Key Insights

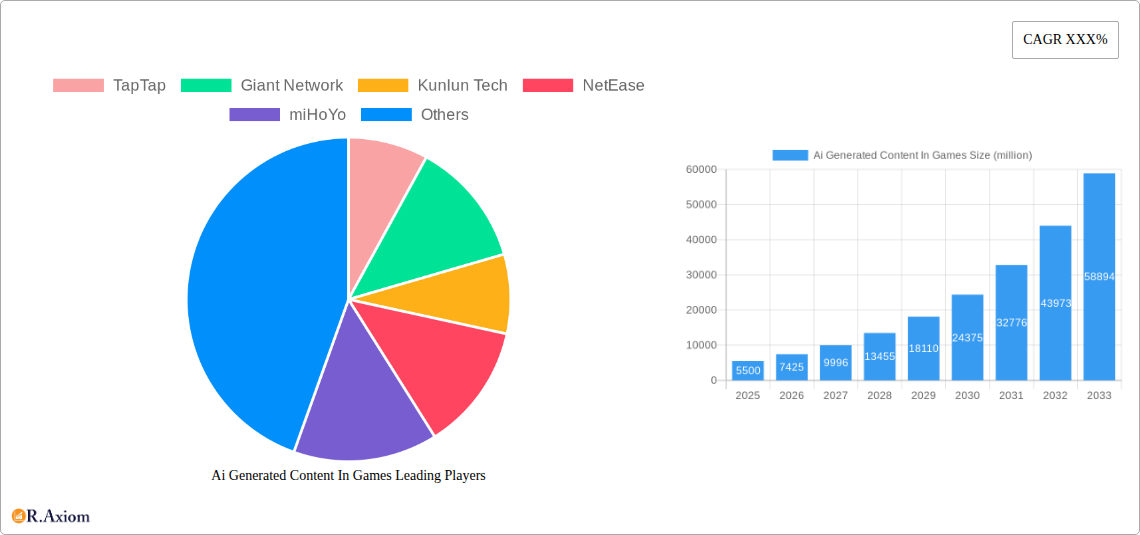

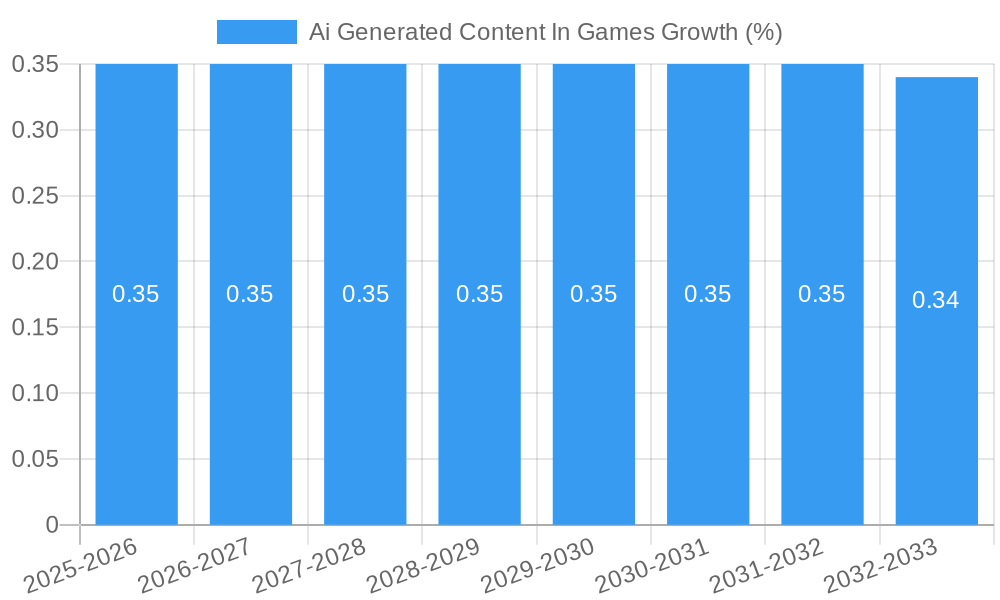

The AI-Generated Content in Games market is poised for substantial growth, projected to reach approximately $5,500 million by 2025, with a Compound Annual Growth Rate (CAGR) of around 35% anticipated from 2025 to 2033. This robust expansion is primarily fueled by the increasing demand for diverse and immersive gaming experiences, coupled with advancements in AI technologies that enable efficient and cost-effective content creation. Key drivers include the burgeoning popularity of genres like role-playing games (RPGs) and open-world titles, which inherently benefit from procedural generation for vast environments and dynamic quests. Furthermore, the integration of AI in game asset generation, from character models to textures, is significantly accelerating development pipelines and reducing production costs for game studios of all sizes. The trend towards personalized and adaptive gaming, where AI dynamically adjusts content based on player behavior, is also a major growth catalyst.

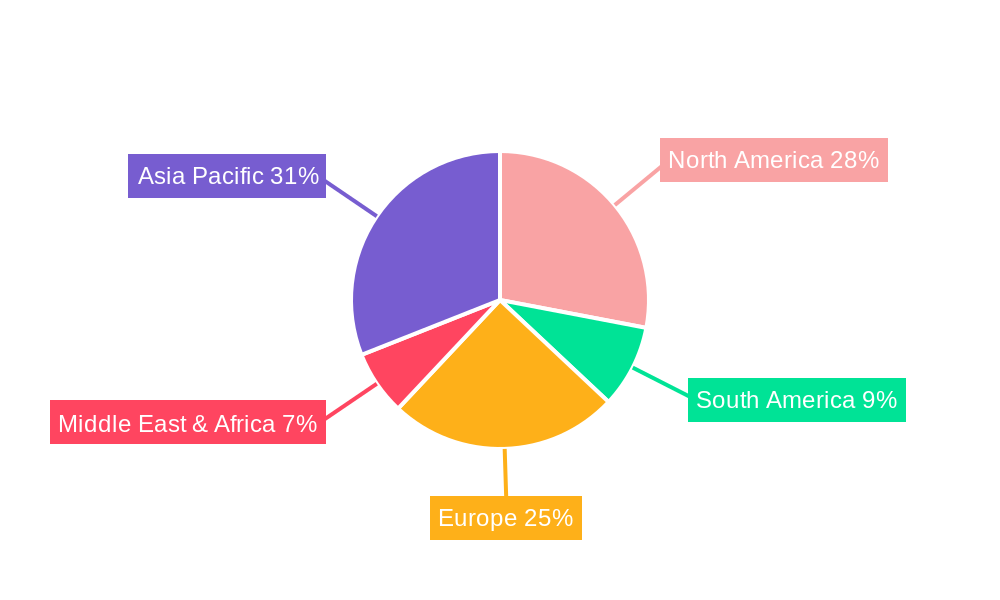

While the market benefits from significant tailwinds, certain restraints may temper its pace. The current limitations in AI's ability to fully replicate human creativity and nuanced storytelling in complex game narratives, alongside the initial investment required for sophisticated AI tools and talent, present hurdles. However, ongoing research and development are rapidly addressing these challenges. The market is segmenting into distinct areas, with Game Character Generation and Game Asset Generation emerging as dominant applications. Procedural Content Generation, particularly for game levels, is another significant segment experiencing rapid adoption. Geographically, Asia Pacific, led by China and Japan, is expected to be a major powerhouse due to its massive gaming market and early adoption of advanced technologies, while North America and Europe will continue to be substantial contributors driven by established gaming ecosystems and strong R&D investment. Companies like Tencent, NetEase, and miHoYo are at the forefront, leveraging AI to innovate and expand their offerings.

This in-depth market research report provides a thorough analysis of the AI Generated Content in Games sector, covering its current landscape and projecting future growth through 2033. This report is essential for understanding the transformative impact of artificial intelligence on game development and content creation, offering actionable insights for stakeholders including developers, publishers, technology providers, and investors. We meticulously examine market dynamics, innovation trends, competitive strategies, and the emerging opportunities that are shaping the future of interactive entertainment.

AI Generated Content in Games Market Concentration & Innovation

The AI Generated Content in Games market is characterized by a dynamic interplay of established gaming giants and emerging AI technology providers, indicating a moderate to high market concentration. Key players like Tencent, NetEase, and miHoYo, with their extensive market presence and substantial R&D investments, are driving significant innovation in AI-powered content creation. Steam, as a dominant distribution platform, also influences market trends. Emerging AI companies such as Promethean AI, Scenario, PixelVibe, and Ludo AI are introducing novel solutions for Game Character Generation and Game Asset Generation, intensifying the competitive landscape. Innovation is primarily driven by advancements in generative adversarial networks (GANs), diffusion models, and reinforcement learning, enabling more sophisticated and efficient content creation workflows. Regulatory frameworks are still evolving, with initial focus on intellectual property rights and ethical AI usage in game development. Product substitutes, such as traditional manual content creation and asset marketplaces, are increasingly being augmented or replaced by AI-generated solutions, demonstrating a clear shift in industry practices. End-user trends show a growing demand for more diverse, personalized, and dynamically generated game experiences, pushing developers to adopt AI solutions. Mergers and acquisitions (M&A) activities are anticipated to increase as larger companies seek to integrate cutting-edge AI capabilities and smaller innovators aim for scalability. The estimated value of M&A deals in this sector is projected to reach several hundred million dollars within the forecast period.

AI Generated Content in Games Industry Trends & Insights

The AI Generated Content in Games market is poised for exponential growth, driven by a confluence of technological advancements, evolving player expectations, and strategic industry investments. The base year of 2025 marks a critical inflection point where AI-generated content is transitioning from a niche application to a mainstream development tool. The Compound Annual Growth Rate (CAGR) for this market is projected to be robust, estimated at xx% over the forecast period of 2025–2033. This surge is fueled by the increasing demand for scalable and cost-effective content creation solutions, especially in the era of live-service games and expansive open-world environments. Technological disruptions, including advancements in natural language processing (NLP) for dialogue generation, sophisticated procedural content generation (PCG) algorithms for environment and level design, and highly realistic character and asset creation tools, are fundamentally altering game development pipelines. Consumer preferences are increasingly leaning towards highly personalized and unique gameplay experiences, which AI-generated content is uniquely positioned to deliver. This includes adaptive narratives, dynamic difficulty adjustments, and procedurally generated quests tailored to individual player actions. Competitive dynamics are intensifying as both established AAA developers and independent studios leverage AI to gain a competitive edge. Companies are investing heavily in AI research and development, fostering in-house AI teams and partnering with specialized AI solution providers. The market penetration of AI-generated content tools is rapidly expanding, moving beyond simple asset generation to encompass complex gameplay mechanics and narrative elements. The historical period of 2019–2024 witnessed early experimentation and proof-of-concept applications of AI in games, laying the groundwork for the rapid adoption seen from the base year onwards. The market is expected to witness significant breakthroughs in real-time AI content generation, enabling dynamic and responsive game worlds that evolve with player interaction. Furthermore, the integration of AI in game testing and quality assurance is also a growing trend, ensuring more polished and bug-free releases. The economic benefits of reduced development cycles and operational costs are also significant drivers for widespread adoption.

Dominant Markets & Segments in AI Generated Content in Games

The AI Generated Content in Games market exhibits significant dominance across specific regions and application segments. North America, particularly the United States, is a leading region due to its well-established gaming industry, high adoption rate of advanced technologies, and substantial venture capital investment in AI startups. The country’s strong infrastructure for research and development in artificial intelligence further solidifies its leading position.

Application Dominance:

- Game Asset Generation: This segment currently holds the largest market share and is projected to continue its dominance throughout the forecast period.

- Key Drivers: The immense demand for a wide variety of in-game assets, from character models and textures to environmental props and animations, makes AI-driven generation highly attractive. The ability to rapidly prototype and iterate on asset designs significantly accelerates the development process, a critical factor for both large studios and independent developers. Companies like Scenario and PixelVibe are making substantial contributions to this segment.

- Game Character Generation: This segment is experiencing rapid growth and is anticipated to become a major market driver.

- Key Drivers: Advancements in AI models have enabled the creation of increasingly realistic and diverse characters with unique features, backstories, and animations. This addresses the industry's need for more inclusive and visually compelling character diversity. Promethean AI and Ludo AI are at the forefront of this innovation.

- Others (Application): This segment, while currently smaller, encompasses areas like AI-assisted narrative generation, dialogue systems, and adaptive music composition, all of which are poised for significant future growth.

Type Dominance:

- Procedural Content Generation (PCG): PCG techniques, enhanced by AI, are a cornerstone of modern game development, particularly for creating vast and explorable game worlds.

- Key Drivers: AI’s ability to generate complex and varied game levels, quests, and environments procedurally offers unparalleled scalability and replayability. This is crucial for open-world games and titles aiming for extensive exploration. The integration of AI with existing PCG frameworks allows for more coherent and engaging world generation.

- Game Level Generation: This is a direct beneficiary of AI-powered PCG, enabling faster creation of intricate and functional game levels.

- Key Drivers: The efficiency gained in designing complex level layouts, puzzles, and enemy placements significantly reduces development time and resources. AI can also optimize levels for player flow and difficulty, leading to better gameplay experiences.

- Others (Type): This category includes AI-driven game balancing, AI-powered enemy behavior, and dynamic difficulty adjustment systems, all of which contribute to a more engaging and responsive player experience.

Economic policies that encourage technological innovation and investment in the gaming sector, coupled with robust digital infrastructure, are critical facilitators of this dominance. The presence of major game development hubs and a skilled workforce further contribute to the leading position of regions and segments heavily invested in AI-generated content.

AI Generated Content in Games Product Developments

Product innovations in AI Generated Content in Games are rapidly evolving, focusing on democratizing complex creation tools and enhancing realism and efficiency. Generative AI models are increasingly capable of producing high-fidelity game assets, from character concepts and 3D models to textures and environments, with minimal human input. This results in significant time and cost savings for developers. Furthermore, AI is being integrated into tools for procedural content generation, allowing for the creation of vast, unique, and dynamic game worlds with unprecedented scalability. AI-powered narrative engines and dialogue generation systems are also emerging, promising more immersive and responsive storytelling experiences. The competitive advantage lies in the ability of these products to streamline development pipelines, enable greater creative exploration, and deliver more personalized player experiences.

Report Scope & Segmentation Analysis

This report meticulously segments the AI Generated Content in Games market to provide granular insights into its various facets. The analysis covers the following key segmentations:

Application Segments:

- Game Character Generation: This segment focuses on AI’s role in creating unique and diverse character models, animations, and backstories. Growth is projected to be substantial, with an estimated market size of several hundred million dollars by 2033, driven by the demand for personalized player avatars and richer NPC experiences. Competitive dynamics are intense, with many startups vying for market share.

- Game Asset Generation: Encompassing the creation of environmental assets, props, textures, and UI elements, this segment is expected to maintain its leading position. Market size is projected to exceed one billion dollars by 2033, fueled by the continuous need for diverse in-game content. Competition is fierce, with established tool providers and new AI-native solutions emerging.

- Others: This segment includes AI applications in narrative generation, dialogue systems, music composition, and AI-driven testing. While currently smaller, it holds significant growth potential, with projected market sizes reaching hundreds of millions of dollars by 2033 as AI capabilities mature in these areas.

Type Segments:

- Game Level Generation: AI’s contribution to creating intricate and engaging game levels, including map design and layout optimization. This segment is expected to grow significantly, with market sizes reaching several hundred million dollars, driven by the demand for vast and replayable game worlds.

- Procedural Content Generation (PCG): This segment focuses on AI-enhanced PCG techniques for generating environments, quests, and other game elements. Its market size is projected to be substantial, exceeding one billion dollars by 2033, as it forms the backbone of many modern open-world and infinite-content games.

- Others: This includes AI applications in areas like game balancing, AI-powered NPCs, and dynamic difficulty adjustments, contributing to a more engaging player experience. This segment is expected to see steady growth, reaching hundreds of millions of dollars by 2033.

Key Drivers of AI Generated Content in Games Growth

The growth of the AI Generated Content in Games market is propelled by a multifaceted set of drivers. Technological Advancements are paramount, with breakthroughs in deep learning, generative adversarial networks (GANs), and diffusion models enabling more realistic, diverse, and efficient content creation. The increasing demand for scalable and cost-effective game development solutions is a significant economic driver, allowing studios to produce more content with fewer resources. Player expectations for personalized and dynamic gameplay experiences are also pushing the adoption of AI-generated content, leading to greater player engagement and retention. Furthermore, advancements in computational power and cloud infrastructure make complex AI model training and deployment more accessible. Regulatory frameworks are slowly evolving to accommodate AI in creative industries, and supportive government initiatives for AI research can also act as catalysts.

Challenges in the AI Generated Content in Games Sector

Despite its promising trajectory, the AI Generated Content in Games sector faces several significant challenges. Intellectual Property (IP) and Copyright Concerns surrounding AI-generated assets and the data used for training models pose a substantial legal and ethical hurdle. Ensuring the quality, coherence, and artistic consistency of AI-generated content remains a technical challenge, often requiring significant human oversight and refinement. The initial investment in AI tools and expertise can be prohibitive for smaller studios, creating a barrier to entry. Potential job displacement concerns within traditional content creation roles also present a socio-economic challenge that needs careful management. The risk of bias in AI-generated content, stemming from biased training data, can lead to undesirable or problematic outputs.

Emerging Opportunities in AI Generated Content in Games

The AI Generated Content in Games market is rife with emerging opportunities. The development of AI-powered tools for real-time content generation presents a significant frontier, enabling truly dynamic and responsive game worlds that evolve with player actions. The integration of AI into non-gaming sectors, such as virtual and augmented reality experiences, offers new avenues for growth. There is a substantial opportunity in developing specialized AI models tailored for specific game genres or art styles, providing highly optimized content creation solutions. The rise of the metaverse creates an insatiable demand for vast and continuously generated virtual environments and assets, making AI-generated content indispensable. Furthermore, the increasing focus on ethical AI development and explainable AI (XAI) in content creation opens opportunities for companies prioritizing transparency and responsible innovation.

Leading Players in the AI Generated Content in Games Market

- Tencent

- NetEase

- miHoYo

- Giant Network

- Kunlun Tech

- XD Inc

- Steam

- Promethean AI

- Scenario

- PixelVibe

- Ludo AI

Key Developments in AI Generated Content in Games Industry

- 2023 - Scenario Launches AI Platform for Game Asset Generation: Introduced advanced AI tools enabling developers to generate unique game assets, significantly reducing production time.

- 2024 - Promethean AI Secures Million in Funding: Raised significant capital to further develop its AI-powered world-building and content creation tools for games.

- 2024 - miHoYo Explores AI for Character Animation: Reports suggest advanced research into AI for generating more fluid and expressive character animations in their upcoming titles.

- 2025 - Steam Integrates AI Content Discovery Tools: Potential for Steam to implement AI-driven features for game asset discovery and creation assistance for developers on its platform.

- 2026 - Ludo AI Partners with Major Publisher for AI-Driven Narrative Design: Collaborative effort to leverage AI for dynamic storytelling and quest generation.

- 2027 - PixelVibe Unveils Real-Time AI Asset Generation Engine: Breakthrough in delivering high-quality assets instantaneously within game development environments.

- 2028 - NetEase Publishes Research on AI-Generated Game Levels: Shared insights into advanced AI techniques for creating complex and engaging game environments.

- 2029 - Giant Network Acquires AI Content Startup: Strategic acquisition to bolster in-house AI capabilities for content creation.

- 2030 - Kunlun Tech Launches AI Ethics Framework for Game Development: Proactive development of guidelines for responsible AI content generation in gaming.

- 2031 - Tencent Invests Heavily in AI for Metaverse Content: Significant capital allocation towards AI-driven content creation for expansive virtual worlds.

- 2032 - Industry-Wide Adoption of AI for Game Asset Generation Reaches xx%: Widespread integration of AI tools across development studios.

- 2033 - Forecasted Dominance of AI-Generated Content in New Game Projects: Projections indicate AI will be a primary content creation method for a majority of new game releases.

Strategic Outlook for AI Generated Content in Games Market

- 2023 - Scenario Launches AI Platform for Game Asset Generation: Introduced advanced AI tools enabling developers to generate unique game assets, significantly reducing production time.

- 2024 - Promethean AI Secures Million in Funding: Raised significant capital to further develop its AI-powered world-building and content creation tools for games.

- 2024 - miHoYo Explores AI for Character Animation: Reports suggest advanced research into AI for generating more fluid and expressive character animations in their upcoming titles.

- 2025 - Steam Integrates AI Content Discovery Tools: Potential for Steam to implement AI-driven features for game asset discovery and creation assistance for developers on its platform.

- 2026 - Ludo AI Partners with Major Publisher for AI-Driven Narrative Design: Collaborative effort to leverage AI for dynamic storytelling and quest generation.

- 2027 - PixelVibe Unveils Real-Time AI Asset Generation Engine: Breakthrough in delivering high-quality assets instantaneously within game development environments.

- 2028 - NetEase Publishes Research on AI-Generated Game Levels: Shared insights into advanced AI techniques for creating complex and engaging game environments.

- 2029 - Giant Network Acquires AI Content Startup: Strategic acquisition to bolster in-house AI capabilities for content creation.

- 2030 - Kunlun Tech Launches AI Ethics Framework for Game Development: Proactive development of guidelines for responsible AI content generation in gaming.

- 2031 - Tencent Invests Heavily in AI for Metaverse Content: Significant capital allocation towards AI-driven content creation for expansive virtual worlds.

- 2032 - Industry-Wide Adoption of AI for Game Asset Generation Reaches xx%: Widespread integration of AI tools across development studios.

- 2033 - Forecasted Dominance of AI-Generated Content in New Game Projects: Projections indicate AI will be a primary content creation method for a majority of new game releases.

Strategic Outlook for AI Generated Content in Games Market

The strategic outlook for the AI Generated Content in Games market is exceptionally bright, characterized by continued innovation and expanding adoption. The market is expected to witness sustained growth driven by the relentless pursuit of more immersive, personalized, and efficiently produced gaming experiences. Companies that strategically invest in advanced AI research and development, foster collaborations with AI technology providers, and adapt their workflows to incorporate AI-generated content will be best positioned for success. The increasing demand for scalable content solutions, particularly in the context of live-service games and burgeoning metaverse environments, will act as a powerful growth catalyst. Furthermore, the development of more intuitive and accessible AI tools will democratize content creation, empowering a wider range of developers. The market's future hinges on its ability to address ethical considerations and integrate AI in a way that enhances, rather than replaces, human creativity.

Ai Generated Content In Games Segmentation

-

1. Application

- 1.1. Game Character Generation

- 1.2. Game Asset Generation

- 1.3. Others

-

2. Type

- 2.1. Game Level Generation

- 2.2. Procedural Content Generation

- 2.3. Others

Ai Generated Content In Games Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Ai Generated Content In Games REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ai Generated Content In Games Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Game Character Generation

- 5.1.2. Game Asset Generation

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Game Level Generation

- 5.2.2. Procedural Content Generation

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Ai Generated Content In Games Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Game Character Generation

- 6.1.2. Game Asset Generation

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Game Level Generation

- 6.2.2. Procedural Content Generation

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Ai Generated Content In Games Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Game Character Generation

- 7.1.2. Game Asset Generation

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Game Level Generation

- 7.2.2. Procedural Content Generation

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Ai Generated Content In Games Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Game Character Generation

- 8.1.2. Game Asset Generation

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Game Level Generation

- 8.2.2. Procedural Content Generation

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Ai Generated Content In Games Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Game Character Generation

- 9.1.2. Game Asset Generation

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Game Level Generation

- 9.2.2. Procedural Content Generation

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Ai Generated Content In Games Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Game Character Generation

- 10.1.2. Game Asset Generation

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Game Level Generation

- 10.2.2. Procedural Content Generation

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 TapTap

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Giant Network

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kunlun Tech

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 NetEase

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 miHoYo

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Tencent

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 XD Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Steam

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Promethean AI

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Scenario

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 PixelVibe

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Ludo AI

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 TapTap

List of Figures

- Figure 1: Global Ai Generated Content In Games Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Ai Generated Content In Games Revenue (million), by Application 2024 & 2032

- Figure 3: North America Ai Generated Content In Games Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Ai Generated Content In Games Revenue (million), by Type 2024 & 2032

- Figure 5: North America Ai Generated Content In Games Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Ai Generated Content In Games Revenue (million), by Country 2024 & 2032

- Figure 7: North America Ai Generated Content In Games Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Ai Generated Content In Games Revenue (million), by Application 2024 & 2032

- Figure 9: South America Ai Generated Content In Games Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Ai Generated Content In Games Revenue (million), by Type 2024 & 2032

- Figure 11: South America Ai Generated Content In Games Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Ai Generated Content In Games Revenue (million), by Country 2024 & 2032

- Figure 13: South America Ai Generated Content In Games Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Ai Generated Content In Games Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Ai Generated Content In Games Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Ai Generated Content In Games Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Ai Generated Content In Games Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Ai Generated Content In Games Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Ai Generated Content In Games Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Ai Generated Content In Games Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Ai Generated Content In Games Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Ai Generated Content In Games Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Ai Generated Content In Games Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Ai Generated Content In Games Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Ai Generated Content In Games Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Ai Generated Content In Games Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Ai Generated Content In Games Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Ai Generated Content In Games Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Ai Generated Content In Games Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Ai Generated Content In Games Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Ai Generated Content In Games Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Ai Generated Content In Games Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Ai Generated Content In Games Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Ai Generated Content In Games Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Ai Generated Content In Games Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Ai Generated Content In Games Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Ai Generated Content In Games Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Ai Generated Content In Games Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Ai Generated Content In Games Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Ai Generated Content In Games Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Ai Generated Content In Games Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Ai Generated Content In Games Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Ai Generated Content In Games Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Ai Generated Content In Games Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Ai Generated Content In Games Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Ai Generated Content In Games Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Ai Generated Content In Games Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Ai Generated Content In Games Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Ai Generated Content In Games Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Ai Generated Content In Games Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Ai Generated Content In Games Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Ai Generated Content In Games Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Ai Generated Content In Games Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Ai Generated Content In Games Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Ai Generated Content In Games Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Ai Generated Content In Games Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Ai Generated Content In Games Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Ai Generated Content In Games Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Ai Generated Content In Games Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Ai Generated Content In Games Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Ai Generated Content In Games Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Ai Generated Content In Games Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Ai Generated Content In Games Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Ai Generated Content In Games Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Ai Generated Content In Games Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Ai Generated Content In Games Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Ai Generated Content In Games Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Ai Generated Content In Games Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Ai Generated Content In Games Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Ai Generated Content In Games Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Ai Generated Content In Games Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Ai Generated Content In Games Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Ai Generated Content In Games Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Ai Generated Content In Games Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Ai Generated Content In Games Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Ai Generated Content In Games Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Ai Generated Content In Games Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Ai Generated Content In Games Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ai Generated Content In Games?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Ai Generated Content In Games?

Key companies in the market include TapTap, Giant Network, Kunlun Tech, NetEase, miHoYo, Tencent, XD Inc, Steam, Promethean AI, Scenario, PixelVibe, Ludo AI.

3. What are the main segments of the Ai Generated Content In Games?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ai Generated Content In Games," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ai Generated Content In Games report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ai Generated Content In Games?

To stay informed about further developments, trends, and reports in the Ai Generated Content In Games, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence