Key Insights

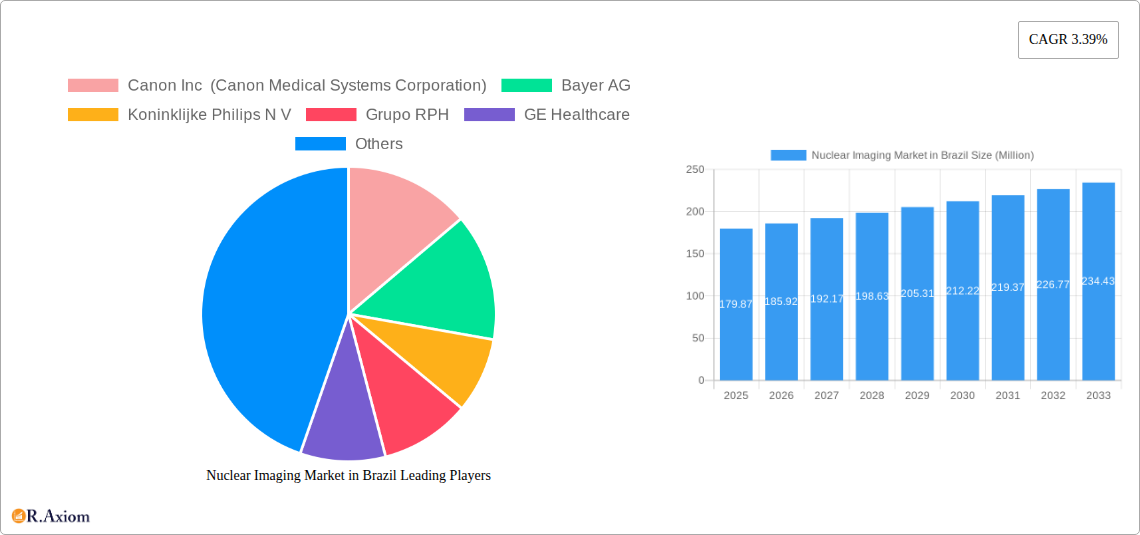

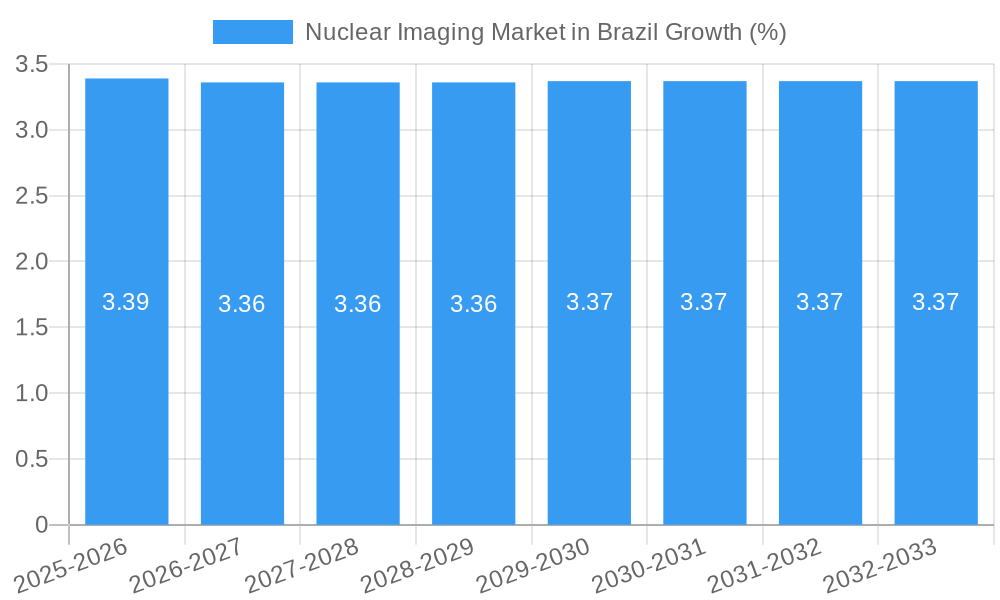

The Brazilian nuclear imaging market is poised for steady growth, projected to reach approximately USD 179.87 million by 2025, with a compound annual growth rate (CAGR) of 3.39% expected through 2033. This expansion is primarily driven by the increasing prevalence of chronic diseases, such as oncology and cardiovascular conditions, which demand advanced diagnostic tools like SPECT and PET imaging. The growing awareness among healthcare professionals and patients regarding the benefits of nuclear imaging in early disease detection and treatment monitoring is a significant catalyst. Furthermore, advancements in radiopharmaceutical development and imaging equipment technology are enhancing diagnostic accuracy and patient outcomes, thereby fueling market adoption. The segment for PET radioisotopes, particularly those used in oncology, is anticipated to witness robust demand due to its superior sensitivity in detecting and staging various cancers.

Despite the positive outlook, the market faces certain restraints. The high cost associated with nuclear imaging equipment and radiopharmaceuticals can be a barrier to widespread adoption, especially in resource-constrained healthcare settings. Reimbursement policies and regulatory hurdles can also influence market penetration. However, strategic initiatives by key players, including expansions, collaborations, and product innovations, are expected to mitigate these challenges. The increasing focus on personalized medicine and the demand for non-invasive diagnostic procedures will continue to propel the nuclear imaging market forward in Brazil. Investments in upgrading healthcare infrastructure and training skilled personnel are crucial for realizing the full potential of this market, ensuring improved patient care and disease management across the nation.

Brazil Nuclear Imaging Market: Comprehensive Analysis, Trends, and Forecasts (2019-2033)

Report Description:

This in-depth report provides a comprehensive analysis of the Brazil nuclear imaging market, offering critical insights into its current state and future trajectory. Covering the study period of 2019–2033, with a base year of 2025, this report delves into market dynamics, CAGR projections, market penetration, and key influencing factors. We meticulously examine the nuclear imaging equipment market, diagnostic radioisotope market, and the burgeoning application segments within SPECT (Cardiology, Neurology, Thyroid, Other SPECT Applications) and PET (Oncology, Other PET Applications). Industry stakeholders, including GE Healthcare, Siemens Healthineers AG, Philips N.V., Canon Medical Systems Corporation, Bayer AG, Fujifilm Holdings Corporation, and Grupo RPH, will find actionable intelligence to inform their strategic decisions. This report addresses the latest industry developments, such as the establishment of InsCer Diagnostic Center for florbetaben PET scans and the significant isotope supply contract between Isotop JSC and IPEN. The analysis is segmented to provide granular insights into dominant markets, product innovations, growth drivers, market challenges, and emerging opportunities, making it an indispensable resource for navigating the evolving Brazilian nuclear medicine landscape.

Nuclear Imaging Market in Brazil Market Concentration & Innovation

The Brazil nuclear imaging market exhibits a moderate to high degree of concentration, with a few dominant global players like GE Healthcare, Siemens Healthineers AG, and Koninklijke Philips N.V. holding significant market shares. These companies consistently invest in research and development, driving innovation in both imaging equipment and radiopharmaceuticals. Key innovation drivers include advancements in detector technology for higher resolution and faster scan times, the development of novel radiotracers for more specific molecular targets, and the integration of artificial intelligence for image analysis and workflow optimization. The regulatory framework in Brazil, overseen by agencies like the ANVISA (National Health Surveillance Agency), plays a crucial role in approving new technologies and ensuring patient safety, influencing the pace of market adoption. While direct product substitutes are limited in the realm of true nuclear imaging, advancements in other diagnostic modalities like advanced MRI and CT scans can indirectly impact market share by offering alternative diagnostic pathways. End-user trends show a growing preference for minimally invasive diagnostic procedures, early disease detection, and personalized medicine, all of which are strong suits for nuclear imaging. Mergers and acquisitions (M&A) activities, although less frequent than in more mature markets, are strategic moves by larger entities to expand their product portfolios and market reach. For instance, hypothetical M&A deals in the range of US$50-150 Million could reshape the competitive landscape by consolidating specialized expertise or distribution networks. The market anticipates continued investment in advanced imaging centers and the increasing utilization of PET/CT and SPECT/CT systems, further solidifying the position of leading manufacturers.

Nuclear Imaging Market in Brazil Industry Trends & Insights

The Brazil nuclear imaging market is poised for robust growth, driven by several interconnected factors. A significant growth driver is the increasing prevalence of chronic diseases, particularly oncology, cardiology, and neurology, which are prime areas for nuclear imaging applications. As Brazil's population ages and lifestyle-related diseases rise, the demand for accurate and early diagnostic tools will intensify. Technological advancements are at the forefront of market expansion. Innovations in SPECT and PET imaging, such as the development of more sensitive detectors, improved reconstruction algorithms, and the introduction of hybrid imaging systems like PET/MRI, are enhancing diagnostic accuracy and patient comfort. The availability and development of novel diagnostic radioisotopes, including SPECT radioisotopes like Technetium-99m and PET radioisotopes such as Fluorine-18, are crucial for expanding the range of treatable conditions and diagnostic capabilities. The market penetration of advanced nuclear imaging technologies is steadily increasing, albeit with regional disparities within Brazil. Government initiatives and private sector investments aimed at improving healthcare infrastructure, particularly in underserved regions, are further fueling market growth. Consumer preferences are shifting towards proactive and preventive healthcare, with patients and physicians increasingly seeking non-invasive methods for precise disease staging and treatment monitoring. The competitive dynamics within the market are characterized by intense rivalry among global giants and a growing presence of specialized local players. Companies are focusing on offering integrated solutions that combine imaging hardware, software, and radiopharmaceutical supply chains to provide comprehensive patient care. The CAGR for the Brazil nuclear imaging market is projected to be in the range of 7-9% over the forecast period. This growth is underpinned by the expanding healthcare sector, a rising awareness of the benefits of nuclear medicine, and the continuous introduction of cutting-edge technologies. The increasing adoption of AI in image analysis is also a significant trend, promising to improve efficiency and diagnostic precision. Furthermore, the expanding reimbursement landscape for nuclear imaging procedures, driven by evidence of clinical utility, will play a vital role in accelerating market adoption. The strategic focus on therapeutic nuclear medicine, also known as theranostics, is another emerging trend that will contribute to market expansion.

Dominant Markets & Segments in Nuclear Imaging Market in Brazil

Within the Brazil nuclear imaging market, the PET Application segment, specifically Oncology, stands out as a dominant force. This dominance is driven by the high and increasing incidence of cancer in Brazil, making early and accurate diagnosis, staging, and treatment response assessment of paramount importance. PET scans, particularly with FDG (Fluorodeoxyglucose), are indispensable tools in the management of various cancers, including lung, breast, colorectal, and lymphoma. The development of novel PET radiotracers targeting specific molecular pathways offers even greater precision in oncological diagnostics.

Key Drivers for Dominance of PET Oncology Application:

- High Cancer Burden: Brazil faces a significant and growing burden of cancer, necessitating advanced diagnostic solutions.

- Diagnostic Accuracy: PET imaging provides functional information that complements anatomical imaging, leading to more precise diagnoses and treatment planning.

- Theranostic Potential: The increasing integration of PET with targeted radionuclide therapies (theranostics) is revolutionizing cancer treatment.

- Technological Advancements: Continuous development of PET scanners with higher sensitivity and resolution, coupled with the availability of new PET radiotracers, enhances clinical utility.

- Reimbursement Policies: Favorable reimbursement policies for PET scans in oncology indications further drive adoption.

Another significant and growing segment is SPECT Application in Cardiology. Cardiovascular diseases remain a leading cause of mortality in Brazil, and SPECT imaging plays a crucial role in assessing myocardial perfusion, detecting ischemia, and evaluating cardiac function. The relatively lower cost and wider availability of SPECT technology compared to PET in certain regions contribute to its sustained importance.

Key Drivers for Growth in SPECT Cardiology Application:

- Prevalence of Cardiovascular Diseases: The persistent high rate of heart disease in Brazil fuels demand for cardiac imaging.

- Established Clinical Utility: SPECT has a long-standing track record of clinical effectiveness in diagnosing and managing heart conditions.

- Cost-Effectiveness: SPECT procedures are generally more cost-effective than PET, making them accessible to a broader patient population.

- Technological Improvements: Ongoing enhancements in SPECT camera design and radiotracer development continue to improve diagnostic capabilities.

The Diagnostic Radioisotope segment is equally critical, with both SPECT Radioisotopes and PET Radioisotopes experiencing demand growth. The supply chain and reliable availability of these crucial components are paramount for the functioning of nuclear imaging departments. Developments in local production and international partnerships are key to ensuring a steady supply. The Equipment segment, encompassing SPECT and PET scanners, is also a major contributor, with continuous upgrades and the adoption of hybrid systems driving market value.

Nuclear Imaging Market in Brazil Product Developments

The Brazil nuclear imaging market is witnessing a steady stream of product innovations aimed at enhancing diagnostic capabilities and patient outcomes. Manufacturers are focusing on developing SPECT and PET scanners with improved spatial resolution, higher sensitivity, and faster acquisition times, leading to more accurate diagnoses and reduced patient scan duration. The introduction of new radiotracers tailored for specific diseases, particularly in oncology and neurology, is expanding the scope of molecular imaging. Hybrid imaging systems, such as PET/CT and the emerging PET/MRI, are gaining traction, offering fused anatomical and functional information in a single examination, thereby improving diagnostic confidence and workflow efficiency. Companies are also investing in advanced software solutions that leverage artificial intelligence and machine learning for image reconstruction, quantitative analysis, and workflow optimization, further enhancing the value proposition of nuclear imaging technologies.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Brazil nuclear imaging market, segmented by Product and Application. The Product segmentation includes Equipment, encompassing SPECT and PET imaging devices, and Diagnostic Radioisotope, further categorized into SPECT Radioisotopes and PET Radioisotopes. The Application segmentation is divided into SPECT Application, covering Cardiology, Neurology, Thyroid, and Other SPECT Applications, and PET Application, focusing on Oncology and Other PET Applications.

The Equipment segment is projected to exhibit substantial growth, driven by the increasing demand for advanced imaging modalities and the replacement of older systems. The Diagnostic Radioisotope segment is also expected to expand, fueled by the growing number of nuclear imaging procedures and efforts to enhance local production capabilities for key isotopes.

Within applications, Oncology under PET applications is anticipated to lead the market in terms of revenue and growth, owing to the high cancer burden in Brazil and the diagnostic efficacy of PET. Cardiology under SPECT applications will continue to be a significant segment, driven by the prevalence of cardiovascular diseases. The Other PET Applications and Other SPECT Applications segments are also expected to witness steady growth as new tracers and diagnostic indications emerge.

Key Drivers of Nuclear Imaging Market in Brazil Growth

The Brazil nuclear imaging market growth is propelled by several key factors. Firstly, the rising incidence of chronic and lifestyle-related diseases, including cancer, cardiovascular conditions, and neurological disorders, necessitates advanced diagnostic tools. Secondly, continuous technological advancements in imaging equipment and radiopharmaceuticals are enhancing diagnostic accuracy and expanding the range of applications. Government initiatives to improve healthcare infrastructure and increase access to advanced medical technologies, coupled with private sector investments, are also significant drivers. Furthermore, a growing awareness among healthcare professionals and patients about the benefits of nuclear imaging for early disease detection, staging, and treatment monitoring is fostering market expansion. The development of more cost-effective imaging solutions and the increasing reimbursement coverage for nuclear medicine procedures are also contributing positively to market growth.

Challenges in the Nuclear Imaging Market in Brazil Sector

Despite its promising growth, the Brazil nuclear imaging market faces several challenges. High initial capital investment for advanced imaging equipment and the associated infrastructure can be a significant barrier for smaller healthcare facilities. The availability and reliable supply chain of diagnostic radioisotopes, particularly specialized ones, can be a constraint, influenced by production capabilities and import regulations. Stringent regulatory approvals for new radiopharmaceuticals and imaging technologies, while essential for patient safety, can lead to prolonged market entry timelines. Shortage of skilled nuclear medicine professionals, including radiologists, technicians, and radiopharmacists, can hinder the widespread adoption and optimal utilization of nuclear imaging services. Reimbursement policies, although improving, can still pose challenges in certain segments, affecting affordability and access for a broader patient population.

Emerging Opportunities in Nuclear Imaging Market in Brazil

The Brazil nuclear imaging market presents several emerging opportunities. The increasing focus on theranostics (diagnostic and therapeutic applications of radionuclides) offers a significant growth avenue, particularly in oncology, with the development of targeted therapies. The expansion of PET/MRI hybrid systems represents another frontier, offering unparalleled diagnostic insights for complex neurological and oncological cases. Growth in home healthcare and decentralized diagnostic models could also create opportunities for more portable and accessible nuclear imaging solutions. Furthermore, collaborations between academic institutions, research bodies like IPEN, and industry players can accelerate the development and commercialization of novel radiotracers and imaging techniques. The increasing demand for preventive healthcare and early disease detection among the growing middle class presents a fertile ground for the adoption of advanced nuclear imaging services.

Leading Players in the Nuclear Imaging Market in Brazil Market

- Canon Inc (Canon Medical Systems Corporation)

- Bayer AG

- Koninklijke Philips N V

- Grupo RPH

- GE Healthcare

- Siemens Healthineers AG

- Fujifilm Holdings Corporation

Key Developments in Nuclear Imaging Market in Brazil Industry

- May 2022: InsCer Diagnostic Center was established by Life Molecular Imaging in collaboration with R2IBF, marking the first facility in Brazil to perform a florbetaben (18F) PET scan, enhancing diagnostic capabilities for neurological conditions.

- June 2021: Isotop JSC (part of Rusatom Healthcare) signed a five-year contract with Brazil's Nuclear and Energy Research Institute (IPEN) to supply medical isotopes lutetium-177 and actinium-225, bolstering the availability of critical radiopharmaceuticals for therapeutic applications in Brazil.

Strategic Outlook for Nuclear Imaging Market in Brazil Market

The strategic outlook for the Brazil nuclear imaging market is highly positive, characterized by sustained growth and evolving technological integration. The increasing demand for advanced diagnostic solutions, driven by the rising burden of chronic diseases, will continue to be a primary growth catalyst. Investments in expanding the domestic radiopharmaceutical production infrastructure, exemplified by partnerships like the one between Isotop JSC and IPEN, will be crucial for ensuring supply chain resilience and affordability. The further development and adoption of theranostic approaches in oncology and other therapeutic areas represent a significant opportunity for market expansion. Strategic collaborations between global manufacturers and local healthcare providers will facilitate the penetration of advanced imaging technologies into a wider range of healthcare settings across Brazil. Continuous innovation in AI-powered image analysis and the integration of hybrid imaging modalities will further enhance the clinical value and economic viability of nuclear imaging, positioning the market for robust and dynamic growth in the coming years.

Nuclear Imaging Market in Brazil Segmentation

-

1. Product

- 1.1. Equipment

-

1.2. Diagnostic Radioisotope

- 1.2.1. SPECT Radioisotopes

- 1.2.2. PET Radioisotopes

-

2. Application

-

2.1. SPECT Application

- 2.1.1. Cardiology

- 2.1.2. Neurology

- 2.1.3. Thyroid

- 2.1.4. Other SPECT Applications

-

2.2. PET Application

- 2.2.1. Oncology

- 2.2.2. Other PET Applications

-

2.1. SPECT Application

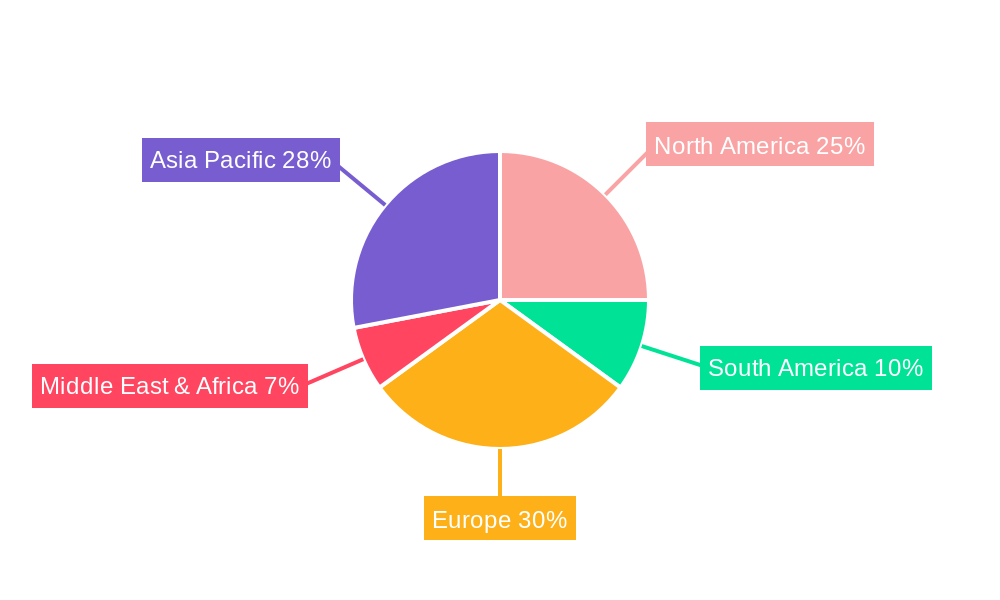

Nuclear Imaging Market in Brazil Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Nuclear Imaging Market in Brazil REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.39% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Chronic Diseases; Rising Geriatric Population; Increasing Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Lack Of Proper Reimbursement And Stringent Regulatory Approval Procedures; High Cost of Equipment

- 3.4. Market Trends

- 3.4.1. Oncology Segment is Expected to Hold a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Nuclear Imaging Market in Brazil Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Equipment

- 5.1.2. Diagnostic Radioisotope

- 5.1.2.1. SPECT Radioisotopes

- 5.1.2.2. PET Radioisotopes

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. SPECT Application

- 5.2.1.1. Cardiology

- 5.2.1.2. Neurology

- 5.2.1.3. Thyroid

- 5.2.1.4. Other SPECT Applications

- 5.2.2. PET Application

- 5.2.2.1. Oncology

- 5.2.2.2. Other PET Applications

- 5.2.1. SPECT Application

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Nuclear Imaging Market in Brazil Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Equipment

- 6.1.2. Diagnostic Radioisotope

- 6.1.2.1. SPECT Radioisotopes

- 6.1.2.2. PET Radioisotopes

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. SPECT Application

- 6.2.1.1. Cardiology

- 6.2.1.2. Neurology

- 6.2.1.3. Thyroid

- 6.2.1.4. Other SPECT Applications

- 6.2.2. PET Application

- 6.2.2.1. Oncology

- 6.2.2.2. Other PET Applications

- 6.2.1. SPECT Application

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America Nuclear Imaging Market in Brazil Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Equipment

- 7.1.2. Diagnostic Radioisotope

- 7.1.2.1. SPECT Radioisotopes

- 7.1.2.2. PET Radioisotopes

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. SPECT Application

- 7.2.1.1. Cardiology

- 7.2.1.2. Neurology

- 7.2.1.3. Thyroid

- 7.2.1.4. Other SPECT Applications

- 7.2.2. PET Application

- 7.2.2.1. Oncology

- 7.2.2.2. Other PET Applications

- 7.2.1. SPECT Application

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe Nuclear Imaging Market in Brazil Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Equipment

- 8.1.2. Diagnostic Radioisotope

- 8.1.2.1. SPECT Radioisotopes

- 8.1.2.2. PET Radioisotopes

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. SPECT Application

- 8.2.1.1. Cardiology

- 8.2.1.2. Neurology

- 8.2.1.3. Thyroid

- 8.2.1.4. Other SPECT Applications

- 8.2.2. PET Application

- 8.2.2.1. Oncology

- 8.2.2.2. Other PET Applications

- 8.2.1. SPECT Application

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa Nuclear Imaging Market in Brazil Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Equipment

- 9.1.2. Diagnostic Radioisotope

- 9.1.2.1. SPECT Radioisotopes

- 9.1.2.2. PET Radioisotopes

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. SPECT Application

- 9.2.1.1. Cardiology

- 9.2.1.2. Neurology

- 9.2.1.3. Thyroid

- 9.2.1.4. Other SPECT Applications

- 9.2.2. PET Application

- 9.2.2.1. Oncology

- 9.2.2.2. Other PET Applications

- 9.2.1. SPECT Application

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific Nuclear Imaging Market in Brazil Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Equipment

- 10.1.2. Diagnostic Radioisotope

- 10.1.2.1. SPECT Radioisotopes

- 10.1.2.2. PET Radioisotopes

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. SPECT Application

- 10.2.1.1. Cardiology

- 10.2.1.2. Neurology

- 10.2.1.3. Thyroid

- 10.2.1.4. Other SPECT Applications

- 10.2.2. PET Application

- 10.2.2.1. Oncology

- 10.2.2.2. Other PET Applications

- 10.2.1. SPECT Application

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Canon Inc (Canon Medical Systems Corporation)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bayer AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Koninklijke Philips N V

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Grupo RPH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 GE Healthcare

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Siemens Healthineers AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fujifilm Holdings Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Canon Inc (Canon Medical Systems Corporation)

List of Figures

- Figure 1: Global Nuclear Imaging Market in Brazil Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Brazil Nuclear Imaging Market in Brazil Revenue (Million), by Country 2024 & 2032

- Figure 3: Brazil Nuclear Imaging Market in Brazil Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Nuclear Imaging Market in Brazil Revenue (Million), by Product 2024 & 2032

- Figure 5: North America Nuclear Imaging Market in Brazil Revenue Share (%), by Product 2024 & 2032

- Figure 6: North America Nuclear Imaging Market in Brazil Revenue (Million), by Application 2024 & 2032

- Figure 7: North America Nuclear Imaging Market in Brazil Revenue Share (%), by Application 2024 & 2032

- Figure 8: North America Nuclear Imaging Market in Brazil Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Nuclear Imaging Market in Brazil Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Nuclear Imaging Market in Brazil Revenue (Million), by Product 2024 & 2032

- Figure 11: South America Nuclear Imaging Market in Brazil Revenue Share (%), by Product 2024 & 2032

- Figure 12: South America Nuclear Imaging Market in Brazil Revenue (Million), by Application 2024 & 2032

- Figure 13: South America Nuclear Imaging Market in Brazil Revenue Share (%), by Application 2024 & 2032

- Figure 14: South America Nuclear Imaging Market in Brazil Revenue (Million), by Country 2024 & 2032

- Figure 15: South America Nuclear Imaging Market in Brazil Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Nuclear Imaging Market in Brazil Revenue (Million), by Product 2024 & 2032

- Figure 17: Europe Nuclear Imaging Market in Brazil Revenue Share (%), by Product 2024 & 2032

- Figure 18: Europe Nuclear Imaging Market in Brazil Revenue (Million), by Application 2024 & 2032

- Figure 19: Europe Nuclear Imaging Market in Brazil Revenue Share (%), by Application 2024 & 2032

- Figure 20: Europe Nuclear Imaging Market in Brazil Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Nuclear Imaging Market in Brazil Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa Nuclear Imaging Market in Brazil Revenue (Million), by Product 2024 & 2032

- Figure 23: Middle East & Africa Nuclear Imaging Market in Brazil Revenue Share (%), by Product 2024 & 2032

- Figure 24: Middle East & Africa Nuclear Imaging Market in Brazil Revenue (Million), by Application 2024 & 2032

- Figure 25: Middle East & Africa Nuclear Imaging Market in Brazil Revenue Share (%), by Application 2024 & 2032

- Figure 26: Middle East & Africa Nuclear Imaging Market in Brazil Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa Nuclear Imaging Market in Brazil Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Nuclear Imaging Market in Brazil Revenue (Million), by Product 2024 & 2032

- Figure 29: Asia Pacific Nuclear Imaging Market in Brazil Revenue Share (%), by Product 2024 & 2032

- Figure 30: Asia Pacific Nuclear Imaging Market in Brazil Revenue (Million), by Application 2024 & 2032

- Figure 31: Asia Pacific Nuclear Imaging Market in Brazil Revenue Share (%), by Application 2024 & 2032

- Figure 32: Asia Pacific Nuclear Imaging Market in Brazil Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Nuclear Imaging Market in Brazil Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Nuclear Imaging Market in Brazil Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Nuclear Imaging Market in Brazil Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Global Nuclear Imaging Market in Brazil Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Nuclear Imaging Market in Brazil Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Nuclear Imaging Market in Brazil Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Global Nuclear Imaging Market in Brazil Revenue Million Forecast, by Product 2019 & 2032

- Table 7: Global Nuclear Imaging Market in Brazil Revenue Million Forecast, by Application 2019 & 2032

- Table 8: Global Nuclear Imaging Market in Brazil Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Nuclear Imaging Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada Nuclear Imaging Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico Nuclear Imaging Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Nuclear Imaging Market in Brazil Revenue Million Forecast, by Product 2019 & 2032

- Table 13: Global Nuclear Imaging Market in Brazil Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Global Nuclear Imaging Market in Brazil Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil Nuclear Imaging Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Nuclear Imaging Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of South America Nuclear Imaging Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Nuclear Imaging Market in Brazil Revenue Million Forecast, by Product 2019 & 2032

- Table 19: Global Nuclear Imaging Market in Brazil Revenue Million Forecast, by Application 2019 & 2032

- Table 20: Global Nuclear Imaging Market in Brazil Revenue Million Forecast, by Country 2019 & 2032

- Table 21: United Kingdom Nuclear Imaging Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Germany Nuclear Imaging Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: France Nuclear Imaging Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Italy Nuclear Imaging Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Spain Nuclear Imaging Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Russia Nuclear Imaging Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Benelux Nuclear Imaging Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Nordics Nuclear Imaging Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe Nuclear Imaging Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Nuclear Imaging Market in Brazil Revenue Million Forecast, by Product 2019 & 2032

- Table 31: Global Nuclear Imaging Market in Brazil Revenue Million Forecast, by Application 2019 & 2032

- Table 32: Global Nuclear Imaging Market in Brazil Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Turkey Nuclear Imaging Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Israel Nuclear Imaging Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: GCC Nuclear Imaging Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: North Africa Nuclear Imaging Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: South Africa Nuclear Imaging Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Middle East & Africa Nuclear Imaging Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Nuclear Imaging Market in Brazil Revenue Million Forecast, by Product 2019 & 2032

- Table 40: Global Nuclear Imaging Market in Brazil Revenue Million Forecast, by Application 2019 & 2032

- Table 41: Global Nuclear Imaging Market in Brazil Revenue Million Forecast, by Country 2019 & 2032

- Table 42: China Nuclear Imaging Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: India Nuclear Imaging Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Japan Nuclear Imaging Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: South Korea Nuclear Imaging Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: ASEAN Nuclear Imaging Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Oceania Nuclear Imaging Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Asia Pacific Nuclear Imaging Market in Brazil Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nuclear Imaging Market in Brazil?

The projected CAGR is approximately 3.39%.

2. Which companies are prominent players in the Nuclear Imaging Market in Brazil?

Key companies in the market include Canon Inc (Canon Medical Systems Corporation), Bayer AG, Koninklijke Philips N V, Grupo RPH, GE Healthcare, Siemens Healthineers AG, Fujifilm Holdings Corporation.

3. What are the main segments of the Nuclear Imaging Market in Brazil?

The market segments include Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 179.87 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Chronic Diseases; Rising Geriatric Population; Increasing Technological Advancements.

6. What are the notable trends driving market growth?

Oncology Segment is Expected to Hold a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Lack Of Proper Reimbursement And Stringent Regulatory Approval Procedures; High Cost of Equipment.

8. Can you provide examples of recent developments in the market?

In May 2022, as the first facility in Brazil to perform a florbetaben (18F) PET scan, InsCer Diagnostic Center was established by Life Molecular Imaging in collaboration with R2IBF.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nuclear Imaging Market in Brazil," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nuclear Imaging Market in Brazil report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nuclear Imaging Market in Brazil?

To stay informed about further developments, trends, and reports in the Nuclear Imaging Market in Brazil, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence