Key Insights

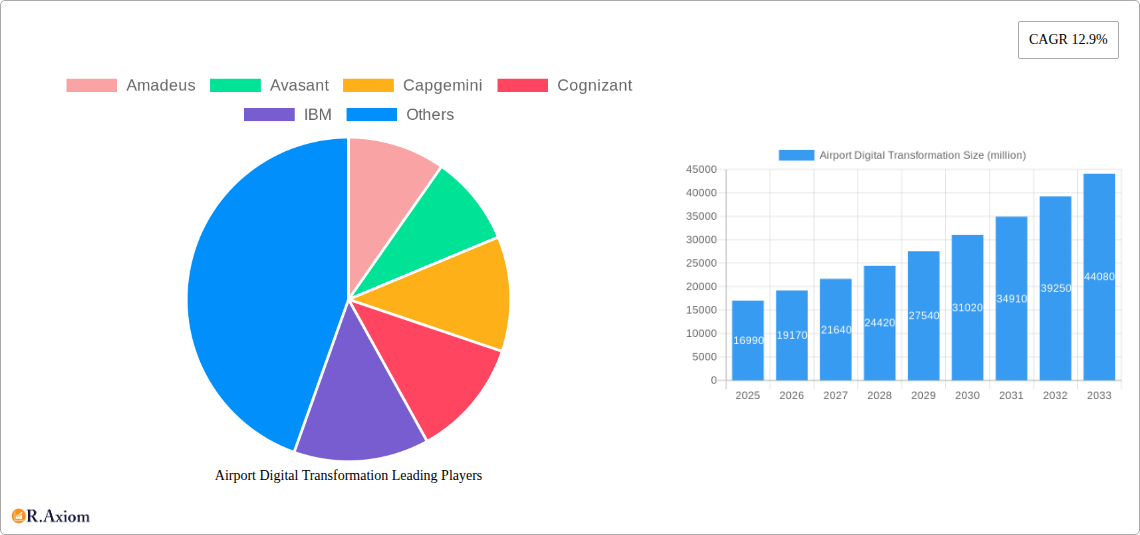

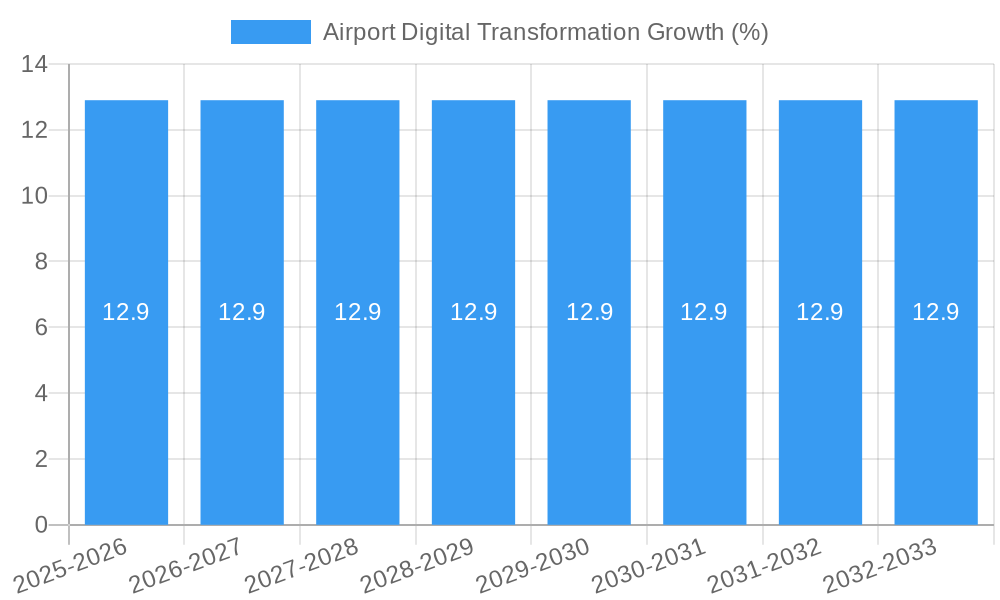

The Airport Digital Transformation market is poised for significant expansion, with a current estimated market size of $16,990 million in 2025, projected to grow at a robust Compound Annual Growth Rate (CAGR) of 12.9% through 2033. This surge is primarily driven by the imperative for airports worldwide to enhance operational efficiency, improve passenger experience, and bolster security through the adoption of advanced technologies. Key growth enablers include the increasing integration of Artificial Intelligence (AI) for predictive maintenance and optimized resource allocation, the deployment of the Internet of Things (IoT) for real-time data collection and management of airport assets, and the shift towards cloud-based solutions for scalability and agility. The ongoing modernization of airport infrastructure, coupled with the need to manage growing air traffic volumes, further fuels this digital revolution. Strategic investments by major aviation players and technological advancements in areas like biometric identification, contactless services, and data analytics are shaping the future of airport operations, making digital transformation a critical component for competitiveness.

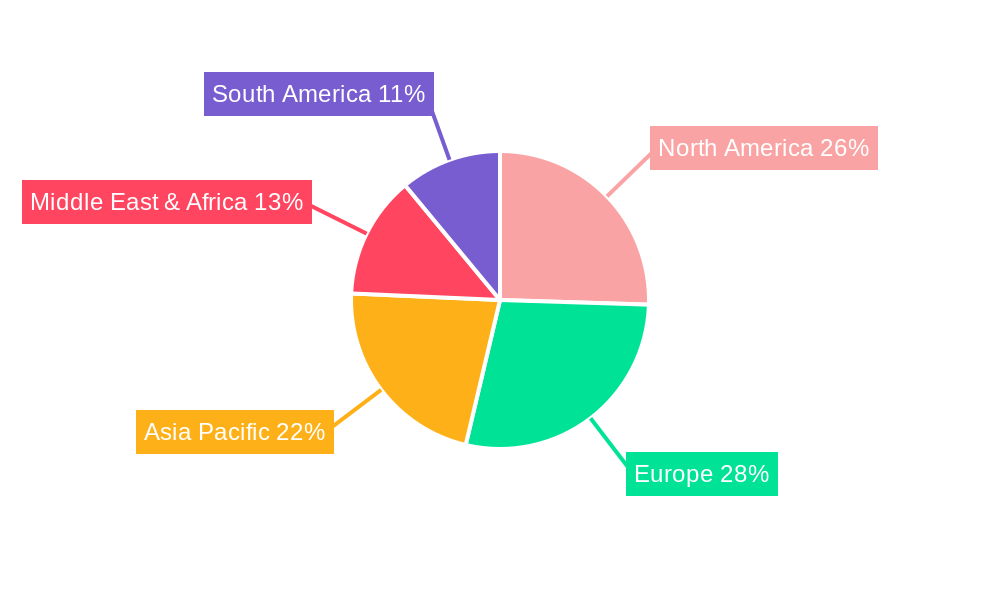

The market segmentation reveals a broad adoption across both Small and Large Airports, with a notable inclination towards Cloud-Based solutions, AI, and IoT technologies. While these advanced segments lead the charge, "Others" encompassing a range of emerging technologies and integrated solutions also play a crucial role. Geographically, North America and Europe are anticipated to lead in market share due to established infrastructure and early adoption of digital initiatives. However, the Asia Pacific region, with its rapidly expanding aviation sector and a growing focus on smart city concepts, is expected to exhibit the highest growth potential in the coming years. Major industry players like Amadeus, IBM, Accenture, and Huawei are at the forefront, offering comprehensive digital transformation solutions. Restraints, such as the high initial investment costs and the complexity of integrating new technologies with legacy systems, are being addressed through phased implementation strategies and the growing availability of cost-effective cloud services. The continued evolution of passenger expectations for seamless and personalized travel experiences will undoubtedly accelerate the demand for innovative digital solutions within the airport ecosystem.

This comprehensive report delves into the dynamic world of Airport Digital Transformation, analyzing the market's evolution from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this study provides actionable insights for industry stakeholders, including airports, technology providers, and investors. We examine the impact of cutting-edge technologies such as Cloud Based, AI, and IoT on Small Airport and Large Airport operations, exploring market concentration, innovation, industry trends, dominant segments, product developments, and growth drivers. The report includes an in-depth analysis of key players like Amadeus, Avasant, Capgemini, Cognizant, IBM, Huawei, Accenture, Fraport, Wipro, Smiths Detection, TAV Technologies, Wavetec, Airsiders, and Segments, offering a strategic outlook for the future of airport digital transformation.

Airport Digital Transformation Market Concentration & Innovation

The Airport Digital Transformation market exhibits a moderate level of concentration, with several leading technology providers vying for market share. Companies such as Accenture, IBM, and Capgemini are prominent players, leveraging their extensive expertise in IT services and digital solutions. Innovation is primarily driven by the relentless pursuit of operational efficiency, enhanced passenger experience, and improved security protocols. Regulatory frameworks, while sometimes creating compliance hurdles, also act as catalysts for digital adoption, pushing airports to invest in advanced systems. Product substitutes, though limited in their direct impact, include incremental upgrades to existing legacy systems. End-user trends are overwhelmingly geared towards seamless, personalized, and contactless passenger journeys, driving demand for AI-powered solutions, IoT-enabled infrastructure, and cloud-based platforms. Mergers and acquisitions (M&A) are a key strategy for market consolidation and talent acquisition. Recent M&A activities have seen significant deal values, with some transactions exceeding one thousand million dollars, aimed at integrating specialized digital capabilities and expanding service portfolios. The market share of the top five players is estimated to be over 50%, highlighting a competitive yet consolidating landscape.

Airport Digital Transformation Industry Trends & Insights

The global Airport Digital Transformation market is experiencing robust growth, propelled by a confluence of technological advancements and evolving passenger expectations. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 15% over the forecast period. A significant driver is the increasing adoption of intelligent automation and AI-powered solutions designed to streamline operations, from baggage handling and passenger flow management to air traffic control. The integration of IoT devices across airport infrastructure is creating a connected ecosystem, enabling real-time data collection and analysis for predictive maintenance, resource optimization, and enhanced security. Cloud-based solutions are becoming the de facto standard for their scalability, flexibility, and cost-effectiveness, allowing airports to manage vast amounts of data and deploy new digital services rapidly. Consumer preferences are shifting towards a seamless, personalized, and contactless travel experience. This includes self-service kiosks, mobile boarding passes, AI-driven personalized offers, and biometric identification systems. The competitive dynamics are intense, with established IT giants, specialized aviation technology firms, and emerging startups all vying for a share of this burgeoning market. Market penetration of digital transformation solutions is steadily increasing, particularly in major international hubs, with smaller airports beginning to adopt more cost-effective and scalable digital solutions. The ongoing pursuit of operational resilience and the need to adapt to unpredictable travel patterns further amplify the demand for agile and data-driven airport operations. The strategic investment in digital infrastructure is no longer a competitive advantage but a fundamental necessity for airports to remain relevant and efficient in the modern aviation landscape.

Dominant Markets & Segments in Airport Digital Transformation

The Large Airport segment is currently the dominant market within Airport Digital Transformation, driven by their extensive operational complexities and the significant financial resources available for technological investment. These airports handle a higher volume of passengers and flights, necessitating sophisticated digital solutions for efficient management. The adoption of Cloud Based solutions is particularly prevalent in this segment, providing the scalability and flexibility required to manage massive data flows and dynamic operational demands. AI is another transformative technology witnessing high adoption in large airports, enabling predictive analytics for flight delays, intelligent passenger flow management, and enhanced security surveillance. The need for sophisticated IoT integration is also paramount, facilitating real-time monitoring of infrastructure, equipment performance, and environmental conditions.

Key drivers for the dominance of large airports and these technology segments include:

- Economic Policies: Governments and aviation authorities in major hubs often prioritize infrastructure development and technological upgrades to support economic growth and tourism.

- Infrastructure Investment: Large airports typically have the capital to invest in comprehensive digital overhauls, from implementing new passenger processing systems to upgrading air traffic control technologies.

- Passenger Experience Demands: The sheer volume of passengers necessitates advanced digital solutions to ensure a smooth, efficient, and enjoyable travel experience, driving demand for AI-powered personalization and IoT-enabled services.

- Security Imperatives: Enhanced security is a critical concern for large international airports, fueling the adoption of AI-driven threat detection and biometric identification systems.

While Small Airports are gradually increasing their digital transformation efforts, their adoption is often more phased and focused on cost-effective solutions like cloud-based platforms for core functionalities. The Other technology category, encompassing specialized solutions beyond Cloud, AI, and IoT, also plays a role, particularly in niche areas like advanced data analytics and cybersecurity. The market penetration of digital transformation in large airports is estimated to be over 70%, with a projected growth of 18% annually.

Airport Digital Transformation Product Developments

Product developments in Airport Digital Transformation are characterized by a focus on seamless passenger journeys and enhanced operational efficiency. Innovations include AI-powered facial recognition for biometric boarding, IoT sensors for real-time baggage tracking, and cloud-based platforms for integrated airport management. These advancements offer competitive advantages by reducing processing times, improving security, and enabling predictive maintenance. The trend is towards integrated, end-to-end digital solutions that cater to the entire airport ecosystem, from passenger arrival to departure.

Report Scope & Segmentation Analysis

This report meticulously segments the Airport Digital Transformation market across key dimensions. The Application segmentation includes Small Airport and Large Airport. Small Airports are projected to witness significant growth in cloud-based and IoT solutions, with an estimated market size of two thousand million dollars by 2033, driven by a need for cost-effective efficiency gains. Large Airports will continue to lead in AI and complex cloud deployments, with an estimated market size exceeding fifty thousand million dollars by 2033, fueled by their comprehensive operational needs and significant investment capacity. The Type segmentation encompasses Cloud Based, AI, IoT, and Others. Cloud Based solutions are expected to dominate, with an estimated market share of thirty-five percent. AI is anticipated to grow at a rapid pace, reaching an estimated twenty-five percent market share, while IoT will hold approximately twenty percent. The Others category will account for the remaining twenty percent, comprising specialized software and data analytics.

Key Drivers of Airport Digital Transformation Growth

The growth of Airport Digital Transformation is propelled by several key factors. Technological advancements, particularly in AI, IoT, and cloud computing, offer unprecedented opportunities for operational efficiency and passenger experience enhancement. The increasing global air traffic volume necessitates scalable and intelligent solutions to manage capacity and streamline operations. Furthermore, a growing emphasis on passenger convenience and security is driving demand for contactless technologies, biometrics, and advanced surveillance systems. Regulatory mandates, pushing for improved safety and cybersecurity, also act as significant catalysts for digital adoption. The competitive pressure among airports to offer superior passenger experiences further fuels investment in digital transformation initiatives, aiming to attract and retain travelers.

Challenges in the Airport Digital Transformation Sector

Despite the promising growth, the Airport Digital Transformation sector faces several challenges. High initial investment costs for implementing new technologies can be a significant barrier, particularly for smaller airports. Integration challenges with existing legacy systems pose a complex hurdle, requiring careful planning and execution. Cybersecurity threats are a constant concern, necessitating robust security measures to protect sensitive passenger data and critical infrastructure. Furthermore, the availability of skilled personnel to manage and operate advanced digital systems is a growing concern, requiring significant investment in training and development. Regulatory complexities and the need for standardization across different jurisdictions can also slow down the adoption of new technologies.

Emerging Opportunities in Airport Digital Transformation

Emerging opportunities in Airport Digital Transformation lie in the pervasive adoption of AI for hyper-personalized passenger experiences, offering tailored services and recommendations in real-time. The expansion of IoT networks to create truly smart airports, enabling predictive maintenance and energy efficiency, presents another significant avenue. The integration of blockchain technology for secure and transparent data management, particularly for ticketing and loyalty programs, is an emerging frontier. Furthermore, the development of sustainable digital solutions that contribute to environmental goals, such as optimizing flight paths to reduce fuel consumption, is gaining traction. The growing trend towards urban air mobility and the integration of new aircraft types also presents opportunities for digital transformation in managing diverse operational needs.

Leading Players in the Airport Digital Transformation Market

- Accenture

- Amadeus

- Avasant

- Capgemini

- Cognizant

- Fraport

- Huawei

- IBM

- Smiths Detection

- TAV Technologies

- Wavetec

- Wipro

- Airsiders

Key Developments in Airport Digital Transformation Industry

- 2023/07: Accenture and IBM partner to accelerate cloud migration for major international airports.

- 2023/11: Capgemini launches a new AI-powered platform for enhanced passenger flow management, aiming to reduce wait times by up to 30%.

- 2024/01: Wipro announces a significant investment in developing IoT solutions for airport infrastructure, focusing on predictive maintenance.

- 2024/03: Fraport implements Smiths Detection's advanced security screening technology to enhance passenger safety and throughput.

- 2024/05: TAV Technologies and Wavetec collaborate on integrated digital solutions for passenger processing, incorporating biometric identification.

- 2024/07: Amadeus expands its portfolio of cloud-based solutions for airlines and airports, focusing on personalized travel experiences.

- 2024/09: Avasant reports a substantial increase in demand for digital transformation consulting services from airports globally.

- 2024/11: Huawei showcases its advancements in 5G and AI integration for smart airport operations.

- 2025/01: Cognizant announces a strategic partnership to develop sustainable digital solutions for airport sustainability initiatives.

- 2025/03: Airsiders introduces an innovative AI-driven solution for real-time air traffic prediction and optimization.

Strategic Outlook for Airport Digital Transformation Market

The strategic outlook for the Airport Digital Transformation market is exceptionally positive, characterized by sustained investment and rapid technological integration. The ongoing drive for enhanced passenger experience, operational resilience, and heightened security will continue to fuel demand for advanced digital solutions. Airports that embrace AI, IoT, and cloud-based architectures will be best positioned to navigate future challenges and capitalize on emerging opportunities. The market is poised for significant growth, with a clear trend towards end-to-end digital ecosystems that connect passengers, airlines, and airport authorities seamlessly. Strategic partnerships and collaborations among technology providers and airport operators will be crucial for successful digital transformation journeys, paving the way for the airports of the future.

Airport Digital Transformation Segmentation

-

1. Application

- 1.1. Small Airport

- 1.2. Large Airport

-

2. Type

- 2.1. Cloud Based

- 2.2. AI

- 2.3. IoT

- 2.4. Others

Airport Digital Transformation Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Airport Digital Transformation REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.9% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Airport Digital Transformation Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Small Airport

- 5.1.2. Large Airport

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Cloud Based

- 5.2.2. AI

- 5.2.3. IoT

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Airport Digital Transformation Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Small Airport

- 6.1.2. Large Airport

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Cloud Based

- 6.2.2. AI

- 6.2.3. IoT

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Airport Digital Transformation Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Small Airport

- 7.1.2. Large Airport

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Cloud Based

- 7.2.2. AI

- 7.2.3. IoT

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Airport Digital Transformation Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Small Airport

- 8.1.2. Large Airport

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Cloud Based

- 8.2.2. AI

- 8.2.3. IoT

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Airport Digital Transformation Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Small Airport

- 9.1.2. Large Airport

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Cloud Based

- 9.2.2. AI

- 9.2.3. IoT

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Airport Digital Transformation Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Small Airport

- 10.1.2. Large Airport

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Cloud Based

- 10.2.2. AI

- 10.2.3. IoT

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Amadeus

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Avasant

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Capgemini

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cognizant

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 IBM

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Huawei

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Accenture

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Fraport

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Wipro

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Smiths Detection

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 TAV Technologies

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Wavetec

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Airsiders

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Amadeus

List of Figures

- Figure 1: Global Airport Digital Transformation Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Airport Digital Transformation Revenue (million), by Application 2024 & 2032

- Figure 3: North America Airport Digital Transformation Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Airport Digital Transformation Revenue (million), by Type 2024 & 2032

- Figure 5: North America Airport Digital Transformation Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Airport Digital Transformation Revenue (million), by Country 2024 & 2032

- Figure 7: North America Airport Digital Transformation Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Airport Digital Transformation Revenue (million), by Application 2024 & 2032

- Figure 9: South America Airport Digital Transformation Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Airport Digital Transformation Revenue (million), by Type 2024 & 2032

- Figure 11: South America Airport Digital Transformation Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Airport Digital Transformation Revenue (million), by Country 2024 & 2032

- Figure 13: South America Airport Digital Transformation Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Airport Digital Transformation Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Airport Digital Transformation Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Airport Digital Transformation Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Airport Digital Transformation Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Airport Digital Transformation Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Airport Digital Transformation Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Airport Digital Transformation Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Airport Digital Transformation Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Airport Digital Transformation Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Airport Digital Transformation Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Airport Digital Transformation Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Airport Digital Transformation Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Airport Digital Transformation Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Airport Digital Transformation Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Airport Digital Transformation Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Airport Digital Transformation Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Airport Digital Transformation Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Airport Digital Transformation Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Airport Digital Transformation Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Airport Digital Transformation Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Airport Digital Transformation Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Airport Digital Transformation Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Airport Digital Transformation Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Airport Digital Transformation Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Airport Digital Transformation Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Airport Digital Transformation Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Airport Digital Transformation Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Airport Digital Transformation Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Airport Digital Transformation Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Airport Digital Transformation Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Airport Digital Transformation Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Airport Digital Transformation Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Airport Digital Transformation Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Airport Digital Transformation Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Airport Digital Transformation Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Airport Digital Transformation Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Airport Digital Transformation Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Airport Digital Transformation Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Airport Digital Transformation Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Airport Digital Transformation Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Airport Digital Transformation Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Airport Digital Transformation Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Airport Digital Transformation Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Airport Digital Transformation Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Airport Digital Transformation Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Airport Digital Transformation Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Airport Digital Transformation Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Airport Digital Transformation Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Airport Digital Transformation Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Airport Digital Transformation Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Airport Digital Transformation Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Airport Digital Transformation Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Airport Digital Transformation Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Airport Digital Transformation Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Airport Digital Transformation Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Airport Digital Transformation Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Airport Digital Transformation Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Airport Digital Transformation Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Airport Digital Transformation Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Airport Digital Transformation Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Airport Digital Transformation Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Airport Digital Transformation Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Airport Digital Transformation Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Airport Digital Transformation Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Airport Digital Transformation Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Airport Digital Transformation?

The projected CAGR is approximately 12.9%.

2. Which companies are prominent players in the Airport Digital Transformation?

Key companies in the market include Amadeus, Avasant, Capgemini, Cognizant, IBM, Huawei, Accenture, Fraport, Wipro, Smiths Detection, TAV Technologies, Wavetec, Airsiders.

3. What are the main segments of the Airport Digital Transformation?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 16990 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Airport Digital Transformation," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Airport Digital Transformation report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Airport Digital Transformation?

To stay informed about further developments, trends, and reports in the Airport Digital Transformation, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence