Key Insights

The China General Surgical Devices Market is forecast to experience robust expansion, projected to reach $43.67 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 9.4%. This growth is propelled by rising chronic disease prevalence, an aging demographic, and government investments in healthcare infrastructure. Increased disposable income also supports patient access to advanced surgical procedures. Technological innovations, particularly in minimally invasive techniques and devices like Laparoscopic and Electrosurgical instruments, are enhancing patient outcomes and recovery.

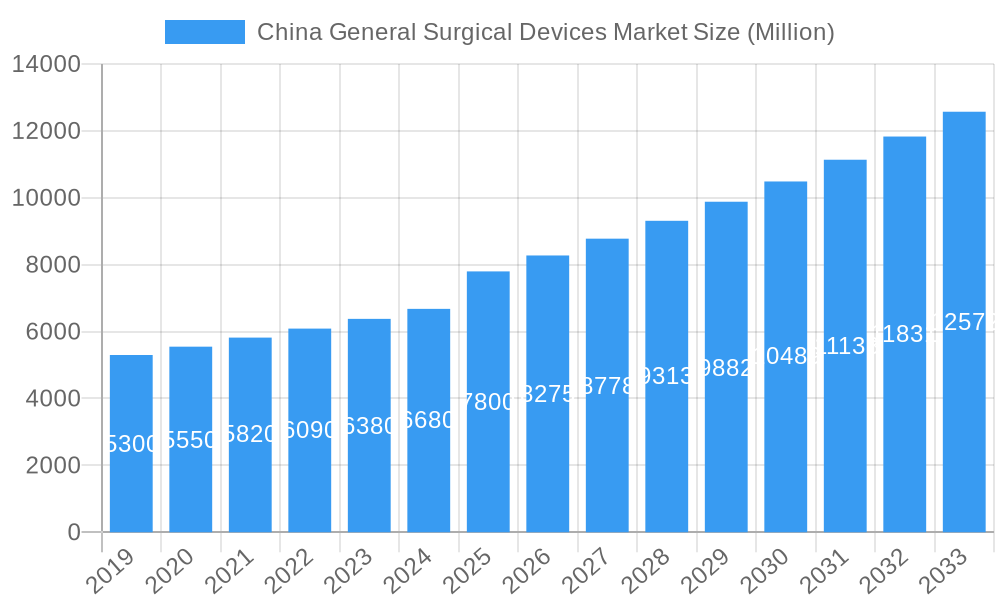

China General Surgical Devices Market Market Size (In Billion)

Key growth segments include Handheld and Laparoscopic Devices, valued for their versatility. Applications in Gynecology, Urology, Cardiology, and Orthopedics are anticipated to drive significant revenue. While high device costs and training requirements present challenges, the market's long-term outlook remains highly favorable, driven by China's evolving healthcare sector.

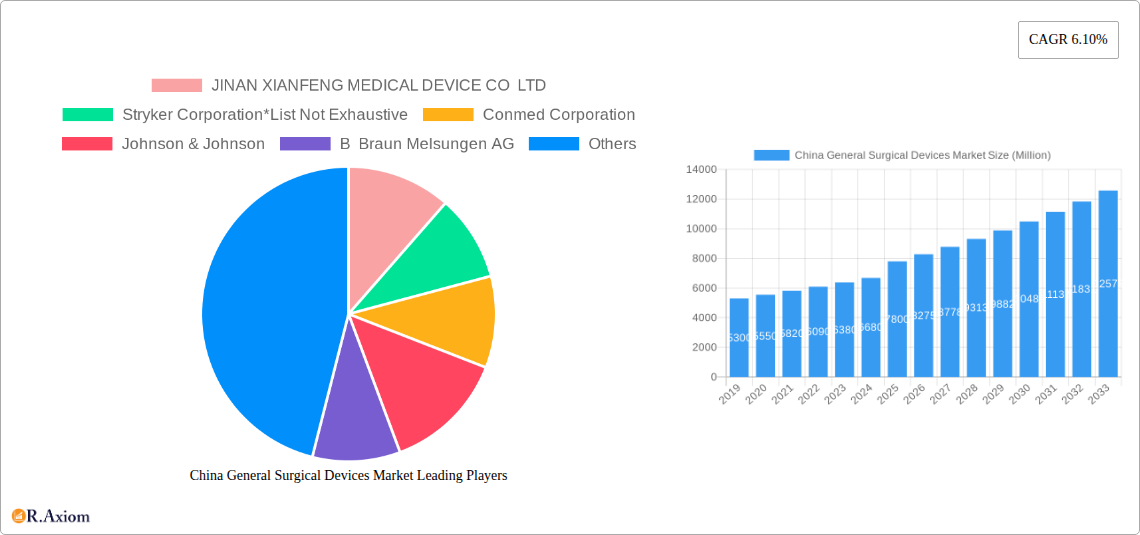

China General Surgical Devices Market Company Market Share

Comprehensive market analysis and forecasts for the China General Surgical Devices Market, including market size, growth rate, and key trends.

China General Surgical Devices Market: In-depth Analysis and Future Outlook (2019-2033)

This comprehensive report provides an in-depth analysis of the China General Surgical Devices Market, covering market concentration, industry trends, dominant segments, product developments, strategic outlook, growth drivers, challenges, emerging opportunities, leading players, and key developments. The study encompasses the historical period (2019-2024), base year (2025), estimated year (2025), and an extensive forecast period (2025-2033). With a projected market size reaching XX Billion USD by 2025, this report is an indispensable resource for industry stakeholders seeking to understand and capitalize on the dynamic Chinese surgical equipment market.

China General Surgical Devices Market Market Concentration & Innovation

The China General Surgical Devices Market is characterized by a moderate to high degree of market concentration, with a few key global and domestic players holding significant market shares. Innovation plays a pivotal role, driven by an increasing demand for minimally invasive surgical procedures, advanced diagnostic capabilities, and improved patient outcomes. Key innovation drivers include advancements in materials science, miniaturization of devices, integration of AI and robotics in surgical tools, and the development of single-use and sterile instruments. Regulatory frameworks, guided by China's National Medical Products Administration (NMPA), are evolving to align with international standards, fostering both innovation and patient safety. Product substitutes, such as traditional open surgery techniques versus minimally invasive approaches, continue to influence device adoption. End-user trends highlight a growing preference for precision, efficiency, and cost-effectiveness in surgical interventions. Mergers and Acquisitions (M&A) activities, while not as pervasive as in some mature markets, are strategic plays by major companies to expand their product portfolios and market reach within China. Recent M&A deals have focused on acquiring innovative technologies and gaining access to burgeoning regional healthcare networks.

China General Surgical Devices Market Industry Trends & Insights

The China General Surgical Devices Market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. This expansion is fueled by several interconnected trends and insights. A primary growth driver is the rapidly aging population in China, leading to an increased incidence of chronic diseases and a subsequent rise in the demand for surgical interventions across various specialties. Furthermore, government initiatives aimed at improving healthcare access and quality, particularly in rural and underserved areas, are significantly boosting market penetration for a wide range of general surgical devices. The increasing disposable income and growing health consciousness among the Chinese populace also contribute to a higher demand for advanced and specialized surgical procedures.

Technological disruptions are reshaping the market landscape. The adoption of laparoscopic devices and electro surgical devices is accelerating due to their advantages in reducing patient trauma, shortening recovery times, and enabling more complex procedures with greater precision. The integration of digital technologies, including AI-powered surgical navigation systems and smart connected devices, is also gaining traction, promising enhanced surgical planning and execution. Handheld devices, essential for a multitude of surgical tasks, are witnessing continuous innovation in ergonomics, material durability, and multi-functionality.

Consumer preferences are evolving towards minimally invasive techniques, driving demand for specialized instruments that facilitate these procedures. Patients are increasingly well-informed and actively seek out hospitals and surgeons employing the latest surgical technologies. This shift influences purchasing decisions, with healthcare providers prioritizing devices that offer superior patient outcomes and operational efficiency.

Competitive dynamics are intense, with both multinational corporations and agile domestic manufacturers vying for market share. Companies like JINAN XIANFENG MEDICAL DEVICE CO LTD, Stryker Corporation, Conmed Corporation, Johnson & Johnson, B Braun Melsungen AG, Boston Scientific Corporation, MEDITECH TECHNOLOGY CO LTD, Olympus Corporation, and Integer Holdings Corporation are actively investing in R&D, expanding their distribution networks, and forming strategic partnerships to navigate the complex Chinese market. The market penetration of advanced surgical devices is steadily increasing, although regional disparities persist, presenting both challenges and opportunities for market expansion. The emphasis on quality, efficacy, and affordability will continue to shape the competitive landscape, with companies that can effectively address these factors poised for significant success.

Dominant Markets & Segments in China General Surgical Devices Market

The China General Surgical Devices Market exhibits dominance across several key regions and segments, driven by a confluence of economic policies, infrastructure development, and evolving healthcare needs.

Dominant Applications:

- Gynecology and Urology: This segment is a significant contributor to market revenue, driven by the high prevalence of urological and gynecological conditions, increasing awareness, and the growing adoption of minimally invasive techniques for procedures such as hysterectomies, prostatectomies, and lithotripsy.

- Key Drivers: Rising rates of reproductive and urinary tract disorders, advancements in robotic-assisted surgery for these applications, and targeted government health programs focusing on women's and men's health.

- Orthopaedic: The aging population and the increasing incidence of sports-related injuries have propelled the orthopaedic segment. Demand for surgical implants, instruments for joint replacements, and trauma fixation devices remains consistently high.

- Key Drivers: Growing prevalence of osteoarthritis and other degenerative joint diseases, increased patient participation in sports and physical activities, and technological advancements in implant materials and surgical navigation for orthopaedic procedures.

- Cardiology: While often considered a specialized area, general surgical devices play a crucial role in cardiovascular procedures, including surgical instruments for bypass surgeries, valve replacements, and implantation of cardiac rhythm management devices.

- Key Drivers: High mortality rates associated with cardiovascular diseases, continuous innovation in cardiac surgical techniques, and increasing government focus on public health initiatives to combat heart disease.

- Neurology: The demand for neurosurgical instruments for treating brain tumors, spinal disorders, and cerebrovascular diseases is steadily growing, fueled by improved diagnostic imaging and a greater understanding of neurological conditions.

- Key Drivers: Advancements in neuroimaging technologies, the development of micro-surgical instruments for delicate brain and spine procedures, and increasing investment in neurological research and treatment centers.

Dominant Product Segments:

- Handheld Devices: This broad category, encompassing scalpels, forceps, retractors, and scissors, remains foundational and consistently high in demand across all surgical specialties.

- Key Drivers: Ubiquitous use in virtually all surgical procedures, continuous innovation in ergonomic design and material science, and the development of specialized handheld tools for niche applications.

- Laproscopic Devices: With the increasing preference for minimally invasive surgery (MIS), laparoscopic instruments, including trocars, graspers, and energy devices, have witnessed exponential growth.

- Key Drivers: Shorter recovery times, reduced scarring, decreased hospital stays, and improved patient outcomes associated with MIS techniques.

- Electro Surgical Devices: These devices, used for cutting, coagulation, and ablation, are integral to many surgical procedures, offering precision and hemostasis.

- Key Drivers: Versatility in tissue manipulation, enhanced safety features in modern devices, and their compatibility with minimally invasive techniques.

- Trocars and Access Devices: Essential for establishing access in laparoscopic and endoscopic surgeries, these devices are critical for the successful implementation of MIS.

- Key Drivers: Direct correlation with the growth of laparoscopic surgery, development of bladeless and advanced trocar designs for reduced tissue trauma.

- Wound Closure Devices: Including sutures, staples, and adhesives, these are indispensable for post-operative recovery and are experiencing innovation in bioabsorbable materials and advanced sealing technologies.

- Key Drivers: Critical role in patient recovery, continuous development of novel materials and application techniques to improve healing and reduce complications.

The dominance of these segments is further reinforced by significant investments in healthcare infrastructure, a growing number of specialized surgical centers, and increasing patient awareness of advanced treatment options across major economic hubs and rapidly developing Tier 2 and Tier 3 cities.

China General Surgical Devices Market Product Developments

Product developments in the China General Surgical Devices Market are characterized by a strong emphasis on enhancing surgical precision, minimizing invasiveness, and improving patient outcomes. Innovations are prevalent in areas such as advanced energy devices for hemostasis and dissection, next-generation laparoscopic instruments with enhanced articulation and visualization, and novel wound closure solutions offering faster healing and reduced scarring. The integration of smart technologies, enabling real-time feedback and data collection during procedures, is also a key trend. Companies are focusing on developing lightweight, ergonomic handheld devices made from advanced materials to reduce surgeon fatigue. Furthermore, the development of single-use, sterile instruments addresses concerns regarding infection control and streamlines surgical workflows. Competitive advantages are being carved out through superior product performance, cost-effectiveness, and adherence to stringent quality and regulatory standards, catering to the evolving needs of Chinese healthcare providers and patients.

Report Scope & Segmentation Analysis

This report offers a granular segmentation of the China General Surgical Devices Market. The market is analyzed by Product into Handheld Devices, Laproscopic Devices, Electro Surgical Devices, Wound Closure Devices, Trocars and Access Devices, and Other Products. Each product segment's growth projections, current market sizes, and competitive dynamics are meticulously detailed. Similarly, the market is segmented by Application into Gynecology and Urology, Cardiology, Orthopaedic, Neurology, and Other Applications. Detailed analysis for each application segment includes its projected growth trajectory, estimated market share, and the key competitive factors influencing its expansion within China. This comprehensive segmentation provides actionable insights into the specific market segments with the highest potential for growth and innovation.

Key Drivers of China General Surgical Devices Market Growth

The China General Surgical Devices Market is propelled by several key drivers. Foremost is the rapidly aging population, leading to a surge in age-related medical conditions requiring surgical intervention. Secondly, increasing government expenditure on healthcare infrastructure and a national push to improve healthcare accessibility and quality, particularly in underserved regions, are significant catalysts. The growing middle class and rising disposable incomes translate into a greater demand for advanced medical treatments and minimally invasive surgical options. Furthermore, technological advancements and innovation in surgical device design, including robotics and AI integration, are driving the adoption of sophisticated equipment. The growing prevalence of chronic diseases such as cardiovascular diseases, cancer, and orthopedic ailments also necessitates a higher volume of surgical procedures. Finally, favorable regulatory reforms aimed at streamlining approval processes for medical devices are encouraging both domestic and international players to invest in the Chinese market.

Challenges in the China General Surgical Devices Market Sector

Despite its robust growth, the China General Surgical Devices Market faces several challenges. Intense price competition among both domestic and international manufacturers can compress profit margins and necessitate aggressive cost-management strategies. Navigating the complex and evolving regulatory landscape, including stringent approval processes and variations in regional implementation, poses a significant hurdle for new entrants and product launches. Supply chain complexities and logistical challenges, particularly in reaching remote areas, can impact market penetration and product availability. Intellectual property rights protection remains a concern, although improving, which can hinder innovation investment. Furthermore, challenges in healthcare reimbursement policies and varying payment capabilities across different healthcare institutions can affect the adoption rate of high-cost advanced devices.

Emerging Opportunities in China General Surgical Devices Market

The China General Surgical Devices Market presents numerous emerging opportunities. The burgeoning demand for minimally invasive surgical (MIS) technologies continues to expand, fueled by patient preference and improved clinical outcomes. The "Healthy China 2030" initiative is driving significant investment in advanced medical technologies and specialized treatment centers, creating demand for innovative surgical solutions. The increasing adoption of robotic-assisted surgery opens avenues for specialized instruments and integrated systems. Furthermore, the development of smart and connected surgical devices, incorporating AI and data analytics for enhanced precision and efficiency, represents a significant growth frontier. Opportunities also exist in catering to emerging specialties and addressing unmet clinical needs in areas such as geriatric care and specialized pediatric surgery. Expansion into lower-tier cities and rural areas with improved healthcare infrastructure also offers substantial untapped market potential.

Leading Players in the China General Surgical Devices Market Market

- JINAN XIANFENG MEDICAL DEVICE CO LTD

- Stryker Corporation

- Conmed Corporation

- Johnson & Johnson

- B Braun Melsungen AG

- Boston Scientific Corporation

- MEDITECH TECHNOLOGY CO LTD

- Olympus Corporation

- Integer Holdings Corporation

Key Developments in China General Surgical Devices Market Industry

- 2023: Launch of new generation laparoscopic instruments with enhanced articulation and visualization capabilities, improving surgical dexterity in complex MIS procedures.

- 2023: Increased investment in R&D for AI-powered surgical navigation systems to enhance precision and reduce surgical errors.

- 2022: Strategic partnerships formed between multinational corporations and Chinese distributors to expand market reach in Tier 2 and Tier 3 cities.

- 2022: Introduction of advanced bioabsorbable wound closure devices offering faster healing and reduced scar formation.

- 2021: Growing adoption of electro-surgical devices with advanced safety features and energy efficiency for a wider range of surgical applications.

- 2021: Government initiatives promoting the localization of medical device manufacturing, encouraging domestic players to innovate and scale up production.

- 2020: Focus on developing and distributing single-use surgical instruments to enhance infection control and streamline hospital workflows.

Strategic Outlook for China General Surgical Devices Market Market

The strategic outlook for the China General Surgical Devices Market is exceptionally promising, driven by a convergence of favorable demographics, supportive government policies, and rapid technological advancements. The sustained demand for minimally invasive procedures, coupled with an increasing emphasis on specialized surgical care, will continue to fuel growth. Key strategies for market participants will involve focusing on product innovation that addresses precision, efficiency, and patient safety. Expanding distribution networks to reach the vast underserved populations in lower-tier cities and rural areas presents a significant opportunity. Furthermore, forming strategic alliances with local healthcare providers and research institutions will be crucial for understanding and adapting to the unique demands of the Chinese market. Embracing digital health technologies and investing in smart surgical solutions will position companies for long-term success in this dynamic and expanding market.

China General Surgical Devices Market Segmentation

-

1. Product

- 1.1. Handheld Devices

- 1.2. Laproscopic Devices

- 1.3. Electro Surgical Devices

- 1.4. Wound Closure Devices

- 1.5. Trocars and Access Devices

- 1.6. Other Products

-

2. Application

- 2.1. Gynecology and Urology

- 2.2. Cardiology

- 2.3. Orthopaedic

- 2.4. Neurology

- 2.5. Other Applications

China General Surgical Devices Market Segmentation By Geography

- 1. China

China General Surgical Devices Market Regional Market Share

Geographic Coverage of China General Surgical Devices Market

China General Surgical Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising Demand for Minimally Invasive Devices; Growing Cases of Injuries and Accidents

- 3.3. Market Restrains

- 3.3.1. ; Improper Reimbursement for Surgical Devices

- 3.4. Market Trends

- 3.4.1. Handheld Device is Expected to Dominate the China General Surgical Devices Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China General Surgical Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Handheld Devices

- 5.1.2. Laproscopic Devices

- 5.1.3. Electro Surgical Devices

- 5.1.4. Wound Closure Devices

- 5.1.5. Trocars and Access Devices

- 5.1.6. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Gynecology and Urology

- 5.2.2. Cardiology

- 5.2.3. Orthopaedic

- 5.2.4. Neurology

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 JINAN XIANFENG MEDICAL DEVICE CO LTD

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Stryker Corporation*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Conmed Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Johnson & Johnson

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 B Braun Melsungen AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Boston Scientific Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 MEDITECH TECHNOLOGY CO LTD

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Olympus Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Integer Holdings Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 JINAN XIANFENG MEDICAL DEVICE CO LTD

List of Figures

- Figure 1: China General Surgical Devices Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China General Surgical Devices Market Share (%) by Company 2025

List of Tables

- Table 1: China General Surgical Devices Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: China General Surgical Devices Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: China General Surgical Devices Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: China General Surgical Devices Market Revenue billion Forecast, by Product 2020 & 2033

- Table 5: China General Surgical Devices Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: China General Surgical Devices Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China General Surgical Devices Market?

The projected CAGR is approximately 9.4%.

2. Which companies are prominent players in the China General Surgical Devices Market?

Key companies in the market include JINAN XIANFENG MEDICAL DEVICE CO LTD, Stryker Corporation*List Not Exhaustive, Conmed Corporation, Johnson & Johnson, B Braun Melsungen AG, Boston Scientific Corporation, MEDITECH TECHNOLOGY CO LTD, Olympus Corporation, Integer Holdings Corporation.

3. What are the main segments of the China General Surgical Devices Market?

The market segments include Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 43.67 billion as of 2022.

5. What are some drivers contributing to market growth?

; Rising Demand for Minimally Invasive Devices; Growing Cases of Injuries and Accidents.

6. What are the notable trends driving market growth?

Handheld Device is Expected to Dominate the China General Surgical Devices Market.

7. Are there any restraints impacting market growth?

; Improper Reimbursement for Surgical Devices.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China General Surgical Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China General Surgical Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China General Surgical Devices Market?

To stay informed about further developments, trends, and reports in the China General Surgical Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence