Key Insights

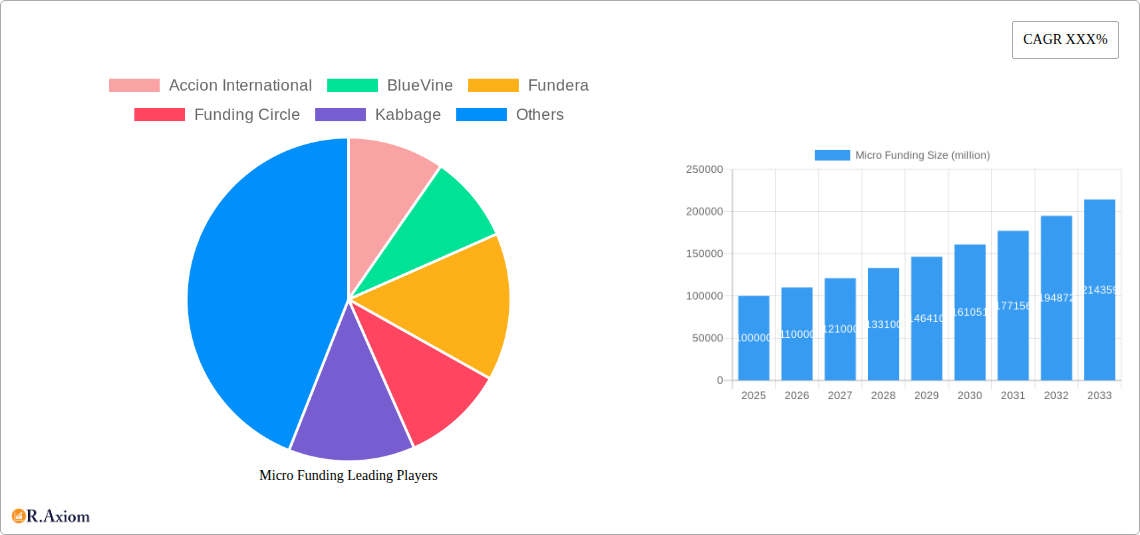

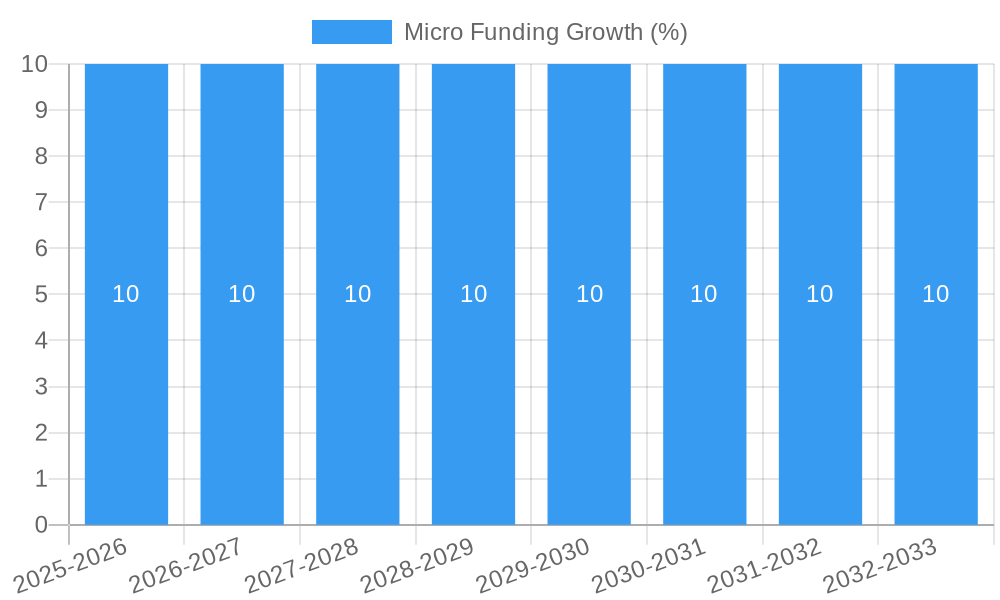

The global micro funding market is poised for substantial growth, projected to reach approximately \$200 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of around 10-12% from 2025. This expansion is primarily fueled by the increasing demand for accessible financing among individuals and small to medium-sized enterprises (SMEs), especially in emerging economies. The proliferation of digital lending platforms and fintech innovations has democratized access to capital, making it easier for underserved populations and nascent businesses to secure the funds they need to thrive. Key drivers include supportive government initiatives aimed at financial inclusion, a growing entrepreneurial spirit, and the inherent agility of micro funding solutions in catering to specific financial needs that traditional banking institutions may overlook. The market's value, estimated at \$100 billion in 2025, is expected to more than double within the forecast period, underscoring its dynamic trajectory.

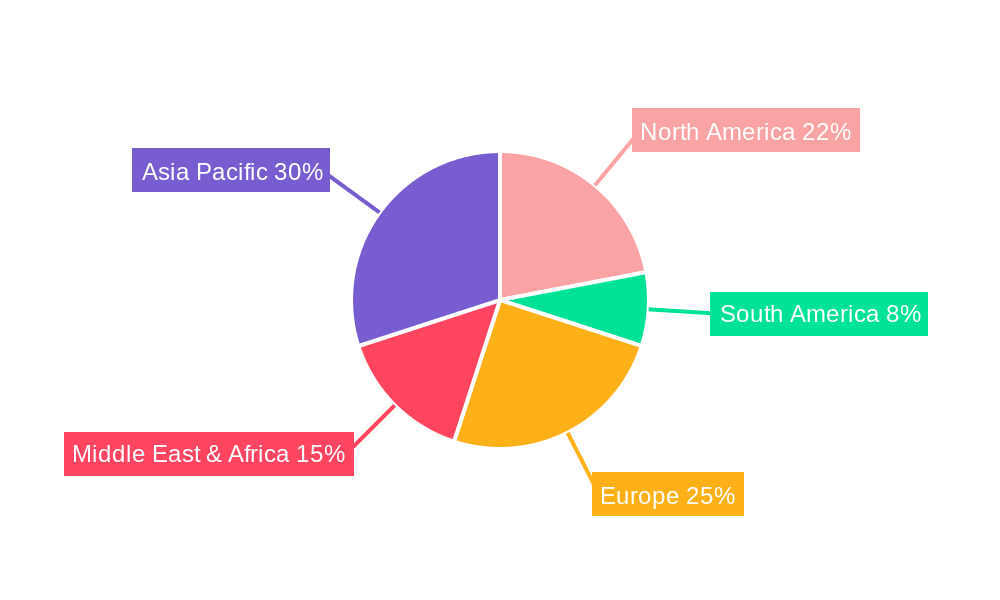

The market is segmented across various applications, with a significant focus on micro enterprises and individuals, reflecting the core beneficiaries of this financial ecosystem. On the supply side, Banks, Micro Finance Institutions (MFIs), and Non-Banking Financial Companies (NBFCs) are key players, alongside innovative online lending platforms. While the digital transformation is a significant trend, enabling faster processing and broader reach, challenges such as regulatory complexities and the potential for over-indebtedness in vulnerable segments require careful management. Geographically, Asia Pacific, driven by the vast populations and burgeoning economies of China and India, is expected to dominate, followed by North America and Europe. Emerging markets in Africa and South America also present significant growth opportunities, driven by the imperative for financial inclusion and economic development.

Micro Funding Market Concentration & Innovation

The micro funding landscape is characterized by a dynamic interplay of established financial institutions and agile fintech disruptors. While market concentration remains moderate, with a few key players like BlueVine, Funding Circle, and OnDeck holding significant market share, ongoing innovation is fostering a more competitive environment. The proliferation of digital platforms has lowered entry barriers, enabling a surge in specialized micro-lending solutions. Regulatory frameworks, particularly those governing digital lending and consumer protection, are evolving, aiming to strike a balance between fostering innovation and mitigating risks. Product substitutes, ranging from traditional bank loans to peer-to-peer lending and crowdfunding, offer diverse options for micro-enterprises and individuals. End-user trends are increasingly driven by the demand for faster, more accessible, and tailored financing solutions, with micro-enterprises and individuals actively seeking alternatives to conventional banking. Mergers and acquisitions (M&A) activity is a notable feature, with recent deals valued in the hundreds of millions, indicative of consolidation and strategic expansion. For instance, Kabbage's acquisition by American Express for an estimated 1,000 million signifies a significant consolidation, integrating its AI-driven lending capabilities into a larger financial services ecosystem. This trend suggests a move towards platform integration and enhanced service offerings.

- Market Share Dynamics: Major players like BlueVine and Funding Circle are estimated to command a combined market share exceeding 200 million in loans disbursed annually.

- M&A Deal Values: Recent M&A activities have seen deal values range from 50 million to over 1,000 million, signaling strong investor confidence and strategic intent.

- Innovation Drivers: Key drivers include advancements in AI and machine learning for credit scoring, blockchain for enhanced security and transparency, and open banking APIs for seamless integration.

Micro Funding Industry Trends & Insights

The micro funding industry is poised for substantial growth, driven by an expanding base of underserved micro-enterprises and individuals seeking agile capital solutions. The global market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 15% over the forecast period, reaching an estimated market size of 10,000 million by 2033. Technological disruptions are at the forefront, with Artificial Intelligence (AI) and Machine Learning (ML) revolutionizing credit assessment, enabling faster loan approvals and more accurate risk management. This has significantly improved market penetration, particularly within emerging economies, where access to traditional finance is limited. Consumer preferences are shifting towards digital-first experiences, demanding intuitive mobile applications, transparent fee structures, and personalized loan products. The competitive dynamics are intensifying, with both traditional banks and new-age fintech companies vying for market share. NBFCs and Micro Finance Institutions are increasingly adopting digital strategies to compete effectively. The ease of application and speed of disbursement are becoming critical differentiators. For example, the integration of digital onboarding processes has reduced the average loan application time by an estimated 50%. Furthermore, the rise of alternative data sources for credit scoring, such as utility payments and social media activity (ethically sourced and with consent), is expanding access to finance for those with thin or no credit history, contributing to increased market penetration. The market penetration of micro funding solutions is expected to reach 60% of the addressable market by the end of the forecast period.

- CAGR: Projected CAGR of 15% from 2025–2033.

- Market Size Projection: Estimated market size to reach 10,000 million by 2033.

- Technological Impact: AI and ML have reduced loan approval times by an average of 50%.

- Market Penetration: Expected to reach 60% of the addressable market by 2033.

Dominant Markets & Segments in Micro Funding

Asia-Pacific, particularly countries like India and China, is emerging as a dominant region in the micro funding market. This dominance is attributed to several key drivers, including robust economic policies supporting small and medium-sized enterprises (SMEs), a large unbanked and underbanked population, and rapid advancements in digital infrastructure and mobile penetration. Government initiatives focused on financial inclusion and SME development have created a fertile ground for micro funding platforms. For instance, India's "Startup India" initiative and China's Ant Group's expansive digital financial services ecosystem have significantly fueled the demand and supply of micro funding.

Within the application segment, Micro Enterprises are the largest beneficiaries and drivers of micro funding, accounting for an estimated 70% of the total loan disbursements. These businesses often require smaller loan amounts for working capital, inventory, or operational expansion and find traditional banking routes too cumbersome. The flexibility and speed offered by micro funding platforms are particularly appealing.

In terms of type, NBFCs (Non-Banking Financial Companies) and Micro Finance Institutions (MFIs) are playing a pivotal role in dominating the micro funding space. They are often more agile and better equipped to cater to the specific needs of micro-enterprises and individuals in underserved communities compared to traditional banks. Their localized presence and tailored product offerings, often incorporating digital solutions, allow them to effectively reach and serve this segment. For example, MFIs are estimated to disburse over 5,000 million in microloans annually across the target regions.

- Leading Region: Asia-Pacific, driven by India and China.

- Key Drivers in Asia-Pacific:

- Supportive government policies for SMEs and financial inclusion.

- Large unbanked and underbanked populations.

- High mobile penetration and digital adoption.

- Rapid economic growth of micro and small enterprises.

- Dominant Application Segment: Micro Enterprises, accounting for approximately 70% of loan disbursements.

- Drivers: Need for working capital, inventory financing, and operational expansion; preference for fast and flexible funding; suitability for digital lending platforms.

- Dominant Type Segment: NBFCs and Micro Finance Institutions.

- Drivers: Agility in product development and delivery; localized presence and understanding of target demographics; effective digital integration; ability to leverage alternative data for credit assessment.

Micro Funding Product Developments

Recent product developments in micro funding are largely focused on enhancing accessibility, speed, and customization through technological innovation. This includes the proliferation of AI-powered underwriting engines that enable near-instantaneous loan decisions and disbursements, often within minutes. Mobile-first lending applications and digital onboarding processes are becoming standard, simplifying the application journey for micro-enterprises and individuals. Blockchain technology is being explored for increased transparency and security in lending transactions. Competitive advantages are being carved out through unique risk assessment models that leverage alternative data, providing access to finance for those traditionally excluded. The market fit is further improved by offering flexible repayment options and tailored loan products designed for specific industry needs.

Report Scope & Segmentation Analysis

This report analyzes the global micro funding market, segmented by Application and Type. The Application segment includes Individual, Micro Enterprises, and Small Enterprises. The Type segment comprises Banks, Micro Finance Institutions, NBFCs, and Others.

- Individual: Focuses on micro-loans for personal use or small-scale self-employment, with an estimated market size of 800 million by 2025, projected to grow at a CAGR of 12%. Competitive dynamics are driven by speed and convenience.

- Micro Enterprises: Represents the largest segment, with an estimated market size of 5,000 million by 2025, projected to grow at a CAGR of 16%. This segment is characterized by high demand for working capital and operational loans, with intense competition among fintechs and NBFCs.

- Small Enterprises: Targets businesses with slightly larger funding needs, estimated at 2,200 million by 2025, with a projected CAGR of 14%. These enterprises benefit from more sophisticated digital lending platforms.

- Banks: Traditional banks are increasing their offerings in micro funding, with an estimated market share of 1,500 million by 2025, growing at 10% CAGR. Their strength lies in existing customer relationships but face challenges in agility.

- Micro Finance Institutions (MFIs): A significant player in underserved markets, with an estimated market size of 3,000 million by 2025, growing at 17% CAGR. They excel in community outreach and tailored support.

- NBFCs: Leading the charge in digital micro funding, with an estimated market size of 3,500 million by 2025, growing at 18% CAGR. They are characterized by rapid innovation and flexible lending.

- Others: Includes P2P lending platforms and crowdfunding, with an estimated market size of 700 million by 2025, growing at 13% CAGR.

Key Drivers of Micro Funding Growth

The micro funding sector is propelled by a confluence of powerful growth drivers. Technological advancements, particularly in AI and machine learning, are enabling more efficient credit scoring and faster loan processing, significantly expanding access to finance. Economic factors, such as the increasing number of individuals and micro-enterprises requiring flexible capital for growth and operational needs, form a substantial demand base. Supportive government initiatives and regulatory reforms aimed at promoting financial inclusion and supporting SMEs are creating a more conducive environment for micro-lending. The rising adoption of digital payment systems and the increasing trust in online financial transactions further facilitate the growth of digital micro funding platforms.

- Technological Advancements: AI/ML for credit scoring, digital onboarding, and automated underwriting.

- Economic Demand: Growing number of individuals and micro-enterprises needing flexible capital.

- Government Support: Financial inclusion policies and SME development programs.

- Digital Adoption: Increased trust in and usage of online financial services.

Challenges in the Micro Funding Sector

Despite robust growth, the micro funding sector faces several challenges. Regulatory hurdles and evolving compliance requirements can be complex and costly, particularly for smaller fintechs. The risk of loan defaults remains a significant concern, exacerbated by limited credit history of some borrowers and economic downturns. Intense competition from a growing number of players can lead to price wars and pressure on profit margins. Operational challenges, such as managing collections and ensuring data security, require continuous investment. Furthermore, a lack of financial literacy among some target borrowers can hinder effective utilization of funds and timely repayment.

- Regulatory Complexities: Navigating diverse and evolving compliance landscapes.

- Credit Risk Management: Addressing higher default rates among underserved populations.

- Intense Competition: Leading to margin compression and innovation pressure.

- Operational Efficiency: Maintaining cost-effective collections and robust data security.

Emerging Opportunities in Micro Funding

Significant emerging opportunities lie in leveraging data analytics for hyper-personalized loan products and expanding into new geographic markets with high potential for financial inclusion. The integration of micro funding with other financial services, such as insurance and advisory services, presents a lucrative avenue for customer retention and revenue diversification. The growing trend of embedded finance, where lending is integrated into e-commerce platforms or business management software, offers a seamless and convenient way to reach micro-enterprises. Furthermore, the development of sustainable and impact-focused micro funding products catering to specific social or environmental objectives is gaining traction.

- Data Analytics: Hyper-personalized loan offerings and enhanced risk assessment.

- Market Expansion: Tapping into underserved regions and populations.

- Financial Service Bundling: Offering integrated financial solutions beyond just loans.

- Embedded Finance: Seamlessly integrating lending into business workflows.

Leading Players in the Micro Funding Market

- Accion International

- BlueVine

- Fundera

- Funding Circle

- Kabbage

- Kiva

- Lendio

- LENDR

- OnDeck

- StreetShares

- Ant Group

Key Developments in Micro Funding Industry

- 2023/01: BlueVine announces expansion of its lending platform with enhanced AI capabilities, aiming to reduce loan approval times by an additional 20%.

- 2023/04: Funding Circle partners with a major bank to increase its lending capacity by 500 million, focusing on small businesses in underserved sectors.

- 2023/07: Kabbage launches a new suite of working capital solutions tailored for e-commerce businesses, seeing an initial uptake of 150 million in new loans.

- 2023/10: Ant Group pilots a blockchain-based micro-lending platform in Southeast Asia, aiming for enhanced transparency and reduced transaction costs, with an estimated value of 300 million.

- 2024/02: OnDeck introduces a new term loan product with flexible repayment options, catering to seasonal businesses, projected to disburse 400 million in its first year.

- 2024/05: Lendio acquires a smaller online lending marketplace, consolidating market share and expanding its reach into new customer segments, with a deal value estimated at 70 million.

- 2024/08: Kiva introduces a new impact investing fund focused on women entrepreneurs in developing countries, attracting 100 million in initial investment.

- 2024/11: StreetShares launches a new digital platform for veteran-owned businesses, providing access to capital and business resources, projecting 250 million in lending by 2026.

Strategic Outlook for Micro Funding Market

The strategic outlook for the micro funding market remains exceptionally positive, driven by a sustained demand for accessible and efficient financial solutions for individuals and small enterprises. The ongoing digital transformation within the financial sector, coupled with supportive regulatory environments in many regions, will continue to fuel innovation and market expansion. Key growth catalysts include the further integration of AI for personalized financial advisory and automated risk management, the development of more sophisticated embedded finance solutions that seamlessly integrate lending into business operations, and the increasing focus on ESG-aligned lending practices. Strategic partnerships between fintechs and traditional financial institutions will likely accelerate, leading to enhanced product offerings and broader market reach, positioning the micro funding sector for robust and sustained growth in the coming years.

Micro Funding Segmentation

-

1. Application

- 1.1. Individual

- 1.2. Micro Enterprises

- 1.3. Small Enterprises

-

2. Type

- 2.1. Banks

- 2.2. Micro Finance Institute

- 2.3. NBFC

- 2.4. Others

Micro Funding Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Micro Funding REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Micro Funding Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Individual

- 5.1.2. Micro Enterprises

- 5.1.3. Small Enterprises

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Banks

- 5.2.2. Micro Finance Institute

- 5.2.3. NBFC

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Micro Funding Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Individual

- 6.1.2. Micro Enterprises

- 6.1.3. Small Enterprises

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Banks

- 6.2.2. Micro Finance Institute

- 6.2.3. NBFC

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Micro Funding Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Individual

- 7.1.2. Micro Enterprises

- 7.1.3. Small Enterprises

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Banks

- 7.2.2. Micro Finance Institute

- 7.2.3. NBFC

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Micro Funding Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Individual

- 8.1.2. Micro Enterprises

- 8.1.3. Small Enterprises

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Banks

- 8.2.2. Micro Finance Institute

- 8.2.3. NBFC

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Micro Funding Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Individual

- 9.1.2. Micro Enterprises

- 9.1.3. Small Enterprises

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Banks

- 9.2.2. Micro Finance Institute

- 9.2.3. NBFC

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Micro Funding Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Individual

- 10.1.2. Micro Enterprises

- 10.1.3. Small Enterprises

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Banks

- 10.2.2. Micro Finance Institute

- 10.2.3. NBFC

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Accion International

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BlueVine

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fundera

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Funding Circle

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kabbage

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kiva

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Lendio

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 LENDR

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 OnDeck

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 StreetShares

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Ant Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Accion International

List of Figures

- Figure 1: Global Micro Funding Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Micro Funding Revenue (million), by Application 2024 & 2032

- Figure 3: North America Micro Funding Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Micro Funding Revenue (million), by Type 2024 & 2032

- Figure 5: North America Micro Funding Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Micro Funding Revenue (million), by Country 2024 & 2032

- Figure 7: North America Micro Funding Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Micro Funding Revenue (million), by Application 2024 & 2032

- Figure 9: South America Micro Funding Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Micro Funding Revenue (million), by Type 2024 & 2032

- Figure 11: South America Micro Funding Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Micro Funding Revenue (million), by Country 2024 & 2032

- Figure 13: South America Micro Funding Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Micro Funding Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Micro Funding Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Micro Funding Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Micro Funding Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Micro Funding Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Micro Funding Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Micro Funding Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Micro Funding Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Micro Funding Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Micro Funding Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Micro Funding Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Micro Funding Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Micro Funding Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Micro Funding Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Micro Funding Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Micro Funding Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Micro Funding Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Micro Funding Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Micro Funding Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Micro Funding Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Micro Funding Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Micro Funding Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Micro Funding Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Micro Funding Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Micro Funding Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Micro Funding Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Micro Funding Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Micro Funding Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Micro Funding Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Micro Funding Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Micro Funding Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Micro Funding Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Micro Funding Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Micro Funding Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Micro Funding Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Micro Funding Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Micro Funding Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Micro Funding Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Micro Funding Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Micro Funding Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Micro Funding Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Micro Funding Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Micro Funding Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Micro Funding Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Micro Funding Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Micro Funding Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Micro Funding Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Micro Funding Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Micro Funding Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Micro Funding Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Micro Funding Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Micro Funding Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Micro Funding Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Micro Funding Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Micro Funding Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Micro Funding Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Micro Funding Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Micro Funding Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Micro Funding Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Micro Funding Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Micro Funding Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Micro Funding Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Micro Funding Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Micro Funding Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Micro Funding Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Micro Funding?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Micro Funding?

Key companies in the market include Accion International, BlueVine, Fundera, Funding Circle, Kabbage, Kiva, Lendio, LENDR, OnDeck, StreetShares, Ant Group.

3. What are the main segments of the Micro Funding?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Micro Funding," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Micro Funding report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Micro Funding?

To stay informed about further developments, trends, and reports in the Micro Funding, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence