Key Insights

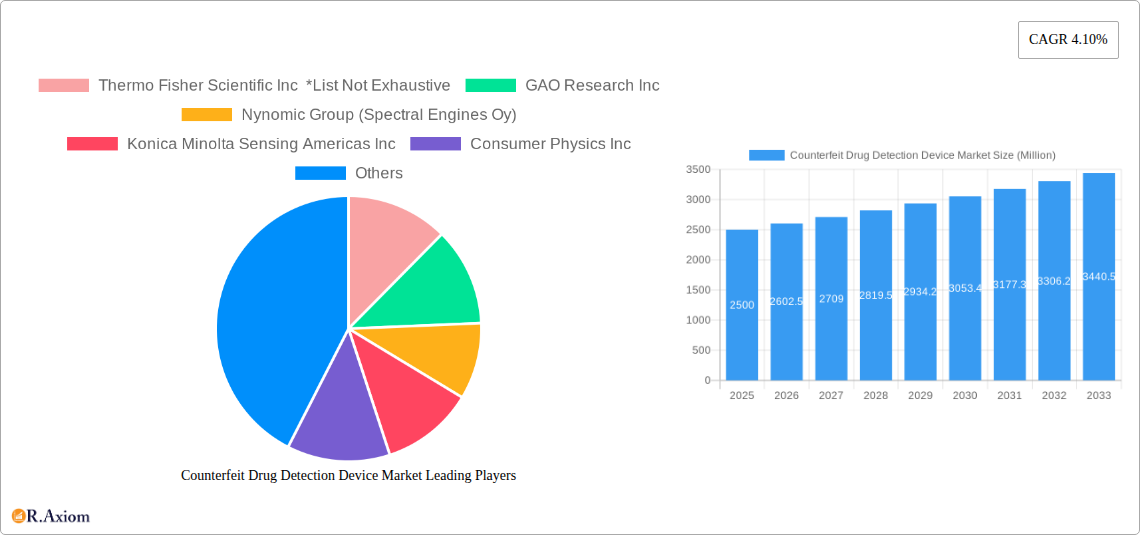

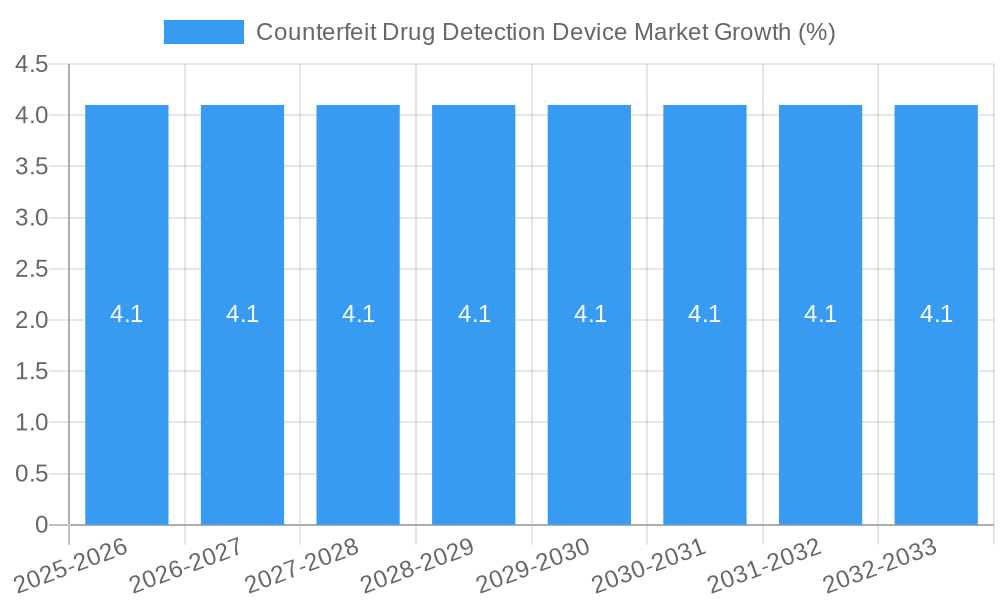

The global Counterfeit Drug Detection Device Market is projected for substantial growth, estimated at USD 2,500 million in 2025 and poised to expand at a Compound Annual Growth Rate (CAGR) of 4.10% through 2033. This upward trajectory is driven by a confluence of critical factors, primarily the escalating global threat of counterfeit pharmaceuticals and the increasing regulatory pressure on governments and pharmaceutical manufacturers to ensure drug authenticity and patient safety. Advancements in spectroscopic technologies, such as Infrared and Near Infrared Spectroscopy, Raman Spectroscopy, and Rapid Chemical Testing, are significantly enhancing detection accuracy and speed, making these devices indispensable for quality control and supply chain integrity. The demand for both benchtop and handheld devices is on the rise, catering to diverse operational needs from laboratory settings to on-site verification.

The market's expansion is further fueled by the growing adoption of these advanced detection solutions across the pharmaceutical value chain, including manufacturing, distribution, and retail. Emerging economies, particularly in the Asia Pacific region, are witnessing a surge in demand due to rising healthcare expenditures and a greater awareness of the perils associated with substandard medicines. While the market is robust, certain restraints such as the high initial cost of sophisticated detection equipment and the need for specialized training for operators could pose challenges. However, ongoing innovation in miniaturization and affordability of technologies like microfluidics and RFID, coupled with strategic collaborations and partnerships among key players, are expected to mitigate these hurdles and propel market growth in the coming years.

This comprehensive report provides an in-depth analysis of the global Counterfeit Drug Detection Device Market, a critical sector driven by the urgent need to combat the pervasive threat of pharmaceutical counterfeiting. The market is projected to witness substantial growth fueled by increasing regulatory scrutiny, advancements in detection technologies, and a rising awareness of the health and economic implications of fake medicines. This report offers actionable insights for stakeholders, including manufacturers, pharmaceutical companies, regulatory bodies, and investors, enabling them to navigate this dynamic landscape effectively.

Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

Counterfeit Drug Detection Device Market Market Concentration & Innovation

The Counterfeit Drug Detection Device Market is characterized by a moderate to high level of concentration, with several key players vying for market share. Innovation is a significant driver, as companies continuously invest in research and development to create more sensitive, accurate, and user-friendly detection solutions. Regulatory frameworks, such as those from the FDA and EMA, are increasingly mandating robust anti-counterfeiting measures, directly impacting market demand. Product substitutes, while present in the form of manual inspection or less sophisticated methods, are gradually being replaced by advanced technological solutions. End-user trends indicate a growing preference for integrated, real-time detection systems that offer end-to-end supply chain visibility. Mergers and acquisitions (M&A) are also shaping the market landscape, with larger entities acquiring innovative startups to expand their technological capabilities and market reach. For instance, in August 2021, Avery Dennison Corporation acquired Vestcom for an investment of USD 1.45 billion, a move aimed at strengthening its branded labeling offerings, which can indirectly benefit counterfeit drug detection through enhanced traceability.

Counterfeit Drug Detection Device Market Industry Trends & Insights

The Counterfeit Drug Detection Device Market is experiencing robust growth, driven by a confluence of factors. The escalating global prevalence of counterfeit and substandard medicines poses a severe threat to public health and represents a significant economic loss for legitimate pharmaceutical manufacturers. This has led to increased pressure from regulatory bodies worldwide to implement stringent measures for drug authenticity verification. Consequently, the demand for advanced detection technologies is on a steep upward trajectory. Technological advancements are at the forefront of this market evolution. Innovations in areas such as Infrared and Near Infrared Spectroscopy, Raman Spectroscopy, Microfluidics, and RFID Technology are enabling the development of highly accurate and rapid detection devices. These technologies allow for the precise identification of chemical compositions, the detection of minute deviations in packaging and labeling, and the tracking of drugs throughout the supply chain, thereby significantly reducing the risk of counterfeit infiltration.

The market penetration of these sophisticated devices is steadily increasing across various segments of the pharmaceutical value chain, from manufacturing plants and distribution centers to pharmacies and even patient-level applications. The compound annual growth rate (CAGR) for the Counterfeit Drug Detection Device Market is estimated to be in the healthy range of 8-10% during the forecast period, reflecting its critical importance and the continuous innovation within the sector. Consumer preferences are also subtly influencing the market, as patients and healthcare providers become more aware of the risks associated with fake drugs and demand greater assurance of product integrity. This heightened awareness is driving the adoption of technologies that can provide verifiable proof of authenticity.

Competitive dynamics within the market are characterized by intense R&D efforts and strategic collaborations. Companies are investing heavily in miniaturizing devices, improving their portability (leading to a rise in Handheld Devices), and enhancing their data analytics capabilities to provide comprehensive supply chain security solutions. The focus is shifting towards solutions that offer not just detection but also prevention and traceability. The increasing complexity of pharmaceutical supply chains, with global sourcing and distribution networks, further amplifies the need for robust counterfeit detection mechanisms. This intricate ecosystem necessitates a multi-faceted approach, combining advanced analytical techniques with secure identification and tracking technologies. The market is thus poised for continued expansion as stakeholders prioritize patient safety and brand integrity.

Dominant Markets & Segments in Counterfeit Drug Detection Device Market

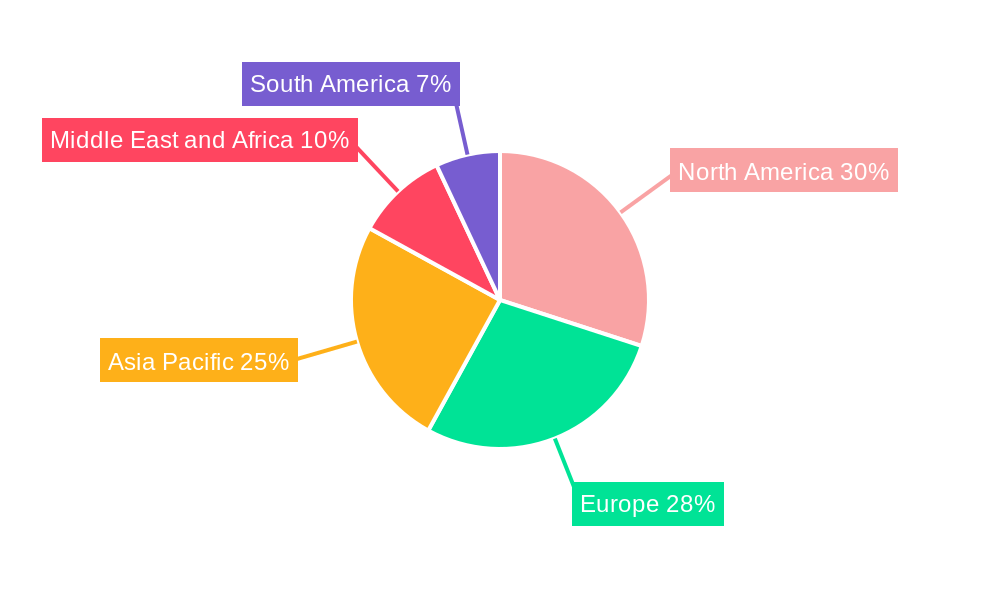

The Counterfeit Drug Detection Device Market exhibits distinct regional dominance and segment leadership, driven by specific economic, regulatory, and technological factors. North America, particularly the United States, currently holds a significant market share due to its stringent regulatory landscape, high pharmaceutical spending, and early adoption of advanced technologies. The presence of major pharmaceutical corporations and a well-established infrastructure for drug manufacturing and distribution further bolster its leadership. European countries also represent a substantial market, with the European Medicines Agency (EMA) playing a crucial role in harmonizing regulations and promoting drug authentication measures.

From a technology perspective, Infrared and Near Infrared Spectroscopy and Raman Spectroscopy are leading segments. These techniques offer non-destructive analysis, enabling rapid and accurate identification of chemical compositions of active pharmaceutical ingredients (APIs) and excipients. Their versatility in analyzing raw materials, finished products, and even identifying adulterants makes them indispensable tools in the fight against counterfeit drugs.

In terms of modality, Handheld Devices are gaining significant traction. Their portability and ease of use allow for on-site and real-time drug verification at various points in the supply chain, from border control and customs to pharmacy shelves and even in remote healthcare settings. This contrasts with Benchtop Devices, which are typically used in laboratory settings for more in-depth analysis and quality control.

Regarding applications, Chemical Composition Detection is a primary driver. Counterfeit drugs often contain incorrect dosages, wrong ingredients, or harmful impurities. Advanced spectroscopic techniques excel at identifying these chemical discrepancies. Packaging and Labeling Detection is another crucial application, as counterfeiters often mimic legitimate packaging. Technologies like RFID and advanced imaging are instrumental in verifying the authenticity of packaging elements, seals, and holographic features.

- Key Drivers of Dominance in North America:

- Strict regulatory mandates from the FDA.

- High volume of pharmaceutical R&D and manufacturing.

- Significant investment in supply chain security solutions.

- Advanced healthcare infrastructure and awareness.

- Key Drivers of Dominance for Spectroscopy Technologies:

- High accuracy and sensitivity in chemical analysis.

- Non-destructive testing capabilities.

- Rapid analysis times crucial for high-throughput environments.

- Established validation protocols for pharmaceutical quality control.

- Key Drivers of Dominance for Handheld Devices:

- Increased demand for on-site and real-time verification.

- Cost-effectiveness compared to laboratory-based analysis for initial screening.

- Facilitation of decentralized drug authenticity checks.

- Growing use in low-resource settings and emerging markets.

The Asia-Pacific region is emerging as a high-growth market, driven by rising pharmaceutical production, increasing health consciousness, and government initiatives to combat counterfeit drugs. Emerging economies in Latin America and the Middle East & Africa are also expected to witness considerable growth as awareness and regulatory frameworks evolve.

Counterfeit Drug Detection Device Market Product Developments

Product developments in the Counterfeit Drug Detection Device Market are characterized by miniaturization, enhanced portability, and integration of advanced analytical capabilities. Companies are focusing on developing devices that can perform rapid, on-site chemical composition analysis and packaging integrity checks. Innovations in Raman Spectroscopy and Near-Infrared (NIR) Spectroscopy are leading to more sensitive and cost-effective handheld instruments capable of identifying drug authenticity with high precision. Furthermore, the integration of RFID Technology into drug packaging and detection systems is offering enhanced supply chain traceability and tamper-evident solutions. These product advancements aim to provide pharmaceutical stakeholders with comprehensive tools to combat the pervasive threat of counterfeit drugs, ensuring patient safety and preserving brand integrity throughout the global supply chain.

Report Scope & Segmentation Analysis

This report comprehensively segments the Counterfeit Drug Detection Device Market to provide granular insights into its diverse landscape. The market is analyzed across key technological segments: Infrared and Near Infrared Spectroscopy, Microfluidic, Rapid Chemical Testing, Raman Spectroscopy, and RFID Technology, alongside Other Technologies. Modalities are categorized into Benchtop Devices and Handheld Devices, reflecting the varying deployment scenarios. Application areas are meticulously detailed, encompassing Chemical Composition analysis and Packaging and Labeling Detection. For each segment, growth projections, estimated market sizes for 2025, and an analysis of competitive dynamics are provided. The Infrared and Near Infrared Spectroscopy segment is expected to witness a CAGR of approximately 9%, driven by its broad applicability in API identification. The RFID Technology segment is projected to grow at a CAGR of around 12%, fueled by its increasing integration into serialization and track-and-trace initiatives. Handheld Devices are anticipated to capture a larger market share due to their portability and on-site verification capabilities.

Key Drivers of Counterfeit Drug Detection Device Market Growth

The growth of the Counterfeit Drug Detection Device Market is primarily propelled by the escalating global incidence of counterfeit and substandard medicines, which poses a severe threat to public health and brand reputation. Stringent regulatory mandates from bodies like the FDA and EMA, enforcing serialization and track-and-trace requirements, are a significant catalyst, compelling pharmaceutical manufacturers and distributors to invest in robust authentication solutions. Technological advancements, particularly in spectroscopic techniques like Raman and NIR, alongside the proliferation of RFID and microfluidic technologies, are enabling more accurate, rapid, and cost-effective detection. Furthermore, increasing awareness among healthcare providers and consumers about the dangers of fake drugs is driving demand for verifiable drug authenticity. The expansion of global pharmaceutical supply chains also necessitates sophisticated detection methods to ensure product integrity across borders.

Challenges in the Counterfeit Drug Detection Device Market Sector

Despite its robust growth, the Counterfeit Drug Detection Device Market faces several challenges. The high cost of advanced detection equipment can be a significant barrier, especially for smaller pharmaceutical companies and healthcare providers in developing economies. The complexity of certain technologies may also require specialized training, leading to operational hurdles. Furthermore, the constantly evolving tactics of counterfeiters necessitate continuous innovation, which can be resource-intensive. Regulatory discrepancies across different regions can create complexities in compliance and market access. Finally, counterfeiters often operate in the grey market, making it difficult to completely eradicate their presence and requiring ongoing vigilance and technological adaptation.

Emerging Opportunities in Counterfeit Drug Detection Device Market

Emerging opportunities in the Counterfeit Drug Detection Device Market are abundant, driven by innovation and evolving market needs. The development of portable, AI-powered, and cloud-connected devices presents a significant avenue for growth, enabling real-time data analysis and remote monitoring of drug authenticity. The expansion of the market into veterinary pharmaceuticals and over-the-counter (OTC) products offers new avenues for revenue. Furthermore, the growing demand for integrated solutions that combine detection with serialization, track-and-trace capabilities, and blockchain technology for enhanced supply chain security represents a substantial opportunity. The increasing focus on personalized medicine and biologics also opens up niches for highly specialized counterfeit detection solutions.

Leading Players in the Counterfeit Drug Detection Device Market Market

- Thermo Fisher Scientific Inc

- GAO Research Inc

- Nynomic Group (Spectral Engines Oy)

- Konica Minolta Sensing Americas Inc

- Consumer Physics Inc

- Bayer AG

- Stratio Inc

- Systech Group Limited

- Rigaku Corporation

Key Developments in Counterfeit Drug Detection Device Market Industry

- February 2022: Avery Dennison Smartrac launched its AD Minidose U9 RAIN RFID inlay for pharmaceutical applications, unlocking critical RFID value for healthcare, pharmacies, and laboratory asset management. This development enhances supply chain visibility and counterfeit prevention through advanced tagging.

- August 2021: Avery Dennison Corporation acquired Vestcom for an investment of USD 1.45 billion. The acquisition aims to expand the company's branded labeling offerings for the retail and consumer packaged goods industries, indirectly supporting counterfeit detection through improved product authentication and traceability.

Strategic Outlook for Counterfeit Drug Detection Device Market Market

The strategic outlook for the Counterfeit Drug Detection Device Market remains exceptionally positive, driven by an unwavering commitment to patient safety and the integrity of the pharmaceutical supply chain. Future market growth will be catalyzed by the ongoing adoption of advanced spectroscopic and RFID technologies, coupled with the increasing demand for integrated, end-to-end solutions that offer both detection and prevention. Strategic collaborations between technology providers, pharmaceutical manufacturers, and regulatory bodies will be crucial in addressing the evolving challenges posed by counterfeiters. Investments in R&D focused on developing more sophisticated, user-friendly, and cost-effective devices, particularly for emerging markets, will unlock significant potential. The market is expected to witness a continuous rise in the deployment of handheld and portable devices, enabling wider accessibility and real-time verification across all stages of drug distribution.

Counterfeit Drug Detection Device Market Segmentation

-

1. Technology

- 1.1. Infrared and Near Infrared Spectroscopy

- 1.2. Microfluidic

- 1.3. Rapid Chemical Testing

- 1.4. Raman Spectroscopy

- 1.5. RFID Technology

- 1.6. Other Technologies

-

2. Modality

- 2.1. Benchtop Devices

- 2.2. Handheld Devices

-

3. Application

- 3.1. Chemical Composition

- 3.2. Packaging and Labeling Detection

Counterfeit Drug Detection Device Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Counterfeit Drug Detection Device Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Emphasis on Advanced Surveillance in the Supply Chain; Shifting Trend from Packaging Security to On-dosage Security; Supportive Government Legislation

- 3.3. Market Restrains

- 3.3.1. Low Awareness of Counterfeit Drugs

- 3.4. Market Trends

- 3.4.1. RFID Technology Segment Dominates the Market and is Expected to Continue to do so During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Counterfeit Drug Detection Device Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Infrared and Near Infrared Spectroscopy

- 5.1.2. Microfluidic

- 5.1.3. Rapid Chemical Testing

- 5.1.4. Raman Spectroscopy

- 5.1.5. RFID Technology

- 5.1.6. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Modality

- 5.2.1. Benchtop Devices

- 5.2.2. Handheld Devices

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Chemical Composition

- 5.3.2. Packaging and Labeling Detection

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Counterfeit Drug Detection Device Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Infrared and Near Infrared Spectroscopy

- 6.1.2. Microfluidic

- 6.1.3. Rapid Chemical Testing

- 6.1.4. Raman Spectroscopy

- 6.1.5. RFID Technology

- 6.1.6. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by Modality

- 6.2.1. Benchtop Devices

- 6.2.2. Handheld Devices

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Chemical Composition

- 6.3.2. Packaging and Labeling Detection

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Counterfeit Drug Detection Device Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Infrared and Near Infrared Spectroscopy

- 7.1.2. Microfluidic

- 7.1.3. Rapid Chemical Testing

- 7.1.4. Raman Spectroscopy

- 7.1.5. RFID Technology

- 7.1.6. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by Modality

- 7.2.1. Benchtop Devices

- 7.2.2. Handheld Devices

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Chemical Composition

- 7.3.2. Packaging and Labeling Detection

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Counterfeit Drug Detection Device Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Infrared and Near Infrared Spectroscopy

- 8.1.2. Microfluidic

- 8.1.3. Rapid Chemical Testing

- 8.1.4. Raman Spectroscopy

- 8.1.5. RFID Technology

- 8.1.6. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by Modality

- 8.2.1. Benchtop Devices

- 8.2.2. Handheld Devices

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Chemical Composition

- 8.3.2. Packaging and Labeling Detection

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Middle East and Africa Counterfeit Drug Detection Device Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Infrared and Near Infrared Spectroscopy

- 9.1.2. Microfluidic

- 9.1.3. Rapid Chemical Testing

- 9.1.4. Raman Spectroscopy

- 9.1.5. RFID Technology

- 9.1.6. Other Technologies

- 9.2. Market Analysis, Insights and Forecast - by Modality

- 9.2.1. Benchtop Devices

- 9.2.2. Handheld Devices

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Chemical Composition

- 9.3.2. Packaging and Labeling Detection

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. South America Counterfeit Drug Detection Device Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Infrared and Near Infrared Spectroscopy

- 10.1.2. Microfluidic

- 10.1.3. Rapid Chemical Testing

- 10.1.4. Raman Spectroscopy

- 10.1.5. RFID Technology

- 10.1.6. Other Technologies

- 10.2. Market Analysis, Insights and Forecast - by Modality

- 10.2.1. Benchtop Devices

- 10.2.2. Handheld Devices

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Chemical Composition

- 10.3.2. Packaging and Labeling Detection

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. North America Counterfeit Drug Detection Device Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Counterfeit Drug Detection Device Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Counterfeit Drug Detection Device Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Counterfeit Drug Detection Device Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Counterfeit Drug Detection Device Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Thermo Fisher Scientific Inc *List Not Exhaustive

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 GAO Research Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Nynomic Group (Spectral Engines Oy)

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Konica Minolta Sensing Americas Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Consumer Physics Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Bayer AG

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Stratio Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Systech Group Limited

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Rigaku Corporation

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.1 Thermo Fisher Scientific Inc *List Not Exhaustive

List of Figures

- Figure 1: Global Counterfeit Drug Detection Device Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Counterfeit Drug Detection Device Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Counterfeit Drug Detection Device Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Counterfeit Drug Detection Device Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Counterfeit Drug Detection Device Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Counterfeit Drug Detection Device Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Counterfeit Drug Detection Device Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Counterfeit Drug Detection Device Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Counterfeit Drug Detection Device Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Counterfeit Drug Detection Device Market Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Counterfeit Drug Detection Device Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Counterfeit Drug Detection Device Market Revenue (Million), by Technology 2024 & 2032

- Figure 13: North America Counterfeit Drug Detection Device Market Revenue Share (%), by Technology 2024 & 2032

- Figure 14: North America Counterfeit Drug Detection Device Market Revenue (Million), by Modality 2024 & 2032

- Figure 15: North America Counterfeit Drug Detection Device Market Revenue Share (%), by Modality 2024 & 2032

- Figure 16: North America Counterfeit Drug Detection Device Market Revenue (Million), by Application 2024 & 2032

- Figure 17: North America Counterfeit Drug Detection Device Market Revenue Share (%), by Application 2024 & 2032

- Figure 18: North America Counterfeit Drug Detection Device Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Counterfeit Drug Detection Device Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Counterfeit Drug Detection Device Market Revenue (Million), by Technology 2024 & 2032

- Figure 21: Europe Counterfeit Drug Detection Device Market Revenue Share (%), by Technology 2024 & 2032

- Figure 22: Europe Counterfeit Drug Detection Device Market Revenue (Million), by Modality 2024 & 2032

- Figure 23: Europe Counterfeit Drug Detection Device Market Revenue Share (%), by Modality 2024 & 2032

- Figure 24: Europe Counterfeit Drug Detection Device Market Revenue (Million), by Application 2024 & 2032

- Figure 25: Europe Counterfeit Drug Detection Device Market Revenue Share (%), by Application 2024 & 2032

- Figure 26: Europe Counterfeit Drug Detection Device Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Counterfeit Drug Detection Device Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Counterfeit Drug Detection Device Market Revenue (Million), by Technology 2024 & 2032

- Figure 29: Asia Pacific Counterfeit Drug Detection Device Market Revenue Share (%), by Technology 2024 & 2032

- Figure 30: Asia Pacific Counterfeit Drug Detection Device Market Revenue (Million), by Modality 2024 & 2032

- Figure 31: Asia Pacific Counterfeit Drug Detection Device Market Revenue Share (%), by Modality 2024 & 2032

- Figure 32: Asia Pacific Counterfeit Drug Detection Device Market Revenue (Million), by Application 2024 & 2032

- Figure 33: Asia Pacific Counterfeit Drug Detection Device Market Revenue Share (%), by Application 2024 & 2032

- Figure 34: Asia Pacific Counterfeit Drug Detection Device Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific Counterfeit Drug Detection Device Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Counterfeit Drug Detection Device Market Revenue (Million), by Technology 2024 & 2032

- Figure 37: Middle East and Africa Counterfeit Drug Detection Device Market Revenue Share (%), by Technology 2024 & 2032

- Figure 38: Middle East and Africa Counterfeit Drug Detection Device Market Revenue (Million), by Modality 2024 & 2032

- Figure 39: Middle East and Africa Counterfeit Drug Detection Device Market Revenue Share (%), by Modality 2024 & 2032

- Figure 40: Middle East and Africa Counterfeit Drug Detection Device Market Revenue (Million), by Application 2024 & 2032

- Figure 41: Middle East and Africa Counterfeit Drug Detection Device Market Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East and Africa Counterfeit Drug Detection Device Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East and Africa Counterfeit Drug Detection Device Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: South America Counterfeit Drug Detection Device Market Revenue (Million), by Technology 2024 & 2032

- Figure 45: South America Counterfeit Drug Detection Device Market Revenue Share (%), by Technology 2024 & 2032

- Figure 46: South America Counterfeit Drug Detection Device Market Revenue (Million), by Modality 2024 & 2032

- Figure 47: South America Counterfeit Drug Detection Device Market Revenue Share (%), by Modality 2024 & 2032

- Figure 48: South America Counterfeit Drug Detection Device Market Revenue (Million), by Application 2024 & 2032

- Figure 49: South America Counterfeit Drug Detection Device Market Revenue Share (%), by Application 2024 & 2032

- Figure 50: South America Counterfeit Drug Detection Device Market Revenue (Million), by Country 2024 & 2032

- Figure 51: South America Counterfeit Drug Detection Device Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Counterfeit Drug Detection Device Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Counterfeit Drug Detection Device Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 3: Global Counterfeit Drug Detection Device Market Revenue Million Forecast, by Modality 2019 & 2032

- Table 4: Global Counterfeit Drug Detection Device Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Global Counterfeit Drug Detection Device Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Counterfeit Drug Detection Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Counterfeit Drug Detection Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Europe Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Counterfeit Drug Detection Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: India Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Australia Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: South Korea Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia Pacific Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Counterfeit Drug Detection Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: GCC Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: South Africa Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of Middle East and Africa Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Counterfeit Drug Detection Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Brazil Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Counterfeit Drug Detection Device Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 33: Global Counterfeit Drug Detection Device Market Revenue Million Forecast, by Modality 2019 & 2032

- Table 34: Global Counterfeit Drug Detection Device Market Revenue Million Forecast, by Application 2019 & 2032

- Table 35: Global Counterfeit Drug Detection Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: United States Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Canada Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Mexico Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Counterfeit Drug Detection Device Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 40: Global Counterfeit Drug Detection Device Market Revenue Million Forecast, by Modality 2019 & 2032

- Table 41: Global Counterfeit Drug Detection Device Market Revenue Million Forecast, by Application 2019 & 2032

- Table 42: Global Counterfeit Drug Detection Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Germany Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: United Kingdom Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: France Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Italy Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Spain Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Europe Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Counterfeit Drug Detection Device Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 50: Global Counterfeit Drug Detection Device Market Revenue Million Forecast, by Modality 2019 & 2032

- Table 51: Global Counterfeit Drug Detection Device Market Revenue Million Forecast, by Application 2019 & 2032

- Table 52: Global Counterfeit Drug Detection Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: China Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Japan Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: India Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Australia Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: South Korea Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Asia Pacific Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Global Counterfeit Drug Detection Device Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 60: Global Counterfeit Drug Detection Device Market Revenue Million Forecast, by Modality 2019 & 2032

- Table 61: Global Counterfeit Drug Detection Device Market Revenue Million Forecast, by Application 2019 & 2032

- Table 62: Global Counterfeit Drug Detection Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 63: GCC Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: South Africa Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Rest of Middle East and Africa Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Global Counterfeit Drug Detection Device Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 67: Global Counterfeit Drug Detection Device Market Revenue Million Forecast, by Modality 2019 & 2032

- Table 68: Global Counterfeit Drug Detection Device Market Revenue Million Forecast, by Application 2019 & 2032

- Table 69: Global Counterfeit Drug Detection Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 70: Brazil Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: Argentina Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Rest of South America Counterfeit Drug Detection Device Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Counterfeit Drug Detection Device Market?

The projected CAGR is approximately 4.10%.

2. Which companies are prominent players in the Counterfeit Drug Detection Device Market?

Key companies in the market include Thermo Fisher Scientific Inc *List Not Exhaustive, GAO Research Inc, Nynomic Group (Spectral Engines Oy), Konica Minolta Sensing Americas Inc, Consumer Physics Inc, Bayer AG, Stratio Inc, Systech Group Limited, Rigaku Corporation.

3. What are the main segments of the Counterfeit Drug Detection Device Market?

The market segments include Technology, Modality, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Emphasis on Advanced Surveillance in the Supply Chain; Shifting Trend from Packaging Security to On-dosage Security; Supportive Government Legislation.

6. What are the notable trends driving market growth?

RFID Technology Segment Dominates the Market and is Expected to Continue to do so During the Forecast Period.

7. Are there any restraints impacting market growth?

Low Awareness of Counterfeit Drugs.

8. Can you provide examples of recent developments in the market?

In February 2022, Avery Dennison Smartrac launched its AD Minidose U9 RAIN RFID inlay for pharmaceutical applications, unlocking critical RFID value for healthcare, pharmacies, and laboratory asset management.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Counterfeit Drug Detection Device Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Counterfeit Drug Detection Device Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Counterfeit Drug Detection Device Market?

To stay informed about further developments, trends, and reports in the Counterfeit Drug Detection Device Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence