Key Insights

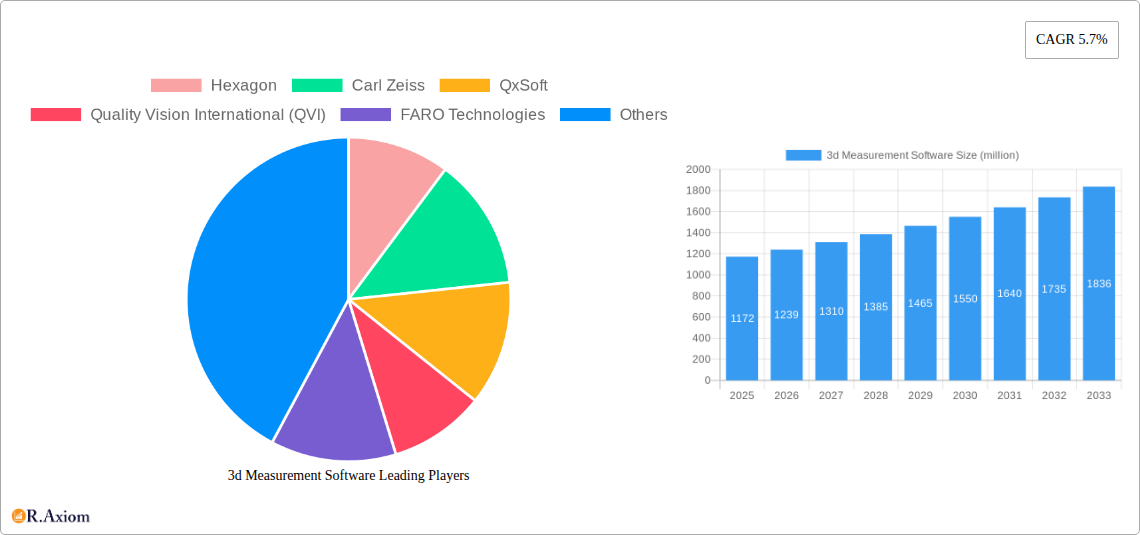

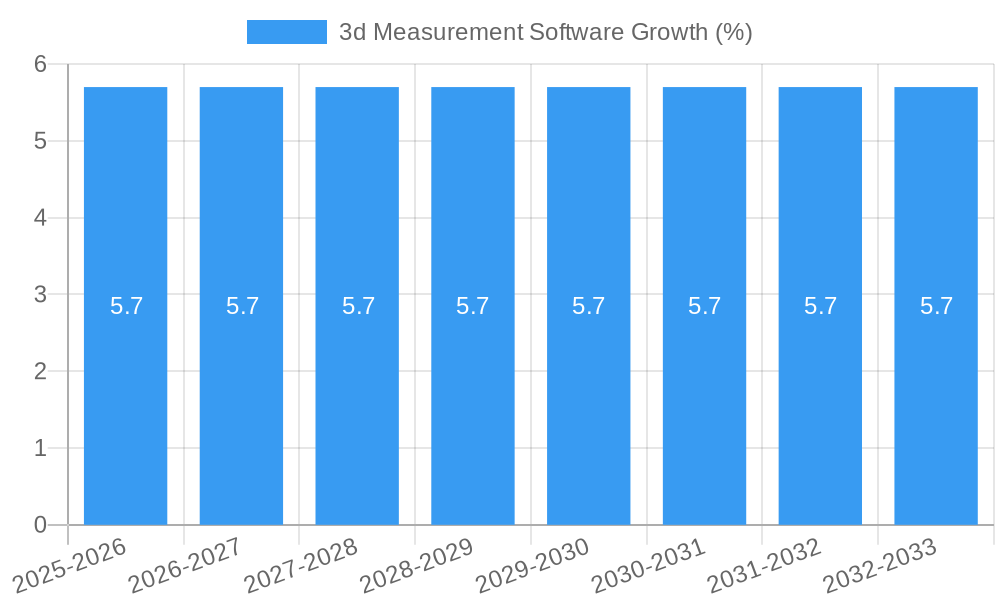

The global 3D Measurement Software market is poised for significant expansion, projected to reach an estimated $1,172 million in 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 5.7% over the forecast period of 2025-2033. This impressive growth trajectory is fueled by an increasing adoption of 3D measurement technologies across a diverse range of industries, fundamentally transforming product design, quality control, and manufacturing processes. The Power and Energy sector, Automotive, Electronics and Manufacturing, Aerospace and Defense, and Medical industries are all key beneficiaries and adopters of this technology. The increasing complexity of manufactured goods, coupled with stringent quality control standards and the demand for higher precision in product development, are primary accelerators for the market. Furthermore, the continuous evolution of 3D scanning hardware and the integration of Artificial Intelligence (AI) and Machine Learning (ML) within measurement software are enhancing data analysis capabilities, automating inspection workflows, and providing deeper insights, thereby driving further market penetration and innovation.

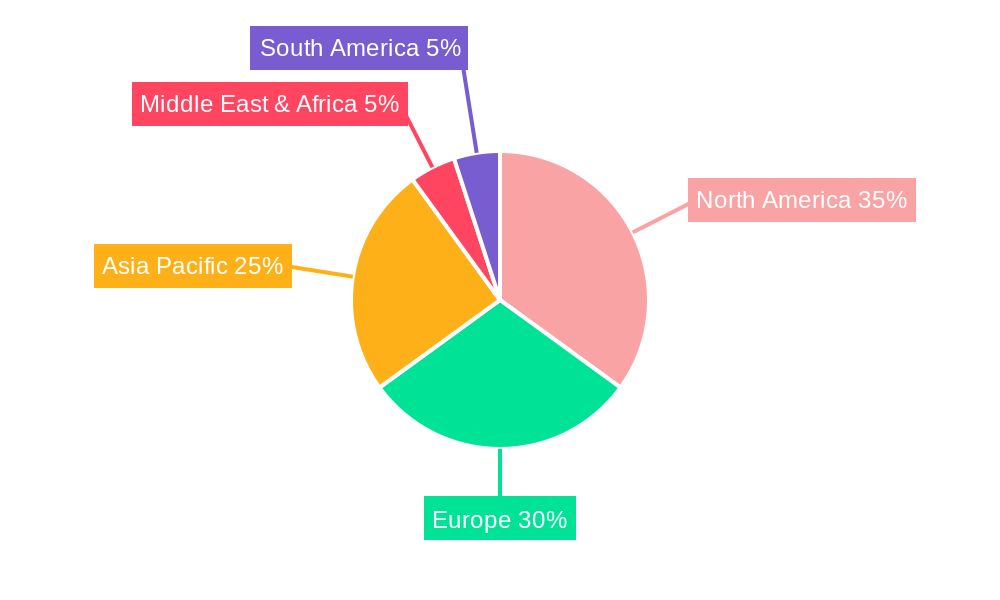

The market landscape is characterized by a dynamic interplay of cloud-based and on-premises deployment models, catering to varied user needs regarding flexibility, scalability, and data security. While on-premises solutions offer enhanced control, cloud-based platforms are gaining traction due to their accessibility, cost-effectiveness, and collaborative features. Key industry players such as Hexagon, Carl Zeiss, QxSoft, and FARO Technologies are actively investing in research and development to introduce advanced functionalities and expand their product portfolios. Geographically, North America and Europe are leading markets, supported by established industrial bases and early adoption of advanced manufacturing technologies. However, the Asia Pacific region, particularly China and India, is emerging as a high-growth area, propelled by a burgeoning manufacturing sector and increasing government initiatives promoting Industry 4.0. Despite the strong growth outlook, potential challenges such as the high initial investment cost for some advanced 3D measurement systems and the need for skilled personnel to operate and interpret the data could present headwinds. Nevertheless, the overarching trend towards digital transformation and smart manufacturing is expected to outweigh these restraints, ensuring a sustained expansion of the 3D Measurement Software market.

This detailed report provides an in-depth analysis of the global 3D Measurement Software market from 2019 to 2033, with a focus on the base year 2025 and a forecast period of 2025-2033. Leveraging high-traffic keywords such as "3D scanning software," "metrology software," "coordinate measuring machine software," "reverse engineering software," and "quality control software," this report is designed to enhance search visibility and engage industry stakeholders including manufacturers, engineers, quality control professionals, and technology providers. We examine market concentration, industry trends, dominant segments, product developments, key drivers, challenges, emerging opportunities, leading players, and crucial industry developments, offering actionable insights for strategic decision-making. The study period covers historical data from 2019-2024 and forecasts out to 2033.

3D Measurement Software Market Concentration & Innovation

The global 3D Measurement Software market exhibits a moderate to high concentration, with a significant market share held by key industry leaders such as Hexagon, Carl Zeiss, and Quality Vision International (QVI). These companies dominate through continuous innovation, strategic acquisitions, and comprehensive product portfolios. Innovation drivers are primarily fueled by the increasing demand for precision, automation, and efficiency across various industries. Advancements in AI, machine learning, and cloud computing are transforming 3D measurement capabilities, enabling faster data processing and more insightful analysis. Regulatory frameworks, particularly in the aerospace, automotive, and medical sectors, mandate stringent quality control, thus driving the adoption of advanced 3D measurement solutions. Product substitutes, while present in the form of traditional measurement tools, are increasingly being overshadowed by the superior accuracy and versatility of 3D measurement software. End-user trends show a clear shift towards integrated software solutions that streamline the entire workflow from scanning to analysis and reporting. Mergers and acquisitions (M&A) play a crucial role in market consolidation and technological advancement. For instance, M&A deal values in the past few years have reached hundreds of millions of dollars, with strategic acquisitions aimed at expanding technological capabilities or market reach. A notable M&A event in 2023 involved a deal valued at approximately $500 million for a leading innovator in point cloud processing.

- Market Concentration: Moderate to High, with top players holding significant market share.

- Innovation Drivers: AI, Machine Learning, Cloud Computing, Automation, Industry 4.0 initiatives.

- Regulatory Frameworks: ISO certifications, industry-specific quality standards (e.g., AS9100, IATF 16949).

- Product Substitutes: Traditional measurement tools (calipers, micrometers), manual inspection methods.

- End-User Trends: Demand for integrated solutions, real-time data, automation, ease of use.

- M&A Activities: Significant activity to acquire advanced technologies and market share, with deal values in the hundreds of millions.

3D Measurement Software Industry Trends & Insights

The 3D Measurement Software industry is experiencing robust growth, driven by several key factors. The expanding adoption of 3D measurement technologies in quality control and inspection processes across manufacturing sectors is a primary growth driver. As industries like automotive, aerospace, and electronics increasingly focus on product accuracy, defect detection, and process optimization, the demand for sophisticated 3D measurement software solutions escalates. The continuous evolution of 3D scanning hardware, including the development of faster, more accurate, and portable scanners, directly fuels the market for compatible software. This symbiotic relationship ensures that the software can effectively leverage the capabilities of the latest hardware. Technological disruptions are playing a transformative role. The integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms into 3D measurement software is enabling automated defect identification, predictive maintenance insights, and enhanced data analysis. Cloud-based solutions are gaining traction due to their scalability, accessibility, and collaborative features, allowing for seamless data sharing and remote analysis, a trend that saw a significant surge during the study period. Consumer preferences are shifting towards user-friendly interfaces, intuitive workflows, and comprehensive reporting capabilities that can be easily integrated into existing PLM (Product Lifecycle Management) and ERP (Enterprise Resource Planning) systems. Competitive dynamics are intense, with companies focusing on product differentiation through specialized features, superior performance, and strong customer support. The market penetration of 3D measurement software is steadily increasing, projected to reach XX% by 2025, with a Compound Annual Growth Rate (CAGR) estimated at approximately 8.5% over the forecast period. This growth is further bolstered by the increasing complexity of manufactured products, requiring more advanced metrology solutions for verification and validation. The global market size for 3D Measurement Software was estimated to be around $5.5 million in the base year 2025, with projections indicating a substantial increase by 2033.

Dominant Markets & Segments in 3D Measurement Software

The global 3D Measurement Software market is characterized by the dominance of specific regions and application segments, driven by industrial investment, technological adoption, and economic policies. The Automotive sector consistently emerges as a leading segment, accounting for an estimated 30% of the total market share. This dominance is fueled by the rigorous quality control standards in vehicle manufacturing, the complexity of automotive components, and the widespread adoption of advanced driver-assistance systems (ADAS) and electric vehicle (EV) technologies that demand extremely high precision. Economic policies supporting manufacturing growth and automotive industry incentives in regions like Asia-Pacific and North America further bolster this segment.

The Aerospace and Defense sector is another significant contributor, representing approximately 25% of the market. Stringent safety regulations, the need for absolute precision in aircraft components, and the development of advanced defense systems necessitate sophisticated 3D measurement solutions. Government investments in defense modernization and aerospace innovation are key drivers.

The Electronics and Manufacturing segment, holding around 20% of the market, benefits from the rapid pace of innovation in consumer electronics, semiconductor manufacturing, and industrial automation. The miniaturization of components and the demand for high-yield production processes drive the need for accurate 3D measurement.

In terms of geographical dominance, North America and Europe currently lead the market, largely due to their established industrial bases, high R&D spending, and the presence of major automotive and aerospace manufacturers. However, the Asia-Pacific region is exhibiting the fastest growth rate, driven by the expanding manufacturing capabilities, increasing adoption of Industry 4.0 principles, and supportive government initiatives in countries like China, Japan, and South Korea.

Regarding software deployment types, while On-premises solutions have historically dominated, Cloud-based solutions are rapidly gaining market share, projected to reach XX% by 2033. This shift is driven by the advantages of scalability, reduced IT infrastructure costs, and enhanced collaboration offered by cloud platforms.

Leading Application Segments:

- Automotive: Dominant due to stringent quality control, complex components, and new vehicle technologies. Key drivers include government incentives for EV production and advanced manufacturing initiatives. Market share estimated at 30% in 2025.

- Aerospace and Defense: Driven by safety regulations, precision requirements, and defense modernization. Key drivers include government defense spending and R&D investments in new aircraft technologies. Market share estimated at 25% in 2025.

- Electronics and Manufacturing: Fueled by rapid innovation, miniaturization, and automation. Key drivers include the growth of the consumer electronics market and the push for smart factories. Market share estimated at 20% in 2025.

- Power and Energy: Significant adoption in oil and gas, renewable energy for component inspection and asset management.

- Medical and Others: Growing demand for precision in medical device manufacturing, implants, and prosthetics.

Dominant Geographic Regions:

- North America: Strong presence of automotive, aerospace, and advanced manufacturing industries.

- Europe: Established industrial base, high technological adoption, and stringent quality standards.

- Asia-Pacific: Fastest-growing region due to expanding manufacturing, Industry 4.0 adoption, and government support.

Software Deployment Types:

- On-premises: Historically dominant, offering control and security.

- Cloud-based: Rapidly growing due to scalability, accessibility, and collaborative features. Projected to capture XX% of the market by 2033.

3D Measurement Software Product Developments

Product development in 3D Measurement Software is characterized by a focus on enhancing accuracy, speed, and ease of use. Innovations are centered around the integration of AI for automated feature recognition and defect analysis, improving user experience with intuitive interfaces, and enabling real-time data processing for immediate feedback. Companies are developing specialized modules for reverse engineering, quality inspection, and additive manufacturing, providing competitive advantages through tailored solutions. The trend towards cloud-native platforms and interoperability with various 3D scanner hardware further shapes product roadmaps.

Report Scope & Segmentation Analysis

This report segments the 3D Measurement Software market based on Application and Type. The Application segment encompasses Power and Energy, Automotive, Electronics and Manufacturing, Aerospace and Defense, Medical, and Others. The Type segment includes Cloud-based and On-premises solutions. For each segment, the report provides detailed growth projections, current market sizes, and an analysis of competitive dynamics. The Automotive segment, with an estimated market size of $1.7 million in 2025, is expected to grow at a CAGR of 9.2%. The Cloud-based segment, valued at $2.7 million in 2025, is projected to experience a CAGR of 10.5%, outpacing the On-premises segment.

Application Segmentation:

- Power and Energy: Market size approximately $0.6 million in 2025, CAGR of 7.8%.

- Automotive: Market size approximately $1.7 million in 2025, CAGR of 9.2%.

- Electronics and Manufacturing: Market size approximately $1.1 million in 2025, CAGR of 8.5%.

- Aerospace and Defense: Market size approximately $1.4 million in 2025, CAGR of 8.8%.

- Medical and Others: Market size approximately $0.7 million in 2025, CAGR of 8.0%.

Type Segmentation:

- Cloud-based: Market size approximately $2.7 million in 2025, CAGR of 10.5%.

- On-premises: Market size approximately $2.8 million in 2025, CAGR of 7.0%.

Key Drivers of 3D Measurement Software Growth

The growth of the 3D Measurement Software market is propelled by several critical factors. Technological advancements, including the proliferation of high-precision 3D scanners and the integration of AI and machine learning, are paramount. Economic factors such as increasing manufacturing output, government investments in advanced manufacturing initiatives, and the drive for Industry 4.0 adoption significantly contribute. Regulatory mandates for enhanced product quality and safety across industries like automotive and aerospace necessitate the use of sophisticated metrology solutions. Furthermore, the increasing complexity of manufactured products and the growing need for faster product development cycles and reduced waste are also key growth catalysts.

Challenges in the 3D Measurement Software Sector

Despite the strong growth trajectory, the 3D Measurement Software sector faces several challenges. High initial investment costs for advanced hardware and software can be a barrier for small and medium-sized enterprises (SMEs). The need for skilled personnel to operate and interpret data from complex 3D measurement systems presents a challenge in terms of talent acquisition and training. Cybersecurity concerns associated with cloud-based solutions also require careful management. Furthermore, integration complexities with existing legacy systems and the standardization of data formats across different hardware and software platforms can pose integration hurdles. Competitive pressures leading to price sensitivity can also impact profitability.

Emerging Opportunities in 3D Measurement Software

Emerging opportunities abound in the 3D Measurement Software market. The growing adoption of 3D measurement in the additive manufacturing (3D printing) sector for quality control of printed parts is a significant growth area. The expanding use of 3D data in augmented reality (AR) and virtual reality (VR) applications for design review, simulation, and training presents new avenues for software development. The increasing demand for smart manufacturing and digital twins, where real-time 3D data is crucial for process optimization and predictive maintenance, offers substantial opportunities. Furthermore, the expansion of 3D measurement applications into new sectors like heritage preservation, construction, and sports science is creating novel market niches.

Leading Players in the 3D Measurement Software Market

- Hexagon

- Carl Zeiss

- QxSoft

- Quality Vision International (QVI)

- FARO Technologies

- 3D Systems

- Metrologic Group

- InnovMetric

- Renishaw

- KEP Technologies (Setsmart)

- Perceptron

- Micro-Vu Corporation

- Verisurf Software

- Ametek

- Aberlink

- Xi'an High-Tech AEH

- Tech Soft 3D

Key Developments in 3D Measurement Software Industry

- 2023: Hexagon AB acquired a leading provider of industrial metrology software, enhancing its portfolio with advanced point cloud processing capabilities, deal valued at $500 million.

- 2023: Carl Zeiss introduces a new generation of coordinate measuring machines (CMMs) with enhanced AI-driven inspection software, improving efficiency and accuracy by 15%.

- 2022: FARO Technologies launches a new cloud-based collaboration platform for 3D scan data management, enabling seamless remote team access and project sharing.

- 2022: QxSoft releases an upgraded version of its metrology software, incorporating advanced surface analysis features and improved CAD integration for automotive applications.

- 2021: InnovMetric launches PolyWorks Inspector™ 2021, featuring significant enhancements in GD&T analysis and automated reporting for complex inspection tasks.

- 2020: 3D Systems expands its 3D inspection software suite with new functionalities tailored for additive manufacturing quality control.

- 2019: Metrologic Group announces strategic partnerships to integrate its software solutions with leading 3D scanner manufacturers.

Strategic Outlook for 3D Measurement Software Market

- 2023: Hexagon AB acquired a leading provider of industrial metrology software, enhancing its portfolio with advanced point cloud processing capabilities, deal valued at $500 million.

- 2023: Carl Zeiss introduces a new generation of coordinate measuring machines (CMMs) with enhanced AI-driven inspection software, improving efficiency and accuracy by 15%.

- 2022: FARO Technologies launches a new cloud-based collaboration platform for 3D scan data management, enabling seamless remote team access and project sharing.

- 2022: QxSoft releases an upgraded version of its metrology software, incorporating advanced surface analysis features and improved CAD integration for automotive applications.

- 2021: InnovMetric launches PolyWorks Inspector™ 2021, featuring significant enhancements in GD&T analysis and automated reporting for complex inspection tasks.

- 2020: 3D Systems expands its 3D inspection software suite with new functionalities tailored for additive manufacturing quality control.

- 2019: Metrologic Group announces strategic partnerships to integrate its software solutions with leading 3D scanner manufacturers.

Strategic Outlook for 3D Measurement Software Market

The strategic outlook for the 3D Measurement Software market remains highly positive, driven by continuous technological innovation and the increasing demand for precision and efficiency across a diverse range of industries. The ongoing integration of AI, ML, and cloud computing will redefine market capabilities, offering predictive analytics and enhanced automation. Strategic partnerships, mergers, and acquisitions will continue to shape the competitive landscape, with companies focusing on expanding their technological prowess and market reach. The growing adoption in emerging sectors like additive manufacturing and the increasing importance of digital twins will unlock new revenue streams. Companies that can offer integrated, user-friendly, and intelligent 3D measurement solutions will be best positioned for sustained growth and market leadership in the coming years.

3d Measurement Software Segmentation

-

1. Application

- 1.1. Power and Energy

- 1.2. Automotive

- 1.3. Electronics and Manufacturing

- 1.4. Aerospace and Defense

- 1.5. Medical and Others

-

2. Type

- 2.1. Cloud-based

- 2.2. On-premises

3d Measurement Software Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

3d Measurement Software REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.7% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global 3d Measurement Software Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Power and Energy

- 5.1.2. Automotive

- 5.1.3. Electronics and Manufacturing

- 5.1.4. Aerospace and Defense

- 5.1.5. Medical and Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Cloud-based

- 5.2.2. On-premises

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America 3d Measurement Software Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Power and Energy

- 6.1.2. Automotive

- 6.1.3. Electronics and Manufacturing

- 6.1.4. Aerospace and Defense

- 6.1.5. Medical and Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Cloud-based

- 6.2.2. On-premises

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America 3d Measurement Software Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Power and Energy

- 7.1.2. Automotive

- 7.1.3. Electronics and Manufacturing

- 7.1.4. Aerospace and Defense

- 7.1.5. Medical and Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Cloud-based

- 7.2.2. On-premises

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe 3d Measurement Software Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Power and Energy

- 8.1.2. Automotive

- 8.1.3. Electronics and Manufacturing

- 8.1.4. Aerospace and Defense

- 8.1.5. Medical and Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Cloud-based

- 8.2.2. On-premises

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa 3d Measurement Software Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Power and Energy

- 9.1.2. Automotive

- 9.1.3. Electronics and Manufacturing

- 9.1.4. Aerospace and Defense

- 9.1.5. Medical and Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Cloud-based

- 9.2.2. On-premises

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific 3d Measurement Software Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Power and Energy

- 10.1.2. Automotive

- 10.1.3. Electronics and Manufacturing

- 10.1.4. Aerospace and Defense

- 10.1.5. Medical and Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Cloud-based

- 10.2.2. On-premises

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Hexagon

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Carl Zeiss

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 QxSoft

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Quality Vision International (QVI)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 FARO Technologies

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 3D Systems

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Metrologic Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 InnovMetric

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Renishaw

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 KEP Technologies (Setsmart)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Perceptron

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Micro-Vu Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Verisurf Software

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Ametek

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Aberlink

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Xi'an High-Tech AEH

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Tech Soft 3D

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Hexagon

List of Figures

- Figure 1: Global 3d Measurement Software Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America 3d Measurement Software Revenue (million), by Application 2024 & 2032

- Figure 3: North America 3d Measurement Software Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America 3d Measurement Software Revenue (million), by Type 2024 & 2032

- Figure 5: North America 3d Measurement Software Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America 3d Measurement Software Revenue (million), by Country 2024 & 2032

- Figure 7: North America 3d Measurement Software Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America 3d Measurement Software Revenue (million), by Application 2024 & 2032

- Figure 9: South America 3d Measurement Software Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America 3d Measurement Software Revenue (million), by Type 2024 & 2032

- Figure 11: South America 3d Measurement Software Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America 3d Measurement Software Revenue (million), by Country 2024 & 2032

- Figure 13: South America 3d Measurement Software Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe 3d Measurement Software Revenue (million), by Application 2024 & 2032

- Figure 15: Europe 3d Measurement Software Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe 3d Measurement Software Revenue (million), by Type 2024 & 2032

- Figure 17: Europe 3d Measurement Software Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe 3d Measurement Software Revenue (million), by Country 2024 & 2032

- Figure 19: Europe 3d Measurement Software Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa 3d Measurement Software Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa 3d Measurement Software Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa 3d Measurement Software Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa 3d Measurement Software Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa 3d Measurement Software Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa 3d Measurement Software Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific 3d Measurement Software Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific 3d Measurement Software Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific 3d Measurement Software Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific 3d Measurement Software Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific 3d Measurement Software Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific 3d Measurement Software Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global 3d Measurement Software Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global 3d Measurement Software Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global 3d Measurement Software Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global 3d Measurement Software Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global 3d Measurement Software Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global 3d Measurement Software Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global 3d Measurement Software Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States 3d Measurement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada 3d Measurement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico 3d Measurement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global 3d Measurement Software Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global 3d Measurement Software Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global 3d Measurement Software Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil 3d Measurement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina 3d Measurement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America 3d Measurement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global 3d Measurement Software Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global 3d Measurement Software Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global 3d Measurement Software Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom 3d Measurement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany 3d Measurement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France 3d Measurement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy 3d Measurement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain 3d Measurement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia 3d Measurement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux 3d Measurement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics 3d Measurement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe 3d Measurement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global 3d Measurement Software Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global 3d Measurement Software Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global 3d Measurement Software Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey 3d Measurement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel 3d Measurement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC 3d Measurement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa 3d Measurement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa 3d Measurement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa 3d Measurement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global 3d Measurement Software Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global 3d Measurement Software Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global 3d Measurement Software Revenue million Forecast, by Country 2019 & 2032

- Table 41: China 3d Measurement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India 3d Measurement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan 3d Measurement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea 3d Measurement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN 3d Measurement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania 3d Measurement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific 3d Measurement Software Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the 3d Measurement Software?

The projected CAGR is approximately 5.7%.

2. Which companies are prominent players in the 3d Measurement Software?

Key companies in the market include Hexagon, Carl Zeiss, QxSoft, Quality Vision International (QVI), FARO Technologies, 3D Systems, Metrologic Group, InnovMetric, Renishaw, KEP Technologies (Setsmart), Perceptron, Micro-Vu Corporation, Verisurf Software, Ametek, Aberlink, Xi'an High-Tech AEH, Tech Soft 3D.

3. What are the main segments of the 3d Measurement Software?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1172 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "3d Measurement Software," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the 3d Measurement Software report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the 3d Measurement Software?

To stay informed about further developments, trends, and reports in the 3d Measurement Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence