Key Insights

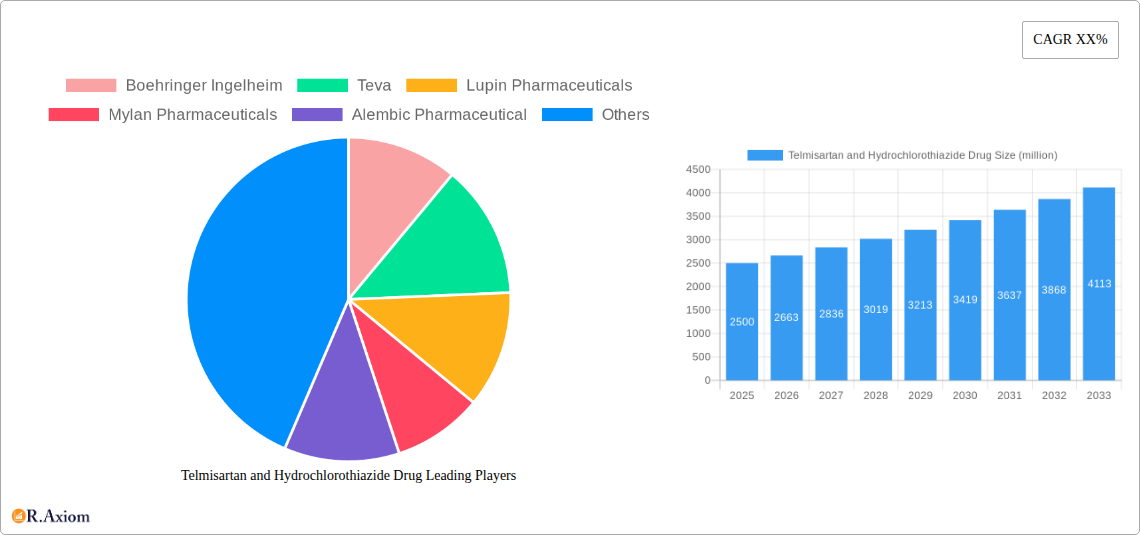

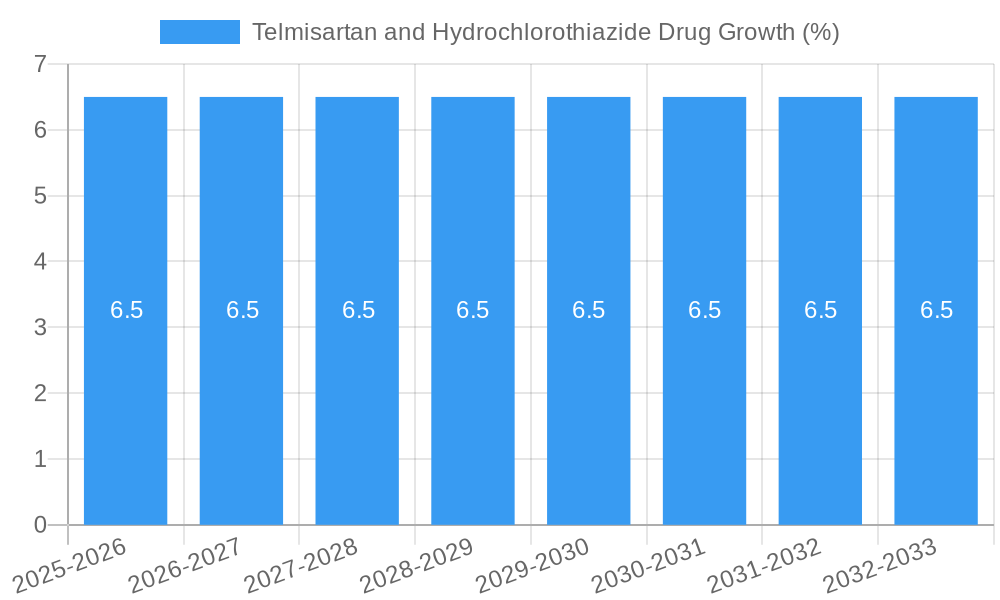

The global Telmisartan and Hydrochlorothiazide drug market is experiencing significant growth, projected to reach approximately $2,500 million by 2025. This expansion is driven by the increasing prevalence of hypertension worldwide, a condition that requires effective and accessible treatment options. Telmisartan, an angiotensin II receptor blocker (ARB), and Hydrochlorothiazide, a diuretic, are frequently prescribed in combination therapy to manage high blood pressure, offering a synergistic approach to patient care. The growing awareness of cardiovascular diseases and the need for long-term blood pressure control further fuel market demand. Key players like Boehringer Ingelheim, Teva, and Lupin Pharmaceuticals are actively engaged in research, development, and market penetration strategies, including the introduction of generic versions, which contributes to market accessibility and affordability, further bolstering growth. The market's robust CAGR of around 6.5% underscores its strong upward trajectory, indicative of sustained demand and the drug's continued importance in cardiovascular pharmacotherapy.

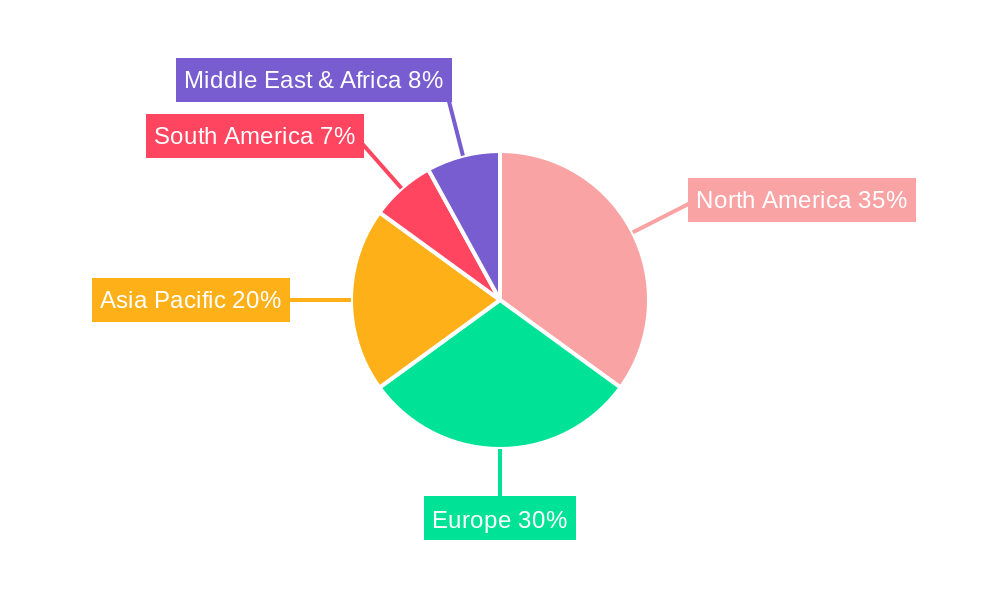

The market segmentation by application highlights the dominance of High Blood Pressure (Hypertension) as the primary use case, reflecting the drug's targeted efficacy. Within types, the 80 mg/12.5 mg Tablets and 40 mg/12.5 mg Tablets represent significant portions of the market due to their widespread clinical adoption. Restraints such as stringent regulatory approvals and the emergence of novel therapeutic alternatives are present, but the established efficacy and cost-effectiveness of Telmisartan and Hydrochlorothiazide combinations are expected to mitigate these challenges. Geographically, North America and Europe currently lead the market, attributed to advanced healthcare infrastructure and higher healthcare spending. However, the Asia Pacific region, particularly China and India, is poised for substantial growth due to a large patient pool, increasing disposable incomes, and a rising focus on chronic disease management. This dynamic landscape suggests a favorable outlook for the Telmisartan and Hydrochlorothiazide drug market, characterized by consistent demand and strategic expansion across diverse therapeutic and geographical segments.

Here is a comprehensive, SEO-optimized report description for the Telmisartan and Hydrochlorothiazide Drug market, designed for immediate use without modification.

Telmisartan and Hydrochlorothiazide Drug Market Concentration & Innovation

The Telmisartan and Hydrochlorothiazide drug market exhibits a dynamic concentration landscape, characterized by the strategic presence of major pharmaceutical manufacturers such as Boehringer Ingelheim, Teva, Lupin Pharmaceuticals, Mylan Pharmaceuticals, Alembic Pharmaceutical, Torrent Pharmaceuticals, Macleods, Zydus Pharmaceuticals, Aurobindo, and Huahai Pharmaceutical. Innovation within this sector is primarily driven by the continuous pursuit of improved drug formulations, enhanced patient compliance, and cost-effective manufacturing processes. Regulatory frameworks, such as stringent FDA and EMA approvals, play a pivotal role in shaping market entry and product lifecycles, ensuring drug safety and efficacy. The market also faces the constant challenge of product substitutes, including alternative antihypertensive classes and generic competition, necessitating ongoing R&D investment. End-user trends indicate a growing preference for combination therapies that offer simplified dosing regimens and improved therapeutic outcomes for managing hypertension. Mergers and acquisitions (M&A) activities within the pharmaceutical industry, with estimated deal values in the hundreds of millions, continue to consolidate market share and drive strategic partnerships, impacting market concentration significantly. The market share for leading players fluctuates, with significant gains observed for manufacturers with robust generic portfolios.

Telmisartan and Hydrochlorothiazide Drug Industry Trends & Insights

The Telmisartan and Hydrochlorothiazide drug industry is experiencing robust growth, fueled by the escalating global prevalence of hypertension. This chronic condition, often exacerbated by lifestyle factors and an aging population, creates a sustained demand for effective and accessible antihypertensive treatments. The market’s Compound Annual Growth Rate (CAGR) is projected to remain strong, driven by increasing healthcare expenditure and a greater focus on preventive cardiology. Technological disruptions, while not as pronounced as in some other pharmaceutical sectors, are evident in advancements in drug delivery systems and manufacturing efficiencies, leading to cost reductions and improved product quality. Consumer preferences are increasingly shifting towards combination therapies like Telmisartan and Hydrochlorothiazide due to their dual-action mechanism, offering comprehensive blood pressure control and reducing the pill burden for patients. This trend directly contributes to higher market penetration for these fixed-dose combinations. Competitive dynamics are intense, with both originator and generic manufacturers vying for market dominance. The patent expiry of key Telmisartan and Hydrochlorothiazide formulations has paved the way for a surge in generic competition, driving down prices while expanding accessibility. Market penetration for combination therapies is estimated to exceed 70% in developed markets, with significant growth potential in emerging economies. The introduction of new fixed-dose combinations with improved pharmacokinetic profiles and reduced side effects also contributes to market expansion. Furthermore, the growing emphasis on patient adherence programs and digital health solutions designed to monitor and manage hypertension is indirectly bolstering the demand for these essential medications. The market penetration of Telmisartan and Hydrochlorothiazide as a first-line or second-line therapy for hypertension is a key indicator of its industry significance. The continuous innovation in pharmaceutical manufacturing processes, including continuous manufacturing and advanced analytical techniques, further strengthens the industry’s ability to meet the growing global demand. The strategic alliances and licensing agreements between pharmaceutical companies play a crucial role in expanding market reach and fostering collaborative innovation.

Dominant Markets & Segments in Telmisartan and Hydrochlorothiazide Drug

The Telmisartan and Hydrochlorothiazide drug market is predominantly driven by the High Blood Pressure (Hypertension) application segment, reflecting the widespread diagnosis and treatment of this cardiovascular condition globally. Within this application, the 80 mg/12.5 mg Tablets type commands a significant market share due to its efficacy and established treatment protocols. Economically, rising disposable incomes in emerging economies are contributing to increased healthcare access and the uptake of essential medications like Telmisartan and Hydrochlorothiazide. Infrastructure development, particularly in healthcare facilities and pharmaceutical distribution networks, is crucial for market expansion in regions with burgeoning populations.

- Leading Region: North America and Europe currently represent the dominant regions due to advanced healthcare systems, high awareness of hypertension management, and robust prescription rates. The presence of major pharmaceutical players and well-established reimbursement policies further solidifies their leadership.

- Key Country: The United States stands out as a leading country, with a high incidence of hypertension, extensive market penetration of combination therapies, and a substantial pharmaceutical market. Germany, the United Kingdom, and Japan also represent significant markets within their respective continents.

- Dominant Application: High Blood Pressure (Hypertension) remains the cornerstone of demand, accounting for over 95% of the market. This is underpinned by the chronic nature of hypertension and the need for long-term management strategies.

- Dominant Type: The 80 mg/12.5 mg Tablets are a primary driver of market growth due to their widely prescribed dosage for effective blood pressure control. The 40 mg/12.5 mg Tablets also hold a substantial share, catering to patients requiring milder titration.

- Economic Policies: Favorable healthcare policies, including insurance coverage for antihypertensive medications and government initiatives to combat chronic diseases, significantly boost market growth.

- Infrastructure: A well-developed pharmaceutical supply chain and accessible healthcare infrastructure are critical for ensuring the widespread availability of Telmisartan and Hydrochlorothiazide drugs, particularly in remote and underserved areas.

Telmisartan and Hydrochlorothiazide Drug Product Developments

Product developments in the Telmisartan and Hydrochlorothiazide drug market focus on optimizing formulations for enhanced efficacy and patient convenience. Innovations include extended-release versions, improved taste-masking for pediatric or elderly patients, and fixed-dose combinations with other cardiovascular agents to address co-morbidities. These developments aim to offer distinct competitive advantages by improving patient adherence, reducing side effects, and simplifying treatment regimens, thereby meeting the evolving demands of healthcare providers and patients seeking comprehensive hypertension management solutions.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Telmisartan and Hydrochlorothiazide drug market across its key segments. The Application segmentation focuses on High Blood Pressure (Hypertension), the primary indication, and Others, encompassing less common or off-label uses. Within Types, the analysis covers 80 mg/12.5 mg Tablets, 40 mg/12.5 mg Tablets, and 80 mg/25 mg Tablets, examining their respective market shares and growth trajectories. Each segment is evaluated for its current market size, projected growth rates, and the competitive landscape influencing its dynamics.

Key Drivers of Telmisartan and Hydrochlorothiazide Drug Growth

The growth of the Telmisartan and Hydrochlorothiazide drug market is propelled by a confluence of factors. The escalating global burden of hypertension, driven by aging populations and lifestyle changes, creates a sustained demand for effective antihypertensive treatments. Technological advancements in pharmaceutical manufacturing, leading to more efficient production and cost-effectiveness, further stimulate market expansion. Favorable regulatory environments in key markets, coupled with increasing healthcare expenditure worldwide, provide a conducive ecosystem for market growth. Moreover, the growing awareness among patients and healthcare professionals regarding the benefits of combination therapies for managing hypertension efficiently is a significant growth catalyst.

Challenges in the Telmisartan and Hydrochlorothiazide Drug Sector

Despite its growth, the Telmisartan and Hydrochlorothiazide drug sector faces several challenges. Intense generic competition following patent expirations can lead to significant price erosion, impacting revenue streams for both originator and generic manufacturers. Stringent regulatory hurdles and lengthy approval processes for new formulations or manufacturing sites can delay market entry and product launches. Supply chain disruptions, particularly those related to the sourcing of active pharmaceutical ingredients (APIs) and geopolitical instabilities, pose a constant risk to production continuity and market availability. Furthermore, the development of novel antihypertensive therapies and advancements in non-pharmacological treatment approaches present potential threats by offering alternative management strategies.

Emerging Opportunities in Telmisartan and Hydrochlorothiazide Drug

Emerging opportunities within the Telmisartan and Hydrochlorothiazide drug market lie in the expansion into underdeveloped and emerging economies where the prevalence of hypertension is rising but access to treatment remains limited. The development of novel fixed-dose combinations incorporating Telmisartan and Hydrochlorothiazide with other cardiovascular agents for comprehensive patient management presents a significant avenue for innovation and market differentiation. Furthermore, the integration of digital health technologies and patient monitoring platforms can enhance treatment adherence and outcomes, creating value-added services for these medications. The exploration of new therapeutic applications or expanded indications for these drug combinations could also unlock substantial market potential.

Leading Players in the Telmisartan and Hydrochlorothiazide Drug Market

- Boehringer Ingelheim

- Teva

- Lupin Pharmaceuticals

- Mylan Pharmaceuticals

- Alembic Pharmaceutical

- Torrent Pharmaceuticals

- Macleods

- Zydus Pharmaceuticals

- Aurobindo

- Huahai Pharmaceutical

Key Developments in Telmisartan and Hydrochlorothiazide Drug Industry

- 2023/08: Launch of new generic Telmisartan and Hydrochlorothiazide formulations in key European markets, increasing accessibility and competition.

- 2023/06: Approval of extended-release Telmisartan and Hydrochlorothiazide formulations in North America, enhancing patient compliance.

- 2022/11: Strategic partnership announced between Teva and a regional distributor to expand reach in Southeast Asia.

- 2022/07: Lupin Pharmaceuticals reports significant sales growth for its Telmisartan and Hydrochlorothiazide portfolio due to market demand.

- 2021/12: Mylan Pharmaceuticals announces investment in advanced manufacturing capabilities for its hypertension drug portfolio.

Strategic Outlook for Telmisartan and Hydrochlorothiazide Drug Market

The strategic outlook for the Telmisartan and Hydrochlorothiazide drug market remains positive, driven by the persistent global demand for effective hypertension management solutions. Future growth will be shaped by the continuous introduction of cost-effective generic alternatives, strategic alliances to enhance market penetration in emerging regions, and the development of innovative drug delivery systems and combination therapies. Increased focus on patient-centric care, coupled with the integration of digital health tools, will further bolster market potential. Manufacturers that can navigate the evolving regulatory landscape, manage supply chain complexities, and capitalize on the growing awareness of cardiovascular health will be well-positioned for sustained success in this vital pharmaceutical segment.

Telmisartan and Hydrochlorothiazide Drug Segmentation

-

1. Application

- 1.1. High Blood Pressure (Hypertension)

- 1.2. Others

-

2. Types

- 2.1. 80 mg/12.5 mg Tablets

- 2.2. 40 mg/12.5 mg Tablets

- 2.3. 80 mg/25 mg Tablets

Telmisartan and Hydrochlorothiazide Drug Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Telmisartan and Hydrochlorothiazide Drug REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Telmisartan and Hydrochlorothiazide Drug Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. High Blood Pressure (Hypertension)

- 5.1.2. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. 80 mg/12.5 mg Tablets

- 5.2.2. 40 mg/12.5 mg Tablets

- 5.2.3. 80 mg/25 mg Tablets

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Telmisartan and Hydrochlorothiazide Drug Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. High Blood Pressure (Hypertension)

- 6.1.2. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. 80 mg/12.5 mg Tablets

- 6.2.2. 40 mg/12.5 mg Tablets

- 6.2.3. 80 mg/25 mg Tablets

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Telmisartan and Hydrochlorothiazide Drug Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. High Blood Pressure (Hypertension)

- 7.1.2. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. 80 mg/12.5 mg Tablets

- 7.2.2. 40 mg/12.5 mg Tablets

- 7.2.3. 80 mg/25 mg Tablets

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Telmisartan and Hydrochlorothiazide Drug Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. High Blood Pressure (Hypertension)

- 8.1.2. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. 80 mg/12.5 mg Tablets

- 8.2.2. 40 mg/12.5 mg Tablets

- 8.2.3. 80 mg/25 mg Tablets

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Telmisartan and Hydrochlorothiazide Drug Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. High Blood Pressure (Hypertension)

- 9.1.2. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. 80 mg/12.5 mg Tablets

- 9.2.2. 40 mg/12.5 mg Tablets

- 9.2.3. 80 mg/25 mg Tablets

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Telmisartan and Hydrochlorothiazide Drug Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. High Blood Pressure (Hypertension)

- 10.1.2. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. 80 mg/12.5 mg Tablets

- 10.2.2. 40 mg/12.5 mg Tablets

- 10.2.3. 80 mg/25 mg Tablets

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Boehringer Ingelheim

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Teva

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lupin Pharmaceuticals

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Mylan Pharmaceuticals

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Alembic Pharmaceutical

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Torrent Pharmaceuticals

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Macleods

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Zydus Pharmaceuticals

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Aurobindo

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Huahai Pharmaceutical

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Boehringer Ingelheim

List of Figures

- Figure 1: Global Telmisartan and Hydrochlorothiazide Drug Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Telmisartan and Hydrochlorothiazide Drug Revenue (million), by Application 2024 & 2032

- Figure 3: North America Telmisartan and Hydrochlorothiazide Drug Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Telmisartan and Hydrochlorothiazide Drug Revenue (million), by Types 2024 & 2032

- Figure 5: North America Telmisartan and Hydrochlorothiazide Drug Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Telmisartan and Hydrochlorothiazide Drug Revenue (million), by Country 2024 & 2032

- Figure 7: North America Telmisartan and Hydrochlorothiazide Drug Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Telmisartan and Hydrochlorothiazide Drug Revenue (million), by Application 2024 & 2032

- Figure 9: South America Telmisartan and Hydrochlorothiazide Drug Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Telmisartan and Hydrochlorothiazide Drug Revenue (million), by Types 2024 & 2032

- Figure 11: South America Telmisartan and Hydrochlorothiazide Drug Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Telmisartan and Hydrochlorothiazide Drug Revenue (million), by Country 2024 & 2032

- Figure 13: South America Telmisartan and Hydrochlorothiazide Drug Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Telmisartan and Hydrochlorothiazide Drug Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Telmisartan and Hydrochlorothiazide Drug Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Telmisartan and Hydrochlorothiazide Drug Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Telmisartan and Hydrochlorothiazide Drug Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Telmisartan and Hydrochlorothiazide Drug Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Telmisartan and Hydrochlorothiazide Drug Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Telmisartan and Hydrochlorothiazide Drug Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Telmisartan and Hydrochlorothiazide Drug Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Telmisartan and Hydrochlorothiazide Drug Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Telmisartan and Hydrochlorothiazide Drug Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Telmisartan and Hydrochlorothiazide Drug Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Telmisartan and Hydrochlorothiazide Drug Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Telmisartan and Hydrochlorothiazide Drug Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Telmisartan and Hydrochlorothiazide Drug Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Telmisartan and Hydrochlorothiazide Drug Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Telmisartan and Hydrochlorothiazide Drug Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Telmisartan and Hydrochlorothiazide Drug Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Telmisartan and Hydrochlorothiazide Drug Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Telmisartan and Hydrochlorothiazide Drug Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Telmisartan and Hydrochlorothiazide Drug Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Telmisartan and Hydrochlorothiazide Drug Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Telmisartan and Hydrochlorothiazide Drug Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Telmisartan and Hydrochlorothiazide Drug Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Telmisartan and Hydrochlorothiazide Drug Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Telmisartan and Hydrochlorothiazide Drug Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Telmisartan and Hydrochlorothiazide Drug Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Telmisartan and Hydrochlorothiazide Drug Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Telmisartan and Hydrochlorothiazide Drug Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Telmisartan and Hydrochlorothiazide Drug Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Telmisartan and Hydrochlorothiazide Drug Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Telmisartan and Hydrochlorothiazide Drug Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Telmisartan and Hydrochlorothiazide Drug Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Telmisartan and Hydrochlorothiazide Drug Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Telmisartan and Hydrochlorothiazide Drug Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Telmisartan and Hydrochlorothiazide Drug Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Telmisartan and Hydrochlorothiazide Drug Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Telmisartan and Hydrochlorothiazide Drug Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Telmisartan and Hydrochlorothiazide Drug?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Telmisartan and Hydrochlorothiazide Drug?

Key companies in the market include Boehringer Ingelheim, Teva, Lupin Pharmaceuticals, Mylan Pharmaceuticals, Alembic Pharmaceutical, Torrent Pharmaceuticals, Macleods, Zydus Pharmaceuticals, Aurobindo, Huahai Pharmaceutical.

3. What are the main segments of the Telmisartan and Hydrochlorothiazide Drug?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 5600.00, USD 8400.00, and USD 11200.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Telmisartan and Hydrochlorothiazide Drug," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Telmisartan and Hydrochlorothiazide Drug report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Telmisartan and Hydrochlorothiazide Drug?

To stay informed about further developments, trends, and reports in the Telmisartan and Hydrochlorothiazide Drug, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence