Key Insights

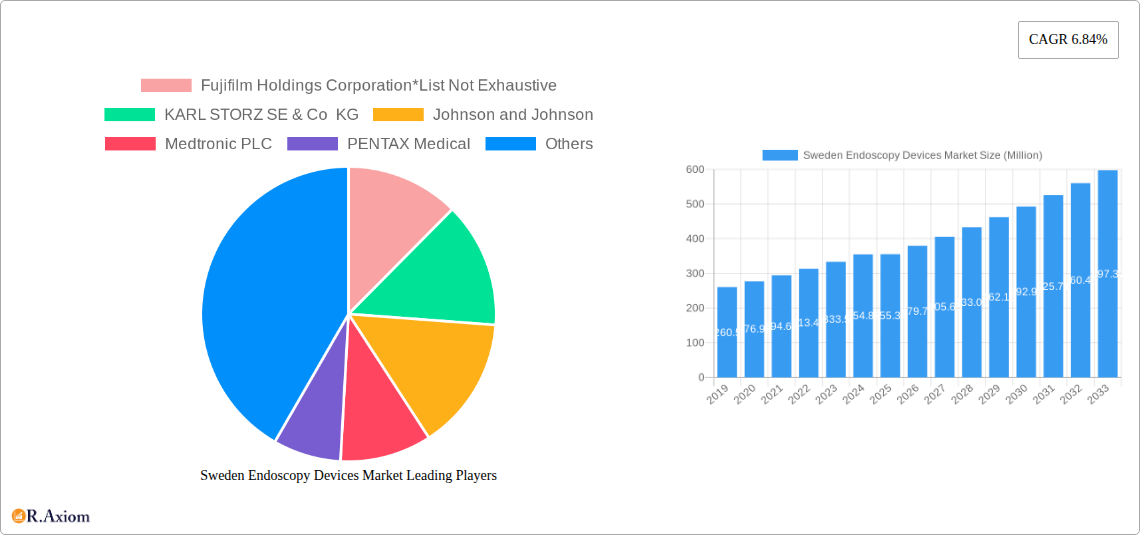

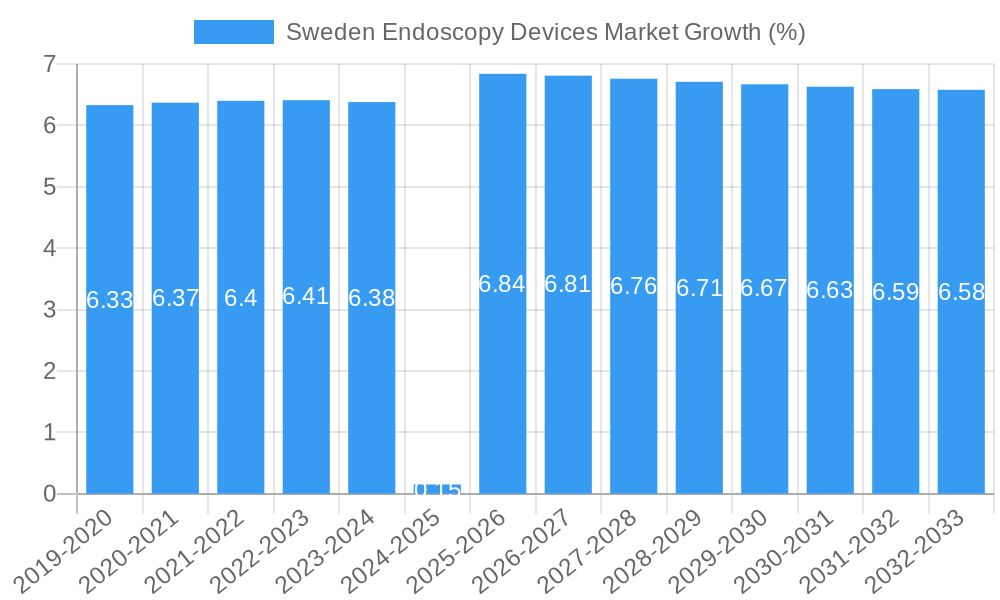

The Swedish endoscopy devices market is poised for significant expansion, projected to reach approximately USD 355.34 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.84% anticipated to extend through 2033. This upward trajectory is underpinned by several key drivers, including the increasing prevalence of chronic diseases requiring minimally invasive diagnostic and therapeutic procedures, such as gastrointestinal disorders and respiratory conditions. Advancements in endoscopic technology, leading to enhanced visualization, miniaturization, and integrated surgical capabilities, are also fueling market growth. The growing adoption of robotic-assisted endoscopy and the development of AI-powered diagnostic tools are further shaping the market landscape, offering improved precision and patient outcomes. Furthermore, a rising awareness among healthcare providers and patients regarding the benefits of endoscopic interventions, such as reduced recovery times and hospital stays, is a critical factor driving demand. The competitive landscape features prominent global players like Fujifilm Holdings Corporation, KARL STORZ SE & Co KG, Johnson and Johnson, Medtronic PLC, PENTAX Medical, Richard Wolf GmbH, and Boston Scientific Corporation, all actively investing in innovation and market penetration within Sweden.

The market is segmented across various device types, with Endoscopes, Endoscopic Operative Devices, and Visualization Equipment forming the core segments. Applications span a wide array of medical specialties, with Gastroenterology and Pulmonology leading the demand, followed by Orthopedic Surgery, Cardiology, ENT Surgery, Gynecology, and Neurology. The increasing focus on early disease detection and preventive healthcare in Sweden, coupled with government initiatives to upgrade healthcare infrastructure and promote advanced medical technologies, will continue to bolster the market. While the market benefits from technological innovation and growing demand, potential restraints such as the high initial cost of advanced endoscopic systems and the need for specialized training for healthcare professionals could present challenges. However, the overall outlook remains strongly positive, driven by the imperative for more efficient, less invasive, and highly accurate diagnostic and treatment modalities in modern healthcare.

This comprehensive report provides an in-depth analysis of the Sweden Endoscopy Devices Market from 2019 to 2033, with a base year of 2025. It forecasts market trends and opportunities between 2025 and 2033, building on historical data from 2019 to 2024. The report examines key market segments including device types (Endoscopes, Endoscopic Operative Devices, Visualization Equipment) and applications (Gastroenterology, Pulmonology, Orthopedic Surgery, Cardiology, ENT Surgery, Gynecology, Neurology, and Other Applications). Stakeholders will gain actionable insights into market concentration, innovation drivers, regulatory frameworks, competitive landscapes, and emerging opportunities within the Swedish endoscopy sector.

Sweden Endoscopy Devices Market Market Concentration & Innovation

The Sweden Endoscopy Devices Market is characterized by a moderate level of market concentration, with key players like Fujifilm Holdings Corporation, KARL STORZ SE & Co KG, Johnson and Johnson, Medtronic PLC, PENTAX Medical, Richard Wolf GmbH, and Boston Scientific Corporation holding significant shares. Innovation in this market is primarily driven by advancements in imaging technology, miniaturization of devices, and the integration of artificial intelligence for enhanced diagnostics and minimally invasive procedures. Regulatory frameworks, governed by bodies such as the Swedish Medical Products Agency (Läkemedelsverket) and adhering to EU MDR regulations, play a crucial role in shaping product development and market access. While direct product substitutes are limited for core endoscopic procedures, advancements in alternative diagnostic imaging modalities and less invasive surgical techniques present indirect competitive pressures. End-user trends are leaning towards demand for higher resolution imaging, improved patient comfort, and increased automation in reprocessing. Merger and acquisition activities, while not extensively detailed in public domain for specific Sweden-focused deals, often occur at a European or global level to consolidate market presence and acquire innovative technologies. For instance, global M&A in the broader medical device sector indicates a trend towards strategic acquisitions aimed at expanding product portfolios and market reach, with estimated deal values in the hundreds of millions to billions of dollars for major transactions.

Sweden Endoscopy Devices Market Industry Trends & Insights

The Sweden Endoscopy Devices Market is poised for significant growth, driven by an aging population, increasing prevalence of chronic diseases such as gastrointestinal disorders and respiratory ailments, and a growing emphasis on early disease detection and minimally invasive surgical techniques. The adoption of advanced endoscopic technologies, including high-definition imaging, robotic-assisted endoscopy, and single-use endoscopes, is a major growth catalyst. The estimated Compound Annual Growth Rate (CAGR) for the market is projected to be around 6.5% to 7.5% during the forecast period (2025–2033). This growth is further bolstered by government initiatives promoting healthcare accessibility and technological integration within the Swedish healthcare system. The Swedish healthcare sector's commitment to adopting cutting-edge medical technologies ensures a receptive environment for innovative endoscopy solutions. Furthermore, the increasing awareness among both healthcare professionals and patients regarding the benefits of endoscopic procedures, such as shorter recovery times and reduced patient trauma, is contributing to higher market penetration. The competitive dynamics within the market are intense, with established players continuously investing in research and development to introduce next-generation devices. The market penetration of advanced endoscopic devices, particularly in specialized applications like oncology and gastroenterology, is expected to rise substantially. The demand for sophisticated visualization equipment, capable of providing real-time data and superior image clarity, is also on an upward trajectory. The integration of artificial intelligence (AI) and machine learning (ML) into endoscopic devices for automated polyp detection and characterization is a transformative trend, promising to enhance diagnostic accuracy and efficiency. The development of specialized endoscopes for niche applications, such as neuroendoscopy and cardiac endoscopy, is also contributing to market expansion. The increasing adoption of telemedicine and remote monitoring solutions in healthcare is indirectly influencing the endoscopy market by fostering the need for integrated digital platforms and data management capabilities for endoscopic procedures. The Swedish market, with its advanced digital infrastructure and early adoption of healthcare technologies, is well-positioned to capitalize on these trends.

Dominant Markets & Segments in Sweden Endoscopy Devices Market

The Gastroenterology application segment is projected to hold the dominant market share in the Sweden Endoscopy Devices Market. This dominance is attributed to the high prevalence of gastrointestinal disorders, including inflammatory bowel disease (IBD), peptic ulcers, and colorectal cancer, which necessitate regular endoscopic examinations and interventions. The increasing adoption of advanced gastrointestinal endoscopy, such as capsule endoscopy and endoscopic retrograde cholangiopancreatography (ERCP), further fuels this segment's growth.

- Key Drivers for Gastroenterology Dominance:

- High Disease Burden: A significant number of Swedish citizens suffer from digestive health issues, driving demand for diagnostic and therapeutic endoscopy.

- Technological Advancements: Innovations in therapeutic endoscopic devices for polyp removal, stent placement, and tumor ablation are expanding the scope of gastroenterological procedures.

- Screening Programs: Colorectal cancer screening programs, which heavily rely on colonoscopies, contribute to sustained demand.

- Minimally Invasive Procedures: Gastroenterologists increasingly prefer endoscopic interventions over traditional surgery due to faster recovery and lower complication rates.

Within the Type of Device segmentation, Endoscopes are expected to represent the largest share. This includes flexible and rigid endoscopes used across various medical specialties. The continuous development of higher resolution, smaller diameter, and multi-functional endoscopes is a key driver for this segment.

- Key Drivers for Endoscope Dominance:

- Versatility: Endoscopes are fundamental to a wide range of diagnostic and therapeutic procedures in multiple medical fields.

- Technological Evolution: Ongoing improvements in optics, imaging sensors, and material science lead to the development of more advanced and user-friendly endoscopes.

- Demand for Diagnostic Accuracy: The need for precise visualization drives the adoption of high-definition and 4K endoscopes.

Pulmonology is another significant application segment, driven by the rising incidence of respiratory diseases like COPD, asthma, and lung cancer. Advanced bronchoscopes and related instruments are crucial for diagnosis, biopsy, and treatment of these conditions. The increasing use of minimally invasive techniques for lung nodule localization and treatment is also contributing to this segment's growth.

- Key Drivers for Pulmonology Growth:

- Prevalence of Respiratory Illnesses: Sweden faces a notable burden of lung diseases, necessitating frequent diagnostic bronchoscopies.

- Early Cancer Detection: Bronchoscopy plays a vital role in the early diagnosis of lung cancer, leading to better patient outcomes.

- Therapeutic Bronchoscopy: Advancements in techniques for airway management, foreign body removal, and stent insertion are expanding the therapeutic applications of bronchoscopy.

The Visualization Equipment segment is crucial, encompassing cameras, light sources, and monitors that are integral to any endoscopic procedure. The demand for high-definition and 3D visualization systems is growing as healthcare providers seek enhanced visual feedback during complex interventions.

- Key Drivers for Visualization Equipment Growth:

- Image Quality: Superior visualization directly impacts diagnostic accuracy and surgical precision.

- Integration: The trend towards integrated endoscopy systems that combine visualization, recording, and data management drives demand for advanced equipment.

- Technological Convergence: The integration of AI and augmented reality in visualization systems is a future growth area.

While Orthopedic Surgery, Cardiology, ENT Surgery, Gynecology, and Neurology represent smaller but growing segments, their importance is increasing due to the expanding applications of minimally invasive endoscopy in these fields. For instance, arthroscopy in orthopedics, cardiac catheterization in cardiology, and neuroendoscopy are all witnessing technological advancements and increased adoption.

Sweden Endoscopy Devices Market Product Developments

Product developments in the Sweden Endoscopy Devices Market are focused on enhancing imaging capabilities, improving procedural efficiency, and increasing patient safety. Innovations include high-definition and 4K visualization systems, AI-powered diagnostic tools for automated lesion detection, and advanced steerable scopes for navigating complex anatomy. The development of smaller, more flexible endoscopes for minimally invasive access in specialized fields like neurology and cardiology is a key trend. Furthermore, the introduction of single-use endoscopes addresses concerns about cross-contamination and reprocessing efficiency, offering a competitive advantage in infection control.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Sweden Endoscopy Devices Market across several key segments. The Type of Device segmentation includes Endoscopes, Endoscopic Operative Devices, and Visualization Equipment. The Application segmentation covers Gastroenterology, Pulmonology, Orthopedic Surgery, Cardiology, ENT Surgery, Gynecology, Neurology, and Other Applications. Market sizes, growth projections, and competitive dynamics are detailed for each segment.

For Endoscopes, growth is driven by demand for higher resolution imaging and advanced functionalities, with projections indicating a continued upward trend due to their fundamental role in diagnostics and therapeutics. Endoscopic Operative Devices, including instruments for biopsy, polypectomy, and tumor removal, are experiencing robust growth due to the increasing preference for minimally invasive surgical interventions. Visualization Equipment is expanding with the adoption of high-definition and AI-integrated systems, offering enhanced diagnostic accuracy and procedural guidance.

In the Application segments, Gastroenterology remains the largest, driven by the high prevalence of digestive diseases and routine screening programs. Pulmonology follows, with rising respiratory illnesses and advancements in bronchoscopic techniques fueling its growth. Orthopedic Surgery is seeing increased adoption of arthroscopy, while Cardiology benefits from advancements in cardiac catheterization and minimally invasive cardiac procedures. ENT Surgery, Gynecology, and Neurology are expanding segments with growing utilization of specialized endoscopic instruments for minimally invasive treatments.

Key Drivers of Sweden Endoscopy Devices Market Growth

Several key drivers are propelling the growth of the Sweden Endoscopy Devices Market. Technologically, the continuous innovation in imaging resolution, miniaturization of devices, and integration of AI for enhanced diagnostics are paramount. Economically, increased healthcare expenditure, favorable reimbursement policies for minimally invasive procedures, and a growing disposable income for healthcare services contribute significantly. From a regulatory standpoint, supportive government policies aimed at improving healthcare access and the adoption of advanced medical technologies foster market expansion. The increasing prevalence of chronic diseases, such as gastrointestinal disorders and respiratory ailments, directly translates into higher demand for diagnostic and therapeutic endoscopic procedures.

Challenges in the Sweden Endoscopy Devices Market Sector

Despite strong growth prospects, the Sweden Endoscopy Devices Market faces several challenges. High acquisition costs for advanced endoscopic systems can be a barrier for smaller healthcare facilities, impacting market penetration. Stringent regulatory approval processes for new medical devices, although ensuring safety, can lead to extended timelines for market introduction. The need for extensive training for healthcare professionals to effectively utilize complex endoscopic equipment and software presents an ongoing challenge. Furthermore, competition from emerging markets and the constant need for technological upgrades to remain competitive put pressure on manufacturers' profit margins.

Emerging Opportunities in Sweden Endoscopy Devices Market

The Sweden Endoscopy Devices Market presents numerous emerging opportunities. The growing demand for robotic-assisted endoscopy offers a significant growth avenue, promising enhanced precision and reduced invasiveness. The increasing adoption of single-use endoscopes addresses infection control concerns and streamlines reprocessing, opening up new market segments. The integration of Artificial Intelligence (AI) and machine learning in endoscopic imaging for automated disease detection and decision support represents a transformative opportunity. Furthermore, the expansion of home healthcare and telemedicine services is creating opportunities for remote diagnostic capabilities and portable endoscopic devices.

Leading Players in the Sweden Endoscopy Devices Market Market

- Fujifilm Holdings Corporation

- KARL STORZ SE & Co KG

- Johnson and Johnson

- Medtronic PLC

- PENTAX Medical

- Richard Wolf GmbH

- Boston Scientific Corporation

Key Developments in Sweden Endoscopy Devices Market Industry

- October 2023: Creo Medical planned to launch its Speedboat UltraSlim device, in early 2024 following guidance from the EU regulator.

- June 2022: Getinge released an updated version of the ED-Flow automated endoscope reprocessor featuring a higher level of digital connectivity and data management to Getinge's endoscope reprocessing customers, resulting in improved uptime and increased productivity.

Strategic Outlook for Sweden Endoscopy Devices Market Market

The strategic outlook for the Sweden Endoscopy Devices Market is highly positive, driven by continuous technological advancements and a robust healthcare infrastructure. The focus on minimally invasive procedures and early disease detection will remain a key growth catalyst. Companies that invest in AI integration, robotic-assisted endoscopy, and single-use device solutions are expected to capture significant market share. Strategic partnerships and collaborations with healthcare providers will be crucial for understanding evolving clinical needs and tailoring product offerings. The growing demand for integrated digital solutions for data management and remote diagnostics will also shape future market strategies, ensuring sustained growth and innovation.

Sweden Endoscopy Devices Market Segmentation

-

1. Type of Device

- 1.1. Endoscopes

- 1.2. Endoscopic Operative Device

- 1.3. Visualization Equipment

-

2. Application

- 2.1. Gastroenterology

- 2.2. Pulmonology

- 2.3. Orthopedic Surgery

- 2.4. Cardiology

- 2.5. ENT Surgery

- 2.6. Gynecology

- 2.7. Neurology

- 2.8. Other Applications

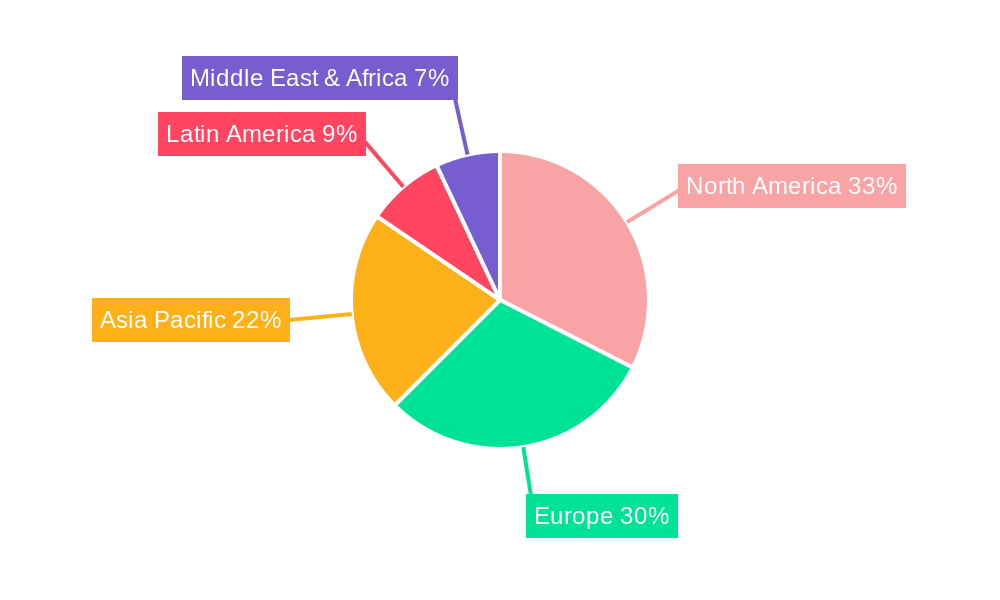

Sweden Endoscopy Devices Market Segmentation By Geography

- 1. Sweden

Sweden Endoscopy Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.84% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Endoscopy for Treatment and Diagnosis; Growing Preference for Minimally-invasive Surgeries; Technological Advancements Leading to Enhanced Applications

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Technicians; Infections Caused by Few Endoscopes

- 3.4. Market Trends

- 3.4.1. Visualization Equipment Segment is Expected to Witness a Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sweden Endoscopy Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 5.1.1. Endoscopes

- 5.1.2. Endoscopic Operative Device

- 5.1.3. Visualization Equipment

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Gastroenterology

- 5.2.2. Pulmonology

- 5.2.3. Orthopedic Surgery

- 5.2.4. Cardiology

- 5.2.5. ENT Surgery

- 5.2.6. Gynecology

- 5.2.7. Neurology

- 5.2.8. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Sweden

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Fujifilm Holdings Corporation*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 KARL STORZ SE & Co KG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Johnson and Johnson

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Medtronic PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PENTAX Medical

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Richard Wolf GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Boston Scientific Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Fujifilm Holdings Corporation*List Not Exhaustive

List of Figures

- Figure 1: Sweden Endoscopy Devices Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Sweden Endoscopy Devices Market Share (%) by Company 2024

List of Tables

- Table 1: Sweden Endoscopy Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Sweden Endoscopy Devices Market Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 3: Sweden Endoscopy Devices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Sweden Endoscopy Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Sweden Endoscopy Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Sweden Endoscopy Devices Market Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 7: Sweden Endoscopy Devices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 8: Sweden Endoscopy Devices Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sweden Endoscopy Devices Market?

The projected CAGR is approximately 6.84%.

2. Which companies are prominent players in the Sweden Endoscopy Devices Market?

Key companies in the market include Fujifilm Holdings Corporation*List Not Exhaustive, KARL STORZ SE & Co KG, Johnson and Johnson, Medtronic PLC, PENTAX Medical, Richard Wolf GmbH, Boston Scientific Corporation.

3. What are the main segments of the Sweden Endoscopy Devices Market?

The market segments include Type of Device, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 355.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Endoscopy for Treatment and Diagnosis; Growing Preference for Minimally-invasive Surgeries; Technological Advancements Leading to Enhanced Applications.

6. What are the notable trends driving market growth?

Visualization Equipment Segment is Expected to Witness a Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Skilled Technicians; Infections Caused by Few Endoscopes.

8. Can you provide examples of recent developments in the market?

October 2023: Creo Medical planned to launch its Speedboat UltraSlim device, in early 2024 following guidance from the EU regulator.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sweden Endoscopy Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sweden Endoscopy Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sweden Endoscopy Devices Market?

To stay informed about further developments, trends, and reports in the Sweden Endoscopy Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence