Key Insights

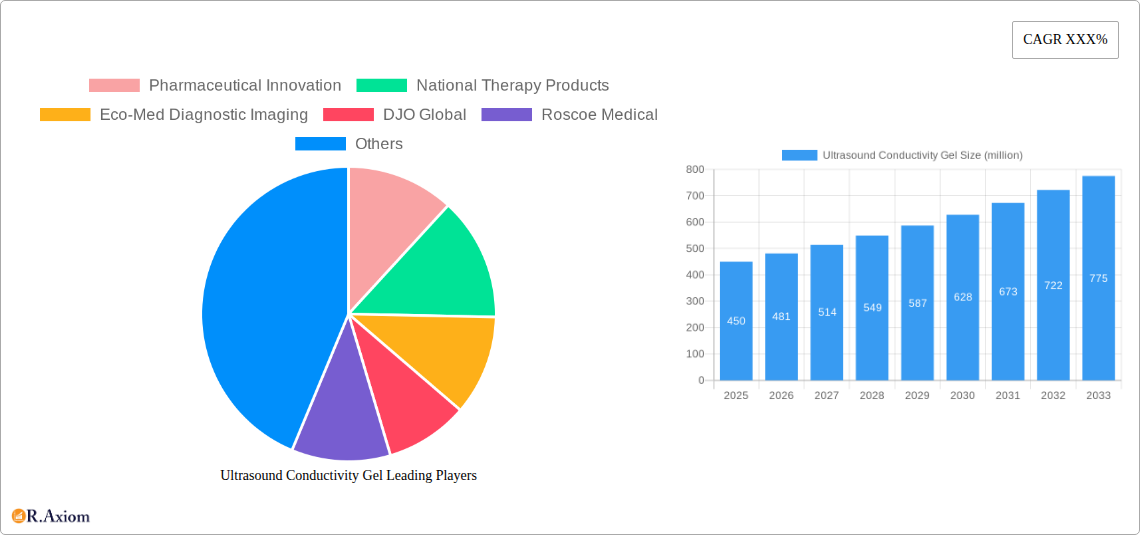

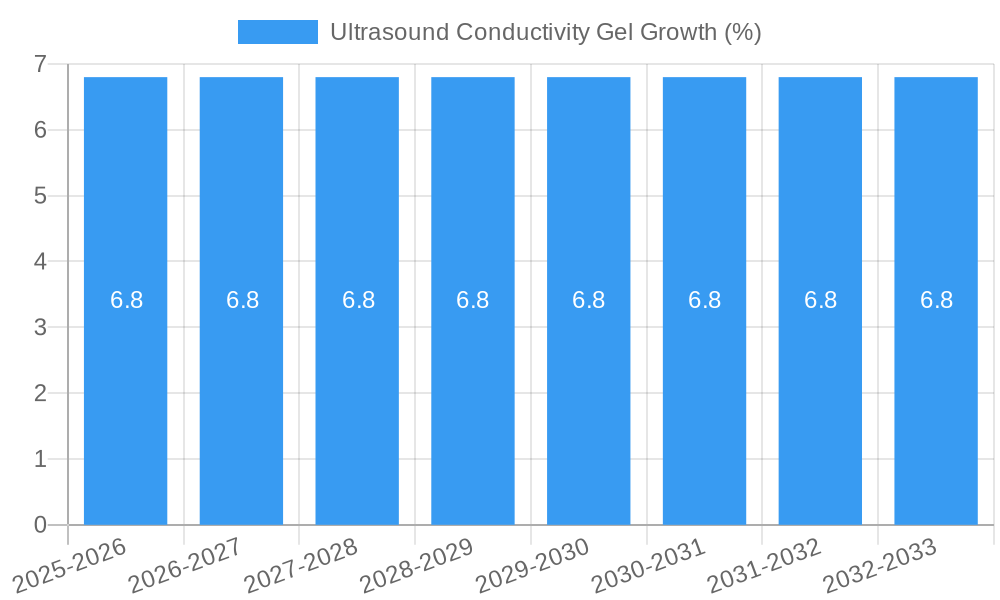

The global Ultrasound Conductivity Gel market is poised for significant expansion, projected to reach an estimated market size of $450 million by 2025, and is expected to witness a robust Compound Annual Growth Rate (CAGR) of 6.8% during the forecast period of 2025-2033. This growth is primarily fueled by the increasing adoption of diagnostic imaging procedures across healthcare settings, driven by a rising global incidence of chronic diseases and an aging population that necessitates more frequent medical evaluations. The expanding healthcare infrastructure in emerging economies, coupled with advancements in ultrasound technology that enhance diagnostic accuracy, further bolsters market momentum. Furthermore, the growing emphasis on preventative healthcare measures and routine screening programs are contributing to a sustained demand for ultrasound procedures, and consequently, for high-quality conductivity gels.

The market segmentation reveals a dynamic landscape. Within applications, Hospitals and Clinics are anticipated to dominate due to their high volume of diagnostic and surgical procedures. Diagnostic Centers are also exhibiting substantial growth as specialized imaging facilities proliferate. In terms of product type, Non-Sterile Gels are expected to hold a larger market share, primarily due to their widespread use in routine diagnostic ultrasounds where sterility is less critical. However, Sterile Gels are projected to see a higher growth rate, driven by their increasing application in invasive procedures and surgical interventions, where infection control is paramount. Key players like Pharmaceutical Innovation, National Therapy Products, and DJO Global are actively investing in research and development to offer innovative gel formulations with improved acoustic properties and patient comfort, further shaping market dynamics. The market is also influenced by trends in eco-friendly and hypoallergenic gel formulations, catering to a growing segment of health-conscious consumers and healthcare providers.

Ultrasound Conductivity Gel Market Concentration & Innovation

The global Ultrasound Conductivity Gel market exhibits a moderately concentrated landscape, with key players like Pharmaceutical Innovation, National Therapy Products, and Eco-Med Diagnostic Imaging holding significant market share, estimated in the billions. Innovation is a critical differentiator, driven by the demand for enhanced patient comfort, superior image clarity, and sterile, hypoallergenic formulations. Regulatory frameworks, particularly stringent in North America and Europe, necessitate adherence to medical device standards, influencing product development and market entry strategies. Product substitutes, while limited in direct application, include alternative coupling agents and gel-free ultrasound transducers, posing a long-term competitive consideration. End-user trends highlight a growing preference for eco-friendly, water-based gels with extended shelf life and improved conductivity. Mergers and acquisitions (M&A) remain a strategic tool for market consolidation and expansion. For instance, recent M&A deals in the ultrasound consumables sector have collectively amounted to several hundred million dollars, indicating active industry consolidation. Pharmaceutical Innovation's acquisition of a specialized gel manufacturer for approximately $XX million exemplifies this trend, aiming to bolster its product portfolio and market reach.

- Market Share Dominance: Pharmaceutical Innovation, National Therapy Products, and Eco-Med Diagnostic Imaging collectively account for an estimated XX% of the global market share.

- M&A Deal Value: Recent M&A activities in the broader ultrasound consumables market have reached an estimated value of $XXX million.

- Innovation Focus Areas: Hypoallergenic formulations, sterile packaging, eco-friendly materials, and enhanced conductivity for superior imaging.

Ultrasound Conductivity Gel Industry Trends & Insights

The Ultrasound Conductivity Gel industry is poised for robust expansion, fueled by a confluence of accelerating technological advancements, a burgeoning global healthcare sector, and an increasing demand for diagnostic imaging procedures. The market is projected to experience a Compound Annual Growth Rate (CAGR) of approximately X.XX% during the forecast period of 2025–2033. This growth is underpinned by several key trends. Firstly, the escalating prevalence of chronic diseases and an aging global population are directly translating into a higher volume of medical diagnostic procedures, including ultrasounds, thereby driving demand for essential consumables like conductivity gels. Secondly, technological disruptions, such as the development of advanced ultrasound machines offering higher resolution and portability, are indirectly stimulating the market. These advanced systems necessitate high-performance conductivity gels to optimize image acquisition and signal transmission. Furthermore, evolving consumer preferences are playing a pivotal role. Patients and healthcare providers alike are increasingly seeking gels that are not only effective but also safe, comfortable, and environmentally sustainable. This has led to a surge in demand for water-based, paraben-free, and fragrance-free formulations. The competitive landscape is characterized by continuous product innovation and strategic partnerships aimed at capturing market share. Companies are investing heavily in research and development to create novel gel formulations that offer improved viscosity, thermal properties, and biocompatibility, addressing specific application needs in areas like cardiology, obstetrics, and surgical imaging. The market penetration of advanced ultrasound technologies, particularly in emerging economies, is expected to significantly contribute to market growth. Furthermore, the growing emphasis on preventative healthcare and early disease detection is spurring the adoption of diagnostic imaging services across a wider spectrum of the population. The increasing integration of AI and machine learning in ultrasound diagnostics may also indirectly influence gel requirements, emphasizing precision and reliability. The industry's resilience is further evidenced by its ability to navigate global health crises, as diagnostic imaging remains a critical component of healthcare delivery. The continuous improvement in manufacturing processes, leading to cost efficiencies and scalability, also supports market expansion. The projected market size by the end of the forecast period is expected to reach several billion dollars.

- CAGR Projection: The Ultrasound Conductivity Gel market is anticipated to grow at a CAGR of approximately X.XX% from 2025 to 2033.

- Market Penetration Drivers: Increasing adoption of advanced ultrasound technology, rising healthcare expenditure, and expanding diagnostic imaging services globally.

- Consumer Preferences: Demand for hypoallergenic, water-based, paraben-free, and eco-friendly ultrasound gels.

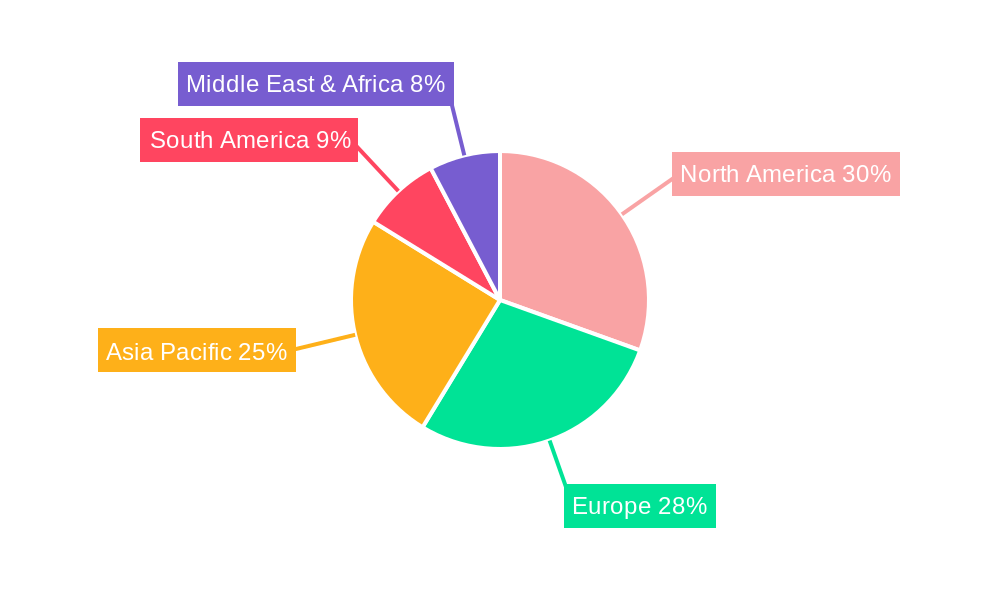

Dominant Markets & Segments in Ultrasound Conductivity Gel

The Ultrasound Conductivity Gel market is characterized by distinct regional dominance and segment leadership, driven by a complex interplay of economic, demographic, and healthcare infrastructure factors. North America, particularly the United States, currently holds the dominant position due to its highly developed healthcare system, extensive adoption of advanced medical technologies, and a significant patient pool. Economic policies that support healthcare infrastructure development and reimbursement frameworks for diagnostic imaging procedures further bolster this dominance. The country's robust research and development ecosystem also contributes to early adoption of innovative ultrasound gels.

Application Segments:

- Diagnostic Centers: This segment is a major contributor to market demand, driven by the routine use of ultrasound for a wide range of diagnostic purposes, from abdominal scans to obstetric examinations. The increasing number of diagnostic centers globally, coupled with advancements in ultrasound technology, fuels consistent demand for high-quality conductivity gels. Economic policies promoting accessible healthcare and early detection of diseases further amplify the growth in this segment.

- Clinics and Hospitals: These institutions represent a substantial market for ultrasound conductivity gels, accounting for a significant portion of the global volume. The high patient turnover and the diverse range of ultrasound applications, including therapeutic and diagnostic uses, necessitate a continuous supply of gels. Government investments in public healthcare infrastructure and the growing emphasis on hospital accreditation standards, which include the use of sterile and high-quality consumables, are key drivers.

- Surgical Centers: While a smaller segment compared to diagnostic centers and hospitals, surgical centers are crucial for specialized ultrasound applications during procedures like minimally invasive surgeries. The requirement for sterile, body-safe gels with excellent conductivity for intraoperative imaging is paramount. Economic incentives for outpatient surgical procedures and technological advancements in surgical navigation systems contribute to the growth of this segment.

- Other: This category encompasses niche applications such as veterinary medicine, physical therapy, and research laboratories. While individually smaller, the collective demand from these diverse areas adds to the overall market volume.

Type Segments:

- Sterile Gels: This segment commands a significant market share due to the stringent requirements for patient safety and infection control, especially in surgical and invasive diagnostic procedures. Regulatory mandates for sterile medical devices and the growing awareness of healthcare-associated infections are primary drivers. The robust reimbursement policies for sterile medical consumables further support this segment.

- Non-Sterile Gels: Non-sterile gels cater to a broader range of less critical applications where sterility is not an absolute prerequisite, such as routine diagnostic imaging in larger healthcare facilities or for home-use diagnostic devices. Cost-effectiveness is a key advantage of non-sterile gels, making them accessible for high-volume usage.

The market penetration of advanced ultrasound equipment in countries like Germany, Japan, and the UK further solidifies regional dominance. The commitment of these nations to cutting-edge healthcare solutions and their proactive approach to adopting medical innovations directly translate into a substantial demand for high-performance ultrasound conductivity gels.

Ultrasound Conductivity Gel Product Developments

Recent product developments in the Ultrasound Conductivity Gel market are centered on enhancing user experience and diagnostic accuracy. Companies are focusing on creating hypoallergenic, water-soluble formulations that minimize patient irritation and are easily cleaned post-procedure. Innovations include advanced formulations with superior acoustic properties, ensuring optimal sound wave transmission for clearer, more detailed imaging. The integration of antimicrobial agents in some sterile gels also addresses infection control concerns. Competitive advantages are being gained through extended shelf-life formulations, eco-friendly packaging, and the development of specialized gels for specific applications like cardiac or transvaginal ultrasounds, thereby catering to niche market demands and offering improved performance.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global Ultrasound Conductivity Gel market, covering the period from 2019 to 2033, with a base year of 2025. The market is segmented by application into Surgical Centers, Diagnostic Centers, Clinics and Hospitals, and Other.

- Surgical Centers: This segment, projected to grow at a CAGR of approximately X.XX%, is characterized by the demand for sterile, high-viscosity gels for intraoperative imaging. Market size is estimated at $XX million in 2025.

- Diagnostic Centers: As a leading segment, Diagnostic Centers are expected to witness a CAGR of X.XX%, driven by routine diagnostic imaging. The market size is estimated at $XXX million in 2025.

- Clinics and Hospitals: This substantial segment, with a projected CAGR of X.XX%, benefits from high patient volumes and diverse ultrasound applications. Market size is estimated at $XXX million in 2025.

- Other: This segment, encompassing niche applications, is projected to grow at a CAGR of X.XX%, contributing a market size of $XX million in 2025.

The report further segments the market by type into Non-Sterile Gels and Sterile Gels.

- Non-Sterile Gels: This segment, expected to grow at a CAGR of X.XX%, offers cost-effectiveness for high-volume use. Market size is estimated at $XXX million in 2025.

- Sterile Gels: With a projected CAGR of X.XX%, this segment's growth is driven by stringent infection control requirements. Market size is estimated at $XXX million in 2025.

Key Drivers of Ultrasound Conductivity Gel Growth

The growth of the Ultrasound Conductivity Gel market is propelled by several critical factors. The expanding global healthcare infrastructure, particularly in emerging economies, is leading to increased accessibility and utilization of diagnostic imaging services. A substantial rise in the prevalence of chronic diseases and an aging population directly translate to a higher demand for ultrasound procedures. Technological advancements in ultrasound equipment, offering enhanced resolution and portability, necessitate the use of high-performance conductivity gels to optimize image quality. Furthermore, stringent regulatory standards emphasizing patient safety and product efficacy are driving the demand for sterile, hypoallergenic, and biocompatible gels. Economic factors, including increased healthcare spending and favorable reimbursement policies for diagnostic imaging, also play a significant role in market expansion.

- Healthcare Infrastructure Development: Expansion of healthcare facilities globally.

- Demographic Shifts: Rising elderly population and increasing prevalence of chronic diseases.

- Technological Advancements: Evolution of ultrasound equipment for improved diagnostics.

- Regulatory Compliance: Demand for safe and effective medical consumables.

- Economic Support: Increased healthcare expenditure and favorable reimbursement policies.

Challenges in the Ultrasound Conductivity Gel Sector

Despite the promising growth trajectory, the Ultrasound Conductivity Gel sector faces several challenges. Intense competition from numerous established and emerging players exerts downward pressure on pricing, impacting profit margins. Regulatory hurdles, particularly varying standards across different regions, can complicate market entry and product approval processes. Fluctuations in the cost of raw materials, such as polymers and water, can affect manufacturing costs and, consequently, product pricing. The availability of counterfeit products poses a threat to brand reputation and patient safety. Lastly, evolving technological trends, such as the development of gel-free ultrasound technologies, could present a long-term disruptive challenge.

- Intense Competition: Numerous players leading to price wars.

- Regulatory Variations: Inconsistent standards across different geographical regions.

- Raw Material Price Volatility: Impact on manufacturing costs and product pricing.

- Counterfeit Products: Threat to brand integrity and patient safety.

- Emergence of Gel-Free Technologies: Potential long-term market disruption.

Emerging Opportunities in Ultrasound Conductivity Gel

The Ultrasound Conductivity Gel market presents numerous emerging opportunities for growth and innovation. The increasing demand for eco-friendly and sustainable products is driving the development of biodegradable gels and packaging solutions. The growing focus on personalized medicine is creating a niche for specialized gels tailored to specific patient needs and ultrasound applications. The expansion of telemedicine and remote diagnostic services opens avenues for the development of gels suitable for at-home diagnostic kits. Furthermore, advancements in material science are enabling the creation of gels with enhanced functionalities, such as self-warming properties or antimicrobial efficacy, offering a competitive edge. The untapped potential in emerging economies, with their rapidly developing healthcare sectors, also represents a significant growth opportunity.

- Sustainable Formulations: Development of eco-friendly and biodegradable ultrasound gels.

- Personalized Medicine: Tailored gels for specific patient needs and applications.

- Telemedicine Integration: Gels for at-home diagnostic kits and remote services.

- Functional Enhancements: Development of gels with advanced properties like self-warming or antimicrobial capabilities.

- Emerging Market Expansion: Tapping into developing healthcare sectors for increased adoption.

Leading Players in the Ultrasound Conductivity Gel Market

- Pharmaceutical Innovation

- National Therapy Products

- Eco-Med Diagnostic Imaging

- DJO Global

- Roscoe Medical

Key Developments in Ultrasound Conductivity Gel Industry

- 2024/01: Pharmaceutical Innovation launched a new line of sterile, hypoallergenic ultrasound gels in sustainable packaging, addressing growing environmental concerns and patient comfort.

- 2023/07: National Therapy Products announced a strategic partnership with a leading diagnostic imaging equipment manufacturer to co-develop gel formulations optimized for advanced ultrasound systems.

- 2023/03: Eco-Med Diagnostic Imaging expanded its manufacturing capacity by XX% to meet the surging demand for its eco-friendly ultrasound gels in the Asian market.

- 2022/11: DJO Global acquired a specialized ultrasound consumables company for an undisclosed sum, aiming to strengthen its product portfolio in the diagnostic imaging sector.

- 2022/05: Roscoe Medical introduced an innovative, long-shelf-life sterile ultrasound gel, addressing supply chain challenges and reducing waste for healthcare providers.

Strategic Outlook for Ultrasound Conductivity Gel Market

The strategic outlook for the Ultrasound Conductivity Gel market remains highly positive, driven by sustained global demand for diagnostic imaging. Key growth catalysts include continued advancements in ultrasound technology that necessitate high-performance gels, an increasing focus on patient comfort and safety promoting hypoallergenic and sterile formulations, and the growing emphasis on sustainability encouraging the adoption of eco-friendly products. Healthcare infrastructure development in emerging economies offers significant untapped potential. Companies that prioritize innovation, strategic partnerships, and a focus on meeting evolving regulatory and consumer demands are well-positioned to capitalize on the market's robust growth prospects and achieve long-term success. The market's resilience, coupled with ongoing technological integration, ensures a dynamic and promising future.

Ultrasound Conductivity Gel Segmentation

-

1. Application

- 1.1. Surgical Centers

- 1.2. Diagnostic Centers

- 1.3. Clinics and Hospitals

- 1.4. Other

-

2. Type

- 2.1. Non Sterile Gels

- 2.2. Sterile Gels

Ultrasound Conductivity Gel Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Ultrasound Conductivity Gel REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ultrasound Conductivity Gel Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Surgical Centers

- 5.1.2. Diagnostic Centers

- 5.1.3. Clinics and Hospitals

- 5.1.4. Other

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Non Sterile Gels

- 5.2.2. Sterile Gels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Ultrasound Conductivity Gel Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Surgical Centers

- 6.1.2. Diagnostic Centers

- 6.1.3. Clinics and Hospitals

- 6.1.4. Other

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Non Sterile Gels

- 6.2.2. Sterile Gels

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Ultrasound Conductivity Gel Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Surgical Centers

- 7.1.2. Diagnostic Centers

- 7.1.3. Clinics and Hospitals

- 7.1.4. Other

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Non Sterile Gels

- 7.2.2. Sterile Gels

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Ultrasound Conductivity Gel Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Surgical Centers

- 8.1.2. Diagnostic Centers

- 8.1.3. Clinics and Hospitals

- 8.1.4. Other

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Non Sterile Gels

- 8.2.2. Sterile Gels

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Ultrasound Conductivity Gel Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Surgical Centers

- 9.1.2. Diagnostic Centers

- 9.1.3. Clinics and Hospitals

- 9.1.4. Other

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Non Sterile Gels

- 9.2.2. Sterile Gels

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Ultrasound Conductivity Gel Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Surgical Centers

- 10.1.2. Diagnostic Centers

- 10.1.3. Clinics and Hospitals

- 10.1.4. Other

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Non Sterile Gels

- 10.2.2. Sterile Gels

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Pharmaceutical Innovation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 National Therapy Products

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Eco-Med Diagnostic Imaging

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DJO Global

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Roscoe Medical

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 Pharmaceutical Innovation

List of Figures

- Figure 1: Global Ultrasound Conductivity Gel Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Ultrasound Conductivity Gel Revenue (million), by Application 2024 & 2032

- Figure 3: North America Ultrasound Conductivity Gel Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Ultrasound Conductivity Gel Revenue (million), by Type 2024 & 2032

- Figure 5: North America Ultrasound Conductivity Gel Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Ultrasound Conductivity Gel Revenue (million), by Country 2024 & 2032

- Figure 7: North America Ultrasound Conductivity Gel Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Ultrasound Conductivity Gel Revenue (million), by Application 2024 & 2032

- Figure 9: South America Ultrasound Conductivity Gel Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Ultrasound Conductivity Gel Revenue (million), by Type 2024 & 2032

- Figure 11: South America Ultrasound Conductivity Gel Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Ultrasound Conductivity Gel Revenue (million), by Country 2024 & 2032

- Figure 13: South America Ultrasound Conductivity Gel Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Ultrasound Conductivity Gel Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Ultrasound Conductivity Gel Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Ultrasound Conductivity Gel Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Ultrasound Conductivity Gel Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Ultrasound Conductivity Gel Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Ultrasound Conductivity Gel Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Ultrasound Conductivity Gel Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Ultrasound Conductivity Gel Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Ultrasound Conductivity Gel Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Ultrasound Conductivity Gel Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Ultrasound Conductivity Gel Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Ultrasound Conductivity Gel Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Ultrasound Conductivity Gel Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Ultrasound Conductivity Gel Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Ultrasound Conductivity Gel Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Ultrasound Conductivity Gel Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Ultrasound Conductivity Gel Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Ultrasound Conductivity Gel Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Ultrasound Conductivity Gel Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Ultrasound Conductivity Gel Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Ultrasound Conductivity Gel Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Ultrasound Conductivity Gel Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Ultrasound Conductivity Gel Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Ultrasound Conductivity Gel Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Ultrasound Conductivity Gel Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Ultrasound Conductivity Gel Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Ultrasound Conductivity Gel Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Ultrasound Conductivity Gel Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Ultrasound Conductivity Gel Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Ultrasound Conductivity Gel Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Ultrasound Conductivity Gel Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Ultrasound Conductivity Gel Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Ultrasound Conductivity Gel Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Ultrasound Conductivity Gel Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Ultrasound Conductivity Gel Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Ultrasound Conductivity Gel Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Ultrasound Conductivity Gel Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Ultrasound Conductivity Gel Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Ultrasound Conductivity Gel Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Ultrasound Conductivity Gel Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Ultrasound Conductivity Gel Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Ultrasound Conductivity Gel Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Ultrasound Conductivity Gel Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Ultrasound Conductivity Gel Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Ultrasound Conductivity Gel Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Ultrasound Conductivity Gel Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Ultrasound Conductivity Gel Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Ultrasound Conductivity Gel Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Ultrasound Conductivity Gel Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Ultrasound Conductivity Gel Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Ultrasound Conductivity Gel Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Ultrasound Conductivity Gel Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Ultrasound Conductivity Gel Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Ultrasound Conductivity Gel Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Ultrasound Conductivity Gel Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Ultrasound Conductivity Gel Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Ultrasound Conductivity Gel Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Ultrasound Conductivity Gel Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Ultrasound Conductivity Gel Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Ultrasound Conductivity Gel Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Ultrasound Conductivity Gel Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Ultrasound Conductivity Gel Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Ultrasound Conductivity Gel Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Ultrasound Conductivity Gel Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Ultrasound Conductivity Gel Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ultrasound Conductivity Gel?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Ultrasound Conductivity Gel?

Key companies in the market include Pharmaceutical Innovation, National Therapy Products, Eco-Med Diagnostic Imaging, DJO Global, Roscoe Medical.

3. What are the main segments of the Ultrasound Conductivity Gel?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ultrasound Conductivity Gel," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ultrasound Conductivity Gel report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ultrasound Conductivity Gel?

To stay informed about further developments, trends, and reports in the Ultrasound Conductivity Gel, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence