Key Insights

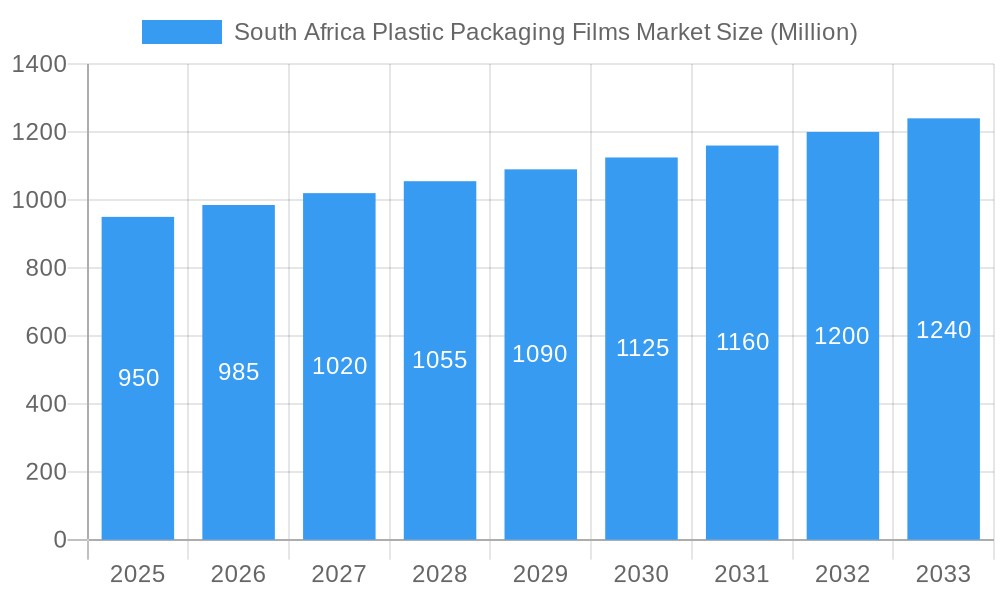

The South African plastic packaging films market is a dynamic sector, projected to reach a substantial market size of 2.81 billion by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 3.25% through 2033. Growth is propelled by robust demand from key end-user industries, notably the food sector. Within food packaging, demand for candy, confectionery, frozen foods, and fresh produce films is significant, driven by evolving consumer preferences for convenience and extended shelf life. The personal care and home care industries also represent substantial and growing application areas, fueled by increasing urbanization and disposable incomes, boosting demand for packaged consumer goods. Furthermore, the healthcare sector's consistent need for sterile and protective packaging solutions contributes steadily to market expansion.

South Africa Plastic Packaging Films Market Market Size (In Billion)

Market expansion is underpinned by the widespread adoption of various film types, with Polypropylene (PP) and Polyethylene (PE) films leading due to their versatility, cost-effectiveness, and excellent barrier properties. Polystyrene and PETG films are also gaining prominence for applications requiring clarity and rigidity. Emerging trends include a growing emphasis on sustainable packaging solutions, with bio-based films slowly carving out a niche, despite facing cost and performance challenges. Market restraints include fluctuations in raw material prices, particularly crude oil, impacting profitability. Stringent environmental regulations regarding plastic waste management in South Africa present a significant hurdle, pushing manufacturers towards innovation in recyclability and recycled content. Despite these challenges, the outlook for the South African plastic packaging films market remains positive, driven by sustained consumer demand and ongoing innovation in material science and packaging technology.

South Africa Plastic Packaging Films Market Company Market Share

This in-depth market research report provides a comprehensive analysis of the South Africa Plastic Packaging Films Market, meticulously examining historical trends, current dynamics, and future projections. Covering the period up to 2033, with a base year of 2025, this report offers invaluable insights into market size, growth drivers, challenges, and emerging opportunities within this vital sector. We delve into the intricacies of various film types, end-user industries, and competitive landscapes, equipping industry stakeholders with actionable intelligence to navigate the evolving market.

South Africa Plastic Packaging Films Market Market Concentration & Innovation

The South Africa Plastic Packaging Films Market exhibits a moderate level of market concentration, with a mix of large multinational players and a significant number of local manufacturers. Innovation is a key differentiator, driven by increasing demand for sustainable packaging solutions, enhanced barrier properties, and improved shelf-life for packaged goods. Regulatory frameworks are progressively influencing the market, with a growing emphasis on recyclability, recycled content, and waste reduction. Product substitutes, such as paper-based packaging and alternative materials, pose a growing challenge, but the inherent advantages of plastic films in terms of cost, durability, and versatility continue to solidify their position. End-user trends are shifting towards lightweight, high-performance films that cater to specific product needs, particularly within the food and beverage sector. Mergers and Acquisitions (M&A) activities, while present, are strategic in nature, often aimed at expanding product portfolios, enhancing geographical reach, or securing technological advancements. The estimated market share of key players and the aggregate value of recent M&A deals provide a quantitative snapshot of the competitive landscape.

South Africa Plastic Packaging Films Market Industry Trends & Insights

The South Africa Plastic Packaging Films Market is experiencing robust growth, propelled by several key factors. The expanding middle class, coupled with increasing urbanization, is driving higher consumption of packaged goods across various sectors, including food, beverages, healthcare, and personal care. This surge in demand directly translates into a greater need for effective and efficient plastic packaging films. Technological advancements are playing a pivotal role, with ongoing innovations in material science leading to the development of advanced films with superior barrier properties, extended shelf life, and enhanced recyclability. The adoption of bioplastics and the increased use of recycled PET (rPET) are significant technological disruptions gaining momentum. Consumer preferences are evolving, with a growing awareness and demand for sustainable, eco-friendly packaging options. Manufacturers are responding by developing films made from recycled materials and exploring biodegradable alternatives. Competitive dynamics are characterized by intense price competition, a focus on product differentiation through specialized functionalities, and strategic collaborations to enhance supply chain efficiency. The market penetration of advanced packaging solutions is steadily increasing, reflecting the industry's commitment to innovation and sustainability. The estimated CAGR for the forecast period is xx%, indicating a healthy growth trajectory for the South Africa Plastic Packaging Films Market.

Dominant Markets & Segments in South Africa Plastic Packaging Films Market

The South Africa Plastic Packaging Films Market is segmented by film type and end-user industry, with certain segments demonstrating pronounced dominance. Polyethylene (PE) films, encompassing both low-density (LDPE) and high-density (HDPE) varieties, are the undisputed leaders, driven by their versatility, cost-effectiveness, and wide applicability across numerous industries, particularly in food packaging. The dominance of PE is further bolstered by its excellent moisture barrier properties and suitability for flexible packaging applications like pouches, bags, and wraps. Within end-user industries, Food Packaging commands the largest market share. This dominance is attributed to South Africa's significant agricultural output and a growing demand for convenience foods, frozen goods, fresh produce, and dairy products. Specifically, the Meat, Poultry, and Seafood sub-segment, along with Frozen Foods and Dairy Products, represent substantial contributors due to the critical need for extended shelf life and protection against spoilage, which plastic films effectively provide.

Key Drivers for Polyethylene Dominance:

- Cost-effectiveness: PE offers a competitive price point for large-volume packaging needs.

- Versatility: Adaptable to various film structures and printing techniques.

- Performance: Excellent moisture barrier and good puncture resistance.

- Recycling Infrastructure: Established recycling streams for common PE types.

Key Drivers for Food Packaging Dominance:

- Growing Consumer Base: Increasing population and urbanization drive demand for packaged food.

- Shelf-Life Extension: Crucial for preserving perishable goods and reducing food waste.

- Food Safety Standards: Plastic films play a vital role in maintaining hygiene and preventing contamination.

- Convenience: Demand for pre-packaged and ready-to-eat meals.

Other influential segments include Healthcare and Personal Care and Home Care, which require specialized films with specific barrier properties and hygiene standards. Industrial Packaging also represents a significant segment, utilizing robust films for product protection during transit and storage. While Bio-based films are an emerging segment, their market penetration is still relatively low due to higher costs and performance limitations compared to traditional plastics. However, increasing environmental consciousness and regulatory push are expected to drive their growth in the long term. The projected market size for key segments highlights the continued importance of PE and food packaging in the South African market.

South Africa Plastic Packaging Films Market Product Developments

Recent product developments in the South Africa Plastic Packaging Films Market are centered on enhancing sustainability, improving performance, and meeting specific application needs. Innovations include the development of multi-layer films with improved barrier properties for extended product shelf life, particularly for food items. The introduction of thinner yet stronger films, reducing material usage without compromising protection, is also a key trend. Furthermore, advancements in the incorporation of recycled content (rPET) into virgin plastic films are becoming more prevalent, driven by both regulatory mandates and consumer demand for a circular economy. Companies are also focusing on developing films with enhanced recyclability, often by simplifying material structures. These product developments aim to offer competitive advantages by addressing the growing demand for eco-friendly and high-performance packaging solutions.

Report Scope & Segmentation Analysis

This report meticulously segments the South Africa Plastic Packaging Films Market by Type and End-user Industry. The Type segmentation includes Polypropylene (PP), Polyethylene (PE), Polystyrene (PS), Bio-based films, Polyvinyl Chloride (PVC), Ethylene Vinyl Alcohol (EVOH), Polyethylene Terephthalate Glycol (PETG), and Other Film Types. The End-user Industry segmentation encompasses Food (with sub-segments like Candy and Confectionery, Frozen Foods, Fresh Produce, Dairy Products, Dry Foods, Meat, Poultry, and Seafood, Pet Food, and Others), Healthcare, Personal Care and Home Care, Industrial Packaging, and Other End-user Industries. Each segment is analyzed for its market size, growth projections, and competitive dynamics. For instance, the Polyethylene segment is projected to maintain its leading position throughout the forecast period due to its widespread applications and cost-effectiveness, with an estimated market share of xx% in 2025.

Key Drivers of South Africa Plastic Packaging Films Market Growth

The South Africa Plastic Packaging Films Market is propelled by several key drivers. The growing population and increasing disposable incomes are directly fueling the demand for packaged goods across food, healthcare, and personal care sectors. Urbanization further amplifies this trend by concentrating consumption. Technological advancements in film manufacturing, leading to thinner, stronger, and more sustainable packaging, are crucial. The growing emphasis on product shelf-life extension and food waste reduction in the food industry is a significant driver for high-barrier plastic films. Additionally, regulatory initiatives promoting recycling and the use of recycled content are indirectly fostering growth by encouraging innovation in sustainable packaging solutions.

Challenges in the South Africa Plastic Packaging Films Market Sector

Despite robust growth, the South Africa Plastic Packaging Films Market faces several challenges. Negative public perception and environmental concerns surrounding plastic waste pose a significant restraint, leading to calls for stricter regulations and bans on certain types of packaging. Fluctuating raw material prices, particularly for petrochemical derivatives, can impact manufacturing costs and profit margins. Supply chain disruptions, exacerbated by global events, can affect the availability and cost of raw materials and finished products. Intensifying competition from alternative packaging materials and a saturated market landscape can also present hurdles for new entrants and smaller players. The cost of implementing and scaling up advanced recycling technologies also remains a challenge.

Emerging Opportunities in South Africa Plastic Packaging Films Market

Emerging opportunities in the South Africa Plastic Packaging Films Market are primarily driven by the growing demand for sustainable and eco-friendly packaging solutions. The increasing focus on the circular economy presents significant opportunities for manufacturers of recycled PET (rPET) films and biodegradable packaging. The expansion of the e-commerce sector is creating a need for robust and protective yet lightweight packaging films. Furthermore, the growing healthcare sector in South Africa, with its demand for sterile and specialized packaging, offers a niche but growing opportunity. Innovations in smart packaging technologies, offering enhanced traceability and consumer engagement, are also poised to create new market avenues.

Leading Players in the South Africa Plastic Packaging Films Market Market

- Berry Global Inc

- AVPack Plastic Manufacturers

- Ampa Plastics Group

- Apac Enterprise Trading

- SRF LIMITED

- Mpact Group

- Flexible Packages Convertors (Pty) Ltd

- Amcor Group GmbH

- UFlex Limited

Key Developments in South Africa Plastic Packaging Films Market Industry

- April 2024: Coca-Cola Beverages Africa (CCBA) and Plastic Packaging joined forces, investing over USD 1.2 million to establish a cutting-edge polyethylene terephthalate (PET) flaking plant in Okahandja, Namibia. This strategic move not only marks the inauguration of a new facility but also promises to amplify the nation's plastic waste recycling capacity, effectively doubling the output of its sole mechanical recycler. Furthermore, the new plant will double the capacity of PET recycling in Namibia, increasing the availability of high-quality recycled PET (rPET) materials. This can provide a stable and increased supply of rPET to South African manufacturers, promoting the use of recycled materials in plastic packaging films.

- September 2023: South African Plastic Recycling Organisation (SAPRO) celebrated its 9th biennial Best Recycled Plastic Product Awards. The event, designed to spotlight and honor innovative recycled plastic products, serves as a catalyst for manufacturers, urging them to enhance the quality and utility of recycled plastic films. Such advancements bolster consumer confidence and foster wider acceptance of recycled goods.

Strategic Outlook for South Africa Plastic Packaging Films Market Market

The strategic outlook for the South Africa Plastic Packaging Films Market is positive, characterized by continued growth driven by evolving consumer demands and technological advancements. The increasing adoption of sustainable packaging solutions, including those made from recycled content and bioplastics, will be a key growth catalyst. Manufacturers focusing on developing high-performance films with enhanced barrier properties, extended shelf life, and improved recyclability will likely gain a competitive edge. Strategic collaborations, investments in advanced recycling infrastructure, and a focus on product innovation will be crucial for long-term success. The market's future potential lies in its ability to balance economic viability with environmental responsibility, catering to the diverse needs of its expanding consumer base and industrial sectors.

South Africa Plastic Packaging Films Market Segmentation

-

1. Type

- 1.1. Polyprop

- 1.2. Polyethy

- 1.3. Polyethy

- 1.4. Polystyrene

- 1.5. Bio-based

- 1.6. PVC, EVOH, PETG, and Other Film Types

-

2. End-user Industry

-

2.1. Food

- 2.1.1. Candy and Confectionery

- 2.1.2. Frozen Foods

- 2.1.3. Fresh Produce

- 2.1.4. Dairy Products

- 2.1.5. Dry Foods

- 2.1.6. Meat, Poultry, and Seafood

- 2.1.7. Pet Food

- 2.1.8. Other Fo

- 2.2. Healthcare

- 2.3. Personal Care and Home Care

- 2.4. Industrial Packaging

- 2.5. Other En

-

2.1. Food

South Africa Plastic Packaging Films Market Segmentation By Geography

- 1. South Africa

South Africa Plastic Packaging Films Market Regional Market Share

Geographic Coverage of South Africa Plastic Packaging Films Market

South Africa Plastic Packaging Films Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Adoption of Packaging Products in E-commerce and Organized Retail Sector; Rising Urbanization and Growing Awareness on Environmental Impact of Packaging

- 3.3. Market Restrains

- 3.3.1. Rise in Adoption of Packaging Products in E-commerce and Organized Retail Sector; Rising Urbanization and Growing Awareness on Environmental Impact of Packaging

- 3.4. Market Trends

- 3.4.1. Polypropylene Film is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Plastic Packaging Films Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Polyprop

- 5.1.2. Polyethy

- 5.1.3. Polyethy

- 5.1.4. Polystyrene

- 5.1.5. Bio-based

- 5.1.6. PVC, EVOH, PETG, and Other Film Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food

- 5.2.1.1. Candy and Confectionery

- 5.2.1.2. Frozen Foods

- 5.2.1.3. Fresh Produce

- 5.2.1.4. Dairy Products

- 5.2.1.5. Dry Foods

- 5.2.1.6. Meat, Poultry, and Seafood

- 5.2.1.7. Pet Food

- 5.2.1.8. Other Fo

- 5.2.2. Healthcare

- 5.2.3. Personal Care and Home Care

- 5.2.4. Industrial Packaging

- 5.2.5. Other En

- 5.2.1. Food

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Berry Global Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AVPack Plastic Manufacturers

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ampa Plastics Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Apac Enterprise Trading

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SRF LIMITED

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mpact Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Flexible Packages Convertors (Pty) Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Amcor Group GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 UFlex Limite

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Berry Global Inc

List of Figures

- Figure 1: South Africa Plastic Packaging Films Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South Africa Plastic Packaging Films Market Share (%) by Company 2025

List of Tables

- Table 1: South Africa Plastic Packaging Films Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: South Africa Plastic Packaging Films Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: South Africa Plastic Packaging Films Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: South Africa Plastic Packaging Films Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: South Africa Plastic Packaging Films Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: South Africa Plastic Packaging Films Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Plastic Packaging Films Market?

The projected CAGR is approximately 3.25%.

2. Which companies are prominent players in the South Africa Plastic Packaging Films Market?

Key companies in the market include Berry Global Inc, AVPack Plastic Manufacturers, Ampa Plastics Group, Apac Enterprise Trading, SRF LIMITED, Mpact Group, Flexible Packages Convertors (Pty) Ltd, Amcor Group GmbH, UFlex Limite.

3. What are the main segments of the South Africa Plastic Packaging Films Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.81 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise in Adoption of Packaging Products in E-commerce and Organized Retail Sector; Rising Urbanization and Growing Awareness on Environmental Impact of Packaging.

6. What are the notable trends driving market growth?

Polypropylene Film is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Rise in Adoption of Packaging Products in E-commerce and Organized Retail Sector; Rising Urbanization and Growing Awareness on Environmental Impact of Packaging.

8. Can you provide examples of recent developments in the market?

April 2024: Coca-Cola Beverages Africa (CCBA) and Plastic Packaging joined forces, investing over USD 1.2 million to establish a cutting-edge polyethylene terephthalate (PET) flaking plant in Okahandja, Namibia. This strategic move not only marks the inauguration of a new facility but also promises to amplify the nation's plastic waste recycling capacity, effectively doubling the output of its sole mechanical recycler.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Plastic Packaging Films Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Plastic Packaging Films Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Plastic Packaging Films Market?

To stay informed about further developments, trends, and reports in the South Africa Plastic Packaging Films Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence