Key Insights

The Ethiopian coffee market is projected for substantial growth, expected to reach $130.09 million by 2025, with a Compound Annual Growth Rate (CAGR) of 3.5%. This expansion is driven by Ethiopia's unparalleled heritage as the birthplace of Arabica coffee, offering diverse and globally sought-after varietals. A growing domestic middle class with increased disposable income is fueling demand for premium whole beans and convenient ground coffee. The expanding foodservice sector presents significant opportunities for on-trade consumption. Government initiatives promoting value addition and export quality further enhance export revenues, a key contributor to market size. Trends like the increasing preference for specialty and single-origin coffees, alongside the convenience of instant coffee, are shaping consumer choices and fostering market innovation.

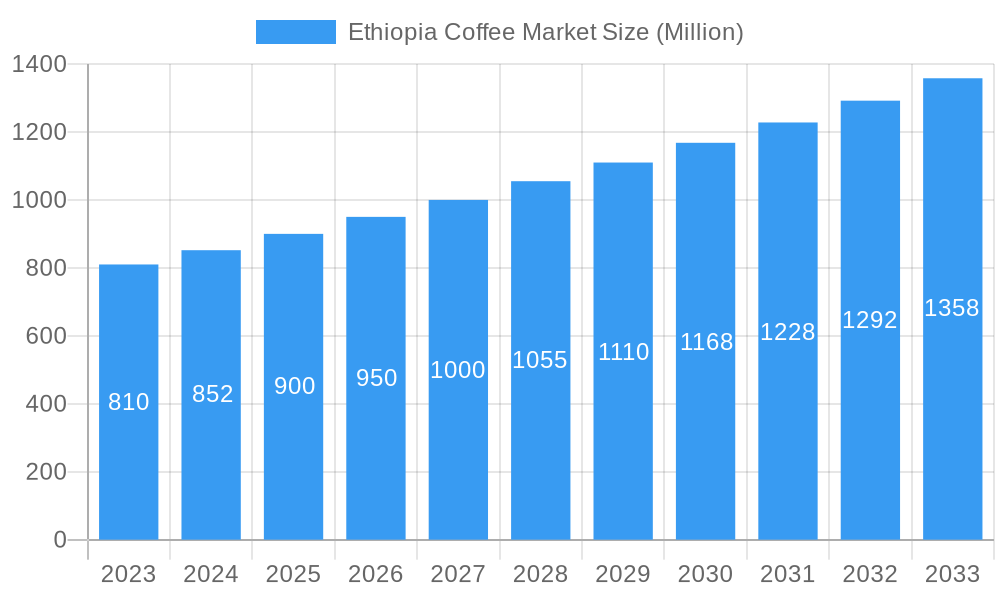

Ethiopia Coffee Market Market Size (In Million)

While robust demand drivers are evident, sustained growth requires addressing market restraints. Global commodity price volatility can impact profitability. Infrastructure limitations in remote coffee-growing regions may affect supply chain efficiency. Competition from other coffee-producing nations and the ongoing need for investment in quality and sustainable practices are critical considerations. The market is segmented by product type, with whole-bean and ground coffee leading due to premium appeal, while instant coffee experiences rapid growth driven by convenience. Off-trade sales, primarily through supermarkets, dominate distribution, though online retail shows considerable promise. Key players include Nestle SA and Enjoy Better Coffee, alongside emerging local brands such as Belco Coffee and Hadero Coffee, signifying a dynamic competitive environment.

Ethiopia Coffee Market Company Market Share

This comprehensive report offers in-depth analysis of the Ethiopian Coffee Market, covering the period from 2019 to 2033. With a base year of 2025, it examines market concentration, innovation drivers, industry trends, dominant segments, product developments, key growth factors, challenges, emerging opportunities, leading players, and crucial industry developments. This research provides actionable insights for industry stakeholders aiming to navigate and capitalize on the burgeoning Ethiopian coffee landscape.

Ethiopia Coffee Market Market Concentration & Innovation

The Ethiopia Coffee Market exhibits a moderate level of concentration, with a mix of large multinational corporations, established regional players, and a significant number of small to medium-sized enterprises (SMEs) and farmer cooperatives. Innovation is a key differentiator, driven by the demand for specialty coffee, sustainable sourcing, and improved processing techniques. Regulatory frameworks, while evolving, aim to support quality standards and market access for Ethiopian coffee. Product substitutes, such as tea and other beverages, exist but the unique flavor profiles and cultural significance of Ethiopian coffee create a strong competitive moat. End-user trends highlight a growing preference for premium, single-origin beans and ethically sourced products. Merger and acquisition (M&A) activities are anticipated to increase as larger players seek to consolidate their presence and access high-quality supply chains. While specific M&A deal values are dynamic, the strategic importance of Ethiopian coffee suggests significant investment flows into the sector.

- Market Share: While precise market share figures are proprietary, the influence of major exporters and roasters is significant. Farmer cooperatives, collectively representing a substantial volume, play a crucial role.

- Innovation Drivers:

- Demand for specialty and single-origin Ethiopian coffee varieties.

- Development of advanced processing techniques (e.g., anaerobic fermentation).

- Investment in traceability and sustainability certifications.

- Technological advancements in roasting and brewing.

- Regulatory Frameworks: Policies promoting direct trade, quality grading, and fair pricing for farmers are crucial.

- Product Substitutes: Tea, other international coffee brands, and alternative beverages.

- End-User Trends: Increasing demand for high-quality, traceable, and sustainably produced coffee.

- M&A Activities: Strategic partnerships and acquisitions by international coffee companies to secure premium sourcing.

Ethiopia Coffee Market Industry Trends & Insights

The Ethiopia Coffee Market is on a robust growth trajectory, propelled by several intertwined industry trends and insights. The estimated Compound Annual Growth Rate (CAGR) for the forecast period (2025–2033) is projected to be around 5.8%, indicating sustained expansion. This growth is underpinned by the increasing global demand for high-quality Arabica coffee, for which Ethiopia is renowned, particularly its distinct heirloom varieties. Technological disruptions are playing a vital role, from precision agriculture techniques aimed at improving yields and quality to advancements in post-harvest processing that enhance flavor profiles and shelf-life. Consumer preferences are shifting towards ethically sourced, traceable, and single-origin coffees, aligning perfectly with Ethiopia's rich coffee heritage. The rise of the "third wave" coffee movement globally has significantly boosted the appreciation for nuanced flavor notes and the stories behind the beans.

Market penetration of specialty coffee within Ethiopia itself is also increasing, driven by a growing middle class and a burgeoning café culture in urban centers like Addis Ababa. International coffee chains and local premium roasters are expanding their presence, catering to this evolving demand. Furthermore, government initiatives and international support are focused on improving farmer livelihoods, enhancing coffee quality through research and training, and streamlining export processes. This holistic approach is crucial for ensuring the long-term sustainability and competitiveness of the Ethiopian coffee sector. The competitive dynamics are intensifying, with both established global players and emerging local brands vying for market share. This competition is fostering innovation and driving up quality standards across the value chain, from cultivation to the final cup. The market penetration for packaged coffee, especially ground and whole-bean varieties, is expected to rise significantly due to improved accessibility through various distribution channels.

Dominant Markets & Segments in Ethiopia Coffee Market

The Ethiopia Coffee Market is characterized by dominant segments in both product type and distribution channels, driven by distinct consumer behaviors and market dynamics.

Product Type Dominance:

Whole-bean Coffee: This segment holds a dominant position, particularly in the export market and within the specialty coffee retail sector.

- Key Drivers:

- Global demand for fresh, high-quality beans for home brewing and specialty cafes.

- Ethiopia's reputation for producing diverse and sought-after single-origin whole beans.

- Growing consumer preference for grinding beans at home to preserve aroma and flavor.

- The inherent quality and unique flavor profiles of Ethiopian Arabica varieties make them premium for whole-bean sales.

- Dominance Analysis: The premiumization trend in the global coffee market directly benefits whole-bean sales. Ethiopia's status as the birthplace of coffee, coupled with its vast array of indigenous varieties, makes its whole-bean offerings highly attractive to roasters and discerning consumers worldwide. The export market for whole beans, particularly to North America and Europe, represents a substantial portion of Ethiopia's coffee revenue.

- Key Drivers:

Ground Coffee: This segment commands a significant share, especially in the domestic market and for consumers seeking convenience.

- Key Drivers:

- Convenience for consumers who do not own grinders.

- Accessibility and ease of use for a broader consumer base.

- Availability in various grinds tailored to different brewing methods.

- Strong presence in both off-trade and on-trade channels for everyday consumption.

- Dominance Analysis: While whole beans cater to the specialty segment, ground coffee remains a staple for mass consumption. Its presence in supermarkets and convenience stores, along with its use in many foodservice establishments, ensures consistent demand. Ethiopia's internal market for ground coffee is expanding with increasing urbanization and disposable income.

- Key Drivers:

Instant Coffee: While historically less dominant for premium Ethiopian beans, this segment is experiencing growth due to convenience and the rise of ready-to-drink coffee products.

- Key Drivers:

- High demand for quick and easy coffee preparation.

- Growth in the ready-to-drink (RTD) coffee market.

- Emerging markets and export opportunities in regions with less developed brewing cultures.

- Technological advancements improving the quality of instant coffee.

- Dominance Analysis: Though not as prestigious as its whole-bean counterparts for specialty markets, instant coffee is crucial for market accessibility and reaching a wider demographic. Growth in this segment is driven by its affordability and convenience, making Ethiopian coffee available to consumers who may not engage with traditional brewing methods.

- Key Drivers:

Distribution Channel Dominance:

Off-trade (Supermarkets/Hypermarkets & Online Retail Stores): These channels are witnessing substantial growth and are increasingly dominant for coffee sales.

- Key Drivers:

- Increasing urbanization and higher disposable incomes.

- Expanding retail infrastructure and the rise of modern trade outlets.

- The convenience and accessibility of online purchasing platforms.

- Greater consumer purchasing power and willingness to experiment with different coffee brands.

- The COVID-19 pandemic significantly accelerated the shift towards online retail for groceries and beverages.

- Dominance Analysis: Supermarkets and hypermarkets offer a one-stop shopping experience, making them prime locations for coffee sales, from everyday brands to premium selections. Online retail stores are rapidly gaining traction, providing consumers with unparalleled choice, competitive pricing, and doorstep delivery, further consolidating the dominance of off-trade channels. The projected market size for this channel is expected to exceed $1,500 Million by 2033.

- Key Drivers:

On-trade (Cafes and Foodservice): This segment is crucial for premiumization and brand building, playing a vital role in consumer experience.

- Key Drivers:

- Growing café culture and demand for artisanal coffee experiences.

- Demand from hotels, restaurants, and corporate offices for quality coffee.

- A platform for introducing new and niche Ethiopian coffee varieties.

- Experiential consumption and the desire for expertly prepared coffee beverages.

- Dominance Analysis: Cafes and foodservice establishments serve as crucial touchpoints for consumers to experience the unique flavors of Ethiopian coffee. While not always the highest volume, the value generated per transaction is often higher, and these venues are instrumental in shaping consumer preferences towards higher-quality coffee. The projected market size for this channel is expected to be over $1,000 Million by 2033, showing steady growth.

- Key Drivers:

Other Off-trade Channels (Convenience Stores): These cater to impulse purchases and on-the-go consumption.

- Key Drivers:

- High foot traffic and accessibility in urban and semi-urban areas.

- Convenience for quick coffee purchases.

- Increasing diversification of product offerings in convenience stores.

- Dominance Analysis: Convenience stores play a supplementary role, ensuring coffee is readily available for immediate consumption. While their individual contribution might be smaller than supermarkets, their widespread presence makes them an important part of the overall distribution network, contributing an estimated $500 Million to the market by 2033.

- Key Drivers:

Ethiopia Coffee Market Product Developments

Product developments in the Ethiopia Coffee Market are increasingly focused on enhancing value addition and catering to discerning global palates. Innovations range from exploring novel processing techniques like extended fermentation and carbonic maceration to develop unique flavor profiles, to introducing meticulously graded and single-origin specialty coffees. Companies are investing in advanced roasting technologies to optimize the expression of inherent Ethiopian varietal characteristics. Product applications are expanding beyond traditional brewing to include premium instant coffee blends and ready-to-drink (RTD) coffee beverages, appealing to convenience-seeking consumers. Competitive advantages are being built through strong traceability systems, blockchain integration for supply chain transparency, and the attainment of various sustainability and quality certifications, all aimed at commanding premium pricing and building consumer trust.

Report Scope & Segmentation Analysis

This report provides a granular analysis of the Ethiopia Coffee Market, segmenting it by Product Type and Distribution Channel.

Product Type: The market is analyzed across Whole-bean, Ground Coffee, and Instant Coffee segments. Each segment's market size, growth projections, and competitive dynamics are detailed, with Whole-bean coffee expected to lead in value due to its premium positioning, while Ground Coffee offers significant volume. Instant Coffee is projected for robust growth driven by convenience.

Distribution Channel: The report examines On-trade (Cafes and Foodservice) and Off-trade channels. Off-trade is further broken down into Supermarkets/Hypermarkets, Convenience Stores, Online Retail Stores, and Other Off-trade Channels. Online Retail Stores and Supermarkets/Hypermarkets are projected to exhibit the highest growth rates within the Off-trade segment due to evolving consumer purchasing habits and expanding retail footprints. The On-trade segment, while smaller in volume, remains critical for premium experiences.

Key Drivers of Ethiopia Coffee Market Growth

The Ethiopia Coffee Market is poised for significant growth, driven by a confluence of technological, economic, and regulatory factors.

- Technological Advancements: Innovations in cultivation, processing (e.g., advanced fermentation techniques), and roasting are enhancing coffee quality and consistency, leading to higher export values. Precision agriculture is improving yields and sustainability.

- Economic Factors: Rising global demand for specialty and premium coffee, coupled with increasing disposable incomes in emerging markets, fuels market expansion. Ethiopia's strong brand reputation as the birthplace of coffee is a significant economic asset.

- Regulatory Support: Government initiatives aimed at improving quality standards, streamlining export procedures, and promoting direct trade are crucial for fostering market growth and farmer profitability. The Ethiopian Coffee and Tea Authority (ECTA) plays a vital role in policy formulation and implementation.

- Increasing Consumer Appreciation for Specialty Coffee: The global "third wave" coffee movement has elevated the appreciation for unique flavor profiles and ethical sourcing, directly benefiting Ethiopian specialty beans.

Challenges in the Ethiopia Coffee Market Sector

Despite its immense potential, the Ethiopia Coffee Market faces several significant challenges that can temper growth.

- Climate Change Vulnerability: Ethiopia's coffee-growing regions are susceptible to erratic weather patterns, affecting yields, quality, and disease outbreaks.

- Infrastructure Deficiencies: Inadequate transportation networks, cold chain logistics, and processing facilities, especially in remote coffee-growing areas, hinder efficient collection, processing, and export.

- Price Volatility: Global commodity price fluctuations can significantly impact farmer incomes and the overall profitability of the sector.

- Competition from Other Producing Nations: While unique, Ethiopian coffee competes with high-quality beans from other African nations and Latin America, necessitating continuous innovation and quality maintenance.

- Access to Finance and Modern Technology for Smallholder Farmers: Many smallholder farmers lack access to capital for upgrading equipment and adopting new farming practices, limiting their productivity and quality.

Emerging Opportunities in Ethiopia Coffee Market

The Ethiopia Coffee Market is ripe with emerging opportunities driven by evolving consumer preferences and market dynamics.

- Growth in Specialty and Micro-Lot Coffee: The increasing global demand for unique, traceable, and single-origin specialty coffees presents a significant opportunity for Ethiopian producers to leverage their diverse heirloom varieties and unique processing methods.

- Direct-to-Consumer (DTC) Sales: Embracing online platforms and building direct relationships with consumers worldwide can enable Ethiopian brands to capture more value and bypass traditional intermediaries.

- Value-Added Products: Expanding into higher-value products such as roasted coffee blends, coffee-based beverages, and even coffee-infused food products can diversify revenue streams.

- Sustainable and Certified Coffee: Growing consumer consciousness about environmental and social responsibility creates opportunities for producers who adopt sustainable farming practices and obtain certifications like Fair Trade or Organic.

- Untapped Domestic Market Potential: The growing middle class and burgeoning café culture within Ethiopia itself offer a substantial and expanding domestic market for quality coffee.

Leading Players in the Ethiopia Coffee Market Market

- Belco Coffee

- Nestle SA

- Enjoy Better Coffee (Mokate)

- Ya Coffee

- Square One Coffee

- Wild Coffee Company

- Hadero Coffee

- Klatch Coffee

- Oromia Coffee Farmers Cooperative Union

- Kalbe International

Key Developments in Ethiopia Coffee Market Industry

- August 2022: World Coffee Research (WCR) announced its plans to work with Ethiopia. In order to support their efforts to provide farmers with better varieties of coffee, WCR inked an agreement (MOU) with the Ethiopian Institute of Agricultural Research (EIAR) and the Jimma Agricultural Research Center (JARC). This development is crucial for enhancing coffee resilience and productivity through advanced research and variety development.

- July 2022: A 15-year coffee development strategy was developed by the Ethiopian Coffee and Tea Authority (ECTA) with the goal of maximizing the nation's coffee production potential. The plan was created in cooperation with the Ethiopian Institute of Agriculture Research (EIAR) and the international NGO TechnoServe. This long-term strategy is foundational for sustainable growth and market leadership.

- June 2021: Ethiopia launched a state-of-the-art coffee training center to deliver modular and practice-based training that aims to enhance the sustainability and value chain in the country's coffee sector. The center is located on the premises of the Ethiopian Coffee and Tea Authority (ECTA) in Addis Ababa. The center has classes that teach the basics of how to process, dry, and store coffee, as well as how to trade and take care of equipment. This initiative directly addresses the need for skill development and capacity building at the farm level, crucial for quality improvement.

Strategic Outlook for Ethiopia Coffee Market Market

The strategic outlook for the Ethiopia Coffee Market is overwhelmingly positive, driven by its inherent strengths and proactive market development initiatives. The nation's unparalleled genetic diversity of coffee, coupled with increasing global demand for specialty and ethically sourced beans, provides a robust foundation for sustained growth. Strategic investments in research and development, such as those by World Coffee Research and the Ethiopian Institute of Agricultural Research, are poised to enhance coffee varietal resilience and productivity. Furthermore, the comprehensive 15-year coffee development strategy signifies a commitment to long-term sustainability and value chain optimization. The establishment of advanced training centers directly empowers farmers, fostering higher quality production and better market integration. The market is expected to witness continued expansion in both export volumes and value, driven by an emphasis on premiumization, traceability, and value-added products, solidifying Ethiopia's position as a leading global coffee producer.

Ethiopia Coffee Market Segmentation

-

1. Product Type

- 1.1. Whole-bean

- 1.2. Ground Coffee

- 1.3. Instant Coffee

-

2. Distribution Channel

- 2.1. On-trade (Cafes and Foodservice)

-

2.2. Off-trade

- 2.2.1. Supermarkets/Hypermarkets

- 2.2.2. Convenience Stores

- 2.2.3. Online Retail Stores

- 2.2.4. Other Off-trade Channels

Ethiopia Coffee Market Segmentation By Geography

- 1. Ethiopia

Ethiopia Coffee Market Regional Market Share

Geographic Coverage of Ethiopia Coffee Market

Ethiopia Coffee Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Trend of Ingestible Beauty Products; Growing demand for Nutrient-Enriched Cosmetic Products

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Beauty Supplements Products

- 3.4. Market Trends

- 3.4.1. Strong Production Base in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Ethiopia Coffee Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Whole-bean

- 5.1.2. Ground Coffee

- 5.1.3. Instant Coffee

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-trade (Cafes and Foodservice)

- 5.2.2. Off-trade

- 5.2.2.1. Supermarkets/Hypermarkets

- 5.2.2.2. Convenience Stores

- 5.2.2.3. Online Retail Stores

- 5.2.2.4. Other Off-trade Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Ethiopia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Belco Coffee

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nestle SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Enjoy Better Coffee (Mokate)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ya Coffee

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Square One Coffee

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Wild Coffee Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hadero Coffee

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Klatch Coffee

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Oromia Coffee Farmers Cooperative Union*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kalbe International

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Belco Coffee

List of Figures

- Figure 1: Ethiopia Coffee Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Ethiopia Coffee Market Share (%) by Company 2025

List of Tables

- Table 1: Ethiopia Coffee Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Ethiopia Coffee Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Ethiopia Coffee Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Ethiopia Coffee Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 5: Ethiopia Coffee Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Ethiopia Coffee Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ethiopia Coffee Market?

The projected CAGR is approximately 3.5%.

2. Which companies are prominent players in the Ethiopia Coffee Market?

Key companies in the market include Belco Coffee, Nestle SA, Enjoy Better Coffee (Mokate), Ya Coffee, Square One Coffee, Wild Coffee Company, Hadero Coffee, Klatch Coffee, Oromia Coffee Farmers Cooperative Union*List Not Exhaustive, Kalbe International.

3. What are the main segments of the Ethiopia Coffee Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 130.09 million as of 2022.

5. What are some drivers contributing to market growth?

Rising Trend of Ingestible Beauty Products; Growing demand for Nutrient-Enriched Cosmetic Products.

6. What are the notable trends driving market growth?

Strong Production Base in the Country.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Beauty Supplements Products.

8. Can you provide examples of recent developments in the market?

August 2022: World Coffee Research (WCR) announced its plans to work with Ethiopia. In order to support their efforts to provide farmers with better varieties of coffee, WCR inked an agreement (MOU) with the Ethiopian Institute of Agricultural Research (EIAR) and the Jimma Agricultural Research Center (JARC).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ethiopia Coffee Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ethiopia Coffee Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ethiopia Coffee Market?

To stay informed about further developments, trends, and reports in the Ethiopia Coffee Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence