Key Insights

The MEA Armored Personnel Carrier (APC) market is poised for robust expansion, projected to reach a significant valuation by 2033. Driven by escalating geopolitical instability and the persistent need for enhanced border security and internal defense capabilities across the Middle East and Africa, demand for advanced APCs is on an upward trajectory. Key factors fueling this growth include increasing defense budgets in several regional nations, coupled with a rising focus on modernizing existing fleets to counter evolving threats. The market is witnessing a surge in interest for vehicles offering superior protection against ballistic threats, mines, and improvised explosive devices (IEDs), alongside improved mobility and advanced communication and surveillance systems. This escalating demand is creating a fertile ground for innovation and strategic partnerships among leading global and regional manufacturers aiming to cater to the specific operational requirements of diverse security forces within the MEA region.

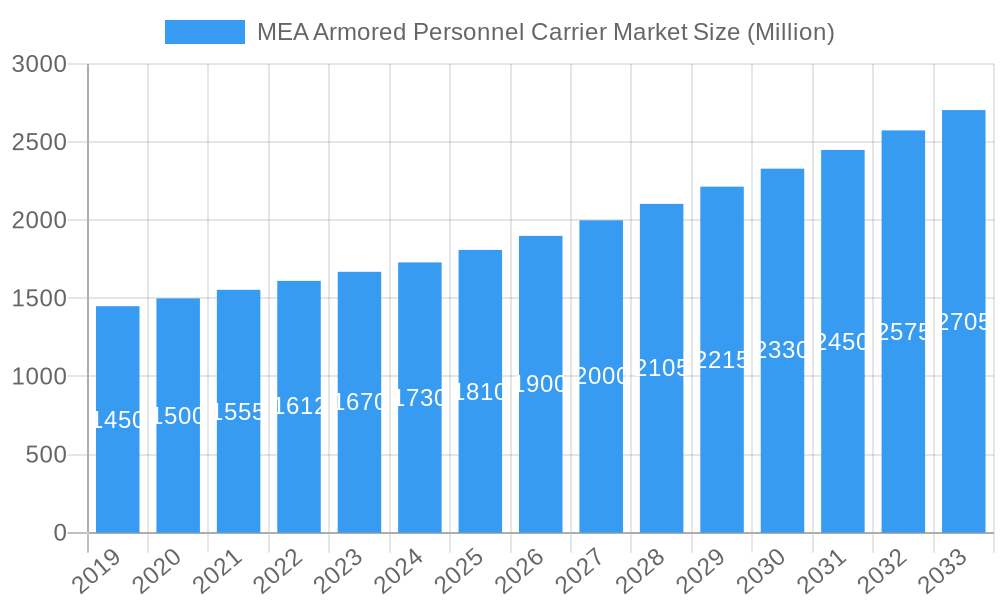

MEA Armored Personnel Carrier Market Market Size (In Billion)

The market's projected Compound Annual Growth Rate (CAGR) of approximately 5.06% underscores a dynamic and evolving landscape. This growth is underpinned by several key trends, including the increasing adoption of wheeled APCs for their agility and cost-effectiveness in various operational theaters, and a growing preference for customized solutions tailored to specific mission profiles. While the substantial market size and positive growth outlook present significant opportunities, certain restraints could influence the pace of expansion. These may include budgetary constraints in some developing economies, evolving international arms regulations, and the lengthy procurement cycles often associated with defense equipment. Nevertheless, the overarching need for enhanced force protection and rapid deployment capabilities is expected to supersede these challenges, ensuring a sustained and significant demand for armored personnel carriers throughout the forecast period.

MEA Armored Personnel Carrier Market Company Market Share

Here's the SEO-optimized, detailed report description for the MEA Armored Personnel Carrier Market, designed for immediate use:

MEA Armored Personnel Carrier Market Market Concentration & Innovation

The MEA Armored Personnel Carrier (APC) market exhibits a moderate to high concentration, with a few key players holding significant market share. NIMR Automotive (EDGE Group PJSC), Oshkosh Corporation, and BAE Systems plc are prominent in this landscape. Innovation is a critical differentiator, driven by increasing demand for advanced protection technologies, enhanced mobility, and integrated weapon systems. Key innovation areas include the development of lightweight composite materials, advanced threat detection systems, and modular designs for versatile mission configurations. Regulatory frameworks, particularly those governing defense procurement and export controls, play a crucial role in shaping market entry and product development. While direct product substitutes for APCs are limited, alternative solutions like enhanced transport vehicles or specialized attack helicopters can address certain tactical needs, although not replicating the direct battlefield survivability and transport capabilities of APCs. End-user trends are shifting towards platforms offering multi-role functionalities, greater crew protection against emerging threats like IEDs and RPGs, and improved situational awareness. Mergers and acquisitions (M&A) are notable, with deal values often in the hundreds of millions of dollars, indicating consolidation and strategic expansion. For instance, acquisitions aimed at bolstering technological capabilities or expanding geographic reach are common.

MEA Armored Personnel Carrier Market Industry Trends & Insights

The MEA Armored Personnel Carrier (APC) market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.2% from 2025 to 2033. This growth is primarily fueled by escalating geopolitical tensions, ongoing regional conflicts, and the persistent threat of terrorism across the Middle East and Africa. Nations within the MEA region are prioritizing the modernization of their defense forces, with a strong emphasis on acquiring advanced armored vehicles to enhance troop survivability and operational effectiveness. Technological disruptions are rapidly reshaping the APC landscape, with a growing demand for vehicles equipped with active protection systems (APS), advanced ballistic protection, and enhanced counter-mine capabilities. The integration of sophisticated C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) systems is also a key trend, enabling better battlefield awareness and networked warfare. Consumer preferences, driven by military end-users, are increasingly focused on platforms that offer a balance of protection, mobility, firepower, and cost-effectiveness. There's a discernible shift towards modular and scalable designs that allow for easier upgrades and adaptation to evolving threats and mission requirements. Competitive dynamics are intense, with both established global defense manufacturers and emerging regional players vying for market share. Strategic partnerships and collaborations are becoming essential for companies to leverage complementary technologies and manufacturing capabilities. Market penetration is deepening as defense budgets in several MEA countries are allocated towards equipping and modernizing their ground forces, recognizing the critical role of APCs in contemporary warfare. The estimated market size in 2025 is projected to be around $4,500 million, with significant growth anticipated throughout the forecast period, driven by ongoing procurement programs and a sustained need for robust land combat capabilities.

Dominant Markets & Segments in MEA Armored Personnel Carrier Market

The Middle East region consistently emerges as the dominant market within the MEA Armored Personnel Carrier (APC) sector. This dominance is propelled by a confluence of factors, including heightened regional instability, significant defense spending, and a proactive approach to national security among key Middle Eastern nations.

Production Analysis:

- Dominant Player: Countries like the United Arab Emirates, Saudi Arabia, and Turkey are significant production hubs, benefiting from substantial government investment in domestic defense industries and the presence of advanced manufacturing facilities.

- Key Drivers: Localization initiatives mandated by governments to foster domestic defense capabilities, transfer of technology agreements, and the establishment of joint ventures with international manufacturers are key drivers. For instance, NIMR Automotive in the UAE has become a prominent regional producer.

Consumption Analysis:

- Dominant Countries: Saudi Arabia, the UAE, and Egypt represent the largest consumers of APCs in the MEA region due to their ongoing military modernization programs and the nature of their security challenges.

- Key Drivers: Escalating regional conflicts, counter-terrorism operations, border security requirements, and the need to replace aging fleets are primary consumption drivers. Economic policies that prioritize defense spending in these nations further bolster demand.

Import Market Analysis (Value & Volume):

- Dominant Importers: Saudi Arabia and the UAE are consistently among the largest importers, seeking advanced and technologically superior APCs from global defense manufacturers.

- Key Drivers: The demand for state-of-the-art protection systems, advanced firepower, and specialized variants that may not be domestically produced drives import volumes and value. The value of imports is projected to reach approximately $2,000 million by 2025, with a steady upward trend.

Export Market Analysis (Value & Volume):

- Dominant Exporters: Turkey, with companies like BMC Otomotiv Ticaret ve Sanayi A Ş, and increasingly the UAE, are emerging as significant exporters, particularly to African nations and other Middle Eastern countries.

- Key Drivers: Competitive pricing, proven battlefield performance, and the ability to offer customized solutions contribute to export growth. The strategic positioning of these countries allows for efficient logistics to neighboring regions.

Price Trend Analysis:

- Trend: Prices for APCs in the MEA region have witnessed a general upward trend, driven by the increasing sophistication of technology, higher material costs, and stringent quality and performance requirements.

- Key Drivers: The incorporation of advanced ballistic materials, active protection systems, and complex electronic warfare suites significantly contributes to the higher price points. The projected average price of an advanced APC is estimated to be around $1.5 million to $5 million, depending on configuration.

MEA Armored Personnel Carrier Market Product Developments

Recent product developments in the MEA Armored Personnel Carrier (APC) market focus on enhancing survivability, operational flexibility, and networked warfare capabilities. Innovations include the integration of advanced modular armor systems offering superior protection against evolving threats, such as IEDs and anti-tank guided missiles. Companies are also prioritizing enhanced mobility through improved powertrain technologies and active suspension systems. The incorporation of C4ISR systems, including advanced situational awareness tools and secure communication suites, is becoming standard. Furthermore, the development of APC variants with diverse weapon stations, including remotely operated turrets, provides enhanced firepower and reduced crew exposure. These developments offer significant competitive advantages by meeting the stringent operational demands of modern militaries in complex environments.

Report Scope & Segmentation Analysis

This report encompasses a comprehensive analysis of the MEA Armored Personnel Carrier (APC) market, covering the historical period of 2019–2024 and extending through a forecast period of 2025–2033, with 2025 serving as the base and estimated year. The segmentation includes Production Analysis, detailing manufacturing capabilities and capacities across the region; Consumption Analysis, identifying key demand drivers and end-users; Import Market Analysis, quantifying value and volume of inbound APC shipments; Export Market Analysis, assessing outbound APC trade dynamics; and Price Trend Analysis, tracking price fluctuations of various APC models. Each segment provides detailed market sizes, growth projections, and analysis of competitive dynamics within their respective areas.

Key Drivers of MEA Armored Personnel Carrier Market Growth

The MEA Armored Personnel Carrier (APC) market is significantly driven by escalating geopolitical instability and regional conflicts, necessitating robust land defense capabilities. Continuous modernization of armed forces across the region, fueled by substantial defense budgets in key economies like Saudi Arabia and the UAE, is a primary growth catalyst. The persistent threat of terrorism and asymmetric warfare demands vehicles offering enhanced troop protection against IEDs and small arms fire. Technological advancements, particularly in areas of active protection systems (APS) and advanced composite materials, are driving demand for next-generation APCs. Furthermore, government initiatives promoting defense industrial localization and self-sufficiency encourage domestic production and technological innovation within the region.

Challenges in the MEA Armored Personnel Carrier Market Sector

The MEA Armored Personnel Carrier (APC) market faces several challenges that can impede growth. High acquisition costs for advanced APCs can be a significant restraint for some nations with limited defense budgets. The complex and stringent regulatory frameworks governing defense procurement and export licenses can prolong procurement cycles and create barriers to entry. Supply chain disruptions, exacerbated by geopolitical events and logistical complexities in the vast MEA region, can affect production timelines and cost-effectiveness. Intense competition among both established global players and emerging regional manufacturers leads to price pressures and necessitates continuous innovation to maintain market share. Furthermore, the rapid pace of technological change requires significant R&D investment to stay competitive.

Emerging Opportunities in MEA Armored Personnel Carrier Market

Emerging opportunities in the MEA Armored Personnel Carrier (APC) market lie in the growing demand for multi-role vehicles capable of performing a wider range of missions, from troop transport to reconnaissance and anti-insurgency operations. The increasing adoption of modular designs that allow for rapid reconfiguration and upgrades presents a significant opportunity for manufacturers. There is also a burgeoning interest in unmanned and optionally manned APC platforms, driven by the need to reduce crew exposure and enhance operational efficiency. Expansion into emerging African defense markets, where security concerns are rising, represents a substantial growth avenue. Furthermore, the demand for highly customized solutions tailored to specific regional threats and operational environments offers niche market opportunities.

Leading Players in the MEA Armored Personnel Carrier Market Market

- NIMR Automotive (EDGE Group PJSC)

- BMC Otomotiv Ticaret ve Sanayi A Ş

- Koç Holding A Ş

- Oshkosh Corporation

- Rheinmetall AG

- Denel SOC Ltd

- IAI

- Mahindra Emirates Vehicle Armouring FZ-LLC

- BAE Systems plc

- Streit Group

Key Developments in MEA Armored Personnel Carrier Market Industry

- 2023/11: NIMR Automotive unveils its new generation of highly protected combat vehicles, enhancing its regional market presence.

- 2023/08: BAE Systems secures a significant contract for the supply of advanced armored vehicles to a Middle Eastern nation, underscoring continued demand for advanced protection.

- 2023/05: Rheinmetall AG announces advancements in its active protection system technology, a key feature in modern APCs.

- 2023/02: Streit Group expands its manufacturing capabilities in the UAE, focusing on meeting regional demand for armored transport solutions.

- 2022/12: Oshkosh Corporation delivers a fleet of specialized armored vehicles to a key African client, showcasing its growing influence in the continent.

- 2022/09: BMC Otomotiv Ticaret ve Sanayi A Ş highlights its versatile armored vehicle platforms designed for diverse mission profiles in challenging terrains.

Strategic Outlook for MEA Armored Personnel Carrier Market Market

The strategic outlook for the MEA Armored Personnel Carrier (APC) market is characterized by sustained demand driven by regional security imperatives and ongoing military modernization. Key growth catalysts include the continuous integration of cutting-edge technologies like AI-powered threat detection and advanced mobility solutions. Opportunities for market expansion exist in emerging African economies and through the development of highly adaptable, multi-role APC variants. Companies that focus on offering cost-effective, technologically advanced, and logistically sound solutions will be best positioned to capitalize on future market potential and secure long-term growth in this dynamic sector.

MEA Armored Personnel Carrier Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

MEA Armored Personnel Carrier Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

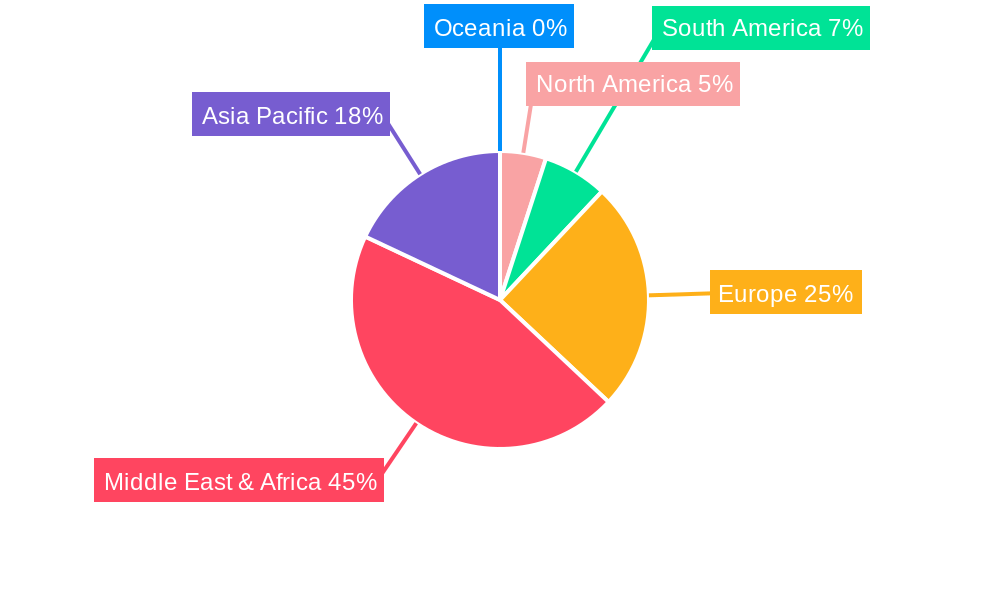

MEA Armored Personnel Carrier Market Regional Market Share

Geographic Coverage of MEA Armored Personnel Carrier Market

MEA Armored Personnel Carrier Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.06% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. Armored Personnel Carrier (APC) Segment will Showcase Remarkable Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MEA Armored Personnel Carrier Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America MEA Armored Personnel Carrier Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America MEA Armored Personnel Carrier Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe MEA Armored Personnel Carrier Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa MEA Armored Personnel Carrier Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific MEA Armored Personnel Carrier Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 NIMR Automotive (EDGE Group PJSC)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BMC Otomotiv Ticaret ve Sanayi A Ş

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Koç Holding A Ş

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Oshkosh Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Rheinmetall AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Denel SOC Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 IAI

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Mahindra Emirates Vehicle Armouring FZ-LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BAE Systems plc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Streit Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 NIMR Automotive (EDGE Group PJSC)

List of Figures

- Figure 1: Global MEA Armored Personnel Carrier Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America MEA Armored Personnel Carrier Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 3: North America MEA Armored Personnel Carrier Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America MEA Armored Personnel Carrier Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 5: North America MEA Armored Personnel Carrier Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America MEA Armored Personnel Carrier Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America MEA Armored Personnel Carrier Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America MEA Armored Personnel Carrier Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America MEA Armored Personnel Carrier Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America MEA Armored Personnel Carrier Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 11: North America MEA Armored Personnel Carrier Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America MEA Armored Personnel Carrier Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America MEA Armored Personnel Carrier Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America MEA Armored Personnel Carrier Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 15: South America MEA Armored Personnel Carrier Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America MEA Armored Personnel Carrier Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 17: South America MEA Armored Personnel Carrier Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America MEA Armored Personnel Carrier Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America MEA Armored Personnel Carrier Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America MEA Armored Personnel Carrier Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America MEA Armored Personnel Carrier Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America MEA Armored Personnel Carrier Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 23: South America MEA Armored Personnel Carrier Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America MEA Armored Personnel Carrier Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America MEA Armored Personnel Carrier Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe MEA Armored Personnel Carrier Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 27: Europe MEA Armored Personnel Carrier Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe MEA Armored Personnel Carrier Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 29: Europe MEA Armored Personnel Carrier Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe MEA Armored Personnel Carrier Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe MEA Armored Personnel Carrier Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe MEA Armored Personnel Carrier Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe MEA Armored Personnel Carrier Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe MEA Armored Personnel Carrier Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe MEA Armored Personnel Carrier Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe MEA Armored Personnel Carrier Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Europe MEA Armored Personnel Carrier Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa MEA Armored Personnel Carrier Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa MEA Armored Personnel Carrier Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa MEA Armored Personnel Carrier Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa MEA Armored Personnel Carrier Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa MEA Armored Personnel Carrier Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa MEA Armored Personnel Carrier Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa MEA Armored Personnel Carrier Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa MEA Armored Personnel Carrier Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa MEA Armored Personnel Carrier Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa MEA Armored Personnel Carrier Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa MEA Armored Personnel Carrier Market Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East & Africa MEA Armored Personnel Carrier Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific MEA Armored Personnel Carrier Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific MEA Armored Personnel Carrier Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific MEA Armored Personnel Carrier Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific MEA Armored Personnel Carrier Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific MEA Armored Personnel Carrier Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific MEA Armored Personnel Carrier Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific MEA Armored Personnel Carrier Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific MEA Armored Personnel Carrier Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific MEA Armored Personnel Carrier Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific MEA Armored Personnel Carrier Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific MEA Armored Personnel Carrier Market Revenue (Million), by Country 2025 & 2033

- Figure 61: Asia Pacific MEA Armored Personnel Carrier Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global MEA Armored Personnel Carrier Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Global MEA Armored Personnel Carrier Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global MEA Armored Personnel Carrier Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global MEA Armored Personnel Carrier Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global MEA Armored Personnel Carrier Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global MEA Armored Personnel Carrier Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global MEA Armored Personnel Carrier Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Global MEA Armored Personnel Carrier Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global MEA Armored Personnel Carrier Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global MEA Armored Personnel Carrier Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global MEA Armored Personnel Carrier Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global MEA Armored Personnel Carrier Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States MEA Armored Personnel Carrier Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada MEA Armored Personnel Carrier Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico MEA Armored Personnel Carrier Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global MEA Armored Personnel Carrier Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 17: Global MEA Armored Personnel Carrier Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global MEA Armored Personnel Carrier Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global MEA Armored Personnel Carrier Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global MEA Armored Personnel Carrier Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global MEA Armored Personnel Carrier Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Brazil MEA Armored Personnel Carrier Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Argentina MEA Armored Personnel Carrier Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America MEA Armored Personnel Carrier Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global MEA Armored Personnel Carrier Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Global MEA Armored Personnel Carrier Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global MEA Armored Personnel Carrier Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global MEA Armored Personnel Carrier Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global MEA Armored Personnel Carrier Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global MEA Armored Personnel Carrier Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: United Kingdom MEA Armored Personnel Carrier Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany MEA Armored Personnel Carrier Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: France MEA Armored Personnel Carrier Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Italy MEA Armored Personnel Carrier Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Spain MEA Armored Personnel Carrier Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Russia MEA Armored Personnel Carrier Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Benelux MEA Armored Personnel Carrier Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Nordics MEA Armored Personnel Carrier Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe MEA Armored Personnel Carrier Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global MEA Armored Personnel Carrier Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 41: Global MEA Armored Personnel Carrier Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global MEA Armored Personnel Carrier Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global MEA Armored Personnel Carrier Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global MEA Armored Personnel Carrier Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global MEA Armored Personnel Carrier Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Turkey MEA Armored Personnel Carrier Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Israel MEA Armored Personnel Carrier Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: GCC MEA Armored Personnel Carrier Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: North Africa MEA Armored Personnel Carrier Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: South Africa MEA Armored Personnel Carrier Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa MEA Armored Personnel Carrier Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Global MEA Armored Personnel Carrier Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 53: Global MEA Armored Personnel Carrier Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global MEA Armored Personnel Carrier Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global MEA Armored Personnel Carrier Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global MEA Armored Personnel Carrier Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global MEA Armored Personnel Carrier Market Revenue Million Forecast, by Country 2020 & 2033

- Table 58: China MEA Armored Personnel Carrier Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 59: India MEA Armored Personnel Carrier Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Japan MEA Armored Personnel Carrier Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: South Korea MEA Armored Personnel Carrier Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: ASEAN MEA Armored Personnel Carrier Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 63: Oceania MEA Armored Personnel Carrier Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific MEA Armored Personnel Carrier Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Armored Personnel Carrier Market?

The projected CAGR is approximately 5.06%.

2. Which companies are prominent players in the MEA Armored Personnel Carrier Market?

Key companies in the market include NIMR Automotive (EDGE Group PJSC), BMC Otomotiv Ticaret ve Sanayi A Ş, Koç Holding A Ş, Oshkosh Corporation, Rheinmetall AG, Denel SOC Ltd, IAI, Mahindra Emirates Vehicle Armouring FZ-LLC, BAE Systems plc, Streit Group.

3. What are the main segments of the MEA Armored Personnel Carrier Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.81 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

Armored Personnel Carrier (APC) Segment will Showcase Remarkable Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Armored Personnel Carrier Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Armored Personnel Carrier Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Armored Personnel Carrier Market?

To stay informed about further developments, trends, and reports in the MEA Armored Personnel Carrier Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence