Key Insights

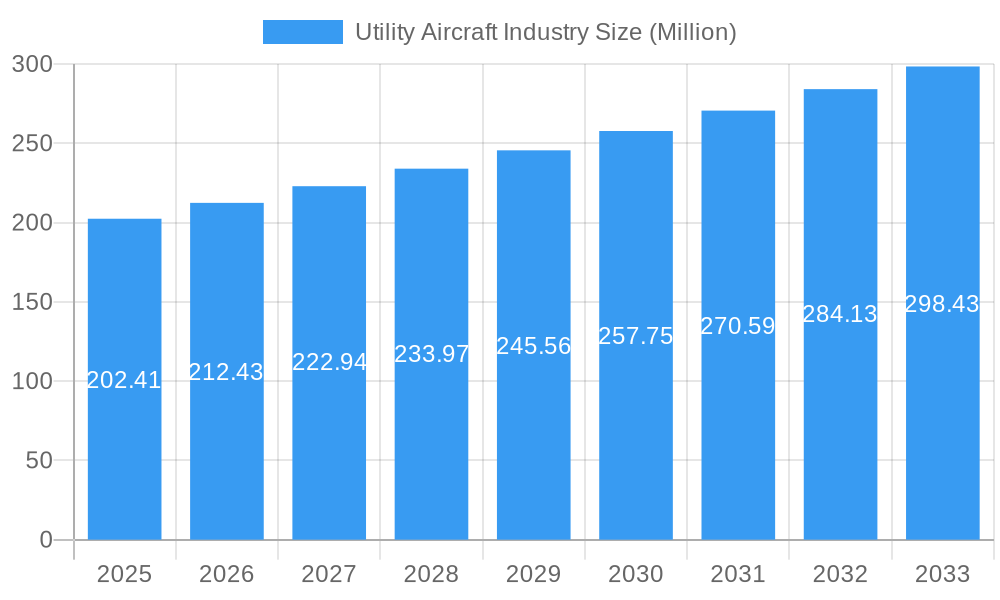

The global Utility Aircraft Market is poised for significant expansion, projected to reach an estimated market size of approximately USD 202.41 million in 2025 and grow at a robust Compound Annual Growth Rate (CAGR) of 4.98% through 2033. This growth is fueled by escalating demand for versatile aircraft across both military and civil sectors. In the military domain, advancements in surveillance, reconnaissance, and troop transport capabilities are driving investments in specialized utility aircraft. Concurrently, the civil and commercial sectors are witnessing increased adoption for applications such as cargo delivery, emergency medical services, agricultural operations, and infrastructure inspection, particularly in remote and underserved regions. The market's expansion is further supported by ongoing technological innovations leading to more fuel-efficient, durable, and multi-functional aircraft designs.

Utility Aircraft Industry Market Size (In Million)

The market's trajectory is shaped by several key drivers, including the modernization of defense fleets and the growing need for efficient logistical support in various industries. However, the market also faces certain restraints, such as the high initial cost of acquisition and maintenance for advanced utility aircraft, along with stringent regulatory frameworks governing aviation operations. Despite these challenges, emerging trends like the integration of advanced avionics, enhanced payload capacities, and the development of electric and hybrid-propulsion systems are expected to propel the market forward. Geographically, North America and Europe are anticipated to remain dominant markets due to established aviation infrastructure and substantial government spending on defense and infrastructure projects. The Asia Pacific region, however, is expected to exhibit the highest growth rate, driven by increasing defense modernization efforts in countries like India and China, and a burgeoning civil aviation sector.

Utility Aircraft Industry Company Market Share

Utility Aircraft Industry Market Concentration & Innovation

The Utility Aircraft Industry is characterized by a moderate to high level of market concentration, with a few dominant players holding significant market share, including Textron Inc., Lockheed Martin Corporation, Airbus SE, The Boeing Company, Aviation Industry Corporation of China, United Aircraft Corporation, Leonardo S.p.A., Bombardier Inc., and Hindustan Aeronautics Limited. Innovation is a key driver, spurred by advancements in materials science, avionics, and propulsion systems. Regulatory frameworks, overseen by aviation authorities worldwide, play a crucial role in ensuring safety and interoperability, often influencing product development timelines and market access. Product substitutes, while limited in the highly specialized utility aircraft sector, can include repurposed civilian aircraft or alternative transportation methods for specific niche applications. End-user trends are shifting towards increased demand for multi-role capabilities, enhanced fuel efficiency, and advanced sensor integration, particularly in military and commercial applications. Mergers and acquisitions (M&A) activity, while not consistently high, can significantly alter market dynamics, with past deals totaling several hundred million to billions of dollars as companies seek to expand their portfolios and technological capabilities. For instance, Textron's acquisition of Beechcraft significantly strengthened its position in the turboprop segment.

- Market Concentration: Dominated by a few major global players.

- Innovation Drivers: Advanced materials, avionics, and propulsion.

- Regulatory Frameworks: Global aviation authorities ensuring safety and standards.

- Product Substitutes: Limited, primarily niche alternatives.

- End-User Trends: Demand for multi-role, fuel-efficient, and sensor-integrated aircraft.

- M&A Activity: Strategic acquisitions impacting market share and capabilities, with deal values often in the hundreds of millions to billions of dollars.

Utility Aircraft Industry Industry Trends & Insights

The utility aircraft industry is poised for robust growth, driven by escalating demand across military, civil, and commercial sectors. A primary catalyst is the increasing need for versatile aircraft capable of diverse missions, from cargo transport and surveillance to search and rescue and troop deployment. Technological advancements are fundamentally reshaping the industry landscape. The integration of artificial intelligence (AI) for enhanced flight automation and mission planning, the development of more fuel-efficient turboprop and turboshaft engines, and the incorporation of advanced composite materials for lighter and stronger airframes are key trends. These innovations not only improve operational efficiency but also reduce environmental impact, aligning with growing global sustainability initiatives. Consumer preferences are evolving, with operators prioritizing aircraft offering greater operational flexibility, reduced maintenance costs, and superior performance in challenging environments. The defense sector, in particular, is a significant growth driver, fueled by geopolitical tensions and modernization programs in various nations. This translates to substantial procurement orders for specialized utility aircraft. For example, ongoing investments in border patrol, maritime surveillance, and counter-terrorism operations necessitate advanced aerial capabilities.

Furthermore, the civil and commercial segments are experiencing a resurgence, driven by the expansion of air cargo operations, the growing need for medical evacuation (medevac) services, and the increasing utilization of utility aircraft for infrastructure development and disaster relief. The development of next-generation turboprop and light jet aircraft with enhanced range and payload capacity is catering to these evolving demands. The competitive dynamics within the industry are intense, with leading manufacturers constantly investing in research and development to maintain their market edge. Strategic partnerships and collaborations are also becoming more prevalent as companies aim to share R&D costs, access new markets, and combine complementary technologies. The market penetration of advanced features like synthetic vision systems and enhanced situational awareness tools is steadily increasing, providing operators with greater operational safety and effectiveness. The overall compound annual growth rate (CAGR) for the utility aircraft industry is projected to be in the healthy single digits, reflecting sustained demand and continuous innovation.

Dominant Markets & Segments in Utility Aircraft Industry

The utility aircraft industry exhibits distinct regional dominance and segment leadership. North America, particularly the United States, stands as the leading market, driven by a substantial defense budget, a well-established aerospace manufacturing base, and significant civil aviation infrastructure. The region's reliance on utility aircraft for diverse applications, including law enforcement, cargo transport, and resource management, further solidifies its position. Asia-Pacific is emerging as a rapidly growing market, fueled by increasing defense expenditures by countries like China and India, coupled with the expansion of commercial aviation and infrastructure development projects. Economic policies that encourage domestic manufacturing and aviation sector growth are key drivers in this region.

In terms of aircraft type, Fixed Wings generally command a larger market share due to their versatility in covering longer distances and carrying substantial payloads. Within fixed wings, Turboprops are particularly dominant, offering a balance of speed, efficiency, and operational range suitable for a wide array of utility missions. Their ability to operate from shorter, unpaved runways makes them invaluable for accessing remote regions. Rotorcrafts, while holding a significant segment, are often more specialized. Medium and Heavy Rotorcrafts are crucial for military applications like troop transport, attack, and heavy-lift operations, whereas Light Rotorcrafts find extensive use in civilian roles such as surveillance, emergency medical services, and personal transport.

The Military application type consistently represents the largest segment within the utility aircraft industry. This is attributable to ongoing global defense modernization programs, increased geopolitical instability, and the persistent need for aircraft in reconnaissance, transport, and combat support roles. Countries are investing heavily in upgrading their air fleets to counter evolving threats and maintain strategic advantage. The Civil & Commercial segment, though smaller than the military, is experiencing robust growth. This expansion is driven by the increasing demand for air cargo, the growing need for efficient medical evacuation services, and the use of utility aircraft in commercial operations like aerial surveying, agricultural support, and executive transport. Infrastructure development and resource exploration in remote areas also contribute significantly to the demand for civil utility aircraft.

- Leading Region: North America (USA), followed by the rapidly growing Asia-Pacific region.

- Key Drivers in Leading Regions:

- North America: High defense spending, established aerospace industry, diverse civil applications.

- Asia-Pacific: Rising defense budgets, economic growth, infrastructure development.

- Dominant Aircraft Type Segment: Fixed Wings, specifically Turboprops.

- Key Drivers for Turboprops: Fuel efficiency, operational range, short-field capability.

- Significant Rotorcraft Segments: Medium and Heavy Rotorcrafts for military; Light Rotorcrafts for civilian applications.

- Dominant Application Type Segment: Military.

- Key Drivers for Military: Defense modernization, geopolitical security concerns, multi-role capabilities.

- Growing Civil & Commercial Segment: Driven by air cargo, medical evacuation, and specialized commercial operations.

Utility Aircraft Industry Product Developments

The utility aircraft industry is witnessing a wave of product developments focused on enhancing performance, efficiency, and mission versatility. Innovations in turboprop and turboshaft engine technology are yielding significant improvements in fuel economy and reduced emissions. The integration of advanced avionics, including sophisticated navigation systems, enhanced synthetic vision, and intelligent flight management systems, is improving pilot situational awareness and operational safety. Furthermore, the adoption of lightweight composite materials is leading to more robust and fuel-efficient airframes. These developments are creating competitive advantages by enabling aircraft to perform more complex missions, operate in harsher environments, and offer lower operating costs, thereby meeting the evolving demands of both military and civilian end-users.

Report Scope & Segmentation Analysis

This report offers a comprehensive analysis of the Utility Aircraft Industry, covering the period from 2019 to 2033, with a base year of 2025. The market is segmented by Aircraft Type, encompassing Rotorcrafts (further divided into Light, Medium, and Heavy categories) and Fixed Wings (subdivided into Turboprop and Turboshaft). Additionally, segmentation is provided by Application Type, distinguishing between Military and Civil & Commercial uses. The analysis includes historical data from 2019-2024, current estimations for 2025, and future projections for the forecast period of 2025-2033.

- Aircraft Type Segmentation:

- Rotorcrafts: This segment includes Light, Medium, and Heavy rotorcraft. Light rotorcrafts are projected to see steady growth driven by civilian applications like personal transport and emergency services. Medium and Heavy rotorcrafts are expected to be dominated by military procurement for troop transport and utility roles.

- Fixed Wings: This segment comprises Turboprop and Turboshaft aircraft. Turboprops are anticipated to maintain strong market share due to their versatility and cost-effectiveness for medium-range missions. Turboshaft fixed-wing aircraft, while a smaller segment, will see growth tied to specialized military and advanced commercial applications.

- Application Type Segmentation:

- Military: This is the largest segment, expected to experience sustained growth due to ongoing defense modernization programs and geopolitical factors.

- Civil & Commercial: This segment is projected for significant expansion, driven by increasing demand for air cargo, regional connectivity, and specialized services such as medical evacuation and infrastructure support.

Key Drivers of Utility Aircraft Industry Growth

The utility aircraft industry's growth is propelled by a confluence of technological advancements, evolving economic policies, and strategic military imperatives. Key drivers include the continuous innovation in engine technology leading to greater fuel efficiency and reduced environmental impact, alongside advancements in materials science for lighter and stronger airframes. Increasing global defense expenditures, driven by geopolitical uncertainties and the need for modernized air forces, significantly boost demand for military utility aircraft. Furthermore, the expansion of global trade and e-commerce is fueling the demand for air cargo, thereby enhancing the utility of fixed-wing and rotorcraft aircraft in the civil and commercial sectors. Government initiatives promoting aerospace manufacturing and infrastructure development in emerging economies also play a crucial role in market expansion.

Challenges in the Utility Aircraft Industry Sector

The utility aircraft industry faces several significant challenges that can hinder its growth trajectory. Stringent and evolving regulatory requirements, particularly concerning safety, emissions, and noise pollution, necessitate substantial investment in research and development and can lead to extended certification processes. Global supply chain disruptions, exacerbated by geopolitical events and economic instability, can impact production timelines and increase component costs. Intense competition among established manufacturers and the emergence of new players also put pressure on pricing and profit margins. Furthermore, the high capital expenditure required for aircraft development and manufacturing, coupled with the long lifecycle of these assets, presents a considerable financial barrier for new entrants and requires robust long-term strategic planning.

Emerging Opportunities in Utility Aircraft Industry

The utility aircraft industry is brimming with emerging opportunities driven by technological innovation and shifting market demands. The increasing focus on sustainable aviation presents a significant avenue for growth, with opportunities in developing electric or hybrid-electric propulsion systems for smaller utility aircraft. The expansion of air mobility concepts, including urban air mobility (UAM) and advanced air cargo delivery, opens new markets for specialized eVTOL (electric Vertical Take-Off and Landing) aircraft and advanced rotorcraft. The growing need for intelligence, surveillance, and reconnaissance (ISR) capabilities in both military and civilian applications is driving demand for advanced sensor integration and unmanned aerial systems (UAS) within the utility aircraft framework. Furthermore, the development of advanced manufacturing techniques, such as additive manufacturing (3D printing), offers opportunities to reduce production costs and lead times for complex aircraft components.

Leading Players in the Utility Aircraft Industry Market

- Textron Inc.

- Lockheed Martin Corporation

- Airbus SE

- The Boeing Company

- Aviation Industry Corporation of China

- United Aircraft Corporation

- Leonardo S.p.A.

- Bombardier Inc.

- Hindustan Aeronautics Limited

Key Developments in Utility Aircraft Industry Industry

- March 2023: The Indian Defence Ministry awarded a contract to HAL to procure 6 Dornier aircraft. The latest addition of six aircraft will be procured with an upgraded fuel-efficient engine coupled with a five-bladed composite propeller.

- July 2022: Poland ordered 32 Modern AW149 Helicopters for the Land Forces Aviation. The contract for the purchase of 32 AW149 helicopters amounts to PLN 8,250 million (USD 1 820 million). The helicopters will be delivered by 2029.

Strategic Outlook for Utility Aircraft Industry Market

The strategic outlook for the utility aircraft industry is highly positive, characterized by sustained growth and innovation. The persistent demand from the military sector, coupled with the burgeoning civil and commercial applications, provides a strong foundation for future expansion. Key growth catalysts include the ongoing development and adoption of advanced technologies such as AI, hybrid-electric propulsion, and advanced composite materials. The industry is well-positioned to capitalize on the increasing need for versatile, efficient, and sustainable aviation solutions across various global markets. Strategic partnerships, focused R&D, and adapting to evolving regulatory landscapes will be crucial for manufacturers to maintain a competitive edge and unlock the full potential of this dynamic market.

Utility Aircraft Industry Segmentation

-

1. Aircraft Type

-

1.1. Rotorcrafts

- 1.1.1. Light

- 1.1.2. Medium

- 1.1.3. Heavy

-

1.2. Fixed Wings

- 1.2.1. Turboprop

- 1.2.2. Turboshaft

-

1.1. Rotorcrafts

-

2. Application Type

- 2.1. Military

- 2.2. Civil & Commercial

Utility Aircraft Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Mexico

- 4.2. Brazil

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Qatar

- 5.2. United Arab Emirates

- 5.3. South Africa

- 5.4. Rest of Middle East and Africa

Utility Aircraft Industry Regional Market Share

Geographic Coverage of Utility Aircraft Industry

Utility Aircraft Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.98% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. Rotorcraft to Dominate Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Utility Aircraft Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 5.1.1. Rotorcrafts

- 5.1.1.1. Light

- 5.1.1.2. Medium

- 5.1.1.3. Heavy

- 5.1.2. Fixed Wings

- 5.1.2.1. Turboprop

- 5.1.2.2. Turboshaft

- 5.1.1. Rotorcrafts

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Military

- 5.2.2. Civil & Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6. North America Utility Aircraft Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6.1.1. Rotorcrafts

- 6.1.1.1. Light

- 6.1.1.2. Medium

- 6.1.1.3. Heavy

- 6.1.2. Fixed Wings

- 6.1.2.1. Turboprop

- 6.1.2.2. Turboshaft

- 6.1.1. Rotorcrafts

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Military

- 6.2.2. Civil & Commercial

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 7. Europe Utility Aircraft Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 7.1.1. Rotorcrafts

- 7.1.1.1. Light

- 7.1.1.2. Medium

- 7.1.1.3. Heavy

- 7.1.2. Fixed Wings

- 7.1.2.1. Turboprop

- 7.1.2.2. Turboshaft

- 7.1.1. Rotorcrafts

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Military

- 7.2.2. Civil & Commercial

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 8. Asia Pacific Utility Aircraft Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 8.1.1. Rotorcrafts

- 8.1.1.1. Light

- 8.1.1.2. Medium

- 8.1.1.3. Heavy

- 8.1.2. Fixed Wings

- 8.1.2.1. Turboprop

- 8.1.2.2. Turboshaft

- 8.1.1. Rotorcrafts

- 8.2. Market Analysis, Insights and Forecast - by Application Type

- 8.2.1. Military

- 8.2.2. Civil & Commercial

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 9. Latin America Utility Aircraft Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 9.1.1. Rotorcrafts

- 9.1.1.1. Light

- 9.1.1.2. Medium

- 9.1.1.3. Heavy

- 9.1.2. Fixed Wings

- 9.1.2.1. Turboprop

- 9.1.2.2. Turboshaft

- 9.1.1. Rotorcrafts

- 9.2. Market Analysis, Insights and Forecast - by Application Type

- 9.2.1. Military

- 9.2.2. Civil & Commercial

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 10. Middle East and Africa Utility Aircraft Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 10.1.1. Rotorcrafts

- 10.1.1.1. Light

- 10.1.1.2. Medium

- 10.1.1.3. Heavy

- 10.1.2. Fixed Wings

- 10.1.2.1. Turboprop

- 10.1.2.2. Turboshaft

- 10.1.1. Rotorcrafts

- 10.2. Market Analysis, Insights and Forecast - by Application Type

- 10.2.1. Military

- 10.2.2. Civil & Commercial

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Textron Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lockheed Martin Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Airbus SE

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 The Boeing Compan

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Aviation Industry Corporation of China

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 United Aircraft Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Leonardo S p A

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Bombardier Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hindustan Aeronautics Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Textron Inc

List of Figures

- Figure 1: Global Utility Aircraft Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Utility Aircraft Industry Revenue (Million), by Aircraft Type 2025 & 2033

- Figure 3: North America Utility Aircraft Industry Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 4: North America Utility Aircraft Industry Revenue (Million), by Application Type 2025 & 2033

- Figure 5: North America Utility Aircraft Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 6: North America Utility Aircraft Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Utility Aircraft Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Utility Aircraft Industry Revenue (Million), by Aircraft Type 2025 & 2033

- Figure 9: Europe Utility Aircraft Industry Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 10: Europe Utility Aircraft Industry Revenue (Million), by Application Type 2025 & 2033

- Figure 11: Europe Utility Aircraft Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 12: Europe Utility Aircraft Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Utility Aircraft Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Utility Aircraft Industry Revenue (Million), by Aircraft Type 2025 & 2033

- Figure 15: Asia Pacific Utility Aircraft Industry Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 16: Asia Pacific Utility Aircraft Industry Revenue (Million), by Application Type 2025 & 2033

- Figure 17: Asia Pacific Utility Aircraft Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 18: Asia Pacific Utility Aircraft Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Utility Aircraft Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Utility Aircraft Industry Revenue (Million), by Aircraft Type 2025 & 2033

- Figure 21: Latin America Utility Aircraft Industry Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 22: Latin America Utility Aircraft Industry Revenue (Million), by Application Type 2025 & 2033

- Figure 23: Latin America Utility Aircraft Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 24: Latin America Utility Aircraft Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Utility Aircraft Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Utility Aircraft Industry Revenue (Million), by Aircraft Type 2025 & 2033

- Figure 27: Middle East and Africa Utility Aircraft Industry Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 28: Middle East and Africa Utility Aircraft Industry Revenue (Million), by Application Type 2025 & 2033

- Figure 29: Middle East and Africa Utility Aircraft Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 30: Middle East and Africa Utility Aircraft Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Utility Aircraft Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Utility Aircraft Industry Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 2: Global Utility Aircraft Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 3: Global Utility Aircraft Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Utility Aircraft Industry Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 5: Global Utility Aircraft Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 6: Global Utility Aircraft Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Utility Aircraft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Utility Aircraft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Utility Aircraft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Utility Aircraft Industry Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 11: Global Utility Aircraft Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 12: Global Utility Aircraft Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Utility Aircraft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Utility Aircraft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Utility Aircraft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Utility Aircraft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Utility Aircraft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Utility Aircraft Industry Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 19: Global Utility Aircraft Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 20: Global Utility Aircraft Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: India Utility Aircraft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: China Utility Aircraft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Utility Aircraft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: South Korea Utility Aircraft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Utility Aircraft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Utility Aircraft Industry Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 27: Global Utility Aircraft Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 28: Global Utility Aircraft Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Mexico Utility Aircraft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Brazil Utility Aircraft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Latin America Utility Aircraft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Utility Aircraft Industry Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 33: Global Utility Aircraft Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 34: Global Utility Aircraft Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 35: Qatar Utility Aircraft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: United Arab Emirates Utility Aircraft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Africa Utility Aircraft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Utility Aircraft Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Utility Aircraft Industry?

The projected CAGR is approximately 4.98%.

2. Which companies are prominent players in the Utility Aircraft Industry?

Key companies in the market include Textron Inc, Lockheed Martin Corporation, Airbus SE, The Boeing Compan, Aviation Industry Corporation of China, United Aircraft Corporation, Leonardo S p A, Bombardier Inc, Hindustan Aeronautics Limited.

3. What are the main segments of the Utility Aircraft Industry?

The market segments include Aircraft Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 202.41 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

Rotorcraft to Dominate Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

March 2023: The Indian Defence Ministry awarded a contract to HAL to procure 6 Dornier aircraft. The latest addition of six aircraft will be procured with an upgraded fuel-efficient engine coupled with a five-bladed composite propeller.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Utility Aircraft Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Utility Aircraft Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Utility Aircraft Industry?

To stay informed about further developments, trends, and reports in the Utility Aircraft Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence