Key Insights

The Asia-Pacific baby food market is projected for significant growth, expected to reach $77.13 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 7.6% during the 2025-2033 forecast period. Key growth drivers include increasing birth rates in major economies, rising parental disposable income, and a heightened awareness of specialized infant nutrition for optimal child development. A notable trend is the growing consumer preference for premium and organic baby food, fueled by a focus on health and natural ingredients. The expansion of organized retail and e-commerce further enhances product accessibility and market penetration across the region.

Asia-Pacific Baby Food Market Market Size (In Billion)

Despite market opportunities, regulatory compliance for food safety and labeling presents a challenge. Fluctuating raw material costs can also impact manufacturing expenses. Segment analysis indicates robust demand across all categories, with milk formula remaining essential. Prepared baby food is gaining popularity due to its convenience for busy parents. Hypermarkets/supermarkets and online retail are leading distribution channels, reflecting changing consumer purchasing behaviors. China and India are anticipated to be the largest markets, driven by their substantial populations and increasing per capita spending on baby care products, followed by Japan and Australia.

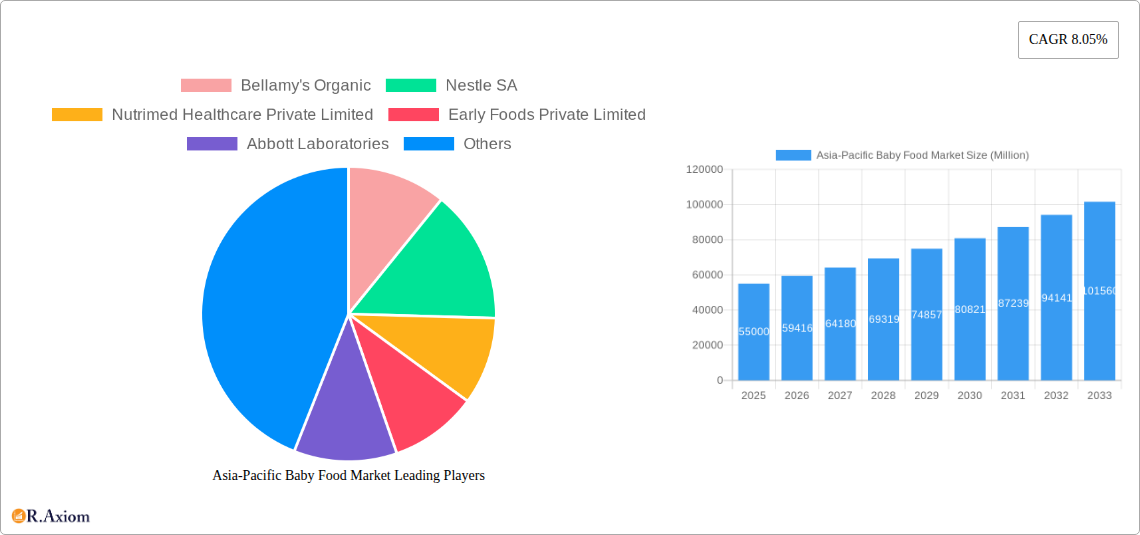

Asia-Pacific Baby Food Market Company Market Share

Asia-Pacific Baby Food Market Market Concentration & Innovation

The Asia-Pacific baby food market exhibits moderate concentration, with a few dominant global players vying for market share alongside a growing number of regional and specialized brands. Innovation is a key differentiator, driven by evolving parental concerns regarding infant nutrition, the demand for organic and natural ingredients, and the development of specialized formulas catering to specific dietary needs and allergies. Regulatory frameworks, while varying across countries, play a significant role in shaping product development and market entry. Increased awareness of health and safety standards, coupled with government initiatives promoting infant health, are fostering innovation in product formulations and packaging. Product substitutes, such as homemade baby food, present a challenge, though convenience and perceived nutritional completeness of commercial baby food often outweigh this. End-user trends highlight a shift towards premiumization, with parents willing to invest in high-quality, nutrient-dense options. This includes a rising demand for organic baby food, allergen-free options, and functional foods designed to support cognitive development and immunity. Mergers and acquisitions (M&A) activities are present, though less prevalent than in more mature markets, with strategic partnerships and smaller acquisitions focused on expanding product portfolios or regional reach. The overall market size for M&A deals is projected to be in the hundreds of millions. Key players are actively pursuing innovation through R&D, focusing on ingredient sourcing, advanced processing technologies, and personalized nutrition solutions to capture market share.

Asia-Pacific Baby Food Market Industry Trends & Insights

The Asia-Pacific baby food market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% over the forecast period. This expansion is fueled by a confluence of favorable demographic, economic, and societal trends. A key driver is the region's large and growing infant population, coupled with increasing disposable incomes, which empowers parents to invest more in premium and specialized baby food products. The rising awareness among parents regarding the critical importance of early nutrition for infant development, cognitive function, and long-term health is a significant catalyst. This heightened awareness is further amplified by widespread access to information through digital platforms and social media, influencing purchasing decisions.

Technological disruptions are also reshaping the industry. Advancements in food processing technologies enable the creation of more nutritious and palatable baby food, while also extending shelf life. Innovations in packaging, such as resealable pouches and single-serving options, enhance convenience for busy parents. Furthermore, the integration of e-commerce and online retail channels has revolutionized distribution, offering parents greater accessibility and a wider selection of products. This digital shift is a major trend, with online retail stores projected to capture a significant portion of market share.

Consumer preferences are increasingly leaning towards organic, natural, and sustainably sourced ingredients. Parents are actively seeking baby food free from artificial additives, preservatives, and added sugars. This has led to a surge in demand for organic baby food, plant-based options, and functional foods fortified with essential vitamins, minerals, and probiotics. The market is also witnessing a growing demand for specialized formulas catering to specific needs, such as hypoallergenic options for infants with allergies, or formulas designed to support immune system development.

Competitive dynamics are intensifying as both global giants and emerging local players vie for market dominance. Companies are focusing on product differentiation through ingredient innovation, unique flavor profiles, and strong branding that emphasizes health and safety. Strategic partnerships, product line expansions, and targeted marketing campaigns are crucial for maintaining a competitive edge. The penetration of specialized baby food products, particularly in developed Asian economies, is already high, while emerging economies present significant opportunities for market expansion. The overall market penetration of the baby food sector is estimated to reach xx% by 2025, indicating substantial room for continued growth.

Dominant Markets & Segments in Asia-Pacific Baby Food Market

The Asia-Pacific baby food market is characterized by diverse regional strengths and segment dominance, painting a dynamic picture of consumer preferences and market opportunities.

Geography

- China stands as the dominant market, driven by its massive population, rapidly urbanizing landscape, and a growing middle class with increasing disposable incomes. Stringent food safety regulations and a heightened parental focus on quality and brand reputation further bolster the demand for premium baby food. Government initiatives promoting childbirth and infant welfare also contribute to market expansion.

- India is emerging as a significant growth engine, fueled by a young population, increasing urbanization, and a rising awareness of infant nutrition. The expanding e-commerce infrastructure and the availability of affordable yet quality baby food options are accelerating market penetration.

- Japan represents a mature market with a focus on high-quality, specialized, and functional baby food products. While the birth rate is declining, consumer demand for premium and innovative offerings remains strong.

- Australia showcases a mature market with a strong emphasis on organic and natural baby food. High consumer awareness of health and wellness, coupled with stringent food safety standards, drives demand for premium products.

- Rest of Asia-Pacific encompasses a broad spectrum of developing and developed economies, each presenting unique growth trajectories. Countries in Southeast Asia are witnessing rapid urbanization and increasing disposable incomes, leading to a growing demand for convenient and nutritious baby food options.

Type

- Milk Formula is the leading segment, accounting for the largest market share. This is attributed to its essential role in infant nutrition, especially for newborns and infants who are not exclusively breastfed. The demand for specialized formulas, including follow-on milk and growing-up milk, further solidifies its dominance.

- Dried Baby Food holds a significant position, offering convenience and a longer shelf life. This segment includes cereals, purees, and snacks that are easily reconstituted.

- Prepared Baby Food is gaining traction, driven by the demand for ready-to-eat meals that offer variety and convenience for busy parents. This segment includes pureed fruits, vegetables, and mixed meals.

- Other Types, encompassing baby snacks, juices, and cereals, represent a growing niche segment, catering to older infants and toddlers as complementary feeding options.

Distribution Channel

- Hypermarkets/Supermarkets continue to be the dominant distribution channel, offering wide product availability, competitive pricing, and a convenient one-stop shopping experience for parents. Their extensive reach and established supply chains make them crucial for market penetration.

- Online Retail Stores are rapidly gaining market share, driven by the convenience of home delivery, wider product selection, and competitive pricing. The proliferation of e-commerce platforms and the increasing digital literacy of consumers are key factors fueling this growth.

- Drugstores/Pharmacies Stores cater to parents seeking specialized or medically recommended baby food products. They often carry a curated selection of premium and functional baby food.

- Convenience Stores offer a supplementary channel for readily available baby food items, particularly for impulse purchases or immediate needs.

- Other Distribution Channels, including direct-to-consumer (DTC) online sales and specialty baby stores, are emerging as niche channels catering to specific consumer segments.

Asia-Pacific Baby Food Market Product Developments

Product innovation in the Asia-Pacific baby food market is heavily focused on leveraging advanced nutritional science and catering to evolving parental demands for health and convenience. Companies are investing in research and development to create formulations enriched with essential micronutrients, prebiotics, probiotics, and omega-3 fatty acids to support cognitive and physical development. The emphasis on clean labels, organic ingredients, and allergen-free options is paramount, with many brands offering plant-based or dairy-free alternatives. For instance, the introduction of formulas derived from 100% Australian grass-fed cow's milk without added sugar, compliant with Codex regulations, exemplifies the trend towards premium, natural ingredients. Furthermore, the development of innovative formats, such as ready-to-eat pouches and convenient snack options, addresses the need for on-the-go nutrition. These product developments aim to provide parents with trusted, safe, and nutritionally superior options that align with their health-conscious lifestyles, thereby gaining a competitive advantage.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Asia-Pacific baby food market, covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033. The market is segmented across key categories to offer granular insights.

Type: The analysis includes Milk Formula, Dried Baby Food, Prepared Baby Food, and Other Types. Milk formula is projected to maintain its leading position due to its indispensable role in infant nutrition. Dried baby food offers convenience and a longer shelf life, while prepared baby food is gaining traction due to increasing demand for ready-to-eat options.

Distribution Channel: The report examines Hypermarkets/Supermarkets, Drugstores/Pharmacies Stores, Convenience Stores, Online Retail Stores, and Other Distribution Channels. Online retail stores are expected to witness the highest growth rate, driven by the convenience and accessibility they offer. Hypermarkets and supermarkets will continue to hold a significant market share due to their wide reach.

Geography: The study encompasses key regions including India, China, Japan, Australia, and the Rest of Asia-Pacific. China is anticipated to dominate the market due to its large population and rising disposable incomes. India is identified as a high-growth potential market.

Key Drivers of Asia-Pacific Baby Food Market Growth

The Asia-Pacific baby food market growth is propelled by several key factors. Firstly, a burgeoning infant population and increasing disposable incomes in emerging economies like India and Southeast Asian nations are driving demand. Secondly, heightened parental awareness regarding the critical importance of early nutrition for healthy development, coupled with the influence of social media and digital information, is leading to a preference for premium and specialized products. Thirdly, the rising adoption of organic, natural, and allergen-free baby food options reflects a global trend towards healthier lifestyles and a greater emphasis on ingredient transparency. Lastly, advancements in food technology and product innovation, including fortified formulas and convenient formats, are meeting the evolving needs of modern parents and expanding market opportunities.

Challenges in the Asia-Pacific Baby Food Market Sector

Despite robust growth, the Asia-Pacific baby food market faces several challenges. Stringent and varying regulatory frameworks across different countries can pose complexities for market entry and product compliance, increasing operational costs. Supply chain disruptions, particularly in the wake of global events, can impact ingredient sourcing and product availability, leading to price volatility. Intense competition from both established global brands and a growing number of local players necessitates continuous innovation and aggressive marketing strategies, potentially impacting profit margins. Furthermore, the resurgence of interest in traditional, homemade baby food in some regions, driven by concerns about processed ingredients, presents a competitive substitute. The cost sensitivity of a significant portion of the consumer base in developing economies also limits the penetration of premium-priced products.

Emerging Opportunities in Asia-Pacific Baby Food Market

Emerging opportunities in the Asia-Pacific baby food market are abundant, driven by evolving consumer preferences and technological advancements. The growing demand for plant-based and vegan baby food alternatives presents a significant untapped market segment. Innovations in functional foods, such as those designed to boost immunity or support gut health through probiotics, are gaining traction. The expansion of e-commerce and direct-to-consumer (DTC) channels offers new avenues for reaching consumers, particularly in remote areas. Furthermore, the increasing demand for personalized nutrition solutions, tailored to individual infant needs and dietary restrictions, represents a promising future direction. Exploring untapped markets within the "Rest of Asia-Pacific" region, with their burgeoning middle classes, also offers substantial growth potential.

Leading Players in the Asia-Pacific Baby Food Market Market

- Bellamy's Organic

- Nestle SA

- Nutrimed Healthcare Private Limited

- Early Foods Private Limited

- Abbott Laboratories

- Wholsum Foods Pvt Ltd (Slurrp Farm)

- Danone SA

- Sun-Maid Growers of California (Plum Organic)

- PZ Cussons plc (Rafferty's Garden)

- Max Biocare

Key Developments in Asia-Pacific Baby Food Market Industry

- November 2022: Nestle Cerelac Homestyle for babies introduced a new variant, meat and vegetable (Daging Sayur), in Indonesia to introduce babies to the goodness of vegetables and meat. Cerelac Homestyle is rich in iron and comes with 10 vitamins and five minerals to combat anemia, which affects babies aged 1-6.

- July 2022: Rafferty's Garden, a brand of PZ Cussons in Australia, teamed up with Vegemite to release a new snack available on supermarket shelves across the country. Rafferty's Garden introduced Vegemite Cheesy Bread Sticks, a snack for kids aged 12 months and above. This delectable snack, made with Vegemite, is a category-first flavor profile containing vitamin B and prebiotics, intended to help introduce the taste of Australia to little buds.

- August 2021: Australian pharma and nutraceutical company Max Biocare expanded its baby food brand Little Étoile with a new infant and toddler formula range. Little Etoile Nutrition's infant and toddler formulas contain ingredients such as lactoferrin and Wellmune beta-glucan that were clinically tested for safety and efficacy. These ingredients were used to promote immunity and reduce the frequency of common cold and upper respiratory tract infections. The formulas are made from 100% Australian grass-fed cow's milk, without added sugar, and are compliant with Codex regulations.

Strategic Outlook for Asia-Pacific Baby Food Market Market

The strategic outlook for the Asia-Pacific baby food market is exceptionally positive, driven by sustained demographic growth and increasing parental investment in infant nutrition. Key growth catalysts include the continued expansion of the middle class in emerging economies, leading to a higher demand for premium and specialized products. Digitalization and the proliferation of e-commerce will continue to be critical for market penetration and consumer engagement. Companies that prioritize ingredient transparency, organic certifications, and innovative functional benefits will likely capture significant market share. Strategic partnerships and potential M&A activities are anticipated to further consolidate the market, especially for players looking to expand their product portfolios or geographical reach. The focus on sustainable sourcing and ethical production practices will also become increasingly important for brand differentiation and consumer loyalty.

Asia-Pacific Baby Food Market Segmentation

-

1. Type

- 1.1. Milk Formula

- 1.2. Dried Baby Food

- 1.3. Prepared Baby Food

- 1.4. Other Types

-

2. Distribution Channel

- 2.1. Hypermarkets/Supermarkets

- 2.2. Drugstores/Pharmacies Stores

- 2.3. Convenience Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

-

3. Geography

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia-Pacific

Asia-Pacific Baby Food Market Segmentation By Geography

- 1. India

- 2. China

- 3. Japan

- 4. Australia

- 5. Rest of Asia Pacific

Asia-Pacific Baby Food Market Regional Market Share

Geographic Coverage of Asia-Pacific Baby Food Market

Asia-Pacific Baby Food Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Popularity of Single-Origin Coffee; Product Differentiation and Marketing Strategies

- 3.3. Market Restrains

- 3.3.1. Presence of Substitutes Hampering Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Awareness Among People and Working Women

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Baby Food Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Milk Formula

- 5.1.2. Dried Baby Food

- 5.1.3. Prepared Baby Food

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarkets/Supermarkets

- 5.2.2. Drugstores/Pharmacies Stores

- 5.2.3. Convenience Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. India

- 5.3.2. China

- 5.3.3. Japan

- 5.3.4. Australia

- 5.3.5. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.4.2. China

- 5.4.3. Japan

- 5.4.4. Australia

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. India Asia-Pacific Baby Food Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Milk Formula

- 6.1.2. Dried Baby Food

- 6.1.3. Prepared Baby Food

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Hypermarkets/Supermarkets

- 6.2.2. Drugstores/Pharmacies Stores

- 6.2.3. Convenience Stores

- 6.2.4. Online Retail Stores

- 6.2.5. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. India

- 6.3.2. China

- 6.3.3. Japan

- 6.3.4. Australia

- 6.3.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. China Asia-Pacific Baby Food Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Milk Formula

- 7.1.2. Dried Baby Food

- 7.1.3. Prepared Baby Food

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Hypermarkets/Supermarkets

- 7.2.2. Drugstores/Pharmacies Stores

- 7.2.3. Convenience Stores

- 7.2.4. Online Retail Stores

- 7.2.5. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. India

- 7.3.2. China

- 7.3.3. Japan

- 7.3.4. Australia

- 7.3.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Japan Asia-Pacific Baby Food Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Milk Formula

- 8.1.2. Dried Baby Food

- 8.1.3. Prepared Baby Food

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Hypermarkets/Supermarkets

- 8.2.2. Drugstores/Pharmacies Stores

- 8.2.3. Convenience Stores

- 8.2.4. Online Retail Stores

- 8.2.5. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. India

- 8.3.2. China

- 8.3.3. Japan

- 8.3.4. Australia

- 8.3.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia Asia-Pacific Baby Food Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Milk Formula

- 9.1.2. Dried Baby Food

- 9.1.3. Prepared Baby Food

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Hypermarkets/Supermarkets

- 9.2.2. Drugstores/Pharmacies Stores

- 9.2.3. Convenience Stores

- 9.2.4. Online Retail Stores

- 9.2.5. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. India

- 9.3.2. China

- 9.3.3. Japan

- 9.3.4. Australia

- 9.3.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Asia Pacific Asia-Pacific Baby Food Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Milk Formula

- 10.1.2. Dried Baby Food

- 10.1.3. Prepared Baby Food

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Hypermarkets/Supermarkets

- 10.2.2. Drugstores/Pharmacies Stores

- 10.2.3. Convenience Stores

- 10.2.4. Online Retail Stores

- 10.2.5. Other Distribution Channels

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. India

- 10.3.2. China

- 10.3.3. Japan

- 10.3.4. Australia

- 10.3.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bellamy's Organic

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nestle SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nutrimed Healthcare Private Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Early Foods Private Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Abbott Laboratories

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Wholsum Foods Pvt Ltd (Slurrp Farm)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Danone SA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sun-Maid Growers of California (Plum Organic)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 PZ Cussons plc (Rafferty's Garden)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Max Biocare*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Bellamy's Organic

List of Figures

- Figure 1: Asia-Pacific Baby Food Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Baby Food Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Baby Food Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Baby Food Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Asia-Pacific Baby Food Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Asia-Pacific Baby Food Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Baby Food Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Asia-Pacific Baby Food Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Asia-Pacific Baby Food Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Asia-Pacific Baby Food Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Asia-Pacific Baby Food Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Asia-Pacific Baby Food Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Asia-Pacific Baby Food Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Baby Food Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Baby Food Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Asia-Pacific Baby Food Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Asia-Pacific Baby Food Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Asia-Pacific Baby Food Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific Baby Food Market Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Asia-Pacific Baby Food Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 19: Asia-Pacific Baby Food Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Asia-Pacific Baby Food Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Baby Food Market Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Asia-Pacific Baby Food Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 23: Asia-Pacific Baby Food Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Asia-Pacific Baby Food Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Baby Food Market?

The projected CAGR is approximately 7.6%.

2. Which companies are prominent players in the Asia-Pacific Baby Food Market?

Key companies in the market include Bellamy's Organic, Nestle SA, Nutrimed Healthcare Private Limited, Early Foods Private Limited, Abbott Laboratories, Wholsum Foods Pvt Ltd (Slurrp Farm), Danone SA, Sun-Maid Growers of California (Plum Organic), PZ Cussons plc (Rafferty's Garden), Max Biocare*List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Baby Food Market?

The market segments include Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 77.13 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Popularity of Single-Origin Coffee; Product Differentiation and Marketing Strategies.

6. What are the notable trends driving market growth?

Increasing Awareness Among People and Working Women.

7. Are there any restraints impacting market growth?

Presence of Substitutes Hampering Market Growth.

8. Can you provide examples of recent developments in the market?

In November 2022, Nestle Cerelac Homestyle for babies introduced a new variant, meat and vegetable (Daging Sayur), in Indonesia to introduce babies to the goodness of vegetables and meat. Cerelac Homestyle is rich in iron and comes with 10 vitamins and five minerals to combat anemia, which affects babies aged 1-6.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Baby Food Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Baby Food Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Baby Food Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Baby Food Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence