Key Insights

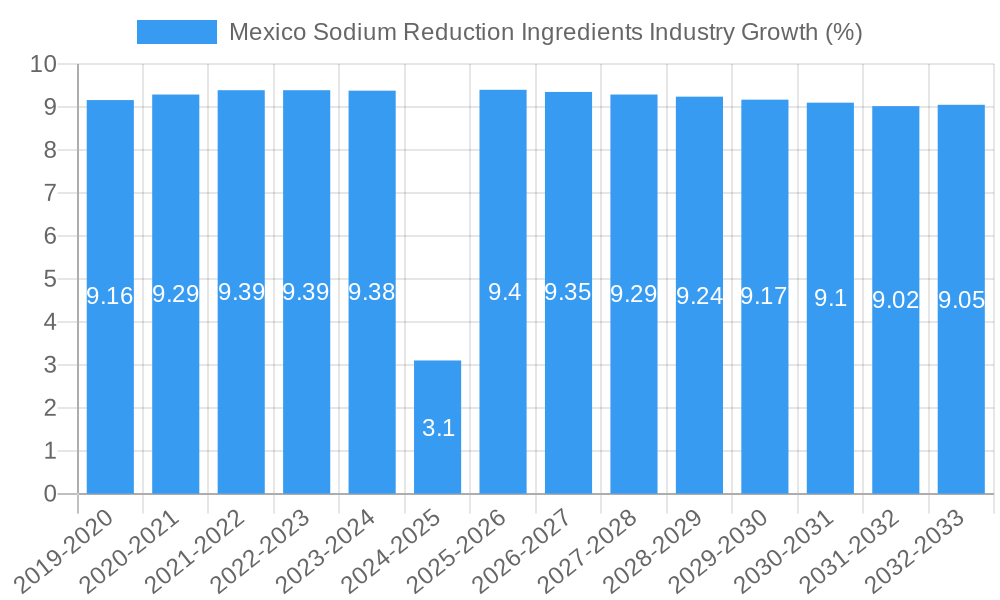

The Mexican Sodium Reduction Ingredients market is poised for significant expansion, projected to reach an estimated value of $137.57 million by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 9.58% through 2033. This growth is fueled by a confluence of factors, primarily driven by increasing consumer health consciousness regarding the detrimental effects of excessive sodium intake. Government initiatives promoting healthier food choices and stricter regulations on sodium content in processed foods are also playing a pivotal role in shaping market dynamics. The burgeoning demand for natural and plant-based alternatives further propels the adoption of innovative sodium reduction solutions. Key application segments such as bakery and confectionery, condiments, seasonings, and sauces, as well as meat and meat products, are expected to witness substantial uptake of these ingredients as manufacturers strive to meet evolving consumer preferences for reduced-sodium, yet flavorful, food options.

Several trends are shaping the landscape of sodium reduction ingredients in Mexico. The rising popularity of yeast extracts and amino acids as effective sodium replacers, offering both flavor enhancement and reduced sodium content, is a notable development. Mineral salts are also gaining traction for their ability to mimic the taste and functional properties of sodium chloride. While the market benefits from strong demand, challenges persist. The cost of some advanced sodium reduction ingredients can be higher than conventional salt, posing a potential restraint for price-sensitive manufacturers and consumers. Additionally, maintaining the desired taste profile and texture in food products after significant sodium reduction requires sophisticated formulation expertise, which can be a hurdle for smaller enterprises. Despite these challenges, the overarching consumer and regulatory push towards healthier diets ensures a dynamic and growing market for sodium reduction ingredients in Mexico.

Mexico Sodium Reduction Ingredients Industry Market Concentration & Innovation

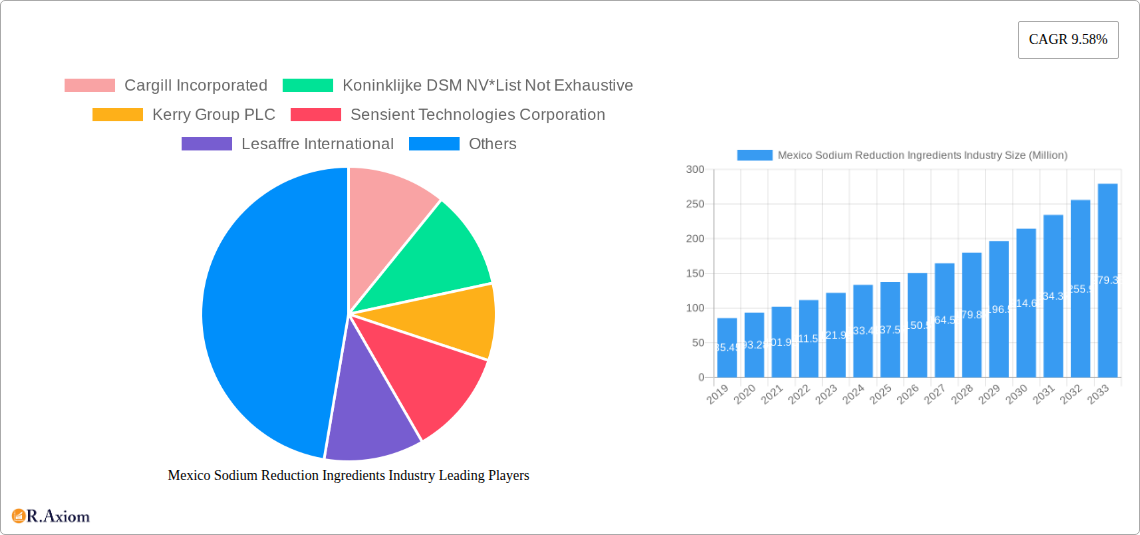

The Mexico sodium reduction ingredients market is characterized by a moderate to high concentration, with a few key players dominating significant market share. Cargill Incorporated, Koninklijke DSM NV, Kerry Group PLC, and Sensient Technologies Corporation are prominent entities driving innovation and influencing market dynamics. Innovation in this sector is primarily fueled by increasing consumer demand for healthier food options, stricter government regulations on sodium intake, and advancements in food science that enable the development of effective and palatable sodium alternatives. Regulatory frameworks, particularly those set by the Mexican government and health organizations, play a crucial role in shaping product development and market access. The presence of product substitutes, such as potassium chloride and flavor enhancers, presents a competitive challenge, though the efficacy and taste profile of specialized sodium reduction ingredients often provide a competitive advantage. End-user trends are shifting towards processed foods with reduced sodium content, driving demand across various applications. Mergers and acquisitions (M&A) activities are observed as companies seek to expand their product portfolios, enhance technological capabilities, and gain a stronger foothold in the growing Mexican market. While specific M&A deal values are proprietary, the strategic importance of this sector suggests continued investment and consolidation. The market share of leading companies is estimated to be above 60%, indicating a concentrated landscape.

Mexico Sodium Reduction Ingredients Industry Industry Trends & Insights

The Mexico sodium reduction ingredients industry is experiencing robust growth, driven by a confluence of factors that are reshaping the food and beverage landscape. The Compound Annual Growth Rate (CAGR) is projected to be around 7.5% during the forecast period of 2025–2033, indicating substantial market expansion. This growth is primarily propelled by escalating health consciousness among Mexican consumers, who are increasingly seeking out food products with lower sodium content due to rising concerns about hypertension and cardiovascular diseases. Government initiatives and public health campaigns aimed at curbing excessive sodium consumption further amplify this trend. Technological disruptions are playing a pivotal role, with ongoing research and development leading to the introduction of novel sodium reduction ingredients that not only effectively lower sodium levels but also maintain or even enhance the sensory attributes of food products, such as taste, texture, and aroma. Companies are investing heavily in R&D to overcome the challenges associated with taste masking and maintaining product palatability when sodium is reduced. Consumer preferences are undeniably shifting towards "healthier" food choices, making sodium reduction a key selling point for manufacturers. This translates into increased demand for ingredients that can facilitate this transition without compromising on consumer satisfaction. The competitive dynamics within the industry are intensifying, with both established global players and emerging local companies vying for market share. Strategic partnerships, product innovation, and aggressive marketing strategies are becoming commonplace as businesses strive to capture a significant portion of this expanding market. The market penetration of sodium reduction ingredients is expected to rise significantly as more food manufacturers integrate these solutions into their product formulations to meet both consumer demand and regulatory pressures. The estimated market size for 2025 is approximately $120 Million, with substantial growth anticipated in the coming years.

Dominant Markets & Segments in Mexico Sodium Reduction Ingredients Industry

The Mexico sodium reduction ingredients market exhibits distinct dominance across specific product types and application segments, largely driven by prevailing consumer habits, regulatory landscapes, and the manufacturing capabilities within the country.

Dominant Product Types:

Amino Acids and Glutamates: This segment holds a significant share, estimated at over 35% of the total market.

- Key Drivers: The ability of amino acids and glutamates, such as monosodium glutamate (MSG) and its alternatives, to provide umami taste and enhance overall flavor profiles makes them highly sought after. They can effectively compensate for the flavor loss resulting from sodium reduction in a wide range of food products. Their versatility across applications like snacks, processed meats, and savory dishes fuels their dominance.

- Dominance Analysis: Manufacturers are investing in optimizing the production and application of these ingredients to meet the growing demand from the food processing industry. The established infrastructure for their production and widespread acceptance by consumers for flavor enhancement contribute to their leading position.

Yeast Extracts: This segment is also a strong contender, accounting for approximately 30% of the market.

- Key Drivers: Yeast extracts offer a complex flavor profile, including savory and umami notes, and can contribute to mouthfeel, making them effective in reducing the need for sodium. Their natural origin appeals to consumers seeking cleaner labels.

- Dominance Analysis: The increasing popularity of natural and clean-label ingredients aligns perfectly with the attributes of yeast extracts. Their application in soups, sauces, seasonings, and savory snacks solidifies their market presence.

Mineral Salts: Holding a market share of around 20%, mineral salts, primarily potassium chloride, are crucial.

- Key Drivers: Potassium chloride is a direct sodium replacer, though its characteristic bitter aftertaste requires careful formulation. Advances in encapsulation and blending technologies are mitigating these taste challenges, enhancing their applicability.

- Dominance Analysis: The direct sodium-replacing functionality makes mineral salts indispensable for manufacturers aiming for significant sodium reduction targets. Their cost-effectiveness and availability also contribute to their market penetration.

Other Product Types: This residual segment, comprising approximately 15%, includes various proprietary blends and emerging ingredients.

- Key Drivers: Continuous innovation by ingredient developers to create synergistic blends that offer improved taste, functionality, and cost-effectiveness.

- Dominance Analysis: While smaller, this segment represents the frontier of innovation, offering tailored solutions for specific food categories and manufacturers.

Dominant Application Segments:

Condiments, Seasonings, and Sauces: This segment is the largest application area, capturing an estimated 40% of the market.

- Key Drivers: These products are historically high in sodium, making them prime targets for reformulation. Consumer demand for flavorful condiments and sauces with reduced sodium content is immense.

- Dominance Analysis: Manufacturers are actively reformulating ketchup, mustard, soy sauce, salad dressings, and spice blends with sodium reduction ingredients to comply with regulations and meet consumer preferences.

Meat and Meat Products: This segment accounts for roughly 25% of the market.

- Key Drivers: Processed meats such as sausages, ham, and deli meats are significant contributors to sodium intake. The demand for healthier versions of these popular products is substantial.

- Dominance Analysis: Ingredient suppliers are developing specialized solutions for meat processing, focusing on maintaining texture, juiciness, and flavor while reducing sodium in cured and processed meats.

Bakery and Confectionery: With a market share of approximately 15%.

- Key Drivers: While traditionally not as high in sodium as savory products, sodium plays a role in texture and leavening in baked goods. Sodium reduction in bread, biscuits, and pastries is gaining traction for overall health benefits.

- Dominance Analysis: Innovations in yeast strains and dough conditioners are enabling sodium reduction in bakery products without compromising quality.

Dairy and Frozen Foods: This segment represents about 10% of the market.

- Key Drivers: Cheese, yogurts, and frozen meals often contain added sodium for preservation and flavor. The trend towards healthier convenience foods drives demand for sodium reduction in these categories.

- Dominance Analysis: Formulators are exploring solutions for processed cheeses, frozen pizzas, and ready-to-eat meals.

Snacks: This segment accounts for the remaining 10% of the market.

- Key Drivers: Savory snacks like chips, crackers, and pretzels are major sources of dietary sodium. The demand for guilt-free snacking options is growing.

- Dominance Analysis: Ingredient innovation is crucial here to maintain the characteristic crunch and savory taste of snacks while significantly lowering sodium levels.

Mexico Sodium Reduction Ingredients Industry Product Developments

Product developments in the Mexico sodium reduction ingredients industry are centered on enhancing flavor profiles and functionalities to overcome the challenges associated with sodium replacement. Innovations include advanced yeast extracts offering superior umami, encapsulated potassium chloride to mask bitterness, and synergistic blends of amino acids and natural flavorings. These developments aim to provide manufacturers with cost-effective solutions that maintain the taste, texture, and overall palatability of food products. Competitive advantages are being gained through the development of ingredients that offer a cleaner label, are derived from natural sources, and provide superior taste modulation compared to traditional sodium replacers.

Report Scope & Segmentation Analysis

This report delves into the Mexico Sodium Reduction Ingredients Industry, providing comprehensive analysis across key segments.

Product Type Segmentation: The analysis covers Amino Acids and Glutamates, Mineral Salts, Yeast Extracts, and Other Product Types. Growth projections for these segments are driven by their specific functional benefits and market acceptance. Market sizes are estimated based on current adoption rates and projected demand. Competitive dynamics within each product type are assessed based on the number of key players and their market influence.

Application Segmentation: The report examines Bakery and Confectionery, Condiments, Seasonings, and Sauces, Dairy and Frozen Foods, Meat and Meat Products, Snacks, and Other Applications. Growth in these application areas is linked to evolving consumer preferences for healthier food options and regulatory mandates. Market sizes reflect the prevalence of sodium reduction initiatives within each sector. Competitive dynamics are analyzed by the level of innovation and adoption of sodium reduction solutions by food manufacturers in these distinct categories.

Key Drivers of Mexico Sodium Reduction Ingredients Industry Growth

Several key drivers are propelling the growth of the Mexico Sodium Reduction Ingredients Industry. Increasing health consciousness among consumers regarding the adverse effects of high sodium intake on cardiovascular health is a primary catalyst. Government regulations and public health initiatives aimed at reducing sodium consumption are creating a favorable environment for sodium reduction ingredient adoption. Technological advancements in food science, leading to the development of more effective and palatable sodium replacers, are crucial enablers. Furthermore, the growing demand for processed and convenience foods, coupled with a desire for healthier options within these categories, fuels the need for sodium reduction solutions. Companies like Cargill Incorporated are investing in R&D to offer innovative ingredient solutions that address these market demands.

Challenges in the Mexico Sodium Reduction Ingredients Industry Sector

Despite robust growth, the Mexico Sodium Reduction Ingredients Industry faces several challenges. Maintaining product palatability and taste when significantly reducing sodium remains a significant hurdle, as sodium contributes to flavor perception and mouthfeel. Consumer perception and acceptance of alternative ingredients, particularly those with unfamiliar names or potential off-tastes, can slow adoption. Higher costs associated with some advanced sodium reduction ingredients compared to traditional salt can impact price-sensitive markets. Complex reformulation processes for manufacturers, requiring extensive testing and R&D investment, present another barrier. Stringent and evolving regulatory landscapes can also pose challenges in terms of compliance and product approvals. The supply chain reliability for specialized ingredients can also be a concern, impacting consistent availability.

Emerging Opportunities in Mexico Sodium Reduction Ingredients Industry

Emerging opportunities in the Mexico Sodium Reduction Ingredients Industry are substantial and diverse. The growing demand for clean-label and natural sodium reduction solutions presents a significant opening for ingredients derived from natural sources like yeast extracts and specific botanical extracts. The expansion of the processed food sector in Mexico, coupled with increasing disposable incomes, creates a larger market for healthier convenience food options. Technological advancements in flavor modulation and taste masking are opening doors for ingredients that can more effectively mimic the sensory attributes of sodium. The increasing focus on preventative healthcare and wellness among the Mexican population will continue to drive demand for foods with reduced sodium content across all product categories. Furthermore, partnerships between ingredient manufacturers and food producers to co-create innovative sodium-reduced products represent a key avenue for growth.

Leading Players in the Mexico Sodium Reduction Ingredients Industry Market

- Cargill Incorporated

- Koninklijke DSM NV

- Kerry Group PLC

- Sensient Technologies Corporation

- Lesaffre International

- CURE Pharmaceutical

- Corbion NV

- Angel Yeast Co Ltd

- Royal DSM

- Lallemand Inc

Key Developments in Mexico Sodium Reduction Ingredients Industry Industry

- 2023/2024: Increased investment in research and development for potassium-based flavor enhancers with improved taste profiles.

- 2022/2023: Strategic partnerships formed between major ingredient suppliers and prominent Mexican food manufacturers to accelerate product reformulation.

- 2021/2022: Launch of new yeast extract formulations specifically designed for savory applications, offering enhanced umami and masking off-tastes.

- 2020/2021: Expansion of production capacities for amino acids and glutamates by key players to meet rising market demand.

- 2019/2020: Introduction of novel mineral salt blends with improved solubility and reduced bitterness in processed meat applications.

Strategic Outlook for Mexico Sodium Reduction Ingredients Industry Market

The strategic outlook for the Mexico Sodium Reduction Ingredients Industry market is highly promising, driven by sustained consumer health consciousness and supportive regulatory frameworks. Growth catalysts include the continuous innovation in taste modulation technologies, enabling the development of more palatable and functional sodium reduction ingredients. The increasing demand for clean-label and natural alternatives presents a significant opportunity for ingredient suppliers focusing on sustainable sourcing and production. As food manufacturers increasingly prioritize health attributes in their product portfolios, strategic collaborations and acquisitions are expected to shape the competitive landscape. The market is poised for continued expansion, with a strong emphasis on providing holistic solutions that address sensory, cost, and regulatory considerations for a wide range of food and beverage applications in Mexico.

Mexico Sodium Reduction Ingredients Industry Segmentation

-

1. Product Type

- 1.1. Amino Acids and Glutamates

- 1.2. Mineral Salts

- 1.3. Yeast Extracts

- 1.4. Other Product Types

-

2. Application

- 2.1. Bakery and Confectionery

- 2.2. Condiments, Seasonings, and Sauces

- 2.3. Dairy and Frozen Foods

- 2.4. Meat and Meat Products

- 2.5. Snacks

- 2.6. Other Applications

Mexico Sodium Reduction Ingredients Industry Segmentation By Geography

- 1. Mexico

Mexico Sodium Reduction Ingredients Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.58% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications and Functionality; Demand For Gluten-Free Products

- 3.3. Market Restrains

- 3.3.1. Easy Availability of Economically Feasible Alternatives

- 3.4. Market Trends

- 3.4.1. Rising Awareness of Heath Effects of High Sodium Intake

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Sodium Reduction Ingredients Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Amino Acids and Glutamates

- 5.1.2. Mineral Salts

- 5.1.3. Yeast Extracts

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery and Confectionery

- 5.2.2. Condiments, Seasonings, and Sauces

- 5.2.3. Dairy and Frozen Foods

- 5.2.4. Meat and Meat Products

- 5.2.5. Snacks

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Cargill Incorporated

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Koninklijke DSM NV*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kerry Group PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sensient Technologies Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lesaffre International

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CURE Pharmaceutical

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Corbion NV

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Angel Yeast Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Royal DSM

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Lallemand Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Cargill Incorporated

List of Figures

- Figure 1: Mexico Sodium Reduction Ingredients Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mexico Sodium Reduction Ingredients Industry Share (%) by Company 2024

List of Tables

- Table 1: Mexico Sodium Reduction Ingredients Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mexico Sodium Reduction Ingredients Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Mexico Sodium Reduction Ingredients Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Mexico Sodium Reduction Ingredients Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Mexico Sodium Reduction Ingredients Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Mexico Sodium Reduction Ingredients Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 7: Mexico Sodium Reduction Ingredients Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 8: Mexico Sodium Reduction Ingredients Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Sodium Reduction Ingredients Industry?

The projected CAGR is approximately 9.58%.

2. Which companies are prominent players in the Mexico Sodium Reduction Ingredients Industry?

Key companies in the market include Cargill Incorporated, Koninklijke DSM NV*List Not Exhaustive, Kerry Group PLC, Sensient Technologies Corporation, Lesaffre International, CURE Pharmaceutical, Corbion NV, Angel Yeast Co Ltd, Royal DSM, Lallemand Inc.

3. What are the main segments of the Mexico Sodium Reduction Ingredients Industry?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 137.57 Million as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications and Functionality; Demand For Gluten-Free Products.

6. What are the notable trends driving market growth?

Rising Awareness of Heath Effects of High Sodium Intake.

7. Are there any restraints impacting market growth?

Easy Availability of Economically Feasible Alternatives.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Sodium Reduction Ingredients Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Sodium Reduction Ingredients Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Sodium Reduction Ingredients Industry?

To stay informed about further developments, trends, and reports in the Mexico Sodium Reduction Ingredients Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence