Key Insights

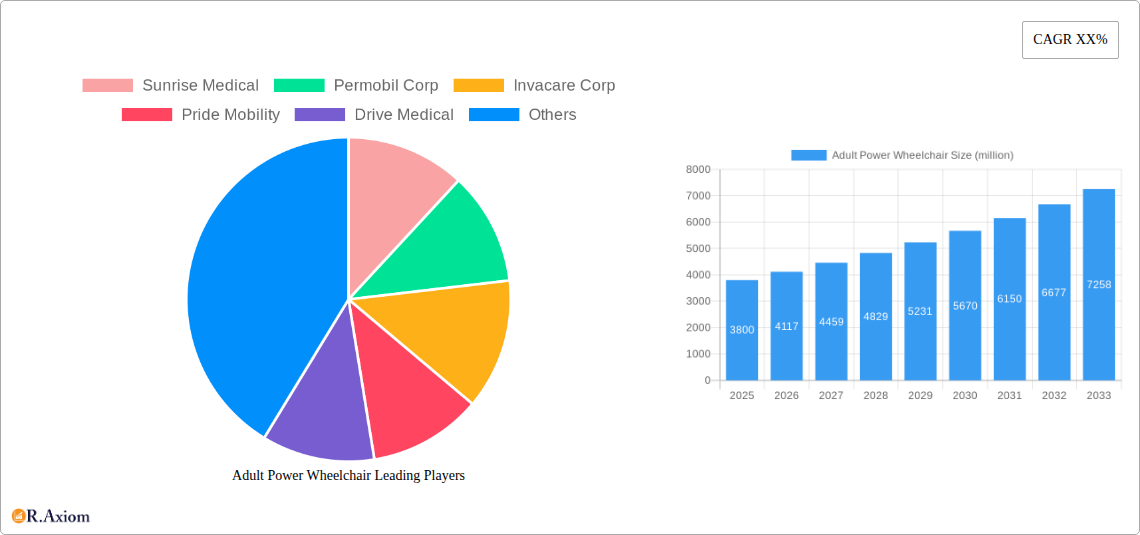

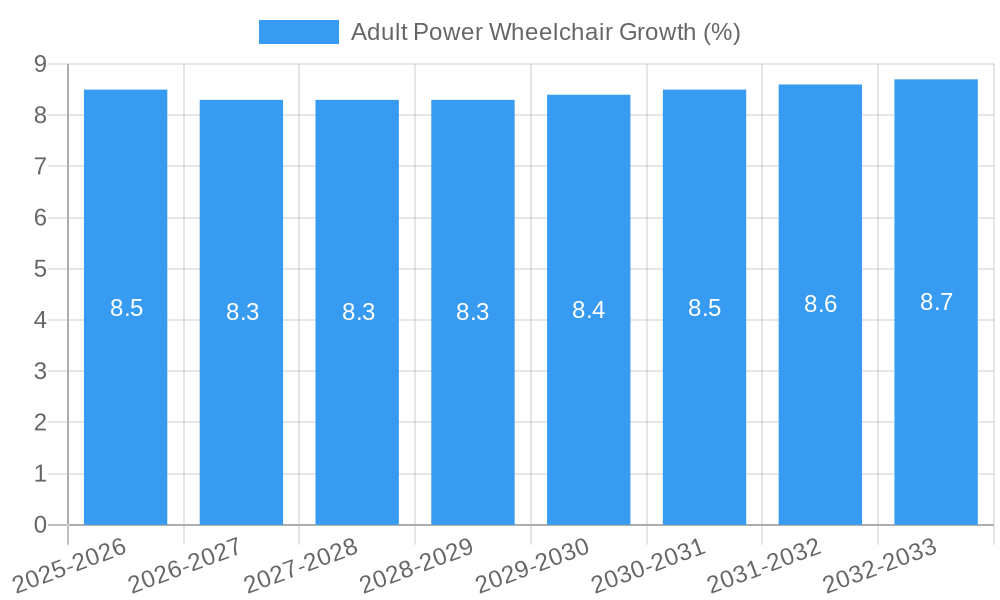

The global adult power wheelchair market is poised for significant expansion, projected to reach an estimated USD 3,800 million in 2025 and grow at a Compound Annual Growth Rate (CAGR) of 8.5% through 2033. This robust growth is primarily driven by the increasing prevalence of age-related mobility issues and a growing number of individuals with physical disabilities seeking enhanced independence and quality of life. Technological advancements are a key catalyst, leading to the development of lighter, more maneuverable, and feature-rich power wheelchairs. Innovations such as advanced battery technology for extended range, intuitive control systems, and integration with smart home devices are making these mobility aids more appealing and functional for a wider user base. Furthermore, supportive government initiatives and reimbursement policies in various regions are making these essential devices more accessible, thereby fueling market demand. The rising awareness about the benefits of powered mobility solutions among end-users and healthcare providers is also contributing to the market's upward trajectory.

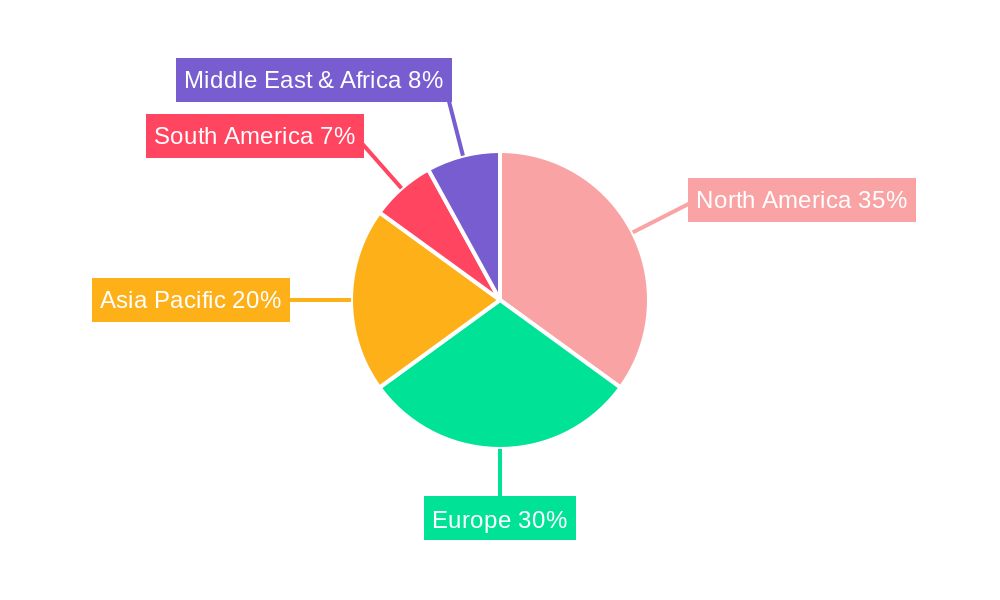

The market segmentation offers a clear view of key areas of focus. The 'Elderly' application segment is expected to dominate, owing to the rapidly aging global population and the associated increase in mobility challenges. The 'Physically Disabled' segment also represents a substantial and growing portion of the market. In terms of types, the Mid-Wheel Powered Wheelchair segment is anticipated to witness the highest growth rate, driven by its superior maneuverability and stability, making it ideal for both indoor and outdoor use. Key industry players like Sunrise Medical, Permobil Corp, and Invacare Corp are actively investing in research and development to introduce innovative products that cater to specific user needs, further stimulating market competition and growth. The Asia Pacific region, particularly China and India, is emerging as a high-potential market due to its large population base, improving healthcare infrastructure, and increasing disposable incomes, signifying a shift in global market dynamics for adult power wheelchairs.

Here is an SEO-optimized, detailed report description for the Adult Power Wheelchair Market:

Adult Power Wheelchair Market Concentration & Innovation

The adult power wheelchair market is characterized by a moderate to high level of concentration, with a significant portion of the market share held by a few key players. Major industry participants like Sunrise Medical, Permobil Corp, Invacare Corp, Pride Mobility, and Drive Medical command substantial market presence through extensive product portfolios, established distribution networks, and brand recognition. Innovation serves as a critical differentiator, driven by advancements in battery technology, lightweight materials, enhanced maneuverability, and user-friendly control systems. Regulatory frameworks, particularly those governed by bodies like the FDA, play a crucial role in product development and market access, ensuring safety and efficacy. The emergence of sophisticated seating systems, smart features, and AI-powered functionalities is further pushing the boundaries of innovation. Product substitutes, while present in the form of manual wheelchairs and mobility scooters, are increasingly being outpaced by the advanced capabilities and independence offered by power wheelchairs. End-user trends are shifting towards greater personalization, customization, and integration with smart home technologies. Mergers and acquisition activities, with estimated deal values in the tens of millions of dollars, are strategically employed by leading companies to expand their product lines, geographic reach, and technological expertise. For instance, the acquisition of smaller, innovative firms by larger corporations has been observed to consolidate market power and accelerate the adoption of new technologies.

- Market Concentration: Dominated by key players, leading to a competitive yet consolidated landscape.

- Innovation Drivers: Battery technology, lightweight materials, advanced controls, smart features.

- Regulatory Frameworks: FDA approvals, safety standards, and efficacy requirements.

- Product Substitutes: Manual wheelchairs, mobility scooters, but with diminishing competitive advantage.

- End-User Trends: Personalization, customization, smart technology integration.

- M&A Activities: Strategic acquisitions in the tens of millions of dollars range, aiming for market expansion and technology integration.

Adult Power Wheelchair Industry Trends & Insights

The adult power wheelchair industry is experiencing robust growth, projected to witness a substantial Compound Annual Growth Rate (CAGR) in the coming years. This expansion is primarily fueled by a confluence of demographic shifts, technological advancements, and increasing awareness of the benefits these mobility solutions offer. The aging global population is a significant demographic driver, as a greater number of individuals require assistive devices to maintain their independence and quality of life. The increasing prevalence of chronic diseases and mobility-limiting conditions, such as stroke, multiple sclerosis, and spinal cord injuries, further bolsters demand. Technological disruptions are at the forefront of this industry's evolution. Innovations in battery technology are leading to longer usage times and faster charging capabilities, addressing a key concern for power wheelchair users. The development of lightweight and durable materials, such as carbon fiber, contributes to enhanced portability and ease of use. Furthermore, advancements in motor efficiency and suspension systems provide a smoother and more comfortable ride, even on challenging terrains.

Consumer preferences are also evolving, with users seeking power wheelchairs that offer greater customization, aesthetics, and integration with their lifestyles. There is a growing demand for sleeker designs, personalized seating options, and advanced control interfaces that are intuitive and easy to operate. The market penetration of advanced power wheelchairs is steadily increasing as healthcare providers, insurers, and end-users recognize their significant impact on improving independence, social participation, and overall well-being. Competitive dynamics within the industry are intense, with established players continuously innovating to maintain market share and new entrants seeking to capitalize on emerging opportunities. Companies are investing heavily in research and development to introduce next-generation power wheelchairs equipped with features like GPS tracking, remote diagnostics, and even semi-autonomous navigation capabilities. The focus is increasingly shifting from basic mobility to comprehensive mobility solutions that enhance the user's life. The market is also witnessing a trend towards integrated ecosystems, where power wheelchairs can seamlessly connect with other assistive technologies and smart devices, creating a more holistic assistive environment. The estimated market size is projected to reach several billion dollars within the forecast period, with significant growth anticipated across various application and type segments.

Dominant Markets & Segments in Adult Power Wheelchair

The global adult power wheelchair market exhibits distinct regional dominance and segment leadership, driven by a complex interplay of economic factors, healthcare infrastructure, and specific end-user needs. North America, particularly the United States, stands as a dominant market due to a combination of factors including a high prevalence of age-related conditions, robust healthcare reimbursement policies, and a proactive approach to adopting advanced assistive technologies. The presence of major manufacturers and a well-established distribution network further solidifies its leading position.

Within the application segments, the Elderly population represents the largest and fastest-growing segment. This is directly attributable to the global demographic shift towards an aging population, with a consequent increase in age-related mobility impairments. Governments and healthcare systems worldwide are increasingly investing in solutions that enable seniors to maintain independence and age in place, making adult power wheelchairs a crucial component of elder care.

Regarding the types of adult power wheelchairs, the Mid-Wheel Powered Wheelchair segment is experiencing significant growth and holds a substantial market share. Its popularity stems from its superior maneuverability and ability to turn in tight spaces, making it ideal for indoor use in homes, offices, and other confined environments. The compact turning radius is a critical advantage for users navigating cluttered spaces.

- Dominant Region (North America):

- Key Drivers: Aging population, comprehensive healthcare reimbursement, strong R&D investment by manufacturers, advanced distribution networks.

- Economic Policies: Favorable insurance coverage and government initiatives supporting assistive device adoption.

- Infrastructure: Well-developed healthcare systems and accessibility standards promoting the use of power wheelchairs.

- Dominant Application Segment (Elderly):

- Key Drivers: Increasing global life expectancy, rising incidence of age-related mobility issues, focus on independent living for seniors, government support for elderly care.

- Consumer Preferences: Demand for ease of use, comfort, and features that enhance safety and independence.

- Dominant Type Segment (Mid-Wheel Powered Wheelchair):

- Key Drivers: Exceptional indoor maneuverability, compact turning radius, suitability for home and office environments, user-friendly operation.

- Technological Advancements: Improved suspension systems and drive trains contributing to a smoother and more stable ride.

Adult Power Wheelchair Product Developments

Product developments in the adult power wheelchair market are increasingly focused on enhancing user experience, functionality, and integration. Innovations include the integration of advanced battery management systems for extended range and faster charging, the use of lightweight composite materials for improved portability, and the development of sophisticated suspension systems for enhanced ride comfort and terrain capability. Smart technologies, such as GPS tracking for location services and remote diagnostics for maintenance alerts, are becoming more prevalent. Furthermore, customizable seating solutions, ergonomic designs, and intuitive control interfaces, including joystick and head array options, are being prioritized to cater to diverse user needs and preferences, providing users with a competitive advantage in navigating their daily lives with greater independence and confidence.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the global adult power wheelchair market, segmenting it by application and type. The application segments include Elderly, Physically Disabled, and Others, with each segment analyzed for its market size, growth projections, and competitive dynamics. The Elderly segment is expected to witness strong growth due to demographic trends. The Physically Disabled segment, encompassing individuals with various mobility impairments, remains a core market. The Others segment includes individuals with temporary mobility challenges or specific medical conditions.

The market is further segmented by type into Front-Wheel Powered Wheelchair, Mid-Wheel Powered Wheelchair, and Rear-Wheel Powered Wheelchair. The Mid-Wheel Powered Wheelchair segment is anticipated to maintain a leading position due to its exceptional maneuverability. The Front-Wheel Powered Wheelchair segment offers enhanced stability and obstacle climbing capabilities. The Rear-Wheel Powered Wheelchair segment provides good straight-line speed and outdoor performance. Growth projections and competitive landscapes are detailed for each of these sub-segments, providing a granular view of the market.

Key Drivers of Adult Power Wheelchair Growth

Several key factors are driving the growth of the adult power wheelchair market. The aging global population is a primary demographic driver, leading to an increased demand for mobility solutions that support independent living. Technological advancements, particularly in battery technology (e.g., longer life, faster charging) and the use of lightweight, durable materials, are enhancing product performance and user convenience. Growing awareness and acceptance of power wheelchairs as essential assistive devices for improving quality of life and independence among individuals with mobility impairments are also significant. Favorable healthcare reimbursement policies and government initiatives in many regions contribute to market accessibility and affordability. The increasing prevalence of chronic conditions that affect mobility further fuels demand.

Challenges in the Adult Power Wheelchair Sector

Despite the robust growth, the adult power wheelchair sector faces several challenges. High product costs can be a significant barrier for some consumers, impacting affordability and market penetration. Complex reimbursement processes and varying insurance coverage across different regions can create hurdles for both users and manufacturers. Regulatory compliance and the stringent approval processes for new medical devices add to development timelines and costs. Limited charging infrastructure and battery limitations for longer excursions can still be a concern for users. Intense competition among established players and emerging niche manufacturers drives down profit margins. Furthermore, supply chain disruptions and the availability of raw materials can impact production volumes and lead times.

Emerging Opportunities in Adult Power Wheelchair

The adult power wheelchair market presents several emerging opportunities. The development of smarter, more connected wheelchairs with features like AI-powered navigation assistance and integration with smart home ecosystems offers significant potential. Advancements in personalized and modular designs catering to specific user needs and preferences will drive innovation and market appeal. The exploration of new market segments, such as specialized power wheelchairs for bariatric users or those with specific neurological conditions, opens up new avenues for growth. Furthermore, the increasing focus on sustainable manufacturing practices and the development of eco-friendly materials could attract environmentally conscious consumers. The expansion of telehealth and remote monitoring capabilities for power wheelchairs could improve post-purchase support and user care.

Leading Players in the Adult Power Wheelchair Market

- Sunrise Medical

- Permobil Corp

- Invacare Corp

- Pride Mobility

- Drive Medical

- Hoveround Corp

- Golden Technologies

- Heartway Medical Products

- Merits Health Products

- C.T.M. Homecare Product

- Magic Mobility

- Karma Wheelchairs

- Meyra

- 21ST Century Scientific

Key Developments in Adult Power Wheelchair Industry

- 2023 - Product Launch: Sunrise Medical launches a new generation of power wheelchairs featuring advanced battery technology and enhanced maneuverability.

- 2023 - Acquisition: Pride Mobility acquires a leading manufacturer of specialized seating solutions, expanding its customization offerings.

- 2022 - Technological Advancement: Permobil Corp introduces AI-powered features for obstacle detection and navigation assistance in its premium power wheelchairs.

- 2022 - Market Expansion: Drive Medical announces strategic partnerships to increase distribution in emerging Asian markets.

- 2021 - Regulatory Approval: Invacare Corp receives FDA clearance for a new lightweight power wheelchair model designed for improved portability.

- 2021 - Partnership: Golden Technologies collaborates with a leading research institution to develop next-generation power assist technologies.

- 2020 - Product Innovation: Merits Health Products introduces a range of power wheelchairs with enhanced suspension for superior outdoor performance.

Strategic Outlook for Adult Power Wheelchair Market

The strategic outlook for the adult power wheelchair market remains highly optimistic, driven by a confluence of sustained demand and continuous innovation. The increasing emphasis on enhancing user independence, comfort, and integration with daily life will continue to fuel product development. Key growth catalysts include the ongoing advancement of battery efficiency, the integration of smart technologies for improved user experience and safety, and the development of more lightweight and portable designs. Companies that focus on customization, personalized solutions, and expanding their service and support networks will likely gain a competitive edge. Strategic collaborations and potential mergers will continue to shape the market landscape, fostering further technological integration and market reach. The market is poised for continued expansion, with a strong focus on delivering advanced mobility solutions that significantly improve the quality of life for users.

Adult Power Wheelchair Segmentation

-

1. Application

- 1.1. Elderly

- 1.2. Physically Disabled

- 1.3. Others

-

2. Types

- 2.1. Front-Wheel Powered Wheelchair

- 2.2. Mid-Wheel Powered Wheelchair

- 2.3. Rear-Wheel Powered Wheelchair

Adult Power Wheelchair Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Adult Power Wheelchair REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Adult Power Wheelchair Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Elderly

- 5.1.2. Physically Disabled

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Front-Wheel Powered Wheelchair

- 5.2.2. Mid-Wheel Powered Wheelchair

- 5.2.3. Rear-Wheel Powered Wheelchair

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Adult Power Wheelchair Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Elderly

- 6.1.2. Physically Disabled

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Front-Wheel Powered Wheelchair

- 6.2.2. Mid-Wheel Powered Wheelchair

- 6.2.3. Rear-Wheel Powered Wheelchair

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Adult Power Wheelchair Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Elderly

- 7.1.2. Physically Disabled

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Front-Wheel Powered Wheelchair

- 7.2.2. Mid-Wheel Powered Wheelchair

- 7.2.3. Rear-Wheel Powered Wheelchair

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Adult Power Wheelchair Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Elderly

- 8.1.2. Physically Disabled

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Front-Wheel Powered Wheelchair

- 8.2.2. Mid-Wheel Powered Wheelchair

- 8.2.3. Rear-Wheel Powered Wheelchair

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Adult Power Wheelchair Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Elderly

- 9.1.2. Physically Disabled

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Front-Wheel Powered Wheelchair

- 9.2.2. Mid-Wheel Powered Wheelchair

- 9.2.3. Rear-Wheel Powered Wheelchair

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Adult Power Wheelchair Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Elderly

- 10.1.2. Physically Disabled

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Front-Wheel Powered Wheelchair

- 10.2.2. Mid-Wheel Powered Wheelchair

- 10.2.3. Rear-Wheel Powered Wheelchair

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Sunrise Medical

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Permobil Corp

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Invacare Corp

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Pride Mobility

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Drive Medical

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hoveround Corp

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Golden Technologies

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Heartway Medical Products

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Merits Health Products

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 C.T.M. Homecare Product

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Magic Mobility

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Karma Wheelchairs

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Meyra

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 21ST Century Scientific

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Sunrise Medical

List of Figures

- Figure 1: Global Adult Power Wheelchair Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Adult Power Wheelchair Revenue (million), by Application 2024 & 2032

- Figure 3: North America Adult Power Wheelchair Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Adult Power Wheelchair Revenue (million), by Types 2024 & 2032

- Figure 5: North America Adult Power Wheelchair Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Adult Power Wheelchair Revenue (million), by Country 2024 & 2032

- Figure 7: North America Adult Power Wheelchair Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Adult Power Wheelchair Revenue (million), by Application 2024 & 2032

- Figure 9: South America Adult Power Wheelchair Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Adult Power Wheelchair Revenue (million), by Types 2024 & 2032

- Figure 11: South America Adult Power Wheelchair Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Adult Power Wheelchair Revenue (million), by Country 2024 & 2032

- Figure 13: South America Adult Power Wheelchair Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Adult Power Wheelchair Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Adult Power Wheelchair Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Adult Power Wheelchair Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Adult Power Wheelchair Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Adult Power Wheelchair Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Adult Power Wheelchair Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Adult Power Wheelchair Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Adult Power Wheelchair Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Adult Power Wheelchair Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Adult Power Wheelchair Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Adult Power Wheelchair Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Adult Power Wheelchair Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Adult Power Wheelchair Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Adult Power Wheelchair Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Adult Power Wheelchair Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Adult Power Wheelchair Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Adult Power Wheelchair Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Adult Power Wheelchair Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Adult Power Wheelchair Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Adult Power Wheelchair Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Adult Power Wheelchair Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Adult Power Wheelchair Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Adult Power Wheelchair Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Adult Power Wheelchair Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Adult Power Wheelchair Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Adult Power Wheelchair Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Adult Power Wheelchair Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Adult Power Wheelchair Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Adult Power Wheelchair Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Adult Power Wheelchair Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Adult Power Wheelchair Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Adult Power Wheelchair Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Adult Power Wheelchair Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Adult Power Wheelchair Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Adult Power Wheelchair Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Adult Power Wheelchair Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Adult Power Wheelchair Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Adult Power Wheelchair Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Adult Power Wheelchair Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Adult Power Wheelchair Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Adult Power Wheelchair Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Adult Power Wheelchair Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Adult Power Wheelchair Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Adult Power Wheelchair Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Adult Power Wheelchair Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Adult Power Wheelchair Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Adult Power Wheelchair Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Adult Power Wheelchair Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Adult Power Wheelchair Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Adult Power Wheelchair Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Adult Power Wheelchair Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Adult Power Wheelchair Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Adult Power Wheelchair Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Adult Power Wheelchair Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Adult Power Wheelchair Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Adult Power Wheelchair Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Adult Power Wheelchair Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Adult Power Wheelchair Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Adult Power Wheelchair Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Adult Power Wheelchair Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Adult Power Wheelchair Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Adult Power Wheelchair Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Adult Power Wheelchair Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Adult Power Wheelchair Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Adult Power Wheelchair Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Adult Power Wheelchair?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Adult Power Wheelchair?

Key companies in the market include Sunrise Medical, Permobil Corp, Invacare Corp, Pride Mobility, Drive Medical, Hoveround Corp, Golden Technologies, Heartway Medical Products, Merits Health Products, C.T.M. Homecare Product, Magic Mobility, Karma Wheelchairs, Meyra, 21ST Century Scientific.

3. What are the main segments of the Adult Power Wheelchair?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Adult Power Wheelchair," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Adult Power Wheelchair report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Adult Power Wheelchair?

To stay informed about further developments, trends, and reports in the Adult Power Wheelchair, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence