Key Insights

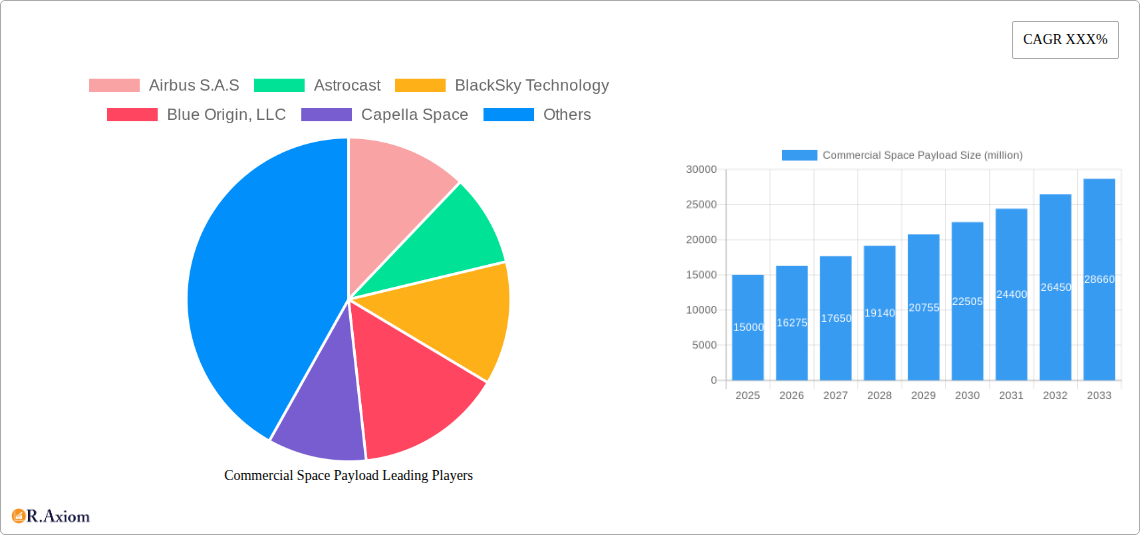

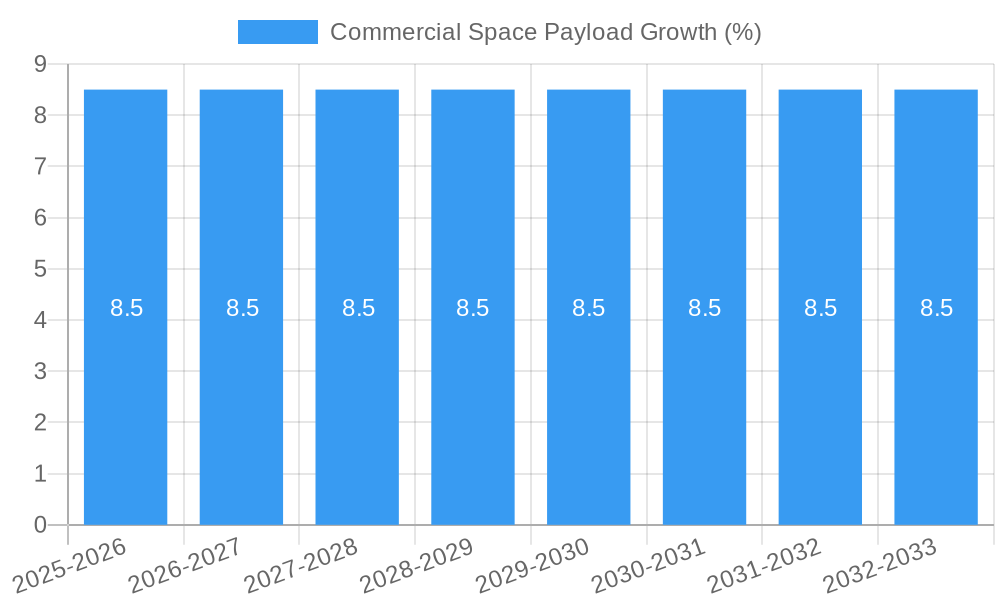

The global commercial space payload market is poised for significant expansion, projected to reach an estimated $15,000 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 8.5% forecasted from 2025 to 2033. This upward trajectory is primarily fueled by the escalating demand across critical applications such as communication, earth observation and remote sensing, and space exploration. Advancements in satellite technology, coupled with increasing private sector investment and government initiatives, are driving the development and deployment of sophisticated payloads designed for a myriad of purposes. The proliferation of small satellites, including nano and micro satellites, is a key trend democratizing access to space and enabling more frequent and cost-effective missions. This surge in demand is directly linked to the growing need for real-time data for environmental monitoring, precision agriculture, disaster management, and the expansion of global connectivity through satellite internet constellations.

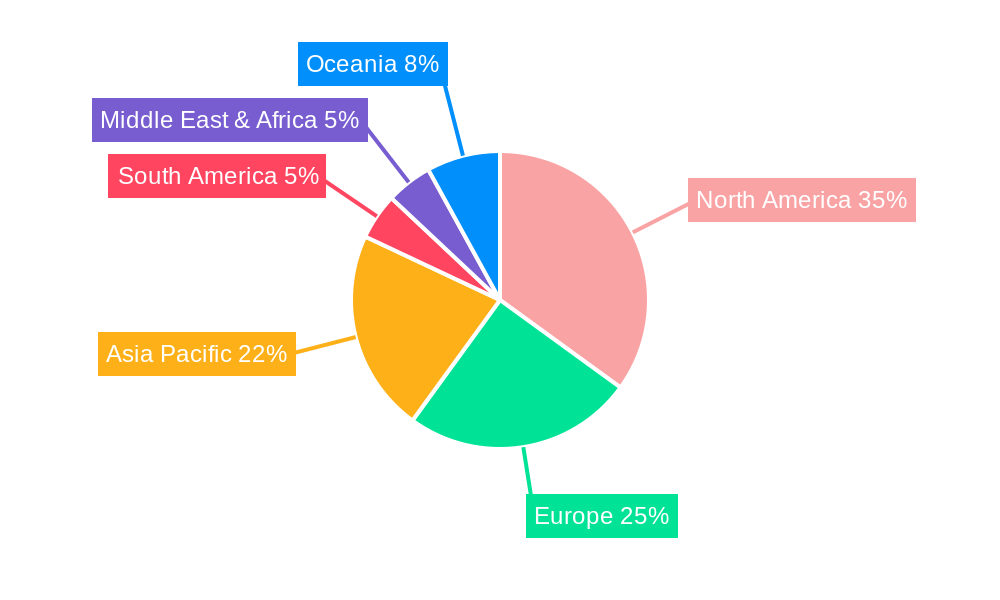

Despite the promising growth, the market faces certain restraints that could temper its pace. High development and launch costs, although decreasing with innovative launch solutions, remain a significant barrier for some players. Stringent regulatory frameworks and the increasing concern around space debris also present challenges that require collaborative solutions and advanced mitigation strategies. However, the overarching trend of miniaturization, enhanced payload capabilities, and the emergence of new space economies are expected to outweigh these restraints. Geographically, North America, particularly the United States, is expected to lead the market, driven by its advanced space infrastructure and substantial private investment. Asia Pacific is anticipated to exhibit the fastest growth, propelled by increasing investments from China and India in their burgeoning space programs and a growing demand for satellite-derived data across various sectors. The market is characterized by intense competition among established aerospace giants and agile new entrants, all vying to capture market share in this dynamic and evolving sector.

This in-depth report provides a definitive analysis of the global commercial space payload market, offering critical insights for stakeholders navigating this rapidly evolving sector. The study covers the historical period from 2019 to 2024, the base year of 2025, and extends to a comprehensive forecast period from 2025 to 2033. With an estimated market size projected to reach trillions of dollars, this report details market concentration, innovation drivers, regulatory landscapes, product substitutes, end-user trends, mergers and acquisitions (M&A), industry trends, dominant markets and segments, product developments, growth drivers, challenges, emerging opportunities, leading players, key developments, and a strategic outlook. Designed for immediate use without modification, this report leverages high-traffic keywords to maximize search visibility and engagement within the aerospace and satellite industry.

Commercial Space Payload Market Concentration & Innovation

The commercial space payload market exhibits a moderate to high concentration, with a few key players holding significant market share in specific segments. Leading companies are investing heavily in research and development, fostering rapid innovation in payload design, miniaturization, and enhanced functionality. Regulatory frameworks, while evolving, are crucial in shaping market entry and operational standards. Product substitutes, primarily in the form of terrestrial technologies for certain applications, are being increasingly outpaced by the unique capabilities offered by space-based payloads. End-user trends are shifting towards demand for high-resolution Earth observation, global connectivity, and specialized space exploration instruments. M&A activities are notable, with strategic acquisitions aiming to consolidate market position and expand technological portfolios. For instance, recent M&A deals in the satellite technology sector have amounted to over ten million dollars, signaling consolidation efforts. Key innovation drivers include the miniaturization of satellites, advancements in sensor technology, and the development of more efficient power and communication systems for payloads. The market share distribution among top players for specialized payloads is estimated to be as follows: Airbus S.A.S. (15%), Lockheed Martin Corporation (12%), Thales Alenia Space (10%), and others collectively holding the remaining share, with significant contributions from emerging players in nano and micro-satellite payloads.

Commercial Space Payload Industry Trends & Insights

The commercial space payload industry is experiencing robust growth, driven by an escalating demand for data and connectivity solutions from various sectors. The Compound Annual Growth Rate (CAGR) is projected to be over fifteen percent, signifying a dynamic and expanding market. This growth is fueled by advancements in launch vehicle technology, leading to more frequent and cost-effective access to space, which in turn drives demand for a wider array of payloads. Technological disruptions, such as the proliferation of small satellite constellations and the development of AI-powered payload processing, are transforming the industry. Consumer preferences are increasingly leaning towards real-time data acquisition and analysis, particularly in Earth Observation and Remote Sensing applications, where higher resolution imagery and faster revisit times are paramount. The competitive dynamics are intense, with both established aerospace giants and agile startups vying for market dominance. Market penetration is accelerating across emerging economies as governments and private entities recognize the strategic importance of space assets. The shift towards commercialization of space activities has opened up new avenues for payload development, from advanced communication modules to sophisticated scientific instruments for space exploration. The overall market penetration of commercial space payloads is projected to reach over seventy percent of all satellite deployments by 2030, indicating a significant transformation from traditional government-dominated space programs.

Dominant Markets & Segments in Commercial Space Payload

The Earth Observation and Remote Sensing segment stands out as a dominant force within the commercial space payload market, driven by a confluence of economic policies, burgeoning infrastructure development, and increasing environmental awareness. This segment is projected to generate revenue exceeding ten billion dollars annually by 2028. Key drivers include governmental initiatives for land management, disaster monitoring, and agricultural precision farming, all of which rely heavily on high-resolution imagery and data analytics provided by Earth observation payloads. Economic policies in leading nations are actively supporting the growth of the commercial space sector, leading to increased investment in satellite infrastructure and payload development. Furthermore, the proliferation of small satellites, particularly nano and micro-satellites (0-200 kg), is significantly contributing to the expansion of this segment. These smaller platforms offer cost-effective solutions for a wide range of applications, including detailed environmental monitoring, urban planning, and resource exploration.

Application Dominance:

- Earth Observation and Remote Sensing: Continues to lead due to demand for high-resolution imagery for agriculture, defense, climate monitoring, and urban planning. Market size in this segment is estimated to be over eight billion dollars in 2025, growing at a CAGR of sixteen percent.

- Communication: Remains a crucial segment, driven by the expansion of global broadband services, IoT connectivity, and satellite constellations like OneWeb and SpaceX Starlink. Projected market size of over seven billion dollars in 2025.

- Surveillance and Reconnaissance: Essential for defense and national security, with growing demand for real-time intelligence and advanced imaging capabilities.

- Space Exploration: Experiencing growth driven by private sector interest in lunar and Martian missions, requiring specialized scientific payloads.

- Others: Encompasses niche applications like space-based manufacturing and in-orbit servicing.

Type Dominance:

- Nano and Micro Satellite (0-200 kg): Dominating market share due to cost-effectiveness, rapid deployment, and suitability for constellation architectures. Expected to represent over fifty percent of all payload shipments by 2030. Market value is expected to reach over five billion dollars in 2025.

- Small Satellite (201-1200 kg): Offers a balance of capability and cost, serving diverse applications from remote sensing to communication.

- Medium Satellite (1,201-2,200 kg): Caters to more demanding applications requiring larger sensor suites or higher power capabilities.

- Large Satellite (Above 2,201 kg): Primarily for complex scientific missions and high-throughput communication satellites.

Geographically, North America and Europe lead in payload development and deployment, supported by strong government funding and a thriving private sector. Asia-Pacific is emerging as a significant growth region, driven by increasing investments in national space programs and commercial satellite initiatives.

Commercial Space Payload Product Developments

Recent product developments in the commercial space payload sector focus on enhanced sensor technologies, miniaturization, and increased data processing capabilities. Companies are introducing payloads with multi-spectral and hyperspectral imaging, providing unprecedented detail for Earth observation. Advancements in artificial intelligence are enabling payloads to perform on-board data analysis, reducing latency and bandwidth requirements. The competitive advantage lies in developing payloads that offer higher resolution, faster revisit times, lower power consumption, and greater resilience to the space environment. For example, BlackSky Technology is developing advanced imaging payloads that can deliver near real-time analytics. Capella Space's synthetic aperture radar (SAR) payloads offer all-weather imaging capabilities. GomSpace is a leader in providing cost-effective nano-satellite solutions for various applications.

Report Scope & Segmentation Analysis

This report comprehensively segments the commercial space payload market across key applications and satellite types. The segmentation is crucial for understanding market dynamics and forecasting growth.

- Application Segmentation: The market is analyzed across Communication, Earth Observation and Remote Sensing, Space Exploration, Surveillance and Reconnaissance, and Others. Earth Observation and Remote Sensing is projected to dominate, with an estimated market size of over eight billion dollars in 2025 and a growth rate of sixteen percent. Communication payloads follow, with an estimated market size of over seven billion dollars.

- Type Segmentation: The analysis includes Nano and Micro Satellite (0-200 kg), Small Satellite (201-1200 kg), Medium Satellite (1,201-2200 kg), and Large Satellite (Above 2201 kg). Nano and Micro Satellites are expected to capture a significant market share exceeding fifty percent of payload shipments by 2030, with a market value projected to reach over five billion dollars in 2025.

Each segment's growth projections, market sizes, and competitive landscapes are detailed within the report, providing granular insights for strategic decision-making.

Key Drivers of Commercial Space Payload Growth

The commercial space payload market is propelled by a combination of powerful drivers. Technologically, the continuous miniaturization of components and increased computational power within payloads enable more sophisticated capabilities on smaller, more affordable platforms. Economically, the declining cost of launch services, led by companies like SpaceX, makes access to space more feasible for commercial ventures, stimulating demand for payloads. Regulatory factors, such as favorable government policies promoting commercial space activities and spectrum allocation for satellite communications, further accelerate growth. The increasing need for global connectivity, real-time Earth data for climate monitoring and disaster management, and the burgeoning space exploration initiatives are significant economic catalysts. For instance, the growth of the IoT sector is driving demand for specialized communication payloads.

Challenges in the Commercial Space Payload Sector

Despite its rapid growth, the commercial space payload sector faces several significant challenges. Regulatory hurdles remain a concern, with complex and sometimes conflicting international regulations impacting satellite deployment and data sharing. Supply chain issues, particularly for specialized electronic components and rare earth materials, can lead to production delays and increased costs. Intense competitive pressures from a growing number of market participants drive down prices, impacting profitability margins for some payload manufacturers. Additionally, the high initial investment required for payload development and launch, coupled with the inherent risks associated with space missions, presents a barrier to entry for smaller companies. The security of space assets against cyber threats and potential debris impact also poses ongoing challenges that require substantial investment in mitigation strategies.

Emerging Opportunities in Commercial Space Payload

The commercial space payload market is ripe with emerging opportunities driven by innovation and evolving market demands. The rise of in-orbit servicing and manufacturing presents a significant new market for specialized payloads designed for these advanced space operations. The increasing demand for hyperspectral and synthetic aperture radar (SAR) payloads for environmental monitoring, resource exploration, and defense applications offers substantial growth potential. Furthermore, the expansion of the space tourism sector is creating opportunities for payloads that enhance passenger experience or support scientific research during spaceflights. The integration of AI and machine learning directly into payloads for on-board data processing and autonomous decision-making is another key area of opportunity, enabling faster insights and reduced reliance on ground control. The development of payloads for lunar and Martian exploration, driven by national and private space agencies, also signifies a long-term growth avenue.

Leading Players in the Commercial Space Payload Market

- Airbus S.A.S

- Astrocast

- BlackSky Technology

- Blue Origin, LLC

- Capella Space

- GomSpace

- Lockheed Martin Corporation

- Oneweb

- Planet IQ

- Planet Labs

- Spaceflight

- SpaceX

- Thales Alenia Space

- Tyvak

- United Launch Alliance, LLC

- Safran

Key Developments in Commercial Space Payload Industry

- 2023: SpaceX successfully launched its Starship rocket for a second test flight, demonstrating progress towards heavy-lift capabilities crucial for deploying large payloads.

- 2023: Astrocast launched its next generation of small satellites, expanding its global IoT network for machine-to-machine communications.

- 2023: BlackSky Technology unveiled its enhanced fleet of electro-optical satellites, offering higher resolution and more frequent revisits for its clients.

- 2024: Thales Alenia Space announced a new line of advanced optical payloads for Earth observation satellites, focusing on enhanced spectral resolution.

- 2024: Capella Space expanded its SAR constellation, providing all-weather imaging capabilities to a broader customer base.

- 2024: Planet Labs acquired a significant amount of funding to further develop its Earth observation satellite constellation and data analytics platform.

- 2024: GomSpace delivered several nano-satellite payloads for various scientific and commercial missions, reinforcing its position in the small satellite market.

- 2024: Lockheed Martin Corporation secured contracts for the development of sophisticated payloads for upcoming defense and exploration missions.

Strategic Outlook for Commercial Space Payload Market

The strategic outlook for the commercial space payload market remains exceptionally positive, driven by sustained innovation, increasing investment, and expanding applications. The continued reduction in launch costs and the development of more capable, miniaturized payloads will democratize access to space, fostering further market growth. Key growth catalysts include the global push for ubiquitous connectivity, the critical need for precise Earth observation data for climate resilience and resource management, and the ambitious goals of commercial space exploration. The integration of advanced AI and machine learning within payloads will unlock new frontiers in autonomous space operations and data analysis. Companies that can offer innovative, cost-effective, and highly reliable payload solutions tailored to these evolving demands are poised for significant success in the coming years. The market is expected to see continued M&A activity as companies seek to consolidate capabilities and expand their market reach.

Commercial Space Payload Segmentation

-

1. Application

- 1.1. Communication

- 1.2. Earth Observation and Remote Sensing

- 1.3. Space Exploration

- 1.4. Surveillance and Reconnaissance

- 1.5. Others

-

2. Type

- 2.1. Nano and Micro Satellite (0-200 kg)

- 2.2. Small Satellite (201-1200 kg)

- 2.3. Medium Satellite (1,201-2200 kg)

- 2.4. Large Satellite (Above 2201 kg)

Commercial Space Payload Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Commercial Space Payload REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Commercial Space Payload Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Communication

- 5.1.2. Earth Observation and Remote Sensing

- 5.1.3. Space Exploration

- 5.1.4. Surveillance and Reconnaissance

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Nano and Micro Satellite (0-200 kg)

- 5.2.2. Small Satellite (201-1200 kg)

- 5.2.3. Medium Satellite (1,201-2200 kg)

- 5.2.4. Large Satellite (Above 2201 kg)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Commercial Space Payload Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Communication

- 6.1.2. Earth Observation and Remote Sensing

- 6.1.3. Space Exploration

- 6.1.4. Surveillance and Reconnaissance

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Nano and Micro Satellite (0-200 kg)

- 6.2.2. Small Satellite (201-1200 kg)

- 6.2.3. Medium Satellite (1,201-2200 kg)

- 6.2.4. Large Satellite (Above 2201 kg)

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Commercial Space Payload Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Communication

- 7.1.2. Earth Observation and Remote Sensing

- 7.1.3. Space Exploration

- 7.1.4. Surveillance and Reconnaissance

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Nano and Micro Satellite (0-200 kg)

- 7.2.2. Small Satellite (201-1200 kg)

- 7.2.3. Medium Satellite (1,201-2200 kg)

- 7.2.4. Large Satellite (Above 2201 kg)

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Commercial Space Payload Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Communication

- 8.1.2. Earth Observation and Remote Sensing

- 8.1.3. Space Exploration

- 8.1.4. Surveillance and Reconnaissance

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Nano and Micro Satellite (0-200 kg)

- 8.2.2. Small Satellite (201-1200 kg)

- 8.2.3. Medium Satellite (1,201-2200 kg)

- 8.2.4. Large Satellite (Above 2201 kg)

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Commercial Space Payload Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Communication

- 9.1.2. Earth Observation and Remote Sensing

- 9.1.3. Space Exploration

- 9.1.4. Surveillance and Reconnaissance

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Nano and Micro Satellite (0-200 kg)

- 9.2.2. Small Satellite (201-1200 kg)

- 9.2.3. Medium Satellite (1,201-2200 kg)

- 9.2.4. Large Satellite (Above 2201 kg)

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Commercial Space Payload Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Communication

- 10.1.2. Earth Observation and Remote Sensing

- 10.1.3. Space Exploration

- 10.1.4. Surveillance and Reconnaissance

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Nano and Micro Satellite (0-200 kg)

- 10.2.2. Small Satellite (201-1200 kg)

- 10.2.3. Medium Satellite (1,201-2200 kg)

- 10.2.4. Large Satellite (Above 2201 kg)

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Airbus S.A.S

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Astrocast

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BlackSky Technology

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Blue Origin LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Capella Space

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 GomSpace

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Lockheed Martin Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Oneweb

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Planet IQ

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Planet Labs

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Spaceflight

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 SpaceX

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Thales Alenia Space

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Tyvak

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 United Launch Alliance LLC

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Safran

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Airbus S.A.S

List of Figures

- Figure 1: Global Commercial Space Payload Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Commercial Space Payload Revenue (million), by Application 2024 & 2032

- Figure 3: North America Commercial Space Payload Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Commercial Space Payload Revenue (million), by Type 2024 & 2032

- Figure 5: North America Commercial Space Payload Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Commercial Space Payload Revenue (million), by Country 2024 & 2032

- Figure 7: North America Commercial Space Payload Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Commercial Space Payload Revenue (million), by Application 2024 & 2032

- Figure 9: South America Commercial Space Payload Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Commercial Space Payload Revenue (million), by Type 2024 & 2032

- Figure 11: South America Commercial Space Payload Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Commercial Space Payload Revenue (million), by Country 2024 & 2032

- Figure 13: South America Commercial Space Payload Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Commercial Space Payload Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Commercial Space Payload Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Commercial Space Payload Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Commercial Space Payload Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Commercial Space Payload Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Commercial Space Payload Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Commercial Space Payload Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Commercial Space Payload Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Commercial Space Payload Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Commercial Space Payload Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Commercial Space Payload Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Commercial Space Payload Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Commercial Space Payload Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Commercial Space Payload Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Commercial Space Payload Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Commercial Space Payload Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Commercial Space Payload Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Commercial Space Payload Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Commercial Space Payload Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Commercial Space Payload Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Commercial Space Payload Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Commercial Space Payload Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Commercial Space Payload Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Commercial Space Payload Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Commercial Space Payload Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Commercial Space Payload Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Commercial Space Payload Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Commercial Space Payload Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Commercial Space Payload Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Commercial Space Payload Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Commercial Space Payload Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Commercial Space Payload Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Commercial Space Payload Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Commercial Space Payload Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Commercial Space Payload Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Commercial Space Payload Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Commercial Space Payload Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Commercial Space Payload Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Commercial Space Payload Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Commercial Space Payload Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Commercial Space Payload Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Commercial Space Payload Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Commercial Space Payload Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Commercial Space Payload Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Commercial Space Payload Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Commercial Space Payload Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Commercial Space Payload Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Commercial Space Payload Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Commercial Space Payload Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Commercial Space Payload Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Commercial Space Payload Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Commercial Space Payload Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Commercial Space Payload Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Commercial Space Payload Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Commercial Space Payload Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Commercial Space Payload Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Commercial Space Payload Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Commercial Space Payload Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Commercial Space Payload Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Commercial Space Payload Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Commercial Space Payload Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Commercial Space Payload Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Commercial Space Payload Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Commercial Space Payload Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Commercial Space Payload Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Commercial Space Payload?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Commercial Space Payload?

Key companies in the market include Airbus S.A.S, Astrocast, BlackSky Technology, Blue Origin, LLC, Capella Space, GomSpace, Lockheed Martin Corporation, Oneweb, Planet IQ, Planet Labs, Spaceflight, SpaceX, Thales Alenia Space, Tyvak, United Launch Alliance, LLC, Safran.

3. What are the main segments of the Commercial Space Payload?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Commercial Space Payload," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Commercial Space Payload report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Commercial Space Payload?

To stay informed about further developments, trends, and reports in the Commercial Space Payload, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence