Key Insights

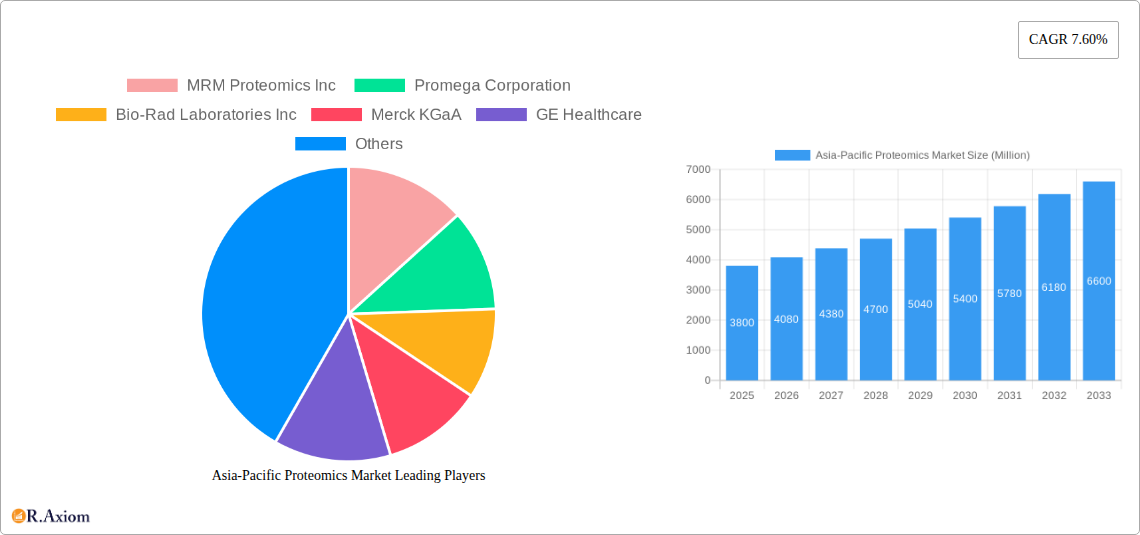

The Asia-Pacific Proteomics Market is poised for significant expansion, projected to reach a substantial market size of approximately USD 3,800 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.60% anticipated throughout the forecast period of 2025-2033. This dynamic growth is primarily propelled by escalating investments in life sciences research and development across the region, coupled with the increasing prevalence of chronic diseases that necessitate advanced diagnostic solutions. Furthermore, the growing adoption of sophisticated proteomics technologies like mass spectrometry and protein microarrays in clinical diagnostics and drug discovery applications is a key driver. Governments in key Asia-Pacific economies are actively promoting biotech innovation, fostering a conducive environment for market players. The demand for personalized medicine and targeted therapies is also fueling the need for detailed proteomic profiling.

Asia-Pacific Proteomics Market Market Size (In Billion)

The market segmentation reveals a strong emphasis on advanced instrumentation, with Spectroscopy, Chromatography, and Electrophoresis technologies leading the charge in driving market value. The Reagents, Software, and Services segments are also crucial, providing the essential tools and support for comprehensive proteomic analysis. Application-wise, Clinical Diagnostics and Drug Discovery are the dominant sectors, reflecting the critical role of proteomics in understanding disease mechanisms and developing novel therapeutics. Geographically, the Asia-Pacific region, particularly China, Japan, and India, is expected to exhibit the highest growth potential due to a burgeoning healthcare infrastructure, increasing R&D expenditure, and a large patient pool. Emerging economies within the region are also contributing to this upward trajectory as they embrace advanced biotechnological solutions. Despite the promising outlook, potential restraints such as high initial investment costs for advanced instrumentation and the need for skilled bioinformatics professionals may pose challenges, though these are being mitigated by increasing technological affordability and educational initiatives.

Asia-Pacific Proteomics Market Company Market Share

This comprehensive report offers an exhaustive analysis of the Asia-Pacific Proteomics Market, providing critical insights and actionable intelligence for stakeholders. The study covers the period from 2019 to 2033, with 2025 as the base and estimated year, and a forecast period from 2025 to 2033, building upon historical data from 2019 to 2024. The report delves into market segmentation by Type (Instrument such as Spectroscopy, Chromatography, Electrophoresis, Protein Microarrays, X-Ray Crystallography, and Other Instrumentation Technologies; Reagents; Software and Services), Application (Clinical Diagnostics, Drug Discovery, and Other Applications), and Geography (Asia-Pacific, including China, Japan, India, Australia, South Korea, and the Rest of Asia-Pacific). With a projected market size of $xx Million in 2025 and an anticipated Compound Annual Growth Rate (CAGR) of xx% during the forecast period, this report is an indispensable resource for understanding the dynamics of this rapidly evolving sector.

Asia-Pacific Proteomics Market Market Concentration & Innovation

The Asia-Pacific Proteomics Market exhibits a moderately concentrated structure, with a few key players holding significant market share, alongside a growing number of emerging companies driving innovation. Innovation is primarily fueled by advancements in mass spectrometry, antibody development, and bioinformatics, which are crucial for precise protein identification and quantification. Regulatory frameworks, while evolving, are increasingly aligning with global standards, particularly in countries like China and Japan, fostering trust and adoption in diagnostic applications. Product substitutes, such as genomics and transcriptomics, offer alternative insights but lack the direct functional information provided by proteomics. End-user trends show a strong preference for high-throughput, automated solutions, especially within drug discovery and clinical diagnostics. Mergers and acquisitions (M&A) are a significant driver of market consolidation and expansion, with deal values ranging from tens to hundreds of millions of dollars as larger companies acquire innovative startups. For instance, the acquisition of niche proteomics technology providers by established life science instrument manufacturers is a recurring theme, aiming to broaden their product portfolios and competitive edge.

- Key Innovation Drivers: Advancements in Mass Spectrometry technology, development of novel antibody-based assays, sophisticated bioinformatics and AI-powered data analysis tools, and progress in multiplexing technologies.

- Regulatory Landscape: Nascent but growing regulatory clarity for proteomics-based diagnostics and therapeutics, with increasing harmonization of standards across key Asia-Pacific nations.

- End-User Preferences: Demand for integrated workflow solutions, cost-effectiveness, and increased accuracy in protein analysis for both research and clinical applications.

- M&A Activity: Strategic acquisitions focused on enhancing technological capabilities and expanding market reach, with significant M&A deals expected to reshape the competitive landscape.

Asia-Pacific Proteomics Market Industry Trends & Insights

The Asia-Pacific Proteomics Market is experiencing robust growth, driven by an increasing understanding of the critical role of proteins in biological processes and disease pathogenesis. This burgeoning awareness fuels demand across diverse applications, from early-stage drug discovery to personalized medicine and advanced clinical diagnostics. The market penetration of proteomics technologies is steadily increasing as research institutions and pharmaceutical companies invest heavily in state-of-the-art equipment and reagents. Technological disruptions, particularly in areas like liquid chromatography-mass spectrometry (LC-MS) and advanced protein array technologies, are enabling deeper and more comprehensive proteomic analyses. These advancements allow for the identification and quantification of thousands of proteins simultaneously, providing unprecedented insights into cellular functions, disease biomarkers, and therapeutic targets.

Consumer preferences are shifting towards more targeted and sensitive diagnostic tests, a trend that proteomics is well-positioned to address. The rising prevalence of chronic diseases, coupled with an aging population across the Asia-Pacific region, further amplifies the need for advanced diagnostic tools, including those leveraging proteomic data. Furthermore, the pharmaceutical industry's relentless pursuit of novel drug candidates and a deeper understanding of drug mechanisms of action is a significant catalyst for proteomics adoption. Contract Research Organizations (CROs) and academic research centers are also key stakeholders, increasingly integrating proteomics into their service offerings and research agendas. The competitive dynamics are characterized by intense innovation, strategic partnerships, and a growing focus on developing platform technologies that can be applied across multiple research and clinical domains. The Asia-Pacific region, with its vast population and increasing healthcare expenditures, represents a significant growth frontier for the global proteomics market, offering substantial opportunities for companies that can cater to local market needs and regulatory requirements. The overall market CAGR is estimated to be in the range of xx% to xx% during the forecast period, reflecting its dynamic growth trajectory.

Dominant Markets & Segments in Asia-Pacific Proteomics Market

Within the Asia-Pacific Proteomics Market, China has emerged as a dominant force, propelled by substantial government investment in life sciences research, a rapidly expanding pharmaceutical and biotechnology sector, and a growing emphasis on precision medicine. The country's large population and the increasing burden of chronic diseases create a significant demand for advanced diagnostic and therapeutic solutions, which proteomics is uniquely positioned to support. China's expanding research infrastructure, coupled with a burgeoning pool of skilled scientists, further solidifies its leading position.

- Dominant Geography: China's dominance is underpinned by:

- Government Initiatives: Strong policy support and funding for R&D in life sciences and biotechnology.

- Market Size: A vast patient population and a rapidly growing domestic market for pharmaceuticals and diagnostics.

- Research Infrastructure: Significant investment in advanced research facilities and academic institutions.

- Technological Adoption: Increasing adoption of cutting-edge proteomics technologies by local research entities.

Among the Type segments, Instruments command a significant market share, driven by the high cost and advanced capabilities of proteomics analysis platforms. Within instruments, Spectroscopy (particularly mass spectrometry) and Chromatography are the most crucial technologies, forming the backbone of most proteomic workflows. Their ability to identify, quantify, and characterize proteins with high sensitivity and specificity makes them indispensable for both research and clinical applications.

- Dominant Type Segment: Instruments, with a particular emphasis on:

- Spectroscopy (Mass Spectrometry): Essential for protein identification, quantification, and post-translational modification analysis.

- Chromatography: Crucial for separating complex protein mixtures prior to mass spectrometry analysis.

- Drivers: The continuous evolution of mass spectrometry technology, leading to higher resolution, sensitivity, and throughput, is a key growth driver for this segment.

In terms of Application, Drug Discovery holds a dominant position. Proteomics plays a vital role in identifying novel drug targets, elucidating drug mechanisms of action, predicting drug efficacy and toxicity, and developing personalized therapeutics. The immense financial investment by pharmaceutical companies in R&D, coupled with the increasing complexity of drug development, necessitates the use of sophisticated proteomic tools.

- Dominant Application Segment: Drug Discovery.

- Key Drivers: The imperative to accelerate drug discovery pipelines, identify biomarkers for drug response, and develop targeted therapies.

- Market Penetration: High penetration in pharmaceutical R&D, with increasing adoption by biopharmaceutical companies and CROs.

Asia-Pacific Proteomics Market Product Developments

Product developments in the Asia-Pacific Proteomics Market are characterized by a focus on enhancing sensitivity, throughput, and user-friendliness. Companies are actively developing advanced mass spectrometry instruments with improved resolution and speed, alongside more robust protein extraction and sample preparation kits. The integration of artificial intelligence and machine learning into data analysis software is a significant trend, enabling deeper insights from complex proteomic datasets. These innovations are driven by the need to support increasingly complex research questions in areas like oncology, neurodegenerative diseases, and infectious diseases, offering competitive advantages through greater accuracy and faster results.

Report Scope & Segmentation Analysis

This report meticulously segments the Asia-Pacific Proteomics Market across key dimensions. The Type segmentation includes advanced Instrument technologies such as Spectroscopy, Chromatography, Electrophoresis, Protein Microarrays, X-Ray Crystallography, and Other Instrumentation Technologies, alongside Reagents, and Software and Services. The Application segmentation covers Clinical Diagnostics, Drug Discovery, and Other Applications (including academic research and food safety). Geographically, the market is analyzed across Asia-Pacific, with detailed insights into China, Japan, India, Australia, South Korea, and the Rest of Asia-Pacific. Projections indicate strong growth across all segments, with Clinical Diagnostics expected to witness a significant CAGR due to increasing adoption in biomarker discovery and disease monitoring. Competitive dynamics are shaping each segment, with companies vying for market leadership through technological innovation and strategic partnerships.

Key Drivers of Asia-Pacific Proteomics Market Growth

The Asia-Pacific Proteomics Market's growth is propelled by several interconnected factors.

- Technological Advancements: Continuous innovation in mass spectrometry, antibody development, and bioinformatics platforms is enhancing the precision and scope of proteomic analysis.

- Rising Healthcare Expenditure: Increasing investment in healthcare infrastructure and services across the region fuels the demand for advanced diagnostic tools and research capabilities.

- Growing Prevalence of Chronic Diseases: The increasing incidence of diseases like cancer, diabetes, and cardiovascular disorders necessitates sophisticated diagnostic and therapeutic approaches, where proteomics plays a crucial role.

- Government Support for R&D: Favorable policies and funding initiatives in countries like China and Japan are fostering a robust research ecosystem for life sciences and biotechnology.

Challenges in the Asia-Pacific Proteomics Market Sector

Despite its promising growth, the Asia-Pacific Proteomics Market faces several challenges.

- High Cost of Instrumentation: The significant capital investment required for advanced proteomics equipment can be a barrier for smaller research institutions and emerging markets.

- Data Complexity and Standardization: Managing and interpreting vast amounts of proteomic data requires specialized bioinformatics expertise and standardized protocols, which are still under development in some regions.

- Skilled Workforce Shortage: A lack of adequately trained personnel in proteomics techniques and data analysis can hinder adoption and effective utilization of available technologies.

- Regulatory Hurdles: Navigating diverse and evolving regulatory pathways for proteomics-based diagnostics and therapeutics across different Asia-Pacific countries can be complex and time-consuming.

Emerging Opportunities in Asia-Pacific Proteomics Market

The Asia-Pacific Proteomics Market is ripe with emerging opportunities. The burgeoning field of personalized medicine, where proteomic profiles are used to tailor treatments, presents a significant avenue for growth. Advancements in liquid biopsy technologies, enabling non-invasive disease detection and monitoring through protein analysis in bodily fluids, are also creating new market frontiers. Furthermore, the application of proteomics in areas beyond healthcare, such as agriculture and food science, is gaining traction. Strategic collaborations between academic institutions and industry players, particularly in emerging economies within the region, offer fertile ground for innovation and market penetration.

Leading Players in the Asia-Pacific Proteomics Market Market

- MRM Proteomics Inc

- Promega Corporation

- Bio-Rad Laboratories Inc

- Merck KGaA

- GE Healthcare

- Waters Corporation

- Thermo Fisher Scientific Inc

- Danaher Corporation

- Agilent Technologies Inc

- Applied Biomics Inc

- Bruker Corporation

Key Developments in Asia-Pacific Proteomics Market Industry

- March 2022: Biognosys, a leader in next-generation proteomics solutions for drug discovery and development, launched its expanded suite of protein platforms that provide pharmaceutical and diagnostics customers with deep biological insights across the entire R&D pipeline, from early-stage discovery to clinical settings.

- January 2022: Illumina, Inc. entered into a definitive co-development agreement with SomaLogic to bring the SomaScan Proteomics Assay onto Illumina's current and future high throughput next-generation sequencing (NGS) platforms in India.

Strategic Outlook for Asia-Pacific Proteomics Market Market

The strategic outlook for the Asia-Pacific Proteomics Market is exceptionally bright, characterized by a strong trajectory of growth and innovation. The increasing demand for precision medicine, coupled with advancements in analytical technologies, will continue to be the primary growth catalysts. Companies focusing on developing integrated workflow solutions, from sample preparation to data analysis, are well-positioned to capture significant market share. Strategic partnerships and collaborations will be crucial for navigating the complex regulatory landscapes and for expanding market reach into diverse applications. The growing emphasis on translational research, bridging the gap between laboratory discoveries and clinical applications, will further drive the adoption of proteomics for diagnostic and therapeutic purposes, solidifying the region's importance in the global proteomics landscape.

Asia-Pacific Proteomics Market Segmentation

-

1. Type

-

1.1. Instrument

- 1.1.1. Spectroscopy

- 1.1.2. Chromatography

- 1.1.3. Electrophoresis

- 1.1.4. Protein Microarrays

- 1.1.5. X-Ray Crystallography

- 1.1.6. Other Instrumentation Technologies

- 1.2. Reagents

- 1.3. Software and Services

-

1.1. Instrument

-

2. Application

- 2.1. Clinical Diagnostics

- 2.2. Drug Discovery

- 2.3. Other Applications

-

3. Geography

-

3.1. Asia-Pacific

- 3.1.1. China

- 3.1.2. Japan

- 3.1.3. India

- 3.1.4. Australia

- 3.1.5. South Korea

- 3.1.6. Rest of Asia-Pacific

-

3.1. Asia-Pacific

Asia-Pacific Proteomics Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. India

- 1.4. Australia

- 1.5. South Korea

- 1.6. Rest of Asia Pacific

Asia-Pacific Proteomics Market Regional Market Share

Geographic Coverage of Asia-Pacific Proteomics Market

Asia-Pacific Proteomics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Personalized Medicine; Increasing R&D Expenditure and Government Funding for Proteomics; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. High Cost of Instruments

- 3.4. Market Trends

- 3.4.1. Drug Discovery Segment is Expected to Register a High Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Proteomics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Instrument

- 5.1.1.1. Spectroscopy

- 5.1.1.2. Chromatography

- 5.1.1.3. Electrophoresis

- 5.1.1.4. Protein Microarrays

- 5.1.1.5. X-Ray Crystallography

- 5.1.1.6. Other Instrumentation Technologies

- 5.1.2. Reagents

- 5.1.3. Software and Services

- 5.1.1. Instrument

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Clinical Diagnostics

- 5.2.2. Drug Discovery

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Asia-Pacific

- 5.3.1.1. China

- 5.3.1.2. Japan

- 5.3.1.3. India

- 5.3.1.4. Australia

- 5.3.1.5. South Korea

- 5.3.1.6. Rest of Asia-Pacific

- 5.3.1. Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 MRM Proteomics Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Promega Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bio-Rad Laboratories Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Merck KGaA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 GE Healthcare

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Waters Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Thermo Fisher Scientific Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Danaher Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Agilent Technologies Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Applied Biomics Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Bruker Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 MRM Proteomics Inc

List of Figures

- Figure 1: Asia-Pacific Proteomics Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Proteomics Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Proteomics Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Proteomics Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Asia-Pacific Proteomics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Asia-Pacific Proteomics Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Asia-Pacific Proteomics Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: Asia-Pacific Proteomics Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 7: Asia-Pacific Proteomics Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Asia-Pacific Proteomics Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Asia-Pacific Proteomics Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Asia-Pacific Proteomics Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 11: Asia-Pacific Proteomics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Asia-Pacific Proteomics Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 13: Asia-Pacific Proteomics Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 14: Asia-Pacific Proteomics Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific Proteomics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Proteomics Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: China Asia-Pacific Proteomics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: China Asia-Pacific Proteomics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Japan Asia-Pacific Proteomics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Japan Asia-Pacific Proteomics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: India Asia-Pacific Proteomics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: India Asia-Pacific Proteomics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Australia Asia-Pacific Proteomics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Australia Asia-Pacific Proteomics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: South Korea Asia-Pacific Proteomics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: South Korea Asia-Pacific Proteomics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Asia-Pacific Proteomics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Asia-Pacific Proteomics Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Proteomics Market?

The projected CAGR is approximately 14.01%.

2. Which companies are prominent players in the Asia-Pacific Proteomics Market?

Key companies in the market include MRM Proteomics Inc , Promega Corporation, Bio-Rad Laboratories Inc, Merck KGaA, GE Healthcare, Waters Corporation, Thermo Fisher Scientific Inc, Danaher Corporation, Agilent Technologies Inc, Applied Biomics Inc, Bruker Corporation.

3. What are the main segments of the Asia-Pacific Proteomics Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Personalized Medicine; Increasing R&D Expenditure and Government Funding for Proteomics; Technological Advancements.

6. What are the notable trends driving market growth?

Drug Discovery Segment is Expected to Register a High Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Instruments.

8. Can you provide examples of recent developments in the market?

In March 2022, Biognosys, a leader in next-generation proteomics solutions for drug discovery and development, launched its expanded suite of protein platforms that provide pharmaceutical and diagnostics customers with deep biological insights across the entire R&D pipeline, from early-stage discovery to clinical settings.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Proteomics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Proteomics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Proteomics Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Proteomics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence