Key Insights

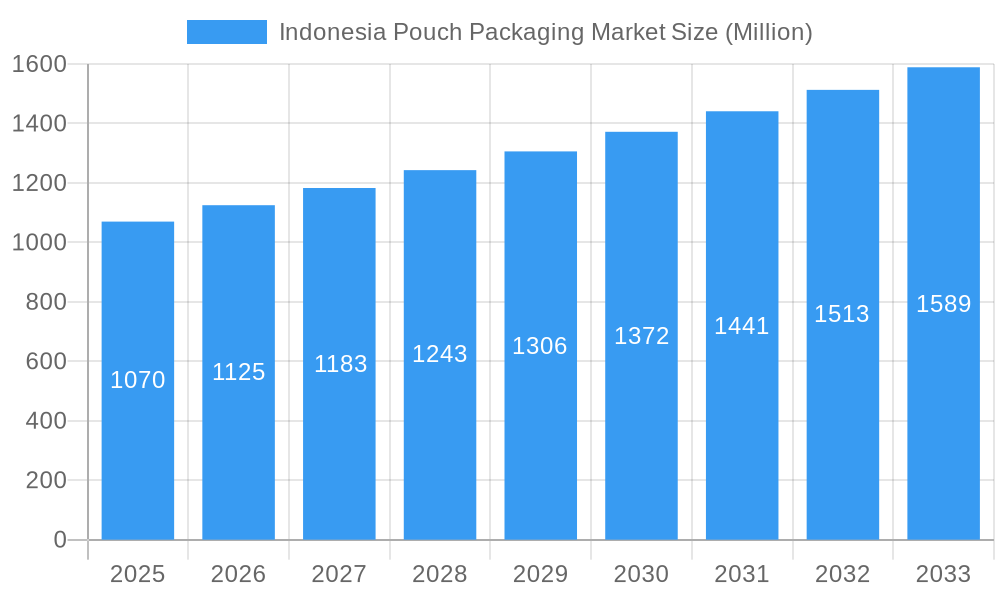

The Indonesian pouch packaging market is poised for robust growth, with an estimated market size of USD 1.07 billion and a projected Compound Annual Growth Rate (CAGR) of 5.22% between 2025 and 2033. This expansion is largely driven by the burgeoning demand from the food and beverage sectors, which represent significant end-user industries for pouch packaging solutions in Indonesia. The increasing consumer preference for convenient, portable, and longer-shelf-life packaging for a wide array of products, from ready-to-eat meals and snacks to dairy and frozen items, is a primary catalyst. Furthermore, the medical and pharmaceutical industry's adoption of pouches for sterile packaging and the personal care and household care segments' shift towards more sustainable and aesthetically appealing packaging options are contributing to this upward trajectory. The market's diverse segmentation by material, including plastics (polyethylene, polypropylene, PET, PVC, EVOH), paper, and aluminum, indicates a dynamic landscape catering to varied functional and sustainability requirements.

Indonesia Pouch Packaging Market Market Size (In Billion)

Key trends shaping the Indonesian pouch packaging market include a growing emphasis on advanced barrier properties to enhance product preservation and extend shelf life, a critical factor for perishable goods. The demand for innovative product formats such as stand-up pouches, which offer superior shelf presence and consumer convenience, is also on the rise. Sustainable packaging solutions, including recyclable and biodegradable materials, are gaining traction as both consumers and regulatory bodies push for environmentally responsible options, presenting both opportunities and challenges for manufacturers. Restraints to growth, such as the fluctuating prices of raw materials and the capital-intensive nature of advanced packaging technologies, need to be strategically managed. Leading players like Amcor Group GmbH, Sonoco Products Company, and PT Supernova Flexible Packaging are actively participating in this evolving market, focusing on innovation and capacity expansion to meet the escalating demand and capitalize on the evolving consumer and industry preferences.

Indonesia Pouch Packaging Market Company Market Share

This detailed report provides an in-depth analysis of the Indonesia pouch packaging market, encompassing historical trends, current dynamics, and future projections from 2019 to 2033, with a base and estimated year of 2025. Delve into market concentration, innovation drivers, regulatory landscapes, competitive strategies, and emerging opportunities within this dynamic sector. We offer actionable insights for industry stakeholders, including manufacturers, suppliers, investors, and end-users, to navigate the evolving demands of the Indonesian pouch packaging industry.

Indonesia Pouch Packaging Market Market Concentration & Innovation

The Indonesia pouch packaging market is characterized by a moderate to high level of market concentration, with a few key players holding significant market share, estimated to be around 55% in 2025. Innovation remains a critical driver, fueled by the growing demand for sustainable and convenient packaging solutions. Companies are investing heavily in research and development to introduce advanced materials and designs that offer superior barrier properties, extended shelf life, and enhanced user experience. Key innovation areas include the development of biodegradable and recyclable pouches, smart packaging features, and high-barrier co-extruded films.

Innovation Drivers:

- Increasing consumer awareness and demand for eco-friendly packaging.

- Technological advancements in material science and printing.

- Stringent regulations promoting sustainable practices.

- The need for extended shelf-life for food and pharmaceutical products.

- Growth of e-commerce requiring robust and lightweight packaging.

Regulatory Frameworks:

- Government initiatives promoting waste reduction and circular economy principles.

- Food safety standards and regulations influencing material choices.

- Potential for future policies regarding single-use plastics.

Product Substitutes:

- Rigid packaging (bottles, jars, cans) for certain applications.

- Other flexible packaging formats like flow wraps and sachets.

End-User Trends:

- Preference for single-serve and resealable pouches.

- Demand for visually appealing and informative packaging.

- Growing adoption of pouches in emerging sectors like pet food and personal care.

Mergers & Acquisitions (M&A) Activities:

- Strategic acquisitions are expected to shape market consolidation, with an estimated M&A deal value of approximately $150 Million during the forecast period. This trend indicates a desire for market expansion and diversification of product portfolios.

Indonesia Pouch Packaging Market Industry Trends & Insights

The Indonesia pouch packaging market is poised for significant growth, driven by a confluence of economic, technological, and societal factors. The Compound Annual Growth Rate (CAGR) is projected to be around 6.8% from 2025 to 2033. This expansion is largely attributed to the burgeoning middle class, increasing urbanization, and a rising demand for convenient, portable, and visually appealing packaging across various end-user industries. The market penetration of pouch packaging is expected to further deepen, surpassing 70% in key segments by 2033.

Technological disruptions are playing a pivotal role. Advancements in material science are leading to the development of lighter, stronger, and more sustainable pouch materials, including biodegradable plastics and recyclable mono-material structures. Enhanced barrier properties are crucial for extending the shelf life of food and beverage products, thereby reducing food waste and meeting consumer expectations for freshness. Digital printing technologies are enabling greater customization and faster turnaround times for packaging runs, catering to the increasing need for personalized marketing and smaller batch productions.

Consumer preferences are a strong catalyst for market evolution. The demand for on-the-go consumption and single-serving portions directly favors the use of pouches. Resealable features enhance convenience and product preservation, becoming a standard expectation for many product categories. Furthermore, the aesthetic appeal of pouches, with their excellent printability and the ability to showcase product visuals effectively, plays a significant role in brand differentiation and consumer engagement on crowded retail shelves.

Competitive dynamics within the Indonesian market are intensifying. Local manufacturers are investing in advanced machinery and aligning their offerings with international quality standards to compete effectively. Simultaneously, global players are expanding their presence, bringing innovation and economies of scale. The strategic importance of sustainability is increasingly influencing competitive strategies, with companies that can offer verifiable eco-friendly solutions gaining a competitive edge. The growth of the e-commerce sector also presents a unique set of demands, requiring packaging that is both protective during transit and visually appealing upon arrival, further driving innovation in pouch design and material robustness.

Dominant Markets & Segments in Indonesia Pouch Packaging Market

The Indonesian pouch packaging market is segmented across various materials, product types, and end-user industries, with certain segments exhibiting pronounced dominance.

Material Segmentation: The Plastic segment holds the largest market share, estimated at 65% of the total market value in 2025. Within plastics, Polyethylene (PE) and Polypropylene (PP) are the most widely used materials due to their cost-effectiveness, versatility, and excellent barrier properties for a wide range of applications.

- Plastic Dominance Drivers:

- Cost-effectiveness and wide availability.

- Excellent barrier properties against moisture, oxygen, and light.

- Versatility in terms of flexibility, strength, and printability.

- Established manufacturing infrastructure and supply chains.

- Growing demand in food and beverage, personal care, and household care segments.

- Specific Plastic Resins:

- Polyethylene (PE): Dominates due to its flexibility and affordability, crucial for general-purpose packaging.

- Polypropylene (PP): Valued for its higher melting point and stiffness, suitable for stand-up pouches and retort applications.

- PET (Polyethylene Terephthalate): Often used in multi-layer structures for its clarity and good barrier properties.

- EVOH (Ethylene Vinyl Alcohol): Incorporated for its exceptional gas barrier properties, vital for extending shelf life.

- PVC (Polyvinyl Chloride): Used in specific applications requiring high clarity and puncture resistance.

- Other Resins: Including specialized polymers for enhanced barrier or performance characteristics.

Paper is gaining traction, particularly for its sustainable appeal, accounting for an estimated 20% market share. Its use is often in composite structures with plastic or aluminum layers to achieve desired functionalities. Aluminum, while a smaller segment at around 15%, remains critical for high-barrier applications, especially in medical and pharmaceutical packaging, and some food products requiring absolute protection against external elements.

Product Segmentation: Stand-up pouches are projected to be the fastest-growing product segment, capturing an estimated 45% market share by 2033. Their appeal lies in their superior shelf presence, ease of use, and reclosability.

- Stand-up Pouch Dominance Drivers:

- Enhanced brand visibility on retail shelves.

- Convenience for consumers due to self-standing capability and reclosability.

- Suitability for a wide array of products, from snacks to pet food.

- Effective utilization of space in transportation and storage.

- Flat (Pillow & Side-Seal) Pouches: remain a significant segment, especially for single-serve portions and high-volume products like snacks and confectionery, estimated to hold around 35% market share.

- Other Pouch Types: Including spout pouches, zipper pouches, and custom-shaped pouches, will account for the remaining 20%, driven by specific application needs.

End-User Industry Segmentation: The Food industry is the largest consumer of pouch packaging in Indonesia, projected to hold approximately 50% of the market. Within the food sector, Dry Foods (e.g., rice, flour, pasta, snacks), Candy & Confectionery, and Dairy Products are major contributors.

- Food Industry Dominance Drivers:

- Indonesia's large and growing population with high food consumption.

- Demand for convenient and ready-to-eat food options.

- Need for extended shelf life to reduce spoilage and meet distribution demands.

- Growing popularity of packaged snacks and convenience foods.

- Specific Food Segments:

- Candy & Confectionery: High demand for attractive, single-serve pouches.

- Frozen Foods: Pouches offer excellent barrier properties and freezer burn resistance.

- Fresh Produce: Increasingly utilizing pouches for controlled atmosphere packaging.

- Dairy Products: Pouches for yogurt, milk, and cheese benefit from barrier protection.

- Dry Foods: A staple for rice, flour, snacks, and grains, where moisture barrier is crucial.

- Meat, Poultry, and Seafood: Pouches offer protection against spoilage and extend shelf life.

- Pet Food: A rapidly growing segment for pouches due to convenience and resealability.

- Beverage industry is a significant and growing segment, estimated at 20%, with pouches increasingly used for juices, ready-to-drink teas, and other liquid products.

- Medical and Pharmaceutical sector, though smaller in volume at around 15%, is a high-value segment demanding stringent quality and barrier properties for sterile packaging.

- Personal Care and Household Care industries are also expanding their use of pouches for products like liquid detergents, soaps, and cosmetics, contributing approximately 15% to the market.

Indonesia Pouch Packaging Market Product Developments

Product development in the Indonesia pouch packaging market is heavily influenced by the pursuit of sustainability, enhanced functionality, and cost-effectiveness. Innovations are centered on creating pouches with improved barrier properties to extend shelf life, thereby reducing food waste. This includes advancements in multi-layer film technology, incorporating materials like EVOH and specialized resins for superior oxygen and moisture resistance. Furthermore, the market is witnessing a surge in the development of recyclable mono-material pouches and biodegradable alternatives, responding to growing environmental concerns and regulatory pressures. The integration of user-friendly features such as resealable zippers, spouts, and easy-tear notches continues to be a key focus, enhancing consumer convenience. The aesthetic appeal is also being leveraged through advanced printing techniques, enabling vibrant graphics and product differentiation.

Report Scope & Segmentation Analysis

The Indonesia Pouch Packaging Market Report provides a comprehensive analysis of the market from 2019 to 2033, with a base year of 2025. The segmentation covers:

- Material: The market is analyzed by Material type including Plastic (further segmented into Polyethylene, Polypropylene, PET, PVC, EVOH, and Other Resins), Paper, and Aluminum. The plastic segment is expected to lead with a projected market size of approximately $1.5 Billion by 2025, driven by its versatility. Paper-based packaging is anticipated to see a CAGR of over 7%, reaching an estimated $480 Million by 2033 due to sustainability trends.

- Product: Segmentation includes Flat (Pillow & Side-Seal) pouches, Stand-up pouches, and other types. Stand-up pouches are projected to witness a strong CAGR of 7.5%, with their market share reaching an estimated $1 Billion by 2033, due to increasing demand for premium product presentation and consumer convenience.

- End-User Industry: Key industries analyzed are Food (with sub-segments like Candy & Confectionery, Frozen Foods, Fresh Produce, Dairy Products, Dry Foods, Meat, Poultry, and Seafood, Pet Food, Other Food), Beverage, Medical and Pharmaceutical, Personal Care and Household Care, and Other Industries. The Food industry segment is expected to maintain its dominance, with a projected market size of $2.4 Billion by 2025, and a steady CAGR of 6.5%.

Key Drivers of Indonesia Pouch Packaging Market Growth

Several key factors are propelling the growth of the Indonesia pouch packaging market. The rising disposable income and a burgeoning middle class are leading to increased consumption of packaged goods, especially convenience foods and personal care items. Technological advancements in manufacturing processes are enabling the production of more sophisticated, durable, and aesthetically pleasing pouches at competitive prices. The inherent advantages of pouch packaging, such as its lightweight nature, extended shelf life capabilities, and reduced material usage compared to rigid alternatives, are significant growth catalysts. Furthermore, the growing e-commerce sector necessitates robust, adaptable, and visually appealing packaging for shipping and delivery.

Challenges in the Indonesia Pouch Packaging Market Sector

Despite robust growth, the Indonesia pouch packaging market faces several challenges. The fluctuating prices of raw materials, particularly petroleum-based plastics, can impact profit margins and necessitate strategic sourcing. The need for significant capital investment in advanced manufacturing technologies and machinery can be a barrier for smaller players. Stringent environmental regulations, while driving innovation, also require substantial compliance efforts and investments in sustainable material development and waste management infrastructure. Furthermore, competition from established rigid packaging solutions and the nascent stages of widespread adoption of truly circular economy models for flexible packaging present ongoing hurdles.

Emerging Opportunities in Indonesia Pouch Packaging Market

The Indonesian pouch packaging market presents numerous emerging opportunities. The growing demand for sustainable packaging solutions, including compostable and biodegradable pouches, offers a significant avenue for growth. The expansion of the e-commerce landscape creates opportunities for specialized pouches designed for online retail, prioritizing product protection and unboxing experience. Increasing consumer focus on health and wellness is driving demand for pouches with enhanced barrier properties for organic and premium food products. Moreover, the untapped potential in niche segments like medical device packaging and specialized industrial applications presents lucrative avenues for market players willing to innovate and adapt.

Leading Players in the Indonesia Pouch Packaging Market Market

- PT Supernova Flexible Packaging

- Amcor Group GmbH

- PT Primajaya Eratama

- Toppan Packaging Service Co Ltd

- Sonoco Products Company

- PT Indogravure

- PT Plasindo Lestari

- ePac Holdings LLC

Key Developments in Indonesia Pouch Packaging Market Industry

- June 2024: Lami Packaging Co. Ltd, an Indonesian packaging company, commenced commercial operations in April 2024. Its factory specializes in paper-based laminated aseptic packaging, equipped with cutting-edge machinery that meets stringent industry benchmarks, enhancing the capacity for high-quality aseptic packaging solutions.

- January 2024: Toppan Packaging Service Co. Ltd, a Japanese firm with operations in Indonesia, showcased its sustainable packaging solutions at ProPak Philippines 2024. This exhibition highlighted their commitment to catering to the diverse and evolving needs of the Asian market's end-use industries, particularly focusing on eco-friendly packaging innovations.

Strategic Outlook for Indonesia Pouch Packaging Market Market

The strategic outlook for the Indonesia pouch packaging market is exceptionally positive, driven by a strong interplay of economic development, evolving consumer preferences, and technological advancements. The increasing adoption of flexible packaging formats across key sectors like food, beverages, and personal care, coupled with the government's push for sustainable practices, presents a fertile ground for innovation and expansion. Companies that can effectively leverage advancements in material science to offer recyclable, biodegradable, and high-performance pouches, while also investing in digital printing technologies for customization and efficiency, will be well-positioned for sustained growth. Strategic partnerships and potential mergers and acquisitions will also play a crucial role in consolidating market share and expanding product portfolios to meet the diverse demands of the Indonesian market. The focus will remain on delivering value through enhanced functionality, improved sustainability credentials, and cost-effectiveness.

Indonesia Pouch Packaging Market Segmentation

-

1. Material

-

1.1. Plastic

- 1.1.1. Polyethylene

- 1.1.2. Polypropylene

- 1.1.3. PET

- 1.1.4. PVC

- 1.1.5. EVOH

- 1.1.6. Other Resins

- 1.2. Paper

- 1.3. Aluminum

-

1.1. Plastic

-

2. Product

- 2.1. Flat (Pillow & Side-Seal)

- 2.2. Stand-up

-

3. End-User Industry

-

3.1. Food

- 3.1.1. Candy & Confectionery

- 3.1.2. Frozen Foods

- 3.1.3. Fresh Produce

- 3.1.4. Dairy Products

- 3.1.5. Dry Foods

- 3.1.6. Meat, Poultry, And Seafood

- 3.1.7. Pet Food

- 3.1.8. Other Fo

- 3.2. Beverage

- 3.3. Medical and Pharmaceutical

- 3.4. Personal Care and Household Care

- 3.5. Other En

-

3.1. Food

Indonesia Pouch Packaging Market Segmentation By Geography

- 1. Indonesia

Indonesia Pouch Packaging Market Regional Market Share

Geographic Coverage of Indonesia Pouch Packaging Market

Indonesia Pouch Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.22% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand of Pouch Packaging in Food Industry; Product Innovation by Manufacturers to Drive the Market Growth

- 3.3. Market Restrains

- 3.3.1. Growing Demand of Pouch Packaging in Food Industry; Product Innovation by Manufacturers to Drive the Market Growth

- 3.4. Market Trends

- 3.4.1. The Standard Pouch Segment is Expected to Register the Highest Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Pouch Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.1.1. Polyethylene

- 5.1.1.2. Polypropylene

- 5.1.1.3. PET

- 5.1.1.4. PVC

- 5.1.1.5. EVOH

- 5.1.1.6. Other Resins

- 5.1.2. Paper

- 5.1.3. Aluminum

- 5.1.1. Plastic

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Flat (Pillow & Side-Seal)

- 5.2.2. Stand-up

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Food

- 5.3.1.1. Candy & Confectionery

- 5.3.1.2. Frozen Foods

- 5.3.1.3. Fresh Produce

- 5.3.1.4. Dairy Products

- 5.3.1.5. Dry Foods

- 5.3.1.6. Meat, Poultry, And Seafood

- 5.3.1.7. Pet Food

- 5.3.1.8. Other Fo

- 5.3.2. Beverage

- 5.3.3. Medical and Pharmaceutical

- 5.3.4. Personal Care and Household Care

- 5.3.5. Other En

- 5.3.1. Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PT Supernova Flexible Packaging

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Amcor Group GmbH

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PT Primajaya Eratama

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Toppan Packaging Service Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sonoco Products Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PT Indogravure

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PT Plasindo Lestari

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ePac Holdings LLC*List Not Exhaustive 8 2 Heat Map Analysi

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 PT Supernova Flexible Packaging

List of Figures

- Figure 1: Indonesia Pouch Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Indonesia Pouch Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Pouch Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Indonesia Pouch Packaging Market Volume Billion Forecast, by Material 2020 & 2033

- Table 3: Indonesia Pouch Packaging Market Revenue Million Forecast, by Product 2020 & 2033

- Table 4: Indonesia Pouch Packaging Market Volume Billion Forecast, by Product 2020 & 2033

- Table 5: Indonesia Pouch Packaging Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 6: Indonesia Pouch Packaging Market Volume Billion Forecast, by End-User Industry 2020 & 2033

- Table 7: Indonesia Pouch Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Indonesia Pouch Packaging Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Indonesia Pouch Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 10: Indonesia Pouch Packaging Market Volume Billion Forecast, by Material 2020 & 2033

- Table 11: Indonesia Pouch Packaging Market Revenue Million Forecast, by Product 2020 & 2033

- Table 12: Indonesia Pouch Packaging Market Volume Billion Forecast, by Product 2020 & 2033

- Table 13: Indonesia Pouch Packaging Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 14: Indonesia Pouch Packaging Market Volume Billion Forecast, by End-User Industry 2020 & 2033

- Table 15: Indonesia Pouch Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Indonesia Pouch Packaging Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Pouch Packaging Market?

The projected CAGR is approximately 5.22%.

2. Which companies are prominent players in the Indonesia Pouch Packaging Market?

Key companies in the market include PT Supernova Flexible Packaging, Amcor Group GmbH, PT Primajaya Eratama, Toppan Packaging Service Co Ltd, Sonoco Products Company, PT Indogravure, PT Plasindo Lestari, ePac Holdings LLC*List Not Exhaustive 8 2 Heat Map Analysi.

3. What are the main segments of the Indonesia Pouch Packaging Market?

The market segments include Material, Product, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.07 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand of Pouch Packaging in Food Industry; Product Innovation by Manufacturers to Drive the Market Growth.

6. What are the notable trends driving market growth?

The Standard Pouch Segment is Expected to Register the Highest Growth.

7. Are there any restraints impacting market growth?

Growing Demand of Pouch Packaging in Food Industry; Product Innovation by Manufacturers to Drive the Market Growth.

8. Can you provide examples of recent developments in the market?

June 2024: Lami Packaging Co. Ltd, a packaging company based in Indonesia, began its commercial operations in April 2024. The Indonesian factory manufactures paper-based laminated aseptic packaging, boasting cutting-edge machinery that meets industry benchmarks.January 2024: Toppan Packaging Service Co. Ltd, a Japanese company with operations in Indonesia, unveiled its sustainable packaging solutions at ProPak Philippines 2024, hosted at the World Trade Center Metro Manila. The focus was on catering to the diverse needs of the Asian market's end-use industries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Pouch Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Pouch Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Pouch Packaging Market?

To stay informed about further developments, trends, and reports in the Indonesia Pouch Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence