and edge computing, is expected to fuel further growth. The market will witness intensified competition among vendors, leading to innovation in server technologies and service offerings. Focus on energy-efficient and sustainable solutions will also play an increasingly important role.

South America Data Center Server Market Segmentation

-

1. Form Factor

- 1.1. Blade Server

- 1.2. Rack Server

- 1.3. Tower Server

-

2. End-User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End-User

-

3. Geography

- 3.1. Brazil

- 3.2. Chile

- 3.3. Rest of South America

South America Data Center Server Market Segmentation By Geography

- 1. Brazil

- 2. Chile

- 3. Rest of South America

South America Data Center Server Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Cloud Technologies; Large-scale commercialization of 5G networks

- 3.3. Market Restrains

- 3.3.1. Rising CapEx for data center construction; Cybersecurity Threats

- 3.4. Market Trends

- 3.4.1. IT & Telecommunication Segment Holds The Major Share.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Data Center Server Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form Factor

- 5.1.1. Blade Server

- 5.1.2. Rack Server

- 5.1.3. Tower Server

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End-User

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Chile

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Chile

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Form Factor

- 6. Brazil South America Data Center Server Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Form Factor

- 6.1.1. Blade Server

- 6.1.2. Rack Server

- 6.1.3. Tower Server

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. IT & Telecommunication

- 6.2.2. BFSI

- 6.2.3. Government

- 6.2.4. Media & Entertainment

- 6.2.5. Other End-User

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Chile

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Form Factor

- 7. Chile South America Data Center Server Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Form Factor

- 7.1.1. Blade Server

- 7.1.2. Rack Server

- 7.1.3. Tower Server

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. IT & Telecommunication

- 7.2.2. BFSI

- 7.2.3. Government

- 7.2.4. Media & Entertainment

- 7.2.5. Other End-User

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Chile

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Form Factor

- 8. Rest of South America South America Data Center Server Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Form Factor

- 8.1.1. Blade Server

- 8.1.2. Rack Server

- 8.1.3. Tower Server

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. IT & Telecommunication

- 8.2.2. BFSI

- 8.2.3. Government

- 8.2.4. Media & Entertainment

- 8.2.5. Other End-User

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Chile

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Form Factor

- 9. Brazil South America Data Center Server Market Analysis, Insights and Forecast, 2019-2031

- 10. Argentina South America Data Center Server Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of South America South America Data Center Server Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Lenovo Group Limited

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 International Business Machines (IBM) Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Inspur Group

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Hewlett Packard Enterprise

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Cisco Systems Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Fujitsu Limited

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Dell Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Kingston Technology Company Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Huawei Technologies Co Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 Lenovo Group Limited

List of Figures

- Figure 1: South America Data Center Server Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Data Center Server Market Share (%) by Company 2024

List of Tables

- Table 1: South America Data Center Server Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Data Center Server Market Revenue Million Forecast, by Form Factor 2019 & 2032

- Table 3: South America Data Center Server Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: South America Data Center Server Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: South America Data Center Server Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South America Data Center Server Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazil South America Data Center Server Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Argentina South America Data Center Server Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of South America South America Data Center Server Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South America Data Center Server Market Revenue Million Forecast, by Form Factor 2019 & 2032

- Table 11: South America Data Center Server Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 12: South America Data Center Server Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: South America Data Center Server Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: South America Data Center Server Market Revenue Million Forecast, by Form Factor 2019 & 2032

- Table 15: South America Data Center Server Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 16: South America Data Center Server Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: South America Data Center Server Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: South America Data Center Server Market Revenue Million Forecast, by Form Factor 2019 & 2032

- Table 19: South America Data Center Server Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 20: South America Data Center Server Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: South America Data Center Server Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Data Center Server Market?

The projected CAGR is approximately 11.60%.

2. Which companies are prominent players in the South America Data Center Server Market?

Key companies in the market include Lenovo Group Limited, International Business Machines (IBM) Corporation, Inspur Group, Hewlett Packard Enterprise, Cisco Systems Inc, Fujitsu Limited, Dell Inc, Kingston Technology Company Inc, Huawei Technologies Co Ltd.

3. What are the main segments of the South America Data Center Server Market?

The market segments include Form Factor, End-User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Cloud Technologies; Large-scale commercialization of 5G networks.

6. What are the notable trends driving market growth?

IT & Telecommunication Segment Holds The Major Share..

7. Are there any restraints impacting market growth?

Rising CapEx for data center construction; Cybersecurity Threats.

8. Can you provide examples of recent developments in the market?

January 2023: Supermicro announced the launch of its new server and storage portfolio with more than 15 families of performance-optimized systems focusing on cloud computing, AI, and HPC, as well as enterprise, media, and 5G/telco/edge workloads. SuperBlade would deliver the computational performance of a whole server rack in a considerably smaller physical footprint by using shared, redundant components, including cooling, networking, power, and chassis management. These blade server systems are geared for AI, Data Analytics, HPC, Cloud, and Enterprise applications and feature GPU-enabled blades.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Data Center Server Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Data Center Server Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Data Center Server Market?

To stay informed about further developments, trends, and reports in the South America Data Center Server Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence