Key Insights

The European sustainable furniture market is projected for substantial growth, fueled by increasing consumer demand for eco-friendly and ethically produced home furnishings. With a current market size of $18.5 billion and a projected Compound Annual Growth Rate (CAGR) of 11% from a base year of 2024, this sector underscores the rising environmental consciousness among European consumers and businesses. Key drivers include heightened awareness of purchasing impacts, a desire for healthier living environments, and an appreciation for the durability and unique aesthetics of sustainable materials like wood and bamboo. Manufacturers are actively innovating with recycled PET and novel materials, expanding the appeal and accessibility of sustainable options. Government initiatives and eco-friendly certifications further bolster market development.

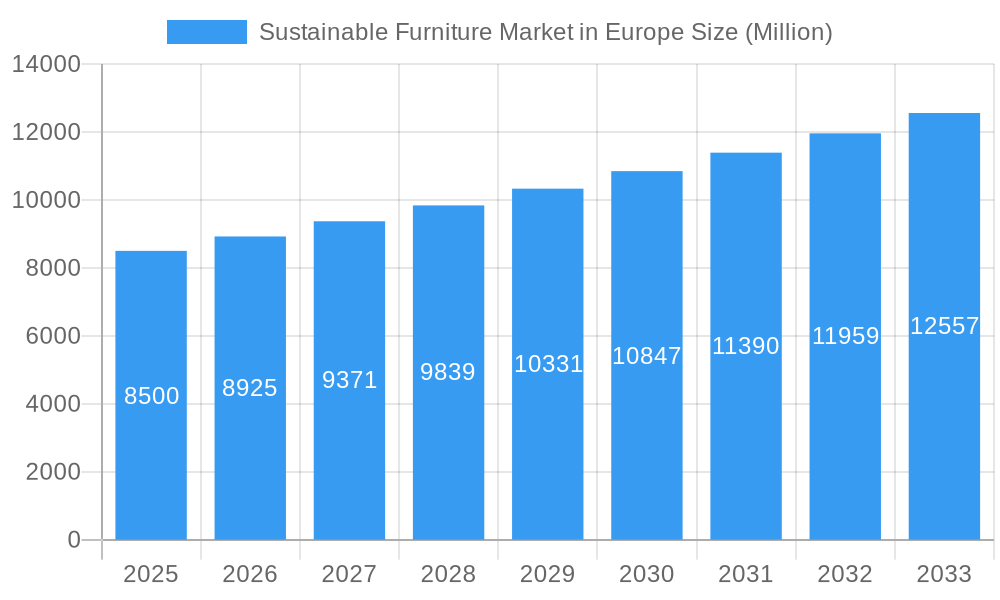

Sustainable Furniture Market in Europe Market Size (In Billion)

Evolving consumer preferences for supply chain transparency significantly influence market trends. This is amplified by expanding online distribution channels, providing consumers greater access to information and a broader selection of sustainable furniture from ethically committed brands. While the transition to sustainability offers significant opportunities, challenges such as the perceived higher initial cost of some sustainable products and scaling production ethically persist. However, the growing availability of diverse materials and the long-term cost-effectiveness of durable, sustainable furniture are progressively addressing these concerns. The integration of smart manufacturing and circular economy principles is set to further enhance market penetration across residential and commercial segments in Europe.

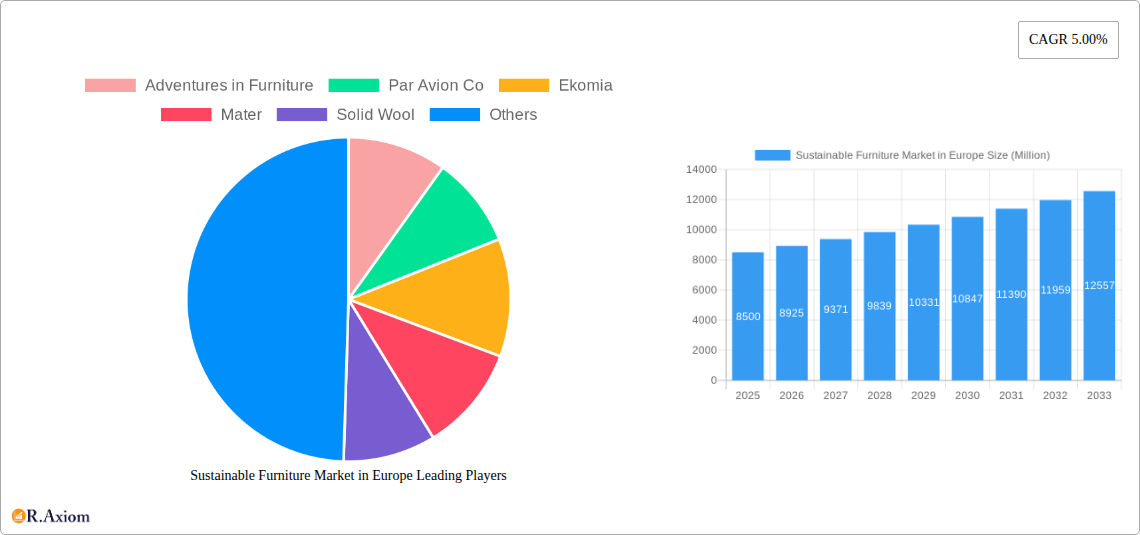

Sustainable Furniture Market in Europe Company Market Share

This comprehensive report offers in-depth analysis of the European sustainable furniture market, providing critical insights for industry stakeholders, manufacturers, suppliers, and investors. Examining the period from 2019 to 2033, with a base year of 2024, the report details market dynamics, segmentation, growth drivers, challenges, and future opportunities. It explores the rising demand for eco-friendly and ethically sourced furniture in residential and commercial applications, driven by environmental awareness and regulatory frameworks. This research equips businesses with the data and strategic foresight essential for navigating and capitalizing on the burgeoning European sustainable furniture sector.

Sustainable Furniture Market in Europe Market Concentration & Innovation

The European sustainable furniture market exhibits a moderate to high degree of market concentration, with key players like Bolia and Knoll holding significant market shares estimated to be between 15-20% and 10-15% respectively. Innovation is a pivotal driver, spurred by companies like Mater and Sebastian Cox, who are pioneering the use of recycled materials and novel sustainable production techniques. Regulatory frameworks, such as the EU's Green Deal and Ecodesign Directive, are increasingly shaping product design and material sourcing, pushing for greater sustainability credentials. Product substitutes, while emerging, are largely in nascent stages, with traditional furniture still dominating but facing growing competition from sustainable alternatives. End-user trends clearly favor transparency in sourcing and manufacturing, with consumers actively seeking certifications and verifiable eco-friendly claims. Mergers and acquisitions (M&A) are becoming more prevalent, with recent deals in the sector valued between €50 Million and €100 Million, aimed at consolidating market presence and acquiring innovative technologies or sustainable supply chains. For instance, the acquisition of a minority stake in Ekomia by a larger furniture group aimed to bolster their sustainable product portfolio, indicating strategic moves towards market integration and expansion.

Sustainable Furniture Market in Europe Industry Trends & Insights

The Sustainable Furniture Market in Europe is experiencing robust growth, with an estimated Compound Annual Growth Rate (CAGR) of approximately 8.5% projected from 2025 to 2033. This expansion is propelled by a confluence of factors, including heightened consumer consciousness regarding environmental impact and a growing preference for products that align with ethical and sustainable values. Regulatory mandates and incentives introduced by European Union member states are also significantly contributing to market penetration, making sustainable practices more attractive and accessible for businesses. Technological advancements are playing a crucial role, with innovations in material science leading to the development of new bio-based and recycled materials that offer comparable or superior performance to conventional alternatives. For instance, the increasing use of PET in furniture manufacturing, derived from recycled plastic bottles, is a testament to this trend. Companies are investing heavily in research and development to create furniture that is not only aesthetically pleasing and functional but also minimizes its ecological footprint throughout its lifecycle. This includes exploring circular economy models, such as furniture leasing, repair services, and end-of-life recycling programs, which are gaining traction among consumers and businesses alike. The competitive landscape is intensifying, with established furniture manufacturers increasingly integrating sustainable lines into their offerings, alongside the rise of specialized sustainable furniture brands like Adventures in Furniture and Grüne Erde. This dynamic environment fosters continuous innovation and price competitiveness, further driving market growth. Consumer preferences are evolving beyond mere aesthetics to encompass the entire product story – from sourcing and manufacturing processes to durability and recyclability. This demand is encouraging greater transparency and traceability in the supply chain, pushing companies to adopt more responsible business practices. The market penetration of sustainable furniture, while still lower than conventional furniture, is steadily increasing, particularly in urban centers and among younger demographics who are more attuned to environmental issues. The shift towards a circular economy is a dominant trend, encouraging businesses to rethink product design for longevity and ease of disassembly, thereby facilitating material recovery and reducing waste.

Dominant Markets & Segments in Sustainable Furniture Market in Europe

The Residential segment currently dominates the Sustainable Furniture Market in Europe, accounting for an estimated 65% of the total market value. This dominance is driven by increasing homeowner awareness of health benefits associated with natural materials and a desire to create eco-conscious living spaces. Key drivers include government incentives for energy-efficient and sustainable home improvements, growing disposable incomes allowing for investment in premium sustainable products, and the influence of home décor trends that emphasize natural elements and minimalist design. Within the material segmentation, Wood remains the dominant material, representing approximately 55% of the market share, owing to its natural renewability, biodegradability, and aesthetic appeal. Countries like Germany, the UK, and France are leading the charge in wood-based sustainable furniture adoption, supported by strong forestry management practices and a mature furniture manufacturing industry. The Commercial segment is experiencing rapid growth, projected to capture a significant market share in the coming years, fueled by corporate social responsibility initiatives and the increasing demand for sustainable office spaces and hospitality interiors. Leading countries in this segment include Scandinavian nations and the Netherlands, known for their progressive environmental policies and forward-thinking business practices.

Application Segment Dominance:

- Residential: Driven by eco-conscious homeowners, a focus on healthy living environments, and aspirational interior design trends. Economic policies promoting green building and renovation further bolster this segment.

- Commercial: Driven by corporate sustainability goals, the desire for branded eco-friendly workplaces and hospitality venues, and certifications like BREEAM and LEED that encourage sustainable fit-outs.

Material Segment Dominance:

- Wood: Continues to lead due to its natural origin, recyclability, and the availability of certified sustainable wood sources. Strong infrastructure for wood processing and a long tradition of woodworking contribute to its dominance.

- Bamboo: Emerging as a strong contender due to its rapid growth and sustainability credentials. Growing investment in bamboo processing infrastructure is a key driver.

- PET: Experiencing substantial growth, particularly for applications like outdoor furniture and upholstery, driven by effective recycling programs and innovation in its processing.

- Others: This category, including materials like cork, recycled textiles, and innovative bio-composites, is gaining traction due to ongoing R&D and increasing consumer demand for novel sustainable options.

Distribution Channel Dominance:

- Online: Experiencing accelerated growth, driven by convenience, wider product selection, and the ability to easily compare sustainability credentials. E-commerce platforms are increasingly integrating eco-friendly filters and information.

- Offline: Still holds a significant share, particularly for high-value items where physical inspection and expert advice are valued. Showrooms and dedicated sustainable furniture stores are crucial for brand building and customer engagement.

Sustainable Furniture Market in Europe Product Developments

Recent product developments in the sustainable furniture market are characterized by an increasing emphasis on circular design principles and innovative material utilization. Companies like Pentatonic are leading the charge in creating modular furniture from recycled plastics and discarded materials, designed for longevity and easy disassembly. Solid Wool is gaining recognition for its innovative use of natural wool fibers in furniture construction, offering superior insulation and breathability. These developments leverage advanced manufacturing techniques and a deep understanding of material science to create aesthetically appealing, functional, and environmentally responsible products. The competitive advantage lies in the unique material stories, verifiable sustainability claims, and the ability to meet the growing demand for transparent and ethical sourcing. Technological trends are leaning towards smart manufacturing, reducing waste, and optimizing energy consumption during production.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Sustainable Furniture Market in Europe across key segmentation dimensions. The Residential segment, projected to reach approximately €15,000 Million by 2033, is driven by increasing consumer demand for eco-friendly homes and a focus on healthy living environments. The Commercial segment, estimated at over €10,000 Million by 2033, is propelled by corporate sustainability mandates and the trend towards green building certifications in offices, hotels, and retail spaces. In terms of materials, Wood is expected to maintain its lead, with a market size exceeding €18,000 Million by 2033, benefiting from sustainable forestry practices and its inherent appeal. Bamboo is poised for significant growth, projected to reach around €3,000 Million, driven by its rapid renewability and versatility. PET is also set to expand, exceeding €2,500 Million, fueled by advancements in recycling technology and its use in durable furniture. The Others material category, including innovative bio-composites and recycled textiles, is expected to grow substantially, offering unique sustainability solutions. The Online distribution channel is projected to reach over €17,000 Million, driven by convenience and digital marketing. The Offline channel will continue to be substantial, estimated at over €11,000 Million, catering to consumers seeking tactile experiences and expert advice.

Key Drivers of Sustainable Furniture Market in Europe Growth

Several key factors are driving the rapid growth of the Sustainable Furniture Market in Europe. Increasing environmental awareness and a growing consumer demand for eco-friendly products are paramount. This is augmented by stringent government regulations and policies promoting sustainability and circular economy principles across the EU. Technological advancements in material science and manufacturing processes are enabling the development of more sustainable and cost-effective furniture. Furthermore, corporate sustainability initiatives and a desire to enhance brand reputation are compelling businesses to invest in sustainable furniture for their commercial spaces. The economic feasibility of recycled and bio-based materials, coupled with efficient supply chain management, further contributes to market expansion.

Challenges in the Sustainable Furniture Market in Europe Sector

Despite its robust growth, the Sustainable Furniture Market in Europe faces several challenges. Higher initial production costs for some sustainable materials and processes can pose a barrier to wider adoption compared to conventional alternatives. Supply chain complexities and the availability of certified sustainable materials can sometimes be inconsistent, impacting scalability. Consumer awareness regarding the true meaning of sustainability and the potential for greenwashing requires ongoing education and transparent labeling. Regulatory fragmentation across different EU member states, while generally supportive, can present compliance hurdles for manufacturers operating across borders. Competitive pressures from lower-cost conventional furniture also remain a significant restraint.

Emerging Opportunities in Sustainable Furniture Market in Europe

The Sustainable Furniture Market in Europe is ripe with emerging opportunities. The expansion of the circular economy model, including furniture leasing, repair services, and take-back programs, presents significant growth potential. The development of innovative bio-based materials derived from agricultural waste or algae offers a novel avenue for sustainable product creation. Smart furniture with integrated sustainable features, such as energy-saving capabilities or modular designs for easy upgrades, is an emerging trend. Furthermore, increased focus on ethical labor practices and supply chain transparency presents an opportunity for brands to build strong consumer trust and loyalty. The growing demand for customizable and personalized sustainable furniture solutions also opens new market niches.

Leading Players in the Sustainable Furniture Market in Europe Market

- Adventures in Furniture

- Par Avion Co

- Ekomia

- Mater

- Solid Wool

- Benchmark

- Geyersbach

- Grüne Erde

- Bolia

- Knoll

- Sebastian Cox

- Pentatonic

Key Developments in Sustainable Furniture Market in Europe Industry

- 2023: Mater launches a new collection utilizing recycled ocean plastic, enhancing its sustainable product portfolio and addressing plastic pollution concerns.

- 2023: Grüne Erde expands its certified organic wood furniture range, reinforcing its commitment to natural and chemical-free production.

- 2024: Bolia introduces a furniture repair and refurbishment service, promoting product longevity and circular economy principles.

- 2024: Knoll announces a new partnership focused on developing bio-based material alternatives for upholstery, aiming to reduce reliance on fossil-fuel-derived components.

- 2024: Ekomia invests in advanced recycling technologies to increase the proportion of recycled materials in its furniture manufacturing processes.

- 2024: Sebastian Cox collaborates with a sustainable textile producer to develop innovative wool-based furniture coverings.

Strategic Outlook for Sustainable Furniture Market in Europe Market

The strategic outlook for the Sustainable Furniture Market in Europe is exceptionally positive, driven by sustained consumer demand, robust regulatory support, and continuous innovation. Future growth will be fueled by the deeper integration of circular economy principles, including product-as-a-service models and advanced recycling initiatives. Companies that prioritize transparency in their supply chains, invest in material innovation, and effectively communicate their sustainability credentials will likely gain a significant competitive advantage. The expansion into new material categories and the development of smart sustainable furniture solutions represent promising avenues for market differentiation and long-term success. The market is poised for continued expansion, driven by a collective commitment towards a more sustainable future in the furniture industry.

Sustainable Furniture Market in Europe Segmentation

-

1. Application

- 1.1. Residential

- 1.2. Commercial

-

2. Material

- 2.1. Wood

- 2.2. Bamboo

- 2.3. PET

- 2.4. Others

-

3. Distribution Channel

- 3.1. Online

- 3.2. Offline

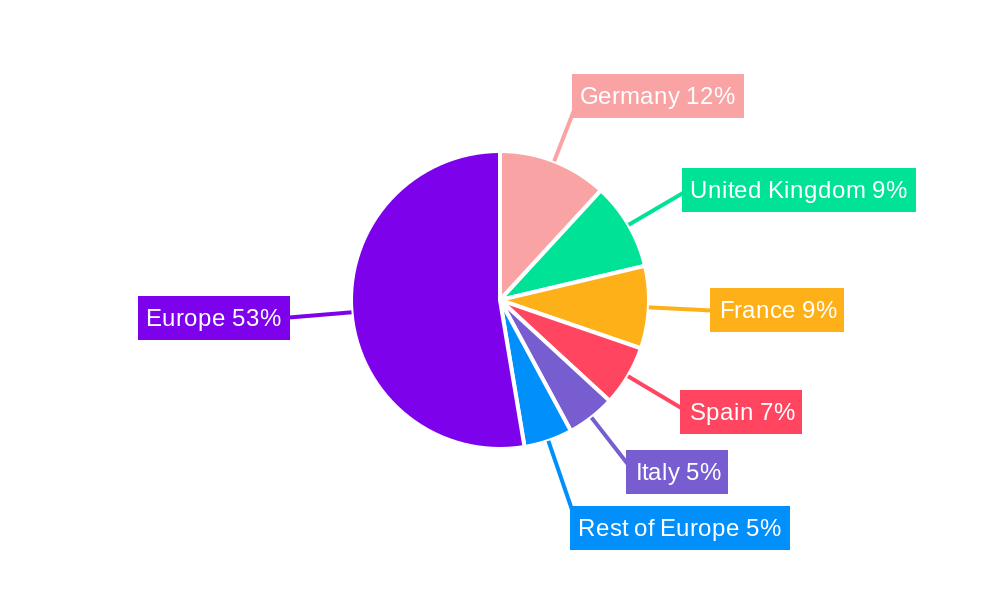

Sustainable Furniture Market in Europe Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Spain

- 5. Italy

- 6. Rest of Europe

Sustainable Furniture Market in Europe Regional Market Share

Geographic Coverage of Sustainable Furniture Market in Europe

Sustainable Furniture Market in Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Advancement booming the industry; Focus on Ergonomics and Comfort

- 3.3. Market Restrains

- 3.3.1. High cost; Limited Target Audience

- 3.4. Market Trends

- 3.4.1. Rising Online Furniture Sales in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sustainable Furniture Market in Europe Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Wood

- 5.2.2. Bamboo

- 5.2.3. PET

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. United Kingdom

- 5.4.3. France

- 5.4.4. Spain

- 5.4.5. Italy

- 5.4.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Germany Sustainable Furniture Market in Europe Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Residential

- 6.1.2. Commercial

- 6.2. Market Analysis, Insights and Forecast - by Material

- 6.2.1. Wood

- 6.2.2. Bamboo

- 6.2.3. PET

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Online

- 6.3.2. Offline

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. United Kingdom Sustainable Furniture Market in Europe Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Residential

- 7.1.2. Commercial

- 7.2. Market Analysis, Insights and Forecast - by Material

- 7.2.1. Wood

- 7.2.2. Bamboo

- 7.2.3. PET

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Online

- 7.3.2. Offline

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. France Sustainable Furniture Market in Europe Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Residential

- 8.1.2. Commercial

- 8.2. Market Analysis, Insights and Forecast - by Material

- 8.2.1. Wood

- 8.2.2. Bamboo

- 8.2.3. PET

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Online

- 8.3.2. Offline

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Spain Sustainable Furniture Market in Europe Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Residential

- 9.1.2. Commercial

- 9.2. Market Analysis, Insights and Forecast - by Material

- 9.2.1. Wood

- 9.2.2. Bamboo

- 9.2.3. PET

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Online

- 9.3.2. Offline

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Italy Sustainable Furniture Market in Europe Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Residential

- 10.1.2. Commercial

- 10.2. Market Analysis, Insights and Forecast - by Material

- 10.2.1. Wood

- 10.2.2. Bamboo

- 10.2.3. PET

- 10.2.4. Others

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Online

- 10.3.2. Offline

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Rest of Europe Sustainable Furniture Market in Europe Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Residential

- 11.1.2. Commercial

- 11.2. Market Analysis, Insights and Forecast - by Material

- 11.2.1. Wood

- 11.2.2. Bamboo

- 11.2.3. PET

- 11.2.4. Others

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. Online

- 11.3.2. Offline

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Adventures in Furniture

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Par Avion Co

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Ekomia

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Mater

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Solid Wool

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Benchmark

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Geyersbach

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Grüne Erde

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Bolia

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Knoll

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Sebastian Cox

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Pentatonic

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Adventures in Furniture

List of Figures

- Figure 1: Sustainable Furniture Market in Europe Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Sustainable Furniture Market in Europe Share (%) by Company 2025

List of Tables

- Table 1: Sustainable Furniture Market in Europe Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Sustainable Furniture Market in Europe Volume K Units Forecast, by Application 2020 & 2033

- Table 3: Sustainable Furniture Market in Europe Revenue billion Forecast, by Material 2020 & 2033

- Table 4: Sustainable Furniture Market in Europe Volume K Units Forecast, by Material 2020 & 2033

- Table 5: Sustainable Furniture Market in Europe Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Sustainable Furniture Market in Europe Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 7: Sustainable Furniture Market in Europe Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Sustainable Furniture Market in Europe Volume K Units Forecast, by Region 2020 & 2033

- Table 9: Sustainable Furniture Market in Europe Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Sustainable Furniture Market in Europe Volume K Units Forecast, by Application 2020 & 2033

- Table 11: Sustainable Furniture Market in Europe Revenue billion Forecast, by Material 2020 & 2033

- Table 12: Sustainable Furniture Market in Europe Volume K Units Forecast, by Material 2020 & 2033

- Table 13: Sustainable Furniture Market in Europe Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 14: Sustainable Furniture Market in Europe Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 15: Sustainable Furniture Market in Europe Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Sustainable Furniture Market in Europe Volume K Units Forecast, by Country 2020 & 2033

- Table 17: Sustainable Furniture Market in Europe Revenue billion Forecast, by Application 2020 & 2033

- Table 18: Sustainable Furniture Market in Europe Volume K Units Forecast, by Application 2020 & 2033

- Table 19: Sustainable Furniture Market in Europe Revenue billion Forecast, by Material 2020 & 2033

- Table 20: Sustainable Furniture Market in Europe Volume K Units Forecast, by Material 2020 & 2033

- Table 21: Sustainable Furniture Market in Europe Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 22: Sustainable Furniture Market in Europe Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 23: Sustainable Furniture Market in Europe Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Sustainable Furniture Market in Europe Volume K Units Forecast, by Country 2020 & 2033

- Table 25: Sustainable Furniture Market in Europe Revenue billion Forecast, by Application 2020 & 2033

- Table 26: Sustainable Furniture Market in Europe Volume K Units Forecast, by Application 2020 & 2033

- Table 27: Sustainable Furniture Market in Europe Revenue billion Forecast, by Material 2020 & 2033

- Table 28: Sustainable Furniture Market in Europe Volume K Units Forecast, by Material 2020 & 2033

- Table 29: Sustainable Furniture Market in Europe Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 30: Sustainable Furniture Market in Europe Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 31: Sustainable Furniture Market in Europe Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Sustainable Furniture Market in Europe Volume K Units Forecast, by Country 2020 & 2033

- Table 33: Sustainable Furniture Market in Europe Revenue billion Forecast, by Application 2020 & 2033

- Table 34: Sustainable Furniture Market in Europe Volume K Units Forecast, by Application 2020 & 2033

- Table 35: Sustainable Furniture Market in Europe Revenue billion Forecast, by Material 2020 & 2033

- Table 36: Sustainable Furniture Market in Europe Volume K Units Forecast, by Material 2020 & 2033

- Table 37: Sustainable Furniture Market in Europe Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 38: Sustainable Furniture Market in Europe Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 39: Sustainable Furniture Market in Europe Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Sustainable Furniture Market in Europe Volume K Units Forecast, by Country 2020 & 2033

- Table 41: Sustainable Furniture Market in Europe Revenue billion Forecast, by Application 2020 & 2033

- Table 42: Sustainable Furniture Market in Europe Volume K Units Forecast, by Application 2020 & 2033

- Table 43: Sustainable Furniture Market in Europe Revenue billion Forecast, by Material 2020 & 2033

- Table 44: Sustainable Furniture Market in Europe Volume K Units Forecast, by Material 2020 & 2033

- Table 45: Sustainable Furniture Market in Europe Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 46: Sustainable Furniture Market in Europe Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 47: Sustainable Furniture Market in Europe Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Sustainable Furniture Market in Europe Volume K Units Forecast, by Country 2020 & 2033

- Table 49: Sustainable Furniture Market in Europe Revenue billion Forecast, by Application 2020 & 2033

- Table 50: Sustainable Furniture Market in Europe Volume K Units Forecast, by Application 2020 & 2033

- Table 51: Sustainable Furniture Market in Europe Revenue billion Forecast, by Material 2020 & 2033

- Table 52: Sustainable Furniture Market in Europe Volume K Units Forecast, by Material 2020 & 2033

- Table 53: Sustainable Furniture Market in Europe Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 54: Sustainable Furniture Market in Europe Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 55: Sustainable Furniture Market in Europe Revenue billion Forecast, by Country 2020 & 2033

- Table 56: Sustainable Furniture Market in Europe Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sustainable Furniture Market in Europe?

The projected CAGR is approximately 11%.

2. Which companies are prominent players in the Sustainable Furniture Market in Europe?

Key companies in the market include Adventures in Furniture, Par Avion Co, Ekomia, Mater, Solid Wool, Benchmark, Geyersbach, Grüne Erde, Bolia, Knoll, Sebastian Cox, Pentatonic.

3. What are the main segments of the Sustainable Furniture Market in Europe?

The market segments include Application, Material, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancement booming the industry; Focus on Ergonomics and Comfort.

6. What are the notable trends driving market growth?

Rising Online Furniture Sales in the Market.

7. Are there any restraints impacting market growth?

High cost; Limited Target Audience.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sustainable Furniture Market in Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sustainable Furniture Market in Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sustainable Furniture Market in Europe?

To stay informed about further developments, trends, and reports in the Sustainable Furniture Market in Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence