Key Insights

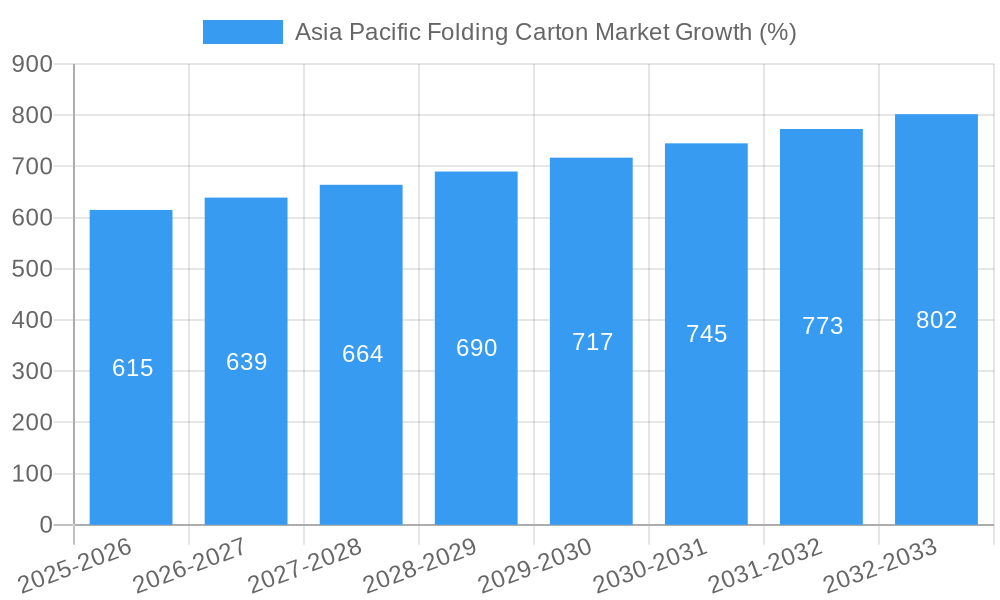

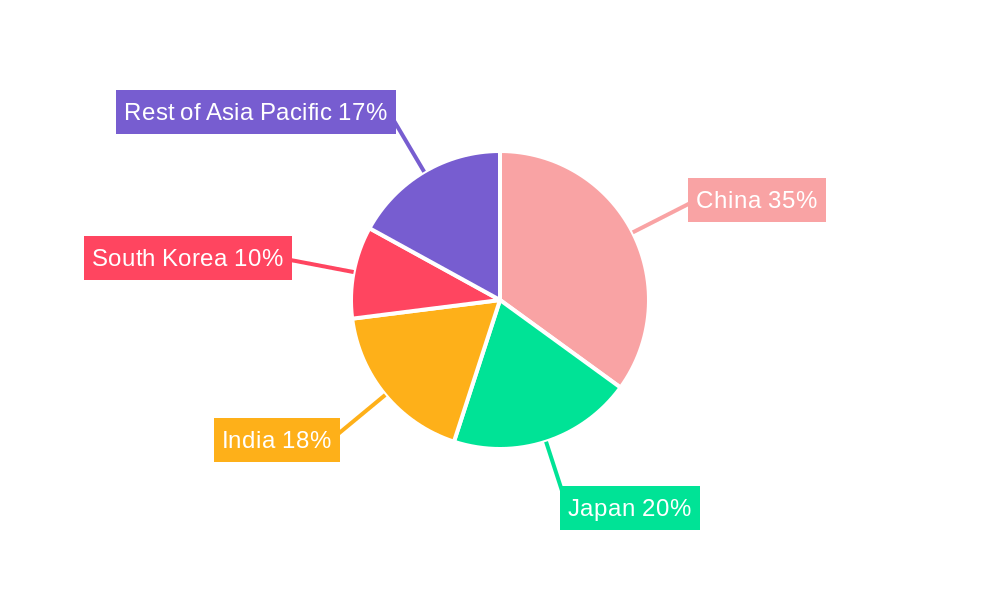

The Asia Pacific folding carton market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 4.10% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning food and beverage industry across the region, particularly in rapidly developing economies like India and China, is a major driver. Increasing consumer demand for packaged goods, coupled with the preference for aesthetically appealing and functional packaging, is boosting market demand. Furthermore, the growth of e-commerce and the consequent rise in online retail are significantly contributing to the market's expansion, as folding cartons are widely utilized for product protection and branding in online deliveries. The healthcare sector also presents a substantial opportunity, with the demand for pharmaceutical and medical device packaging continuously increasing. While the market faces challenges such as fluctuating raw material prices and stringent environmental regulations, innovative packaging solutions emphasizing sustainability are mitigating these restraints and shaping future growth. China, Japan, India, and South Korea represent the largest national markets within the Asia Pacific region, contributing significantly to overall market volume due to their advanced manufacturing sectors and substantial consumer bases.

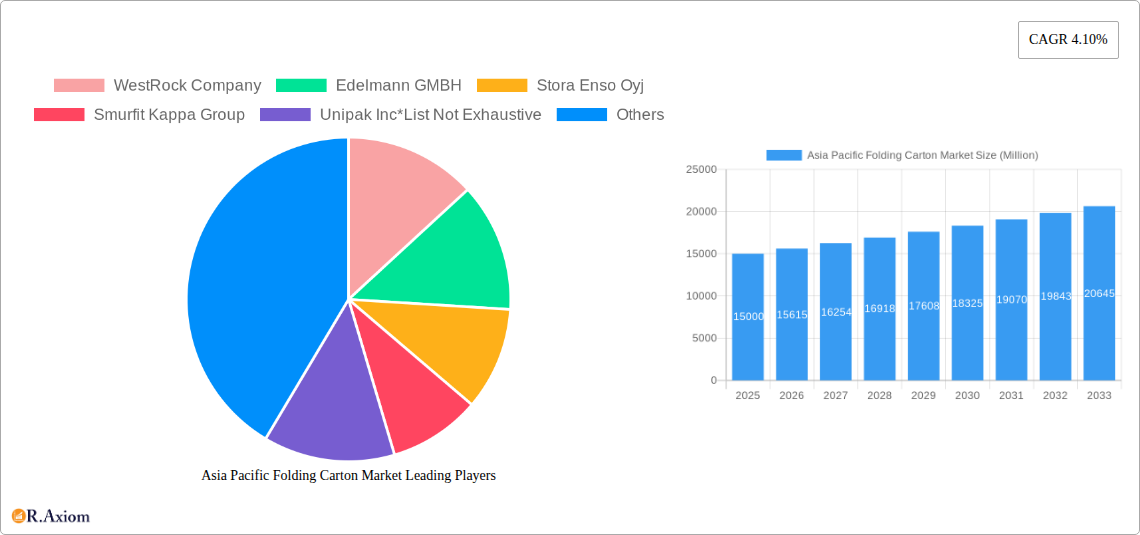

The competitive landscape is characterized by a mix of established multinational corporations and regional players. Companies like WestRock, Smurfit Kappa, and Stora Enso hold significant market share due to their global presence and extensive product portfolios. However, smaller, regional players are also gaining traction through localized production and cost-effective solutions tailored to specific market needs. The future of the Asia Pacific folding carton market hinges on the continued growth of consumer spending, the adoption of sustainable packaging practices, and technological advancements in printing and packaging technologies. Continuous innovation in materials, design, and functionality will be critical for companies to maintain competitiveness and capitalize on the expanding market opportunities. Increased focus on e-commerce logistics and the growing demand for customized packaging further contribute to optimistic growth projections throughout the forecast period.

Asia Pacific Folding Carton Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Asia Pacific folding carton market, offering actionable insights for industry stakeholders. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report examines market dynamics, key players, and future growth opportunities. The report's findings are based on extensive research, encompassing market size estimations, CAGR calculations, and competitive landscape analysis.

Asia Pacific Folding Carton Market Market Concentration & Innovation

The Asia Pacific folding carton market exhibits a moderately concentrated structure, with a handful of multinational corporations holding significant market share. Key players like WestRock Company, Smurfit Kappa Group, and Stora Enso Oyj compete intensely, driving innovation in materials, design, and sustainability. Market share data reveals that the top five players collectively account for approximately xx% of the market in 2025, while smaller regional players maintain a considerable presence. Innovation is propelled by increasing demand for sustainable packaging, leading to investments in eco-friendly materials and production processes. Regulatory frameworks concerning waste management and sustainability are also shaping market dynamics. Significant M&A activity has been observed, with deal values exceeding USD xx billion in the past five years, indicating consolidation trends within the industry. The emergence of new technologies, such as digital printing and automated production lines, is further transforming the market. Substitutes for folding cartons include alternative packaging materials, such as plastics and flexible films, posing a challenge to market growth. However, the inherent advantages of folding cartons in terms of recyclability and brand customization are likely to mitigate this threat. End-user trends increasingly favor sustainable and customizable packaging, driving demand for innovative solutions.

- Market Concentration: Top 5 players hold xx% market share (2025).

- M&A Activity: Deal values exceeding USD xx billion (2020-2024).

- Innovation Drivers: Sustainable packaging, digital printing, automation.

- Regulatory Frameworks: Emphasis on waste reduction and sustainability.

Asia Pacific Folding Carton Market Industry Trends & Insights

The Asia Pacific folding carton market is experiencing robust growth, driven by factors such as rising consumer spending, the expansion of e-commerce, and the increasing demand for packaged goods. The market is projected to register a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, particularly in printing and automation, are significantly impacting production efficiency and customization capabilities. Consumer preferences are shifting towards sustainable and convenient packaging solutions, pushing manufacturers to adopt eco-friendly materials and design innovations. Competitive dynamics are characterized by intense rivalry amongst established players and the emergence of new entrants, leading to strategic pricing and product differentiation strategies. Market penetration of sustainable folding cartons is steadily increasing, with xx% of the market adopting eco-friendly options in 2025. The increasing adoption of digital printing technologies has further streamlined the packaging process and allowed for greater customization and personalization. This has led to a rise in demand for shorter print runs and customized packaging solutions, particularly in sectors such as food and beverages and cosmetics.

Dominant Markets & Segments in Asia Pacific Folding Carton Market

China dominates the Asia Pacific folding carton market, driven by its large and rapidly growing consumer base, robust manufacturing sector, and substantial investments in infrastructure. Japan and India follow as significant markets, characterized by high per capita consumption of packaged goods and expanding e-commerce sectors. South Korea showcases a high demand for sophisticated and customized packaging solutions. The “Rest of Asia Pacific” demonstrates diverse growth patterns across emerging economies.

- China: Largest market driven by strong consumer base and manufacturing sector. Key Drivers: Rapid economic growth, rising disposable incomes, and expanding e-commerce sector.

- Japan: High per capita consumption of packaged goods and mature market with a focus on high-quality packaging. Key Drivers: Strong consumer demand and emphasis on premium packaging.

- India: Rapidly growing market with a large and young population. Key Drivers: Increasing urbanization, rising middle class, and growth in FMCG sector.

- South Korea: High demand for sophisticated and customized packaging solutions, advanced technology adoption. Key Drivers: Strong technological infrastructure, innovative product development.

- Rest of Asia Pacific: Diverse growth patterns across various emerging markets, with varying levels of development and consumer preferences.

End-User Industry Segmentation: The Food and Beverage segment leads the end-user industry, followed by Household and Personal Care, Healthcare, and Other End-User Industries. The Food and Beverage segment is dominated by the need for safe, hygienic, and attractive packaging that enhances shelf life and brand appeal. The Household and Personal Care segment is characterized by a focus on convenience, aesthetics, and sustainability. The Healthcare segment requires specialized packaging to ensure product safety, sterility, and traceability.

Asia Pacific Folding Carton Market Product Developments

Recent product innovations focus on enhanced sustainability features, including the use of recycled and renewable materials, biodegradable coatings, and compostable options. New applications are emerging in e-commerce packaging, requiring greater durability and tamper-evidence features. Competitive advantages are increasingly linked to sustainable practices, reduced environmental impact, and enhanced customization options through digital printing technologies. The market is witnessing a trend towards lightweighting of folding cartons to reduce material consumption and shipping costs, while maintaining product protection.

Report Scope & Segmentation Analysis

This report comprehensively segments the Asia Pacific folding carton market by end-user industry (Food and Beverage, Household and Personal Care, Healthcare, Other) and by country (China, Japan, India, South Korea, Rest of Asia Pacific). Growth projections, market sizes, and competitive dynamics are analyzed for each segment. Each segment demonstrates unique growth trajectories based on specific consumer demand, regulatory frameworks, and industrial developments. The Food and Beverage sector is predicted to maintain its dominant position, while the Household and Personal Care and Healthcare sectors are expected to witness strong growth due to changing consumer preferences and healthcare infrastructure development, respectively. Market size estimates are provided for each segment and country, along with detailed analysis of growth drivers, challenges, and opportunities.

Key Drivers of Asia Pacific Folding Carton Market Growth

The Asia Pacific folding carton market is propelled by several key factors. The rising demand for packaged goods, driven by increasing consumer spending and urbanization, is a significant driver. The growth of e-commerce necessitates innovative and durable packaging solutions. Government regulations promoting sustainable packaging practices are also creating new opportunities. Technological advancements in printing and manufacturing further enhance efficiency and customization.

Challenges in the Asia Pacific Folding Carton Market Sector

The Asia Pacific folding carton market faces challenges such as fluctuations in raw material prices, particularly paper pulp, which impact production costs and profitability. Stringent environmental regulations necessitate investments in sustainable technologies. Intense competition from alternative packaging materials, such as plastics and flexible films, also pose a significant challenge. Supply chain disruptions, particularly during periods of economic uncertainty, can affect production timelines and market stability. Importantly, the varying regulations and standards across different countries in the region present logistical and compliance hurdles for manufacturers.

Emerging Opportunities in Asia Pacific Folding Carton Market

Emerging opportunities lie in the growing demand for sustainable and eco-friendly packaging options, driving innovation in biodegradable and compostable materials. The e-commerce boom presents opportunities for specialized packaging solutions for online deliveries. The increasing adoption of digital printing technologies allows for greater customization and personalization, appealing to brands seeking to enhance their product presentation. Furthermore, emerging markets in the region present significant growth potential, driven by increasing disposable incomes and changing consumer habits.

Leading Players in the Asia Pacific Folding Carton Market Market

- WestRock Company

- Edelmann GMBH

- Stora Enso Oyj

- Smurfit Kappa Group

- Unipak Inc

- Mayr Melnhof Packaging International GmbH

- Bell Inc

- Graphic Packaging International LLC

- Essentra PLC

- DS Smith

Key Developments in Asia Pacific Folding Carton Market Industry

- March 2022: Asia Pacific Resources International Limited (APRIL Group) announced a USD 2.3 billion investment in a sustainable paperboard production facility in Indonesia, capable of producing 1.2 Million tonnes of recyclable and biodegradable folding boxboard annually. This significantly boosts the supply of sustainable packaging materials in the region.

- March 2022: APRIL Group commenced construction of a USD 2.33 billion paperboard production facility in Indonesia, signifying substantial investment in the region's folding carton industry and underscoring the growing demand for sustainable packaging solutions.

Strategic Outlook for Asia Pacific Folding Carton Market Market

The Asia Pacific folding carton market presents significant growth potential driven by the region's dynamic economic landscape, rising consumer spending, and increasing focus on sustainability. Future opportunities lie in developing innovative packaging solutions that address e-commerce needs, cater to growing consumer preferences for eco-friendly options, and leverage technological advancements in production and customization. Companies that effectively integrate sustainable practices, embrace digital technologies, and cater to evolving consumer preferences are expected to thrive in this competitive market.

Asia Pacific Folding Carton Market Segmentation

-

1. End-User Industry

- 1.1. Food and Beverage

- 1.2. Household and Personalcare

- 1.3. Healthcare

- 1.4. Other End-User Industries

Asia Pacific Folding Carton Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Folding Carton Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Eco Friendly Solutions and Scope for Printing Innovations Propelling the Growth in the End-user Segments; Potential Growth in Packaged Food Sales

- 3.3. Market Restrains

- 3.3.1. Concerns over Material Availability and Fluctuations in the Price of Raw Materials

- 3.4. Market Trends

- 3.4.1. Healthcare Industry to Show Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Folding Carton Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 5.1.1. Food and Beverage

- 5.1.2. Household and Personalcare

- 5.1.3. Healthcare

- 5.1.4. Other End-User Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 6. China Asia Pacific Folding Carton Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia Pacific Folding Carton Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia Pacific Folding Carton Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia Pacific Folding Carton Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia Pacific Folding Carton Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia Pacific Folding Carton Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia Pacific Folding Carton Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 WestRock Company

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Edelmann GMBH

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Stora Enso Oyj

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Smurfit Kappa Group

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Unipak Inc*List Not Exhaustive

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Mayr Melnhof Packaging International GmbH

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Bell Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Graphic Packaging International LLC

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Essentra PLC

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 DS Smith

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 WestRock Company

List of Figures

- Figure 1: Asia Pacific Folding Carton Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Folding Carton Market Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Folding Carton Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Folding Carton Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 3: Asia Pacific Folding Carton Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Asia Pacific Folding Carton Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: China Asia Pacific Folding Carton Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Japan Asia Pacific Folding Carton Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: India Asia Pacific Folding Carton Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South Korea Asia Pacific Folding Carton Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Taiwan Asia Pacific Folding Carton Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Australia Asia Pacific Folding Carton Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Asia-Pacific Asia Pacific Folding Carton Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Asia Pacific Folding Carton Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 13: Asia Pacific Folding Carton Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: China Asia Pacific Folding Carton Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Japan Asia Pacific Folding Carton Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South Korea Asia Pacific Folding Carton Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: India Asia Pacific Folding Carton Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Australia Asia Pacific Folding Carton Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: New Zealand Asia Pacific Folding Carton Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Indonesia Asia Pacific Folding Carton Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Malaysia Asia Pacific Folding Carton Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Singapore Asia Pacific Folding Carton Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Thailand Asia Pacific Folding Carton Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Vietnam Asia Pacific Folding Carton Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Philippines Asia Pacific Folding Carton Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Folding Carton Market?

The projected CAGR is approximately 4.10%.

2. Which companies are prominent players in the Asia Pacific Folding Carton Market?

Key companies in the market include WestRock Company, Edelmann GMBH, Stora Enso Oyj, Smurfit Kappa Group, Unipak Inc*List Not Exhaustive, Mayr Melnhof Packaging International GmbH, Bell Inc, Graphic Packaging International LLC, Essentra PLC, DS Smith.

3. What are the main segments of the Asia Pacific Folding Carton Market?

The market segments include End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Eco Friendly Solutions and Scope for Printing Innovations Propelling the Growth in the End-user Segments; Potential Growth in Packaged Food Sales.

6. What are the notable trends driving market growth?

Healthcare Industry to Show Significant Growth.

7. Are there any restraints impacting market growth?

Concerns over Material Availability and Fluctuations in the Price of Raw Materials.

8. Can you provide examples of recent developments in the market?

March 2022 - Sustainable fiber and product producer Asia Pacific Resources International Limited (APRIL Group) has announced that will invest IDR 33.4 trillion (USD 2.3 billion) in a sustainable paperboard production facility in Indonesia. Through the investment, Singapore-based APRIL Group aims to expand its product portfolio in the downstream sector along with supporting the growth of the green economy in Indonesia. The new facility that is being built can produce 1.2 million tonnes of fully recyclable and biodegradable folding boxboard annually to meet the demand for sustainable packaging products in the domestic and international markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Folding Carton Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Folding Carton Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Folding Carton Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Folding Carton Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence