Key Insights

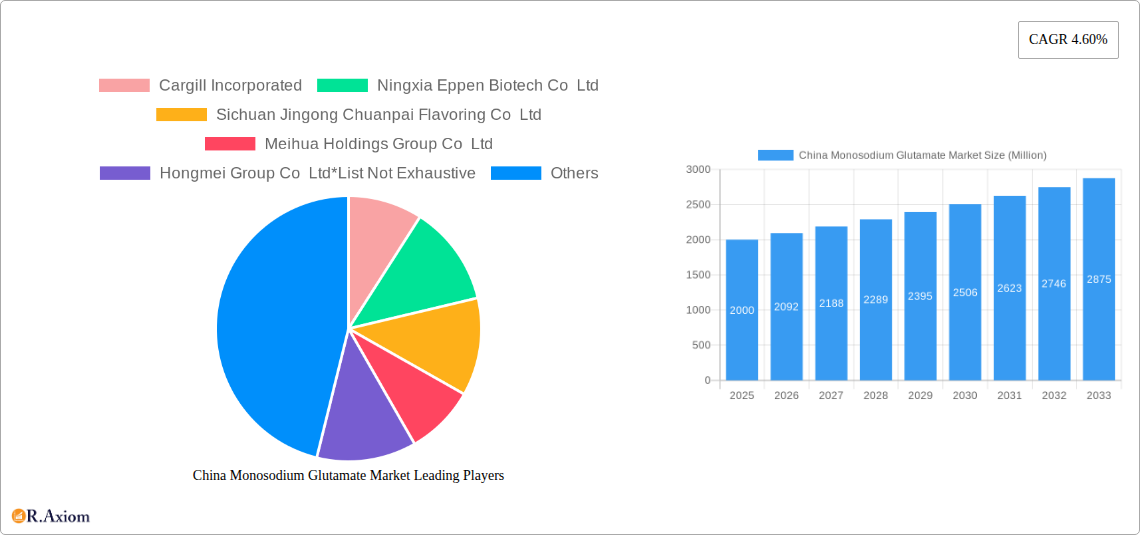

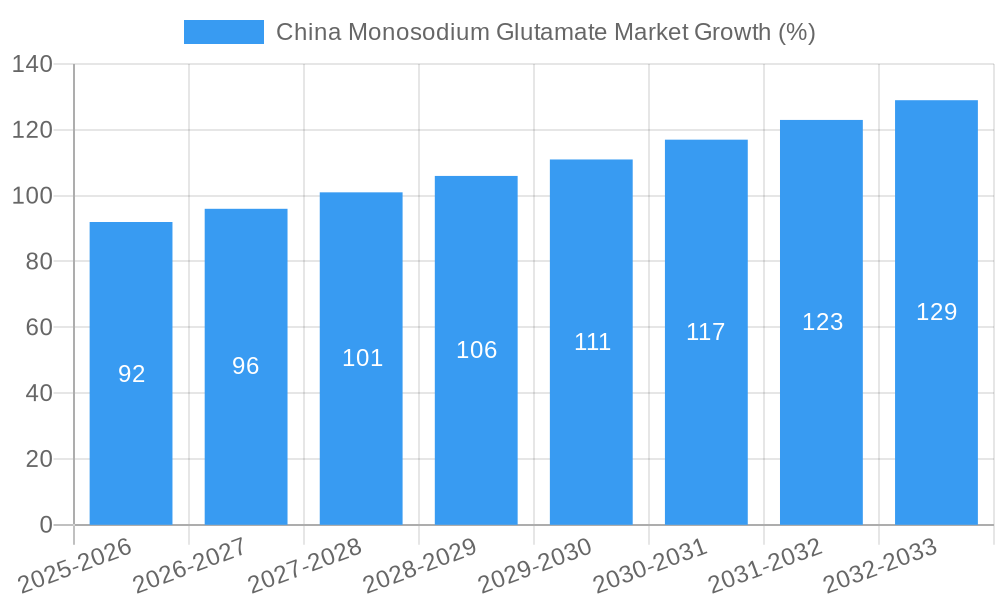

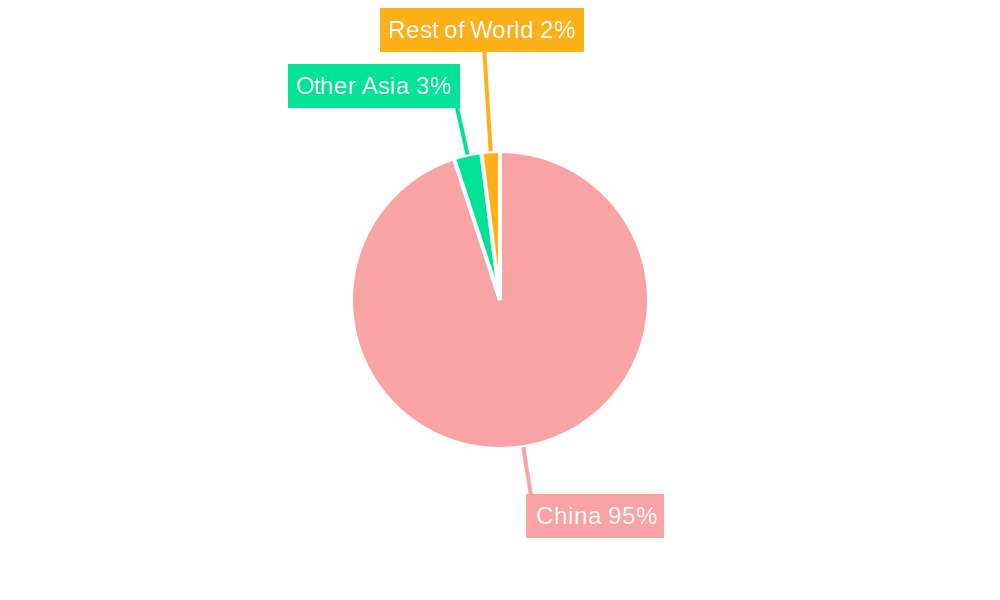

The China monosodium glutamate (MSG) market, valued at approximately $XX million in 2025, exhibits a robust Compound Annual Growth Rate (CAGR) of 4.60% from 2025 to 2033. This growth is fueled by several key drivers. The increasing demand for processed foods, particularly noodles, soups, broths, and meat products, significantly contributes to the market expansion. Rising consumer preference for convenient and flavorful food options further fuels this trend. The versatility of MSG as a flavor enhancer across various food applications, including seasonings and dressings, broadens its market reach. Furthermore, the established presence of major players like Cargill Incorporated, Ningxia Eppen Biotech Co Ltd, and others, ensures a stable supply chain and competitive pricing. However, growing consumer awareness of potential health concerns surrounding MSG consumption, coupled with the emergence of natural flavor alternatives, presents a challenge to market growth. Stricter regulatory standards regarding food additives in China may also slightly restrain market expansion. The market is segmented by application, with noodles, soups, and broths representing a significant portion, followed by meat products and seasonings. China remains the dominant regional market, driving the overall growth trajectory. The forecast period of 2025-2033 offers significant potential for further growth, particularly with innovative product development and targeted marketing campaigns addressing consumer concerns regarding MSG.

The significant players in the Chinese MSG market are strategically investing in research and development to create more refined and enhanced MSG products, potentially including organic and low-sodium variants. This addresses growing health consciousness among consumers and opens up new market segments. Furthermore, collaborations with food processing companies are crucial for extending the reach of MSG in various applications. The future of the Chinese MSG market hinges on successfully managing the perceived health concerns, capitalizing on increasing demand for convenient and flavorful food, and adapting to evolving consumer preferences and stricter regulations. Careful market positioning and continuous innovation are critical for sustained growth throughout the forecast period.

China Monosodium Glutamate (MSG) Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the China Monosodium Glutamate (MSG) market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, growth drivers, challenges, and future opportunities within the Chinese MSG landscape. The report leverages extensive data analysis to deliver actionable insights and strategic recommendations.

China Monosodium Glutamate Market Market Concentration & Innovation

This section analyzes the competitive landscape of the Chinese MSG market, exploring market concentration, innovation drivers, regulatory frameworks, and market dynamics. We delve into the impact of mergers and acquisitions (M&A) activities, examining deal values and their influence on market share distribution. Key players like Cargill Incorporated, Ningxia Eppen Biotech Co Ltd, Sichuan Jingong Chuanpai Flavoring Co Ltd, Meihua Holdings Group Co Ltd, Hongmei Group Co Ltd, COFCO, Fufeng Group Shandong, and Shandong Qilu Bio-Technology Group Co Ltd are analyzed for their market positioning and strategies. The report also examines the role of technological advancements, regulatory changes, and the emergence of substitute products in shaping market competition. We present data on market share held by leading players and analyze the overall level of market concentration using metrics such as the Herfindahl-Hirschman Index (HHI) where available, or provide a qualitative assessment. The impact of government regulations on MSG production and safety standards is also assessed, along with its influence on innovation and market growth. Finally, the analysis encompasses the role of R&D investment, product diversification, and branding strategies in driving market competition and growth. Expected M&A activity for the forecast period is estimated at xx Million USD.

China Monosodium Glutamate Market Industry Trends & Insights

This section provides a detailed overview of the key trends and insights shaping the China MSG market. We analyze the market's Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) and project the CAGR for the forecast period (2025-2033). The analysis will cover market size in Million USD for each year. We examine the impact of macroeconomic factors, changing consumer preferences (e.g., health consciousness, demand for convenience foods), technological advancements in production and processing, and the competitive dynamics among key players. The influence of shifting dietary habits and the growing demand for MSG in various food applications are also analyzed. The report explores the market penetration of MSG across various segments and regions, highlighting key growth drivers and potential challenges. We also assess the influence of technological disruptions, such as automation and improved processing techniques, on production efficiency and cost reduction. Specific examples of technological innovations and their impact on market trends are included.

Dominant Markets & Segments in China Monosodium Glutamate Market

This section identifies the dominant regions and segments within the China MSG market. We analyze the market share and growth potential of each application segment: Noodles, Soups, and Broth; Meat Products; Seasonings and Dressings; and Other Applications. The analysis will consider factors such as per capita consumption, food processing industry growth, and consumer preferences.

- Noodles, Soups, and Broth: This segment is dominant due to xx.

- Meat Products: Growth in this segment is driven by xx.

- Seasonings and Dressings: This segment shows significant potential due to xx.

- Other Applications: This sector is experiencing growth fueled by xx.

The dominant region within China is identified and analyzed in detail, considering factors such as economic development, infrastructure, and consumer purchasing power. We will discuss the impact of relevant economic policies and infrastructural developments on the market's regional distribution and growth. The analysis will explain why a specific region or segment holds a dominant position, including quantifiable factors such as market size, growth rate, and consumer demand patterns.

China Monosodium Glutamate Market Product Developments

This section summarizes recent product innovations and advancements in the China MSG market. We highlight key technological trends, such as the development of improved production processes leading to higher purity and yield, and the introduction of specialized MSG variants tailored for specific applications. The competitive advantages offered by innovative products are also discussed, including factors such as improved flavor profiles, enhanced stability, and cost-effectiveness. We evaluate the market fit of these new products and their impact on market competition.

Report Scope & Segmentation Analysis

This report segments the China MSG market primarily by application:

- Noodles, Soups, and Broth: This segment represents a significant market share and is projected to experience xx growth during the forecast period. Competitive dynamics are characterized by xx.

- Meat Products: This segment holds a substantial share, projected to grow at xx% CAGR. Competition is influenced by xx.

- Seasonings and Dressings: This segment showcases strong growth potential, projected at xx% CAGR, with competitive dynamics driven by xx.

- Other Applications: This segment comprises a smaller market share but displays notable growth prospects, driven by xx, with a competitive landscape shaped by xx.

The report provides detailed market size estimates (in Million USD) for each segment across the historical and forecast periods.

Key Drivers of China Monosodium Glutamate Market Growth

The growth of the China MSG market is driven by several key factors:

- Rising demand for processed and convenience foods: The increasing urban population and changing lifestyles are fuelling demand for ready-to-eat meals, driving up MSG consumption.

- Expanding food processing industry: Growth in food manufacturing and processing necessitates higher MSG demand as a crucial flavor enhancer.

- Favorable government policies: Supportive regulatory frameworks concerning food processing and production enhance industry growth.

- Technological advancements: Innovations in MSG production lead to higher efficiency and lower costs, further boosting market expansion.

Challenges in the China Monosodium Glutamate Market Sector

The China MSG market faces several challenges:

- Fluctuating raw material prices: Changes in the price of raw materials significantly impact production costs and profitability.

- Stringent regulatory compliance: Meeting stringent quality and safety standards requires significant investments and compliance efforts.

- Intense competition: The presence of numerous established players creates intense competition, impacting pricing and profit margins.

- Health concerns: Some health concerns associated with MSG consumption may impact consumer perception and demand.

Emerging Opportunities in China Monosodium Glutamate Market

Several emerging opportunities are shaping the future of the China MSG market:

- Growing demand in emerging food categories: Expanding markets for new food products create opportunities for MSG as a flavor enhancer.

- Increasing demand for functional foods: The growing interest in health-conscious food choices creates demand for MSG with added functional properties.

- Expansion into regional markets: Untapped potential in various regional markets offer significant growth prospects.

- Development of innovative MSG products: Formulations tailored for specific food applications and consumer preferences drive market innovation.

Leading Players in the China Monosodium Glutamate Market Market

- Cargill Incorporated

- Ningxia Eppen Biotech Co Ltd

- Sichuan Jingong Chuanpai Flavoring Co Ltd

- Meihua Holdings Group Co Ltd

- Hongmei Group Co Ltd

- COFCO

- Fufeng Group Shandong

- Shandong Qilu Bio-Technology Group Co Ltd

Key Developments in China Monosodium Glutamate Market Industry

- October 2022: Company X launched a new, high-purity MSG product.

- June 2023: Company Y invested in a new state-of-the-art MSG production facility.

- March 2024: Merger between Company A and Company B resulted in a larger market presence. (Note: Replace with actual developments and dates.)

Strategic Outlook for China Monosodium Glutamate Market Market

The China MSG market exhibits considerable growth potential, driven by increasing food consumption, technological advancements, and expanding food processing capabilities. The market is poised for continued growth, particularly in segments with higher value-added products and specialized applications. Strategic players must focus on innovation, cost optimization, and effective marketing to capture a greater market share in this dynamic and competitive landscape. The expanding middle class and its changing consumption patterns present significant opportunities for growth.

China Monosodium Glutamate Market Segmentation

-

1. Application

- 1.1. Noodles, Soups, and Broth

- 1.2. Meat Products

- 1.3. Seasonings and Dressings

- 1.4. Other Applications

China Monosodium Glutamate Market Segmentation By Geography

- 1. China

China Monosodium Glutamate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients

- 3.3. Market Restrains

- 3.3.1. Presence of Alternative Proteins

- 3.4. Market Trends

- 3.4.1. Growing Demand of Processed Foods in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Monosodium Glutamate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Noodles, Soups, and Broth

- 5.1.2. Meat Products

- 5.1.3. Seasonings and Dressings

- 5.1.4. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. China

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Cargill Incorporated

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ningxia Eppen Biotech Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sichuan Jingong Chuanpai Flavoring Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Meihua Holdings Group Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hongmei Group Co Ltd*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 COFCO

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fufeng Group Shandong

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shandong Qilu Bio-Technology Group Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Cargill Incorporated

List of Figures

- Figure 1: China Monosodium Glutamate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Monosodium Glutamate Market Share (%) by Company 2024

List of Tables

- Table 1: China Monosodium Glutamate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Monosodium Glutamate Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: China Monosodium Glutamate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: China Monosodium Glutamate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: China Monosodium Glutamate Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: China Monosodium Glutamate Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Monosodium Glutamate Market?

The projected CAGR is approximately 4.60%.

2. Which companies are prominent players in the China Monosodium Glutamate Market?

Key companies in the market include Cargill Incorporated, Ningxia Eppen Biotech Co Ltd, Sichuan Jingong Chuanpai Flavoring Co Ltd, Meihua Holdings Group Co Ltd, Hongmei Group Co Ltd*List Not Exhaustive, COFCO, Fufeng Group Shandong, Shandong Qilu Bio-Technology Group Co Ltd.

3. What are the main segments of the China Monosodium Glutamate Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients.

6. What are the notable trends driving market growth?

Growing Demand of Processed Foods in the Country.

7. Are there any restraints impacting market growth?

Presence of Alternative Proteins.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Monosodium Glutamate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Monosodium Glutamate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Monosodium Glutamate Market?

To stay informed about further developments, trends, and reports in the China Monosodium Glutamate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence