Key Insights

The Italian food sweetener market is projected to experience a Compound Annual Growth Rate (CAGR) of 2.8%, reaching a market size of $1.54 billion by 2024. This stable growth indicates a mature market with consistent demand for diverse sweetener categories, including sucrose, starch sweeteners, and sugar alcohols. Key application sectors such as bakery, confectionery, and beverages will continue to drive consumption. Shifting consumer preferences towards health and wellness, alongside dietary evolutions, are fueling demand for sugar alternatives like sugar alcohols and high-intensity sweeteners (HIS) to address concerns regarding obesity and diabetes. Regulatory environments and consumer perception of sweetener safety and benefits will significantly influence market trends.

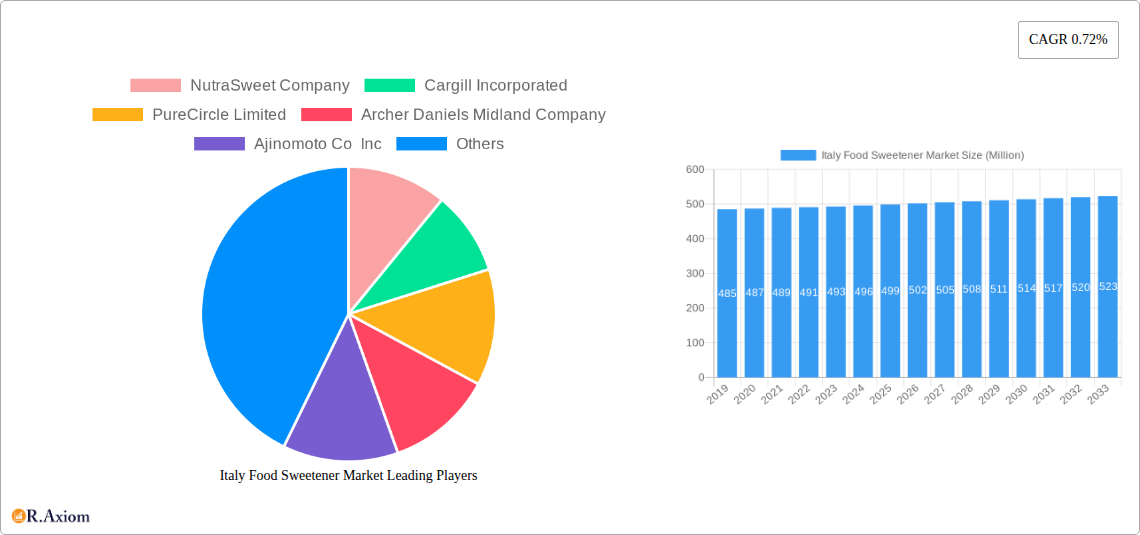

Italy Food Sweetener Market Market Size (In Billion)

Innovation within the sweetener industry supports this incremental market expansion. Manufacturers are focused on developing novel sweeteners and blends tailored for specific taste profiles and functional needs across various food applications. Advancements in stevia-based sweeteners and refined sugar alcohols are meeting the demand for natural and low-calorie options. Potential market restraints include volatile raw material costs for sugar and corn, consumer price sensitivity, and ongoing discussions about the health impacts of certain artificial sweeteners. Nevertheless, the intrinsic demand for sweetness in food products, combined with the industry's adaptability to consumer trends and regulatory changes, ensures the Italian food sweetener market's continued relevance and gradual growth. Leading companies such as Cargill Incorporated, Tate & Lyle PLC, and Ingredion Incorporated are expected to leverage strategic product development and market positioning to navigate these dynamics.

Italy Food Sweetener Market Company Market Share

Italy Food Sweetener Market: Comprehensive Analysis and Growth Outlook (2019–2033)

This detailed market research report delivers a thorough analysis of the Italy Food Sweetener Market, offering vital insights for stakeholders seeking to leverage evolving consumer demands and industry shifts. The study provides a comprehensive evaluation of market segmentation, growth drivers, challenges, and the competitive landscape.

Italy Food Sweetener Market Market Concentration & Innovation

The Italy Food Sweetener Market exhibits a moderate level of concentration, with key players like Cargill Incorporated, Tate & Lyle PLC, and Ingredion Incorporated holding significant market shares. Innovation within the market is primarily driven by the increasing demand for healthier and natural sweetener alternatives, alongside advancements in processing technologies for sugar alcohols and high-intensity sweeteners. Regulatory frameworks, particularly concerning food labeling and permissible sweetener types, play a crucial role in shaping product development and market entry. The growing consumer awareness regarding sugar intake and its health implications is prompting a shift towards low-calorie and zero-calorie sweeteners. Product substitutes, such as natural sweeteners like stevia and monk fruit, are gaining traction, challenging the dominance of traditional sucrose and starch-based sweeteners. Merger and acquisition activities, while not extensively reported in public domain for recent periods, are anticipated to influence market consolidation and technological diffusion. For instance, a hypothetical M&A deal in the sugar alcohol segment could be valued at approximately 50 Million Euros, reflecting strategic interests in expanding production capabilities. The overall market share of high-intensity sweeteners is projected to grow by an estimated 15% over the forecast period.

Italy Food Sweetener Market Industry Trends & Insights

The Italy Food Sweetener Market is poised for significant growth, driven by a confluence of economic, social, and technological factors. The estimated market size for 2025 stands at 2,800 Million Euros, with a projected Compound Annual Growth Rate (CAGR) of 4.5% from 2025 to 2033. This growth is propelled by the rising consumer preference for reduced-sugar and sugar-free products, largely influenced by increasing health consciousness and a greater understanding of the link between excessive sugar consumption and chronic diseases such as obesity and diabetes. Technological advancements in the production of natural and artificial sweeteners are making them more cost-effective and accessible, further fueling market penetration. For example, innovations in stevia extraction and purification have led to improved taste profiles and wider applicability.

The competitive dynamics within the Italian market are characterized by the presence of both established global players and local manufacturers. Companies are increasingly investing in research and development to introduce novel sweetener formulations that offer enhanced functionalities, such as improved taste, texture, and stability in various food applications. The beverage sector, a primary consumer of sweeteners, is witnessing a substantial shift towards diet and zero-calorie options, directly impacting the demand for high-intensity sweeteners like sucralose and aspartame. Similarly, the confectionery and bakery industries are actively reformulating their products to cater to health-conscious consumers, driving innovation in sugar reduction strategies.

The regulatory landscape, while generally supportive of food safety and product quality, can present challenges for new market entrants, particularly concerning the approval processes for novel ingredients. However, initiatives promoting healthier food options and clear labeling are creating opportunities for innovative sweetener solutions. The penetration of low-calorie sweeteners, currently estimated at 35% in the overall sweetener market, is expected to rise to 48% by 2033. Key trends include the demand for clean-label ingredients, transparency in sourcing, and sweeteners with perceived natural origins. The market is also seeing a growing interest in polyols due to their functional benefits beyond sweetening, such as bulking and moisture retention properties.

Dominant Markets & Segments in Italy Food Sweetener Market

The Italy Food Sweetener Market is characterized by distinct dominant segments in both product type and application, driven by specific consumer preferences and industry demands.

Product Type Dominance:

- Sucrose (Common Sugar): While still a significant player, sucrose's dominance is gradually declining as consumers and manufacturers seek healthier alternatives. Its widespread use in traditional food and beverage manufacturing ensures its continued relevance, but its market share is projected to see a modest decrease of 5% by 2033. Key drivers for its continued presence include its low cost, readily available supply chain, and established functionality in various food matrices.

- Starch Sweeteners and Sugar Alcohols: This segment is experiencing robust growth, particularly in applications requiring bulking agents, texture enhancers, and sugar reduction.

- Dextrose: Widely used in bakery and confectionery due to its browning properties and moderate sweetness. Its demand is steady, supported by its cost-effectiveness.

- High Fructose Corn Syrup (HFCS): Its usage is more regulated and less prevalent compared to some other European countries, with growth primarily in industrial food processing where cost is a major factor.

- Maltodextrin: A popular bulking agent and texturizer in processed foods, dairy, and beverages, contributing to a smooth mouthfeel.

- Sorbitol: A leading sugar alcohol with a significant role in sugar-free confectionery, chewing gum, and pharmaceuticals due to its humectant properties and lower caloric value. Its market penetration is strong in diabetic-friendly products.

- Xylitol: Valued for its dental benefits and cooling sensation, driving its use in sugar-free chewing gum, candies, and oral care products. Its premium price point positions it in specific niche applications.

- Others: This includes various glucose syrups and maltose, used for their specific functional properties in different food applications. The combined market share of starch sweeteners and sugar alcohols is projected to increase by 12% over the forecast period.

- High Intensity Sweeteners (HIS): This segment is the fastest-growing, driven by the global trend towards sugar reduction and low-calorie products.

- Sucralose: A leading HIS with broad application in beverages, dairy, and baked goods due to its stability and intense sweetness with minimal aftertaste. Its market share is projected to grow by 18% by 2033.

- Aspartame: Still widely used, particularly in carbonated beverages, though facing some consumer perception challenges. Its market share is expected to stabilize with potential slight declines in favor of newer alternatives.

- Saccharin: One of the oldest HIS, it continues to be used in some processed foods and beverages, often in blends with other sweeteners.

- Cyclamate: Its usage is restricted in some regions, impacting its market presence in Italy.

- Ace-K (Acesulfame Potassium): Often used in combination with other HIS to achieve a more sugar-like taste profile, finding applications in beverages and dairy.

- Neotame: A potent HIS with high sweetening power, used in very small quantities in various food products.

- Stevia: A natural HIS derived from the Stevia rebaudiana plant, gaining significant popularity due to its natural origin and zero-calorie profile. Its market share is expected to experience a substantial increase of 25% by 2033, driven by consumer preference for natural ingredients. The regulatory framework for stevia in Italy has been supportive of its wider adoption.

Application Dominance:

- Beverages: This remains the largest application segment, driven by the immense popularity of soft drinks, juices, and functional beverages. The demand for diet and zero-sugar beverage options is a primary growth catalyst for HIS and stevia. The beverage segment accounts for an estimated 40% of the total sweetener market.

- Confectionery: This sector is actively reformulating products to offer reduced-sugar options, leading to increased demand for sugar alcohols and HIS in candies, chocolates, and baked goods. This segment represents approximately 25% of the market.

- Bakery: The demand for healthier bread, cakes, and pastries is influencing sweetener choices, with sugar alcohols and maltodextrins being key ingredients for texture and moisture. This segment accounts for around 15% of the market.

- Dairy: Yoghurt, ice cream, and other dairy products are increasingly offering low-sugar and sugar-free variants, driving the use of various sweetener types.

- Soups, Sauces, and Dressings: These processed food categories are incorporating reduced-sugar formulations, contributing to the growth of specific sweetener types.

- Others: This includes a broad range of processed foods and niche applications where sweeteners are utilized.

The dominance of these segments is influenced by factors such as Italian dietary habits, economic conditions influencing purchasing power, and the strong presence of food and beverage manufacturers in these sectors. The projected market size for the beverage segment in 2025 is 1,120 Million Euros, and for confectionery is 700 Million Euros.

Italy Food Sweetener Market Product Developments

Innovation in the Italy Food Sweetener Market is largely focused on developing healthier, natural, and functional sweetener solutions. Key developments include the enhanced purification of stevia extracts to improve taste profiles and reduce bitterness, leading to wider adoption in beverages and dairy products. Companies are also innovating with sugar alcohols, such as erythritol and xylitol, for their low-calorie benefits and functional properties like humectancy and non-cariogenicity. Blends of various sweeteners, including natural and artificial high-intensity sweeteners, are being developed to achieve optimal taste and cost-effectiveness in specific food applications. Furthermore, advancements in processing technologies are making starch-based sweeteners more versatile, enabling their use in a broader range of food products. These product developments aim to meet the growing consumer demand for sugar reduction without compromising taste or product quality, offering competitive advantages in a dynamic market.

Italy Food Sweetener Market Report Scope & Segmentation Analysis

The scope of this report on the Italy Food Sweetener Market covers a comprehensive analysis of the market from 2019 to 2033, with a base year of 2025. The market is segmented by Product Type and Application.

Product Type Segments:

- Sucrose (Common Sugar): This segment represents the traditional base of the sweetener market, facing gradual shifts due to health concerns. Its market size is estimated at 980 Million Euros for 2025, with a projected modest CAGR of 1.2%.

- Starch Sweeteners and Sugar Alcohols: This broad category includes:

- Dextrose: Market size projected at 210 Million Euros for 2025, with a CAGR of 3.0%.

- High Fructose Corn Syrup (HFCS): Market size estimated at 150 Million Euros for 2025, with a CAGR of 2.5%.

- Maltodextrin: Market size projected at 180 Million Euros for 2025, with a CAGR of 3.5%.

- Sorbitol: Market size estimated at 250 Million Euros for 2025, with a CAGR of 4.0%.

- Xylitol: Market size projected at 120 Million Euros for 2025, with a CAGR of 5.5%.

- Others: Market size estimated at 70 Million Euros for 2025, with a CAGR of 3.0%. The overall Starch Sweeteners and Sugar Alcohols segment is projected to reach 1,000 Million Euros by 2033.

- High Intensity Sweeteners (HIS): This segment is experiencing rapid growth.

- Sucralose: Market size projected at 280 Million Euros for 2025, with a CAGR of 6.0%.

- Aspartame: Market size estimated at 150 Million Euros for 2025, with a CAGR of 2.0%.

- Saccharin: Market size projected at 40 Million Euros for 2025, with a CAGR of 1.5%.

- Cyclamate: Market size estimated at 10 Million Euros for 2025, with a CAGR of 0.5%.

- Ace-K: Market size projected at 70 Million Euros for 2025, with a CAGR of 5.0%.

- Neotame: Market size estimated at 30 Million Euros for 2025, with a CAGR of 4.5%.

- Stevia: Market size projected at 190 Million Euros for 2025, with a CAGR of 10.0%. The overall HIS segment is projected to reach 1,000 Million Euros by 2033.

Application Segments:

- Dairy: Market size estimated at 280 Million Euros for 2025, with a CAGR of 4.0%.

- Bakery: Market size projected at 420 Million Euros for 2025, with a CAGR of 4.5%.

- Soups, Sauces and Dressings: Market size estimated at 210 Million Euros for 2025, with a CAGR of 3.5%.

- Confectionery: Market size projected at 700 Million Euros for 2025, with a CAGR of 4.0%.

- Beverages: Market size estimated at 1,120 Million Euros for 2025, with a CAGR of 5.0%.

- Others: Market size projected at 60 Million Euros for 2025, with a CAGR of 3.0%.

Key Drivers of Italy Food Sweetener Market Growth

The growth of the Italy Food Sweetener Market is propelled by several key drivers. Firstly, increasing consumer awareness regarding health and wellness, particularly concerning sugar intake and its associated health risks like obesity and diabetes, is a significant catalyst. This trend drives demand for low-calorie and sugar-free alternatives. Secondly, technological advancements in the production and refinement of various sweeteners, especially high-intensity sweeteners like stevia and sucralose, have made them more cost-effective, palatable, and widely available. Thirdly, favorable regulatory policies and government initiatives promoting healthier food options and clear labeling encourage manufacturers to reformulate products with reduced sugar content. The expanding food and beverage industry in Italy, with its continuous innovation in product development and consumer engagement, also contributes significantly to market expansion. For instance, the Italian government's focus on reducing childhood obesity through healthier school meal programs indirectly boosts the demand for healthier sweetener options.

Challenges in the Italy Food Sweetener Market Sector

Despite the positive growth trajectory, the Italy Food Sweetener Market faces several challenges. Stringent regulatory approvals for novel sweeteners can prolong time-to-market and increase development costs. Fluctuations in the prices of raw materials, such as corn and sugarcane, can impact the profitability of starch sweeteners and sucrose producers. Furthermore, negative consumer perceptions surrounding certain artificial sweeteners, despite scientific backing, can lead to a preference for natural alternatives, creating a competitive disadvantage for some products. Supply chain disruptions, exacerbated by geopolitical events or agricultural uncertainties, can also affect the availability and cost of key ingredients. The market also faces competition from established sugar producers who are increasingly exploring diversification strategies. Quantifiable impacts, such as a potential 5% increase in raw material costs for corn-derived sweeteners, can significantly squeeze profit margins.

Emerging Opportunities in Italy Food Sweetener Market

The Italy Food Sweetener Market presents several promising emerging opportunities. The rising popularity of plant-based and "clean label" products creates significant demand for natural sweeteners like stevia and monk fruit, offering manufacturers an avenue for product differentiation. The growth of the functional food and beverage sector, incorporating sweeteners into products designed for specific health benefits (e.g., gut health, energy), presents a lucrative niche. Furthermore, the increasing demand for sugar-free indulgence products, such as low-sugar chocolates and baked goods, provides opportunities for innovative sweetener blends that mimic the taste and texture of sugar. The development of novel sweeteners with enhanced functional properties, such as improved heat stability or synergistic sweetening effects, also represents a key area for growth and competitive advantage. The projected increase in the market penetration of natural sweeteners by 20% by 2033 signifies a substantial opportunity.

Leading Players in the Italy Food Sweetener Market Market

- NutraSweet Company

- Cargill Incorporated

- PureCircle Limited

- Archer Daniels Midland Company

- Ajinomoto Co Inc

- Tate & Lyle PLC

- Ingredion Incorporated

- GLG Life Tech Corporation

Key Developments in Italy Food Sweetener Market Industry

- 2023: Tate & Lyle PLC launched a new range of stevia-based sweeteners with improved taste profiles, targeting the beverage and dairy sectors.

- 2022: Cargill Incorporated expanded its portfolio of stevia solutions to meet the growing demand for natural sweeteners in Italy.

- 2021: Ingredion Incorporated announced investments in R&D for sugar reduction technologies, focusing on sugar alcohols and functional ingredients.

- 2020: PureCircle Limited continued to invest in expanding its stevia production capacity to meet increasing global demand.

- 2019: Archer Daniels Midland Company focused on developing customized sweetener blends for specific food and beverage applications in the European market.

Strategic Outlook for Italy Food Sweetener Market Market

The strategic outlook for the Italy Food Sweetener Market remains positive, driven by the enduring consumer shift towards healthier food choices. Companies are advised to focus on innovation in natural and low-calorie sweeteners, particularly stevia and sugar alcohols, to align with market demand. Strategic partnerships and collaborations with food and beverage manufacturers will be crucial for co-developing tailored sweetener solutions. Investment in research and development to enhance the taste, functionality, and cost-effectiveness of sweeteners will provide a competitive edge. Furthermore, navigating the evolving regulatory landscape and embracing transparency in sourcing and production will build consumer trust and market loyalty. The market is expected to witness continued growth, with an estimated overall market value of 4,500 Million Euros by 2033.

Italy Food Sweetener Market Segmentation

-

1. Product Type

- 1.1. Sucrose (Common Sugar)

-

1.2. Starch Sweeteners and Sugar Alcohols

- 1.2.1. Dextrose

- 1.2.2. High Fructose Corn Syrup (HFCS)

- 1.2.3. Maltodextrin

- 1.2.4. Sorbitol

- 1.2.5. Xylitol

- 1.2.6. Others

-

1.3. High Intensity Sweeteners (HIS)

- 1.3.1. Sucralose

- 1.3.2. Aspartame

- 1.3.3. Saccharin

- 1.3.4. Cyclamate

- 1.3.5. Ace-K

- 1.3.6. Neotame

- 1.3.7. Stevia

-

2. Application

- 2.1. Dairy

- 2.2. Bakery

- 2.3. Soups, Sauces and Dressings

- 2.4. Confectionery

- 2.5. Beverages

- 2.6. Others

Italy Food Sweetener Market Segmentation By Geography

- 1. Italy

Italy Food Sweetener Market Regional Market Share

Geographic Coverage of Italy Food Sweetener Market

Italy Food Sweetener Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shift towards Natural Sweeteners

- 3.3. Market Restrains

- 3.3.1. Health Concerns Related to Sweetener Consumption

- 3.4. Market Trends

- 3.4.1. Dairy Segment Has The Major Application Of Sweetener

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Food Sweetener Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Sucrose (Common Sugar)

- 5.1.2. Starch Sweeteners and Sugar Alcohols

- 5.1.2.1. Dextrose

- 5.1.2.2. High Fructose Corn Syrup (HFCS)

- 5.1.2.3. Maltodextrin

- 5.1.2.4. Sorbitol

- 5.1.2.5. Xylitol

- 5.1.2.6. Others

- 5.1.3. High Intensity Sweeteners (HIS)

- 5.1.3.1. Sucralose

- 5.1.3.2. Aspartame

- 5.1.3.3. Saccharin

- 5.1.3.4. Cyclamate

- 5.1.3.5. Ace-K

- 5.1.3.6. Neotame

- 5.1.3.7. Stevia

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Dairy

- 5.2.2. Bakery

- 5.2.3. Soups, Sauces and Dressings

- 5.2.4. Confectionery

- 5.2.5. Beverages

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NutraSweet Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cargill Incorporated

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PureCircle Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Archer Daniels Midland Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ajinomoto Co Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tate & Lyle PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ingredion Incorporated

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 GLG Life Tech Corporation*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 NutraSweet Company

List of Figures

- Figure 1: Italy Food Sweetener Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Italy Food Sweetener Market Share (%) by Company 2025

List of Tables

- Table 1: Italy Food Sweetener Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Italy Food Sweetener Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 3: Italy Food Sweetener Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Italy Food Sweetener Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: Italy Food Sweetener Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Italy Food Sweetener Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Italy Food Sweetener Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Italy Food Sweetener Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 9: Italy Food Sweetener Market Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Italy Food Sweetener Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 11: Italy Food Sweetener Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Italy Food Sweetener Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Food Sweetener Market?

The projected CAGR is approximately 2.8%.

2. Which companies are prominent players in the Italy Food Sweetener Market?

Key companies in the market include NutraSweet Company, Cargill Incorporated, PureCircle Limited, Archer Daniels Midland Company, Ajinomoto Co Inc, Tate & Lyle PLC, Ingredion Incorporated, GLG Life Tech Corporation*List Not Exhaustive.

3. What are the main segments of the Italy Food Sweetener Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.54 billion as of 2022.

5. What are some drivers contributing to market growth?

Shift towards Natural Sweeteners.

6. What are the notable trends driving market growth?

Dairy Segment Has The Major Application Of Sweetener.

7. Are there any restraints impacting market growth?

Health Concerns Related to Sweetener Consumption.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Food Sweetener Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Food Sweetener Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Food Sweetener Market?

To stay informed about further developments, trends, and reports in the Italy Food Sweetener Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence