Key Insights

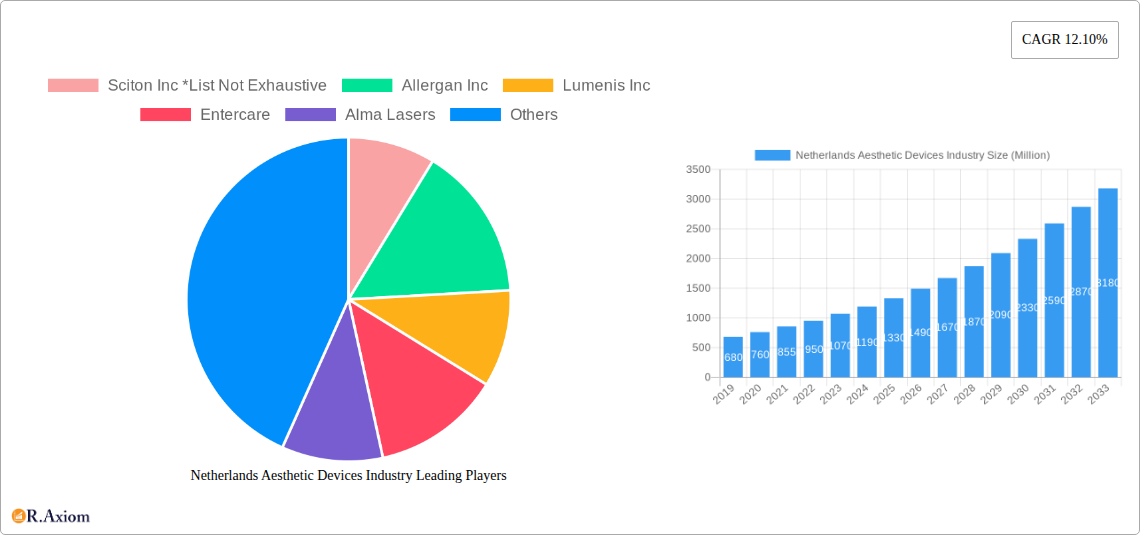

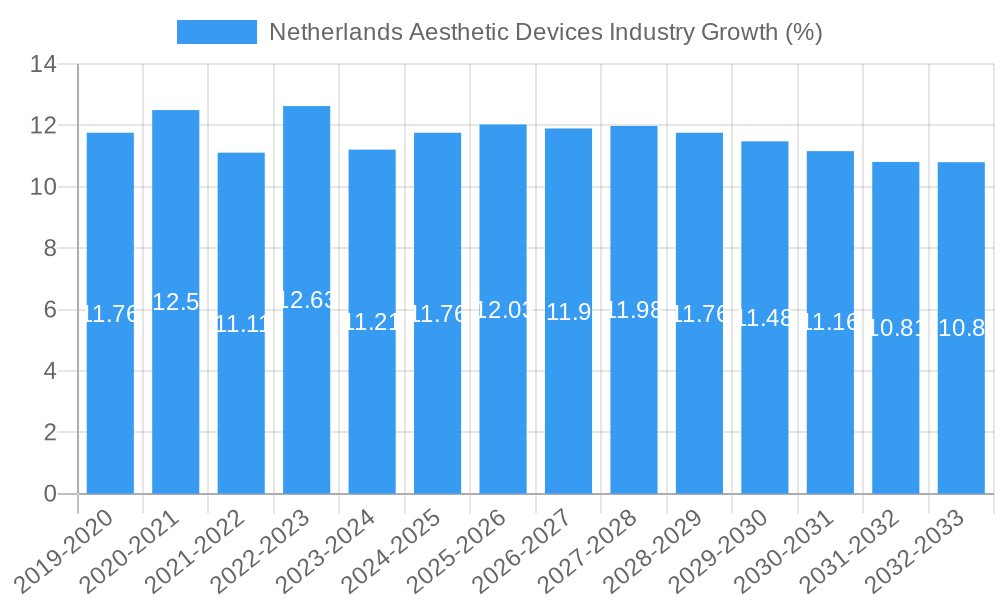

The Netherlands aesthetic devices market is poised for significant expansion, projected to reach approximately $1,200 million by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 12.10%. This growth trajectory is primarily fueled by an increasing consumer demand for minimally invasive and non-surgical cosmetic procedures, alongside a heightened awareness of aesthetic enhancements. Key market drivers include the rising disposable incomes, a growing aging population seeking rejuvenation treatments, and the continuous innovation in energy-based devices such as laser, RF, and ultrasound technologies. Furthermore, the burgeoning popularity of non-energy-based devices like dermal fillers and botulinum toxin injections contributes substantially to market value. The Dutch market benefits from a well-established healthcare infrastructure and a receptive consumer base for advanced beauty and wellness solutions.

The market segmentation reveals a dynamic landscape with strong performance expected across various applications and end-users. Skin resurfacing and tightening, along with body contouring and cellulite reduction, are anticipated to be leading application segments, reflecting the ongoing pursuit of flawless skin and sculpted physiques. Hair removal and tattoo removal also represent significant growth areas. While hospitals and clinics are established demand centers, the emergence of home-use aesthetic devices presents a burgeoning opportunity, catering to convenience-seeking consumers. Companies like Sciton Inc., Allergan Inc., Lumenis Inc., and Alma Lasers are actively shaping this market through product development and strategic partnerships, indicating a competitive yet opportunistic environment. The forecast period (2025-2033) anticipates sustained momentum, solidifying the Netherlands as a key player in the European aesthetic devices industry.

Netherlands Aesthetic Devices Industry Market Concentration & Innovation

The Netherlands aesthetic devices market exhibits a moderate level of concentration, with a few key players like Sciton Inc., Allergan Inc., Lumenis Inc., Entercare, Alma Lasers, Johnson & Johnson, and Galderma SA (Nestle) holding significant market share. Innovation is a primary driver, fueled by advancements in energy-based devices such as laser, radiofrequency (RF), light, and ultrasound technologies, alongside the continuous development of non-energy-based solutions like botulinum toxin, dermal fillers, and implants. The regulatory framework, while ensuring safety and efficacy, can also present hurdles for new entrants. Product substitutes, including advanced skincare and minimally invasive cosmetic procedures, pose a competitive challenge. End-user trends indicate a growing preference for non-invasive and minimally invasive treatments, driving demand for sophisticated aesthetic devices in clinics and hospitals. Mergers and acquisitions (M&A) are a notable strategy for market expansion and technological integration. For instance, M&A deals in the broader European aesthetic market have been in the range of tens to hundreds of million euros, indicating strategic consolidation. The market share of leading companies in the Netherlands is estimated to be around 15-25% for the top three players. The value of M&A deals within the niche Netherlands aesthetic device sector is projected to reach approximately €50 million annually in the coming years.

Netherlands Aesthetic Devices Industry Industry Trends & Insights

The Netherlands aesthetic devices industry is experiencing robust growth, driven by an increasing consumer demand for cosmetic procedures, a growing awareness of aesthetic treatments, and technological advancements. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 8.5% over the forecast period of 2025–2033. Market penetration is steadily increasing, particularly in urban centers, as more individuals seek to enhance their appearance and address signs of aging.

Technological disruptions are playing a pivotal role. The advent of sophisticated energy-based devices, including advanced laser systems for skin resurfacing and tightening, and RF-based devices for body contouring and cellulite reduction, has revolutionized the industry. Innovations in ultrasound aesthetic devices are also gaining traction for non-invasive facial lifting and body sculpting. Concurrently, advancements in non-energy-based devices, such as new formulations of dermal fillers with longer-lasting effects and improved safety profiles, are expanding treatment options. Botulinum toxin remains a cornerstone for addressing dynamic wrinkles.

Consumer preferences are shifting towards non-invasive and minimally invasive procedures, driven by factors such as reduced downtime, lower risk, and comparable aesthetic outcomes to traditional surgical methods. This trend directly fuels the demand for innovative aesthetic devices that offer these benefits. The aging population in the Netherlands also contributes significantly to market growth, as older demographics increasingly opt for aesthetic treatments to maintain a youthful appearance.

Competitive dynamics are characterized by intense innovation and strategic partnerships. Key players are investing heavily in research and development to introduce next-generation devices and expand their product portfolios. The market penetration of advanced aesthetic devices is estimated to reach 30% of the target demographic by 2030. The market size for aesthetic devices in the Netherlands was approximately €800 million in 2023, with projections to reach over €1.5 billion by 2028.

Dominant Markets & Segments in Netherlands Aesthetic Devices Industry

Within the Netherlands aesthetic devices industry, Clinics emerge as the dominant end-user segment, accounting for an estimated 60% of the market share. This dominance is driven by several factors:

- Economic Policies: Favorable economic policies that encourage private healthcare investment and disposable income for elective procedures support the growth of private clinics.

- Infrastructure: Well-established healthcare infrastructure, with a high density of specialized aesthetic clinics equipped with advanced technologies, caters to a wide range of patient needs.

Among the Type of Device, Energy-based Aesthetic Devices represent the largest segment, holding approximately 55% of the market value. Within this category:

- Laser-based Aesthetic Devices: These are particularly dominant, driven by their versatility in applications like skin resurfacing, tightening, hair removal, and tattoo removal. The demand for advanced laser technologies with improved efficacy and reduced side effects is substantial.

- Radiofrequency- (RF) based Aesthetic Devices: This sub-segment is rapidly growing due to its effectiveness in skin tightening, body contouring, and cellulite reduction, offering non-invasive alternatives to surgical procedures.

Regarding Application, Skin Resurfacing and Tightening is the leading application area, comprising an estimated 35% of the market. This is closely followed by Body Contouring and Cellulite Reduction, which accounts for around 30% of the market.

- Key Drivers for Skin Resurfacing and Tightening:

- Increasing prevalence of skin aging concerns among the population.

- Growing demand for non-surgical rejuvenation procedures.

- Advancements in fractional laser and RF technologies.

- Key Drivers for Body Contouring and Cellulite Reduction:

- Rising rates of obesity and a focus on body aesthetics.

- Popularity of non-invasive fat reduction and skin-tightening technologies.

- Influence of social media and celebrity endorsements.

The Base Year market size for Clinics as End Users is estimated at €480 Million, with a projected growth to €900 Million by 2028. The Energy-based Aesthetic Devices segment's market size in the Base Year is approximately €440 Million, projected to reach €825 Million by 2028. For the leading application, Skin Resurfacing and Tightening, the Base Year market size is estimated at €280 Million, with a forecast of €525 Million by 2028.

Netherlands Aesthetic Devices Industry Product Developments

Product developments in the Netherlands aesthetic devices industry are characterized by a strong focus on enhancing efficacy, patient comfort, and safety. Innovations in energy-based devices include multi-platform systems offering diverse treatment modalities and AI-powered calibration for personalized treatments. For non-energy-based devices, advancements are seen in longer-lasting dermal fillers with improved biocompatibility and novel formulations of botulinum toxin for precise muscle relaxation. These developments aim to achieve superior clinical outcomes, reduce treatment times, and cater to the growing demand for minimally invasive aesthetic solutions, thereby gaining a competitive edge in the dynamic Dutch market. The estimated investment in R&D for new product development is in the range of €15-20 million annually.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Netherlands aesthetic devices industry across key segmentations. The Type of Device is segmented into Energy-based Aesthetic Devices (Laser-based, Radiofrequency- (RF) based, Light-based, Ultrasound Aesthetic Devices) and Non-energy-based Aesthetic Devices (Botulinum Toxin, Dermal Fillers and Aesthetic Threads, Chemical Peels, Microdermabrasion, Implants – Facial, Breast, Other, Other Aesthetic Devices). The Application segment covers Skin Resurfacing and Tightening, Body Contouring and Cellulite Reduction, Hair Removal, Tattoo Removal, Breast Augmentation, and Other Applications. The End User segment includes Hospitals, Clinics, and Home Settings. The report forecasts market sizes and growth rates for each segment, projecting significant growth in energy-based devices for skin resurfacing and tightening, driven by clinics as the primary end-users. The estimated market size for the total Netherlands aesthetic devices industry in the base year 2025 is €850 Million, with a projected CAGR of 8.5% over the forecast period, reaching an estimated €1.6 Billion by 2033.

Key Drivers of Netherlands Aesthetic Devices Industry Growth

The Netherlands aesthetic devices industry is propelled by several key drivers. An increasingly affluent population with higher disposable incomes fuels demand for elective cosmetic procedures. Growing awareness and acceptance of aesthetic treatments, amplified by social media and celebrity trends, contribute significantly. Technological advancements in both energy-based and non-energy-based devices offer more effective, safer, and less invasive solutions. The aging demographic also seeks to address signs of aging, further boosting the market. Furthermore, the presence of advanced healthcare infrastructure and a well-established network of specialized aesthetic clinics provides the necessary platform for market expansion. The estimated annual growth contribution from these drivers is around 7-9%.

Challenges in the Netherlands Aesthetic Devices Industry Sector

Despite robust growth, the Netherlands aesthetic devices industry faces several challenges. Stringent regulatory frameworks, while ensuring patient safety, can increase the time and cost associated with product approvals and market entry. The high cost of advanced aesthetic devices can be a barrier for smaller clinics and individual practitioners, impacting market penetration. Intense competition from both established players and emerging companies necessitates continuous innovation and competitive pricing. Furthermore, potential negative publicity surrounding certain procedures, as exemplified by the Allergan breast implant case, can create apprehension among consumers and lead to market restraints. The estimated market impact of regulatory hurdles can be a delay of 6-12 months for new product launches.

Emerging Opportunities in Netherlands Aesthetic Devices Industry

Emerging opportunities in the Netherlands aesthetic devices industry lie in the burgeoning demand for personalized and combination treatments. The development of AI-powered devices that offer tailored treatment plans based on individual patient data presents a significant opportunity. There is also a growing interest in non-invasive and minimally invasive technologies for preventative aesthetic care, catering to a younger demographic. The expansion of home-use aesthetic devices, offering convenience and affordability, represents another promising avenue. Furthermore, the integration of digital health platforms for patient monitoring and treatment follow-up can enhance customer engagement and loyalty. The market for AI-driven aesthetic devices is expected to grow by 25% annually.

Leading Players in the Netherlands Aesthetic Devices Industry Market

- Sciton Inc.

- Allergan Inc.

- Lumenis Inc.

- Entercare

- Alma Lasers

- Johnson & Johnson

- Galderma SA (Nestle)

Key Developments in Netherlands Aesthetic Devices Industry Industry

- January 2022: BTL Industries launched disruptive technologies and high-intensity focused electromagnetic (HIFEM) muscle-building therapies, Emsculpt NEO and Emsella, that help in revolutionizing non-invasive body sculpting. This development significantly impacted the body contouring segment, offering advanced non-invasive solutions.

- July 2021: Bureau Clara Wichmann took legal action against Allergan to pay for the removal of its breast implant from Dutch women with cancer risk, as 52 women in the Netherlands developed a form of lymphoma from implants. This event is expected to restrain the market growth for breast implants and necessitate stricter scrutiny of implant safety, impacting manufacturers in this specific sub-segment.

Strategic Outlook for Netherlands Aesthetic Devices Industry Market

The strategic outlook for the Netherlands aesthetic devices industry is optimistic, driven by sustained consumer interest in cosmetic enhancement and continuous technological innovation. Key growth catalysts include the increasing adoption of minimally invasive and non-invasive procedures, the development of advanced energy-based and device-based technologies, and a growing focus on personalized treatment approaches. The market will likely see further consolidation through M&A activities as companies seek to expand their portfolios and market reach. The industry should focus on addressing regulatory challenges proactively, emphasizing patient safety and clinical evidence to build consumer trust, particularly in light of past incidents. The predicted market growth is estimated at €1.8 Billion by 2030.

Netherlands Aesthetic Devices Industry Segmentation

-

1. Type of Device

-

1.1. Energy-based Aesthetic Devices

- 1.1.1. Laser-based Aesthetic Devices

- 1.1.2. Radiofrequency- (RF) based Aesthetic Devices

- 1.1.3. Light-based Aesthetic Devices

- 1.1.4. Ultrasound Aesthetic Devices

-

1.2. Non-energy-based Aesthetic Devices

- 1.2.1. Botulinum Toxin

- 1.2.2. Dermal Fillers and Aesthetic Threads

- 1.2.3. Chemical Peels

- 1.2.4. Microdermabrasion

-

1.2.5. Implants

- 1.2.5.1. Facial Implants

- 1.2.5.2. Breast Implants

- 1.2.5.3. Other Impalnts

- 1.2.6. Other Aesthetic Devices

-

1.1. Energy-based Aesthetic Devices

-

2. Application

- 2.1. Skin Resurfacing and Tightening

- 2.2. Body Contouring and Cellulite Reduction

- 2.3. Hair Removal

- 2.4. Tattoo Removal

- 2.5. Breast Augmentation

- 2.6. Other Applications

-

3. End User

- 3.1. Hospitals

- 3.2. Clinics

- 3.3. Home Settings

Netherlands Aesthetic Devices Industry Segmentation By Geography

- 1. Netherlands

Netherlands Aesthetic Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Number of Cosmetic Surgeries; Rising Adoption of Minimally Invasive Devices

- 3.3. Market Restrains

- 3.3.1. Poor Reimbursement Scenario

- 3.4. Market Trends

- 3.4.1. Breast Implants Segment Expects to Register a Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Netherlands Aesthetic Devices Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 5.1.1. Energy-based Aesthetic Devices

- 5.1.1.1. Laser-based Aesthetic Devices

- 5.1.1.2. Radiofrequency- (RF) based Aesthetic Devices

- 5.1.1.3. Light-based Aesthetic Devices

- 5.1.1.4. Ultrasound Aesthetic Devices

- 5.1.2. Non-energy-based Aesthetic Devices

- 5.1.2.1. Botulinum Toxin

- 5.1.2.2. Dermal Fillers and Aesthetic Threads

- 5.1.2.3. Chemical Peels

- 5.1.2.4. Microdermabrasion

- 5.1.2.5. Implants

- 5.1.2.5.1. Facial Implants

- 5.1.2.5.2. Breast Implants

- 5.1.2.5.3. Other Impalnts

- 5.1.2.6. Other Aesthetic Devices

- 5.1.1. Energy-based Aesthetic Devices

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Skin Resurfacing and Tightening

- 5.2.2. Body Contouring and Cellulite Reduction

- 5.2.3. Hair Removal

- 5.2.4. Tattoo Removal

- 5.2.5. Breast Augmentation

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals

- 5.3.2. Clinics

- 5.3.3. Home Settings

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Netherlands

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Sciton Inc *List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Allergan Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lumenis Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Entercare

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Alma Lasers

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Johnson & Johnson

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Galderma SA (Nestle)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Sciton Inc *List Not Exhaustive

List of Figures

- Figure 1: Netherlands Aesthetic Devices Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Netherlands Aesthetic Devices Industry Share (%) by Company 2024

List of Tables

- Table 1: Netherlands Aesthetic Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Netherlands Aesthetic Devices Industry Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 3: Netherlands Aesthetic Devices Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Netherlands Aesthetic Devices Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Netherlands Aesthetic Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Netherlands Aesthetic Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Netherlands Aesthetic Devices Industry Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 8: Netherlands Aesthetic Devices Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 9: Netherlands Aesthetic Devices Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 10: Netherlands Aesthetic Devices Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Netherlands Aesthetic Devices Industry?

The projected CAGR is approximately 12.10%.

2. Which companies are prominent players in the Netherlands Aesthetic Devices Industry?

Key companies in the market include Sciton Inc *List Not Exhaustive, Allergan Inc, Lumenis Inc, Entercare, Alma Lasers, Johnson & Johnson, Galderma SA (Nestle).

3. What are the main segments of the Netherlands Aesthetic Devices Industry?

The market segments include Type of Device, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Number of Cosmetic Surgeries; Rising Adoption of Minimally Invasive Devices.

6. What are the notable trends driving market growth?

Breast Implants Segment Expects to Register a Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Poor Reimbursement Scenario.

8. Can you provide examples of recent developments in the market?

January 2022: BTL Industries launched disruptive technologies and high-intensity focused electromagnetic (HIFEM) muscle-building therapies, Emsculpt NEO and Emsella, that help in revolutionizing non-invasive body sculpting.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Netherlands Aesthetic Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Netherlands Aesthetic Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Netherlands Aesthetic Devices Industry?

To stay informed about further developments, trends, and reports in the Netherlands Aesthetic Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence