Key Insights

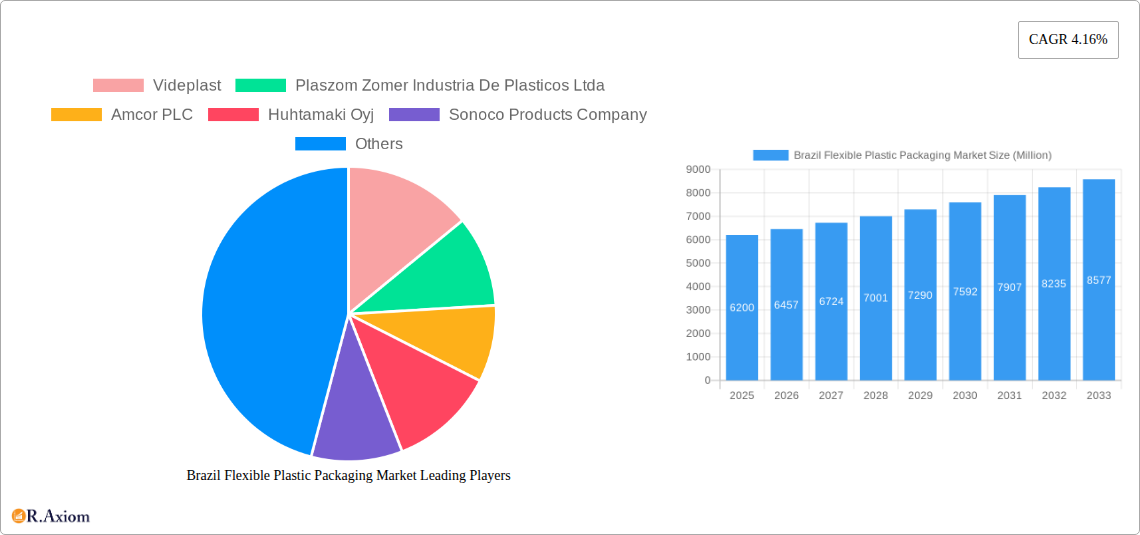

The Brazilian flexible plastic packaging market is set for substantial growth, projected to reach a market size of $6,200 million by 2025. The market is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 4.16% through 2033. This growth is driven by consumer preference for convenience, extended shelf-life, and attractive product presentation across diverse industries. The food and beverage sector remains a key driver, with widespread adoption for products such as confectionery, dairy, frozen foods, and ready-to-eat meals. Emerging personal care, household care, and medical/pharmaceutical segments, demanding sterile and secure packaging, also contribute significantly. Polyethylene (PE) and Bi-oriented Polypropylene (BOPP) are expected to lead due to their versatility, cost-effectiveness, and excellent barrier properties. A significant trend is the increasing demand for sustainable packaging, including recyclable and biodegradable options, prompting innovation in eco-friendly materials and processes.

Brazil Flexible Plastic Packaging Market Market Size (In Million)

Market dynamics are influenced by rising disposable income and urbanization, increasing consumption of packaged goods. Advances in printing and lamination technologies are enabling more sophisticated and visually appealing packaging, enhancing brand visibility. The growing e-commerce sector further fuels demand for robust, protective packaging suitable for shipping. Key challenges include fluctuating raw material prices, stringent environmental regulations, and growing consumer awareness of plastic waste. This necessitates a strategic shift towards sustainable alternatives and improved recycling infrastructure. Leading companies such as Amcor PLC, Berry Global Inc., and Sonoco Products Company are investing in research and development to address these challenges and leverage opportunities in high-consumption regions with evolving consumer preferences.

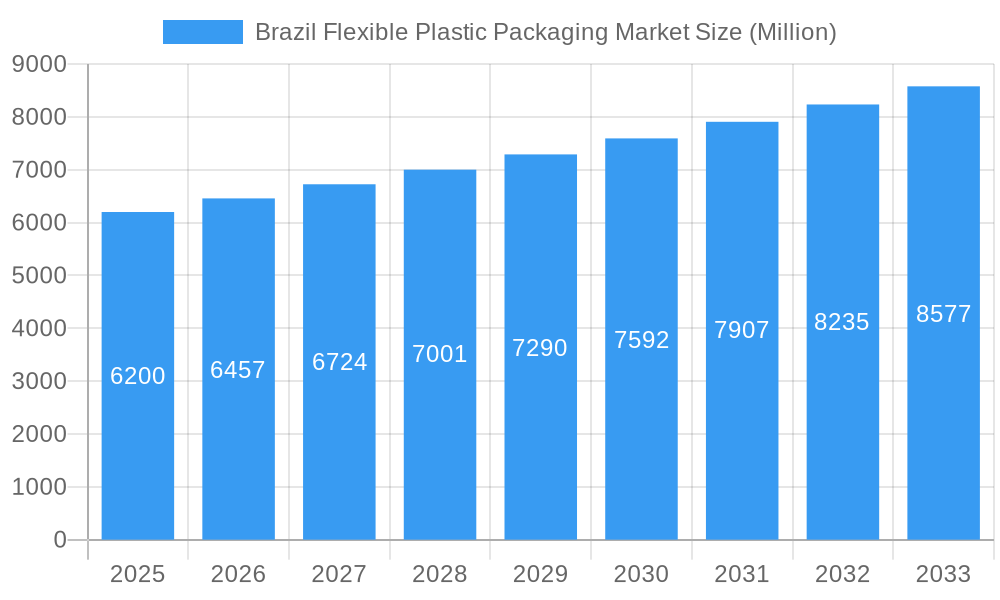

Brazil Flexible Plastic Packaging Market Company Market Share

Brazil Flexible Plastic Packaging Market Market Concentration & Innovation

The Brazil flexible plastic packaging market exhibits moderate concentration, with a mix of large multinational players and significant domestic manufacturers vying for market share. Innovation is a key differentiator, driven by the increasing demand for sustainable packaging solutions, enhanced product shelf-life, and consumer convenience. Regulatory frameworks, particularly those promoting recyclability and reducing single-use plastics, are shaping product development and investment strategies. Product substitutes, such as rigid packaging and paper-based alternatives, are present but often face challenges in terms of cost-effectiveness and barrier properties for certain applications. End-user trends, especially the growing preference for convenient and on-the-go formats, are fueling innovation in pouch and bag designs. Mergers and acquisitions (M&A) are a notable aspect of market dynamics, with companies seeking to expand their product portfolios, geographical reach, and technological capabilities. For instance, recent strategic alliances highlight the drive for collaborative innovation. While specific M&A deal values are dynamic, the overall trend indicates a consolidation phase aimed at achieving economies of scale and enhancing competitive positioning within the burgeoning Brazilian market.

Brazil Flexible Plastic Packaging Market Industry Trends & Insights

The Brazil flexible plastic packaging market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2025 to 2033, reaching an estimated market size of xx Million by 2033. This significant expansion is propelled by a confluence of factors, including Brazil's large and growing population, increasing disposable incomes, and a burgeoning middle class with evolving consumption patterns. The food and beverage industry, being the largest consumer of flexible packaging in Brazil, is a primary growth driver. Consumers are increasingly seeking convenient, portion-controlled, and aesthetically pleasing packaging solutions that extend product shelf life and maintain freshness. This trend is particularly evident in categories like ready-to-eat meals, snacks, and premium beverages.

Technological advancements are playing a pivotal role in shaping the industry. The development of advanced barrier films, high-performance printing techniques, and innovative closure systems are enabling manufacturers to offer superior packaging functionalities. The growing emphasis on sustainability is also a significant disruptor and opportunity. Increased consumer and regulatory pressure is driving the adoption of recyclable, compostable, and bio-based flexible packaging materials. Manufacturers are investing in R&D to develop eco-friendlier alternatives without compromising on performance. This includes exploring innovations in multi-layer structures that facilitate easier separation of materials for recycling.

Consumer preferences are shifting towards lighter-weight, more portable, and resealable packaging formats. This is particularly influencing the demand for pouches and bags, which offer superior convenience and portion control compared to traditional rigid packaging. The e-commerce boom in Brazil has further amplified the need for robust yet lightweight flexible packaging that can withstand the rigors of shipping while minimizing transportation costs.

Competitive dynamics are intense, characterized by both domestic and international players. Strategic partnerships, product differentiation through specialized functionalities, and a focus on cost-efficiency are crucial for success. Companies are also investing in local manufacturing capabilities and supply chain optimization to better serve the vast Brazilian market. The penetration of flexible packaging is expected to deepen across various end-user industries, including medical, pharmaceutical, and personal care, as these sectors increasingly recognize the benefits of flexible solutions in terms of product protection, shelf appeal, and cost-effectiveness. The overall outlook for the Brazil flexible plastic packaging market remains highly optimistic, driven by sustained economic growth, evolving consumer demands, and a strong push towards sustainable innovation.

Dominant Markets & Segments in Brazil Flexible Plastic Packaging Market

The Brazil flexible plastic packaging market is dominated by several key segments, each driven by unique factors and contributing significantly to the overall market growth.

Material Type Dominance:

- Polyethene (PE): This is the leading material type, accounting for a substantial market share due to its versatility, cost-effectiveness, and excellent barrier properties. Key drivers for PE's dominance include:

- High Demand in Food Packaging: PE films are widely used for packaging a broad range of food products, from fresh produce and dry goods to frozen foods, owing to their good moisture barrier and sealability.

- Cost-Effectiveness: Compared to some other advanced polymers, PE offers a competitive price point, making it an attractive option for mass-market applications.

- Recyclability: Many types of PE are readily recyclable, aligning with the growing sustainability agenda in Brazil.

- Bi-oriented Polypropylene (BOPP): BOPP is another significant segment, prized for its excellent clarity, stiffness, and printability. Its dominance is fueled by:

- Premium Product Packaging: BOPP is extensively used for packaging confectionery, snacks, and bakery products where visual appeal is paramount.

- High Strength and Durability: Its biaxial orientation provides superior tensile strength and puncture resistance.

- Food Grade Compliance: BOPP meets stringent food safety regulations, making it a reliable choice for various food applications.

- Cast Polypropylene (CPP): CPP offers a balance of properties, including good heat sealability and clarity, making it suitable for specific applications within the food and medical sectors. Its growth is supported by:

- Lamination Applications: CPP is often used as a lamination layer in multi-layer flexible packaging structures.

- Heat Sealing Performance: Its excellent heat sealing characteristics are crucial for maintaining product integrity.

Product Type Dominance:

- Pouches: Pouches, encompassing stand-up pouches, retort pouches, and spout pouches, are the fastest-growing and a dominant product type. Their ascendancy is attributed to:

- Consumer Convenience: Pouches offer ease of opening, resealability, and portability, aligning perfectly with modern lifestyles.

- Extended Shelf Life: Advanced pouch designs with barrier layers can significantly extend the shelf life of perishable goods.

- Brand Differentiation: The large surface area of pouches provides ample space for attractive branding and product information.

- Innovation in Spouted Pouches: The March 2024 development of spouted pouch packaging for yogurt highlights this trend.

- Films and Wraps: These remain a staple in the industry, used for a wide array of applications from primary packaging for produce to secondary packaging for various goods. Their dominance is maintained by:

- Cost-Effectiveness and Versatility: Films and wraps are often the most economical choice for many packaging needs.

- Protection and Preservation: They effectively protect products from moisture, oxygen, and physical damage.

- High-Volume Applications: The sheer volume of products requiring film and wrap packaging ensures their continued market significance.

End-User Industry Dominance:

- Food: This is by far the largest and most dominant end-user industry for flexible plastic packaging in Brazil. The drivers for this dominance are multifaceted:

- Large Consumer Base: Brazil's substantial population translates into high demand for packaged food products.

- Diverse Food Categories: Flexible packaging is indispensable across a wide spectrum of food items, including Candy & Confectionery, Frozen Foods, Fresh Produce, Dairy Products, Dry Foods, Meat, Poultry, And Seafood, and Pet Food. The June 2024 investment in Hellmann's squeeze bottle production for tomato sauce exemplifies the demand for innovative food packaging.

- Shelf-Life Extension Requirements: Many food products require advanced barrier properties to maintain freshness and prevent spoilage, where flexible packaging excels.

- Convenience Foods Trend: The increasing popularity of ready-to-eat meals and convenience snacks directly fuels the demand for flexible packaging.

- Beverage: The beverage sector is another significant consumer, with flexible packaging used for pouches, sachets, and some bottled beverage shrink films. Growth is driven by:

- Single-Serve Portions: Pouches are ideal for single-serving beverages, catering to on-the-go consumption.

- Cost-Effective Packaging: For certain beverages, flexible packaging offers a more economical alternative to glass or rigid plastic bottles.

Brazil Flexible Plastic Packaging Market Product Developments

Product developments in Brazil's flexible plastic packaging market are increasingly focused on enhancing sustainability, convenience, and functionality. Innovations include the development of multi-layer films with improved recyclability through material design and advanced adhesives. The introduction of high-barrier EVOH-based films for extended shelf-life in food applications, alongside retort-capable pouches for processed foods, are key advancements. The rise of sophisticated printing technologies allows for vibrant branding and complex graphic designs, enhancing shelf appeal. Furthermore, the integration of smart features and antimicrobial properties in packaging materials is gaining traction for specific medical and food applications, offering competitive advantages through enhanced product protection and consumer appeal.

Report Scope & Segmentation Analysis

The Brazil Flexible Plastic Packaging Market is comprehensively analyzed across key segmentation dimensions. The Material Type segment includes Polyethene (PE), Bi-oriented Polypropylene (BOPP), Cast Polypropylene (CPP), Polyvinyl Chloride (PVC), Ethylene Vinyl Alcohol (EVOH), and Other Materials, each with projected growth rates and market sizes reflecting their respective demand drivers and applications. The Product Type segment covers Pouches, Bags, Films and Wraps, and Other Product Types (Blister Packs, Liners, etc.), with a focus on the rising dominance of pouches due to convenience trends. The End-User Industry segment is extensively detailed, encompassing Food (including sub-segments like Candy & Confectionery, Frozen Foods, Fresh Produce, Dairy Products, Dry Foods, Meat, Poultry, And Seafood, Pet Food, Other Food), Beverage, Medical and Pharmaceutical, Personal Care and Household Care, and Other End-User Industries, highlighting the significant contribution of the food sector. Growth projections and competitive dynamics are analyzed within each of these segments.

Key Drivers of Brazil Flexible Plastic Packaging Market Growth

Several key drivers are fueling the growth of the Brazil flexible plastic packaging market. Economically, Brazil's large and growing population, coupled with increasing disposable incomes, translates to higher consumer spending on packaged goods. Technologically, advancements in material science are enabling the creation of high-barrier, lightweight, and recyclable flexible packaging solutions. Regulatory pushes towards sustainability are also a significant driver, encouraging the adoption of eco-friendlier materials and designs. Furthermore, the expanding e-commerce sector necessitates robust, protective, and cost-effective packaging, which flexible options readily provide. The convenience-seeking nature of Brazilian consumers, particularly for on-the-go consumption, strongly favors pouch and bag formats.

Challenges in the Brazil Flexible Plastic Packaging Market Sector

Despite robust growth, the Brazil flexible plastic packaging market faces several challenges. Environmental concerns and increasing regulatory scrutiny regarding plastic waste necessitate significant investment in developing and implementing truly circular economy solutions, including advanced recycling infrastructure, which is still nascent in many parts of the country. Supply chain disruptions, exacerbated by global economic volatility and logistical complexities within Brazil's vast geography, can impact raw material availability and cost. Fluctuations in the price of petrochemical feedstocks, the primary input for most plastics, pose a constant threat to profit margins. Moreover, the presence of less sustainable, cheaper alternatives and the ongoing debate around plastic bans in certain regions can create market uncertainty and pressure manufacturers to innovate rapidly.

Emerging Opportunities in Brazil Flexible Plastic Packaging Market

Emerging opportunities in the Brazil flexible plastic packaging market are abundant and driven by evolving consumer demands and technological innovations. The growing consumer preference for sustainable packaging presents a significant opportunity for manufacturers offering biodegradable, compostable, or easily recyclable flexible solutions. The expansion of the e-commerce market in Brazil creates a demand for specialized flexible packaging that ensures product protection during transit while remaining lightweight. Innovations in smart packaging, such as those with embedded sensors for temperature monitoring or indicators for product freshness, are opening new avenues, particularly in the food and pharmaceutical sectors. Furthermore, the increasing demand for convenient, single-serve packaging formats in emerging urban centers and for on-the-go consumption continues to drive the market for pouches and sachets.

Leading Players in the Brazil Flexible Plastic Packaging Market Market

- Videplast

- Plaszom Zomer Industria De Plasticos Ltda

- Amcor PLC

- Huhtamaki Oyj

- Sonoco Products Company

- Sealed Air Corporation

- Berry Global Inc

- Guala pack SpA

- Parnaplast Industria De Plasticos Ltda

- Embaquim

Key Developments in Brazil Flexible Plastic Packaging Market Industry

- June 2024: Unilever PLC announced a USD 16 million investment in a new factory line for Hellmann's in Brazil, aiming to meet surging demand for recyclable tomato sauce squeeze bottles.

- March 2024: SIG Group forged a strategic alliance with DPA Brasil to roll out spouted pouch packaging for DPA Brasil's Chamyto yogurt brand, featuring a SIG CloverCap closure and SIG Prime 120 filling equipment.

Strategic Outlook for Brazil Flexible Plastic Packaging Market Market

The strategic outlook for the Brazil flexible plastic packaging market is overwhelmingly positive, characterized by sustained growth driven by strong domestic demand and a global shift towards more sustainable packaging solutions. Key growth catalysts include continuous innovation in material science to deliver enhanced barrier properties and recyclability, alongside increased investment in advanced manufacturing technologies to improve efficiency and product quality. The expanding e-commerce landscape in Brazil will continue to spur demand for protective and lightweight flexible packaging. Furthermore, strategic collaborations between packaging manufacturers, raw material suppliers, and end-users will be crucial for developing comprehensive recycling infrastructure and promoting circular economy principles, ensuring long-term market viability and stakeholder value.

Brazil Flexible Plastic Packaging Market Segmentation

-

1. Material Type

- 1.1. Polyethene (PE)

- 1.2. Bi-oriented Polypropylene (BOPP)

- 1.3. Cast Polypropylene (CPP)

- 1.4. Polyvinyl Chloride (PVC)

- 1.5. Ethylene Vinyl Alcohol (EVOH)

- 1.6. Other Ma

-

2. Product Type

- 2.1. Pouches

- 2.2. Bags

- 2.3. Films and Wraps

- 2.4. Other Product Types (Blister Packs, Liners, etc)

-

3. End-User Industry

-

3.1. Food

- 3.1.1. Candy & Confectionery

- 3.1.2. Frozen Foods

- 3.1.3. Fresh Produce

- 3.1.4. Dairy Products

- 3.1.5. Dry Foods

- 3.1.6. Meat, Poultry, And Seafood

- 3.1.7. Pet Food

- 3.1.8. Other Fo

- 3.2. Beverage

- 3.3. Medical and Pharmaceutical

- 3.4. Personal Care and Household Care

- 3.5. Other En

-

3.1. Food

Brazil Flexible Plastic Packaging Market Segmentation By Geography

- 1. Brazil

Brazil Flexible Plastic Packaging Market Regional Market Share

Geographic Coverage of Brazil Flexible Plastic Packaging Market

Brazil Flexible Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Significant Growth in the Food Industry is Expected to Enhance Product Demand; Rising Demand for Flexible Packaging from the Healthcare Industry

- 3.3. Market Restrains

- 3.3.1. Significant Growth in the Food Industry is Expected to Enhance Product Demand; Rising Demand for Flexible Packaging from the Healthcare Industry

- 3.4. Market Trends

- 3.4.1. Polyethylene (PE) is Estimated to Have the Largest Market Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Flexible Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Polyethene (PE)

- 5.1.2. Bi-oriented Polypropylene (BOPP)

- 5.1.3. Cast Polypropylene (CPP)

- 5.1.4. Polyvinyl Chloride (PVC)

- 5.1.5. Ethylene Vinyl Alcohol (EVOH)

- 5.1.6. Other Ma

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Pouches

- 5.2.2. Bags

- 5.2.3. Films and Wraps

- 5.2.4. Other Product Types (Blister Packs, Liners, etc)

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Food

- 5.3.1.1. Candy & Confectionery

- 5.3.1.2. Frozen Foods

- 5.3.1.3. Fresh Produce

- 5.3.1.4. Dairy Products

- 5.3.1.5. Dry Foods

- 5.3.1.6. Meat, Poultry, And Seafood

- 5.3.1.7. Pet Food

- 5.3.1.8. Other Fo

- 5.3.2. Beverage

- 5.3.3. Medical and Pharmaceutical

- 5.3.4. Personal Care and Household Care

- 5.3.5. Other En

- 5.3.1. Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Videplast

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Plaszom Zomer Industria De Plasticos Ltda

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Amcor PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Huhtamaki Oyj

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sonoco Products Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sealed Air Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Berry Global Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Guala pack SpA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Parnaplast Industria De Plasticos Ltda

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Embaquim*List Not Exhaustive 8 2 Heat Map Analysi

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Videplast

List of Figures

- Figure 1: Brazil Flexible Plastic Packaging Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Brazil Flexible Plastic Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Flexible Plastic Packaging Market Revenue million Forecast, by Material Type 2020 & 2033

- Table 2: Brazil Flexible Plastic Packaging Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 3: Brazil Flexible Plastic Packaging Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 4: Brazil Flexible Plastic Packaging Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Brazil Flexible Plastic Packaging Market Revenue million Forecast, by Material Type 2020 & 2033

- Table 6: Brazil Flexible Plastic Packaging Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 7: Brazil Flexible Plastic Packaging Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 8: Brazil Flexible Plastic Packaging Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Flexible Plastic Packaging Market?

The projected CAGR is approximately 4.16%.

2. Which companies are prominent players in the Brazil Flexible Plastic Packaging Market?

Key companies in the market include Videplast, Plaszom Zomer Industria De Plasticos Ltda, Amcor PLC, Huhtamaki Oyj, Sonoco Products Company, Sealed Air Corporation, Berry Global Inc, Guala pack SpA, Parnaplast Industria De Plasticos Ltda, Embaquim*List Not Exhaustive 8 2 Heat Map Analysi.

3. What are the main segments of the Brazil Flexible Plastic Packaging Market?

The market segments include Material Type, Product Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.87 million as of 2022.

5. What are some drivers contributing to market growth?

Significant Growth in the Food Industry is Expected to Enhance Product Demand; Rising Demand for Flexible Packaging from the Healthcare Industry.

6. What are the notable trends driving market growth?

Polyethylene (PE) is Estimated to Have the Largest Market Share in the Market.

7. Are there any restraints impacting market growth?

Significant Growth in the Food Industry is Expected to Enhance Product Demand; Rising Demand for Flexible Packaging from the Healthcare Industry.

8. Can you provide examples of recent developments in the market?

June 2024: Unilever PLC, a British fast-moving consumer goods company, announced a USD 16 million investment in a new factory line for Hellmann's in Brazil. This move aims to meet the surging demand for tomato sauce in squeeze bottles across the country. The investment is set to bolster the production capacity of Unilever's recyclable tomato ketchup squeeze bottles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Flexible Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Flexible Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Flexible Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the Brazil Flexible Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence