Key Insights

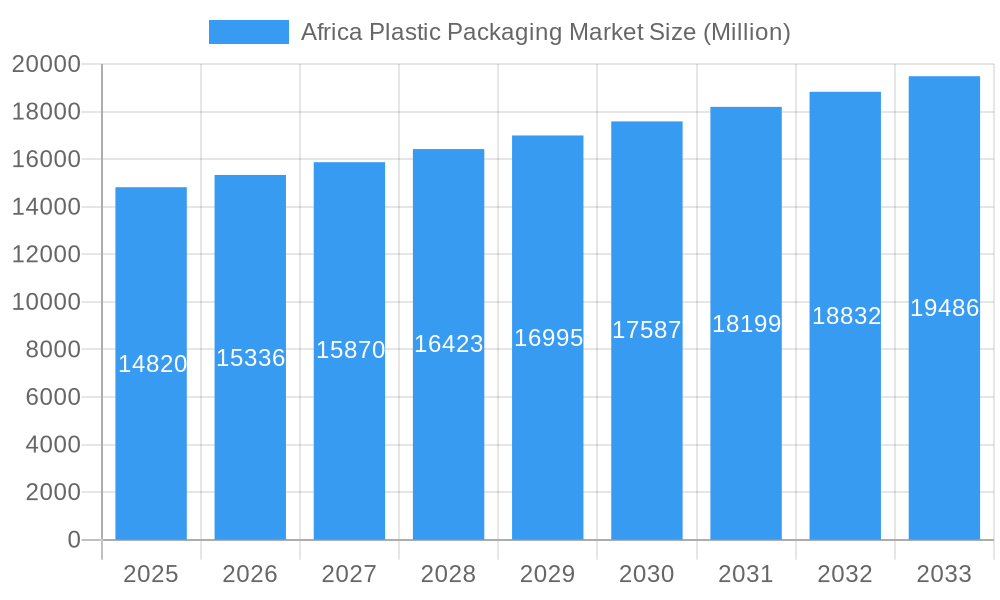

The Africa plastic packaging market, valued at $14.82 billion in 2025, is projected to experience steady growth, driven by a compound annual growth rate (CAGR) of 3.38% from 2025 to 2033. This expansion is fueled by several key factors. The rising population across numerous African nations, coupled with increasing urbanization and a burgeoning middle class, is leading to heightened consumer demand for packaged goods. The growth of the food and beverage, personal care, and pharmaceutical sectors further stimulates this demand. Furthermore, improvements in the region's infrastructure, including enhanced logistics and distribution networks, are facilitating the wider adoption of plastic packaging solutions. While environmental concerns regarding plastic waste present a challenge, the market is witnessing the adoption of sustainable packaging alternatives like biodegradable plastics and recycled content, mitigating some of these concerns. This shift towards environmentally conscious practices is expected to influence future market dynamics and shape packaging choices among manufacturers.

Africa Plastic Packaging Market Market Size (In Billion)

However, certain factors restrain market growth. The relatively underdeveloped manufacturing infrastructure in some African countries can lead to higher production costs and limited access to advanced packaging technologies. Fluctuations in raw material prices, particularly oil-based polymers, also impact overall market stability. Economic instability in certain regions can further dampen demand. Despite these challenges, the long-term outlook remains positive, primarily due to the significant growth potential across major African economies like South Africa, Nigeria, and Egypt, which are driving much of the market’s expansion. The increasing focus on flexible packaging, which offers cost and transportation efficiency advantages, is another significant trend reshaping this market landscape. Companies are actively investing in innovative and sustainable solutions to cater to the evolving demands of consumers and regulatory requirements.

Africa Plastic Packaging Market Company Market Share

This in-depth report provides a comprehensive analysis of the Africa Plastic Packaging Market, covering the period 2019-2033. It offers actionable insights into market dynamics, competitive landscapes, and future growth potential, making it an essential resource for industry stakeholders, investors, and strategic decision-makers. The report leverages extensive data analysis, incorporating detailed segmentation and key performance indicators to provide a holistic understanding of this dynamic market.

Africa Plastic Packaging Market Concentration & Innovation

This section analyzes the level of market concentration in the African plastic packaging industry, identifying key players and their market shares. It explores innovation drivers, including technological advancements in materials and manufacturing processes, as well as regulatory frameworks impacting the sector. The influence of product substitutes, evolving end-user trends, and mergers and acquisitions (M&A) activities on market dynamics is also examined.

Market Concentration: The African plastic packaging market exhibits a moderately concentrated structure, with a few large multinational corporations alongside numerous smaller regional players. Market share data for key players like Amcor PLC, and Nampak Ltd will be presented, showing their dominance in specific segments.

Innovation Drivers: Growth in e-commerce and increasing demand for convenience foods drive innovation in flexible packaging. Sustainable packaging solutions are gaining traction, prompting development of biodegradable and recyclable plastics.

Regulatory Framework: Government regulations concerning plastic waste management and environmental sustainability significantly influence the market. Analysis will include the impact of different national policies across Africa.

Product Substitutes: The growing availability of alternative packaging materials, such as paper and bioplastics, presents a competitive challenge to traditional plastic packaging. The report will assess the competitive pressure and the market share of these alternatives.

End-User Trends: Shifting consumer preferences toward convenient, tamper-evident, and sustainable packaging are impacting packaging design and material choices. The report analyzes these preferences and their implications.

M&A Activity: Consolidation through mergers and acquisitions is a significant trend. The report will analyze significant M&A deals in the historical period, providing deal values where available (e.g., xx Million USD).

Africa Plastic Packaging Market Industry Trends & Insights

This section delves into the key trends shaping the African plastic packaging market. It examines growth drivers such as rising population, urbanization, and economic development. The impact of technological disruptions, evolving consumer preferences (e.g., focus on sustainability), and competitive dynamics are thoroughly analyzed.

The report will present a detailed analysis of market size (in Million USD) and compound annual growth rate (CAGR) for the forecast period (2025-2033), along with insights into market penetration for different packaging types. Specific factors contributing to market growth, including changes in consumption patterns and the rise of organized retail, are considered. The impact of technological advancements such as automation and advanced materials is assessed.

Dominant Markets & Segments in Africa Plastic Packaging Market

This section pinpoints the leading regions, countries, and segments within the African plastic packaging market. Dominance analysis considers factors such as economic growth, infrastructure development, regulatory environment, and consumer demand.

Leading Countries: South Africa, Nigeria, and Egypt are expected to dominate the market due to their larger economies, substantial populations, and relatively developed infrastructure. Kenya and Morocco are also key markets. Detailed market size analysis for each country (in Million USD) is included.

Key Drivers:

- Economic Growth: Strong GDP growth in several African countries fuels increased consumption and demand for packaged goods.

- Infrastructure Development: Improved logistics and supply chains enhance the efficiency of packaging distribution.

- Government Policies: Government initiatives to promote industrialization and support local manufacturing can significantly influence market growth.

- Rapid Urbanization: Growing urban populations and changing lifestyles drive demand for convenience-oriented packaging solutions.

Detailed analysis of each country’s market size, along with an examination of market share and CAGR are presented.

Rigid Packaging: This segment includes bottles, containers, and tubs, primarily used for food and beverage, personal care, and household products. Analysis includes dominant materials (e.g., PET, HDPE, PP) and their market share.

Flexible Packaging: This includes films, pouches, and bags used for food, beverages, and other consumer goods. Analysis includes dominant materials (e.g., PE, PP, BOPP films) and their market share.

Other Materials: This segment encompasses other packaging materials such as paperboard and corrugated materials. Analysis will cover market size and growth forecasts.

End-User Segments: Analysis covers food & beverage, personal care, healthcare, industrial, and other end-use applications. The report will examine the market size and growth prospects within these sectors.

Africa Plastic Packaging Market Product Developments

This section summarizes recent product innovations, focusing on technological trends and market fit. New materials, advanced manufacturing techniques, and sustainable packaging solutions are highlighted. Competitive advantages are analyzed, emphasizing product differentiation and market positioning.

Report Scope & Segmentation Analysis

This section details the scope of the report and its segmentation approach.

Geographical Segmentation: The report covers key African countries: South Africa, Nigeria, Egypt, Kenya, Morocco, Ghana, Ethiopia, Tanzania, and Zambia. Growth projections and market size estimates are provided for each country.

Material Segmentation: The report segments the market based on packaging material type (Rigid and Flexible) and further divides them into specific materials (e.g., PET, HDPE, PP, PE, BOPP). Analysis will include market size and growth forecasts for each material segment.

End-User Segmentation: The market is segmented by end-user industries, such as food and beverage, personal care, healthcare, and others. Growth projections and competitive dynamics are detailed for each segment.

Detailed market size, growth forecasts, and competitive dynamics are provided for each segment.

Key Drivers of Africa Plastic Packaging Market Growth

Several factors drive growth in the African plastic packaging market: rapid economic expansion and rising disposable incomes leading to increased consumer spending, urbanization and changing lifestyles, and an expanding food and beverage sector. Government initiatives to improve infrastructure and support local manufacturing, as well as the growth of the e-commerce sector contribute significantly.

Challenges in the Africa Plastic Packaging Market Sector

The market faces challenges such as the increasing cost of raw materials, supply chain disruptions, and stringent environmental regulations. Fluctuations in currency exchange rates and limited access to advanced technologies are also noteworthy. The lack of infrastructure in some regions poses logistical hurdles. The estimated negative impact of these challenges on market growth is presented in quantitative terms where possible (e.g., xx% reduction in projected growth).

Emerging Opportunities in Africa Plastic Packaging Market

Emerging opportunities exist in the growing demand for sustainable packaging solutions (bioplastics, recyclables), the rise of e-commerce and the need for protective packaging, and the growth of the organized retail sector. Investment in innovative packaging technologies and expansion into underserved markets present significant potential for growth.

Leading Players in the Africa Plastic Packaging Market

- Polyoak Packaging

- Sonoco Products Company (Sonoco Products Company)

- Plastipak Holdings Inc (Plastipak Holdings Inc)

- Nampak Ltd (Nampak Ltd)

- Foster International Packaging

- Tetra Pak SA (Tetra Pak SA)

- Amcor PLC (Amcor PLC)

- Mondi PLC (Mondi PLC)

- LIQUIBOX (Sealed Air Corporation) (Sealed Air Corporation)

- Toppan Inc (Toppan Inc)

- Mpact Pty Ltd (Mpact Pty Ltd)

- Constantia Flexibles (Constantia Flexibles)

- Huhtamaki Oyj (Huhtamaki Oyj)

- Berry Astrapak (Berry Global Group Inc ) (Berry Global Group Inc)

- ALPLA Group (ALPLA Group)

Key Developments in Africa Plastic Packaging Market Industry

April 2023: Egypt and India laid the foundation stone for a USD 110 Million PET production factory in Ain Sokhna, Suez governorate. A monthly output capacity of 30,000 tonnes is anticipated. This significantly increases PET resin supply in the region, potentially impacting prices and availability.

November 2022: Tempo Paper Pulp & Packaging Ltd established a second BOPP film line in Nigeria with an annual capacity of 42,000 tons. This expansion addresses the rising demand for high-quality flexible packaging films in the region, increasing competition and potentially lowering prices.

Strategic Outlook for Africa Plastic Packaging Market

The African plastic packaging market presents significant growth opportunities due to factors such as expanding economies, rising consumer demand, and increasing urbanization. Companies that invest in sustainable packaging solutions, leverage technological advancements, and adapt to evolving consumer preferences are poised to benefit significantly from the market's considerable future potential. The market is projected to experience robust growth in the coming years, presenting attractive investment opportunities for both domestic and international players.

Africa Plastic Packaging Market Segmentation

-

1. Rigid Packaging

-

1.1. Material

- 1.1.1. Polyethylene (PE)

- 1.1.2. Polyethylene Terephthalate (PET)

- 1.1.3. Polypropylene (PP)

- 1.1.4. Polystyrene (PS) and Expanded Polystyrene (EPS)

- 1.1.5. Polyvinyl Chloride (PVC)

- 1.1.6. Other Materials

-

1.2. End User

- 1.2.1. Food

- 1.2.2. Beverage

- 1.2.3. Healthcare and Pharmaceutical

- 1.2.4. Personal Care and Cosmetics

- 1.2.5. Other End Users

-

1.1. Material

-

2. Flexible Packaging

-

2.1. Material

- 2.1.1. Polyethylene (PE)

- 2.1.2. Bi-orientated Polypropylene (BOPP)

- 2.1.3. Cast Polypropylene (CPP)

- 2.1.4. Polyvinyl Chloride (PVC)

- 2.1.5. Ethylene Vinyl Alcohol (EVOH)

- 2.1.6. Other Materials

-

2.2. End User

- 2.2.1. Food

- 2.2.2. Beverage

- 2.2.3. Personal Care and Cosmetics

- 2.2.4. Other End Users

-

2.1. Material

Africa Plastic Packaging Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Plastic Packaging Market Regional Market Share

Geographic Coverage of Africa Plastic Packaging Market

Africa Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.38% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Pet Bottles is Expected to Drive the Need for Rigid Packaging in the Region; Beverage Packaging is Expected to Gain Traction over the Coming Years

- 3.3. Market Restrains

- 3.3.1. In-house packaging

- 3.4. Market Trends

- 3.4.1. Food Industry to Hold Major Share in Both Rigid and Flexible Plastic Packaging Markets

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Rigid Packaging

- 5.1.1. Material

- 5.1.1.1. Polyethylene (PE)

- 5.1.1.2. Polyethylene Terephthalate (PET)

- 5.1.1.3. Polypropylene (PP)

- 5.1.1.4. Polystyrene (PS) and Expanded Polystyrene (EPS)

- 5.1.1.5. Polyvinyl Chloride (PVC)

- 5.1.1.6. Other Materials

- 5.1.2. End User

- 5.1.2.1. Food

- 5.1.2.2. Beverage

- 5.1.2.3. Healthcare and Pharmaceutical

- 5.1.2.4. Personal Care and Cosmetics

- 5.1.2.5. Other End Users

- 5.1.1. Material

- 5.2. Market Analysis, Insights and Forecast - by Flexible Packaging

- 5.2.1. Material

- 5.2.1.1. Polyethylene (PE)

- 5.2.1.2. Bi-orientated Polypropylene (BOPP)

- 5.2.1.3. Cast Polypropylene (CPP)

- 5.2.1.4. Polyvinyl Chloride (PVC)

- 5.2.1.5. Ethylene Vinyl Alcohol (EVOH)

- 5.2.1.6. Other Materials

- 5.2.2. End User

- 5.2.2.1. Food

- 5.2.2.2. Beverage

- 5.2.2.3. Personal Care and Cosmetics

- 5.2.2.4. Other End Users

- 5.2.1. Material

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Rigid Packaging

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Polyoak Packagin

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sonoco Products Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Plastipak Holdings Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nampak Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Foster International Packaging

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tetra Pak SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Amcor PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mondi PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 LIQUIBOX (Sealed Air Corporation)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Toppan Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Mpact Pty Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Constantia Flexibles

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Huhtamaki Oyj

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Berry Astrapak (Berry Global Group Inc )

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 ALPLA Group

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Polyoak Packagin

List of Figures

- Figure 1: Africa Plastic Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Africa Plastic Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Africa Plastic Packaging Market Revenue Million Forecast, by Rigid Packaging 2020 & 2033

- Table 2: Africa Plastic Packaging Market Revenue Million Forecast, by Flexible Packaging 2020 & 2033

- Table 3: Africa Plastic Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Africa Plastic Packaging Market Revenue Million Forecast, by Rigid Packaging 2020 & 2033

- Table 5: Africa Plastic Packaging Market Revenue Million Forecast, by Flexible Packaging 2020 & 2033

- Table 6: Africa Plastic Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Nigeria Africa Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: South Africa Africa Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Egypt Africa Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Kenya Africa Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Ethiopia Africa Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Morocco Africa Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Ghana Africa Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Algeria Africa Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Tanzania Africa Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Ivory Coast Africa Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Plastic Packaging Market?

The projected CAGR is approximately 3.38%.

2. Which companies are prominent players in the Africa Plastic Packaging Market?

Key companies in the market include Polyoak Packagin, Sonoco Products Company, Plastipak Holdings Inc, Nampak Ltd, Foster International Packaging, Tetra Pak SA, Amcor PLC, Mondi PLC, LIQUIBOX (Sealed Air Corporation), Toppan Inc, Mpact Pty Ltd, Constantia Flexibles, Huhtamaki Oyj, Berry Astrapak (Berry Global Group Inc ), ALPLA Group.

3. What are the main segments of the Africa Plastic Packaging Market?

The market segments include Rigid Packaging, Flexible Packaging .

4. Can you provide details about the market size?

The market size is estimated to be USD 14.82 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Pet Bottles is Expected to Drive the Need for Rigid Packaging in the Region; Beverage Packaging is Expected to Gain Traction over the Coming Years.

6. What are the notable trends driving market growth?

Food Industry to Hold Major Share in Both Rigid and Flexible Plastic Packaging Markets.

7. Are there any restraints impacting market growth?

In-house packaging.

8. Can you provide examples of recent developments in the market?

April 2023: Egypt and India laid the foundation stone for a USD 110 million PET production factory in Ain Sokhna, Suez governorate. A monthly output capacity of 30,000 tonnes is anticipated for the project. Construction is expected to be completed in two stages, the first of which will begin in the first half of 2024 and the second in the middle of 2025.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the Africa Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence