Key Insights

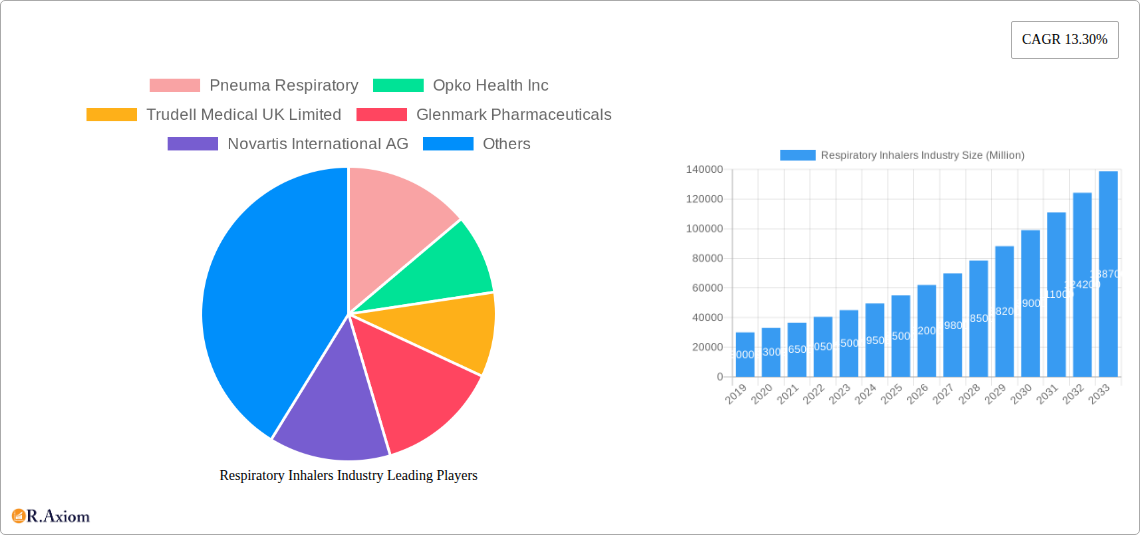

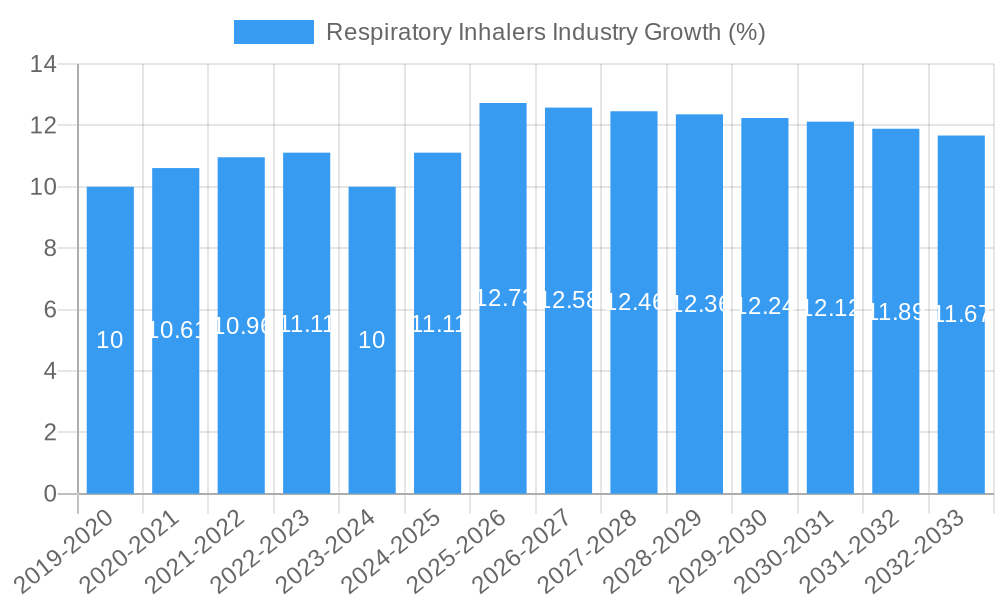

The global Respiratory Inhalers market is poised for robust expansion, projected to reach an estimated USD 55,000 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 13.30% through 2033. This significant market trajectory is primarily fueled by the escalating prevalence of chronic respiratory diseases such as Chronic Obstructive Pulmonary Disease (COPD) and asthma, which are increasingly impacting global populations. Advancements in inhaler technology, including the development of more efficient and user-friendly Metered Dose Inhalers (MDIs) and Dry Powder Inhalers (DPIs), are also acting as powerful growth catalysts. These innovations are enhancing drug delivery mechanisms, improving patient adherence, and ultimately leading to better treatment outcomes, thereby driving demand across both branded and generic segments. The growing awareness among patients and healthcare providers regarding the benefits of effective inhalation therapy further solidifies the positive market outlook.

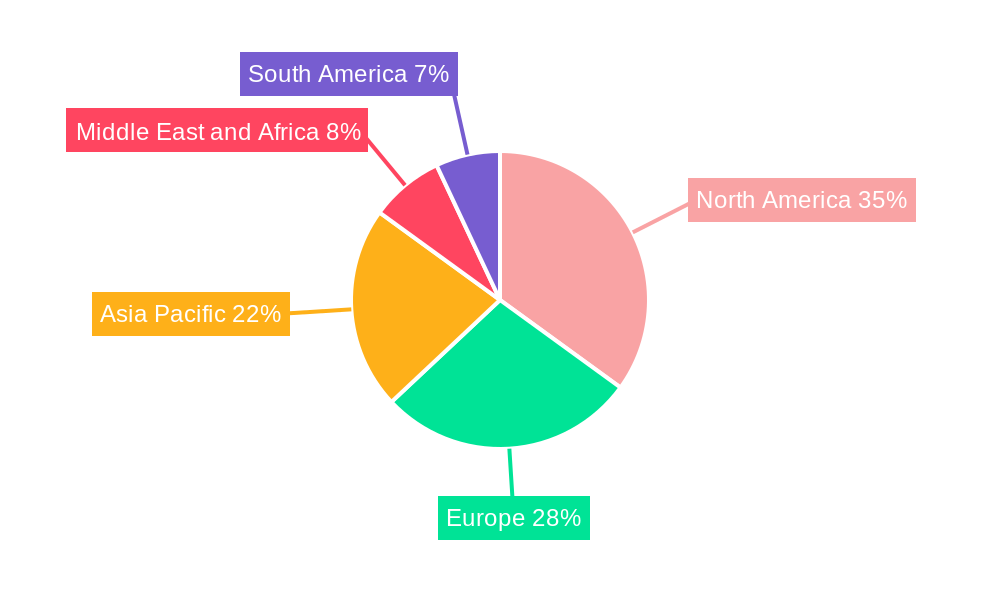

The market's growth is further supported by strategic investments and innovations from leading companies like Novartis International AG, Teva Pharmaceutical Industries Ltd, and Koninklijke Philips N.V., who are actively developing next-generation respiratory devices and therapies. The increasing focus on digital health integration, exemplified by companies offering smart inhalers with adherence tracking and data analytics, is another significant trend shaping the market. However, challenges such as the high cost of some advanced inhaler devices and stringent regulatory hurdles for new product approvals could potentially moderate growth in certain segments. Despite these restraints, the persistent burden of respiratory diseases and ongoing technological advancements ensure a dynamic and expanding market for respiratory inhalers worldwide. North America is expected to maintain a dominant market share, driven by high healthcare spending and advanced medical infrastructure, followed by Europe and the rapidly growing Asia Pacific region due to increasing disease incidence and improving healthcare access.

Respiratory Inhalers Industry Market Concentration & Innovation

The global Respiratory Inhalers market, valued at an estimated $20,000 Million in 2025, exhibits a moderate to high level of concentration. Key players like Novartis International AG, Teva Pharmaceutical Industries Ltd, and Koninklijke Philips N V hold significant market shares, dominating both branded and generic segments. Innovation remains a critical driver, spurred by the increasing prevalence of respiratory diseases such as Asthma and Chronic Obstructive Pulmonary Disease (COPD). The development of next-generation inhalers, focusing on improved efficacy, patient adherence, and environmental sustainability, is a major trend. Regulatory frameworks, overseen by bodies like the FDA and EMA, play a crucial role in shaping market access and product approvals, emphasizing safety and performance standards. The threat of product substitutes, while present in terms of alternative drug delivery methods, is mitigated by the established efficacy and patient familiarity with inhaler devices. End-user trends are shifting towards digital integration, enhancing patient monitoring and treatment personalization. Mergers and acquisitions (M&A) are strategically employed to expand product portfolios and gain market access. For instance, significant M&A deals in the historical period (2019-2024) are estimated to be in the range of $1,000 Million to $5,000 Million, demonstrating the competitive landscape's dynamic nature.

- Market Share Snapshot (2025 Estimated): Leading companies collectively hold over 60% of the market.

- Innovation Focus Areas: Smart inhalers, eco-friendly propellants, patient-centric design.

- Regulatory Landscape: Stringent approval processes for new drug delivery systems and propellants.

- M&A Deal Value Trends (2019-2024): Consistent strategic acquisitions to consolidate market position.

Respiratory Inhalers Industry Industry Trends & Insights

The Respiratory Inhalers market is poised for significant growth, driven by a confluence of escalating respiratory disease prevalence, technological advancements, and evolving patient preferences. The compound annual growth rate (CAGR) for the forecast period (2025-2033) is projected to be around 7.5%, with the market size expected to reach approximately $35,000 Million by 2033. A primary growth catalyst is the increasing incidence of asthma and COPD worldwide, fueled by factors such as air pollution, aging populations, and lifestyle changes. Technological disruptions are profoundly impacting the industry, with the advent of smart inhalers revolutionizing patient care. These connected devices, like those developed by Propeller Health and Amiko Digital Health Limited, offer real-time data on inhaler usage, environmental triggers, and patient adherence, enabling personalized treatment plans and improved disease management. This surge in digital health solutions is pushing the market penetration of connected respiratory devices to an estimated 15% by 2025.

Furthermore, consumer preferences are increasingly leaning towards user-friendly and effective drug delivery systems that enhance medication adherence. Dry Powder Inhalers (DPIs) and Metered Dose Inhalers (MDIs) continue to be the dominant product segments due to their established efficacy and diverse therapeutic applications. However, innovation in DPI design, aiming for simpler handling and more accurate dosing, is gaining traction. Competitive dynamics are intensifying, with both established pharmaceutical giants and innovative startups vying for market share. Companies are investing heavily in research and development to create inhalers with lower global warming potential propellants, aligning with environmental sustainability goals. This proactive approach to environmental concerns, exemplified by partnerships like AstraZeneca and Honeywell's collaboration on HFO-1234ze propellant technology, is becoming a key differentiator. The generic inhaler market also plays a vital role, offering cost-effective alternatives and expanding accessibility to a broader patient population, contributing significantly to overall market volume.

- CAGR (2025-2033): Projected at 7.5%.

- Market Size Projection (2033): Estimated at $35,000 Million.

- Key Growth Drivers: Rising prevalence of asthma and COPD, technological innovation in smart inhalers, increasing demand for patient adherence solutions.

- Technological Disruption: Emergence of connected inhalers for remote patient monitoring and personalized treatment.

- Market Penetration of Smart Inhalers (2025): Estimated at 15%.

- Consumer Preference Shift: Towards user-friendly, adherence-focused, and sustainable respiratory devices.

- Competitive Landscape: Intense rivalry between established players and innovative startups, with strategic R&D investments.

Dominant Markets & Segments in Respiratory Inhalers Industry

The Respiratory Inhalers market demonstrates clear dominance within specific regions and segments, driven by a combination of healthcare infrastructure, disease prevalence, and economic factors. North America, particularly the United States, and Europe are leading geographical markets, accounting for an estimated 55% of the global market share in 2025. This dominance is attributed to advanced healthcare systems, high awareness of respiratory diseases, robust research and development ecosystems, and significant patient populations suffering from Asthma and Chronic Obstructive Pulmonary Disease (COPD).

Within product segments, Metered Dose Inhalers (MDIs) currently hold the largest market share, estimated at 58% in 2025, due to their established history, versatility, and wide range of available medications. However, Dry Powder Inhalers (DPIs) are experiencing substantial growth, projected to capture an increasing share of the market, driven by advancements in design for improved ease of use and patient adherence, especially for pediatric and elderly populations.

In terms of application, Asthma and COPD are the primary therapeutic areas driving demand. Asthma alone accounts for an estimated 40% of the respiratory inhaler market, while COPD represents another significant 35%. The "Others" category, encompassing conditions like cystic fibrosis and idiopathic pulmonary fibrosis, represents a smaller but growing segment with specialized inhaler needs.

The Type segment is characterized by a healthy balance between branded and generic inhalers. Branded inhalers, often associated with innovative drug formulations and delivery devices, command a higher price point and cater to a significant portion of the market, estimated at 52% in 2025. Generic inhalers, however, are crucial for market accessibility and affordability, especially in emerging economies, and are projected to hold a 48% share. Economic policies, such as healthcare reimbursements and generic drug promotion initiatives, significantly influence the growth of this segment. Infrastructure development in healthcare facilities and widespread access to diagnostic tools further bolster the dominance of these key markets and segments.

- Leading Regions: North America (specifically the US) and Europe, collectively holding an estimated 55% market share in 2025.

- Dominant Product Segment: Metered Dose Inhalers (MDIs) at an estimated 58% market share in 2025, with Dry Powder Inhalers (DPIs) showing strong growth.

- Key Applications: Asthma (estimated 40% market share) and Chronic Obstructive Pulmonary Disease (COPD) (estimated 35% market share).

- Type Segment Dominance: Branded inhalers hold an estimated 52% market share in 2025, with a substantial and growing generic segment at 48%.

- Drivers of Segment Dominance:

- Economic Policies: Government incentives for generic drug adoption, healthcare reimbursement policies.

- Healthcare Infrastructure: Advanced diagnostic capabilities, widespread availability of specialist care.

- Disease Prevalence: High incidence rates of asthma and COPD in leading regions.

- Technological Adoption: Willingness to adopt new device technologies in developed markets.

Respiratory Inhalers Industry Product Developments

Product innovation in the respiratory inhalers sector is primarily focused on enhancing patient experience and therapeutic outcomes. The development of smart inhalers, which integrate digital technology for usage tracking and data analysis, is a significant trend. These devices, such as Aptar Pharma's HeroTracker Sense, offer patients and healthcare providers unprecedented insights into treatment adherence and effectiveness. Concurrently, there is a strong push towards developing inhalers with reduced environmental impact. The collaboration between AstraZeneca and Honeywell to utilize HFO-1234ze, a low global warming potential propellant, exemplifies this commitment. These advancements not only improve the functionality and sustainability of inhalers but also provide a competitive advantage by meeting the evolving demands of environmentally conscious healthcare systems and patients.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global Respiratory Inhalers market, segmented across key dimensions to offer granular insights. The Product segmentation includes Dry Powder Inhalers (DPIs) and Metered Dose Inhalers (MDIs), each analyzed for market size, growth projections, and competitive dynamics. The Application segmentation covers Chronic Obstructive Pulmonary Disease (COPD), Asthma, and Others, detailing the specific demand drivers and therapeutic nuances within each category. The Type segmentation distinguishes between Branded and Generic inhalers, highlighting their respective market penetration, pricing strategies, and growth trajectories.

- Product Segmentation: Dry Powder Inhalers (DPIs) and Metered Dose Inhalers (MDIs) are analyzed, with DPIs projected for robust growth due to design innovations.

- Application Segmentation: Chronic Obstructive Pulmonary Disease (COPD) and Asthma remain the dominant applications, with a growing segment for "Others" like cystic fibrosis.

- Type Segmentation: Branded inhalers continue to lead in value, while generic inhalers are crucial for market accessibility and volume growth.

Key Drivers of Respiratory Inhalers Industry Growth

The respiratory inhalers industry is propelled by several interconnected drivers. The escalating global burden of respiratory diseases, including asthma and COPD, driven by factors like air pollution, aging populations, and increased urbanization, forms the bedrock of market expansion. Technological innovation plays a pivotal role, with the rise of smart inhalers and digital health solutions enhancing patient adherence and disease management. Furthermore, increased healthcare expenditure globally, coupled with supportive government initiatives aimed at improving respiratory care access and affordability, further fuels market growth. The development of eco-friendly propellants is also emerging as a significant driver, aligning with global sustainability goals and regulatory pressures.

Challenges in the Respiratory Inhalers Industry Sector

Despite robust growth prospects, the respiratory inhalers industry faces significant challenges. Stringent and evolving regulatory frameworks, particularly concerning new propellant technologies and device approvals, can lead to lengthy development cycles and increased costs. Supply chain complexities, exacerbated by global disruptions and the need for specialized manufacturing processes, pose a risk to product availability. Intense competition, both from established players and emerging innovators, pressures profit margins, especially in the generic segment. Moreover, the high cost of advanced smart inhaler technology can be a barrier to widespread adoption, particularly in price-sensitive markets. Patient adherence remains a perennial challenge, with suboptimal inhaler technique contributing to treatment failures.

Emerging Opportunities in Respiratory Inhalers Industry

The respiratory inhalers market is ripe with emerging opportunities. The expanding digital health ecosystem presents a significant avenue for growth through the development and integration of connected inhaler technologies, offering remote patient monitoring and personalized treatment algorithms. The growing demand for sustainable healthcare solutions opens doors for companies pioneering inhalers with low global warming potential propellants and eco-friendly packaging. Furthermore, the increasing prevalence of respiratory diseases in emerging economies presents a substantial untapped market for both branded and generic inhalers, particularly focusing on improving accessibility and affordability. Personalized medicine approaches, leveraging real-time data from smart inhalers, offer opportunities for tailored therapies and improved patient outcomes.

Leading Players in the Respiratory Inhalers Industry Market

- Pneuma Respiratory

- Opko Health Inc

- Trudell Medical UK Limited

- Glenmark Pharmaceuticals

- Novartis International AG

- BreatheSuite Inc

- Koninklijke Philips N V

- AptarGroup Inc

- Amiko Digital Health Limited

- Teva Pharmaceutical Industries Ltd

- Propeller Health

- H&T Presspart Manufacturing Ltd

Key Developments in Respiratory Inhalers Industry Industry

- February 2022: AstraZeneca and Honeywell partnered to develop next-generation respiratory inhalers using the propellant HFO-1234ze, which has up to 99.9% less global warming potential than propellants currently used in respiratory medicines.

- February 2022: Aptar Pharma launched HeroTracker Sense, a novel digital respiratory health solution that transforms a standard metered dose inhaler into a smart connected healthcare device.

Strategic Outlook for Respiratory Inhalers Industry Market

The strategic outlook for the respiratory inhalers market is highly promising, driven by sustained demand for effective respiratory disease management and rapid technological advancements. The increasing integration of digital health solutions, particularly smart inhalers, is set to redefine patient care, offering personalized treatment pathways and improved adherence. A key growth catalyst will be the continued development and adoption of environmentally sustainable propellants and inhaler designs, aligning with global climate initiatives. Furthermore, the expanding healthcare infrastructure and rising disposable incomes in emerging markets present significant opportunities for market penetration. Companies focusing on user-centric design, robust R&D pipelines, and strategic partnerships will be well-positioned to capitalize on the evolving landscape and achieve sustained growth.

Respiratory Inhalers Industry Segmentation

-

1. Product

- 1.1. Dry Powder Inhalers

- 1.2. Metered Dose Inhalers

-

2. Application

- 2.1. Chronic Obstructive Pulmonary Disease

- 2.2. Asthma

- 2.3. Others

-

3. Type

- 3.1. Branded

- 3.2. Generic

Respiratory Inhalers Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Respiratory Inhalers Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Chronic Respiratory Diseases; Soaring Geriatric Population Afflicted With Respiratory Disorders; Increasing R&D Investment for Technological Improvement and Device Miniaturization

- 3.3. Market Restrains

- 3.3.1. High Cost of the Devices

- 3.4. Market Trends

- 3.4.1. Dry Powder Inhalers (DPI) are Expected to Hold a Major Share in the Growth of the Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Respiratory Inhalers Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Dry Powder Inhalers

- 5.1.2. Metered Dose Inhalers

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Chronic Obstructive Pulmonary Disease

- 5.2.2. Asthma

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. Branded

- 5.3.2. Generic

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Respiratory Inhalers Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Dry Powder Inhalers

- 6.1.2. Metered Dose Inhalers

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Chronic Obstructive Pulmonary Disease

- 6.2.2. Asthma

- 6.2.3. Others

- 6.3. Market Analysis, Insights and Forecast - by Type

- 6.3.1. Branded

- 6.3.2. Generic

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Respiratory Inhalers Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Dry Powder Inhalers

- 7.1.2. Metered Dose Inhalers

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Chronic Obstructive Pulmonary Disease

- 7.2.2. Asthma

- 7.2.3. Others

- 7.3. Market Analysis, Insights and Forecast - by Type

- 7.3.1. Branded

- 7.3.2. Generic

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Respiratory Inhalers Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Dry Powder Inhalers

- 8.1.2. Metered Dose Inhalers

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Chronic Obstructive Pulmonary Disease

- 8.2.2. Asthma

- 8.2.3. Others

- 8.3. Market Analysis, Insights and Forecast - by Type

- 8.3.1. Branded

- 8.3.2. Generic

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Respiratory Inhalers Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Dry Powder Inhalers

- 9.1.2. Metered Dose Inhalers

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Chronic Obstructive Pulmonary Disease

- 9.2.2. Asthma

- 9.2.3. Others

- 9.3. Market Analysis, Insights and Forecast - by Type

- 9.3.1. Branded

- 9.3.2. Generic

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Respiratory Inhalers Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Dry Powder Inhalers

- 10.1.2. Metered Dose Inhalers

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Chronic Obstructive Pulmonary Disease

- 10.2.2. Asthma

- 10.2.3. Others

- 10.3. Market Analysis, Insights and Forecast - by Type

- 10.3.1. Branded

- 10.3.2. Generic

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. North America Respiratory Inhalers Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Respiratory Inhalers Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Respiratory Inhalers Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Respiratory Inhalers Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Respiratory Inhalers Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Pneuma Respiratory

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Opko Health Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Trudell Medical UK Limited

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Glenmark Pharmaceuticals

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Novartis International AG

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 BreatheSuite Inc *List Not Exhaustive

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Koninklijke Philips N V

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 AptarGroup Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Amiko Digital Health Limited

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Teva Pharmaceutical Industries Ltd

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Propeller Health

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 H&T Presspart Manufacturing Ltd

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 Pneuma Respiratory

List of Figures

- Figure 1: Global Respiratory Inhalers Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Respiratory Inhalers Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Respiratory Inhalers Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Respiratory Inhalers Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Respiratory Inhalers Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Respiratory Inhalers Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Respiratory Inhalers Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Respiratory Inhalers Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Respiratory Inhalers Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Respiratory Inhalers Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Respiratory Inhalers Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Respiratory Inhalers Industry Revenue (Million), by Product 2024 & 2032

- Figure 13: North America Respiratory Inhalers Industry Revenue Share (%), by Product 2024 & 2032

- Figure 14: North America Respiratory Inhalers Industry Revenue (Million), by Application 2024 & 2032

- Figure 15: North America Respiratory Inhalers Industry Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America Respiratory Inhalers Industry Revenue (Million), by Type 2024 & 2032

- Figure 17: North America Respiratory Inhalers Industry Revenue Share (%), by Type 2024 & 2032

- Figure 18: North America Respiratory Inhalers Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Respiratory Inhalers Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Respiratory Inhalers Industry Revenue (Million), by Product 2024 & 2032

- Figure 21: Europe Respiratory Inhalers Industry Revenue Share (%), by Product 2024 & 2032

- Figure 22: Europe Respiratory Inhalers Industry Revenue (Million), by Application 2024 & 2032

- Figure 23: Europe Respiratory Inhalers Industry Revenue Share (%), by Application 2024 & 2032

- Figure 24: Europe Respiratory Inhalers Industry Revenue (Million), by Type 2024 & 2032

- Figure 25: Europe Respiratory Inhalers Industry Revenue Share (%), by Type 2024 & 2032

- Figure 26: Europe Respiratory Inhalers Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Respiratory Inhalers Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Respiratory Inhalers Industry Revenue (Million), by Product 2024 & 2032

- Figure 29: Asia Pacific Respiratory Inhalers Industry Revenue Share (%), by Product 2024 & 2032

- Figure 30: Asia Pacific Respiratory Inhalers Industry Revenue (Million), by Application 2024 & 2032

- Figure 31: Asia Pacific Respiratory Inhalers Industry Revenue Share (%), by Application 2024 & 2032

- Figure 32: Asia Pacific Respiratory Inhalers Industry Revenue (Million), by Type 2024 & 2032

- Figure 33: Asia Pacific Respiratory Inhalers Industry Revenue Share (%), by Type 2024 & 2032

- Figure 34: Asia Pacific Respiratory Inhalers Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific Respiratory Inhalers Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Respiratory Inhalers Industry Revenue (Million), by Product 2024 & 2032

- Figure 37: Middle East and Africa Respiratory Inhalers Industry Revenue Share (%), by Product 2024 & 2032

- Figure 38: Middle East and Africa Respiratory Inhalers Industry Revenue (Million), by Application 2024 & 2032

- Figure 39: Middle East and Africa Respiratory Inhalers Industry Revenue Share (%), by Application 2024 & 2032

- Figure 40: Middle East and Africa Respiratory Inhalers Industry Revenue (Million), by Type 2024 & 2032

- Figure 41: Middle East and Africa Respiratory Inhalers Industry Revenue Share (%), by Type 2024 & 2032

- Figure 42: Middle East and Africa Respiratory Inhalers Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East and Africa Respiratory Inhalers Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: South America Respiratory Inhalers Industry Revenue (Million), by Product 2024 & 2032

- Figure 45: South America Respiratory Inhalers Industry Revenue Share (%), by Product 2024 & 2032

- Figure 46: South America Respiratory Inhalers Industry Revenue (Million), by Application 2024 & 2032

- Figure 47: South America Respiratory Inhalers Industry Revenue Share (%), by Application 2024 & 2032

- Figure 48: South America Respiratory Inhalers Industry Revenue (Million), by Type 2024 & 2032

- Figure 49: South America Respiratory Inhalers Industry Revenue Share (%), by Type 2024 & 2032

- Figure 50: South America Respiratory Inhalers Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: South America Respiratory Inhalers Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Respiratory Inhalers Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Respiratory Inhalers Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Global Respiratory Inhalers Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Respiratory Inhalers Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 5: Global Respiratory Inhalers Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Respiratory Inhalers Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Respiratory Inhalers Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Europe Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Respiratory Inhalers Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: India Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Australia Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: South Korea Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia Pacific Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Respiratory Inhalers Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: GCC Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: South Africa Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of Middle East and Africa Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Respiratory Inhalers Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Brazil Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Respiratory Inhalers Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 33: Global Respiratory Inhalers Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 34: Global Respiratory Inhalers Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 35: Global Respiratory Inhalers Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 36: United States Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Canada Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Mexico Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Respiratory Inhalers Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 40: Global Respiratory Inhalers Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 41: Global Respiratory Inhalers Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 42: Global Respiratory Inhalers Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Germany Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: United Kingdom Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: France Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Italy Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Spain Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Europe Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Respiratory Inhalers Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 50: Global Respiratory Inhalers Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 51: Global Respiratory Inhalers Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 52: Global Respiratory Inhalers Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 53: China Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Japan Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: India Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Australia Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: South Korea Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Asia Pacific Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Global Respiratory Inhalers Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 60: Global Respiratory Inhalers Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 61: Global Respiratory Inhalers Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 62: Global Respiratory Inhalers Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 63: GCC Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: South Africa Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Rest of Middle East and Africa Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Global Respiratory Inhalers Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 67: Global Respiratory Inhalers Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 68: Global Respiratory Inhalers Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 69: Global Respiratory Inhalers Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 70: Brazil Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: Argentina Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Rest of South America Respiratory Inhalers Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Respiratory Inhalers Industry?

The projected CAGR is approximately 13.30%.

2. Which companies are prominent players in the Respiratory Inhalers Industry?

Key companies in the market include Pneuma Respiratory, Opko Health Inc, Trudell Medical UK Limited, Glenmark Pharmaceuticals, Novartis International AG, BreatheSuite Inc *List Not Exhaustive, Koninklijke Philips N V, AptarGroup Inc, Amiko Digital Health Limited, Teva Pharmaceutical Industries Ltd, Propeller Health, H&T Presspart Manufacturing Ltd.

3. What are the main segments of the Respiratory Inhalers Industry?

The market segments include Product, Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Chronic Respiratory Diseases; Soaring Geriatric Population Afflicted With Respiratory Disorders; Increasing R&D Investment for Technological Improvement and Device Miniaturization.

6. What are the notable trends driving market growth?

Dry Powder Inhalers (DPI) are Expected to Hold a Major Share in the Growth of the Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of the Devices.

8. Can you provide examples of recent developments in the market?

In February 2022 Astrazeneca and Honeywell partnered to develop next-generation respiratory inhalers using the propellant HFO-1234ze, which has up to 99.9% less global warming potential than propellants currently used in respiratory medicines.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Respiratory Inhalers Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Respiratory Inhalers Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Respiratory Inhalers Industry?

To stay informed about further developments, trends, and reports in the Respiratory Inhalers Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence