Key Insights

The United States rigid plastic packaging market is projected for substantial growth, anticipated to reach a market size of $252.64 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 3% through 2033. This expansion is driven by consistent demand across vital sectors like food & beverage, healthcare, and cosmetics, which leverage the protective and versatile attributes of rigid plastic packaging. Key growth catalysts include rising consumer preference for convenience, the surge in e-commerce demanding secure and lightweight solutions, and continuous advancements in material science and design.

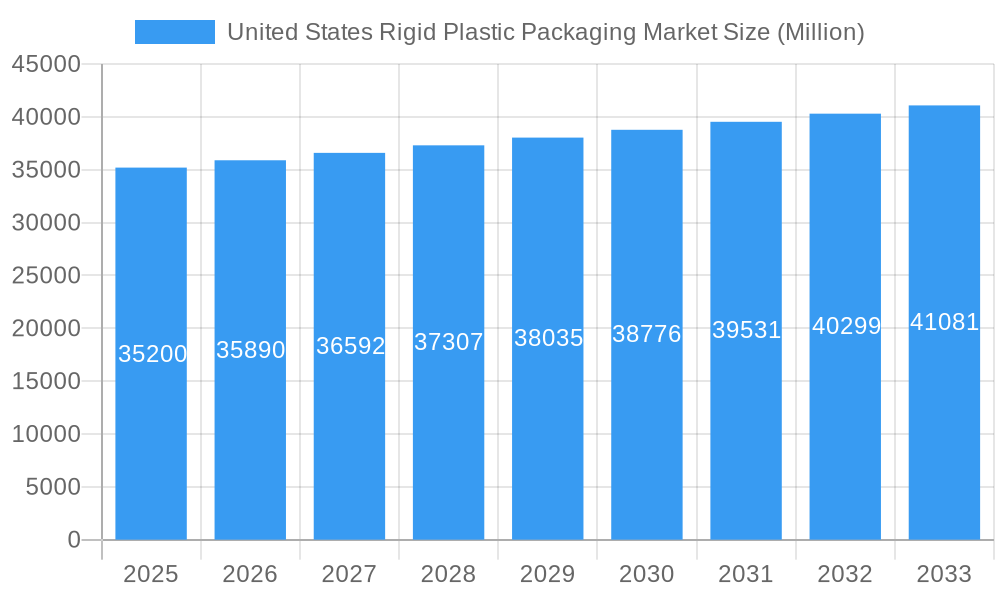

United States Rigid Plastic Packaging Market Market Size (In Billion)

While the outlook remains robust, evolving environmental concerns and regulatory landscapes around plastic waste management are influencing the market. This necessitates a strong focus on sustainability, including the incorporation of recycled content and the development of biodegradable alternatives, presenting both challenges and opportunities for innovation. The inherent benefits of rigid plastic packaging—durability, cost-efficiency, and design flexibility—ensure its continued prominence. Emerging trends such as smart packaging for enhanced tracking and authentication, and the increased utilization of specialized resins like PET and HDPE, will shape the future of this segment.

United States Rigid Plastic Packaging Market Company Market Share

This report offers a comprehensive analysis of the United States rigid plastic packaging market, detailing its current state, future projections, and primary growth drivers. Covering the historical period (2019–2024), a base year of 2025, and a forecast to 2033, it provides crucial insights for stakeholders. The analysis includes segmentation by product, material, and end-use industry, alongside an examination of leading players, market trends, and emerging opportunities. High-traffic keywords such as "rigid plastic packaging," "US packaging market," "PET packaging," "food packaging solutions," "beverage containers," "healthcare packaging," "cosmetic packaging," "industrial packaging," and "sustainable packaging" are integrated for optimal search visibility.

United States Rigid Plastic Packaging Market Market Concentration & Innovation

The United States Rigid Plastic Packaging Market exhibits a moderate to high market concentration, with a few dominant players controlling a significant market share. Berry Global Inc., Aptar Group Inc., and Amcor Group GmbH are key entities driving this landscape, collectively holding an estimated xx% of the market in the base year 2025. Innovation within the sector is primarily fueled by the escalating demand for sustainable packaging solutions, driven by both consumer preferences and stringent regulatory mandates. Companies are investing heavily in research and development for advanced materials, such as bio-based plastics and high-performance recycled plastics (e.g., rPET). Key innovation drivers include:

- Advancements in Material Science: Development of lighter, stronger, and more recyclable plastic resins.

- Process Optimization: Implementation of energy-efficient manufacturing techniques and automation for cost reduction and increased output.

- Circular Economy Initiatives: Focus on closed-loop systems, increasing the use of post-consumer recycled (PCR) content, and designing for recyclability.

- Smart Packaging Technologies: Integration of RFID and other sensors for supply chain traceability and product integrity.

Regulatory frameworks, particularly those promoting plastic recycling and reducing single-use plastics, are shaping product development and market strategies. The growing awareness of environmental impact is also leading to increased scrutiny of product substitutes, such as glass and metal packaging, although rigid plastics continue to offer a compelling balance of cost, performance, and versatility for a wide range of applications. Mergers and acquisitions (M&A) activities remain a significant aspect of market dynamics, with strategic consolidation aimed at expanding product portfolios, geographic reach, and technological capabilities. Notable M&A deals in recent years have involved substantial valuations, reflecting the strategic importance of this sector. For instance, the acquisition of Silgan Holdings Inc. by an undisclosed entity in late 2023 was valued at an estimated $xx Million, highlighting the ongoing consolidation trend.

United States Rigid Plastic Packaging Market Industry Trends & Insights

The United States Rigid Plastic Packaging Market is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of xx% over the forecast period of 2025–2033. This upward trajectory is underpinned by several interconnected industry trends and insights. A primary growth driver is the expanding food and beverage industry, which represents the largest end-use sector, demanding innovative and safe rigid plastic containers for a variety of products, from dairy and processed foods to carbonated drinks and water. The increasing consumer preference for convenience, portion control, and extended shelf life further fuels the demand for specialized plastic packaging solutions.

Technological disruptions are playing a pivotal role in reshaping the market. The adoption of advanced manufacturing technologies, including high-speed injection molding, blow molding, and extrusion processes, is enhancing production efficiency and enabling the creation of complex packaging designs. Automation and Artificial Intelligence (AI) are being integrated into manufacturing lines to optimize quality control, reduce waste, and improve overall operational agility. Furthermore, the continuous innovation in plastic resin development, particularly in the realm of polyethylene terephthalate (PET) and high-density polyethylene (HDPE), offers improved barrier properties, enhanced durability, and greater design flexibility, making them preferred choices for many applications.

Consumer preferences are evolving rapidly, with a pronounced shift towards sustainable and eco-friendly packaging. This trend is compelling manufacturers to increase the incorporation of recycled content, such as recycled PET (rPET), into their products and to invest in developing biodegradable or compostable alternatives where feasible. Brands are actively communicating their sustainability efforts on packaging, influencing consumer purchasing decisions. The healthcare sector also presents a significant growth avenue, driven by the increasing demand for sterile, tamper-evident, and child-resistant rigid plastic packaging for pharmaceuticals, medical devices, and personal protective equipment. Stringent regulatory requirements in this sector necessitate high-quality, reliable packaging solutions.

The competitive landscape is characterized by intense rivalry, with companies focusing on product differentiation, cost leadership, and strategic partnerships. Emerging players are leveraging innovative technologies and sustainable practices to challenge established giants. Market penetration for rigid plastic packaging remains high across various end-use industries, but opportunities for niche market development and customized solutions are continuously emerging. The overall market penetration for rigid plastic packaging in the US is estimated to be around xx% of total packaging solutions in 2025. The focus on lightweighting of packaging to reduce material usage and transportation costs is another critical trend, contributing to both economic and environmental benefits. The growth of e-commerce also necessitates robust and protective packaging, further boosting the demand for rigid plastic solutions that can withstand the rigors of shipping and handling.

Dominant Markets & Segments in United States Rigid Plastic Packaging Market

The United States Rigid Plastic Packaging Market is characterized by the dominance of specific segments and end-use industries, driven by underlying economic policies, infrastructure development, and evolving consumer behaviors.

Dominant Product Segments:

- Bottles and Jars: This segment holds the largest market share, projected to reach approximately $xx Billion by 2025. The sustained demand from the food, beverage, and healthcare industries, coupled with the versatility of PET and HDPE for a wide array of liquid and solid product containment, solidifies its leading position. The ongoing trend of single-serving packaging and the growth of bottled water consumption are key drivers.

- Trays and Containers: Valued at an estimated $xx Billion in 2025, this segment is crucial for the food, healthcare, and consumer goods sectors. Innovations in thermoformed plastic trays and injection-molded containers are enabling better product protection, extended shelf life, and attractive display options. The rise of ready-to-eat meals and the need for specialized packaging in medical applications contribute significantly to this segment's growth.

- Caps and Closures: While often considered a sub-segment, the market for caps and closures is substantial, estimated at $xx Billion in 2025. These components are critical for product safety, tamper evidence, and ease of use. The increasing complexity of dispensing mechanisms and the demand for sustainable closure solutions, including those made from recycled materials, are driving innovation.

Dominant Material Segments:

- Polyethylene Terephthalate (PET): PET dominates the rigid plastic packaging market due to its excellent clarity, strength, lightweight properties, and recyclability. It is the material of choice for beverage bottles, including water, soft drinks, and juices, as well as food jars. The market for PET packaging is expected to reach $xx Billion by 2025, driven by its widespread adoption and the increasing availability of recycled PET (rPET).

- Polyethylene (PE) - HDPE & LDPE/LLDPE: High-Density Polyethylene (HDPE) is extensively used for milk jugs, detergent bottles, and chemical containers owing to its strength and chemical resistance. Low-Density Polyethylene (LDPE) and Linear Low-Density Polyethylene (LLDPE) are also significant, particularly in films and certain container types, although less prevalent in rigid forms compared to HDPE. The combined PE segment is projected to be valued at $xx Billion in 2025.

- Polypropylene (PP): PP is gaining traction due to its excellent heat resistance, rigidity, and chemical inertness, making it suitable for food containers, microwaveable packaging, and automotive components. The PP segment is estimated to reach $xx Billion by 2025.

Dominant End-use Industry Segments:

- Food: The food industry represents the largest end-use sector, accounting for an estimated xx% of the rigid plastic packaging market in 2025. This is driven by the extensive use of rigid plastics for packaging a wide range of food products, including dairy, bakery, confectionery, processed foods, and fresh produce. Economic policies supporting food production and distribution, alongside a growing population with increased demand for packaged foods, are key drivers.

- Beverage: This sector is the second-largest consumer, with an estimated market share of xx% in 2025. The pervasive use of PET bottles for water, soft drinks, juices, and other beverages makes this segment a powerhouse. The development of infrastructure for beverage production and distribution networks significantly contributes to this dominance.

- Healthcare: The healthcare industry's demand for rigid plastic packaging is steadily growing, projected to account for xx% of the market in 2025. The need for sterile, safe, and tamper-evident packaging for pharmaceuticals, medical devices, and diagnostic kits is paramount. Stringent regulatory requirements and investments in healthcare infrastructure bolster this segment.

United States Rigid Plastic Packaging Market Product Developments

Product innovations in the United States Rigid Plastic Packaging Market are primarily focused on enhancing sustainability, functionality, and consumer appeal. Key developments include the increasing use of 100% recycled PET (rPET) for bottles, exemplified by brands transitioning to more sustainable packaging. Advancements in lightweighting technologies are reducing material usage without compromising structural integrity, leading to cost savings and environmental benefits. The market is also seeing innovations in barrier technologies to extend shelf life and preserve product quality, particularly for sensitive food and pharmaceutical products. Furthermore, the development of mono-material packaging solutions is gaining momentum, facilitating easier recycling processes. These innovations provide a competitive advantage by meeting evolving consumer demands for eco-friendly and high-performance packaging.

Report Scope & Segmentation Analysis

This report offers a granular analysis of the United States Rigid Plastic Packaging Market, encompassing detailed segmentation across key categories to provide actionable insights.

Product Segmentation: The market is analyzed by Bottles and Jars, Trays and Containers, Caps and Closures, Intermediate Bulk Containers (IBCs), Drums, Pallets, and Other Products. The forecast period from 2025–2033 will witness robust growth across all these categories, with bottles and jars and trays and containers expected to maintain their dominant positions. Competitive dynamics within each product segment are influenced by specialized manufacturing capabilities and end-user requirements.

Material Segmentation: The report segments the market by Polyethylene (PE) (LDPE & LLDPE, HDPE), Polyethylene terephthalate (PET), Polypropylene (PP), Polystyrene (PS) and Expanded Polystyrene (EPS), Polyvinyl chloride (PVC), and Other Rigid Plastics. PET is projected for significant growth due to its recyclability and versatility, while PE and PP are expected to maintain strong market presence across various applications. The competitive landscape is shaped by material properties, cost-effectiveness, and sustainability profiles.

End-use Industry Segmentation: The analysis covers Food, Beverage, Healthcare, Cosmetics and Personal Care, Industrial, Building and Construction, Automotive, and Other End-use Industries. The food and beverage sectors are anticipated to lead market growth, followed by the healthcare and cosmetics industries, which demand specialized packaging solutions. Economic policies influencing these sectors and evolving consumer lifestyles will impact their respective market shares and growth projections.

Key Drivers of United States Rigid Plastic Packaging Market Growth

The growth of the United States Rigid Plastic Packaging Market is propelled by several interconnected factors. The increasing demand for convenience and on-the-go consumption across food and beverage sectors directly translates to a higher need for easily portable and safe rigid plastic containers. The expanding healthcare industry, driven by an aging population and advancements in medical treatments, fuels the demand for sterile and protective pharmaceutical and medical device packaging. Furthermore, growing consumer awareness and preference for sustainable packaging options are pushing manufacturers to innovate with recycled content and design for recyclability, which, paradoxically, supports the continued use and development of rigid plastics that can be integrated into circular economy models. Regulatory support for recycling initiatives and the development of new recycling infrastructure also act as significant catalysts.

Challenges in the United States Rigid Plastic Packaging Market Sector

Despite robust growth prospects, the United States Rigid Plastic Packaging Market faces several challenges. Negative public perception and environmental concerns surrounding plastic waste pose a significant hurdle, leading to increased regulatory scrutiny and calls for bans on certain single-use plastic items. Fluctuations in raw material prices, particularly for petroleum-based resins, can impact manufacturing costs and profit margins. The complex and sometimes inconsistent recycling infrastructure across different regions in the U.S. hinders effective closed-loop systems and can limit the widespread adoption of recycled content. Additionally, intense competition from alternative packaging materials, such as paperboard, glass, and metal, requires continuous innovation and cost optimization to maintain market share.

Emerging Opportunities in United States Rigid Plastic Packaging Market

The United States Rigid Plastic Packaging Market presents numerous emerging opportunities. The growing demand for sustainable and bio-based rigid plastic alternatives offers a significant avenue for innovation and market penetration. The expansion of the e-commerce sector necessitates robust, lightweight, and protective packaging solutions, creating demand for specialized rigid plastic containers designed for shipping and handling. The increasing adoption of smart packaging technologies, such as those incorporating RFID or QR codes for traceability and consumer engagement, opens new revenue streams and value propositions. Furthermore, the development of novel barrier technologies for extended shelf life and product preservation in the food and healthcare sectors presents a considerable opportunity for specialized manufacturers.

Leading Players in the United States Rigid Plastic Packaging Market Market

- Berry Global Inc.

- Aptar Group Inc.

- Amcor Group GmbH

- Graham Packaging Company

- Sonoco Products Company

- Altium Packaging

- Silgan Holdings Inc.

- Reliable Caps LLC

- Pretium Packaging

- Axium Packaging Inc

Key Developments in United States Rigid Plastic Packaging Market Industry

- August 2024: Origin Materials, a tech firm dedicated to facilitating the global shift toward sustainable materials, has teamed up with Reed City Group, a comprehensive injection mold builder and molder, hydraulic press manufacturer, and provider of automation solutions. Together, they aim to mass-produce PET caps and closures in North America. At Reed City Group's facilities in Michigan, the duo is set to run commercial manufacturing lines for Origin's PET caps and closures. These lines are set to utilize advanced high-speed equipment and automation to transform both virgin and recycled PET into caps. Notably, Origin's caps are set to be the first commercially viable PET closures to penetrate the mass market.

- October 2023: Chlorophyll Water, a mountain spring mineral water company based in the United States, transitioned to using 100% recycled polyethylene terephthalate (rPET) for its water bottles. In addition to purified water, the company infuses its bottles with chlorophyll and vitamins A, B12, C, and D. Notably, Chlorophyll Water achieved a significant milestone by becoming the first bottled water brand in the United States to obtain the Clean Label Project Certification, which involved independent, third-party testing for over 90 potential industrial environmental contaminants.

Strategic Outlook for United States Rigid Plastic Packaging Market Market

The strategic outlook for the United States Rigid Plastic Packaging Market is one of continued innovation and adaptation to evolving market demands. Growth catalysts include the persistent need for efficient and safe packaging solutions in the food, beverage, and healthcare industries, coupled with increasing investment in sustainable materials and circular economy initiatives. Companies that focus on developing advanced recycled plastic packaging and explore bio-based alternatives will be well-positioned for future success. The integration of digital technologies and automation in manufacturing processes will be crucial for enhancing efficiency and cost-competitiveness. Strategic partnerships and M&A activities will continue to shape the market landscape, enabling companies to expand their portfolios and technological capabilities to meet the growing demand for high-performance and environmentally responsible rigid plastic packaging solutions.

United States Rigid Plastic Packaging Market Segmentation

-

1. Product

- 1.1. Bottles and Jars

- 1.2. Trays and Containers

- 1.3. Caps and Closures

- 1.4. Intermediate Bulk Containers (IBCs)

- 1.5. Drums

- 1.6. Pallets

- 1.7. Other Pr

-

2. Material

-

2.1. Polyethylene (PE)

- 2.1.1. LDPE & LLDPE

- 2.1.2. HDPE

- 2.2. Polyethylene terephthalate (PET)

- 2.3. Polypropylene (PP)

- 2.4. Polystyrene (PS) and Expanded polystyrene (EPS)

- 2.5. Polyvinyl chloride (PVC)

- 2.6. Other Ri

-

2.1. Polyethylene (PE)

-

3. End-use Industry

- 3.1. Food

- 3.2. Beverage

- 3.3. Healthcare

- 3.4. Cosmetics and Personal Care

- 3.5. Industri

- 3.6. Building and Construction

- 3.7. Automotive

- 3.8. Other En

United States Rigid Plastic Packaging Market Segmentation By Geography

- 1. United States

United States Rigid Plastic Packaging Market Regional Market Share

Geographic Coverage of United States Rigid Plastic Packaging Market

United States Rigid Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption in Food and Beverage Sector; Increasing Rigid Plastic Packaging Solutions Demand Across the Industrial Sector

- 3.3. Market Restrains

- 3.3.1. Growing Adoption in Food and Beverage Sector; Increasing Rigid Plastic Packaging Solutions Demand Across the Industrial Sector

- 3.4. Market Trends

- 3.4.1. Food And Beverage Sector Drives Demand For Rigid Plastic Packaging Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Rigid Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Bottles and Jars

- 5.1.2. Trays and Containers

- 5.1.3. Caps and Closures

- 5.1.4. Intermediate Bulk Containers (IBCs)

- 5.1.5. Drums

- 5.1.6. Pallets

- 5.1.7. Other Pr

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Polyethylene (PE)

- 5.2.1.1. LDPE & LLDPE

- 5.2.1.2. HDPE

- 5.2.2. Polyethylene terephthalate (PET)

- 5.2.3. Polypropylene (PP)

- 5.2.4. Polystyrene (PS) and Expanded polystyrene (EPS)

- 5.2.5. Polyvinyl chloride (PVC)

- 5.2.6. Other Ri

- 5.2.1. Polyethylene (PE)

- 5.3. Market Analysis, Insights and Forecast - by End-use Industry

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.3. Healthcare

- 5.3.4. Cosmetics and Personal Care

- 5.3.5. Industri

- 5.3.6. Building and Construction

- 5.3.7. Automotive

- 5.3.8. Other En

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Berry Global Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Aptar Group Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Amcor Group GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Graham Packaging Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sonoco Products Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Altium Packaging

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Silgan Holdings Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Reliable Caps LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pretium Packaging

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Axium Packaging Inc 7 2 Heat Map Analysis7 3 Competitor Analysis - Emerging vs Established Player

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Berry Global Inc

List of Figures

- Figure 1: United States Rigid Plastic Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Rigid Plastic Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: United States Rigid Plastic Packaging Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: United States Rigid Plastic Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 3: United States Rigid Plastic Packaging Market Revenue billion Forecast, by End-use Industry 2020 & 2033

- Table 4: United States Rigid Plastic Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: United States Rigid Plastic Packaging Market Revenue billion Forecast, by Product 2020 & 2033

- Table 6: United States Rigid Plastic Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 7: United States Rigid Plastic Packaging Market Revenue billion Forecast, by End-use Industry 2020 & 2033

- Table 8: United States Rigid Plastic Packaging Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Rigid Plastic Packaging Market?

The projected CAGR is approximately 3%.

2. Which companies are prominent players in the United States Rigid Plastic Packaging Market?

Key companies in the market include Berry Global Inc, Aptar Group Inc, Amcor Group GmbH, Graham Packaging Company, Sonoco Products Company, Altium Packaging, Silgan Holdings Inc, Reliable Caps LLC, Pretium Packaging, Axium Packaging Inc 7 2 Heat Map Analysis7 3 Competitor Analysis - Emerging vs Established Player.

3. What are the main segments of the United States Rigid Plastic Packaging Market?

The market segments include Product, Material, End-use Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 252.64 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption in Food and Beverage Sector; Increasing Rigid Plastic Packaging Solutions Demand Across the Industrial Sector.

6. What are the notable trends driving market growth?

Food And Beverage Sector Drives Demand For Rigid Plastic Packaging Products.

7. Are there any restraints impacting market growth?

Growing Adoption in Food and Beverage Sector; Increasing Rigid Plastic Packaging Solutions Demand Across the Industrial Sector.

8. Can you provide examples of recent developments in the market?

August 2024: Origin Materials, a tech firm dedicated to facilitating the global shift toward sustainable materials, has teamed up with Reed City Group, a comprehensive injection mold builder and molder, hydraulic press manufacturer, and provider of automation solutions. Together, they aim to mass-produce PET caps and closures in North America. At Reed City Group's facilities in Michigan, the duo is set to run commercial manufacturing lines for Origin's PET caps and closures. These lines are set to utilize advanced high-speed equipment and automation to transform both virgin and recycled PET into caps. Notably, Origin's caps are set to be the first commercially viable PET closures to penetrate the mass market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Rigid Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Rigid Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Rigid Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the United States Rigid Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence