Key Insights

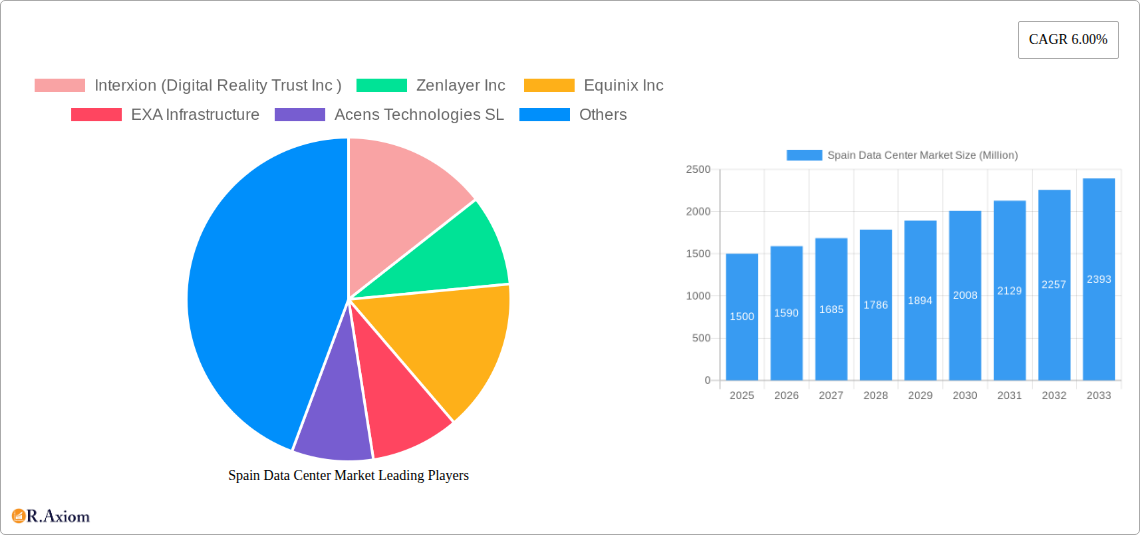

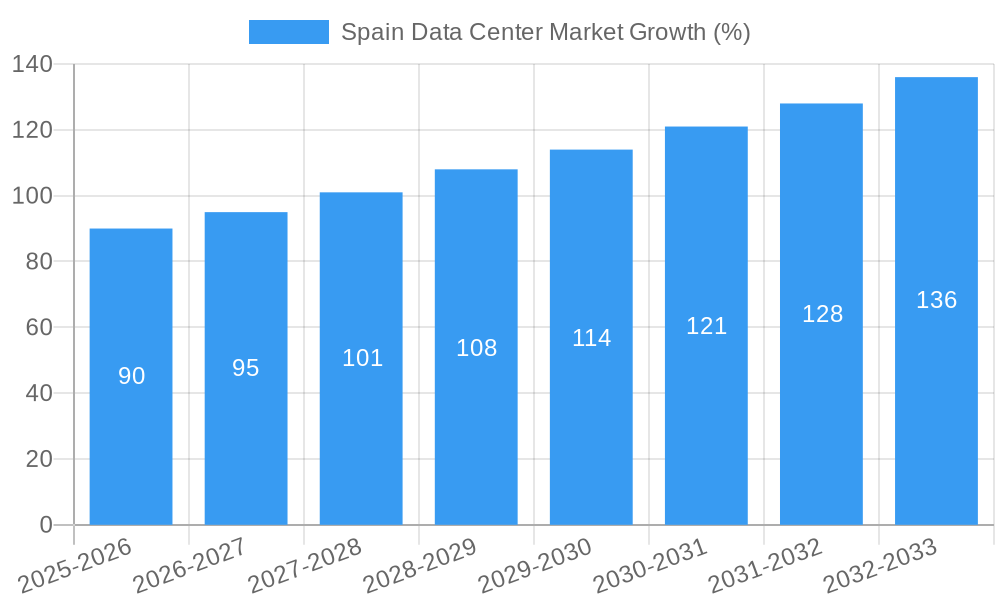

The Spain data center market, valued at approximately €X million in 2025 (assuming a logical estimation based on a 6% CAGR from a prior year), is experiencing robust growth, projected to reach €Y million by 2033. This expansion is fueled by several key drivers: the increasing adoption of cloud computing and digital transformation initiatives across various sectors, the rising demand for colocation services, and substantial investments in high-speed internet infrastructure. The market is segmented by data center size (small, medium, mega, massive, large), tier type (Tier 1, Tier 2, Tier 3, Tier 4), absorption (utilized, non-utilized), end-user (other end-users), and key hotspots like Madrid and the rest of Spain. The growth is further accelerated by Spain's strategic geographic location, making it a critical hub for connectivity between Europe, Africa, and the Americas. Leading players such as Equinix, Interxion (Digital Realty), and Global Switch are actively expanding their presence, adding further impetus to the market's growth trajectory.

However, the market also faces certain restraints. These include the relatively high cost of land and energy in prime locations, and the potential challenges related to securing necessary permits and approvals for new data center construction. Competition among existing players is intense, leading to pressure on pricing and margins. Despite these challenges, the long-term outlook for the Spain data center market remains positive, driven by continued digitalization and increasing demand for data storage and processing capabilities. The market’s growth is expected to remain strong, underpinned by ongoing investment and innovation within the sector. The focus on sustainability and energy efficiency in data center operations will also be a significant factor in shaping the market landscape in the coming years.

This in-depth report provides a comprehensive analysis of the Spain data center market, covering market size, segmentation, key players, industry trends, and future growth prospects. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period encompasses 2019-2024. The report is designed to provide actionable insights for industry stakeholders, investors, and strategic decision-makers.

Spain Data Center Market: Market Concentration & Innovation

This section analyzes the competitive landscape of the Spain data center market, encompassing market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities. The market exhibits a moderately concentrated structure with a few major players holding significant market share. For example, Equinix Inc. and Interxion (Digital Realty Trust Inc.) are likely to command a significant portion of the market, possibly exceeding xx% combined. However, smaller players such as Acens Technologies SL and Nabiax are filling niche market segments through specialized services and strategic regional expansion.

- Market Share: Equinix Inc. (xx%), Interxion (Digital Realty Trust Inc.) (xx%), Others (xx%). Exact figures require further in-depth analysis.

- Innovation Drivers: Increasing demand for cloud services, the rise of big data analytics, and the need for edge computing are key drivers of innovation.

- Regulatory Framework: The Spanish government’s supportive policies regarding digital infrastructure development significantly influence market growth.

- Product Substitutes: While traditional on-premise data centers still have a place, cloud computing is a significant substitute, impacting the adoption rate of traditional infrastructure.

- End-User Trends: The growth of industries like finance, telecom, and e-commerce is fueling the demand for data center services.

- M&A Activities: The value of M&A deals in the Spanish data center market during the past five years has totaled approximately xx Million, reflecting ongoing consolidation in the sector. Recent activity reflects a strong interest in expanding capacity and infrastructure.

Spain Data Center Market: Industry Trends & Insights

The Spain data center market is witnessing robust growth, driven by factors such as increasing digitalization, expanding cloud adoption, and the burgeoning demand for data storage and processing capabilities. The compound annual growth rate (CAGR) is estimated to be xx% during the forecast period (2025-2033). Market penetration is increasing as more organizations move towards cloud-based solutions and the adoption of modern infrastructure technologies gains momentum. Technological disruptions, such as the widespread adoption of 5G and the development of advanced hyperscale data centers, are transforming the industry landscape. Competitive dynamics are shaped by factors such as pricing strategies, service differentiation, and expansion into new geographic regions. Consumer preferences are leaning towards higher levels of security, reliability, and energy efficiency, which further influence industry development.

Dominant Markets & Segments in Spain Data Center Market

The Madrid region dominates the Spain data center market, driven by its established infrastructure, strong connectivity, and concentration of businesses. Other regions are showing growth, but Madrid remains the primary hotspot.

Key Drivers for Madrid's Dominance:

- Established Infrastructure: Existing fiber optic networks and robust power supply.

- Connectivity: Excellent connectivity to other European data centers.

- Business Concentration: High concentration of businesses in various sectors, driving high demand for data center services.

Data Center Size: The Mega and Large data center segments are expected to dominate, driven by the needs of hyperscale cloud providers and large enterprises. Small and Medium sized data centers serve a niche market. The Massive segment is still in early stages of development.

Tier Type: Tier III and Tier IV data centers are becoming more prevalent due to their higher levels of redundancy and reliability.

Absorption: Utilized capacity is currently high, reflecting strong demand. Non-utilized capacity is being absorbed at a faster rate in key regions like Madrid.

Other End Users: Government agencies and educational institutions are also driving significant demand.

Spain Data Center Market: Product Developments

Recent product developments highlight a focus on increasing energy efficiency, improving security features, and enhancing connectivity. Innovations such as liquid cooling systems and AI-powered data center management solutions are gaining traction. The market is increasingly focused on providing tailored solutions and flexible service models to cater to the evolving demands of various customer segments. These developments are driving higher adoption of advanced technologies and more efficient overall operations.

Report Scope & Segmentation Analysis

This report segments the Spain data center market based on several key factors, providing a granular view of market dynamics within each segment. Growth projections and competitive dynamics are assessed for each segment.

- Data Center Size: Small, Medium, Mega, Large, Massive. Growth rates vary based on market demand and technology adoption.

- Tier Type: Tier I, Tier II, Tier III, Tier IV. Higher-tier data centers command higher prices and are experiencing faster growth.

- Absorption: Utilized, Non-Utilized. Market projections account for current utilization rates and future demand.

- Hotspot: Madrid, Rest of Spain. Madrid exhibits higher growth due to concentrated demand.

- Other End Users: Government, Education, Healthcare, etc. Growth rates vary based on the unique needs of each segment.

Key Drivers of Spain Data Center Market Growth

Several factors are driving growth in the Spain data center market:

- Government Support: Government initiatives aimed at bolstering digital infrastructure are attracting investment.

- Growing Digital Economy: Rapid growth of e-commerce, cloud computing, and other data-intensive industries fuels the demand for data center services.

- Improved Connectivity: Enhanced network infrastructure across Spain is attracting international businesses.

- Increased Investment: Significant private and public sector investment is expanding capacity and modernizing existing facilities.

Challenges in the Spain Data Center Market Sector

The Spain data center market also faces some challenges:

- Energy Costs: High energy costs can negatively affect profitability for data center operators.

- Land Availability: Finding suitable land for new data center construction in prime locations is becoming difficult.

- Competition: Intense competition among existing and new entrants may lead to price wars and pressure on profit margins. This is particularly true in densely populated areas such as Madrid.

- Regulatory Compliance: Meeting stringent environmental regulations can add complexity and cost to operations.

Emerging Opportunities in Spain Data Center Market

The Spain data center market presents several promising opportunities:

- Edge Computing: Expanding demand for edge computing services offers significant growth potential.

- Hyperscale Data Centers: Growing interest from hyperscale cloud providers represents a key growth driver.

- Sustainability Initiatives: Focus on building more energy-efficient and sustainable data centers will unlock further growth.

- Specialized Services: Data centers providing niche services can differentiate themselves and capture specialized market segments.

Leading Players in the Spain Data Center Market

- Interxion (Digital Realty Trust Inc)

- Zenlayer Inc

- Equinix Inc

- EXA Infrastructure

- Acens Technologies SL

- Digital Data Centre Bidco SL (Nabiax)

- NetActuate Inc

- Adam Ecotech SA

- Global Switch Holdings Limited

- VPS House Technology Group LLC

- T-Systems International GmbH

Key Developments in Spain Data Center Market Industry

- May 2022: A company expanded its Mediterranean presence in Barcelona with the development of a new colocation and connectivity hub, with a capacity of 15 MW of total installed IT power, commencing construction in 2022 and anticipating completion in 2024.

- October 2022: Equinix opened its IBX facility (MD6) in Madrid, featuring 1,466 sqm (15,780 sq ft) and a power capacity of 4.8 MW, offering space for 600 racks.

- December 2022: A company invested in the Iberian Peninsula by establishing a terrestrial transport route between Spain and Lisbon, connecting to EXA’s Spanish backbone. This new northern route enhances connectivity across the Iberian Peninsula and links to data center hubs in Europe.

Strategic Outlook for Spain Data Center Market

The Spain data center market is poised for continued strong growth, driven by increasing digitalization, technological advancements, and supportive government policies. The expansion of cloud computing, the rise of edge computing, and the growing adoption of sustainable technologies will create new opportunities for data center operators. Strategic investments in infrastructure, innovation, and sustainability will be crucial for success in this dynamic and competitive market. The market is predicted to reach xx Million by 2033.

Spain Data Center Market Segmentation

-

1. Product Type

- 1.1. Cloud

- 1.2. Colocation

- 1.3. Managed Services

-

2. End-User

- 2.1. BFSI

- 2.2. Cloud

- 2.3. E-Commerce

- 2.4. Government

- 2.5. Manufacturing

- 2.6. Media & Entertainment

- 2.7. Telecom

- 2.8. Other End User

-

3. Data Center Size

- 3.1. Large

- 3.2. Massive

- 3.3. Medium

- 3.4. Mega

- 3.5. Small

-

4. Tier Type

- 4.1. Tier 1 and 2

- 4.2. Tier 3

- 4.3. Tier 4

-

5. Absorption

- 5.1. Non-Utilized

-

6. Colocation Type

- 6.1. Hyperscale

- 6.2. Retail

- 6.3. Wholesale

Spain Data Center Market Segmentation By Geography

- 1. Spain

Spain Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; High Mobile penetration

- 3.2.2 Low Tariff

- 3.2.3 and Mature Regulatory Authority; Successful Privatization and Liberalization Initiatives

- 3.3. Market Restrains

- 3.3.1. ; Difficulties in Customization According to Business Needs

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cloud

- 5.1.2. Colocation

- 5.1.3. Managed Services

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. BFSI

- 5.2.2. Cloud

- 5.2.3. E-Commerce

- 5.2.4. Government

- 5.2.5. Manufacturing

- 5.2.6. Media & Entertainment

- 5.2.7. Telecom

- 5.2.8. Other End User

- 5.3. Market Analysis, Insights and Forecast - by Data Center Size

- 5.3.1. Large

- 5.3.2. Massive

- 5.3.3. Medium

- 5.3.4. Mega

- 5.3.5. Small

- 5.4. Market Analysis, Insights and Forecast - by Tier Type

- 5.4.1. Tier 1 and 2

- 5.4.2. Tier 3

- 5.4.3. Tier 4

- 5.5. Market Analysis, Insights and Forecast - by Absorption

- 5.5.1. Non-Utilized

- 5.6. Market Analysis, Insights and Forecast - by Colocation Type

- 5.6.1. Hyperscale

- 5.6.2. Retail

- 5.6.3. Wholesale

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Interxion (Digital Reality Trust Inc )

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Zenlayer Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Equinix Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 EXA Infrastructure

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Acens Technologies SL

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Digital Data Centre Bidco SL (Nabiax)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 NetActuate Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Adam Ecotech SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Data

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Global Switch Holdings Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 VPS House Technology Group LLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 T-Systems International GmbH

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Interxion (Digital Reality Trust Inc )

List of Figures

- Figure 1: Spain Data Center Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Spain Data Center Market Share (%) by Company 2024

List of Tables

- Table 1: Spain Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Spain Data Center Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Spain Data Center Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Spain Data Center Market Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 5: Spain Data Center Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 6: Spain Data Center Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 7: Spain Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 8: Spain Data Center Market Volume K Unit Forecast, by Data Center Size 2019 & 2032

- Table 9: Spain Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 10: Spain Data Center Market Volume K Unit Forecast, by Tier Type 2019 & 2032

- Table 11: Spain Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 12: Spain Data Center Market Volume K Unit Forecast, by Absorption 2019 & 2032

- Table 13: Spain Data Center Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 14: Spain Data Center Market Volume K Unit Forecast, by Colocation Type 2019 & 2032

- Table 15: Spain Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 16: Spain Data Center Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 17: Spain Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Spain Data Center Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: Spain Data Center Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: Spain Data Center Market Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 21: Spain Data Center Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 22: Spain Data Center Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 23: Spain Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 24: Spain Data Center Market Volume K Unit Forecast, by Data Center Size 2019 & 2032

- Table 25: Spain Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 26: Spain Data Center Market Volume K Unit Forecast, by Tier Type 2019 & 2032

- Table 27: Spain Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 28: Spain Data Center Market Volume K Unit Forecast, by Absorption 2019 & 2032

- Table 29: Spain Data Center Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 30: Spain Data Center Market Volume K Unit Forecast, by Colocation Type 2019 & 2032

- Table 31: Spain Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Spain Data Center Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Data Center Market?

The projected CAGR is approximately 6.00%.

2. Which companies are prominent players in the Spain Data Center Market?

Key companies in the market include Interxion (Digital Reality Trust Inc ), Zenlayer Inc , Equinix Inc, EXA Infrastructure, Acens Technologies SL, Digital Data Centre Bidco SL (Nabiax), NetActuate Inc, Adam Ecotech SA, Data, Global Switch Holdings Limited, VPS House Technology Group LLC, T-Systems International GmbH.

3. What are the main segments of the Spain Data Center Market?

The market segments include Product Type, End-User, Data Center Size, Tier Type, Absorption, Colocation Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; High Mobile penetration. Low Tariff. and Mature Regulatory Authority; Successful Privatization and Liberalization Initiatives.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

; Difficulties in Customization According to Business Needs.

8. Can you provide examples of recent developments in the market?

December 2022: The company invested in the Iberian Peninsula with terrestrial transport route between Spain and Lisbon connecting to EXA’s Spanish backbone. The new northern route serves to fulfill customer demand across the Iberian Peninsula connecting to data centre hubs across Europe.October 2022: Equinix to open IBX facility, known as MD6, with area of 1,466 sqm (15,780 sq ft) and a power of 4.8 MW, offering capacity for 600 racks.May 2022: The company expanded Mediterranean Presence in Barcelona with Development of New Colocation and Connectivity Hub. The land parcel has the capacity to house 15MW of total installed IT power. The constructiin is to commence in 2022 anticipated to complete in 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Data Center Market?

To stay informed about further developments, trends, and reports in the Spain Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence