Key Insights

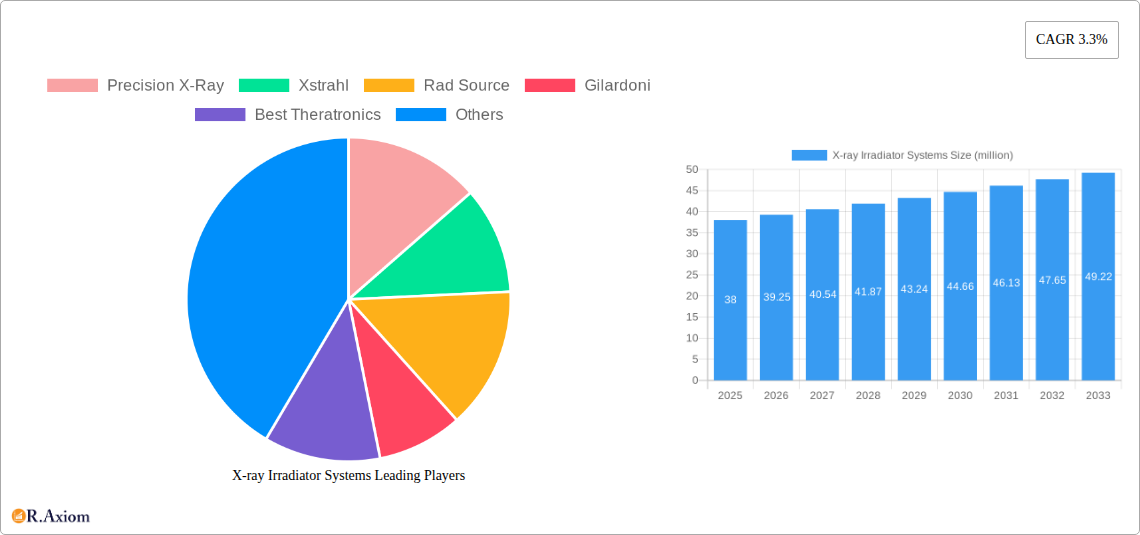

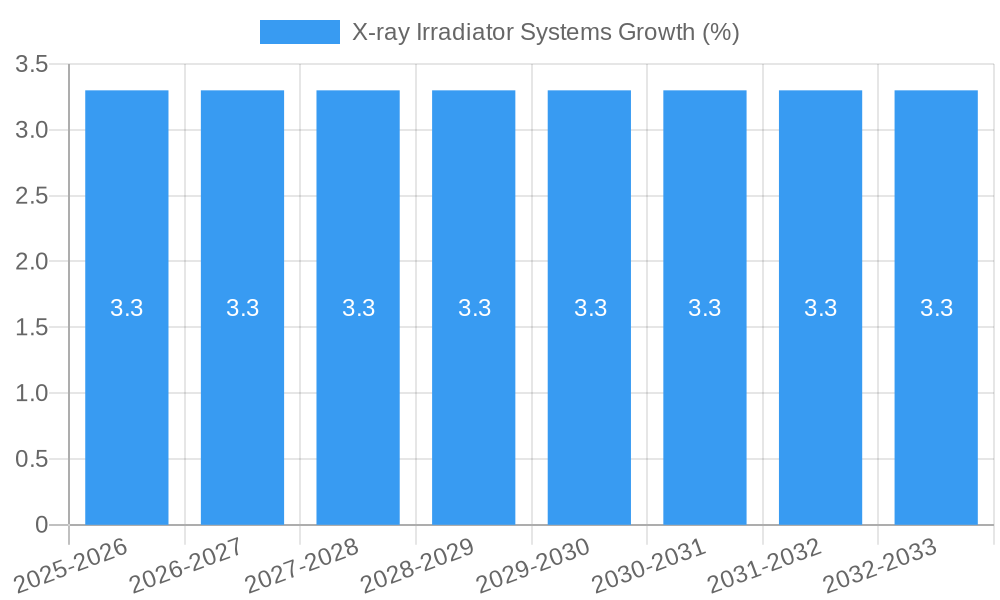

The global X-ray Irradiator Systems market is projected to witness robust growth, reaching an estimated market size of $38 million in 2025 and expanding at a Compound Annual Growth Rate (CAGR) of 3.3% through 2033. This expansion is fueled by a confluence of factors, primarily driven by the increasing demand for advanced sterilization and irradiation solutions across critical sectors. In the healthcare industry, X-ray irradiation plays a pivotal role in blood irradiation for preventing transfusion-associated graft-versus-host disease (TA-GvHD) and in sterilizing medical devices, a need amplified by heightened awareness of infection control protocols. Furthermore, the material irradiation segment is gaining traction, with applications in enhancing material properties for various industries. The animal irradiation segment, though nascent, shows promising growth potential for veterinary applications. These diverse applications underscore the versatility and indispensable nature of X-ray irradiator systems in modern scientific and industrial landscapes.

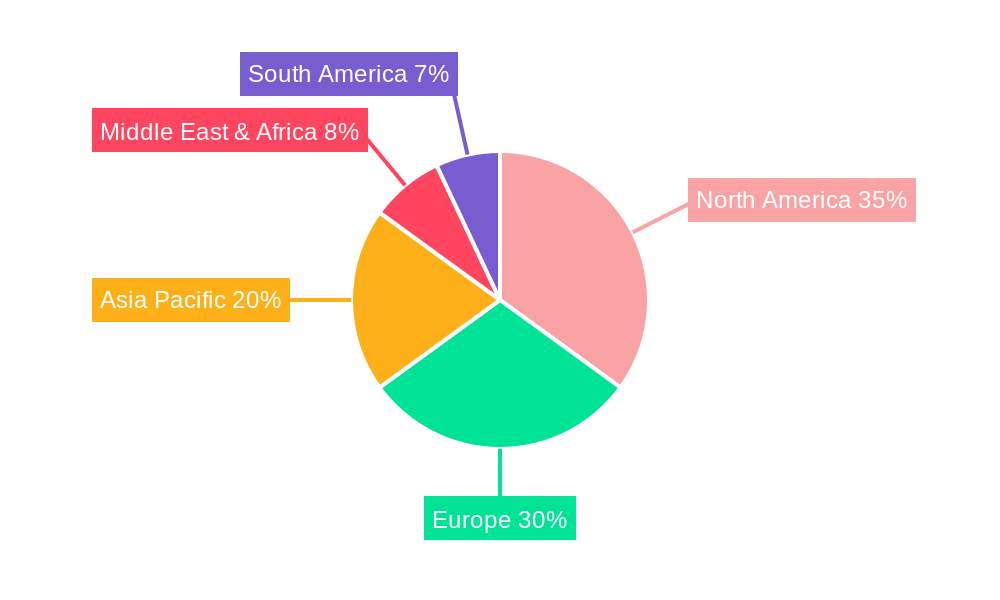

The market's trajectory is shaped by key trends and a few discernible restraints. Emerging trends include the development of more compact, energy-efficient, and precisely controlled X-ray irradiator systems, particularly in the image-guided X-ray irradiators segment, which offers enhanced accuracy for targeted irradiation. Advancements in diagnostic imaging integrated with irradiation technology are also paving the way for more sophisticated treatment modalities. Geographically, North America and Europe are anticipated to dominate the market due to established healthcare infrastructure, high adoption rates of advanced medical technologies, and stringent regulatory standards favoring sterile and safe medical products. However, the high initial capital investment and the need for specialized technical expertise to operate and maintain these systems can pose a challenge to widespread adoption, especially in emerging economies. Nevertheless, the overarching demand for reliable and effective irradiation solutions is expected to overcome these hurdles, driving sustained market expansion.

This comprehensive report, "X-ray Irradiator Systems: Market Dynamics, Forecast, and Competitive Landscape (2019–2033)," offers an in-depth analysis of the global X-ray irradiator systems market. The study covers the historical period from 2019 to 2024, with a base year of 2025 and an estimated year of 2025, projecting growth through 2033. This report is an essential resource for industry stakeholders seeking to understand market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities. It provides actionable insights into industry trends, dominant markets and segments, product developments, key growth drivers, challenges, and emerging opportunities. The report also includes a detailed competitive landscape with profiles of leading players and key industry developments.

X-ray Irradiator Systems Market Concentration & Innovation

The X-ray irradiator systems market exhibits moderate to high concentration, with several prominent players like Precision X-Ray, Xstrahl, and Rad Source holding significant market share, estimated in the range of 15-25 million for leading entities. Innovation remains a key differentiator, driven by advancements in imaging technologies, dose control, and automation. Regulatory frameworks, particularly for blood and animal irradiation applications, play a crucial role in shaping market entry and product development, demanding adherence to strict safety and efficacy standards. Product substitutes, such as gamma irradiation systems, pose a competitive challenge, though X-ray systems offer advantages in terms of flexibility and footprint. End-user trends are leaning towards more compact, user-friendly, and versatile systems. Merger and acquisition (M&A) activities are anticipated to increase as companies seek to expand their product portfolios and geographical reach, with estimated M&A deal values ranging from 50-100 million.

- Key Innovation Drivers:

- Development of image-guided systems for precise targeting.

- Enhanced dose uniformity and reproducibility.

- Increased automation and remote operation capabilities.

- Miniaturization and improved energy efficiency.

- Regulatory Landscape:

- FDA approvals for medical applications.

- ISO certifications for safety and quality.

- Country-specific radiation safety regulations.

- M&A Activity:

- Consolidation to gain market share.

- Acquisitions to integrate new technologies.

- Partnerships for market penetration.

X-ray Irradiator Systems Industry Trends & Insights

The global X-ray irradiator systems market is projected to experience robust growth, driven by increasing demand for sterilization and irradiation in healthcare, research, and industrial applications. The estimated Compound Annual Growth Rate (CAGR) for the forecast period 2025–2033 is anticipated to be between 6% and 8%, translating to a market size projected to exceed 1,500 million by 2033. Technological disruptions, particularly in the development of image-guided X-ray irradiators, are revolutionizing applications such as blood irradiation, where precise targeting minimizes damage to sensitive components. Cabinet X-ray irradiators are gaining traction due to their safety features and suitability for laboratory and industrial use. Consumer preferences are shifting towards systems that offer enhanced safety, ease of use, and lower operating costs. Competitive dynamics are characterized by a mix of established players and emerging innovators, with a growing emphasis on after-sales service and technical support. Market penetration is expected to increase across both developed and developing economies as awareness of irradiation benefits grows.

- Market Growth Drivers:

- Rising incidence of infectious diseases necessitating blood irradiation.

- Expanding research in material science and life sciences requiring irradiation.

- Increasing adoption of X-ray irradiation for sterilization in pharmaceutical and food industries.

- Technological advancements leading to more efficient and safer systems.

- Technological Disruptions:

- Integration of AI for optimized dose delivery.

- Development of compact and mobile X-ray irradiator units.

- Advancements in detector technology for real-time monitoring.

- Consumer Preferences:

- Demand for energy-efficient and eco-friendly solutions.

- Preference for automated and user-friendly interfaces.

- Focus on systems with robust safety interlocks and monitoring.

- Competitive Dynamics:

- Intense competition among key manufacturers.

- Strategic collaborations and partnerships to enhance market reach.

- Increasing focus on differentiation through specialized features.

Dominant Markets & Segments in X-ray Irradiator Systems

North America currently dominates the X-ray irradiator systems market, driven by strong healthcare infrastructure, substantial research and development investments, and stringent regulatory requirements that favor advanced irradiation technologies. The United States, in particular, is a key market due to the high volume of blood transfusions and the extensive use of irradiation in medical device sterilization and life science research. The increasing prevalence of cancer and the associated need for radiotherapy further bolsters the market. Economically, the region benefits from a robust healthcare budget and a proactive approach to adopting innovative medical technologies.

In terms of applications, Blood Irradiation is a dominant segment. The critical need to prevent transfusion-associated graft-versus-host disease (TA-GvHD) in immunocompromised patients fuels the demand for precise and reliable blood irradiation systems. Hospitals and blood banks are major adopters, investing in systems that ensure the inactivation of lymphocytes without compromising the quality of blood products. Factors such as increased blood donation rates and the rising number of organ transplant procedures contribute to the sustained growth of this segment, with market penetration expected to reach over 75% in developed nations by 2030.

Among the types, Image Guided X-ray Irradiators are witnessing significant growth. These systems offer enhanced precision and control, allowing for targeted irradiation of specific biological samples or materials. This is particularly crucial in research applications, where precise dose delivery can significantly impact experimental outcomes. The integration of advanced imaging technologies, such as CT or MRI, with X-ray irradiators enables real-time monitoring and adjustment of irradiation parameters, minimizing collateral damage and maximizing therapeutic or sterilization efficacy. This segment is projected to account for approximately 40-50% of the total market revenue by 2033.

- Leading Region: North America

- Economic Policies: Favorable reimbursement policies for irradiation procedures in healthcare.

- Infrastructure: Well-developed healthcare and research infrastructure.

- Regulatory Frameworks: Stringent quality and safety standards driving adoption of advanced systems.

- Key Markets: United States, Canada.

- Dominant Application: Blood Irradiation

- Key Drivers: Prevention of TA-GvHD, increasing demand for sterile blood products, growing transplant procedures.

- Market Size: Estimated to contribute over 600 million in 2025.

- Growth Projections: Expected to grow at a CAGR of 7-9% through 2033.

- Dominant Type: Image Guided X-ray Irradiators

- Key Drivers: Precision targeting, advanced visualization capabilities, suitability for complex research and therapeutic applications.

- Market Share: Projected to capture 40-50% of the market by 2033.

- Technological Advancements: Integration with advanced imaging modalities.

X-ray Irradiator Systems Product Developments

Product innovation in X-ray irradiator systems is centered on enhancing safety, precision, and user experience. Manufacturers are increasingly incorporating advanced imaging capabilities, such as real-time dose monitoring and feedback systems, to ensure accurate and reproducible irradiation. Development of more compact and energy-efficient cabinet X-ray irradiators is also a key trend, making these systems more accessible for laboratory and industrial settings. Competitive advantages are being gained through improved software interfaces, remote diagnostics, and modular designs that allow for system customization. These developments cater to the growing demand for versatile and reliable irradiation solutions across blood irradiation, material irradiation, and animal irradiation applications.

Report Scope & Segmentation Analysis

This report segments the X-ray irradiator systems market based on Application and Type. The Application segments include Blood Irradiation, Material Irradiation, and Animal Irradiation. The Type segments encompass Image Guided X-ray Irradiators and Cabinet X-ray Irradiators. Each segment is analyzed for its market size, growth projections, and competitive dynamics during the study period.

- Blood Irradiation: This segment focuses on systems used for preventing transfusion-associated graft-versus-host disease (TA-GvHD). Market size is projected to reach over 700 million by 2033, with a CAGR of approximately 7-9%.

- Material Irradiation: This segment covers applications in sterilization, cross-linking, and modification of various materials. Expected market size by 2033 is around 400 million, with a CAGR of 5-7%.

- Animal Irradiation: This segment involves irradiation for research purposes and veterinary medicine. Market size is projected to be over 200 million by 2033, with a CAGR of 4-6%.

- Image Guided X-ray Irradiators: This segment highlights advanced systems with integrated imaging for precision. Market size is estimated to reach over 650 million by 2033, with a CAGR of 7-9%.

- Cabinet X-ray Irradiators: This segment focuses on self-contained, shielded systems. Market size is projected to be around 550 million by 2033, with a CAGR of 5-7%.

Key Drivers of X-ray Irradiator Systems Growth

The growth of the X-ray irradiator systems market is propelled by several interconnected factors. Technologically, advancements in digital imaging and automation are leading to more precise and efficient irradiation processes. The increasing global focus on patient safety in healthcare, particularly concerning blood transfusions, drives demand for effective irradiation solutions. Regulatory bodies worldwide are emphasizing the need for sterilization and inactivation of pathogens, further bolstering the adoption of X-ray irradiation technology. Economically, increasing healthcare expenditures and investments in research and development across life sciences and material sciences are contributing to market expansion. The growing awareness of the benefits of X-ray irradiation in various industries, from medical to manufacturing, is also a significant growth catalyst.

Challenges in the X-ray Irradiator Systems Sector

Despite the positive growth trajectory, the X-ray irradiator systems sector faces certain challenges. Stringent regulatory approval processes for medical devices can lead to extended product development timelines and increased costs. High initial capital investment for advanced X-ray irradiator systems can be a barrier, especially for smaller research institutions or healthcare facilities in developing economies. Furthermore, the availability of alternative irradiation technologies, such as gamma irradiation, presents a competitive challenge, requiring X-ray irradiator manufacturers to continually demonstrate superior value propositions. Supply chain disruptions and the sourcing of specialized components can also impact production and delivery schedules, potentially affecting market growth.

Emerging Opportunities in X-ray Irradiator Systems

Emerging opportunities in the X-ray irradiator systems market lie in the development of more portable and cost-effective solutions, particularly for low-resource settings and point-of-care applications. The expansion of material irradiation applications, such as in the semiconductor industry and advanced manufacturing, presents a significant growth avenue. Furthermore, the increasing use of X-ray irradiation in research for drug discovery, genomics, and cell therapy offers substantial potential. The integration of artificial intelligence (AI) and machine learning for optimizing irradiation parameters and predicting outcomes represents a key technological frontier. Growing interest in non-thermal sterilization methods for sensitive materials also opens new market possibilities.

Leading Players in the X-ray Irradiator Systems Market

- Precision X-Ray

- Xstrahl

- Rad Source

- Gilardoni

- Best Theratronics

- Kimtron

- Hopewell Designs

- FUJIFILM Healthcare

- KUBTEC Scientific

- Aolong Group

- Zhuhai Livzon Diagnostics

- Dandong Tongda

Key Developments in X-ray Irradiator Systems Industry

- 2023: Launch of next-generation image-guided X-ray irradiators with enhanced dose accuracy by Precision X-Ray.

- 2022: Xstrahl announces strategic partnership to expand its presence in the Asian market.

- 2021: Rad Source introduces a new compact cabinet X-ray irradiator for laboratory research.

- 2020: Gilardoni receives regulatory approval for its advanced blood irradiation system in Europe.

- 2019: Best Theratronics unveils a novel automated system for animal irradiation studies.

Strategic Outlook for X-ray Irradiator Systems Market

- 2023: Launch of next-generation image-guided X-ray irradiators with enhanced dose accuracy by Precision X-Ray.

- 2022: Xstrahl announces strategic partnership to expand its presence in the Asian market.

- 2021: Rad Source introduces a new compact cabinet X-ray irradiator for laboratory research.

- 2020: Gilardoni receives regulatory approval for its advanced blood irradiation system in Europe.

- 2019: Best Theratronics unveils a novel automated system for animal irradiation studies.

Strategic Outlook for X-ray Irradiator Systems Market

The strategic outlook for the X-ray irradiator systems market remains highly positive, fueled by sustained demand from the healthcare sector for blood irradiation and sterilization, coupled with growing applications in materials science and research. Continuous technological innovation, particularly in image guidance and automation, will be crucial for maintaining a competitive edge. Strategic collaborations, market expansion into emerging economies, and a focus on providing comprehensive after-sales support will be key growth catalysts. The market is poised for significant expansion as these advanced irradiation technologies become more accessible and indispensable across a wider array of applications.

X-ray Irradiator Systems Segmentation

-

1. Application

- 1.1. Blood Irradiation

- 1.2. Material Irradiation

- 1.3. Animal Irradiation

-

2. Types

- 2.1. Image Guided X-ray Irradiators

- 2.2. Cabinet X-ray Irradiators

X-ray Irradiator Systems Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

X-ray Irradiator Systems REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.3% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global X-ray Irradiator Systems Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Blood Irradiation

- 5.1.2. Material Irradiation

- 5.1.3. Animal Irradiation

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Image Guided X-ray Irradiators

- 5.2.2. Cabinet X-ray Irradiators

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America X-ray Irradiator Systems Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Blood Irradiation

- 6.1.2. Material Irradiation

- 6.1.3. Animal Irradiation

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Image Guided X-ray Irradiators

- 6.2.2. Cabinet X-ray Irradiators

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America X-ray Irradiator Systems Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Blood Irradiation

- 7.1.2. Material Irradiation

- 7.1.3. Animal Irradiation

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Image Guided X-ray Irradiators

- 7.2.2. Cabinet X-ray Irradiators

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe X-ray Irradiator Systems Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Blood Irradiation

- 8.1.2. Material Irradiation

- 8.1.3. Animal Irradiation

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Image Guided X-ray Irradiators

- 8.2.2. Cabinet X-ray Irradiators

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa X-ray Irradiator Systems Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Blood Irradiation

- 9.1.2. Material Irradiation

- 9.1.3. Animal Irradiation

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Image Guided X-ray Irradiators

- 9.2.2. Cabinet X-ray Irradiators

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific X-ray Irradiator Systems Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Blood Irradiation

- 10.1.2. Material Irradiation

- 10.1.3. Animal Irradiation

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Image Guided X-ray Irradiators

- 10.2.2. Cabinet X-ray Irradiators

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Precision X-Ray

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Xstrahl

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Rad Source

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Gilardoni

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Best Theratronics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kimtron

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hopewell Designs

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 FUJIFILM Healthcare

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 KUBTEC Scientific

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Aolong Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Zhuhai Livzon Diagnostics

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Dandong Tongda

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Precision X-Ray

List of Figures

- Figure 1: Global X-ray Irradiator Systems Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America X-ray Irradiator Systems Revenue (million), by Application 2024 & 2032

- Figure 3: North America X-ray Irradiator Systems Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America X-ray Irradiator Systems Revenue (million), by Types 2024 & 2032

- Figure 5: North America X-ray Irradiator Systems Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America X-ray Irradiator Systems Revenue (million), by Country 2024 & 2032

- Figure 7: North America X-ray Irradiator Systems Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America X-ray Irradiator Systems Revenue (million), by Application 2024 & 2032

- Figure 9: South America X-ray Irradiator Systems Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America X-ray Irradiator Systems Revenue (million), by Types 2024 & 2032

- Figure 11: South America X-ray Irradiator Systems Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America X-ray Irradiator Systems Revenue (million), by Country 2024 & 2032

- Figure 13: South America X-ray Irradiator Systems Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe X-ray Irradiator Systems Revenue (million), by Application 2024 & 2032

- Figure 15: Europe X-ray Irradiator Systems Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe X-ray Irradiator Systems Revenue (million), by Types 2024 & 2032

- Figure 17: Europe X-ray Irradiator Systems Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe X-ray Irradiator Systems Revenue (million), by Country 2024 & 2032

- Figure 19: Europe X-ray Irradiator Systems Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa X-ray Irradiator Systems Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa X-ray Irradiator Systems Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa X-ray Irradiator Systems Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa X-ray Irradiator Systems Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa X-ray Irradiator Systems Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa X-ray Irradiator Systems Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific X-ray Irradiator Systems Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific X-ray Irradiator Systems Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific X-ray Irradiator Systems Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific X-ray Irradiator Systems Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific X-ray Irradiator Systems Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific X-ray Irradiator Systems Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global X-ray Irradiator Systems Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global X-ray Irradiator Systems Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global X-ray Irradiator Systems Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global X-ray Irradiator Systems Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global X-ray Irradiator Systems Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global X-ray Irradiator Systems Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global X-ray Irradiator Systems Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States X-ray Irradiator Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada X-ray Irradiator Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico X-ray Irradiator Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global X-ray Irradiator Systems Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global X-ray Irradiator Systems Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global X-ray Irradiator Systems Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil X-ray Irradiator Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina X-ray Irradiator Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America X-ray Irradiator Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global X-ray Irradiator Systems Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global X-ray Irradiator Systems Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global X-ray Irradiator Systems Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom X-ray Irradiator Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany X-ray Irradiator Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France X-ray Irradiator Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy X-ray Irradiator Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain X-ray Irradiator Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia X-ray Irradiator Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux X-ray Irradiator Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics X-ray Irradiator Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe X-ray Irradiator Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global X-ray Irradiator Systems Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global X-ray Irradiator Systems Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global X-ray Irradiator Systems Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey X-ray Irradiator Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel X-ray Irradiator Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC X-ray Irradiator Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa X-ray Irradiator Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa X-ray Irradiator Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa X-ray Irradiator Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global X-ray Irradiator Systems Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global X-ray Irradiator Systems Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global X-ray Irradiator Systems Revenue million Forecast, by Country 2019 & 2032

- Table 41: China X-ray Irradiator Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India X-ray Irradiator Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan X-ray Irradiator Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea X-ray Irradiator Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN X-ray Irradiator Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania X-ray Irradiator Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific X-ray Irradiator Systems Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the X-ray Irradiator Systems?

The projected CAGR is approximately 3.3%.

2. Which companies are prominent players in the X-ray Irradiator Systems?

Key companies in the market include Precision X-Ray, Xstrahl, Rad Source, Gilardoni, Best Theratronics, Kimtron, Hopewell Designs, FUJIFILM Healthcare, KUBTEC Scientific, Aolong Group, Zhuhai Livzon Diagnostics, Dandong Tongda.

3. What are the main segments of the X-ray Irradiator Systems?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 38 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "X-ray Irradiator Systems," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the X-ray Irradiator Systems report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the X-ray Irradiator Systems?

To stay informed about further developments, trends, and reports in the X-ray Irradiator Systems, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence