Key Insights

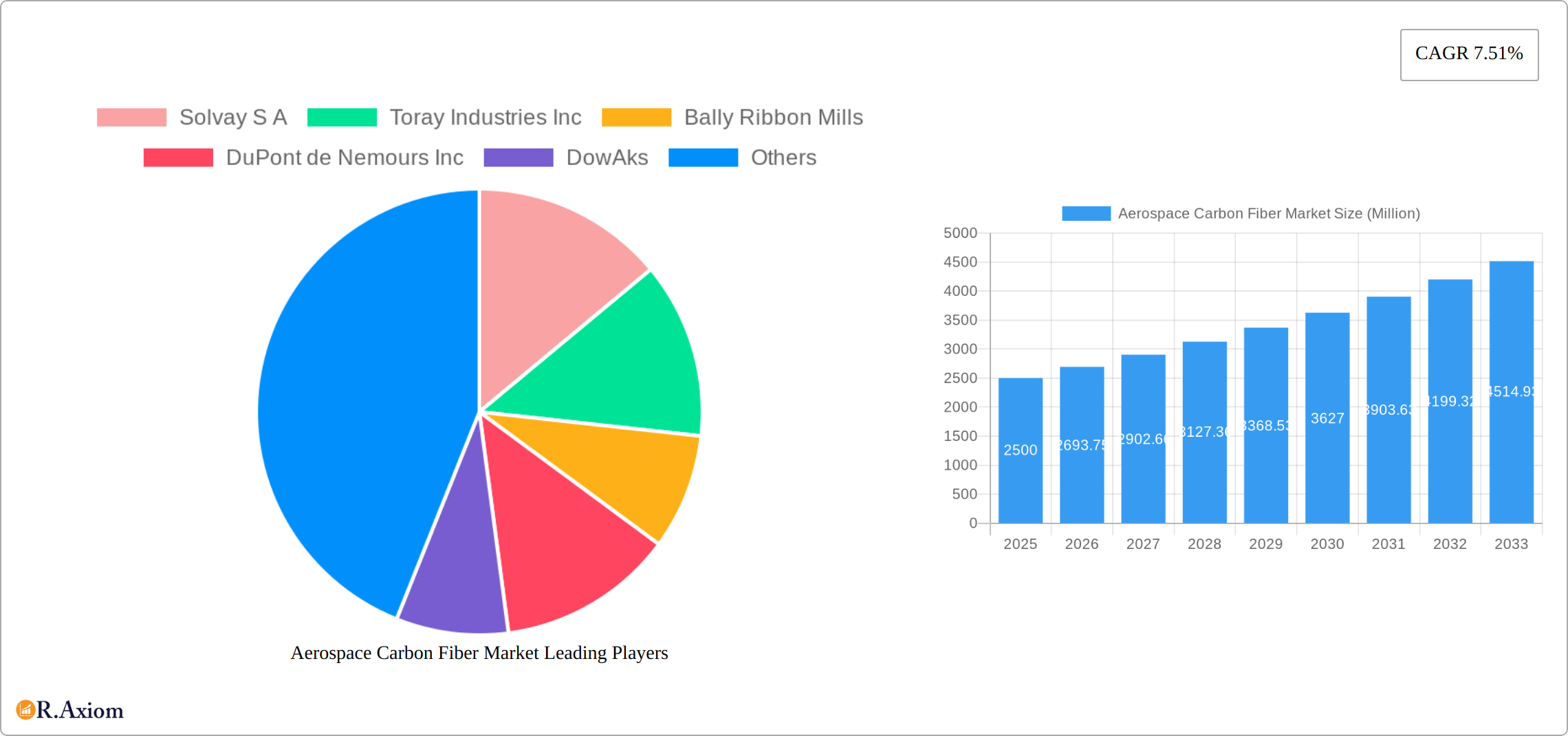

The Aerospace Carbon Fiber Market is experiencing robust growth, driven by the increasing demand for lightweight yet high-strength materials in aircraft manufacturing. The market, valued at approximately $XX million in 2025 (assuming a logical extrapolation based on the provided CAGR and market size), is projected to witness a Compound Annual Growth Rate (CAGR) of 7.51% from 2025 to 2033. This expansion is fueled by several key factors. The rising adoption of carbon fiber reinforced polymers (CFRP) in commercial fixed-wing aircraft, military fixed-wing aircraft, and rotorcraft is a primary driver. The inherent advantages of CFRP, including superior strength-to-weight ratio, enhanced fuel efficiency, and improved aerodynamic performance, are compelling airlines and defense contractors to integrate this material into new aircraft designs and retrofit existing fleets. Furthermore, ongoing technological advancements in carbon fiber production, leading to lower costs and improved material properties, are contributing to market expansion. While challenges remain, such as the relatively high initial cost of carbon fiber compared to traditional materials and the need for specialized manufacturing processes, the long-term benefits in terms of fuel savings and performance improvements are expected to outweigh these limitations, further propelling market growth.

Significant regional variations exist within the aerospace carbon fiber market. North America and Europe currently hold a substantial market share, driven by a strong presence of established aerospace manufacturers and a robust research and development ecosystem. However, the Asia-Pacific region is anticipated to experience the fastest growth during the forecast period, propelled by the rapid expansion of the aviation industry in countries like China and India. The competitive landscape is characterized by both established players like Solvay S.A., Toray Industries Inc., and Hexcel Corporation, and emerging companies vying for market share. These companies are focused on innovation, strategic partnerships, and geographic expansion to cater to the growing demand for high-performance carbon fiber materials in the aerospace sector. The market segmentation by aircraft type (Commercial Fixed-wing, Military Fixed-wing, Rotorcraft) reflects the diverse applications and varying demand levels across these sectors.

This detailed report provides a comprehensive analysis of the Aerospace Carbon Fiber Market, covering the period from 2019 to 2033. It offers actionable insights into market dynamics, growth drivers, challenges, and opportunities, equipping stakeholders with the knowledge necessary to navigate this rapidly evolving landscape. The report features detailed segmentation analysis, competitive landscape assessment, and projections for future market growth, encompassing both historical data (2019-2024) and future forecasts (2025-2033), with 2025 serving as the base year and estimated year. The market size is projected to reach xx Million by 2033.

Aerospace Carbon Fiber Market Concentration & Innovation

The Aerospace Carbon Fiber market exhibits a moderately concentrated structure, with a few major players holding significant market share. Companies like Solvay S.A., Toray Industries Inc., and Hexcel Corporation dominate the landscape, leveraging their extensive R&D capabilities and established supply chains. However, the market also includes several smaller players who are focusing on niche applications and specialized products. The overall market share of the top 5 players is estimated at xx%, while the remaining market share is distributed among several smaller companies. Mergers and acquisitions (M&A) activity has been moderate in recent years, with deal values averaging approximately xx Million per transaction. This activity reflects the increasing consolidation within the industry as companies seek to expand their product portfolios and market reach. Innovation is a key driver, with ongoing research focusing on developing lighter, stronger, and more cost-effective carbon fiber materials. Stringent regulatory frameworks related to aviation safety influence material selection and testing procedures, while the emergence of advanced materials and manufacturing processes continually presents both opportunities and challenges. The increasing adoption of lightweight materials in aerospace applications is a major driver of market growth.

- Market Concentration: Top 5 players hold xx% market share.

- M&A Activity: Average deal value: xx Million.

- Innovation Drivers: Lightweighting, improved strength, cost reduction.

- Regulatory Frameworks: Stringent safety standards influence material selection.

- Product Substitutes: Limited direct substitutes, but competition from alternative composite materials exists.

- End-User Trends: Increasing demand for fuel-efficient aircraft drives adoption of carbon fiber.

Aerospace Carbon Fiber Market Industry Trends & Insights

The Aerospace Carbon Fiber market is experiencing robust growth, driven by the increasing demand for lightweight and high-strength materials in aerospace applications. The market's Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%. This growth is fueled by several key factors, including the rising adoption of advanced composite materials in commercial and military aircraft, the increasing production of new aircraft, and the ongoing technological advancements leading to improved material properties and manufacturing processes. Technological advancements such as the development of high-strength carbon fibers are enhancing the properties of the materials, further increasing their applicability in the aerospace industry. Consumer preferences are shifting towards fuel-efficient and environmentally friendly aircraft, which necessitates the use of lightweight materials such as carbon fiber. The competitive dynamics are marked by intense competition among leading players, who are constantly striving to improve their product offerings, expand their market reach, and enhance their technological capabilities. Market penetration for carbon fiber in aerospace components is expected to reach xx% by 2033, indicating significant market growth.

Dominant Markets & Segments in Aerospace Carbon Fiber Market

The Commercial Fixed-wing Aircraft segment continues to be the undisputed leader within the aerospace carbon fiber market, with North America and Europe at the forefront of regional adoption. This sustained dominance is a direct consequence of the robust expansion in global commercial air travel and the ongoing imperative for aircraft manufacturers to integrate advanced composite materials, particularly carbon fiber, into their new builds to enhance performance and efficiency. The drive towards lighter, more fuel-efficient aircraft is a pivotal factor, compelling airlines and manufacturers to prioritize lightweighting solutions.

-

Key Drivers in Commercial Fixed-wing Aircraft Segment:

- Persistent and growing demand for aircraft offering superior fuel efficiency to reduce operational costs and environmental impact.

- Continuous technological advancements in carbon fiber manufacturing, including faster curing times, improved resin systems, and automated lay-up processes, leading to reduced production costs and increased scalability.

- Substantial and ongoing investments in aerospace infrastructure, research and development of new composite applications, and advanced manufacturing capabilities.

- Stringent aviation regulations and global sustainability initiatives pushing for reduced emissions and greater fuel economy.

-

Dominance Analysis: The overwhelming demand from major aircraft Original Equipment Manufacturers (OEMs) like Boeing and Airbus, predominantly based in North America and Europe, is the bedrock of this segment's supremacy. These giants are actively incorporating carbon fiber composites to achieve critical lightweighting targets, thereby boosting fuel efficiency and operational range. The trend towards enhanced performance and extended service life for both commercial and military fixed-wing aircraft solidifies the position of carbon fiber. Concurrently, the Military Fixed-wing Aircraft segment is poised for steady growth, fueled by global defense modernization efforts and the persistent need for advanced, high-performance aerial platforms. Although currently a smaller segment, Rotorcraft applications are also experiencing a discernible uptick, driven by the increasing requirement for helicopters that are both lighter and more fuel-efficient, thereby enhancing payload capacity and operational endurance.

Aerospace Carbon Fiber Market Product Developments

Recent innovations have focused on developing higher-strength, lighter-weight carbon fibers with improved processability. Companies are also developing tailored carbon fiber solutions to meet the specific needs of different aerospace applications. These developments aim to improve the performance of aerospace structures while reducing manufacturing costs. The market is also witnessing the emergence of advanced fiber architectures and hybrid composite materials incorporating carbon fibers with other advanced materials. These technological advancements are improving the overall performance and cost-effectiveness of carbon fiber composite materials in aerospace applications. The introduction of new carbon fibers with enhanced properties is leading to a significant increase in the adoption of carbon fiber composites in both commercial and military aircraft.

Report Scope & Segmentation Analysis

This report segments the Aerospace Carbon Fiber Market based on application:

Commercial Fixed-wing Aircraft: This segment is expected to experience significant growth due to increasing air travel and demand for fuel-efficient aircraft. Market size is projected to reach xx Million by 2033. Competitive dynamics are characterized by intense competition among major players.

Military Fixed-wing Aircraft: This segment demonstrates steady growth fueled by defense modernization programs and the demand for high-performance aircraft. The market size is projected to reach xx Million by 2033. The competitive landscape is more concentrated compared to the commercial segment.

Rotorcraft: This segment exhibits moderate growth, driven by the increasing demand for fuel-efficient and lighter helicopters. Market size is estimated at xx Million by 2033. The competitive landscape is characterized by both established and emerging players.

Key Drivers of Aerospace Carbon Fiber Market Growth

The growth trajectory of the Aerospace Carbon Fiber market is propelled by a confluence of potent factors. Foremost among these is the unyielding demand for aircraft that exhibit enhanced fuel efficiency and reduced weight, a critical necessity driven by both economic considerations and environmental stewardship. The escalating pressure from stringent environmental regulations worldwide is a significant catalyst, compelling the aerospace industry to embrace lightweight materials like carbon fiber to substantially cut carbon emissions and meet ambitious sustainability targets. Furthermore, proactive government initiatives, coupled with substantial investments in research and development dedicated to cutting-edge aerospace materials, are continuously fostering market expansion. The ongoing evolution and refinement of carbon fiber manufacturing technologies are also playing a crucial role, rendering the material increasingly cost-effective, accessible, and suitable for a wider array of aerospace applications.

Challenges in the Aerospace Carbon Fiber Market Sector

The aerospace carbon fiber market faces challenges including high raw material costs, stringent quality control requirements, and the complexity of manufacturing processes. Supply chain disruptions can impact production timelines and costs. Competitive pressures from alternative materials and established players also present ongoing challenges. The high cost of carbon fiber and its associated manufacturing processes compared to other materials poses a significant barrier to its wider adoption.

Emerging Opportunities in Aerospace Carbon Fiber Market

The landscape of the Aerospace Carbon Fiber market is ripe with emerging opportunities. Significant potential lies in the continued development of next-generation high-performance carbon fiber materials with tailored properties for specific aerospace demands. The integration of carbon fiber into the design and manufacturing of innovative, next-generation aircraft architectures, including those incorporating advanced aerodynamic concepts, presents a substantial growth avenue. Moreover, the burgeoning field of unmanned aerial vehicles (UAVs), or drones, offers a vast and expanding market for lightweight, durable composite structures. Similarly, the domain of space exploration, with its demanding requirements for lightweight and robust materials, represents another exciting frontier. The increasing application of carbon fiber in smaller aircraft, the general aviation sector, and crucially, its integration into hybrid and all-electric propulsion systems, signal further promising avenues for market expansion and innovation.

Leading Players in the Aerospace Carbon Fiber Market Market

- Solvay S.A.

- Toray Industries Inc.

- Bally Ribbon Mills

- DuPont de Nemours Inc.

- DowAks

- Hexcel Corporation

- TEIJIN LIMITED

- SGL Carbon SE

- Mitsubishi Chemical Group

- BGF Industries Inc

Key Developments in Aerospace Carbon Fiber Market Industry

- March 2022: Solvay and Wichita State University's NIAR announced a partnership to develop future solutions for the aviation industry.

- March 2023: SGL Carbon launched the new SIGRAFIL T50-4.9/235 carbon fiber for high-strength pressure vessels.

Strategic Outlook for Aerospace Carbon Fiber Market Market

The Aerospace Carbon Fiber market is poised for continued growth driven by the sustained demand for lightweight and high-performance materials in the aerospace industry. Technological advancements, increased production of new aircraft, and stringent environmental regulations will continue to propel market expansion. Strategic investments in R&D and collaborations are expected to lead to innovative solutions and new market opportunities. The market's future prospects appear promising, with significant growth anticipated across various segments and regions.

Aerospace Carbon Fiber Market Segmentation

-

1. Application

- 1.1. Commercial Fixed-wing Aircraft

- 1.2. Military Fixed-wing Aircraft

- 1.3. Rotorcraft

Aerospace Carbon Fiber Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. Latin America

- 4.1. Mexico

- 4.2. Brazil

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. South Africa

- 5.4. Rest of Middle East and Africa

Aerospace Carbon Fiber Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.51% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Commercial Fixed-wing Aircraft Segment is Expected to Dominate the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aerospace Carbon Fiber Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial Fixed-wing Aircraft

- 5.1.2. Military Fixed-wing Aircraft

- 5.1.3. Rotorcraft

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Aerospace Carbon Fiber Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commercial Fixed-wing Aircraft

- 6.1.2. Military Fixed-wing Aircraft

- 6.1.3. Rotorcraft

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Aerospace Carbon Fiber Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commercial Fixed-wing Aircraft

- 7.1.2. Military Fixed-wing Aircraft

- 7.1.3. Rotorcraft

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Aerospace Carbon Fiber Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Commercial Fixed-wing Aircraft

- 8.1.2. Military Fixed-wing Aircraft

- 8.1.3. Rotorcraft

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Aerospace Carbon Fiber Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Commercial Fixed-wing Aircraft

- 9.1.2. Military Fixed-wing Aircraft

- 9.1.3. Rotorcraft

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Aerospace Carbon Fiber Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Commercial Fixed-wing Aircraft

- 10.1.2. Military Fixed-wing Aircraft

- 10.1.3. Rotorcraft

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. North America Aerospace Carbon Fiber Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Aerospace Carbon Fiber Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United Kingdom

- 12.1.2 France

- 12.1.3 Germany

- 12.1.4 Italy

- 12.1.5 Rest of Europe

- 13. Asia Pacific Aerospace Carbon Fiber Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 India

- 13.1.3 Japan

- 13.1.4 Rest of Asia Pacific

- 14. Latin America Aerospace Carbon Fiber Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Mexico

- 14.1.2 Brazil

- 14.1.3 Rest of Latin America

- 15. Middle East and Africa Aerospace Carbon Fiber Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Saudi Arabia

- 15.1.2 United Arab Emirates

- 15.1.3 South Africa

- 15.1.4 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Solvay S A

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Toray Industries Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Bally Ribbon Mills

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 DuPont de Nemours Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 DowAks

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Hexcel Corporation

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 TEIJIN LIMITED

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 SGL Carbon SE

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Mitsubishi Chemical Group

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 BGF Industries Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Solvay S A

List of Figures

- Figure 1: Global Aerospace Carbon Fiber Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Aerospace Carbon Fiber Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Aerospace Carbon Fiber Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Aerospace Carbon Fiber Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Aerospace Carbon Fiber Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Aerospace Carbon Fiber Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Aerospace Carbon Fiber Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Aerospace Carbon Fiber Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Aerospace Carbon Fiber Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Aerospace Carbon Fiber Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Aerospace Carbon Fiber Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Aerospace Carbon Fiber Market Revenue (Million), by Application 2024 & 2032

- Figure 13: North America Aerospace Carbon Fiber Market Revenue Share (%), by Application 2024 & 2032

- Figure 14: North America Aerospace Carbon Fiber Market Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Aerospace Carbon Fiber Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Aerospace Carbon Fiber Market Revenue (Million), by Application 2024 & 2032

- Figure 17: Europe Aerospace Carbon Fiber Market Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Aerospace Carbon Fiber Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Aerospace Carbon Fiber Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Aerospace Carbon Fiber Market Revenue (Million), by Application 2024 & 2032

- Figure 21: Asia Pacific Aerospace Carbon Fiber Market Revenue Share (%), by Application 2024 & 2032

- Figure 22: Asia Pacific Aerospace Carbon Fiber Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Aerospace Carbon Fiber Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Latin America Aerospace Carbon Fiber Market Revenue (Million), by Application 2024 & 2032

- Figure 25: Latin America Aerospace Carbon Fiber Market Revenue Share (%), by Application 2024 & 2032

- Figure 26: Latin America Aerospace Carbon Fiber Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Latin America Aerospace Carbon Fiber Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East and Africa Aerospace Carbon Fiber Market Revenue (Million), by Application 2024 & 2032

- Figure 29: Middle East and Africa Aerospace Carbon Fiber Market Revenue Share (%), by Application 2024 & 2032

- Figure 30: Middle East and Africa Aerospace Carbon Fiber Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Middle East and Africa Aerospace Carbon Fiber Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Aerospace Carbon Fiber Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Aerospace Carbon Fiber Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global Aerospace Carbon Fiber Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Aerospace Carbon Fiber Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Aerospace Carbon Fiber Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United Kingdom Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: France Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Germany Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Italy Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Aerospace Carbon Fiber Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: China Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: India Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Japan Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Asia Pacific Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Aerospace Carbon Fiber Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Mexico Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Brazil Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Latin America Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Aerospace Carbon Fiber Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Saudi Arabia Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: United Arab Emirates Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Africa Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Middle East and Africa Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Aerospace Carbon Fiber Market Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Global Aerospace Carbon Fiber Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: United States Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Canada Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Aerospace Carbon Fiber Market Revenue Million Forecast, by Application 2019 & 2032

- Table 32: Global Aerospace Carbon Fiber Market Revenue Million Forecast, by Country 2019 & 2032

- Table 33: United Kingdom Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: France Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Germany Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Italy Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Europe Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Aerospace Carbon Fiber Market Revenue Million Forecast, by Application 2019 & 2032

- Table 39: Global Aerospace Carbon Fiber Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: China Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: India Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Japan Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Rest of Asia Pacific Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global Aerospace Carbon Fiber Market Revenue Million Forecast, by Application 2019 & 2032

- Table 45: Global Aerospace Carbon Fiber Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Mexico Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Brazil Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Latin America Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Aerospace Carbon Fiber Market Revenue Million Forecast, by Application 2019 & 2032

- Table 50: Global Aerospace Carbon Fiber Market Revenue Million Forecast, by Country 2019 & 2032

- Table 51: Saudi Arabia Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: United Arab Emirates Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: South Africa Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Middle East and Africa Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aerospace Carbon Fiber Market?

The projected CAGR is approximately 7.51%.

2. Which companies are prominent players in the Aerospace Carbon Fiber Market?

Key companies in the market include Solvay S A, Toray Industries Inc, Bally Ribbon Mills, DuPont de Nemours Inc, DowAks, Hexcel Corporation, TEIJIN LIMITED, SGL Carbon SE, Mitsubishi Chemical Group, BGF Industries Inc.

3. What are the main segments of the Aerospace Carbon Fiber Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Commercial Fixed-wing Aircraft Segment is Expected to Dominate the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In March 2022, Solvay and Wichita State University's National Institute for Aviation Research (NIAR) announced a partnership on research and materials development at NIAR's facilities in Wichita, Kansas. The partnership is aimed at developing future solutions to bolster the aviation industry and create opportunities for companies of all sizes to revolutionize the future of flight.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aerospace Carbon Fiber Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aerospace Carbon Fiber Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aerospace Carbon Fiber Market?

To stay informed about further developments, trends, and reports in the Aerospace Carbon Fiber Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence