Key Insights

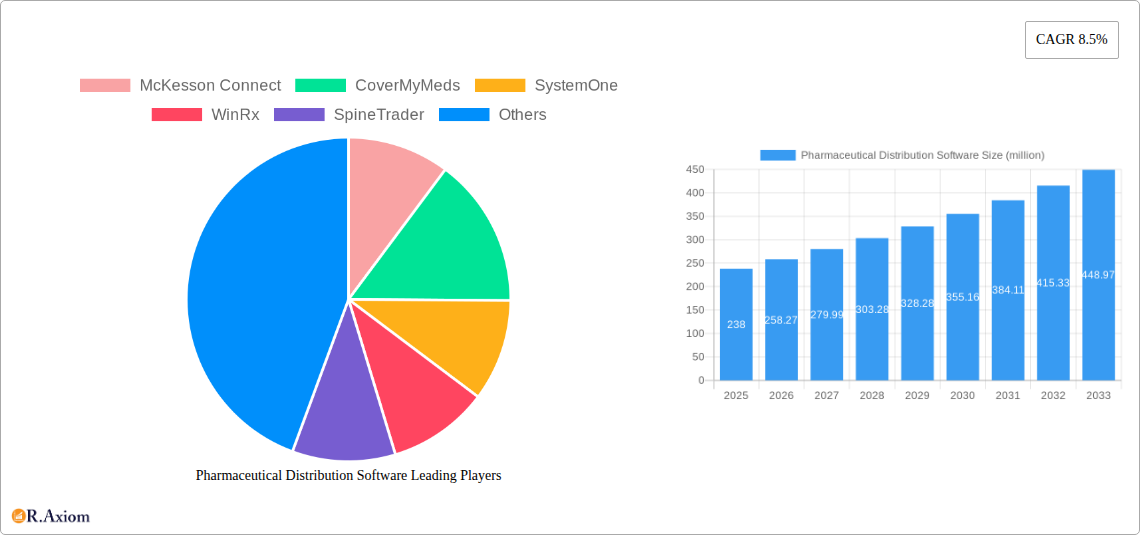

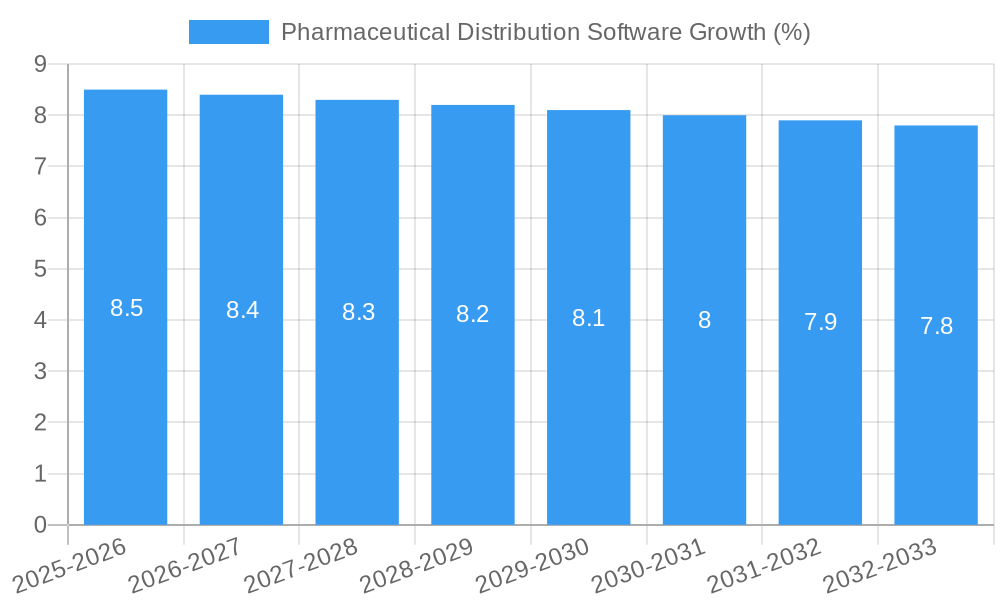

The global Pharmaceutical Distribution Software market is poised for significant expansion, projected to reach an estimated market size of USD 238 million in 2025. With a robust Compound Annual Growth Rate (CAGR) of 8.5%, the market is expected to witness sustained and accelerated growth throughout the forecast period of 2025-2033. This upward trajectory is primarily driven by the increasing complexity of pharmaceutical supply chains, the growing demand for efficient inventory management, and the imperative for enhanced regulatory compliance within the industry. As pharmaceutical companies strive to optimize their distribution networks, reduce operational costs, and ensure the timely and secure delivery of medications, the adoption of advanced software solutions becomes paramount. The market's growth is further bolstered by the increasing digitization of healthcare and a greater emphasis on data-driven decision-making in supply chain operations.

Key trends shaping the Pharmaceutical Distribution Software market include the burgeoning adoption of cloud-based solutions, offering greater scalability, accessibility, and cost-effectiveness for businesses of all sizes, from large enterprises to SMEs. The continuous development of web-based platforms, providing seamless integration and real-time tracking capabilities, is also a significant factor. However, certain restraints, such as the high initial investment costs associated with implementing sophisticated software and the potential for data security concerns, need to be addressed by vendors to foster wider market penetration. Nonetheless, the inherent benefits of these software solutions in streamlining workflows, minimizing errors, and improving overall supply chain visibility are expected to outweigh these challenges, driving substantial market evolution.

Pharmaceutical Distribution Software Market Concentration & Innovation

The pharmaceutical distribution software market is characterized by a moderate level of concentration, with a few dominant players like McKesson Connect, CoverMyMeds, and SystemOne holding significant market share, estimated to be around 40% in recent years. Innovation is a key differentiator, driven by the increasing demand for enhanced supply chain visibility, real-time data analytics, and robust compliance solutions. Leading companies are investing heavily in cloud-based platforms, artificial intelligence for demand forecasting, and blockchain for track-and-trace capabilities. Regulatory frameworks, such as the Drug Supply Chain Security Act (DSCSA) in the US and similar legislation globally, are crucial innovation drivers, compelling distributors to adopt advanced software for serialization and traceability. Product substitutes are minimal, as specialized pharmaceutical distribution software offers functionalities not found in generic ERP or inventory management systems. End-user trends are leaning towards integrated solutions that streamline order processing, inventory management, and regulatory reporting. Mergers and acquisitions (M&A) activity remains steady, with significant deals valued in the tens of millions of dollars, aimed at expanding product portfolios and market reach. For instance, acquisitions of smaller software providers by larger entities seeking to bolster their offerings in areas like patient adherence or specialty drug distribution are common. The overall market innovation is a response to the intricate demands of the pharmaceutical supply chain.

Pharmaceutical Distribution Software Industry Trends & Insights

The pharmaceutical distribution software market is experiencing robust growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 12% over the forecast period of 2025–2033. This upward trajectory is primarily fueled by the escalating complexities within the global pharmaceutical supply chain, including increasing drug volumes, the rise of biologics and specialty medications, and stringent regulatory mandates. Technological disruptions are a significant trend, with cloud-based solutions gaining immense traction due to their scalability, flexibility, and cost-effectiveness. Companies are increasingly migrating from traditional on-premise systems to Software-as-a-Service (SaaS) models, offering continuous updates and accessibility. Furthermore, advancements in artificial intelligence (AI) and machine learning (ML) are revolutionizing demand forecasting, inventory optimization, and risk management, enabling distributors to predict market fluctuations with greater accuracy and reduce stockouts or overstocking. Consumer preferences, which in this context refer to the demands of pharmacies, hospitals, and other healthcare providers, are shifting towards integrated platforms that offer end-to-end visibility, from procurement to patient delivery. This includes features such as real-time inventory tracking, automated order fulfillment, and seamless integration with electronic health records (EHRs) and pharmacy management systems. The competitive dynamics are intensifying, with established players like McKesson Connect and CoverMyMeds innovating rapidly while smaller, agile companies like WinRx and ARxIUM carve out niches by offering specialized solutions. The market penetration of advanced pharmaceutical distribution software is expected to increase significantly, driven by the need for enhanced operational efficiency, compliance assurance, and improved patient outcomes. The industry is also witnessing a growing emphasis on data security and privacy, given the sensitive nature of pharmaceutical data, leading to higher adoption of encrypted and secure cloud infrastructure. The overall market penetration of sophisticated distribution software is currently estimated at around 60%, with significant room for expansion.

Dominant Markets & Segments in Pharmaceutical Distribution Software

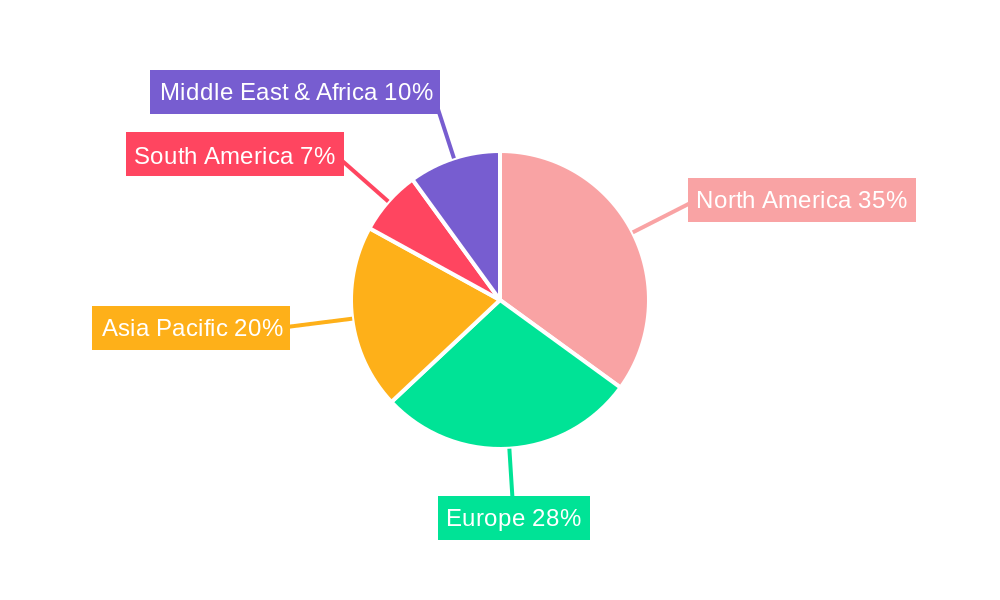

The global pharmaceutical distribution software market is demonstrating robust growth, with North America currently leading in terms of market size and adoption. This dominance is attributed to several key drivers, including a well-established healthcare infrastructure, high pharmaceutical spending, and proactive regulatory bodies like the FDA that mandate advanced tracking and tracing solutions. The United States, in particular, is a powerhouse, driven by a large patient population, a thriving pharmaceutical manufacturing sector, and a sophisticated distribution network. Economic policies in the region favor technological adoption and innovation within the healthcare supply chain, further bolstering the demand for advanced software solutions.

The Large Enterprises segment is a dominant force within the Application segmentation, accounting for an estimated 70% of the total market value in the base year 2025. These enterprises, including major pharmaceutical wholesalers and third-party logistics providers (3PLs), leverage sophisticated, often customized, pharmaceutical distribution software to manage vast volumes of products, complex inventory, and extensive distribution networks. The primary drivers for their dominance include the sheer scale of their operations, the critical need for regulatory compliance across multiple jurisdictions, and the substantial investment capacity they possess for cutting-edge technology. Their operational complexity necessitates comprehensive solutions that offer advanced features like multi-warehouse management, dynamic pricing, and sophisticated route optimization.

In terms of Type segmentation, Cloud Based solutions are rapidly emerging as the preferred choice, projected to capture over 65% of the market share by 2025 and continuing to grow at an accelerated pace. The transition to cloud platforms is driven by their inherent scalability, agility, and cost-effectiveness compared to on-premise systems. For both Large Enterprises and SMEs, cloud solutions offer continuous updates, enhanced accessibility from anywhere, and reduced IT infrastructure burden. The ability to quickly scale resources up or down based on demand, a critical factor in the volatile pharmaceutical market, makes cloud-based pharmaceutical distribution software exceptionally attractive.

SMEs, while smaller in individual scale, collectively represent a significant and growing segment within the pharmaceutical distribution software market. Their adoption is increasingly driven by the availability of more affordable and specialized cloud-based solutions. Key drivers for SME growth include the need to improve efficiency to remain competitive against larger players, the increasing regulatory burden that necessitates better tracking and reporting, and the desire for enhanced supply chain visibility to reduce costs and prevent stockouts.

Pharmaceutical Distribution Software Product Developments

Product developments in the pharmaceutical distribution software market are centered on enhancing efficiency, compliance, and data-driven decision-making. Innovations include the integration of AI and machine learning for predictive analytics in inventory management and demand forecasting, significantly reducing waste and stockouts. Real-time tracking and tracing capabilities, often powered by blockchain technology, are becoming standard for ensuring drug integrity and combating counterfeiting. Furthermore, user interfaces are becoming more intuitive and customizable, with a focus on mobile accessibility for field operations. Competitive advantages are derived from seamless integration with other healthcare IT systems, robust cybersecurity features, and comprehensive reporting tools that meet stringent regulatory requirements, thereby offering a comprehensive solution for modern pharmaceutical logistics.

Report Scope & Segmentation Analysis

This report offers a comprehensive analysis of the pharmaceutical distribution software market, segmented by Application into Large Enterprises and SMEs, and by Type into Cloud Based and Web Based solutions. The Large Enterprises segment, projected to hold a market value of approximately $8,000 million by 2025, is characterized by high adoption rates of integrated, feature-rich software essential for managing complex, global supply chains and adhering to strict regulations. SMEs, a segment valued at around $3,000 million in 2025, are increasingly adopting scalable and cost-effective cloud solutions to enhance their operational efficiency and competitiveness, with a projected CAGR of 14% during the forecast period. The Cloud Based segment, expected to reach $9,500 million by 2025, is driven by its inherent flexibility, scalability, and accessibility, making it the preferred choice for businesses of all sizes. The Web Based segment, while still significant, is projected to grow at a more moderate pace, valued at approximately $1,500 million in 2025, as cloud offerings continue to gain dominance due to advanced features and continuous updates.

Key Drivers of Pharmaceutical Distribution Software Growth

The pharmaceutical distribution software market is propelled by several interconnected growth drivers. Firstly, the increasing complexity of global pharmaceutical supply chains, driven by the proliferation of specialty drugs and biologics, necessitates sophisticated software for efficient management. Secondly, stringent regulatory mandates worldwide, such as serialization and track-and-trace requirements, compel distributors to adopt advanced solutions to ensure compliance and patient safety. Technological advancements, particularly in cloud computing, AI, and blockchain, offer unprecedented opportunities for optimizing operations, enhancing visibility, and reducing costs. Furthermore, the growing demand for real-time data analytics empowers distributors to make informed decisions, predict market trends, and improve inventory management, thereby minimizing waste and maximizing profitability. The expansion of the global pharmaceutical market itself, fueled by an aging population and increasing healthcare access, directly translates to a higher demand for efficient distribution software.

Challenges in the Pharmaceutical Distribution Software Sector

Despite the robust growth, the pharmaceutical distribution software sector faces several significant challenges. The high cost of implementing and integrating advanced software solutions can be a barrier for smaller and medium-sized enterprises (SMEs), limiting their access to cutting-edge technologies. Evolving and often fragmented regulatory landscapes across different regions add complexity and require continuous adaptation of software functionalities, increasing compliance costs. Supply chain disruptions, such as those experienced during global pandemics or geopolitical events, highlight the need for highly resilient and agile software, but achieving this level of resilience can be technically challenging and expensive. Furthermore, the cybersecurity threat landscape is continuously evolving, demanding substantial investments in robust security measures to protect sensitive patient and company data, a significant operational and financial burden. Intense competition among software providers also drives down profit margins, requiring companies to constantly innovate and differentiate their offerings to maintain market share.

Emerging Opportunities in Pharmaceutical Distribution Software

Emerging opportunities in the pharmaceutical distribution software sector are largely driven by technological innovation and evolving industry needs. The widespread adoption of AI and machine learning presents significant opportunities for predictive analytics in demand forecasting, personalized medicine distribution, and optimizing cold chain logistics. The growing focus on patient-centric care is creating demand for software solutions that facilitate direct-to-patient delivery, enhance medication adherence monitoring, and integrate seamlessly with telemedicine platforms. The increasing use of IoT devices for real-time monitoring of temperature, humidity, and location throughout the supply chain offers new avenues for enhanced visibility and quality control. Furthermore, the expansion of emerging markets and the increasing digitization of healthcare infrastructure in these regions represent significant untapped potential for pharmaceutical distribution software providers. The continued drive for greater supply chain transparency and security also opens doors for blockchain-based solutions that can provide immutable audit trails for drug provenance.

Leading Players in the Pharmaceutical Distribution Software Market

- McKesson Connect

- CoverMyMeds

- SystemOne

- WinRx

- SpineTrader

- ARxIUM

- MedEx

- PharmASSIST

- ScriptPro

- FormWeb

Key Developments in Pharmaceutical Distribution Software Industry

- 2023 March: CoverMyMeds launches enhanced AI-powered prior authorization workflow automation, significantly reducing processing times for healthcare providers.

- 2023 June: McKesson Connect announces integration with a new blockchain platform to bolster drug traceability and combat counterfeiting, aiming for end-to-end supply chain transparency.

- 2023 October: ARxIUM introduces a next-generation automated dispensing cabinet (ADC) with advanced inventory management capabilities and improved user interface, targeting hospital pharmacies.

- 2024 January: ScriptPro unveils its latest cloud-based pharmacy management system, offering enhanced scalability and real-time data analytics for independent and chain pharmacies.

- 2024 April: SystemOne announces a strategic partnership with a major logistics provider to optimize cold chain distribution for biologics, leveraging real-time IoT monitoring.

- 2024 August: WinRx releases an updated version of its distribution software with enhanced compliance reporting features to meet upcoming regulatory changes in international markets.

- 2025 February: MedEx introduces a new module for its platform focusing on direct-to-patient specialty drug delivery, streamlining logistics for high-value medications.

- 2025 May: PharmASSIST rolls out advanced analytics dashboards to provide deeper insights into customer behavior and market trends for pharmaceutical distributors.

- 2025 September: SpineTrader enhances its platform with improved interoperability with EHR systems, facilitating seamless data exchange for better patient care coordination.

- 2025 December: FormWeb announces the successful integration of its platform with leading e-prescription networks, simplifying the prescription fulfillment process.

Strategic Outlook for Pharmaceutical Distribution Software Market

The strategic outlook for the pharmaceutical distribution software market is highly optimistic, driven by an unyielding demand for efficiency, compliance, and advanced technological integration within the global pharmaceutical supply chain. Future growth will be significantly shaped by the increasing adoption of cloud-native architectures, enabling greater scalability and agility. The integration of AI and machine learning will continue to be a key differentiator, empowering distributors with predictive capabilities for demand, inventory, and risk management. The push for end-to-end supply chain visibility, amplified by the potential of blockchain technology, will further solidify the market’s reliance on sophisticated software solutions. Furthermore, the evolving landscape of pharmaceutical products, including personalized medicines and cell and gene therapies, will create new opportunities for specialized distribution software that can handle unique logistical challenges, such as ultra-cold chain requirements and precise patient-specific delivery. Strategic collaborations and mergers will remain crucial for market players to expand their technological portfolios and geographical reach, ensuring they can cater to the diverse and dynamic needs of the pharmaceutical industry.

Pharmaceutical Distribution Software Segmentation

-

1. Application

- 1.1. Large Enterprises

- 1.2. SMEs

-

2. Type

- 2.1. Cloud Based

- 2.2. Web Based

Pharmaceutical Distribution Software Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Pharmaceutical Distribution Software REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.5% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pharmaceutical Distribution Software Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Large Enterprises

- 5.1.2. SMEs

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Cloud Based

- 5.2.2. Web Based

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Pharmaceutical Distribution Software Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Large Enterprises

- 6.1.2. SMEs

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Cloud Based

- 6.2.2. Web Based

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Pharmaceutical Distribution Software Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Large Enterprises

- 7.1.2. SMEs

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Cloud Based

- 7.2.2. Web Based

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Pharmaceutical Distribution Software Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Large Enterprises

- 8.1.2. SMEs

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Cloud Based

- 8.2.2. Web Based

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Pharmaceutical Distribution Software Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Large Enterprises

- 9.1.2. SMEs

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Cloud Based

- 9.2.2. Web Based

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Pharmaceutical Distribution Software Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Large Enterprises

- 10.1.2. SMEs

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Cloud Based

- 10.2.2. Web Based

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 McKesson Connect

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 CoverMyMeds

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SystemOne

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 WinRx

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SpineTrader

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ARxIUM

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MedEx

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 PharmASSIST

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ScriptPro

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 FormWeb

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 McKesson Connect

List of Figures

- Figure 1: Global Pharmaceutical Distribution Software Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Pharmaceutical Distribution Software Revenue (million), by Application 2024 & 2032

- Figure 3: North America Pharmaceutical Distribution Software Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Pharmaceutical Distribution Software Revenue (million), by Type 2024 & 2032

- Figure 5: North America Pharmaceutical Distribution Software Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Pharmaceutical Distribution Software Revenue (million), by Country 2024 & 2032

- Figure 7: North America Pharmaceutical Distribution Software Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Pharmaceutical Distribution Software Revenue (million), by Application 2024 & 2032

- Figure 9: South America Pharmaceutical Distribution Software Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Pharmaceutical Distribution Software Revenue (million), by Type 2024 & 2032

- Figure 11: South America Pharmaceutical Distribution Software Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Pharmaceutical Distribution Software Revenue (million), by Country 2024 & 2032

- Figure 13: South America Pharmaceutical Distribution Software Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Pharmaceutical Distribution Software Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Pharmaceutical Distribution Software Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Pharmaceutical Distribution Software Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Pharmaceutical Distribution Software Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Pharmaceutical Distribution Software Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Pharmaceutical Distribution Software Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Pharmaceutical Distribution Software Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Pharmaceutical Distribution Software Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Pharmaceutical Distribution Software Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Pharmaceutical Distribution Software Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Pharmaceutical Distribution Software Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Pharmaceutical Distribution Software Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Pharmaceutical Distribution Software Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Pharmaceutical Distribution Software Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Pharmaceutical Distribution Software Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Pharmaceutical Distribution Software Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Pharmaceutical Distribution Software Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Pharmaceutical Distribution Software Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Pharmaceutical Distribution Software Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Pharmaceutical Distribution Software Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Pharmaceutical Distribution Software Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Pharmaceutical Distribution Software Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Pharmaceutical Distribution Software Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Pharmaceutical Distribution Software Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Pharmaceutical Distribution Software Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Pharmaceutical Distribution Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Pharmaceutical Distribution Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Pharmaceutical Distribution Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Pharmaceutical Distribution Software Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Pharmaceutical Distribution Software Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Pharmaceutical Distribution Software Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Pharmaceutical Distribution Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Pharmaceutical Distribution Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Pharmaceutical Distribution Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Pharmaceutical Distribution Software Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Pharmaceutical Distribution Software Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Pharmaceutical Distribution Software Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Pharmaceutical Distribution Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Pharmaceutical Distribution Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Pharmaceutical Distribution Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Pharmaceutical Distribution Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Pharmaceutical Distribution Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Pharmaceutical Distribution Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Pharmaceutical Distribution Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Pharmaceutical Distribution Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Pharmaceutical Distribution Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Pharmaceutical Distribution Software Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Pharmaceutical Distribution Software Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Pharmaceutical Distribution Software Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Pharmaceutical Distribution Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Pharmaceutical Distribution Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Pharmaceutical Distribution Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Pharmaceutical Distribution Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Pharmaceutical Distribution Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Pharmaceutical Distribution Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Pharmaceutical Distribution Software Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Pharmaceutical Distribution Software Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Pharmaceutical Distribution Software Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Pharmaceutical Distribution Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Pharmaceutical Distribution Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Pharmaceutical Distribution Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Pharmaceutical Distribution Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Pharmaceutical Distribution Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Pharmaceutical Distribution Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Pharmaceutical Distribution Software Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pharmaceutical Distribution Software?

The projected CAGR is approximately 8.5%.

2. Which companies are prominent players in the Pharmaceutical Distribution Software?

Key companies in the market include McKesson Connect, CoverMyMeds, SystemOne, WinRx, SpineTrader, ARxIUM, MedEx, PharmASSIST, ScriptPro, FormWeb.

3. What are the main segments of the Pharmaceutical Distribution Software?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 238 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pharmaceutical Distribution Software," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pharmaceutical Distribution Software report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pharmaceutical Distribution Software?

To stay informed about further developments, trends, and reports in the Pharmaceutical Distribution Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence