Key Insights

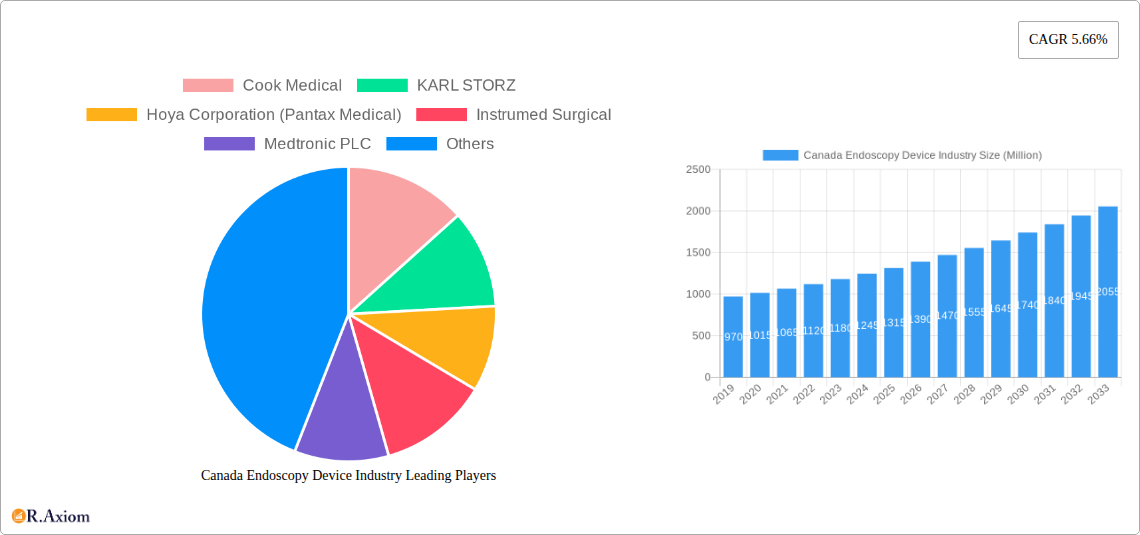

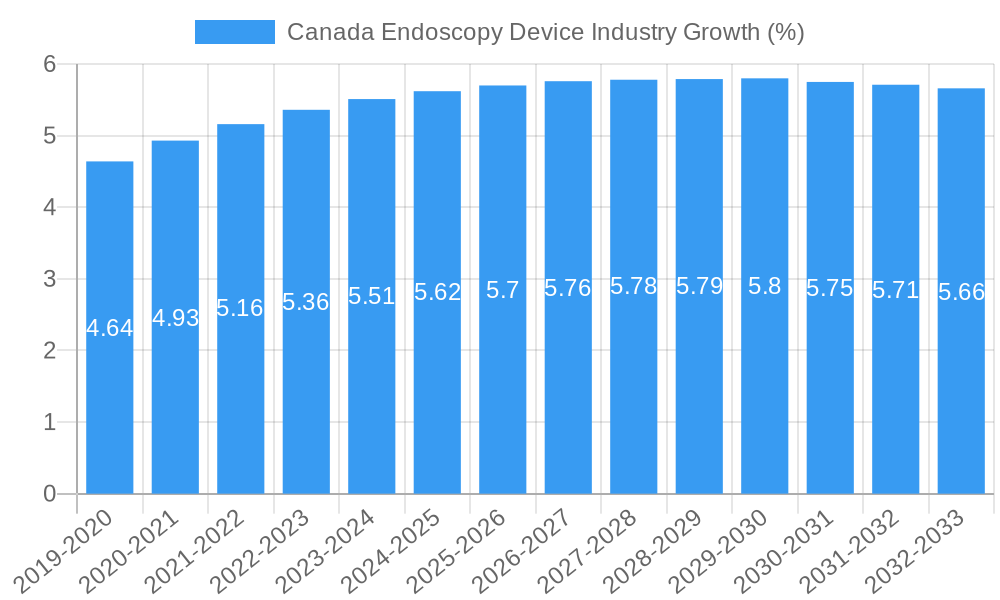

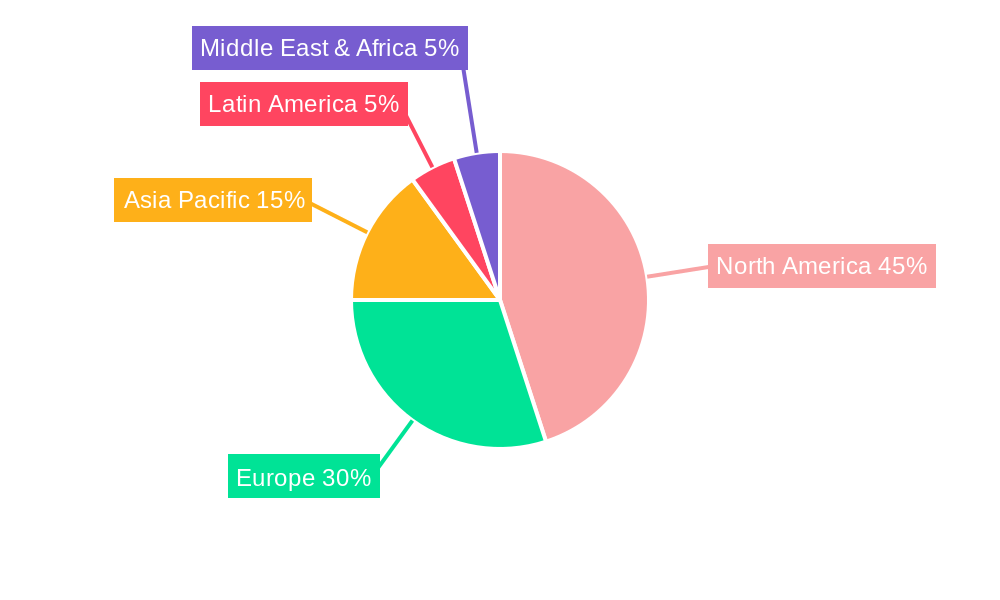

The Canadian endoscopy device market is poised for significant expansion, projected to reach approximately $1.36 billion by 2025. This growth is fueled by a robust Compound Annual Growth Rate (CAGR) of 5.66%, indicating a healthy and sustained upward trajectory through the forecast period ending in 2033. The increasing prevalence of gastrointestinal disorders, coupled with the rising demand for minimally invasive surgical procedures across various medical specialties like cardiology, pulmonology, and urology, are primary growth drivers. Furthermore, advancements in endoscopic technologies, including the development of robot-assisted endoscopes and sophisticated visualization equipment, are enhancing diagnostic accuracy and therapeutic capabilities, thereby stimulating market demand. The market's expansion is further supported by an aging population in Canada, which often correlates with a higher incidence of conditions requiring endoscopic interventions.

Key segments within the Canadian endoscopy device market are demonstrating substantial potential. The endoscope segment, encompassing rigid, flexible, and capsule endoscopes, is expected to witness considerable adoption due to their diverse applications in diagnostics and treatment. Robot-assisted endoscopes, though currently representing a nascent but rapidly evolving category, are anticipated to gain significant traction as their benefits in precision and patient recovery become more widely recognized. Endoscopic operative devices and visualization equipment are also integral to this market, with continuous innovation driving demand for enhanced functionality and user experience. Major industry players like Medtronic PLC, Boston Scientific Corporation, and Olympus Corporation are actively investing in research and development, launching new products, and expanding their market presence in Canada, further solidifying the market's growth prospects and competitive landscape.

Canada Endoscopy Device Industry Market: In-depth Analysis and Forecast (2019-2033)

This comprehensive report provides a detailed analysis of the Canada Endoscopy Device Industry. It delves into market dynamics, key trends, competitive landscape, and future projections, offering actionable insights for stakeholders. The study covers the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033.

Canada Endoscopy Device Industry Market Concentration & Innovation

The Canada Endoscopy Device Industry exhibits a moderate to high market concentration, with a few major global players dominating significant market share. Leading companies such as Medtronic PLC, Johnson and Johnson, Stryker Corporation, Boston Scientific Corporation, and Olympus Corporation hold substantial sway, driven by their extensive product portfolios, established distribution networks, and robust R&D investments. Innovation is a critical differentiator, fueled by advancements in miniaturization, imaging technology, and artificial intelligence integration. Regulatory frameworks, governed by Health Canada, play a crucial role in market access and product approval, ensuring patient safety and efficacy. The threat of product substitutes, while present in some therapeutic areas, is mitigated by the specialized nature and high performance of advanced endoscopic solutions. End-user trends are increasingly leaning towards minimally invasive procedures, demanding higher precision and better visualization. Merger and acquisition (M&A) activities are strategic, aimed at acquiring innovative technologies or expanding market reach. For instance, a significant M&A deal in the broader medical device sector could be valued in the hundreds of millions to billions of dollars, reflecting the strategic importance of consolidating capabilities and intellectual property. The market share of leading players can range from 10% to 25% each, depending on specific sub-segments.

Canada Endoscopy Device Industry Industry Trends & Insights

The Canada Endoscopy Device Industry is poised for significant growth, projected to expand at a robust Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period. This expansion is underpinned by a confluence of factors, including an aging Canadian population, a rising prevalence of chronic diseases requiring diagnostic and therapeutic endoscopic interventions, and increasing healthcare expenditure. Technological disruptions are a primary growth driver, with the rapid adoption of robot-assisted endoscopy and AI-powered diagnostic tools revolutionizing surgical precision and patient outcomes. The integration of high-definition imaging, advanced visualization techniques, and single-use disposable endoscopes is enhancing patient safety and infection control. Consumer preferences are increasingly aligning with minimally invasive procedures, driven by reduced recovery times, lower pain levels, and improved aesthetics. This trend directly fuels the demand for sophisticated endoscopic devices. Competitive dynamics are characterized by intense innovation, strategic partnerships, and a focus on differentiated product offerings. Market penetration of advanced endoscopy is steadily increasing across various medical specialties, driven by physician adoption and growing awareness of the benefits. The market size is estimated to reach over $2,500 Million by 2025, with significant growth anticipated in the subsequent years.

Dominant Markets & Segments in Canada Endoscopy Device Industry

The Gastroenterology segment emerges as the dominant application within the Canada Endoscopy Device Industry, owing to the high prevalence of gastrointestinal disorders such as inflammatory bowel disease, peptic ulcers, and colorectal cancer, necessitating frequent endoscopic examinations and interventions. Flexible Endoscopes, particularly gastroscopes and colonoscopes, represent the leading type of device due to their non-invasive nature and suitability for examining the intricate pathways of the gastrointestinal tract.

- Gastroenterology Dominance: This application benefits from a well-established diagnostic and therapeutic pathway, supported by favorable reimbursement policies and a high volume of procedures performed annually. The increasing incidence of gastrointestinal cancers and the emphasis on early detection contribute significantly to its leading position.

- Flexible Endoscopes: The versatility and patient comfort offered by flexible endoscopes make them the preferred choice for upper and lower gastrointestinal procedures. Technological advancements in imaging clarity and maneuverability further solidify their market dominance.

- Visualization Equipment: High-definition and 3D visualization systems are crucial enablers across all endoscopic applications, enhancing surgical precision and diagnostic accuracy. Their widespread adoption contributes to market growth.

- Pulmonology: The rising incidence of lung cancer and respiratory diseases is driving demand for flexible bronchoscopes, making this segment a significant contributor to the industry's growth.

- Orthopedic Surgery: Arthroscopy, a key application of rigid endoscopes in orthopedic surgery, is experiencing robust growth due to the increasing popularity of minimally invasive joint repair procedures.

- Urology: Endoscopic procedures for conditions like kidney stones and benign prostatic hyperplasia, utilizing specialized ureteroscopes and cystoscopes, represent a substantial market segment.

- Cardiology: While a smaller segment, cardiac catheterization and related interventional procedures utilizing specialized endoscopic tools contribute to the overall market.

- ENT Surgery: Nasopharyngoscopes and laryngoscopes are essential for diagnosing and treating various ear, nose, and throat conditions.

- Gynecology: Hysteroscopes and laparoscopes are vital for minimally invasive gynecological procedures.

- Neurology: Endoscopic applications in neurosurgery, though highly specialized, are gaining traction for minimally invasive brain and spine surgeries.

Canada Endoscopy Device Industry Product Developments

Recent product developments in the Canada Endoscopy Device Industry highlight a strong focus on enhanced visualization, improved patient safety, and expanded procedural capabilities. Innovations in capsule endoscopy are offering less invasive diagnostic solutions for the gastrointestinal tract. Furthermore, advancements in robot-assisted endoscopy are enabling greater precision and control for surgeons in complex procedures. The integration of artificial intelligence for image analysis and diagnostic assistance is a significant emerging trend, promising to revolutionize early detection and treatment planning. These developments aim to provide clinicians with superior tools, leading to better patient outcomes and more efficient healthcare delivery.

Report Scope & Segmentation Analysis

This report segments the Canada Endoscopy Device Industry by Type of Device and Application.

- Type of Device: This segmentation includes Endoscopes (further categorized into Rigid Endoscope, Flexible Endoscope, Capsule Endoscope, and Robot-assisted Endoscope), Endoscopic Operative Devices, and Visualization Equipment. The market size for Endoscopes is projected to reach over $1,500 Million by 2025, driven by flexible and robot-assisted variants. Endoscopic Operative Devices are estimated at over $500 Million, while Visualization Equipment is expected to be around $400 Million, both showing steady growth.

- Application: Key application segments include Gastroenterology, Pulmonology, Orthopedic Surgery, Cardiology, ENT Surgery, Gynecology, Neurology, and Urology. Gastroenterology is the largest application segment, valued at over $1,000 Million in 2025, with strong projected growth. Pulmonology and Orthopedic Surgery are also significant contributors, with market sizes estimated at over $300 Million each.

Key Drivers of Canada Endoscopy Device Industry Growth

The Canada Endoscopy Device Industry is propelled by several key drivers. Technological advancements, particularly in imaging resolution, miniaturization, and robotics, are paramount. The increasing prevalence of chronic diseases and an aging population are driving higher demand for diagnostic and therapeutic endoscopic procedures. Government initiatives and healthcare reforms aimed at promoting minimally invasive surgery and improving access to advanced medical technologies also play a crucial role. Furthermore, growing physician adoption and patient preference for less invasive treatment options are significant growth catalysts.

Challenges in the Canada Endoscopy Device Industry Sector

Despite its growth trajectory, the Canada Endoscopy Device Industry faces several challenges. High upfront costs associated with advanced endoscopic equipment can be a barrier for smaller healthcare facilities. Stringent regulatory approval processes by Health Canada can lead to extended product launch timelines. Reimbursement policies that do not adequately reflect the value of innovative technologies can also hinder adoption. Moreover, supply chain disruptions, as observed in recent global events, can impact product availability and cost. Fierce competition among established players and emerging innovators also presents a challenge.

Emerging Opportunities in Canada Endoscopy Device Industry

Emerging opportunities in the Canada Endoscopy Device Industry are abundant. The expanding application of AI and machine learning in endoscopy for enhanced diagnostics and personalized treatment plans presents a significant growth avenue. The increasing adoption of single-use endoscopes offers solutions for infection control and cost management. Furthermore, advancements in nanotechnology and bio-compatible materials are paving the way for novel endoscopic interventions. The growing demand for home-based diagnostics and remote patient monitoring also opens up new possibilities for specialized endoscopic devices.

Leading Players in the Canada Endoscopy Device Industry Market

The Canada Endoscopy Device Industry is characterized by the presence of several prominent global players, including:

- Cook Medical

- KARL STORZ

- Hoya Corporation (Pantax Medical)

- Instrumed Surgical

- Medtronic PLC

- Johnson and Johnson

- Stryker Corporation

- Fujifilm Holdings

- Boston Scientific Corporation

- Olympus Corporation

Key Developments in Canada Endoscopy Device Industry Industry

- November 2022: PENTAX Medical launched the new Performance Endoscopic Ultrasound (EUS) system, a combination of the new ARIETTA 65 PX ultrasound scanner and their best-in-class J10 Series Ultrasound Gastroscopes in Canada, enhancing diagnostic capabilities in gastroenterology.

- December 2021: Medtronic Canada ULC, a subsidiary of Medtronic plc, received a Health Canada license for the Hugo robotic-assisted surgery (RAS) system for use in urologic and gynecologic laparoscopic surgical procedures, which make up about half of all robotic procedures performed in Canada, signifying a major step forward for robotic surgery in the country.

Strategic Outlook for Canada Endoscopy Device Industry Market

The strategic outlook for the Canada Endoscopy Device Industry remains highly positive, driven by continuous innovation and increasing demand for advanced healthcare solutions. Investment in R&D focused on artificial intelligence, robotics, and minimally invasive technologies will be crucial for market leadership. Strategic partnerships and potential M&A activities will likely shape the competitive landscape. Healthcare providers are expected to increasingly adopt these advanced endoscopic solutions to improve patient outcomes, reduce hospital stays, and enhance procedural efficiency, ensuring sustained market growth and expansion. The market is anticipated to reach over $4,000 Million by 2033.

Canada Endoscopy Device Industry Segmentation

-

1. Type of Device

-

1.1. Endoscopes

- 1.1.1. Rigid Endoscope

- 1.1.2. Flexible Endoscope

- 1.1.3. Capsule Endoscope

- 1.1.4. Robot-assisted Endoscope

- 1.2. Endoscopic Operative Device

- 1.3. Visualization Equipment

-

1.1. Endoscopes

-

2. Application

- 2.1. Gastroenterology

- 2.2. Pulmonology

- 2.3. Orthopedic Surgery

- 2.4. Cardiology

- 2.5. ENT Surgery

- 2.6. Gynecology

- 2.7. Neurology

- 2.8. Urology

Canada Endoscopy Device Industry Segmentation By Geography

- 1. Canada

Canada Endoscopy Device Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.66% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Preference for Minimally Invasive Surgeries; Technological Advancements Leading to Enhanced Applications

- 3.3. Market Restrains

- 3.3.1. Infections Caused by Few Endoscopes

- 3.4. Market Trends

- 3.4.1. Gastroenterology is Expected to Hold a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Endoscopy Device Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 5.1.1. Endoscopes

- 5.1.1.1. Rigid Endoscope

- 5.1.1.2. Flexible Endoscope

- 5.1.1.3. Capsule Endoscope

- 5.1.1.4. Robot-assisted Endoscope

- 5.1.2. Endoscopic Operative Device

- 5.1.3. Visualization Equipment

- 5.1.1. Endoscopes

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Gastroenterology

- 5.2.2. Pulmonology

- 5.2.3. Orthopedic Surgery

- 5.2.4. Cardiology

- 5.2.5. ENT Surgery

- 5.2.6. Gynecology

- 5.2.7. Neurology

- 5.2.8. Urology

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 6. Eastern Canada Canada Endoscopy Device Industry Analysis, Insights and Forecast, 2019-2031

- 7. Western Canada Canada Endoscopy Device Industry Analysis, Insights and Forecast, 2019-2031

- 8. Central Canada Canada Endoscopy Device Industry Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Cook Medical

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 KARL STORZ

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Hoya Corporation (Pantax Medical)

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Instrumed Surgical

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Medtronic PLC

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Johnson and Johnson

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Stryker Corporation*List Not Exhaustive

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Fujifilm Holdings

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Boston Scientific Corporation

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Olympus Corporation

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Cook Medical

List of Figures

- Figure 1: Canada Endoscopy Device Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Endoscopy Device Industry Share (%) by Company 2024

List of Tables

- Table 1: Canada Endoscopy Device Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Endoscopy Device Industry Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 3: Canada Endoscopy Device Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Canada Endoscopy Device Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Canada Endoscopy Device Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Eastern Canada Canada Endoscopy Device Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Western Canada Canada Endoscopy Device Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Central Canada Canada Endoscopy Device Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Endoscopy Device Industry Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 10: Canada Endoscopy Device Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 11: Canada Endoscopy Device Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Endoscopy Device Industry?

The projected CAGR is approximately 5.66%.

2. Which companies are prominent players in the Canada Endoscopy Device Industry?

Key companies in the market include Cook Medical, KARL STORZ, Hoya Corporation (Pantax Medical), Instrumed Surgical, Medtronic PLC, Johnson and Johnson, Stryker Corporation*List Not Exhaustive, Fujifilm Holdings, Boston Scientific Corporation, Olympus Corporation.

3. What are the main segments of the Canada Endoscopy Device Industry?

The market segments include Type of Device, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.36 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Preference for Minimally Invasive Surgeries; Technological Advancements Leading to Enhanced Applications.

6. What are the notable trends driving market growth?

Gastroenterology is Expected to Hold a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Infections Caused by Few Endoscopes.

8. Can you provide examples of recent developments in the market?

November 2022: PENTAX Medical launched the new Performance Endoscopic Ultrasound (EUS) system, a combination of the new ARIETTA 65 PX ultrasound scanner and their best-in-class J10 Series Ultrasound Gastroscopes in Canada.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Endoscopy Device Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Endoscopy Device Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Endoscopy Device Industry?

To stay informed about further developments, trends, and reports in the Canada Endoscopy Device Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence