Key Insights

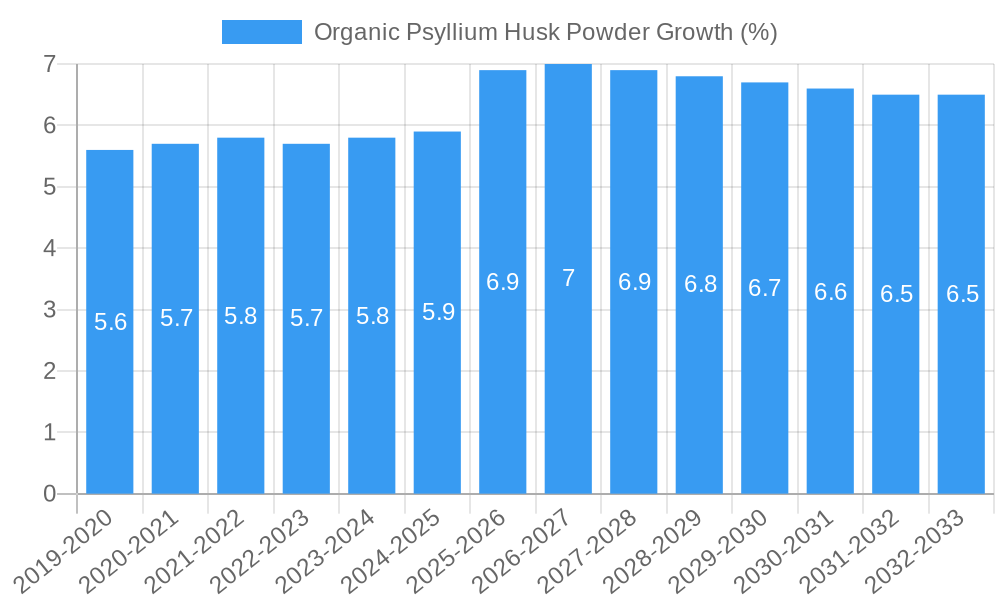

The global Organic Psyllium Husk Powder market is poised for significant expansion, projected to reach approximately USD 950 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.5% anticipated to extend through 2033. This growth is propelled by a confluence of rising health consciousness and an increasing demand for natural ingredients across various industries. The Food Industry stands as a dominant application segment, encompassing beverages, ice cream, and bakery products, where psyllium husk powder's dietary fiber content is highly valued for its digestive health benefits and its ability to improve texture and stability. The Pharmaceutical Industry also represents a substantial market, leveraging psyllium's laxative properties and its use in formulating health supplements and bulk-forming agents. Furthermore, the Cosmetic Industry is increasingly incorporating psyllium for its emulsifying and thickening properties in personal care products.

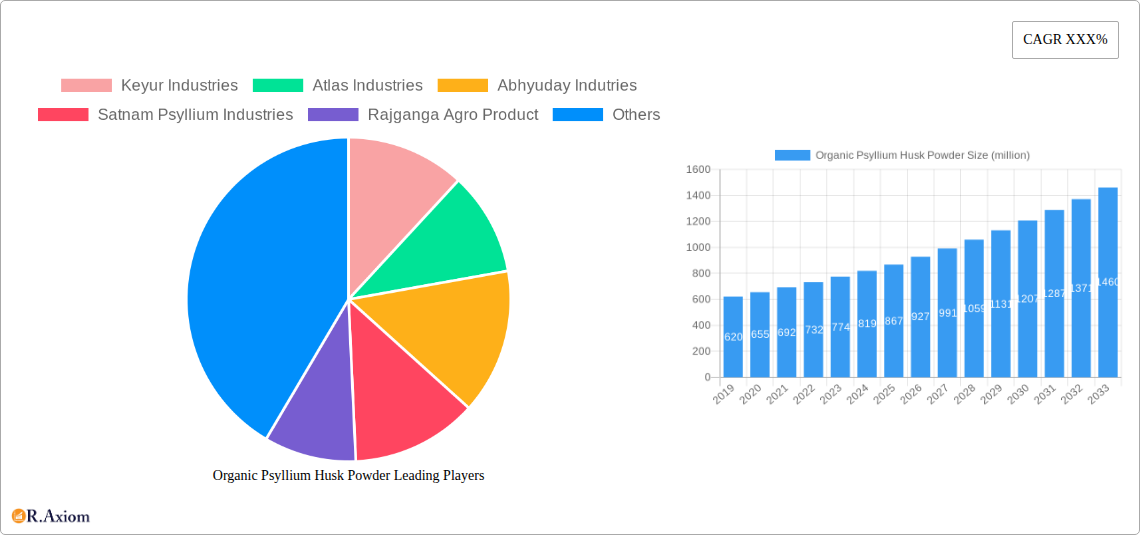

The market is characterized by distinct product segments, with Psyllium Husk Powder 95% and 98% holding considerable market share due to their widespread use and balanced properties. However, the demand for higher purity grades, such as 99%, is steadily growing as applications become more specialized and stringent quality requirements emerge. Key market drivers include the escalating prevalence of lifestyle-related diseases, the growing preference for plant-based and organic food alternatives, and advancements in processing technologies that enhance the quality and availability of psyllium husk powder. Restraints, such as price volatility of raw psyllium and potential supply chain disruptions, are being navigated through strategic sourcing and production efficiencies. Leading companies like Keyur Industries, Atlas Industries, and NOW are actively contributing to market innovation and expansion, particularly in regions like North America and Asia Pacific, which are expected to lead market growth.

Organic Psyllium Husk Powder Market Concentration & Innovation

The organic psyllium husk powder market exhibits a moderate to high concentration, with a few key players holding significant market share. Innovation in this sector is primarily driven by advancements in processing techniques to enhance purity and solubility, alongside the development of novel applications in functional foods and pharmaceuticals. Regulatory frameworks, particularly those pertaining to organic certification and food/drug safety standards, play a crucial role in shaping market entry and product development. While direct product substitutes are limited, alternative fiber sources and synthetic ingredients pose indirect competitive threats. End-user trends indicate a strong preference for natural and organic ingredients, driven by growing health consciousness and demand for gut health solutions. Mergers and acquisitions (M&A) activities, while not extensively reported in terms of specific deal values, are expected to increase as larger companies seek to consolidate their market position and expand their product portfolios. The market share distribution is dynamic, with leading companies continuously investing in R&D to maintain a competitive edge. M&A deal values are predicted to rise as market consolidation accelerates.

- Key Innovation Drivers:

- Improved extraction and purification methods.

- Development of value-added psyllium-based ingredients.

- Exploration of new therapeutic and functional food applications.

- Regulatory Impact:

- Strict organic certification requirements.

- Adherence to pharmaceutical GMP standards.

- Food safety regulations influencing product formulation.

- End-User Preferences:

- Growing demand for plant-based and natural ingredients.

- Increased awareness of digestive health benefits.

- Preference for gluten-free and low-calorie food options.

Organic Psyllium Husk Powder Industry Trends & Insights

The global organic psyllium husk powder market is poised for significant expansion, driven by a confluence of escalating health consciousness, a surge in demand for natural and functional ingredients, and increasing applications across diverse industries. The market is projected to witness a robust Compound Annual Growth Rate (CAGR) of approximately 7.5% over the forecast period of 2025–2033. This growth is underpinned by a growing understanding of psyllium husk's extensive health benefits, particularly its efficacy as a dietary fiber for promoting digestive health, aiding in weight management, and regulating blood sugar levels. Consumers are actively seeking natural remedies and preventative health solutions, making organic psyllium husk powder an attractive ingredient for both food and pharmaceutical formulations. Technological disruptions in processing and extraction technologies are enhancing the quality, purity, and solubility of psyllium husk powder, thereby expanding its applicability. For instance, advancements in micronization techniques are yielding finer powders with improved textural properties, making them more suitable for incorporation into a wider range of food products like beverages and baked goods.

Consumer preferences are shifting towards clean-label products, free from artificial additives and preservatives, further boosting the appeal of organic psyllium husk powder. The rising prevalence of lifestyle-related diseases such as obesity, diabetes, and gastrointestinal disorders is compelling individuals to adopt healthier dietary habits, thereby increasing the consumption of fiber-rich products. The pharmaceutical industry is leveraging psyllium husk for its laxative properties and its potential in managing cholesterol and blood sugar levels, leading to an increased demand for high-purity grades. The cosmetic industry is also exploring psyllium husk for its moisturizing and skin-conditioning properties. The competitive landscape is characterized by a mix of established global players and emerging regional manufacturers, all vying for market share through product differentiation, strategic partnerships, and geographical expansion. The market penetration of organic psyllium husk powder is steadily increasing as awareness and adoption grow across developed and developing economies. The trend towards plant-based diets also contributes significantly to this growth trajectory.

Dominant Markets & Segments in Organic Psyllium Husk Powder

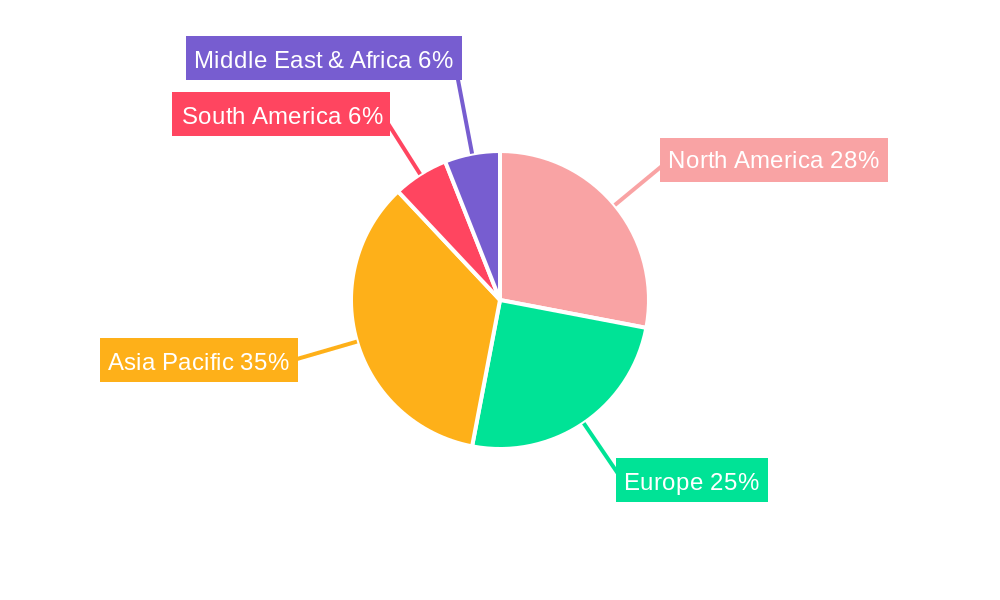

The organic psyllium husk powder market's dominance is multifaceted, with specific regions, countries, and product segments exhibiting exceptional growth and consumption patterns. Geographically, North America and Europe currently represent the largest markets, driven by high disposable incomes, advanced healthcare infrastructure, and a strong consumer awareness regarding the health benefits of dietary fiber. Within these regions, the United States and Germany stand out as key consumption hubs.

Application Segment Dominance:

- Food Industry (Beverages, Ice Cream, Bakery Products, etc.): This segment is a significant growth engine. The increasing demand for healthy and functional food products, including gluten-free baked goods, fiber-fortified beverages, and low-calorie ice cream formulations, is propelling the use of organic psyllium husk powder. Its ability to improve texture, act as a binder, and enhance nutritional profiles makes it a versatile ingredient for food manufacturers seeking to cater to evolving consumer preferences. Economic policies promoting healthy eating and food innovation further support this segment's dominance.

- Pharmaceutical Industry: This segment is a cornerstone of the market. Psyllium husk's well-established efficacy as a bulk-forming laxative, coupled with its recognized role in managing cholesterol and blood glucose levels, ensures consistent demand from pharmaceutical companies. Regulatory approvals for its use in over-the-counter and prescription medications solidify its position. Infrastructure in terms of pharmaceutical manufacturing and distribution networks facilitates its widespread availability.

- Cosmetic Industry: While a smaller segment, the cosmetic industry presents emerging opportunities. Psyllium husk's natural moisturizing and emollient properties are attracting cosmetic formulators looking for organic ingredients in skincare products. Consumer demand for natural beauty products fuels this niche's growth.

Type Segment Dominance:

- Psyllium Husk Powder 95% and 98%: These grades are currently the most dominant due to their balance of purity, functionality, and cost-effectiveness, making them suitable for a broad range of food and pharmaceutical applications.

- Psyllium Husk Powder 99%: This premium grade is gaining traction, particularly in the pharmaceutical sector and high-end functional food products where maximum purity is paramount. Its higher cost is often justified by its superior performance and compliance with stringent quality standards.

- Psyllium Husk Powder 85%: While less dominant, this grade finds applications in less demanding food and animal feed sectors where cost is a primary consideration.

The overall dominance is also influenced by infrastructure development, particularly robust supply chains that ensure the consistent availability of high-quality organic psyllium husk. Economic policies that support the agricultural sector and incentivize organic farming practices indirectly bolster the market's leading positions.

Organic Psyllium Husk Powder Product Developments

Recent product developments in the organic psyllium husk powder market focus on enhancing its functional properties and expanding its utility. Innovations include the development of highly soluble psyllium powders for seamless integration into beverages, as well as micronized variants offering improved texture and mouthfeel in baked goods and confectionery. The competitive advantage lies in offering specific purity grades (e.g., 99% for pharmaceutical applications) and certifications (e.g., USDA Organic, Kosher) that meet stringent industry requirements. Companies are also exploring synergistic formulations with other natural ingredients to create enhanced health and wellness products.

Report Scope & Segmentation Analysis

This comprehensive report delves into the global organic psyllium husk powder market, segmenting it by application and product type. The study encompasses the historical period of 2019–2024 and provides detailed forecasts up to 2033, with a base year of 2025.

- Application Segmentation: The market is analyzed across the Food Industry (including specific sub-segments like Beverages, Ice Cream, and Bakery Products), the Pharmaceutical Industry, and the Cosmetic Industry. Each application segment's market size, growth projections, and competitive dynamics are thoroughly examined.

- Type Segmentation: The report further segments the market by product type, focusing on Psyllium Husk Powder 85%, Psyllium Husk Powder 95%, Psyllium Husk Powder 98%, and Psyllium Husk Powder 99%. The market share, growth trends, and end-use suitability of each grade are meticulously assessed.

Key Drivers of Organic Psyllium Husk Powder Growth

The organic psyllium husk powder market is propelled by several critical growth drivers. Firstly, the escalating global demand for natural and plant-based ingredients, driven by increasing health consciousness and a preference for clean-label products, is a primary catalyst. Secondly, the well-documented health benefits of psyllium, particularly its role in digestive health, weight management, and blood sugar control, are fueling its incorporation into functional foods and dietary supplements. Thirdly, advancements in processing technologies are enhancing the purity, solubility, and sensory attributes of psyllium husk powder, making it more versatile for various applications. Finally, the pharmaceutical industry's sustained use of psyllium as an active pharmaceutical ingredient (API) for laxative and cardiovascular health applications provides a stable and growing demand base.

Challenges in the Organic Psyllium Husk Powder Sector

Despite its promising growth trajectory, the organic psyllium husk powder sector faces several challenges. Supply chain disruptions, stemming from climatic variations affecting agricultural output and geopolitical factors, can lead to price volatility and availability issues. Stringent and evolving regulatory frameworks governing organic certification and food safety standards across different regions can pose compliance hurdles for manufacturers. Furthermore, the presence of alternative fiber sources and synthetic ingredients, though not direct substitutes, presents indirect competition, requiring continuous innovation and marketing efforts to highlight psyllium's unique benefits. The cost of production, especially for premium organic grades, can also be a barrier to market penetration in price-sensitive segments.

Emerging Opportunities in Organic Psyllium Husk Powder

Emerging opportunities in the organic psyllium husk powder market are abundant. The growing trend of personalized nutrition and functional foods tailored for specific health needs presents a significant avenue for innovation. Expanding into emerging economies with rising disposable incomes and increasing health awareness offers substantial market potential. Furthermore, research into novel therapeutic applications of psyllium, such as its potential in managing inflammatory bowel disease and its prebiotic effects, can unlock new market segments. The development of value-added psyllium derivatives with enhanced functionalities and the integration of psyllium into plant-based meat alternatives and dairy-free products are also promising areas for growth.

Leading Players in the Organic Psyllium Husk Powder Market

- Keyur Industries

- Atlas Industries

- Abhyuday Indutries

- Satnam Psyllium Industries

- Rajganga Agro Product

- Shree Mahalaxmi psyllium

- Jyotindra International

- Urvesh Psyllium Industries

- Virdhara International

- JYOT Overseas

- Shubh Psyllium Industries

- NOW

Key Developments in Organic Psyllium Husk Powder Industry

- 2023/2024: Several companies focused on enhancing their organic certification processes and expanding production capacities to meet escalating global demand.

- 2022/2023: Increased investment in research and development to explore novel applications in functional beverages and plant-based food products.

- 2021/2022: Reports of strategic partnerships and collaborations to strengthen distribution networks and market reach, particularly in emerging markets.

- 2020/2021: A surge in demand for psyllium husk as a digestive health supplement, driven by heightened health consciousness during the global pandemic.

- 2019/2020: Introduction of new, highly soluble psyllium husk powder variants catering to the beverage industry.

Strategic Outlook for Organic Psyllium Husk Powder Market

The strategic outlook for the organic psyllium husk powder market remains highly positive, driven by persistent consumer demand for natural health solutions and functional ingredients. Future growth catalysts will center on innovation in product development, particularly in creating enhanced functionalities and expanding applications within the food and pharmaceutical sectors. Strategic acquisitions and partnerships will likely play a key role in market consolidation and expanding geographical footprints. Companies that focus on sustainable sourcing, robust quality control, and adherence to global regulatory standards will be best positioned for sustained success. The continuous exploration of new therapeutic and nutritional benefits of psyllium husk will further fuel market expansion and unlock untapped potential in the coming years.

Organic Psyllium Husk Powder Segmentation

-

1. Application

- 1.1. Food Industry (Beverages,Ice Cream,Bakery Products, etc.)

- 1.2. Pharmaceutical Industry

- 1.3. Cosmetic Industry

-

2. Type

- 2.1. Psyllium Husk Powder 85%

- 2.2. Psyllium Husk Powder 95%

- 2.3. Psyllium Husk Powder 98%

- 2.4. Psyllium Husk Powder 99%

Organic Psyllium Husk Powder Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Organic Psyllium Husk Powder REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Organic Psyllium Husk Powder Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Food Industry (Beverages,Ice Cream,Bakery Products, etc.)

- 5.1.2. Pharmaceutical Industry

- 5.1.3. Cosmetic Industry

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Psyllium Husk Powder 85%

- 5.2.2. Psyllium Husk Powder 95%

- 5.2.3. Psyllium Husk Powder 98%

- 5.2.4. Psyllium Husk Powder 99%

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Organic Psyllium Husk Powder Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Food Industry (Beverages,Ice Cream,Bakery Products, etc.)

- 6.1.2. Pharmaceutical Industry

- 6.1.3. Cosmetic Industry

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Psyllium Husk Powder 85%

- 6.2.2. Psyllium Husk Powder 95%

- 6.2.3. Psyllium Husk Powder 98%

- 6.2.4. Psyllium Husk Powder 99%

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Organic Psyllium Husk Powder Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Food Industry (Beverages,Ice Cream,Bakery Products, etc.)

- 7.1.2. Pharmaceutical Industry

- 7.1.3. Cosmetic Industry

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Psyllium Husk Powder 85%

- 7.2.2. Psyllium Husk Powder 95%

- 7.2.3. Psyllium Husk Powder 98%

- 7.2.4. Psyllium Husk Powder 99%

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Organic Psyllium Husk Powder Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Food Industry (Beverages,Ice Cream,Bakery Products, etc.)

- 8.1.2. Pharmaceutical Industry

- 8.1.3. Cosmetic Industry

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Psyllium Husk Powder 85%

- 8.2.2. Psyllium Husk Powder 95%

- 8.2.3. Psyllium Husk Powder 98%

- 8.2.4. Psyllium Husk Powder 99%

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Organic Psyllium Husk Powder Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Food Industry (Beverages,Ice Cream,Bakery Products, etc.)

- 9.1.2. Pharmaceutical Industry

- 9.1.3. Cosmetic Industry

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Psyllium Husk Powder 85%

- 9.2.2. Psyllium Husk Powder 95%

- 9.2.3. Psyllium Husk Powder 98%

- 9.2.4. Psyllium Husk Powder 99%

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Organic Psyllium Husk Powder Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Food Industry (Beverages,Ice Cream,Bakery Products, etc.)

- 10.1.2. Pharmaceutical Industry

- 10.1.3. Cosmetic Industry

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Psyllium Husk Powder 85%

- 10.2.2. Psyllium Husk Powder 95%

- 10.2.3. Psyllium Husk Powder 98%

- 10.2.4. Psyllium Husk Powder 99%

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Keyur Industries

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Atlas Industries

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Abhyuday Indutries

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Satnam Psyllium Industries

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Rajganga Agro Product

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Shree Mahalaxmi psyllium

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Jyotindra International

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Urvesh Psyllium Industries

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Virdhara International

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 JYOT Overseas

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Shubh Psyllium Industries

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 NOW

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Keyur Industries

List of Figures

- Figure 1: Global Organic Psyllium Husk Powder Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Organic Psyllium Husk Powder Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Organic Psyllium Husk Powder Revenue (million), by Application 2024 & 2032

- Figure 4: North America Organic Psyllium Husk Powder Volume (K), by Application 2024 & 2032

- Figure 5: North America Organic Psyllium Husk Powder Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Organic Psyllium Husk Powder Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Organic Psyllium Husk Powder Revenue (million), by Type 2024 & 2032

- Figure 8: North America Organic Psyllium Husk Powder Volume (K), by Type 2024 & 2032

- Figure 9: North America Organic Psyllium Husk Powder Revenue Share (%), by Type 2024 & 2032

- Figure 10: North America Organic Psyllium Husk Powder Volume Share (%), by Type 2024 & 2032

- Figure 11: North America Organic Psyllium Husk Powder Revenue (million), by Country 2024 & 2032

- Figure 12: North America Organic Psyllium Husk Powder Volume (K), by Country 2024 & 2032

- Figure 13: North America Organic Psyllium Husk Powder Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Organic Psyllium Husk Powder Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Organic Psyllium Husk Powder Revenue (million), by Application 2024 & 2032

- Figure 16: South America Organic Psyllium Husk Powder Volume (K), by Application 2024 & 2032

- Figure 17: South America Organic Psyllium Husk Powder Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Organic Psyllium Husk Powder Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Organic Psyllium Husk Powder Revenue (million), by Type 2024 & 2032

- Figure 20: South America Organic Psyllium Husk Powder Volume (K), by Type 2024 & 2032

- Figure 21: South America Organic Psyllium Husk Powder Revenue Share (%), by Type 2024 & 2032

- Figure 22: South America Organic Psyllium Husk Powder Volume Share (%), by Type 2024 & 2032

- Figure 23: South America Organic Psyllium Husk Powder Revenue (million), by Country 2024 & 2032

- Figure 24: South America Organic Psyllium Husk Powder Volume (K), by Country 2024 & 2032

- Figure 25: South America Organic Psyllium Husk Powder Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Organic Psyllium Husk Powder Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Organic Psyllium Husk Powder Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Organic Psyllium Husk Powder Volume (K), by Application 2024 & 2032

- Figure 29: Europe Organic Psyllium Husk Powder Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Organic Psyllium Husk Powder Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Organic Psyllium Husk Powder Revenue (million), by Type 2024 & 2032

- Figure 32: Europe Organic Psyllium Husk Powder Volume (K), by Type 2024 & 2032

- Figure 33: Europe Organic Psyllium Husk Powder Revenue Share (%), by Type 2024 & 2032

- Figure 34: Europe Organic Psyllium Husk Powder Volume Share (%), by Type 2024 & 2032

- Figure 35: Europe Organic Psyllium Husk Powder Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Organic Psyllium Husk Powder Volume (K), by Country 2024 & 2032

- Figure 37: Europe Organic Psyllium Husk Powder Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Organic Psyllium Husk Powder Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Organic Psyllium Husk Powder Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Organic Psyllium Husk Powder Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Organic Psyllium Husk Powder Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Organic Psyllium Husk Powder Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Organic Psyllium Husk Powder Revenue (million), by Type 2024 & 2032

- Figure 44: Middle East & Africa Organic Psyllium Husk Powder Volume (K), by Type 2024 & 2032

- Figure 45: Middle East & Africa Organic Psyllium Husk Powder Revenue Share (%), by Type 2024 & 2032

- Figure 46: Middle East & Africa Organic Psyllium Husk Powder Volume Share (%), by Type 2024 & 2032

- Figure 47: Middle East & Africa Organic Psyllium Husk Powder Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Organic Psyllium Husk Powder Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Organic Psyllium Husk Powder Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Organic Psyllium Husk Powder Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Organic Psyllium Husk Powder Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Organic Psyllium Husk Powder Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Organic Psyllium Husk Powder Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Organic Psyllium Husk Powder Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Organic Psyllium Husk Powder Revenue (million), by Type 2024 & 2032

- Figure 56: Asia Pacific Organic Psyllium Husk Powder Volume (K), by Type 2024 & 2032

- Figure 57: Asia Pacific Organic Psyllium Husk Powder Revenue Share (%), by Type 2024 & 2032

- Figure 58: Asia Pacific Organic Psyllium Husk Powder Volume Share (%), by Type 2024 & 2032

- Figure 59: Asia Pacific Organic Psyllium Husk Powder Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Organic Psyllium Husk Powder Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Organic Psyllium Husk Powder Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Organic Psyllium Husk Powder Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Organic Psyllium Husk Powder Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Organic Psyllium Husk Powder Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Organic Psyllium Husk Powder Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Organic Psyllium Husk Powder Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Organic Psyllium Husk Powder Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Organic Psyllium Husk Powder Volume K Forecast, by Type 2019 & 2032

- Table 7: Global Organic Psyllium Husk Powder Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Organic Psyllium Husk Powder Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Organic Psyllium Husk Powder Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Organic Psyllium Husk Powder Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Organic Psyllium Husk Powder Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Organic Psyllium Husk Powder Volume K Forecast, by Type 2019 & 2032

- Table 13: Global Organic Psyllium Husk Powder Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Organic Psyllium Husk Powder Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Organic Psyllium Husk Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Organic Psyllium Husk Powder Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Organic Psyllium Husk Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Organic Psyllium Husk Powder Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Organic Psyllium Husk Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Organic Psyllium Husk Powder Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Organic Psyllium Husk Powder Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Organic Psyllium Husk Powder Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Organic Psyllium Husk Powder Revenue million Forecast, by Type 2019 & 2032

- Table 24: Global Organic Psyllium Husk Powder Volume K Forecast, by Type 2019 & 2032

- Table 25: Global Organic Psyllium Husk Powder Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Organic Psyllium Husk Powder Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Organic Psyllium Husk Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Organic Psyllium Husk Powder Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Organic Psyllium Husk Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Organic Psyllium Husk Powder Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Organic Psyllium Husk Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Organic Psyllium Husk Powder Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Organic Psyllium Husk Powder Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Organic Psyllium Husk Powder Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Organic Psyllium Husk Powder Revenue million Forecast, by Type 2019 & 2032

- Table 36: Global Organic Psyllium Husk Powder Volume K Forecast, by Type 2019 & 2032

- Table 37: Global Organic Psyllium Husk Powder Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Organic Psyllium Husk Powder Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Organic Psyllium Husk Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Organic Psyllium Husk Powder Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Organic Psyllium Husk Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Organic Psyllium Husk Powder Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Organic Psyllium Husk Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Organic Psyllium Husk Powder Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Organic Psyllium Husk Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Organic Psyllium Husk Powder Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Organic Psyllium Husk Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Organic Psyllium Husk Powder Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Organic Psyllium Husk Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Organic Psyllium Husk Powder Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Organic Psyllium Husk Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Organic Psyllium Husk Powder Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Organic Psyllium Husk Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Organic Psyllium Husk Powder Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Organic Psyllium Husk Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Organic Psyllium Husk Powder Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Organic Psyllium Husk Powder Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Organic Psyllium Husk Powder Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Organic Psyllium Husk Powder Revenue million Forecast, by Type 2019 & 2032

- Table 60: Global Organic Psyllium Husk Powder Volume K Forecast, by Type 2019 & 2032

- Table 61: Global Organic Psyllium Husk Powder Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Organic Psyllium Husk Powder Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Organic Psyllium Husk Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Organic Psyllium Husk Powder Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Organic Psyllium Husk Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Organic Psyllium Husk Powder Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Organic Psyllium Husk Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Organic Psyllium Husk Powder Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Organic Psyllium Husk Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Organic Psyllium Husk Powder Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Organic Psyllium Husk Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Organic Psyllium Husk Powder Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Organic Psyllium Husk Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Organic Psyllium Husk Powder Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Organic Psyllium Husk Powder Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Organic Psyllium Husk Powder Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Organic Psyllium Husk Powder Revenue million Forecast, by Type 2019 & 2032

- Table 78: Global Organic Psyllium Husk Powder Volume K Forecast, by Type 2019 & 2032

- Table 79: Global Organic Psyllium Husk Powder Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Organic Psyllium Husk Powder Volume K Forecast, by Country 2019 & 2032

- Table 81: China Organic Psyllium Husk Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Organic Psyllium Husk Powder Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Organic Psyllium Husk Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Organic Psyllium Husk Powder Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Organic Psyllium Husk Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Organic Psyllium Husk Powder Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Organic Psyllium Husk Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Organic Psyllium Husk Powder Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Organic Psyllium Husk Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Organic Psyllium Husk Powder Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Organic Psyllium Husk Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Organic Psyllium Husk Powder Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Organic Psyllium Husk Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Organic Psyllium Husk Powder Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Organic Psyllium Husk Powder?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Organic Psyllium Husk Powder?

Key companies in the market include Keyur Industries, Atlas Industries, Abhyuday Indutries, Satnam Psyllium Industries, Rajganga Agro Product, Shree Mahalaxmi psyllium, Jyotindra International, Urvesh Psyllium Industries, Virdhara International, JYOT Overseas, Shubh Psyllium Industries, NOW.

3. What are the main segments of the Organic Psyllium Husk Powder?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Organic Psyllium Husk Powder," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Organic Psyllium Husk Powder report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Organic Psyllium Husk Powder?

To stay informed about further developments, trends, and reports in the Organic Psyllium Husk Powder, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence