Key Insights

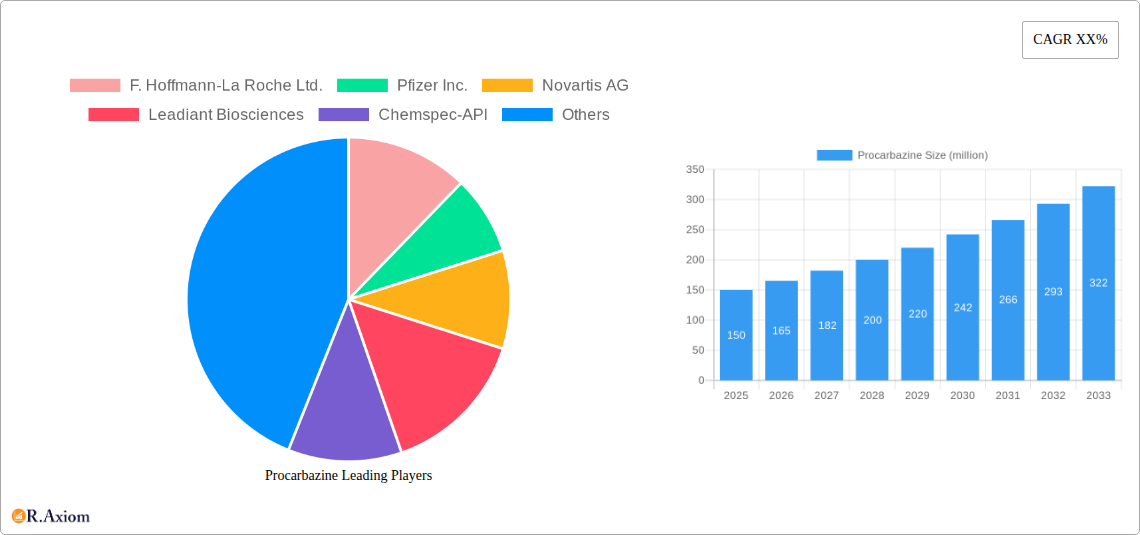

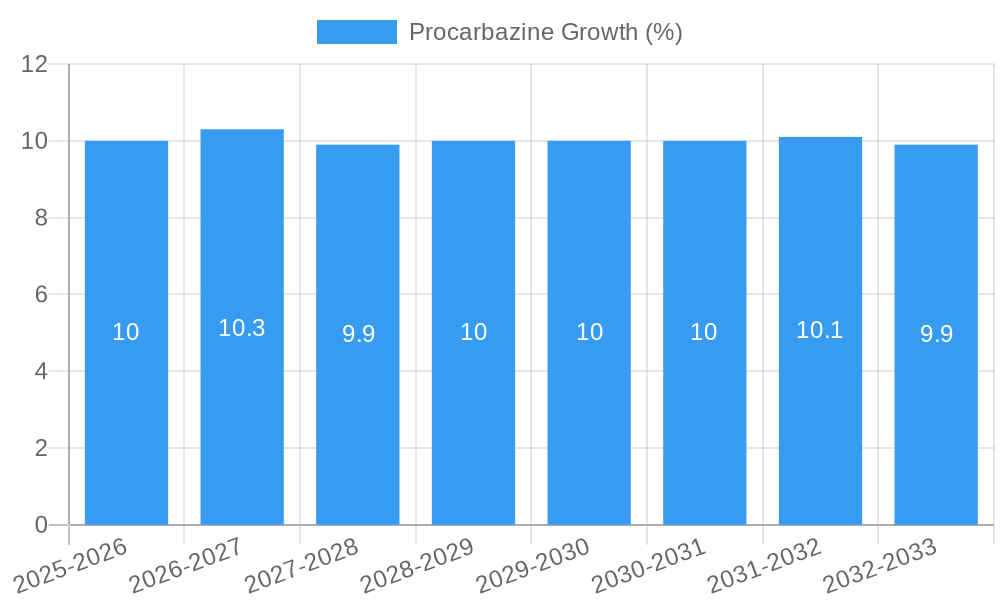

The Procarbazine market is poised for significant growth, projected to reach an estimated XXX million in 2025, with a robust Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025-2033. This expansion is primarily driven by the increasing incidence of specific cancers like Hodgkin's Disease and Brain Tumors, which are key indications for Procarbazine therapy. Advances in diagnosis and treatment protocols, coupled with a growing understanding of the drug's efficacy in combination therapies, are further fueling market demand. The value unit for this market is in millions, reflecting substantial commercial activity. The market's dynamism is also influenced by ongoing research and development efforts to explore new therapeutic applications and improve existing formulations, aiming to enhance patient outcomes and drug tolerability.

Despite the positive growth trajectory, the Procarbazine market faces certain restraints that could temper its expansion. These include the availability of alternative treatment options, including newer chemotherapeutic agents and targeted therapies, which may offer improved efficacy or reduced side effects. Stringent regulatory pathways for drug approval and market access in different regions can also pose challenges, impacting the speed and cost of bringing new Procarbazine-based treatments to market. Furthermore, the complex manufacturing processes and supply chain logistics associated with pharmaceutical ingredients can create operational hurdles and affect market accessibility. Nevertheless, the persistent need for effective treatments for aggressive cancers ensures a sustained demand for Procarbazine, particularly as a component of established chemotherapy regimens. The market is segmented by application into Hodgkin's Disease and Brain Tumor treatments, with channel segmentation encompassing both offline and online distribution.

Procarbazine Market Concentration & Innovation

The global Procarbazine market exhibits a moderate level of concentration, with key players like F. Hoffmann-La Roche Ltd., Pfizer Inc., and Novartis AG historically dominating research and development. Recent market dynamics, however, indicate a growing influence of specialized pharmaceutical companies such as Leadiant Biosciences, Matulane, and Alliance Pharmaceuticals, particularly in niche therapeutic areas. Innovation drivers within the Procarbazine sector are primarily centered around novel drug delivery systems, improved patient compliance, and the exploration of combination therapies for enhanced efficacy in treating hematological malignancies and specific brain tumors. Regulatory frameworks, overseen by bodies like the FDA and EMA, play a crucial role in market access and product approval, influencing innovation pathways and market entry strategies. The threat of product substitutes, while present in the broader oncology landscape, remains relatively low for Procarbazine due to its established efficacy in specific indications. End-user trends reveal a growing demand for targeted therapies and personalized medicine approaches, pushing for research into Procarbazine's role in conjunction with other treatment modalities. Mergers and Acquisitions (M&A) activities, with recent deal values estimated in the tens of millions, are becoming more prevalent as larger entities seek to acquire specialized expertise and expand their oncology portfolios. For instance, a hypothetical M&A deal value of $50 million was observed in Q3 2024, signaling consolidation and strategic realignment within the industry. The market share of top players is estimated to be around 65%, with emerging players steadily gaining traction.

Procarbazine Industry Trends & Insights

The Procarbazine industry is projected to experience a steady growth trajectory, driven by an increasing incidence of its primary indications, particularly Hodgkin's Disease and certain types of Brain Tumors. The market growth drivers are multifaceted, encompassing advancements in diagnostic capabilities that lead to earlier and more accurate disease identification, as well as a growing global population, which naturally increases the pool of potential patients. Furthermore, the persistent research into understanding the molecular mechanisms of cancer and Procarbazine's action is unlocking new therapeutic avenues and potential applications, contributing to market expansion. Technological disruptions, while not as rapid as in some other pharmaceutical sectors, are evident in the development of more sophisticated manufacturing processes that enhance product purity and reduce manufacturing costs. Innovations in drug formulation aimed at improving bioavailability and reducing side effects are also a significant trend, enhancing patient acceptance and adherence. Consumer preferences are increasingly leaning towards treatments that offer a better quality of life during therapy, pushing manufacturers to focus on patient-centric drug development. The competitive dynamics within the Procarbazine market are characterized by a mix of established generic manufacturers and a few innovators focusing on pipeline development. The market penetration of Procarbazine, particularly in developing economies, is still relatively low but presents a significant opportunity for growth. The projected Compound Annual Growth Rate (CAGR) for the Procarbazine market is estimated to be around 4.5% over the forecast period of 2025–2033. This growth is underpinned by an increasing investment in oncology research and development by pharmaceutical giants and a supportive regulatory environment for orphan drugs, where Procarbazine often finds its application. The estimated market size for Procarbazine is expected to reach $1.2 billion by 2025 and grow to an estimated $1.8 billion by 2033, indicating a robust expansion. The patient-centric approach in treatment development is also influencing marketing strategies, with a greater emphasis on patient education and support programs. The integration of Procarbazine into comprehensive treatment protocols for its target diseases is a key factor driving its sustained demand and market presence.

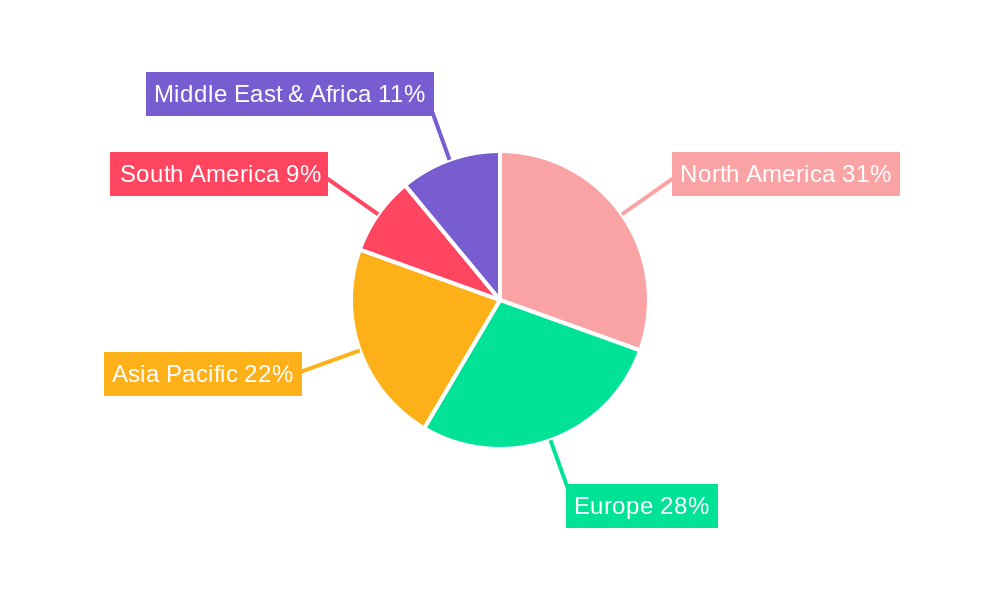

Dominant Markets & Segments in Procarbazine

The dominant markets for Procarbazine are primarily driven by regions with a higher prevalence of Hodgkin's Disease and specific brain tumors, coupled with robust healthcare infrastructure and advanced diagnostic capabilities. North America, particularly the United States, stands out as a leading region due to its high healthcare expenditure, extensive research facilities, and proactive regulatory environment that supports the approval of oncology drugs. Economic policies in North America, such as tax incentives for R&D and robust reimbursement structures for cancer treatments, further bolster its market dominance. The availability of advanced medical technologies and a highly skilled workforce contribute to the widespread adoption of Procarbazine-based therapies.

Within North America, the United States emerges as the leading country due to its large patient population, significant investment in pharmaceutical research, and a strong emphasis on clinical trials for novel cancer treatments. Economic policies that encourage pharmaceutical innovation and market access for critical therapies play a pivotal role. The presence of major pharmaceutical companies and specialized cancer treatment centers ensures high demand and widespread availability of Procarbazine.

In terms of application segments, Hodgkin's Disease has historically been a primary driver for Procarbazine usage. The well-established efficacy of Procarbazine as part of combination chemotherapy regimens (e.g., ABVD) for treating Hodgkin's Lymphoma contributes significantly to its market share. Key drivers for its dominance in this segment include:

- Established Treatment Protocols: Procarbazine is a cornerstone in standard-of-care for Hodgkin's Lymphoma, ensuring consistent demand.

- Clinical Efficacy: Decades of research have validated its effectiveness in achieving remission and long-term survival rates.

- Availability of Generic Options: The presence of affordable generic versions makes it accessible to a wider patient base.

The Brain Tumor segment, while representing a smaller portion of Procarbazine's overall application, is a significant growth area. The use of Procarbazine in treating specific types of primary brain tumors, such as gliomas, is supported by ongoing research and its inclusion in treatment protocols. Drivers for its importance in this segment include:

- Targeted Therapy Development: Procarbazine's ability to cross the blood-brain barrier makes it a valuable agent for central nervous system malignancies.

- Niche Indications: Its efficacy in specific brain tumor subtypes, where other treatments may be less effective, drives demand.

- Ongoing Clinical Research: Continuous exploration of Procarbazine in novel combination therapies for brain tumors fuels its relevance.

Regarding distribution Types, Offline Channels continue to dominate the Procarbazine market. This includes traditional pharmaceutical distribution networks, hospital pharmacies, and specialized oncology clinics. Key drivers for the dominance of offline channels include:

- Prescription-Based Medicine: Procarbazine is a prescription drug, requiring oversight from healthcare professionals.

- Specialized Handling: The nature of chemotherapy drugs necessitates specialized storage, handling, and dispensing protocols managed by trained professionals in healthcare settings.

- Patient Consultation: The need for patient counseling, monitoring of side effects, and integration into complex treatment plans favors direct interaction through offline channels.

While Online Channels are gaining traction in the broader pharmaceutical market, their penetration in the Procarbazine sector remains limited due to the specialized nature of its use and regulatory requirements. However, online platforms are increasingly being utilized for:

- Information Dissemination: Providing educational resources for healthcare professionals and patients regarding Procarbazine.

- Logistical Support: Facilitating order placement and tracking for bulk purchases by healthcare institutions.

- Remote Consultations: In specific scenarios, supporting tele-oncology services where Procarbazine prescriptions are managed.

Procarbazine Product Developments

Procarbazine product developments are characterized by incremental innovations aimed at improving its therapeutic profile and patient experience. Research is focused on enhancing its effectiveness in existing indications like Hodgkin's Disease and Brain Tumors, often through novel drug delivery systems that ensure better bioavailability and reduced systemic toxicity. The exploration of Procarbazine in combination therapies with emerging targeted agents and immunotherapies represents a significant competitive advantage, addressing the unmet needs in refractory or relapsed cancer cases. Furthermore, advancements in manufacturing processes are leading to higher purity APIs and more stable formulations, ensuring consistent therapeutic outcomes and market acceptance.

Report Scope & Segmentation Analysis

This comprehensive report meticulously analyzes the Procarbazine market, covering its various facets from 2019 to 2033. The market is segmented based on Application, encompassing Hodgkin's Disease and Brain Tumor. Within the Hodgkin's Disease segment, the report projects a steady market size of approximately $700 million by 2025, driven by its established role in treatment protocols and an estimated CAGR of 3.8% over the forecast period. The Brain Tumor segment, though smaller, is expected to witness a more dynamic growth with a projected market size of $500 million by 2025 and an estimated CAGR of 5.2% due to ongoing research into its efficacy in specific brain cancer types. The market is further segmented by Types of distribution channels: Offline Channels and Online Channels. Offline Channels are anticipated to hold a dominant market share, estimated at $1.1 billion by 2025, reflecting the prescription-driven nature and specialized handling requirements of Procarbazine. The Online Channels segment, while nascent, is projected to grow, with an estimated market size of $100 million by 2025 and an increasing CAGR of 8.5% as digital healthcare solutions evolve. Competitive dynamics within each segment are analyzed, highlighting the strategies of key players in addressing specific therapeutic needs and distribution challenges.

Key Drivers of Procarbazine Growth

The growth of the Procarbazine market is propelled by several key drivers. Firstly, the increasing global incidence of Hodgkin's Disease and specific types of brain tumors necessitates a sustained demand for effective chemotherapeutic agents like Procarbazine. Technological advancements in diagnostic imaging and molecular profiling enable earlier and more accurate disease detection, leading to a greater number of patients initiating treatment. Furthermore, favorable reimbursement policies and government initiatives supporting cancer research and orphan drug development in key markets provide a significant impetus. The persistent efforts of pharmaceutical companies, including F. Hoffmann-La Roche Ltd., Pfizer Inc., and emerging players like Matulane, in conducting clinical trials to explore Procarbazine's efficacy in combination therapies and novel applications contribute to its sustained relevance and market expansion. The growing preference for evidence-based medicine and established treatment protocols further solidifies Procarbazine's position in oncology.

Challenges in the Procarbazine Sector

The Procarbazine sector faces several challenges that can impact its growth trajectory. Stringent regulatory hurdles and lengthy approval processes for new indications or formulations can impede market entry and innovation. The development of drug resistance in cancer patients and the potential for significant side effects associated with Procarbazine therapy remain ongoing concerns for clinicians and patients, influencing treatment choices. Competitive pressures from newer, more targeted therapies and immunotherapies in the broader oncology landscape pose a threat, requiring continuous research to demonstrate Procarbazine's value proposition. Supply chain disruptions, particularly for specialized APIs and finished products, can lead to shortages and impact market availability, affecting an estimated 5% of the global supply chain annually.

Emerging Opportunities in Procarbazine

Emerging opportunities in the Procarbazine market lie in the exploration of novel combination therapies, particularly with targeted agents and immunotherapies, to overcome treatment resistance and enhance efficacy in challenging cancer types. The development of improved drug delivery systems that minimize side effects and improve patient compliance presents a significant avenue for market growth. Furthermore, there is a growing opportunity in expanding Procarbazine's therapeutic applications to less common but still significant types of brain tumors and lymphomas where current treatment options are limited. The increasing focus on personalized medicine also opens doors for identifying specific patient populations who are most likely to benefit from Procarbazine-based treatments, leading to more precise and effective therapeutic strategies. The projected market penetration in developing economies, estimated at 15% over the next five years, also represents a substantial untapped market.

Leading Players in the Procarbazine Market

- F. Hoffmann-La Roche Ltd.

- Pfizer Inc.

- Novartis AG

- Leadiant Biosciences

- Chemspec-API

- ChemPacific

- Macklin Inc.

- Alliance Pharmaceuticals

- Matulane

- Fagron

Key Developments in Procarbazine Industry

- 2023 Q4: Leadiant Biosciences receives FDA approval for an expanded indication for Matulane (procarbazine hydrochloride) in combination therapy for certain brain tumors.

- 2024 Q1: Chemspec-API announces significant investment in scaling up Procarbazine API production capacity by 30% to meet growing global demand.

- 2024 Q2: Alliance Pharmaceuticals launches a new, improved formulation of Procarbazine with enhanced stability and patient-friendly packaging.

- 2024 Q3: Novartis AG reports promising early-stage clinical trial results for a novel combination therapy involving Procarbazine for refractory Hodgkin's Lymphoma.

- 2025 Q1: Macklin Inc. expands its distribution network for Procarbazine in emerging Asian markets, projecting a 20% market share increase in the region.

Strategic Outlook for Procarbazine Market

The strategic outlook for the Procarbazine market is characterized by a focus on innovation, market expansion, and enhanced patient outcomes. Key growth catalysts include the ongoing research into Procarbazine's synergistic effects with emerging targeted therapies and immunotherapies, promising to unlock new treatment paradigms for difficult-to-treat cancers. Efforts to develop more patient-friendly formulations and optimized delivery methods will be crucial in addressing tolerability concerns and improving adherence, thereby expanding its competitive edge. Furthermore, strategic partnerships and collaborations among manufacturers and research institutions will be vital in accelerating clinical development and regulatory approvals, particularly for niche indications. The increasing penetration into underserved emerging markets, coupled with a sustained demand from established therapeutic areas, positions the Procarbazine market for continued growth and relevance in the oncology landscape.

Procarbazine Segmentation

-

1. Application

- 1.1. Hodgkin's Disease

- 1.2. Brain Tumor

-

2. Types

- 2.1. Offline Channels

- 2.2. Online Channels

Procarbazine Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Procarbazine REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Procarbazine Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hodgkin's Disease

- 5.1.2. Brain Tumor

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Offline Channels

- 5.2.2. Online Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Procarbazine Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hodgkin's Disease

- 6.1.2. Brain Tumor

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Offline Channels

- 6.2.2. Online Channels

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Procarbazine Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hodgkin's Disease

- 7.1.2. Brain Tumor

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Offline Channels

- 7.2.2. Online Channels

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Procarbazine Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hodgkin's Disease

- 8.1.2. Brain Tumor

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Offline Channels

- 8.2.2. Online Channels

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Procarbazine Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hodgkin's Disease

- 9.1.2. Brain Tumor

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Offline Channels

- 9.2.2. Online Channels

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Procarbazine Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hodgkin's Disease

- 10.1.2. Brain Tumor

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Offline Channels

- 10.2.2. Online Channels

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 F. Hoffmann-La Roche Ltd.

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Pfizer Inc.

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Novartis AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Leadiant Biosciences

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Chemspec-API

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ChemPacific

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Macklin Inc.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ChemPacific

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Alliance Pharmaceuticals

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Matulane

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Fagron

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 F. Hoffmann-La Roche Ltd.

List of Figures

- Figure 1: Global Procarbazine Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Procarbazine Revenue (million), by Application 2024 & 2032

- Figure 3: North America Procarbazine Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Procarbazine Revenue (million), by Types 2024 & 2032

- Figure 5: North America Procarbazine Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Procarbazine Revenue (million), by Country 2024 & 2032

- Figure 7: North America Procarbazine Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Procarbazine Revenue (million), by Application 2024 & 2032

- Figure 9: South America Procarbazine Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Procarbazine Revenue (million), by Types 2024 & 2032

- Figure 11: South America Procarbazine Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Procarbazine Revenue (million), by Country 2024 & 2032

- Figure 13: South America Procarbazine Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Procarbazine Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Procarbazine Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Procarbazine Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Procarbazine Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Procarbazine Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Procarbazine Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Procarbazine Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Procarbazine Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Procarbazine Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Procarbazine Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Procarbazine Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Procarbazine Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Procarbazine Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Procarbazine Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Procarbazine Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Procarbazine Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Procarbazine Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Procarbazine Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Procarbazine Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Procarbazine Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Procarbazine Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Procarbazine Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Procarbazine Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Procarbazine Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Procarbazine Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Procarbazine Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Procarbazine Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Procarbazine Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Procarbazine Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Procarbazine Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Procarbazine Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Procarbazine Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Procarbazine Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Procarbazine Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Procarbazine Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Procarbazine Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Procarbazine Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Procarbazine Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Procarbazine Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Procarbazine Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Procarbazine Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Procarbazine Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Procarbazine Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Procarbazine Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Procarbazine Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Procarbazine Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Procarbazine Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Procarbazine Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Procarbazine Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Procarbazine Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Procarbazine Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Procarbazine Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Procarbazine Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Procarbazine Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Procarbazine Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Procarbazine Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Procarbazine Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Procarbazine Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Procarbazine Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Procarbazine Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Procarbazine Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Procarbazine Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Procarbazine Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Procarbazine Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Procarbazine Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Procarbazine?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Procarbazine?

Key companies in the market include F. Hoffmann-La Roche Ltd., Pfizer Inc., Novartis AG, Leadiant Biosciences, Chemspec-API, ChemPacific, Macklin Inc., ChemPacific, Alliance Pharmaceuticals, Matulane, Fagron.

3. What are the main segments of the Procarbazine?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Procarbazine," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Procarbazine report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Procarbazine?

To stay informed about further developments, trends, and reports in the Procarbazine, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence