Key Insights

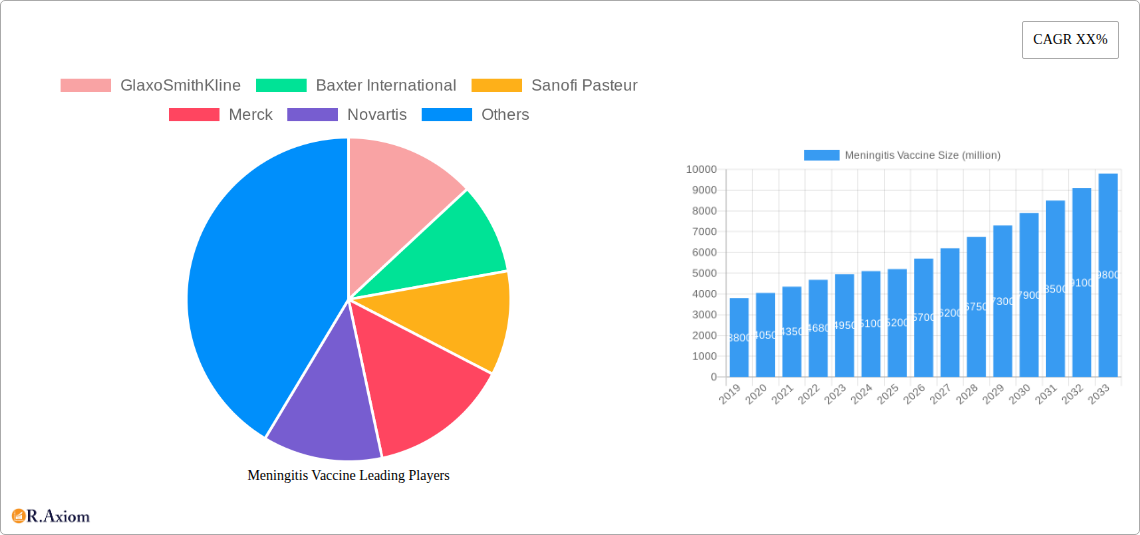

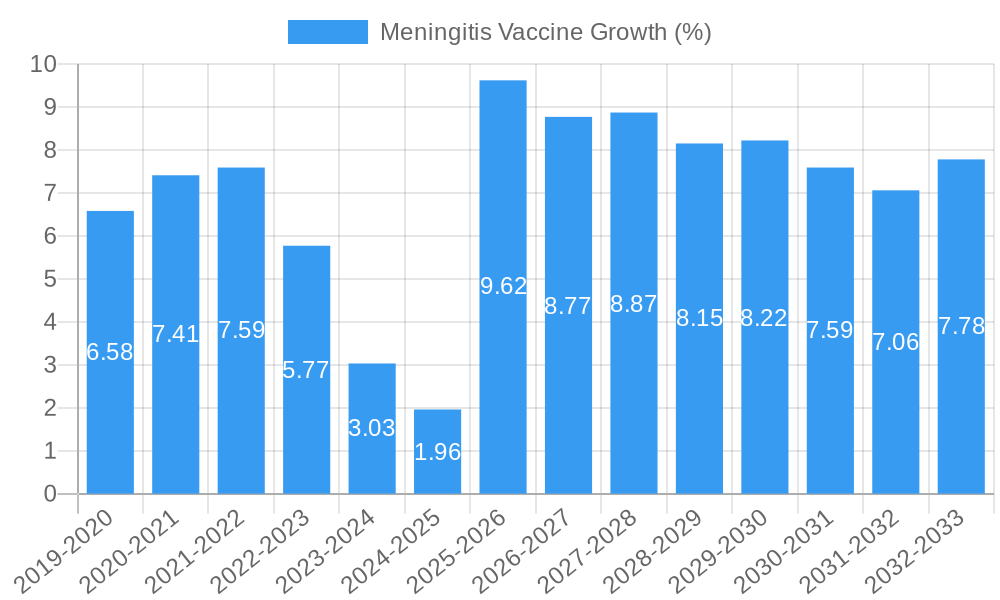

The global meningitis vaccine market is poised for robust growth, projected to reach approximately \$8,500 million by 2033, expanding from an estimated \$5,200 million in 2025. This expansion is driven by a Compound Annual Growth Rate (CAGR) of roughly 9.5% over the forecast period of 2025-2033. A primary driver of this growth is the increasing global focus on preventative healthcare and the rising incidence of meningococcal disease outbreaks, particularly in developing regions. Government immunization programs and the expanding pediatric vaccination schedules globally are further fueling demand. Furthermore, advancements in vaccine technology, leading to the development of more effective and broader-spectrum vaccines, such as those targeting multiple serogroups like Meningitis ACWY135, are significantly contributing to market expansion. The increasing awareness among healthcare providers and the public about the severe and often fatal consequences of meningitis is also playing a crucial role in driving vaccine adoption.

The market is segmented by application, with Medical Care and Hospitals representing key sectors for vaccine administration, both contributing to the overall demand. The vaccine types segment highlights the growing importance of multivalent vaccines, with Meningitis ACWY135 and Meningitis A+C vaccines anticipated to dominate due to their ability to protect against a wider range of prevalent serogroups. However, the market faces certain restraints, including the high cost of some advanced vaccines and challenges in cold chain logistics, particularly in remote or underdeveloped regions. The competitive landscape is characterized by the presence of major global players like GlaxoSmithKline, Sanofi Pasteur, and Merck, alongside emerging regional manufacturers in China and India. Continuous research and development efforts aimed at creating even more effective and accessible vaccines will shape the future trajectory of this vital market.

Meningitis Vaccine Market Overview: Comprehensive Analysis and Future Projections (2019-2033)

This comprehensive report provides an in-depth analysis of the global Meningitis Vaccine market, forecasting its trajectory from 2019 to 2033. With a base year of 2025 and a forecast period extending from 2025 to 2033, the study meticulously examines historical trends (2019-2024) and estimates the market's state in 2025. Industry stakeholders, including pharmaceutical manufacturers, healthcare providers, and investors, will find actionable insights into market concentration, innovation drivers, regulatory landscapes, competitive dynamics, and emerging opportunities within this critical vaccine sector. The report utilizes million for all monetary values and employs predictive figures where specific data is unavailable.

Meningitis Vaccine Market Concentration & Innovation

The Meningitis Vaccine market exhibits a moderate concentration, with key players like GlaxoSmithKline, Pfizer, and Sanofi Pasteur holding significant market shares, estimated in the hundreds of millions. Innovation is primarily driven by advancements in vaccine technology, including the development of conjugate vaccines and novel approaches to target specific meningococcal serogroups. Regulatory frameworks, such as those established by the FDA and EMA, play a crucial role in market access and product approval, influencing the pace of innovation and market entry. Product substitutes, while limited for direct meningococcal disease prevention, can include antibiotics for treatment and broader public health initiatives aimed at reducing transmission. End-user trends are increasingly focused on broader serogroup coverage and improved vaccine efficacy, particularly in high-risk populations. Mergers and acquisitions (M&A) activity, while not consistently high, has seen strategic partnerships aimed at expanding geographical reach and product portfolios, with past deal values estimated in the tens to hundreds of millions.

- Key Innovation Drivers:

- Development of next-generation meningococcal vaccines with broader serogroup coverage.

- Enhanced vaccine efficacy and duration of immunity.

- Advancements in manufacturing processes for cost-effectiveness and scalability.

- Regulatory Impact:

- Stringent approval processes requiring extensive clinical trials.

- Vaccination schedule recommendations by global health organizations.

- Government procurement policies and tenders influencing market demand.

- M&A Activity:

- Strategic alliances for R&D collaboration.

- Acquisitions to gain access to specific vaccine technologies or market segments.

- Estimated M&A deal values: XX to XXX million.

Meningitis Vaccine Industry Trends & Insights

The Meningitis Vaccine industry is poised for significant growth, driven by a confluence of factors including increasing awareness of meningococcal disease, expanding vaccination programs, and ongoing technological advancements. The global market is projected to experience a Compound Annual Growth Rate (CAGR) of approximately 5-7% over the forecast period. Market penetration is steadily increasing, particularly in regions with established national immunization programs and a high prevalence of meningococcal outbreaks. Technological disruptions are central to this growth, with continuous research into novel vaccine formulations and delivery methods enhancing both efficacy and patient compliance. Consumer preferences are evolving, with a growing demand for vaccines offering protection against multiple serogroups (e.g., Meningitis ACWY135) and improved safety profiles. Competitive dynamics are characterized by intense innovation and strategic collaborations among major pharmaceutical companies. The rising incidence of meningococcal disease outbreaks, coupled with a proactive approach from public health organizations to prevent such outbreaks, further fuels market expansion. The robust pipeline of meningococcal vaccines under development promises to address unmet needs and further drive market growth. The estimated market size for 2025 is projected to be in the range of XXXX to XXXX million.

Dominant Markets & Segments in Meningitis Vaccine

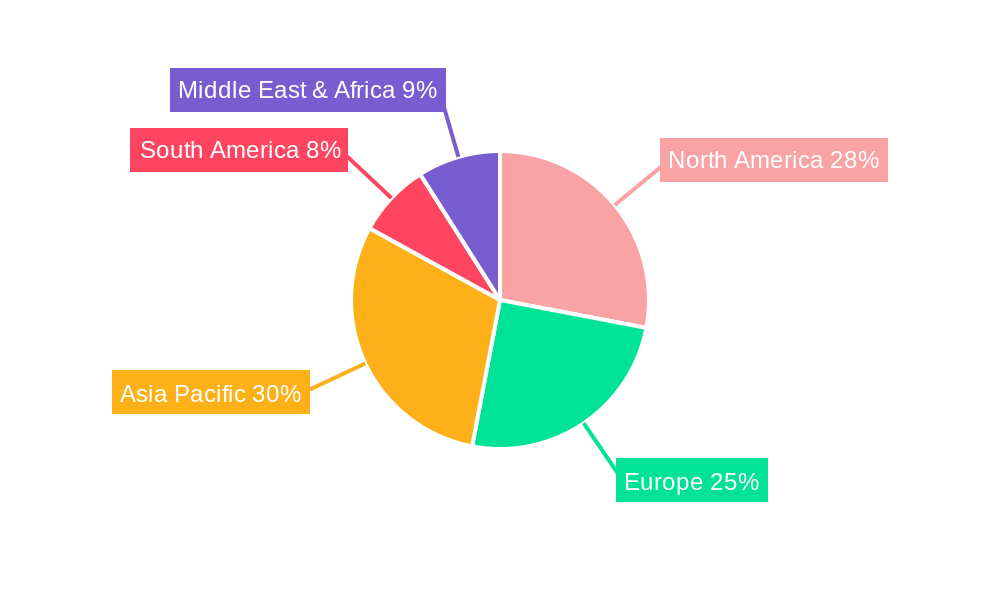

The Meningitis Vaccine market is led by the Medical Care application segment, encompassing hospitals, clinics, and public health facilities, which accounted for an estimated market share of over 60% in 2025. This dominance is attributable to widespread vaccination mandates and the critical role of healthcare infrastructure in administering vaccines and managing disease outbreaks. Geographically, North America and Europe currently represent the largest markets, driven by high healthcare spending, robust regulatory environments, and well-established vaccination programs. However, the Asia Pacific region is emerging as a significant growth engine, fueled by increasing healthcare expenditure, a rising prevalence of meningococcal disease in certain areas, and growing government initiatives to expand immunization coverage.

Within vaccine types, Meningitis ACWY135 vaccines command a substantial market share due to their ability to protect against four of the five most common meningococcal serogroups (A, C, W, and Y), offering broader protection than monovalent or bivalent vaccines. This has made them the preferred choice for routine immunization schedules in many countries.

- Key Drivers for Medical Care Segment Dominance:

- Government-led vaccination campaigns and mandatory immunization policies.

- High patient footfall in hospitals and clinics for routine check-ups and vaccinations.

- Established reimbursement policies for vaccine administration.

- Drivers for North America & Europe Dominance:

- High disposable incomes and advanced healthcare infrastructure.

- Strong emphasis on preventative healthcare and public health funding.

- Presence of major vaccine manufacturers and R&D centers.

- Growth Drivers for Asia Pacific:

- Increasing public health awareness and government investment in immunization.

- Large, young populations susceptible to meningococcal disease.

- Economies of scale enabling potential for lower vaccine prices.

- Dominance of Meningitis ACWY135 Vaccines:

- Broader spectrum of protection against major serogroups.

- Recommendation by major health organizations for routine immunization.

- Development of combination vaccines incorporating ACWY coverage.

Meningitis Vaccine Product Developments

The Meningitis Vaccine market is experiencing a wave of innovation focused on enhancing vaccine efficacy, broadening serogroup coverage, and improving delivery mechanisms. Companies are actively developing next-generation conjugate vaccines and exploring novel antigen targets to combat emerging strains of Neisseria meningitidis. Key developments include the introduction of vaccines providing extended protection, reducing the number of doses required, and offering improved safety profiles. These advancements are crucial for addressing unmet medical needs, particularly in vulnerable populations and during outbreak situations. The competitive advantage lies in offering comprehensive protection against the most prevalent and virulent serogroups, thereby contributing significantly to global public health efforts in meningitis prevention.

Report Scope & Segmentation Analysis

This report segments the Meningitis Vaccine market across key applications and vaccine types. The primary application segments include Medical Care and Hospital. Vaccine types are categorized as Meningitis A+C, Meningitis ACWY135, and Meningitis B. The Medical Care segment, encompassing general practitioners and public health centers, is expected to witness robust growth due to routine immunization programs, with an estimated market size of XXXX million in 2025, projected to reach XXXX million by 2033. The Hospital segment, crucial for managing outbreak responses and specialized pediatric care, is also projected for steady growth. The Meningitis ACWY135 vaccine type is anticipated to maintain its leading position, with an estimated market value of XXXX million in 2025, driven by its broad-spectrum protection. The Meningitis B vaccine segment is also exhibiting significant growth potential as awareness and demand for protection against this serogroup increase.

Key Drivers of Meningitis Vaccine Growth

The Meningitis Vaccine market's expansion is propelled by several critical drivers. Increasing global awareness of meningococcal disease and its potential for rapid spread and severe outcomes is a primary catalyst. Government-backed immunization programs and national vaccination policies, which often mandate or strongly recommend specific vaccines, significantly boost demand. Technological advancements in vaccine research and development are leading to more effective and broader-spectrum vaccines, such as the ACWY135 formulations, which are crucial for comprehensive protection. Furthermore, the rising incidence of meningococcal disease outbreaks in various regions prompts urgent public health responses, including increased vaccine procurement and administration. Economic factors, such as growing healthcare expenditure in emerging economies, are also contributing to market expansion by enhancing access to vaccines.

Challenges in the Meningitis Vaccine Sector

Despite robust growth prospects, the Meningitis Vaccine sector faces several challenges. High development costs and lengthy regulatory approval processes for new vaccines can be significant barriers for manufacturers. Vaccine hesitancy and misinformation can lead to lower vaccination rates, impacting market penetration. Supply chain complexities and cold chain management are critical for maintaining vaccine efficacy, especially in remote or resource-limited areas. Competitive pressures from established players and the potential for pricing sensitivities in large-scale public health tenders can also pose challenges. Additionally, the emergence of new or rare meningococcal serotypes may necessitate the development of novel vaccines, requiring ongoing investment in research and development.

Emerging Opportunities in Meningitis Vaccine

The Meningitis Vaccine market is ripe with emerging opportunities. The development of universal meningococcal vaccines that offer protection against all major serogroups would be a significant breakthrough, addressing unmet needs and expanding market reach. Innovative delivery systems, such as needle-free injectors or self-administered vaccines, could improve patient compliance and accessibility. The growing focus on pediatric and adolescent immunization schedules in many countries presents a substantial opportunity for increased vaccine uptake. Furthermore, expanding vaccination programs into underserved and low-income regions presents a significant untapped market, contingent on developing cost-effective vaccine solutions and robust distribution networks. The increasing demand for vaccines with longer durations of immunity is also driving research and development.

Leading Players in the Meningitis Vaccine Market

- GlaxoSmithKline

- Pfizer

- Sanofi Pasteur

- Merck

- Baxter International

- Novartis

- Hualan

- Zhejiang Tianyuan

- Beijing Tiantan Biological

Key Developments in Meningitis Vaccine Industry

- 2023: Launch of a novel meningococcal B vaccine with an improved dosing schedule, enhancing patient convenience and compliance.

- 2022: Strategic partnership formed between a leading pharmaceutical company and a biotechnology firm to accelerate the development of a universal meningococcal vaccine.

- 2021: Significant increase in government tenders for Meningitis ACWY135 vaccines in response to a surge in cases in several African nations.

- 2020: Approval of a new meningococcal conjugate vaccine offering extended protection against multiple serogroups, reducing the need for booster doses.

- 2019: Investment of several hundred million in R&D for next-generation meningococcal vaccines targeting previously unaddressed serotypes.

Strategic Outlook for Meningitis Vaccine Market

The strategic outlook for the Meningitis Vaccine market remains highly positive, driven by continuous innovation and a growing global commitment to infectious disease prevention. The market is expected to benefit from sustained demand for broader-spectrum vaccines and the ongoing efforts to enhance vaccination coverage worldwide. Strategic investments in research and development for novel vaccine technologies, coupled with expansion into emerging markets, will be crucial for sustained growth. Collaborations among key stakeholders, including vaccine manufacturers, governments, and public health organizations, will further accelerate market development and ensure wider access to these life-saving vaccines. The market's ability to adapt to evolving epidemiological landscapes and technological advancements will define its future success.

Meningitis Vaccine Segmentation

-

1. Application

- 1.1. Medical Care

- 1.2. Hospital

-

2. Types

- 2.1. Meningitis A+C

- 2.2. Meningitis ACWY135

- 2.3. Meningitis B

Meningitis Vaccine Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Meningitis Vaccine REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Meningitis Vaccine Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Medical Care

- 5.1.2. Hospital

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Meningitis A+C

- 5.2.2. Meningitis ACWY135

- 5.2.3. Meningitis B

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Meningitis Vaccine Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Medical Care

- 6.1.2. Hospital

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Meningitis A+C

- 6.2.2. Meningitis ACWY135

- 6.2.3. Meningitis B

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Meningitis Vaccine Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Medical Care

- 7.1.2. Hospital

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Meningitis A+C

- 7.2.2. Meningitis ACWY135

- 7.2.3. Meningitis B

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Meningitis Vaccine Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Medical Care

- 8.1.2. Hospital

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Meningitis A+C

- 8.2.2. Meningitis ACWY135

- 8.2.3. Meningitis B

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Meningitis Vaccine Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Medical Care

- 9.1.2. Hospital

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Meningitis A+C

- 9.2.2. Meningitis ACWY135

- 9.2.3. Meningitis B

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Meningitis Vaccine Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Medical Care

- 10.1.2. Hospital

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Meningitis A+C

- 10.2.2. Meningitis ACWY135

- 10.2.3. Meningitis B

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 GlaxoSmithKline

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Baxter International

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sanofi Pasteur

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Merck

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Novartis

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Pfizer

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hualan

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Zhejiang Tianyuan

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Beijing Tiantan Biological

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 GlaxoSmithKline

List of Figures

- Figure 1: Global Meningitis Vaccine Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Meningitis Vaccine Revenue (million), by Application 2024 & 2032

- Figure 3: North America Meningitis Vaccine Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Meningitis Vaccine Revenue (million), by Types 2024 & 2032

- Figure 5: North America Meningitis Vaccine Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Meningitis Vaccine Revenue (million), by Country 2024 & 2032

- Figure 7: North America Meningitis Vaccine Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Meningitis Vaccine Revenue (million), by Application 2024 & 2032

- Figure 9: South America Meningitis Vaccine Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Meningitis Vaccine Revenue (million), by Types 2024 & 2032

- Figure 11: South America Meningitis Vaccine Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Meningitis Vaccine Revenue (million), by Country 2024 & 2032

- Figure 13: South America Meningitis Vaccine Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Meningitis Vaccine Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Meningitis Vaccine Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Meningitis Vaccine Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Meningitis Vaccine Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Meningitis Vaccine Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Meningitis Vaccine Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Meningitis Vaccine Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Meningitis Vaccine Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Meningitis Vaccine Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Meningitis Vaccine Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Meningitis Vaccine Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Meningitis Vaccine Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Meningitis Vaccine Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Meningitis Vaccine Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Meningitis Vaccine Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Meningitis Vaccine Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Meningitis Vaccine Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Meningitis Vaccine Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Meningitis Vaccine Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Meningitis Vaccine Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Meningitis Vaccine Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Meningitis Vaccine Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Meningitis Vaccine Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Meningitis Vaccine Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Meningitis Vaccine Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Meningitis Vaccine Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Meningitis Vaccine Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Meningitis Vaccine Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Meningitis Vaccine Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Meningitis Vaccine Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Meningitis Vaccine Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Meningitis Vaccine Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Meningitis Vaccine Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Meningitis Vaccine Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Meningitis Vaccine Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Meningitis Vaccine Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Meningitis Vaccine Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Meningitis Vaccine Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Meningitis Vaccine Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Meningitis Vaccine Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Meningitis Vaccine Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Meningitis Vaccine Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Meningitis Vaccine Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Meningitis Vaccine Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Meningitis Vaccine Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Meningitis Vaccine Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Meningitis Vaccine Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Meningitis Vaccine Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Meningitis Vaccine Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Meningitis Vaccine Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Meningitis Vaccine Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Meningitis Vaccine Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Meningitis Vaccine Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Meningitis Vaccine Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Meningitis Vaccine Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Meningitis Vaccine Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Meningitis Vaccine Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Meningitis Vaccine Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Meningitis Vaccine Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Meningitis Vaccine Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Meningitis Vaccine Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Meningitis Vaccine Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Meningitis Vaccine Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Meningitis Vaccine Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Meningitis Vaccine Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Meningitis Vaccine?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Meningitis Vaccine?

Key companies in the market include GlaxoSmithKline, Baxter International, Sanofi Pasteur, Merck, Novartis, Pfizer, Hualan, Zhejiang Tianyuan, Beijing Tiantan Biological.

3. What are the main segments of the Meningitis Vaccine?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 5600.00, USD 8400.00, and USD 11200.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Meningitis Vaccine," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Meningitis Vaccine report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Meningitis Vaccine?

To stay informed about further developments, trends, and reports in the Meningitis Vaccine, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence