Key Insights

The Asia-Pacific dairy-based beverages market is projected for substantial growth, expected to reach $202.81 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 4.84% from 2025 to 2033. This expansion is driven by a growing middle class, rising disposable incomes in key markets like China and India, and increasing consumer demand for healthier, nutrient-rich beverage options. Product innovation, including functional beverages with probiotics and added vitamins, is further stimulating market penetration. Heightened consumer awareness of dairy's health benefits, such as improved bone health and gut wellness, also fuels demand.

Asia-Pacific Dairy-Based Beverages Industry Market Size (In Billion)

Market dynamics are influenced by evolving consumer preferences and advanced distribution strategies. While milk and yogurt remain dominant, fermented dairy beverages like kefir are gaining traction due to their probiotic properties. The flavored dairy drink segment is highly active, with manufacturers introducing diverse flavor profiles. Distribution is expanding through online channels, complementing established retail networks like supermarkets and hypermarkets. Potential restraints include volatile raw material costs and the competitive rise of plant-based alternatives. Nevertheless, the inherent nutritional value and broad consumer acceptance of dairy-based beverages ensure sustained, robust market growth in the Asia-Pacific region.

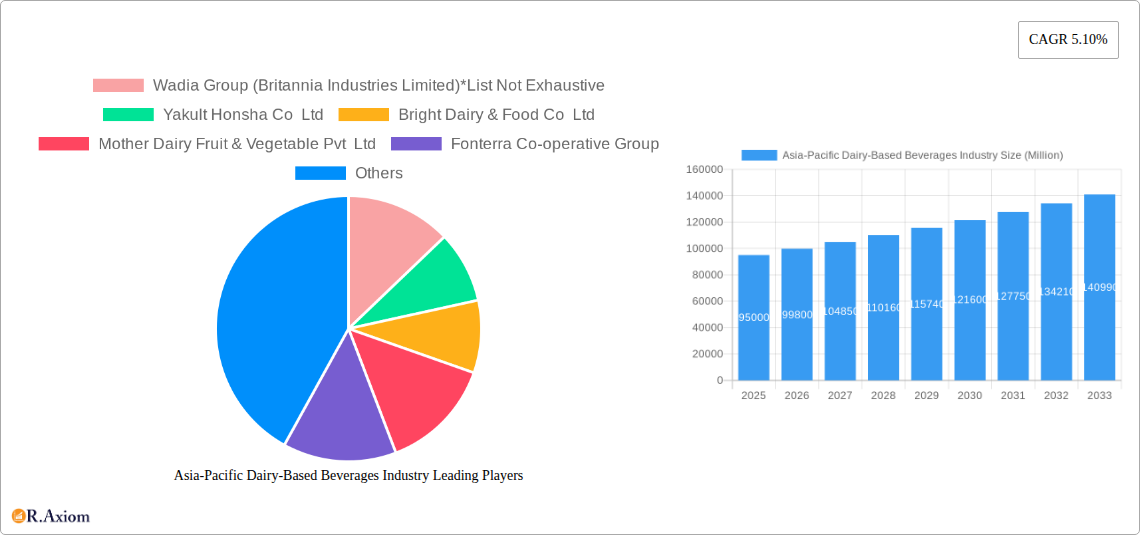

Asia-Pacific Dairy-Based Beverages Industry Company Market Share

Asia-Pacific Dairy-Based Beverages Industry Market Concentration & Innovation

The Asia-Pacific dairy-based beverages market exhibits a moderate to high concentration, with a few dominant players controlling a significant share. Key companies like Wadia Group (Britannia Industries Limited), Yakult Honsha Co Ltd, Bright Dairy & Food Co Ltd, Mother Dairy Fruit & Vegetable Pvt Ltd, Fonterra Co-operative Group, and GCMMF (Amul) lead the charge, driven by robust distribution networks and established brand loyalty. Innovation is a crucial differentiator, fueled by increasing consumer demand for healthier, functional, and convenient beverage options. This includes the development of lactose-free alternatives, fortified beverages with vitamins and probiotics, and plant-based dairy alternatives that challenge traditional dairy. Regulatory frameworks, while varying by country, are increasingly focusing on food safety standards, labeling transparency, and nutritional guidelines, influencing product development and market entry strategies. Product substitutes, primarily from the burgeoning plant-based beverage sector (soy, almond, oat), pose a significant competitive threat, necessitating continuous innovation and product differentiation by dairy-based beverage manufacturers. End-user trends are shifting towards personalized nutrition, sustainability, and ethical sourcing, pushing companies to adapt their offerings and marketing. Merger and acquisition (M&A) activities, valued in the hundreds of millions of USD, are anticipated to continue as companies seek to expand their product portfolios, geographical reach, and technological capabilities, consolidating market share and enhancing competitive advantage.

Asia-Pacific Dairy-Based Beverages Industry Industry Trends & Insights

The Asia-Pacific dairy-based beverages industry is poised for substantial growth, driven by a confluence of powerful trends shaping consumer behavior and market dynamics. A projected Compound Annual Growth Rate (CAGR) of 6.5% is expected to propel the market forward, reaching an estimated value of USD 150 Billion by 2033. This expansion is underpinned by increasing disposable incomes across the region, leading to greater consumer spending on premium and health-conscious food and beverage products. Urbanization is another significant factor, with a growing population in metropolitan areas demanding convenient, ready-to-drink options that fit into their fast-paced lifestyles.

Technological disruptions are playing a pivotal role in shaping product innovation and market accessibility. Advances in processing and packaging technologies are enabling the creation of longer shelf-life products, enhanced nutritional profiles, and novel flavor experiences. For instance, the integration of probiotics and prebiotics into yogurt-based drinks and milk beverages is a growing trend, catering to the rising consumer interest in gut health and overall wellness. Furthermore, sophisticated online retail platforms and delivery services have dramatically increased market penetration, allowing consumers to access a wider variety of dairy-based beverages from the comfort of their homes. This has particularly benefited specialty and niche products that might have previously faced distribution challenges in traditional brick-and-mortar channels.

Consumer preferences are a primary driver of market evolution. There is a discernible shift towards healthier choices, with a particular emphasis on reduced sugar content, natural ingredients, and functional benefits. This has spurred the development of a diverse range of flavored milk drinks, yogurt-based beverages, and kefir products fortified with essential vitamins, minerals, and other bioactives. While traditional milk remains a staple, flavored milk varieties, especially those appealing to younger demographics, are experiencing robust demand. Similarly, yogurt drinks are gaining traction as convenient and nutritious snack options.

The competitive landscape is intensifying, characterized by both domestic and international players vying for market share. Strategic partnerships, product differentiation through unique flavor profiles and health claims, and aggressive marketing campaigns are common strategies employed by leading companies. The burgeoning demand for plant-based alternatives, while presenting a challenge, also pushes traditional dairy players to innovate and highlight the unique nutritional advantages of their products, such as higher protein content and calcium bioavailability. The industry is adapting by offering a wider spectrum of choices, including lactose-free dairy options, to cater to evolving dietary needs and preferences within the region. The overall market penetration is estimated to reach 35% of the total beverage market by 2033, indicating a strong and sustained demand for dairy-based beverages.

Dominant Markets & Segments in Asia-Pacific Dairy-Based Beverages Industry

The Asia-Pacific dairy-based beverages industry is characterized by a dynamic interplay of dominant markets and segments, each contributing to the overall market's expansion. China stands out as the leading regional market, driven by its vast population, rapidly growing middle class, and increasing adoption of Western dietary habits. This dominance is further amplified by significant investments in domestic dairy production and distribution infrastructure. South Korea and Japan also represent substantial markets, characterized by a high consumer preference for premium, functional, and health-oriented dairy products. India, with its substantial dairy production and a significant portion of its population relying on traditional dairy consumption, also plays a crucial role, though its market is segmented by diverse economic strata and evolving consumer preferences.

Within the Type segmentation, Milk beverages are undeniably the dominant category, forming the backbone of the dairy-based beverage market. This includes plain milk, flavored milk, and functional milk drinks. The widespread availability, affordability, and perception of milk as a fundamental source of nutrition for all age groups contribute to its leading position. However, Yogurt-based beverages are witnessing a remarkable surge in popularity, driven by their perceived health benefits, particularly for gut health, and their versatility as a convenient on-the-go snack or meal replacement. Kefir, while a niche segment, is also experiencing growing interest, especially among health-conscious consumers seeking probiotic-rich options.

In terms of Category, Flavored Drinks hold a commanding position. The ability to introduce diverse and appealing flavors, from traditional fruit essences to more exotic and trending profiles, significantly drives consumer engagement, particularly among younger demographics. This segment offers greater scope for product differentiation and premiumization. Unflavored drinks, while essential for basic nutritional intake and as a base for other applications, represent a more mature segment with slower growth.

The Distribution Channel landscape is evolving, with Supermarkets/Hypermarkets continuing to be the primary channel for broad reach and volume sales. These large retail formats offer consumers a wide selection and often competitive pricing. However, the rapid growth of Online Channels is a transformative trend. E-commerce platforms and direct-to-consumer (DTC) models are increasingly important, offering convenience, wider product availability, and the ability for niche brands to reach a national audience. Convenience Stores also play a vital role in the on-the-go consumption segment, offering quick access to popular dairy-based beverages.

Key drivers of dominance in these segments include:

- Economic Policies: Government support for domestic dairy industries, import/export regulations, and trade agreements influence market accessibility and pricing.

- Infrastructure Development: Robust cold chain logistics and efficient transportation networks are crucial for maintaining the quality and availability of perishable dairy products, particularly in vast countries like China and India.

- Consumer Education and Awareness: Campaigns promoting the health benefits of dairy products, coupled with increasing media exposure to global food trends, drive demand for specific types and categories.

- Technological Adoption: Advancements in UHT processing, aseptic packaging, and fortification technologies enable wider distribution and longer shelf-life for dairy beverages, expanding market reach.

- Demographic Shifts: The growing young population in many Asian countries, with their openness to new flavors and health trends, significantly influences the demand for flavored and functional dairy drinks.

Asia-Pacific Dairy-Based Beverages Industry Product Developments

Product innovation in the Asia-Pacific dairy-based beverages industry is primarily focused on health and wellness, convenience, and novel sensory experiences. Manufacturers are actively developing fortified beverages enriched with probiotics, prebiotics, vitamins, and minerals to cater to the growing demand for functional foods. There's a noticeable trend towards sugar reduction and the use of natural sweeteners, aligning with consumer concerns about health. Furthermore, the development of lactose-free dairy options and the exploration of novel flavor combinations, including plant-based dairy alternatives that mimic traditional dairy taste and texture, are key competitive advantages being pursued by leading companies to capture diverse consumer preferences and dietary needs.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Asia-Pacific dairy-based beverages market, segmented by Type, Category, and Distribution Channel. The Type segmentation includes Milk, Yogurt, Kefir, and Others, each expected to exhibit distinct growth trajectories based on evolving consumer preferences and health consciousness. The Category segmentation differentiates between Flavoured Drinks and Unflavored Drinks, with flavored variants projected to lead market growth due to their appeal to a broader consumer base. The Distribution Channel analysis covers Supermarkets/hypermarkets, Convenience stores, Specialty Stores, Online Channels, and Others, highlighting the increasing importance of e-commerce and the evolving retail landscape. Growth projections for each segment range from 5% to 9% CAGR, with specific market sizes detailed within the full report, reflecting varying levels of maturity and emerging opportunities.

Key Drivers of Asia-Pacific Dairy-Based Beverages Industry Growth

Several key drivers are propelling the Asia-Pacific dairy-based beverages industry forward. Rising Disposable Incomes and a burgeoning middle class are leading to increased consumer spending on premium, health-conscious products. Growing Health and Wellness Consciousness is a significant factor, driving demand for functional beverages fortified with probiotics, vitamins, and minerals, as well as those with reduced sugar content. Urbanization and the associated demand for convenient, on-the-go options further boost the market. Technological advancements in processing and packaging enhance product shelf-life and accessibility. Furthermore, positive Government Initiatives supporting the dairy sector and evolving dietary habits are creating a fertile ground for sustained growth.

Challenges in the Asia-Pacific Dairy-Based Beverages Industry Sector

Despite robust growth, the Asia-Pacific dairy-based beverages sector faces several challenges. Intensifying Competition from both domestic and international players, as well as the rapidly expanding plant-based beverage market, poses a constant threat. Volatile Raw Material Prices, particularly for milk, can impact profit margins and pricing strategies. Strict Regulatory Frameworks regarding food safety, labeling, and permissible ingredients can create hurdles for market entry and product development in certain countries. Supply Chain Complexities, including maintaining a consistent cold chain and managing distribution in vast and diverse geographical areas, can lead to operational inefficiencies and product spoilage. Consumer Health Concerns related to lactose intolerance and dairy allergies necessitate continuous product innovation and clear labeling.

Emerging Opportunities in Asia-Pacific Dairy-Based Beverages Industry

Emerging opportunities in the Asia-Pacific dairy-based beverages industry lie in several key areas. The continued growth of the Functional Beverage segment, focusing on specific health benefits like immunity boosting and cognitive enhancement, presents significant potential. The increasing demand for Plant-Based Dairy Alternatives is also creating opportunities for dairy companies to diversify their portfolios or collaborate with plant-based ingredient suppliers. E-commerce and Direct-to-Consumer (DTC) models offer a direct channel to reach consumers and gather valuable market insights. Exploring Niche Markets such as organic, artisanal, and ethically sourced dairy beverages can attract a premium consumer segment. Furthermore, leveraging Technological Innovations in product formulation and packaging to create novel textures, flavors, and enhanced nutritional profiles will unlock new avenues for growth.

Leading Players in the Asia-Pacific Dairy-Based Beverages Industry Market

- Wadia Group (Britannia Industries Limited)

- Yakult Honsha Co Ltd

- Bright Dairy & Food Co Ltd

- Mother Dairy Fruit & Vegetable Pvt Ltd

- Fonterra Co-operative Group

- GCMMF (Amul)

Key Developments in Asia-Pacific Dairy-Based Beverages Industry Industry

- 2023: Britannia Industries launches a new range of probiotic-fortified milk drinks in India, targeting the gut health conscious consumer.

- 2023: Yakult Honsha Co Ltd expands its distribution network into several Southeast Asian countries, increasing its market reach.

- 2022: Bright Dairy & Food Co Ltd invests in advanced UHT processing technology to enhance the shelf-life and quality of its milk beverages for export markets.

- 2022: Fonterra Co-operative Group announces a strategic partnership with a leading Asian food conglomerate to develop innovative dairy ingredients for the region.

- 2021: GCMMF (Amul) introduces a new line of lactose-free yogurt drinks, catering to the growing demand for dairy products suitable for lactose-intolerant individuals.

Strategic Outlook for Asia-Pacific Dairy-Based Beverages Industry Market

The strategic outlook for the Asia-Pacific dairy-based beverages market is overwhelmingly positive, driven by sustained economic growth and evolving consumer preferences for healthier, more convenient, and functional food and beverage options. Companies that prioritize innovation in product development, focusing on fortified beverages, reduced sugar content, and appealing flavor profiles, are best positioned for success. Expanding distribution networks, particularly through robust online channels and efficient cold chain logistics, will be crucial for market penetration. Strategic collaborations and potential M&A activities will likely shape the competitive landscape, enabling players to enhance their product portfolios and geographical reach. Adapting to the rising demand for plant-based alternatives while highlighting the unique nutritional benefits of dairy will be a key differentiator for long-term sustainability and market leadership.

Asia-Pacific Dairy-Based Beverages Industry Segmentation

-

1. Type

- 1.1. Milk

- 1.2. Yogurt

- 1.3. Kefir

- 1.4. Others

-

2. Category

- 2.1. Flavoured Drink

- 2.2. Unflavored Drink

-

3. Distribution Channel

- 3.1. Supermarkets/hypermarkets

- 3.2. Convenience stores

- 3.3. Specialty Stores

- 3.4. Online Channels

- 3.5. Others

Asia-Pacific Dairy-Based Beverages Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

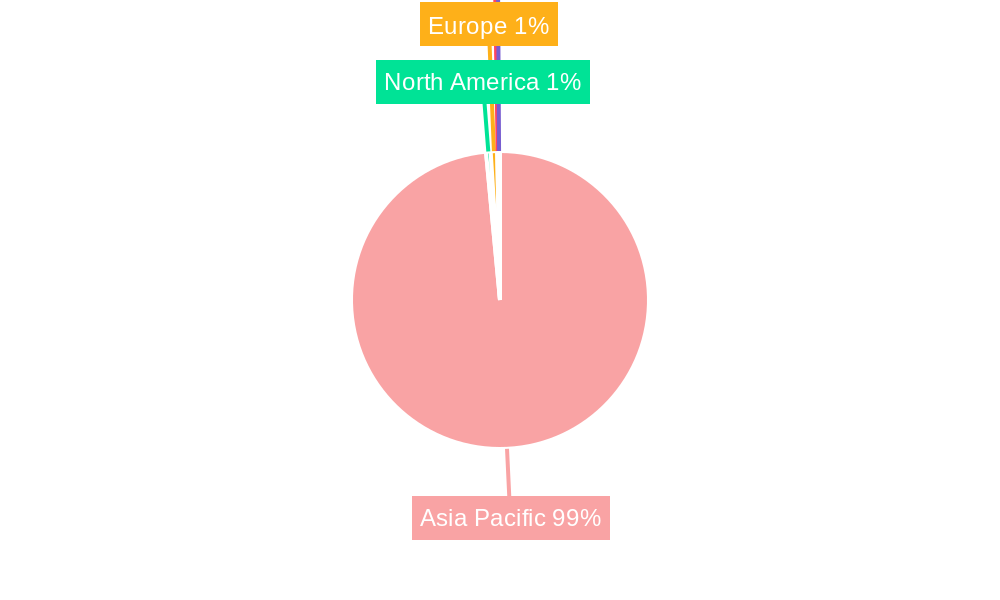

Asia-Pacific Dairy-Based Beverages Industry Regional Market Share

Geographic Coverage of Asia-Pacific Dairy-Based Beverages Industry

Asia-Pacific Dairy-Based Beverages Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing application of Gelatin in healthcare and pharmaceutical sector

- 3.3. Market Restrains

- 3.3.1. Rising demand for clean label products

- 3.4. Market Trends

- 3.4.1. Rising Demand for Probiotic Drinks in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Dairy-Based Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Milk

- 5.1.2. Yogurt

- 5.1.3. Kefir

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Flavoured Drink

- 5.2.2. Unflavored Drink

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/hypermarkets

- 5.3.2. Convenience stores

- 5.3.3. Specialty Stores

- 5.3.4. Online Channels

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Wadia Group (Britannia Industries Limited)*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Yakult Honsha Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bright Dairy & Food Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mother Dairy Fruit & Vegetable Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fonterra Co-operative Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 GCMMF (Amul)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Wadia Group (Britannia Industries Limited)*List Not Exhaustive

List of Figures

- Figure 1: Asia-Pacific Dairy-Based Beverages Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Dairy-Based Beverages Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Dairy-Based Beverages Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Dairy-Based Beverages Industry Volume K Units Forecast, by Type 2020 & 2033

- Table 3: Asia-Pacific Dairy-Based Beverages Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 4: Asia-Pacific Dairy-Based Beverages Industry Volume K Units Forecast, by Category 2020 & 2033

- Table 5: Asia-Pacific Dairy-Based Beverages Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Asia-Pacific Dairy-Based Beverages Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 7: Asia-Pacific Dairy-Based Beverages Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Asia-Pacific Dairy-Based Beverages Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 9: Asia-Pacific Dairy-Based Beverages Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Asia-Pacific Dairy-Based Beverages Industry Volume K Units Forecast, by Type 2020 & 2033

- Table 11: Asia-Pacific Dairy-Based Beverages Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 12: Asia-Pacific Dairy-Based Beverages Industry Volume K Units Forecast, by Category 2020 & 2033

- Table 13: Asia-Pacific Dairy-Based Beverages Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 14: Asia-Pacific Dairy-Based Beverages Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 15: Asia-Pacific Dairy-Based Beverages Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Dairy-Based Beverages Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 17: China Asia-Pacific Dairy-Based Beverages Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: China Asia-Pacific Dairy-Based Beverages Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 19: Japan Asia-Pacific Dairy-Based Beverages Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Japan Asia-Pacific Dairy-Based Beverages Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 21: South Korea Asia-Pacific Dairy-Based Beverages Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: South Korea Asia-Pacific Dairy-Based Beverages Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 23: India Asia-Pacific Dairy-Based Beverages Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: India Asia-Pacific Dairy-Based Beverages Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 25: Australia Asia-Pacific Dairy-Based Beverages Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Australia Asia-Pacific Dairy-Based Beverages Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 27: New Zealand Asia-Pacific Dairy-Based Beverages Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: New Zealand Asia-Pacific Dairy-Based Beverages Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 29: Indonesia Asia-Pacific Dairy-Based Beverages Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Indonesia Asia-Pacific Dairy-Based Beverages Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 31: Malaysia Asia-Pacific Dairy-Based Beverages Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Malaysia Asia-Pacific Dairy-Based Beverages Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 33: Singapore Asia-Pacific Dairy-Based Beverages Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Singapore Asia-Pacific Dairy-Based Beverages Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 35: Thailand Asia-Pacific Dairy-Based Beverages Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Thailand Asia-Pacific Dairy-Based Beverages Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 37: Vietnam Asia-Pacific Dairy-Based Beverages Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Vietnam Asia-Pacific Dairy-Based Beverages Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 39: Philippines Asia-Pacific Dairy-Based Beverages Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Philippines Asia-Pacific Dairy-Based Beverages Industry Volume (K Units) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Dairy-Based Beverages Industry?

The projected CAGR is approximately 4.84%.

2. Which companies are prominent players in the Asia-Pacific Dairy-Based Beverages Industry?

Key companies in the market include Wadia Group (Britannia Industries Limited)*List Not Exhaustive, Yakult Honsha Co Ltd, Bright Dairy & Food Co Ltd, Mother Dairy Fruit & Vegetable Pvt Ltd, Fonterra Co-operative Group, GCMMF (Amul).

3. What are the main segments of the Asia-Pacific Dairy-Based Beverages Industry?

The market segments include Type, Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 202.81 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing application of Gelatin in healthcare and pharmaceutical sector.

6. What are the notable trends driving market growth?

Rising Demand for Probiotic Drinks in the Region.

7. Are there any restraints impacting market growth?

Rising demand for clean label products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Dairy-Based Beverages Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Dairy-Based Beverages Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Dairy-Based Beverages Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Dairy-Based Beverages Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence