Key Insights

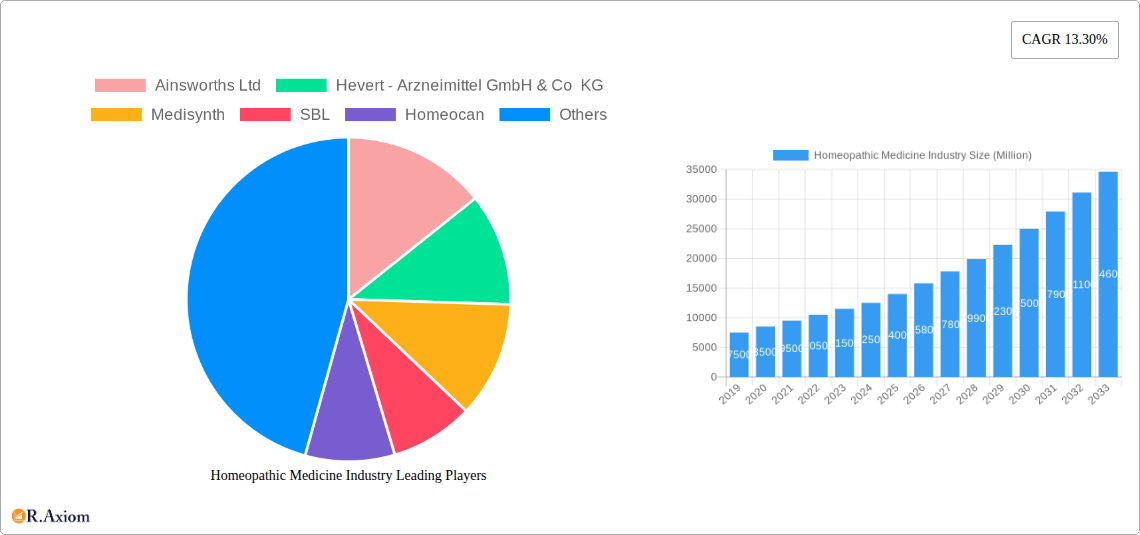

The global Homeopathic Medicine market is projected for significant expansion, expected to reach a market size of USD 8.97 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 13.12% through 2033. This growth is driven by increasing consumer preference for natural and holistic healthcare solutions and a growing awareness of homeopathic remedies for various ailments. As individuals increasingly seek alternatives to conventional pharmaceuticals, demand for homeopathic medicines is set to surge, particularly in therapeutic areas like pain management, fever reduction, and respiratory conditions. Ongoing research and development, alongside favorable regulatory environments in key regions, are further fueling market accessibility and application scope.

Homeopathic Medicine Industry Market Size (In Billion)

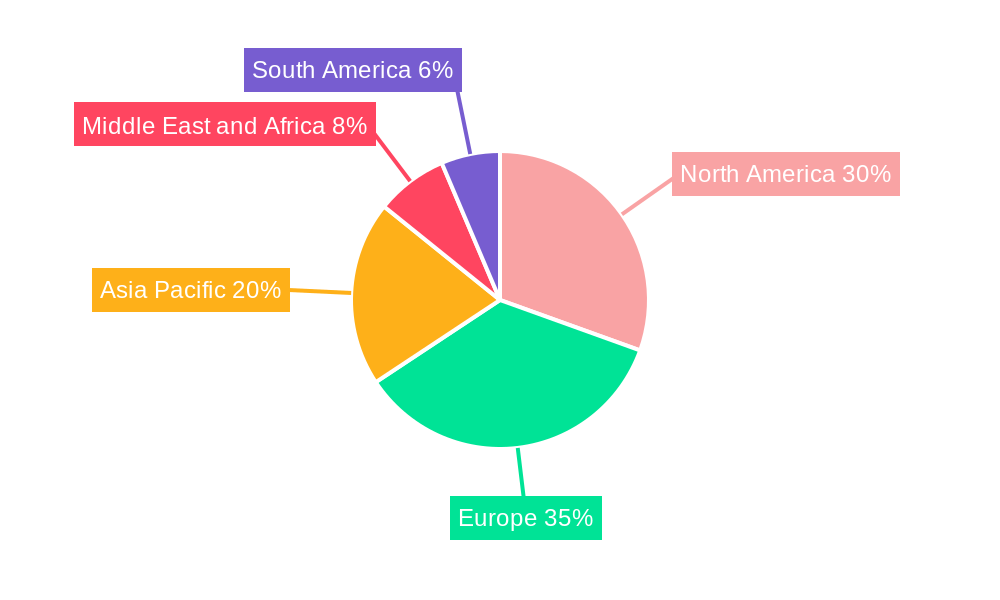

The market offers diverse product types, including tinctures, dilutions, and tablets, to meet varied patient preferences. The analgesics and antipyretics application segment is a primary growth driver, reflecting the widespread use of homeopathy for common discomforts. Neurology and respiratory segments also show considerable potential. North America and Europe are expected to remain dominant markets due to established practices and strong consumer bases. However, the Asia Pacific region presents substantial growth opportunities, driven by rising disposable incomes, increasing health consciousness, and growing acceptance of alternative medicine. Key industry players are actively engaged in product innovation, strategic collaborations, and market expansion to capitalize on these trends and address evolving global healthcare needs.

Homeopathic Medicine Industry Company Market Share

This report provides in-depth analysis of the dynamic Homeopathic Medicine Industry. The study covers the historical period, with a base year of 2025 and a forecast period from 2025 to 2033. We meticulously analyze market concentration, key growth drivers, segmentation, competitive landscape, and emerging trends to equip businesses with a strategic roadmap for success in this evolving sector. This report offers precise data and predictive analytics for informed decision-making.

Homeopathic Medicine Industry Market Concentration & Innovation

The global Homeopathic Medicine market exhibits a moderate level of concentration, with a few key players dominating significant market share. However, there is substantial room for growth and innovation, driven by increasing consumer interest in natural and alternative therapies. Innovation in product development, particularly in enhanced delivery mechanisms and targeted formulations, is a critical driver. Regulatory frameworks, while present, are often complex and vary significantly by region, influencing market entry and product approval. The presence of established conventional medicine as a product substitute presents a constant competitive challenge. End-user trends are shifting towards personalized wellness and preventative healthcare, favoring homeopathic solutions. Merger and acquisition (M&A) activities, though not as prevalent as in some other pharmaceutical sectors, are strategically employed to consolidate market presence and acquire innovative technologies. Projected M&A deal values are expected to increase, reflecting growing investor confidence in the segment.

- Market Share: Leading companies hold an estimated 55% of the global market share.

- Innovation Drivers:

- Development of novel delivery systems.

- Research into efficacy for chronic conditions.

- Combination therapies and personalized medicine approaches.

- Regulatory Frameworks: Varying approval processes across North America, Europe, and Asia-Pacific.

- Product Substitutes: Conventional pharmaceuticals, herbal remedies, and other alternative medicine.

- End-User Trends: Growing preference for natural ingredients, focus on holistic health, and demand for non-addictive pain management.

- M&A Activities: Strategic acquisitions to enhance product portfolios and expand geographical reach. Estimated M&A deal values in the range of XX Million to XX Million USD.

Homeopathic Medicine Industry Industry Trends & Insights

The Homeopathic Medicine Industry is poised for significant expansion, fueled by a confluence of factors that underscore its growing appeal. A primary growth driver is the escalating consumer demand for natural healthcare solutions and a heightened awareness of the potential side effects associated with synthetic drugs. This trend is further amplified by a global shift towards preventative medicine and holistic well-being, where homeopathy is perceived as a gentle and effective approach. Technological disruptions, while not as rapid as in some biotech fields, are contributing to product refinement and improved manufacturing processes, ensuring higher quality and consistency. Consumer preferences are increasingly leaning towards products that are perceived as safer, with fewer adverse reactions, making homeopathic remedies a compelling choice. The competitive dynamics are characterized by a blend of established global players and emerging regional manufacturers, each vying for market share through product differentiation, strategic pricing, and robust distribution networks. The Compound Annual Growth Rate (CAGR) for the homeopathic medicine market is projected to be approximately 6.5% over the forecast period. Market penetration is expected to deepen, particularly in developing economies where healthcare access and affordability are key concerns. The increasing integration of homeopathy into mainstream wellness practices and its growing acceptance by a segment of medical professionals are also significant contributors to its upward trajectory. The influence of digital platforms in educating consumers and facilitating direct-to-consumer sales is another burgeoning trend reshaping the industry's landscape.

Dominant Markets & Segments in Homeopathic Medicine Industry

The Homeopathic Medicine Industry showcases distinct regional dominance and segment preferences. Globally, Europe currently leads the market, driven by a long-standing tradition of homeopathic practice and a strong consumer base that values natural healthcare. Within Europe, Germany stands out as a particularly significant market due to supportive regulatory environments and widespread acceptance. Asia-Pacific, especially India, is emerging as a rapidly growing region, propelled by increasing disposable incomes, a growing middle class, and government initiatives supporting traditional medicine.

Product Type Segmentation:

- Dilutions represent the largest segment, accounting for an estimated 45% of the market share. Their versatility and wide range of applications contribute to this dominance.

- Tablets are gaining traction, projected to grow at a CAGR of 7.0%, driven by convenience and ease of administration.

- Tinctures hold a stable market share, particularly in traditional homeopathic formulations.

- Others, including creams and gels, represent a smaller but growing segment.

Application Segmentation:

- The Respiratory application segment is a major contributor, with an estimated 30% market share, driven by the prevalence of respiratory ailments.

- Analgesic and Antipyretic applications are also significant, catering to common pain and fever management needs.

- Neurology applications are witnessing steady growth, as consumers seek alternatives for neurological discomfort.

- Others, encompassing a broad spectrum of conditions, collectively form a substantial portion of the market.

Source Segmentation:

- Plants are the predominant source, forming approximately 60% of all homeopathic remedies, owing to their diverse medicinal properties.

- Minerals constitute the second-largest source, valued for their specific therapeutic effects.

- Animals are used in a smaller proportion of homeopathic preparations.

Key drivers for regional dominance include favorable economic policies, robust healthcare infrastructure, and an educated consumer base receptive to alternative medicine. Growing investments in research and development within key countries are further solidifying their leading positions.

Homeopathic Medicine Industry Product Developments

Product developments in the Homeopathic Medicine Industry are increasingly focused on enhancing efficacy, improving patient compliance, and expanding therapeutic applications. Innovations are centered around optimizing the potency and bioavailability of homeopathic remedies through advanced dilution and potentization techniques. Manufacturers are also exploring novel delivery systems, such as fast-dissolving tablets and topical applications, to cater to diverse patient needs and improve convenience. The development of combination remedies for specific ailments and the exploration of personalized homeopathic treatment plans represent key competitive advantages. Technological advancements in manufacturing ensure greater standardization and quality control, building consumer trust. Market fit is enhanced by addressing unmet needs in areas like chronic condition management and supportive care alongside conventional treatments.

Report Scope & Segmentation Analysis

The Homeopathic Medicine Industry is segmented comprehensively to provide granular market insights. The analysis covers Product Type, including Tincture, Dilutions, Tablets, and Others. Each of these segments is projected to experience steady growth, with Dilutions currently leading and Tablets demonstrating a high growth potential. The Application segmentation dissects the market into Analgesic and Antipyretic, Respiratory, Neurology, and Others, with the Respiratory segment holding a significant market share and Analgesic and Antipyretic applications showing consistent demand. The Source segmentation categorizes remedies derived from Plants, Animals, and Minerals, with Plant-based remedies dominating the market due to their wide availability and established therapeutic uses. Growth projections for each segment range from 5.5% to 7.2% CAGR, with competitive dynamics evolving as new product innovations and market penetration strategies are adopted.

Key Drivers of Homeopathic Medicine Industry Growth

The Homeopathic Medicine Industry is propelled by several key drivers. A significant factor is the escalating global demand for natural and organic healthcare products, driven by increased health consciousness and a preference for gentle, non-toxic therapies. The growing awareness of the potential side effects of conventional pharmaceuticals also steers consumers towards alternatives like homeopathy. Furthermore, supportive government initiatives in certain regions, promoting traditional and alternative medicine, foster market expansion. Technological advancements in manufacturing and quality control are enhancing the credibility and accessibility of homeopathic products. The increasing acceptance by a segment of medical professionals and the integration of homeopathy into holistic wellness practices also contribute significantly to its growth trajectory.

Challenges in the Homeopathic Medicine Industry Sector

Despite its growth potential, the Homeopathic Medicine Industry faces several challenges. Regulatory hurdles remain a significant barrier, with varying approval processes and standards across different countries, impacting market entry and product standardization. The scientific validation and acceptance of homeopathy by mainstream medical communities continue to be debated, leading to skepticism among some consumers and healthcare providers. Supply chain complexities for sourcing raw materials and ensuring product integrity can also pose challenges. Intense competitive pressure from conventional pharmaceuticals and other alternative medicine providers requires continuous innovation and effective marketing strategies to differentiate homeopathic offerings and maintain market share.

Emerging Opportunities in Homeopathic Medicine Industry

The Homeopathic Medicine Industry is ripe with emerging opportunities. The increasing global focus on preventative healthcare and wellness presents a significant avenue for growth, as consumers actively seek natural methods to maintain health and well-being. The rising popularity of personalized medicine also opens doors for tailored homeopathic formulations to address individual health needs. Expansion into emerging economies, where access to affordable healthcare is a priority, offers substantial untapped market potential. Furthermore, advancements in scientific research and technology are enabling the development of more targeted and potent homeopathic remedies, attracting a wider consumer base and gaining greater acceptance within the medical community.

Leading Players in the Homeopathic Medicine Industry Market

- Ainsworths Ltd

- Hevert - Arzneimittel GmbH & Co KG

- Medisynth

- SBL

- Homeocan

- Dr Reckeweg & Co

- A Nelson & Co Ltd

- Powell Laboratories Pvt Ltd

- Biologische Heilmittel Heel GmbH

- Boiron

- Dr Willmar Schwabe GmbH & Co KG

- Hahnemann Laboratories

Key Developments in Homeopathic Medicine Industry Industry

- August 2022: The Academy of Homeopathy Education partnered with the American Institute of Homeopathy (AIH) to launch Acute Care Homeopathy course for medical professionals in a hybrid model. The customized educational program enhances medical professionals' practice and expands the treatment tools available with acute care homeopathy. In the course, participants will learn safe and effective ways to manage pain and mitigate antibiotic overuse with FDA-regulated and approved Homeopathic remedies.

- April 2022: Kaps3 Lifesciences Pvt Ltd., headquartered in Gujarat, India, launched its 'Kaps3 Homeopathy Division' to support the growing demand for homeopathy products in the country.

Strategic Outlook for Homeopathic Medicine Industry Market

The Homeopathic Medicine Industry is on a robust growth trajectory, driven by evolving consumer preferences towards natural and holistic healthcare. The strategic outlook emphasizes innovation in product development, focusing on enhanced efficacy, convenient delivery systems, and personalized treatment approaches. Expanding market penetration into underserved regions and capitalizing on the growing wellness trend are key growth catalysts. Strategic partnerships and collaborations with healthcare institutions and regulatory bodies will be crucial for fostering wider acceptance and market integration. The industry's ability to address unmet healthcare needs through safe and effective homeopathic solutions positions it for sustained expansion and increased market share in the coming years, promising substantial future market potential and lucrative opportunities for stakeholders.

Homeopathic Medicine Industry Segmentation

-

1. Product Type

- 1.1. Tincture

- 1.2. Dilutions

- 1.3. Tablets

- 1.4. Others

-

2. Application

- 2.1. Analgesic and Antipyretic

- 2.2. Respiratory

- 2.3. Neurology

- 2.4. Others

-

3. Source

- 3.1. Plants

- 3.2. Animals

- 3.3. Minerals

Homeopathic Medicine Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Homeopathic Medicine Industry Regional Market Share

Geographic Coverage of Homeopathic Medicine Industry

Homeopathic Medicine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.1199999999999% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Awareness Regarding the Homeopathy Medicine; Rising Prevalence of Lifestyle-Associated Diseases

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness about Homeopathic Products

- 3.4. Market Trends

- 3.4.1. Dilutions Segment is Expected to Hold a Significant Market Share Over The Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Homeopathic Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Tincture

- 5.1.2. Dilutions

- 5.1.3. Tablets

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Analgesic and Antipyretic

- 5.2.2. Respiratory

- 5.2.3. Neurology

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Source

- 5.3.1. Plants

- 5.3.2. Animals

- 5.3.3. Minerals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Homeopathic Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Tincture

- 6.1.2. Dilutions

- 6.1.3. Tablets

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Analgesic and Antipyretic

- 6.2.2. Respiratory

- 6.2.3. Neurology

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by Source

- 6.3.1. Plants

- 6.3.2. Animals

- 6.3.3. Minerals

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Homeopathic Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Tincture

- 7.1.2. Dilutions

- 7.1.3. Tablets

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Analgesic and Antipyretic

- 7.2.2. Respiratory

- 7.2.3. Neurology

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by Source

- 7.3.1. Plants

- 7.3.2. Animals

- 7.3.3. Minerals

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Homeopathic Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Tincture

- 8.1.2. Dilutions

- 8.1.3. Tablets

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Analgesic and Antipyretic

- 8.2.2. Respiratory

- 8.2.3. Neurology

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by Source

- 8.3.1. Plants

- 8.3.2. Animals

- 8.3.3. Minerals

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Homeopathic Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Tincture

- 9.1.2. Dilutions

- 9.1.3. Tablets

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Analgesic and Antipyretic

- 9.2.2. Respiratory

- 9.2.3. Neurology

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by Source

- 9.3.1. Plants

- 9.3.2. Animals

- 9.3.3. Minerals

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South America Homeopathic Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Tincture

- 10.1.2. Dilutions

- 10.1.3. Tablets

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Analgesic and Antipyretic

- 10.2.2. Respiratory

- 10.2.3. Neurology

- 10.2.4. Others

- 10.3. Market Analysis, Insights and Forecast - by Source

- 10.3.1. Plants

- 10.3.2. Animals

- 10.3.3. Minerals

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ainsworths Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hevert - Arzneimittel GmbH & Co KG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Medisynth

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SBL

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Homeocan

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dr Reckeweg & Co

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 A Nelson & Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Powell Laboratories Pvt Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Biologische Heilmittel Heel GmbH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Boiron

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Dr Willmar Schwabe GmbH & Co KG*List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Hahnemann Laboratories

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Ainsworths Ltd

List of Figures

- Figure 1: Global Homeopathic Medicine Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Homeopathic Medicine Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Homeopathic Medicine Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Homeopathic Medicine Industry Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Homeopathic Medicine Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Homeopathic Medicine Industry Revenue (billion), by Source 2025 & 2033

- Figure 7: North America Homeopathic Medicine Industry Revenue Share (%), by Source 2025 & 2033

- Figure 8: North America Homeopathic Medicine Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Homeopathic Medicine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Homeopathic Medicine Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 11: Europe Homeopathic Medicine Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Homeopathic Medicine Industry Revenue (billion), by Application 2025 & 2033

- Figure 13: Europe Homeopathic Medicine Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Homeopathic Medicine Industry Revenue (billion), by Source 2025 & 2033

- Figure 15: Europe Homeopathic Medicine Industry Revenue Share (%), by Source 2025 & 2033

- Figure 16: Europe Homeopathic Medicine Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Homeopathic Medicine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Homeopathic Medicine Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Homeopathic Medicine Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Homeopathic Medicine Industry Revenue (billion), by Application 2025 & 2033

- Figure 21: Asia Pacific Homeopathic Medicine Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Homeopathic Medicine Industry Revenue (billion), by Source 2025 & 2033

- Figure 23: Asia Pacific Homeopathic Medicine Industry Revenue Share (%), by Source 2025 & 2033

- Figure 24: Asia Pacific Homeopathic Medicine Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Homeopathic Medicine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Homeopathic Medicine Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Homeopathic Medicine Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Homeopathic Medicine Industry Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East and Africa Homeopathic Medicine Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Homeopathic Medicine Industry Revenue (billion), by Source 2025 & 2033

- Figure 31: Middle East and Africa Homeopathic Medicine Industry Revenue Share (%), by Source 2025 & 2033

- Figure 32: Middle East and Africa Homeopathic Medicine Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East and Africa Homeopathic Medicine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Homeopathic Medicine Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 35: South America Homeopathic Medicine Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: South America Homeopathic Medicine Industry Revenue (billion), by Application 2025 & 2033

- Figure 37: South America Homeopathic Medicine Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: South America Homeopathic Medicine Industry Revenue (billion), by Source 2025 & 2033

- Figure 39: South America Homeopathic Medicine Industry Revenue Share (%), by Source 2025 & 2033

- Figure 40: South America Homeopathic Medicine Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: South America Homeopathic Medicine Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Homeopathic Medicine Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Homeopathic Medicine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Homeopathic Medicine Industry Revenue billion Forecast, by Source 2020 & 2033

- Table 4: Global Homeopathic Medicine Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Homeopathic Medicine Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Global Homeopathic Medicine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Global Homeopathic Medicine Industry Revenue billion Forecast, by Source 2020 & 2033

- Table 8: Global Homeopathic Medicine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Homeopathic Medicine Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 13: Global Homeopathic Medicine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Homeopathic Medicine Industry Revenue billion Forecast, by Source 2020 & 2033

- Table 15: Global Homeopathic Medicine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Germany Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: France Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Spain Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Homeopathic Medicine Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 23: Global Homeopathic Medicine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 24: Global Homeopathic Medicine Industry Revenue billion Forecast, by Source 2020 & 2033

- Table 25: Global Homeopathic Medicine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: China Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Japan Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: India Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Australia Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Korea Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Homeopathic Medicine Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 33: Global Homeopathic Medicine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 34: Global Homeopathic Medicine Industry Revenue billion Forecast, by Source 2020 & 2033

- Table 35: Global Homeopathic Medicine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: GCC Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Africa Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Global Homeopathic Medicine Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 40: Global Homeopathic Medicine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 41: Global Homeopathic Medicine Industry Revenue billion Forecast, by Source 2020 & 2033

- Table 42: Global Homeopathic Medicine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 43: Brazil Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Argentina Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Homeopathic Medicine Industry?

The projected CAGR is approximately 13.1199999999999%.

2. Which companies are prominent players in the Homeopathic Medicine Industry?

Key companies in the market include Ainsworths Ltd, Hevert - Arzneimittel GmbH & Co KG, Medisynth, SBL, Homeocan, Dr Reckeweg & Co, A Nelson & Co Ltd, Powell Laboratories Pvt Ltd, Biologische Heilmittel Heel GmbH, Boiron, Dr Willmar Schwabe GmbH & Co KG*List Not Exhaustive, Hahnemann Laboratories.

3. What are the main segments of the Homeopathic Medicine Industry?

The market segments include Product Type, Application, Source.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.97 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Awareness Regarding the Homeopathy Medicine; Rising Prevalence of Lifestyle-Associated Diseases.

6. What are the notable trends driving market growth?

Dilutions Segment is Expected to Hold a Significant Market Share Over The Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Awareness about Homeopathic Products.

8. Can you provide examples of recent developments in the market?

August 2022: the Academy of Homeopathy Education partnered with the American Institute of Homeopathy (AIH) to launch Acute Care Homeopathy course for medical professionals in a hybrid model. The customized educational program enhances medical professionals' practice and expands the treatment tools available with acute care homeopathy. In the course, participants will learn safe and effective ways to manage pain and mitigate antibiotic overuse with FDA-regulated and approved Homeopathic remedies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Homeopathic Medicine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Homeopathic Medicine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Homeopathic Medicine Industry?

To stay informed about further developments, trends, and reports in the Homeopathic Medicine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence