Key Insights

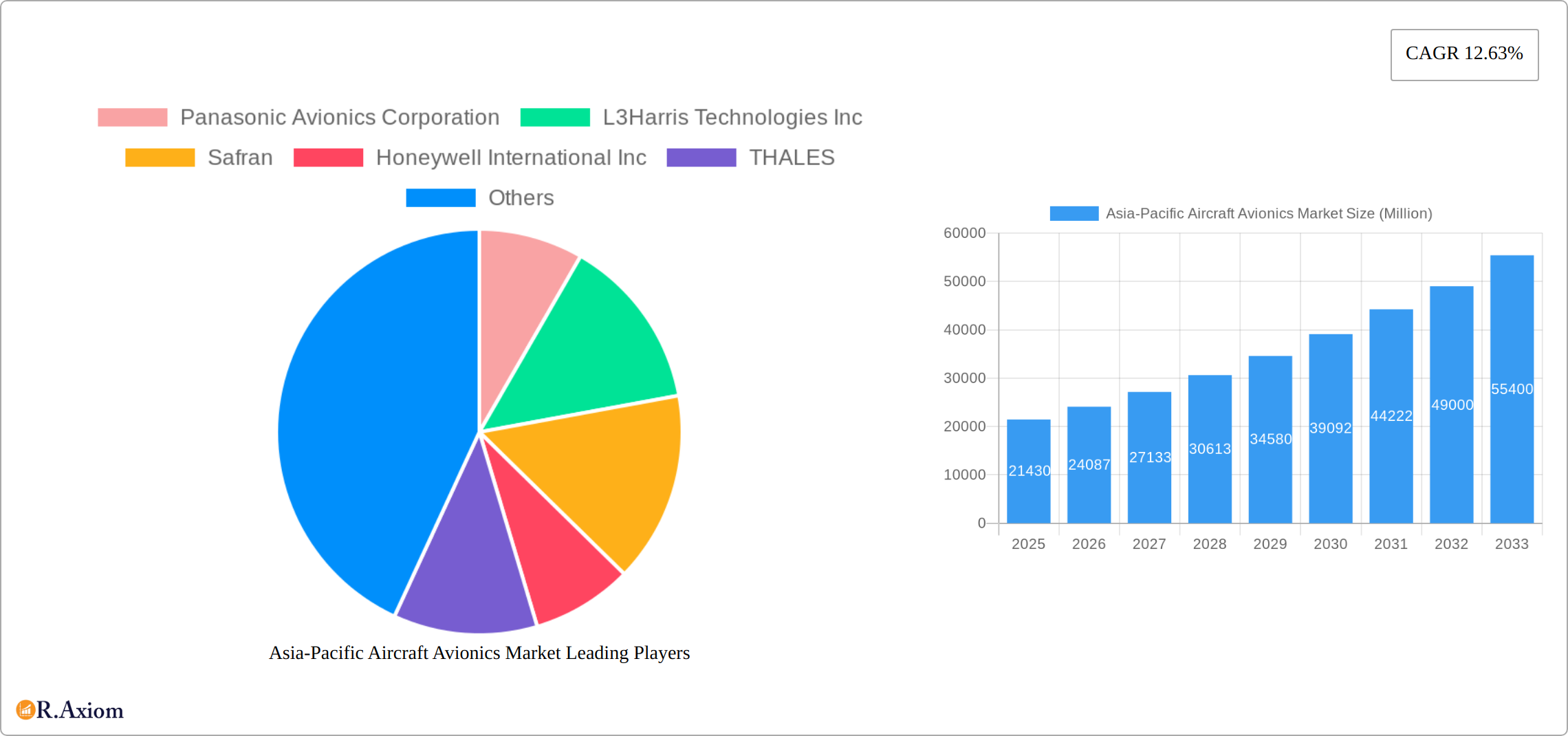

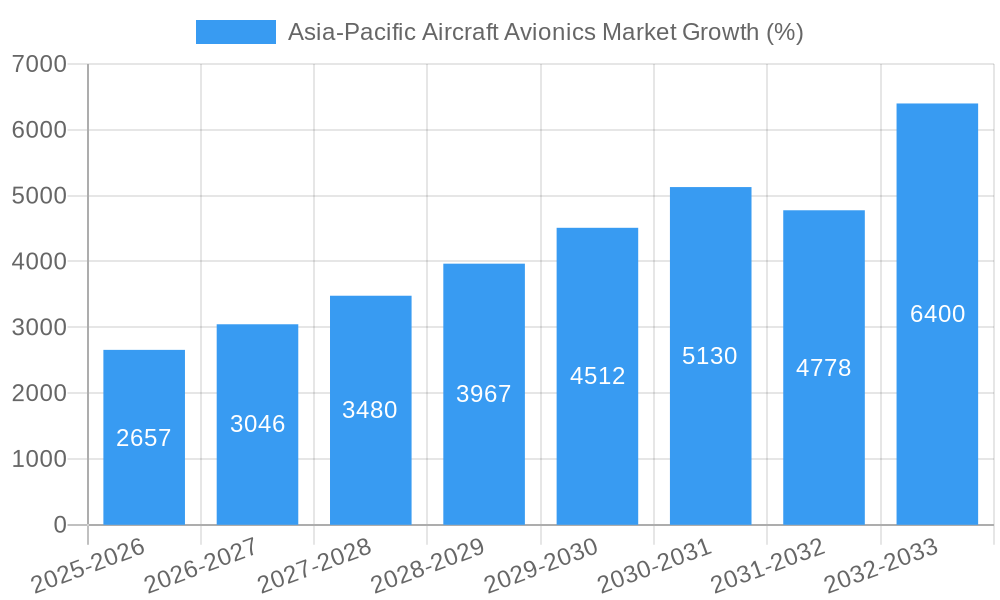

The Asia-Pacific aircraft avionics market is experiencing robust growth, projected to reach \$21.43 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 12.63% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the region's burgeoning aviation industry, particularly in countries like China and India, is driving significant demand for advanced avionics systems. The increasing number of commercial and military aircraft deliveries necessitates the integration of sophisticated navigation, communication, surveillance, and flight control systems. Secondly, a rising focus on enhancing safety and operational efficiency is pushing airlines and defense organizations to adopt next-generation avionics solutions, characterized by improved accuracy, reliability, and data analytics capabilities. Finally, technological advancements in areas such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) are enabling the development of increasingly intelligent and integrated avionics systems, further stimulating market growth.

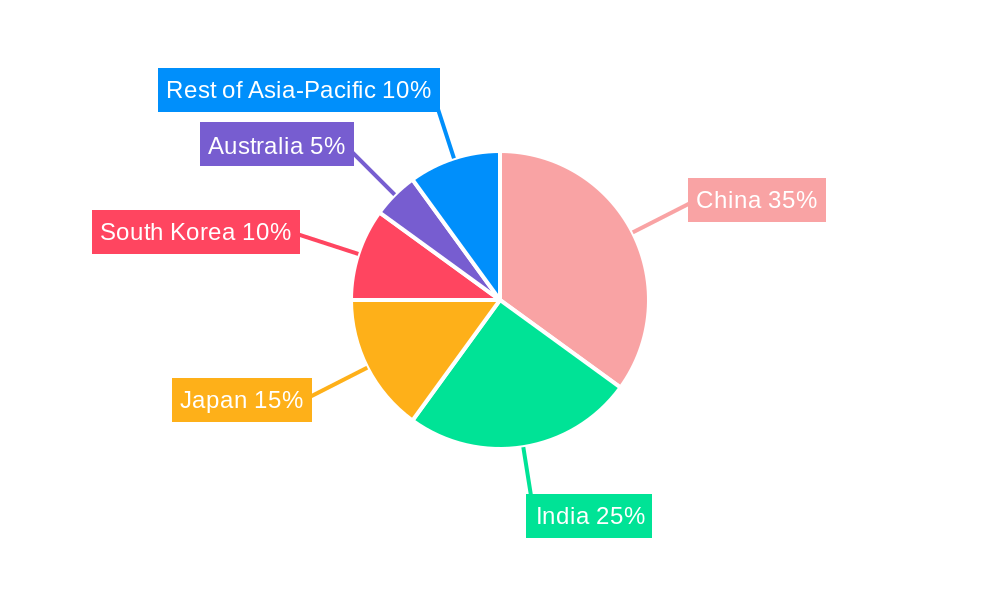

The market segmentation reveals significant opportunities across various applications (commercial, military, and general aviation) and countries within the Asia-Pacific region. China and India are expected to remain the largest contributors to market revenue due to their rapidly expanding air travel sectors and robust military modernization programs. However, other countries like Japan, South Korea, and Australia are also witnessing considerable growth, driven by factors such as increasing air passenger traffic, modernization of existing fleets, and regional security concerns. The leading players in the market, including Panasonic Avionics, L3Harris Technologies, Safran, and Honeywell, are strategically investing in research and development to capitalize on these growth opportunities and maintain their market share. Competition is intense, with companies focusing on developing innovative products, forging strategic partnerships, and expanding their geographic reach to cater to the diverse needs of the Asia-Pacific market.

This in-depth report provides a comprehensive analysis of the Asia-Pacific aircraft avionics market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. Key market segments are analyzed, including commercial, military, and general aviation aircraft across major Asia-Pacific countries: China, India, Japan, South Korea, Australia, and the Rest of Asia-Pacific. The report leverages extensive data analysis to provide actionable strategic recommendations.

Asia-Pacific Aircraft Avionics Market Market Concentration & Innovation

The Asia-Pacific aircraft avionics market presents a moderately concentrated landscape, dominated by established international players such as Panasonic Avionics Corporation, L3Harris Technologies Inc, Safran, Honeywell International Inc, THALES, Collins Aerospace (RTX Corporation), Northrop Grumman Corporation, Elbit Systems Ltd, Esterline Technologies Corporation, Garmin Ltd, Cobham Limited, and Diehl Stiftung & Co KG. These industry giants collectively held a significant market share, estimated at approximately [Insert Updated Percentage]% in 2024. However, the market's dynamic nature is characterized by the growing presence of regional players, intensifying competition and fostering innovation. This competitive pressure drives the development of cutting-edge technologies and services.

Innovation within the sector is fueled by the escalating demand for advanced features, including heightened situational awareness, sophisticated communication systems, and seamlessly integrated flight management systems. Stringent safety regulations and the ongoing pursuit of improved operational efficiency are primary catalysts for this innovation. The market's robust research and development (R&D) investment focuses on incorporating transformative technologies such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) to enhance aircraft performance, safety, and overall operational effectiveness. Mergers and acquisitions (M&A) activity has significantly shaped market dynamics, with notable transactions valued at [Insert Updated Value] Million in the past five years, primarily aimed at expanding product portfolios and geographical reach. The consolidation of smaller avionics companies by larger players has further contributed to increased market concentration. The regulatory environment, while stringent, is adapting to technological advancements, thereby fostering a culture of continuous innovation. Product substitution remains limited due to the high level of standardization and safety requirements; however, emerging technologies create exciting opportunities for disruptive innovation. End-user trends demonstrate a strong preference for integrated and sophisticated systems, substantially impacting the growth trajectories of specific avionics segments. This preference for comprehensive solutions is influencing manufacturers' strategies and product development roadmaps.

Asia-Pacific Aircraft Avionics Market Industry Trends & Insights

The Asia-Pacific aircraft avionics market is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is driven by several factors, including the rising demand for air travel, particularly in rapidly developing economies like China and India. Increased air passenger traffic translates to a greater need for new aircraft, thus boosting demand for advanced avionics systems. Technological disruptions, such as the integration of AI and machine learning algorithms for enhanced flight safety and efficiency, are also shaping the market trajectory. Consumer preferences increasingly favor user-friendly interfaces, enhanced connectivity options, and improved in-flight entertainment systems. The competitive landscape is dynamic, with both established players and emerging startups vying for market share. The market penetration rate of advanced avionics systems is gradually increasing, although it remains relatively low in certain segments of general aviation within the region. Technological advancements are playing a key role in driving market penetration, as sophisticated systems with improved safety and operational capabilities are becoming increasingly accessible. The market is also witnessing shifts in consumer preferences, with a growing emphasis on connectivity and in-flight entertainment. The market penetration of newer technologies like AI and IoT is expected to increase significantly during the forecast period.

Dominant Markets & Segments in Asia-Pacific Aircraft Avionics Market

Leading Region: China dominates the Asia-Pacific aircraft avionics market, driven by its robust domestic aviation industry, significant government investments in infrastructure development, and a rapidly expanding air travel sector.

Leading Country: China's dominance is further emphasized by its large fleet of commercial aircraft and a growing military aviation sector. The country's economic policies supporting domestic aerospace manufacturing also contribute to this market leadership.

Leading Segment (Application): The commercial aircraft segment holds the largest market share due to high air passenger traffic and the continuous fleet expansion of airlines within the region. The rapid growth of budget airlines is another significant factor, driving the adoption of cost-effective yet technologically advanced avionics systems.

Other Countries: India is a fast-growing market, driven by government initiatives to modernize its aviation sector. Japan and South Korea also contribute significantly, reflecting their advanced technological capabilities and well-established aviation industries. Australia shows moderate growth, largely influenced by its regional aviation and tourism sectors.

Key Drivers (China):

- Rapid expansion of air travel and passenger numbers.

- Government support for domestic aerospace manufacturing and infrastructure development.

- High investments in modernization of commercial and military aircraft fleets.

- Stringent safety regulations encouraging adoption of advanced avionics technologies.

Asia-Pacific Aircraft Avionics Market Product Developments

Recent product innovations focus on lightweight, efficient, and highly integrated systems incorporating advanced sensors, data processing capabilities, and improved communication technologies. These advancements enhance flight safety, operational efficiency, and passenger experience. Companies are focusing on developing avionics solutions with improved fuel efficiency and reduced maintenance costs, addressing key concerns of airline operators. The market is also witnessing the integration of Artificial Intelligence (AI) and Machine Learning (ML) for predictive maintenance, automated flight control, and enhanced situational awareness. The adoption of these technologies is gradually increasing, enhancing market competitiveness and providing new solutions for improved aviation safety.

Report Scope & Segmentation Analysis

This report segments the Asia-Pacific aircraft avionics market based on application (Commercial Aircraft, Military Aircraft, General Aviation Aircraft) and country (China, India, Japan, South Korea, Australia, Rest of Asia-Pacific). Each segment's growth projection, market size (in Million), and competitive landscape are thoroughly analyzed. The Commercial Aircraft segment exhibits the highest growth, driven by increasing passenger traffic. The Military Aircraft segment shows steady growth, fueled by government spending on defense modernization. The General Aviation segment displays moderate growth, limited by smaller fleet sizes. China holds the largest market share, followed by India and Japan, reflecting the varying sizes and developmental stages of their aviation sectors.

Key Drivers of Asia-Pacific Aircraft Avionics Market Growth

The growth of the Asia-Pacific aircraft avionics market is primarily driven by a confluence of factors: increasing air passenger traffic; government investments in aviation infrastructure; rising demand for technologically advanced aircraft equipped with sophisticated avionics; and stringent safety regulations promoting adoption of modern systems. Technological advancements, such as AI, ML, and IoT integration, are further accelerating growth. The focus on enhancing in-flight connectivity and passenger comfort also boosts demand for advanced avionics solutions. Finally, supportive government policies and incentives in several countries are fostering growth within the sector.

Challenges in the Asia-Pacific Aircraft Avionics Market Sector

The Asia-Pacific aircraft avionics market faces challenges such as the high initial investment costs associated with advanced avionics systems, potentially hindering adoption, especially among smaller operators. Supply chain disruptions and geopolitical uncertainties can impact the availability of crucial components and increase production costs. Intense competition among established international players and rising regional players creates pressure on pricing and margins. Regulatory complexities and differences across countries can also pose challenges for manufacturers seeking market access. Finally, the cybersecurity risks associated with increasingly interconnected avionics systems need to be addressed proactively.

Emerging Opportunities in Asia-Pacific Aircraft Avionics Market

Emerging opportunities include the growth of the general aviation sector, particularly in countries with expanding private aviation markets. The integration of advanced technologies, such as AI and IoT, presents numerous opportunities for innovation and the development of new functionalities. The increasing demand for enhanced passenger experience, particularly in terms of in-flight connectivity and entertainment, opens avenues for innovation. Finally, the growing focus on sustainable aviation fuels and environmental concerns presents opportunities for the development of fuel-efficient and environmentally friendly avionics solutions.

Leading Players in the Asia-Pacific Aircraft Avionics Market Market

- Panasonic Avionics Corporation

- L3Harris Technologies Inc

- Safran

- Honeywell International Inc

- THALES

- Collins Aerospace (RTX Corporation)

- Northrop Grumman Corporation

- Elbit Systems Ltd

- Esterline Technologies Corporation

- Garmin Ltd

- Cobham Limited

- Diehl Stiftung & Co KG

Key Developments in Asia-Pacific Aircraft Avionics Market Industry

- March 2023: Paras Defence and Space Technologies Limited received a contract for an Avionics Suite for Saras MK-2 Aircraft, boosting the Indian domestic avionics sector.

- November 2022: Collins Aerospace extended its on-site support contract with China Southern Airlines, highlighting the importance of long-term maintenance contracts in the market.

Strategic Outlook for Asia-Pacific Aircraft Avionics Market Market

The Asia-Pacific aircraft avionics market is poised for sustained growth, driven by several factors including rising air passenger numbers, investments in fleet modernization, and technological innovations. The increasing adoption of advanced technologies, such as AI and IoT, will transform the industry, enhancing safety, efficiency, and passenger experience. Opportunities exist for players focusing on cost-effective solutions, customized offerings for specific regional needs, and sustainable aviation technologies. The market will continue to witness consolidation through M&A activities, leading to a more concentrated landscape. However, the entrance of new players with innovative solutions will maintain a level of competitive dynamism.

Asia-Pacific Aircraft Avionics Market Segmentation

-

1. Application

- 1.1. Commercial Aircraft

- 1.2. Military Aircraft

- 1.3. General Aviation Aircraft

Asia-Pacific Aircraft Avionics Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Aircraft Avionics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.63% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Commercial Aircraft Segment will Dominate the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Aircraft Avionics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial Aircraft

- 5.1.2. Military Aircraft

- 5.1.3. General Aviation Aircraft

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. China Asia-Pacific Aircraft Avionics Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Aircraft Avionics Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Aircraft Avionics Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Aircraft Avionics Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Aircraft Avionics Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Aircraft Avionics Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Aircraft Avionics Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Panasonic Avionics Corporation

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 L3Harris Technologies Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Safran

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Honeywell International Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 THALES

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Collins Aerospace (RTX Corporation)

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Northrop Grumman Corporatio

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Elbit Systems Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Esterline Technologies Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Garmin Ltd

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Cobham Limited

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Diehl Stiftung & Co KG

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Panasonic Avionics Corporation

List of Figures

- Figure 1: Asia-Pacific Aircraft Avionics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Aircraft Avionics Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Aircraft Avionics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Aircraft Avionics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Asia-Pacific Aircraft Avionics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Asia-Pacific Aircraft Avionics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: China Asia-Pacific Aircraft Avionics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Japan Asia-Pacific Aircraft Avionics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: India Asia-Pacific Aircraft Avionics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South Korea Asia-Pacific Aircraft Avionics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Taiwan Asia-Pacific Aircraft Avionics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Australia Asia-Pacific Aircraft Avionics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Asia-Pacific Asia-Pacific Aircraft Avionics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Asia-Pacific Aircraft Avionics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 13: Asia-Pacific Aircraft Avionics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: China Asia-Pacific Aircraft Avionics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Japan Asia-Pacific Aircraft Avionics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South Korea Asia-Pacific Aircraft Avionics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: India Asia-Pacific Aircraft Avionics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Australia Asia-Pacific Aircraft Avionics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: New Zealand Asia-Pacific Aircraft Avionics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Indonesia Asia-Pacific Aircraft Avionics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Malaysia Asia-Pacific Aircraft Avionics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Singapore Asia-Pacific Aircraft Avionics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Thailand Asia-Pacific Aircraft Avionics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Vietnam Asia-Pacific Aircraft Avionics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Philippines Asia-Pacific Aircraft Avionics Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Aircraft Avionics Market?

The projected CAGR is approximately 12.63%.

2. Which companies are prominent players in the Asia-Pacific Aircraft Avionics Market?

Key companies in the market include Panasonic Avionics Corporation, L3Harris Technologies Inc, Safran, Honeywell International Inc, THALES, Collins Aerospace (RTX Corporation), Northrop Grumman Corporatio, Elbit Systems Ltd, Esterline Technologies Corporation, Garmin Ltd, Cobham Limited, Diehl Stiftung & Co KG.

3. What are the main segments of the Asia-Pacific Aircraft Avionics Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.43 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Commercial Aircraft Segment will Dominate the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

March 2023: Paras Defence and Space Technologies Limited received a contract from the Council of Scientific and Industrial Research (CSIR) - National Aerospace Laboratories (NAL) for an Avionics Suite for Saras MK-2 Aircraft. The aircraft is the first Indian multi-purpose civilian aircraft in the light transport aircraft category designed by the CSIR-NAL.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Aircraft Avionics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Aircraft Avionics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Aircraft Avionics Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Aircraft Avionics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence