Key Insights

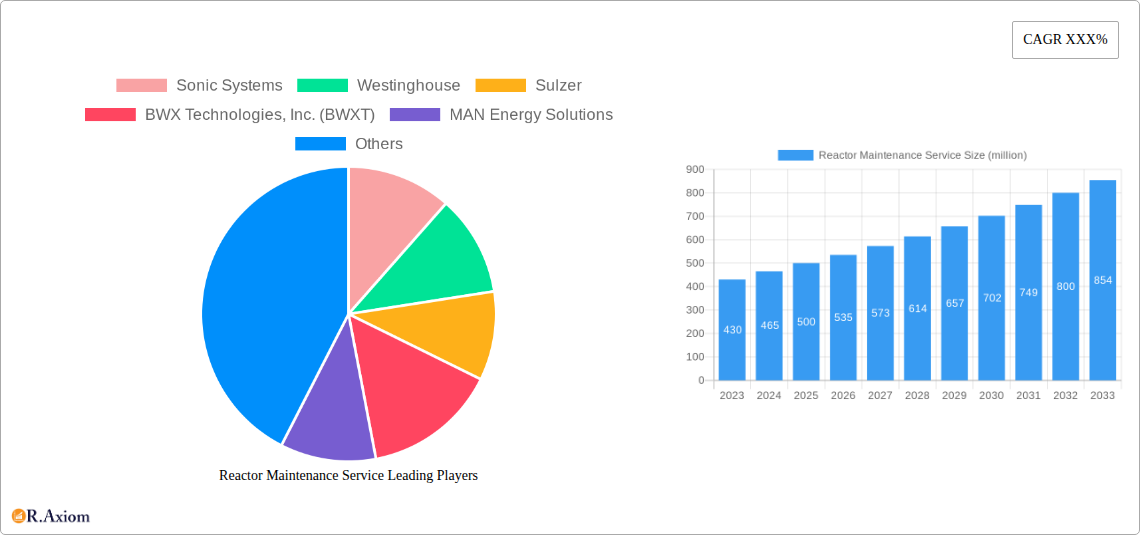

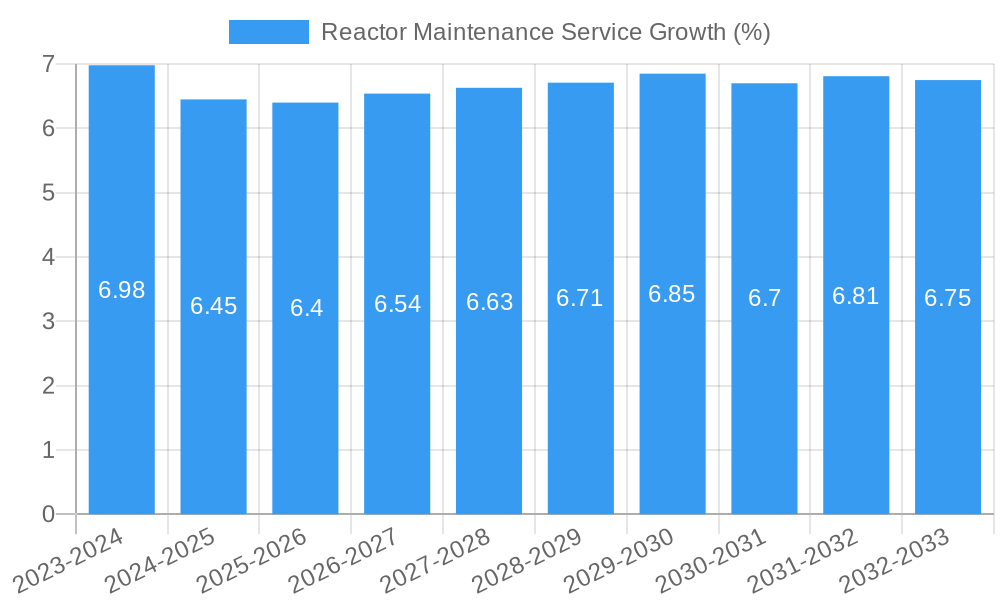

The global Reactor Maintenance Service market is poised for significant expansion, projected to reach approximately $500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 6.5% anticipated through 2033. This impressive growth trajectory is primarily fueled by the increasing demand for reliable and efficient operation of nuclear and chemical reactors across various industries. The aging infrastructure of existing nuclear power plants worldwide necessitates continuous and advanced maintenance to ensure safety, regulatory compliance, and prolonged operational life. Furthermore, the burgeoning chemical industry, driven by advancements in materials science and the production of specialty chemicals, also contributes to this escalating demand for specialized reactor upkeep.

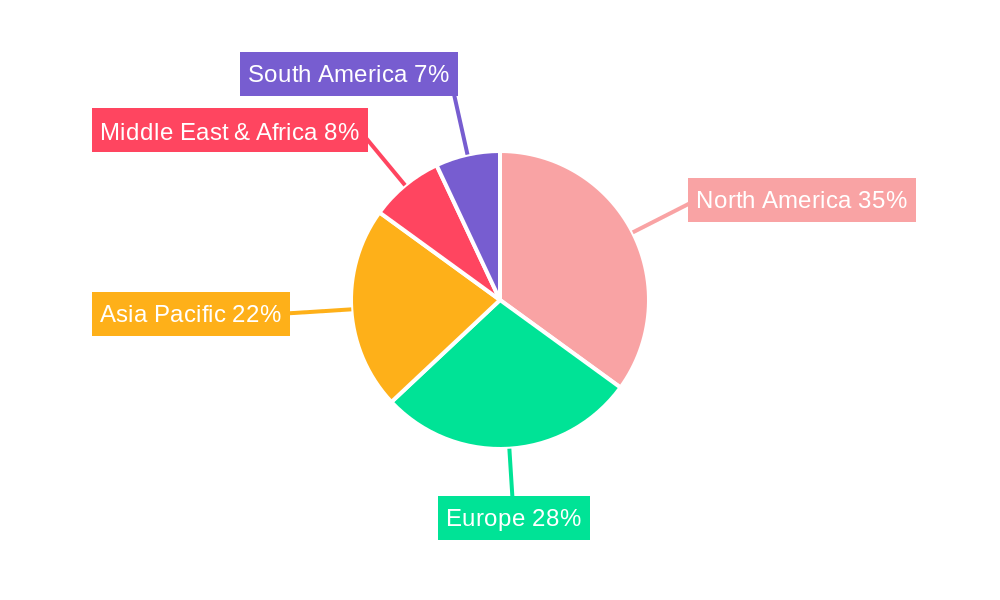

Key market drivers include stringent safety regulations in the nuclear sector, the imperative to minimize downtime for chemical production facilities, and the continuous technological advancements in diagnostic and repair tools. The market segmentation reveals that Reactor Body Maintenance and Reactor Electrical System Maintenance represent the most significant application areas, reflecting the critical nature of these components. While North America currently holds a substantial market share due to its established nuclear and chemical infrastructure, the Asia Pacific region is emerging as a high-growth area, driven by rapid industrialization and increasing investments in new reactor installations, particularly in China and India. Companies like Westinghouse, Sulzer, and BWX Technologies are at the forefront, offering a comprehensive suite of services, from routine inspections to complex repair and refurbishment operations, to cater to this dynamic market.

Reactor Maintenance Service Market Concentration & Innovation

The Reactor Maintenance Service market exhibits a moderate to high concentration, driven by the specialized expertise and stringent regulatory requirements inherent in maintaining critical infrastructure like nuclear and chemical reactors. Key players such as Westinghouse, Sulzer, and BWX Technologies, Inc. (BWXT) hold significant market share due to their established track records, proprietary technologies, and extensive service networks. Innovation is a crucial differentiator, with companies actively investing in advanced inspection techniques, predictive maintenance solutions, and novel repair methodologies to enhance safety, efficiency, and asset lifespan. The integration of AI and IoT for real-time monitoring and diagnostics is a prominent innovation driver. Regulatory frameworks, particularly in the nuclear sector, dictate rigorous standards for maintenance procedures and safety protocols, influencing market entry and operational costs. Product substitutes, while limited for core reactor components, exist in the form of advanced materials and coatings that can extend component life and reduce the frequency of major maintenance interventions. End-user trends are increasingly focused on cost optimization, risk mitigation, and extending the operational life of existing assets, pushing demand for proactive and predictive maintenance strategies. Mergers and acquisitions (M&A) activities are notable, with deal values often in the tens to hundreds of millions of dollars, as larger entities seek to expand their service portfolios, geographical reach, and technological capabilities. For instance, a significant acquisition could involve a specialized inspection firm being integrated into a larger engineering services provider to offer a more comprehensive solution, valued at approximately 50 million.

Reactor Maintenance Service Industry Trends & Insights

The Reactor Maintenance Service industry is poised for robust growth, propelled by escalating investments in energy infrastructure and the imperative to maintain the integrity and longevity of operational reactors globally. The Compound Annual Growth Rate (CAGR) for this sector is projected to be in the range of 5% to 7% over the forecast period of 2025–2033. Several key trends are shaping market dynamics. Firstly, the increasing lifespan of existing nuclear and chemical plants, coupled with the ongoing construction of new facilities, directly translates to sustained demand for comprehensive maintenance services. This surge in demand is a significant growth driver. Secondly, technological disruptions are revolutionizing the sector. The adoption of digital twins, artificial intelligence (AI) for predictive analytics, and advanced robotics for remote inspections and repairs are becoming commonplace. These technologies not only enhance safety by minimizing human exposure to hazardous environments but also significantly improve the efficiency and cost-effectiveness of maintenance operations. Market penetration of these advanced solutions is steadily increasing, with early adopters reporting substantial reductions in downtime and maintenance costs. For example, a leading chemical plant might achieve a 15% reduction in unplanned downtime through the implementation of AI-powered predictive maintenance.

Furthermore, evolving consumer preferences, predominantly driven by utility companies and chemical manufacturers, are shifting towards more proactive and condition-based maintenance strategies rather than traditional time-based or reactive approaches. This trend is fueled by the desire to optimize operational budgets, minimize disruptive outages, and ensure compliance with increasingly stringent environmental and safety regulations. The competitive landscape is characterized by a mix of large, diversified industrial service providers and specialized niche players. Companies like Sonic Systems and Expertech are vying for market share by offering specialized expertise in specific reactor types or maintenance techniques. Strategic partnerships and collaborations are becoming increasingly prevalent as companies aim to leverage complementary strengths and expand their service offerings to meet the diverse needs of clients. The increasing focus on sustainability and the global energy transition also plays a role, with maintenance services for reactors being critical for ensuring the reliable operation of both existing fossil fuel power plants and the burgeoning renewable energy sector's energy storage solutions, which may also involve complex reactor-like systems. The global market size for reactor maintenance services is estimated to reach over 150 million by 2025.

Dominant Markets & Segments in Reactor Maintenance Service

The dominant market and segments within the Reactor Maintenance Service industry are heavily influenced by the application of these critical systems and the specific types of maintenance required.

Application: Nuclear Reactors

Nuclear Reactors represent a paramount segment in the reactor maintenance service market. The sheer scale of investment in nuclear power generation, coupled with the exceptionally high safety and regulatory standards, necessitates continuous and highly specialized maintenance. Countries with significant nuclear fleets, such as the United States, France, China, and South Korea, are key geographical drivers.

- Key Drivers in Nuclear Reactors:

- Aging Infrastructure: A substantial portion of the global nuclear reactor fleet is aging, requiring extensive refurbishment and life extension programs, driving demand for specialized maintenance.

- Stringent Safety Regulations: The uncompromising safety culture and regulatory oversight in the nuclear industry mandate rigorous inspection, testing, and repair protocols, creating a consistent demand for expert services.

- New Builds and Decommissioning: Ongoing new nuclear power plant construction and the eventual decommissioning of older plants both generate substantial maintenance and specialized service needs.

- Technological Advancements in Safety: The continuous drive for enhanced nuclear safety through advanced monitoring and containment technologies also fuels maintenance services.

- Energy Security and Decarbonization Goals: Many nations are re-evaluating and investing in nuclear power as a stable, low-carbon energy source, ensuring continued investment in its operational integrity.

The dominance of the nuclear reactor segment is underscored by the multi-million dollar contracts associated with maintenance campaigns, refueling outages, and component replacements. Companies like Westinghouse and BWX Technologies, Inc. (BWXT) are deeply entrenched in this segment due to their historical involvement in reactor design and manufacturing. The global market for nuclear reactor maintenance services is estimated to be around 90 million in 2025.

Application: Chemical Reactors

The Chemical Reactors segment, encompassing a vast array of industrial processes, also constitutes a significant portion of the reactor maintenance service market. This segment's growth is tied to the expansion of the global chemical industry, driven by demand for petrochemicals, pharmaceuticals, fertilizers, and specialty chemicals.

- Key Drivers in Chemical Reactors:

- Industrial Expansion: Growth in downstream industries like automotive, construction, and healthcare directly fuels demand for chemical production and, consequently, reactor maintenance.

- Process Optimization and Efficiency: Chemical companies continuously seek to optimize production processes, which often involves upgrading and maintaining reactors to improve yield and reduce energy consumption.

- Material Degradation and Corrosion: Harsh chemical environments lead to material degradation and corrosion, necessitating regular inspections and repairs to prevent failures.

- Environmental Compliance: Increasingly stringent environmental regulations require chemical plants to maintain their equipment to minimize emissions and ensure safe operation.

- Shift Towards Specialty Chemicals: The growing demand for high-value specialty chemicals often involves complex reactor designs and specialized maintenance requirements.

The market for chemical reactor maintenance services is projected to grow at a CAGR of approximately 6.5%, reaching an estimated 70 million by 2025. Players like Sulzer and GMM Pfaudler are prominent in this segment, offering a wide range of maintenance and repair solutions for various types of chemical reactors.

Application: Other

The Other application segment includes reactor maintenance for specialized industrial equipment, such as those found in power generation (non-nuclear), aerospace, and advanced materials manufacturing. While individually smaller, collectively, these applications contribute to market diversity.

- Key Drivers in Other Applications:

- Industrial Diversification: The continuous innovation in manufacturing processes creates new types of reactors and systems requiring specialized maintenance expertise.

- Aerospace and Defense: The demanding operational environments in aerospace and defense necessitate highly reliable and well-maintained reactor-like systems.

- Research and Development: Advanced research facilities often utilize unique reactor designs that require bespoke maintenance solutions.

- Emerging Technologies: Sectors like advanced battery manufacturing and hydrogen production are developing new reactor technologies with their own maintenance needs.

This segment is expected to grow steadily, driven by niche applications and technological advancements, contributing an additional 10 million to the overall market by 2025.

Type: Reactor Body Maintenance

Reactor Body Maintenance is a core service encompassing the inspection, repair, and refurbishment of the physical structure of reactors. This includes addressing issues like structural integrity, corrosion, erosion, and material fatigue.

- Key Drivers in Reactor Body Maintenance:

- Preventive and Predictive Maintenance: Regular inspections and condition monitoring are crucial for identifying potential issues before they escalate into critical failures.

- Material Fatigue and Degradation: Over time, reactor bodies are subjected to extreme temperatures, pressures, and chemical stresses, leading to material fatigue and degradation requiring repair or replacement.

- Safety Upgrades and Modifications: Structural modifications to enhance safety or adapt to new operational requirements fall under this category.

- Life Extension Programs: Extending the operational life of reactors often involves significant body maintenance and structural reinforcement.

This segment is a fundamental component of the overall reactor maintenance market, valued at approximately 120 million in 2025.

Type: Reactor Electrical System Maintenance

Reactor Electrical System Maintenance focuses on the intricate network of electrical components, instrumentation, and control systems essential for the safe and efficient operation of reactors. This includes power distribution, control logic, sensor calibration, and safety interlock systems.

- Key Drivers in Reactor Electrical System Maintenance:

- Aging Electrical Components: Electrical systems are susceptible to wear and tear, obsolescence, and failure, requiring regular maintenance and upgrades.

- Sophistication of Control Systems: Modern reactors employ highly sophisticated digital control systems that demand specialized expertise for maintenance and troubleshooting.

- Cybersecurity: Protecting reactor control systems from cyber threats is becoming an increasingly critical aspect of electrical system maintenance.

- Instrumentation and Calibration: Accurate sensor readings are vital for safe operation, necessitating regular calibration and maintenance of instrumentation.

The increasing complexity and digitalization of reactor control systems drive demand in this segment, estimated to be around 50 million in 2025.

Type: Others

The Others type category for reactor maintenance services includes a broad spectrum of specialized services such as specialized cleaning, non-destructive testing (NDT) beyond standard body inspections, waste management related to maintenance activities, and advanced diagnostics.

- Key Drivers in Others:

- Specialized Cleaning and Decontamination: Critical for maintaining operational efficiency and safety, especially in nuclear and chemical environments.

- Advanced NDT Techniques: The development and application of cutting-edge NDT methods for more accurate and detailed inspections.

- Environmental and Waste Management: Disposal and management of materials and waste generated during maintenance operations.

- Consultancy and Engineering Support: Specialized engineering services for maintenance planning, optimization, and troubleshooting.

This segment, though diverse, contributes to the overall comprehensiveness of reactor maintenance offerings, valued at approximately 30 million in 2025.

Reactor Maintenance Service Product Developments

Product developments in Reactor Maintenance Service are increasingly focused on enhancing safety, efficiency, and predictive capabilities. Innovations include the deployment of advanced robotic systems for remote inspections within hazardous environments, reducing human exposure and improving data acquisition. Furthermore, the integration of AI and machine learning algorithms into diagnostic tools allows for predictive maintenance, anticipating potential failures before they occur and minimizing costly downtime. Companies are also developing novel materials and coatings that offer superior resistance to corrosion and extreme conditions, extending the lifespan of reactor components. These advancements are crucial for maintaining the integrity of nuclear reactors, chemical reactors, and other critical industrial equipment, offering competitive advantages through reduced operational costs and enhanced reliability.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global Reactor Maintenance Service market. The market is segmented by Application into Nuclear Reactors, Chemical Reactors, and Other. The Nuclear Reactors segment, valued at approximately 90 million in 2025, is driven by stringent safety regulations and the aging global fleet. The Chemical Reactors segment, estimated at 70 million in 2025, benefits from the expanding chemical industry and the need for process optimization. The Other segment, valued at 10 million, encompasses niche industrial applications.

The market is further segmented by Type of Maintenance: Reactor Body Maintenance, Reactor Electrical System Maintenance, and Others. Reactor Body Maintenance, valued at 120 million, addresses structural integrity and component wear. Reactor Electrical System Maintenance, at 50 million, focuses on complex control and instrumentation systems. The Others segment, at 30 million, includes specialized services like advanced NDT and decontamination. Growth projections and competitive dynamics will be analyzed across all these segments.

Key Drivers of Reactor Maintenance Service Growth

The Reactor Maintenance Service market is propelled by several critical growth drivers. Firstly, the aging global infrastructure of both nuclear and chemical reactors necessitates continuous and advanced maintenance to ensure operational safety and extend asset life. Secondly, increasingly stringent regulatory frameworks worldwide, particularly in the nuclear sector, mandate high standards of inspection, repair, and safety protocols, creating a constant demand for specialized services. Thirdly, technological advancements, including the adoption of AI for predictive maintenance, robotics for remote operations, and advanced NDT techniques, are driving efficiency and reducing downtime, making proactive maintenance more economically viable. The ongoing expansion of the chemical industry and the stable, albeit debated, role of nuclear power in the global energy mix further contribute to sustained market growth. For instance, the projected investments in life extension programs for existing nuclear power plants are in the hundreds of millions, directly fueling maintenance service demand.

Challenges in the Reactor Maintenance Service Sector

The Reactor Maintenance Service sector faces several significant challenges that can impede growth and profitability. One major hurdle is the highly specialized nature of the work, requiring a skilled workforce with niche expertise, leading to talent shortages and increased labor costs. The stringent and evolving regulatory landscape, especially in the nuclear sector, can lead to increased compliance costs and lengthy approval processes for maintenance procedures. Furthermore, the inherent risks associated with working in hazardous environments (e.g., radiation in nuclear plants, corrosive chemicals in chemical plants) demand significant investment in safety protocols and equipment, further adding to operational expenses. Supply chain disruptions for critical components and specialized materials can also lead to project delays and cost overruns. The long lead times for critical repairs and component replacements, particularly for unique or obsolete parts, can also pose a challenge. Finally, budgetary constraints faced by operators, especially during economic downturns, can lead to deferred maintenance, potentially increasing long-term risks. For example, a delay in critical inspection might lead to a 10 million increase in repair costs if a minor issue escalates.

Emerging Opportunities in Reactor Maintenance Service

Emerging opportunities in the Reactor Maintenance Service sector are abundant, driven by technological innovation and evolving industry needs. The increasing adoption of digitalization and AI-powered predictive maintenance presents a significant opportunity for service providers to offer enhanced monitoring and proactive repair solutions, thereby reducing unplanned downtime and optimizing operational costs. The global push for energy transition is also creating new avenues, with maintenance services for advanced nuclear reactor designs (e.g., Small Modular Reactors) and critical components in renewable energy infrastructure (e.g., energy storage systems with reactor-like processes) gaining traction. Furthermore, the growing emphasis on asset life extension programs for aging nuclear and chemical plants offers a substantial market for specialized refurbishment and modernization services. The development of advanced robotics and automation for inspection and repair in hazardous environments is another key opportunity, promising improved safety and efficiency. Companies that can offer integrated, data-driven maintenance solutions are well-positioned to capitalize on these emerging trends.

Leading Players in the Reactor Maintenance Service Market

- Westinghouse

- Sulzer

- BWX Technologies, Inc. (BWXT)

- MAN Energy Solutions

- Linde PLC

- Sonic Systems

- Expertech

- Protexa

- Plant-Tech

- Mirion Technologies, Inc.

- GMM Pfaudler

- Powerhouse Resources

- Catalyst Services

Key Developments in Reactor Maintenance Service Industry

- October 2023: Westinghouse announces a new suite of digital tools for predictive maintenance in nuclear reactors, leveraging AI to identify potential component failures.

- August 2023: Sulzer secures a multi-million dollar contract for the comprehensive maintenance of critical pumps and rotating equipment at a major chemical processing facility.

- June 2023: BWX Technologies, Inc. (BWXT) completes a significant reactor vessel inspection using advanced robotic technology, demonstrating enhanced safety and efficiency.

- April 2023: MAN Energy Solutions launches a new service offering focused on optimizing the lifespan of large industrial gas turbines through condition-based maintenance.

- January 2023: Linde PLC expands its industrial gas supply and maintenance services to support new chemical reactor installations in the Asia-Pacific region.

- November 2022: Sonic Systems enhances its inspection capabilities with the deployment of drone technology for the internal inspection of nuclear reactor components.

- September 2022: Expertech partners with a leading utility to implement a predictive maintenance program for a fleet of nuclear power plants, aiming to reduce outages by an estimated 10%.

- July 2022: Protexa secures a long-term maintenance contract for a large-scale chemical refinery, focusing on asset integrity and reliability.

- May 2022: Plant-Tech invests in advanced simulation software to improve its reactor maintenance planning and execution capabilities.

- March 2022: Mirion Technologies, Inc. introduces a new generation of radiation monitoring equipment designed for more accurate and real-time data collection during reactor maintenance.

- December 2021: GMM Pfaudler announces the acquisition of a specialized chemical reactor maintenance firm, expanding its service portfolio in the European market.

- October 2021: Powerhouse Resources reports a successful implementation of a novel cleaning technology for a nuclear reactor's heat exchangers, significantly improving thermal efficiency.

- August 2021: Catalyst Services launches a new consulting arm focused on optimizing maintenance strategies for chemical reactors in emerging markets.

Strategic Outlook for Reactor Maintenance Service Market

The strategic outlook for the Reactor Maintenance Service market remains highly positive, driven by an enduring need for safe, reliable, and efficient operation of critical industrial assets. The ongoing decommissioning and life extension of aging nuclear fleets, coupled with the robust expansion of the global chemical industry, will continue to fuel demand. The increasing integration of advanced digital technologies, such as AI and IoT for predictive maintenance, presents a significant opportunity for service providers to offer value-added solutions, optimizing operational efficiency and reducing downtime. Furthermore, the growing focus on sustainability and decarbonization may open new markets for maintenance services in advanced energy storage and potentially future reactor technologies. Companies that invest in specialized expertise, embrace technological innovation, and can offer comprehensive, integrated service solutions will be best positioned for sustained growth and market leadership in this vital sector. The market is expected to see continued consolidation and strategic partnerships as players seek to enhance their capabilities and expand their global reach.

Reactor Maintenance Service Segmentation

-

1. Application

- 1.1. Nuclear Reactors

- 1.2. Chemical Reactors

- 1.3. Other

-

2. Type

- 2.1. Reactor Body Maintenance

- 2.2. Reactor Electrical System Maintenance

- 2.3. Others

Reactor Maintenance Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Reactor Maintenance Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Reactor Maintenance Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Nuclear Reactors

- 5.1.2. Chemical Reactors

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Reactor Body Maintenance

- 5.2.2. Reactor Electrical System Maintenance

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Reactor Maintenance Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Nuclear Reactors

- 6.1.2. Chemical Reactors

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Reactor Body Maintenance

- 6.2.2. Reactor Electrical System Maintenance

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Reactor Maintenance Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Nuclear Reactors

- 7.1.2. Chemical Reactors

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Reactor Body Maintenance

- 7.2.2. Reactor Electrical System Maintenance

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Reactor Maintenance Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Nuclear Reactors

- 8.1.2. Chemical Reactors

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Reactor Body Maintenance

- 8.2.2. Reactor Electrical System Maintenance

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Reactor Maintenance Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Nuclear Reactors

- 9.1.2. Chemical Reactors

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Reactor Body Maintenance

- 9.2.2. Reactor Electrical System Maintenance

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Reactor Maintenance Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Nuclear Reactors

- 10.1.2. Chemical Reactors

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Reactor Body Maintenance

- 10.2.2. Reactor Electrical System Maintenance

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Sonic Systems

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Westinghouse

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sulzer

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BWX Technologies Inc. (BWXT)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 MAN Energy Solutions

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Protexa

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Powerhouse Resources

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Catalyst Services

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Plant-Tech

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mirion Technologies Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Linde PLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 GMM Pfaudler

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Expertech

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Sonic Systems

List of Figures

- Figure 1: Global Reactor Maintenance Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Reactor Maintenance Service Revenue (million), by Application 2024 & 2032

- Figure 3: North America Reactor Maintenance Service Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Reactor Maintenance Service Revenue (million), by Type 2024 & 2032

- Figure 5: North America Reactor Maintenance Service Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Reactor Maintenance Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Reactor Maintenance Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Reactor Maintenance Service Revenue (million), by Application 2024 & 2032

- Figure 9: South America Reactor Maintenance Service Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Reactor Maintenance Service Revenue (million), by Type 2024 & 2032

- Figure 11: South America Reactor Maintenance Service Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Reactor Maintenance Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Reactor Maintenance Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Reactor Maintenance Service Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Reactor Maintenance Service Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Reactor Maintenance Service Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Reactor Maintenance Service Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Reactor Maintenance Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Reactor Maintenance Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Reactor Maintenance Service Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Reactor Maintenance Service Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Reactor Maintenance Service Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Reactor Maintenance Service Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Reactor Maintenance Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Reactor Maintenance Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Reactor Maintenance Service Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Reactor Maintenance Service Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Reactor Maintenance Service Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Reactor Maintenance Service Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Reactor Maintenance Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Reactor Maintenance Service Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Reactor Maintenance Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Reactor Maintenance Service Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Reactor Maintenance Service Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Reactor Maintenance Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Reactor Maintenance Service Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Reactor Maintenance Service Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Reactor Maintenance Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Reactor Maintenance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Reactor Maintenance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Reactor Maintenance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Reactor Maintenance Service Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Reactor Maintenance Service Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Reactor Maintenance Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Reactor Maintenance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Reactor Maintenance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Reactor Maintenance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Reactor Maintenance Service Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Reactor Maintenance Service Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Reactor Maintenance Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Reactor Maintenance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Reactor Maintenance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Reactor Maintenance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Reactor Maintenance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Reactor Maintenance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Reactor Maintenance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Reactor Maintenance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Reactor Maintenance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Reactor Maintenance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Reactor Maintenance Service Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Reactor Maintenance Service Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Reactor Maintenance Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Reactor Maintenance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Reactor Maintenance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Reactor Maintenance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Reactor Maintenance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Reactor Maintenance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Reactor Maintenance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Reactor Maintenance Service Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Reactor Maintenance Service Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Reactor Maintenance Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Reactor Maintenance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Reactor Maintenance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Reactor Maintenance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Reactor Maintenance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Reactor Maintenance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Reactor Maintenance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Reactor Maintenance Service Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Reactor Maintenance Service?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Reactor Maintenance Service?

Key companies in the market include Sonic Systems, Westinghouse, Sulzer, BWX Technologies, Inc. (BWXT), MAN Energy Solutions, Protexa, Powerhouse Resources, Catalyst Services, Plant-Tech, Mirion Technologies, Inc, Linde PLC, GMM Pfaudler, Expertech.

3. What are the main segments of the Reactor Maintenance Service?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Reactor Maintenance Service," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Reactor Maintenance Service report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Reactor Maintenance Service?

To stay informed about further developments, trends, and reports in the Reactor Maintenance Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence